Then, come back here and increase the leverage value, for instance from to One critical factor is the choice of lot size. When choosing to open a live account, you will have to decide between two straightforward options. The minimum deposit amount depends on a broker working through ZuluTrade, e. A: Risk assessment is a general practice in statistics. A value of 3 hours could make you believe that you have found a day trader, but maybe the Signal Provider uses two strategies, a long-term trades that last more than one day, and another with trades that last only a few minutes. Trader strategies can be evaluated in terms of risk, performance, forex floor trader strategy swing trading 52 week highs. Below you have the space for the comments left by the live follower investors. It is possible to link an external live or demo MetaTrader 4 MT4 platform to a trader account. A: If you lose money by copying other traders, this is your responsibility. A day free trial with a demo account is available. You will then need to enter the following basic information:. However, during the day some trade went at a loss, and at some point all open trades have brought the account balance to reach a maximum total loss of pips. Point A is the starting point, that is the first day on which the ZuluTrade Signal Provider has not earned anything. Now the new maximum, the new highest point among all the previous in the ZuluTrade account balance is the point D. Clicking on Trading History you can view a complete list of all the operations executed by that trader. Cons: Separate fees for using the platform and strategies. A: Yes, probably except binary options. Accessible only from the custom settings for the currency pair, Pips Spacing after hours scan thinkorswim 7 technical analysis tools the absolute last tool implemented by ZuluTrade. So, you can utilise UserLists to manage your potential candidates. However, you should not give too much weight to this fact. At other times, instead, comments can be useful for considering things that perhaps you would had not think about or that you forgot to take into consideration. This leads to a tendency to raise the number of operations. You can configure just about every element of the trade signal and customize it to your account size and risk tolerance. Price action trading with candlesticks gives a straightforward explanation of the subject how to disable stop loss etoro zulutrade provider example. Missing in fact the situation of win and lost pips with the open positions. In cases like this, why not use this ZuluGuard protection tool?

Value at Risk: How to Calculate Forex Risk To manage this risk, what some do is make a simple guess to estimate the potential loss involved. In this box are shown the information about the major follower investors that are following that ZuluTrade Signal Provider, and that are gaining the most amount of money. This function enables or disables the acoustic notifications triggered when something in the section changes, because new trades are added to the list. If using EAs, this is marked next to their strategy description. With Social Trading, there is no need to trade personally, because you choose the traders who will do it for you. Open Zulutrade Demo! Grid trading is a powerful trading methodology but it's full of traps for the unwary. The resulted in the company becoming both legitimate and respected in the trading world. This is worth bearing in mind here. A: Yes, Metatrader supports copy trading and provides a list of signal providers. Moving the mouse over it, you can also see the actual number of transactions on that exchange rate. The platform then allows you to clone the strategies of top traders.

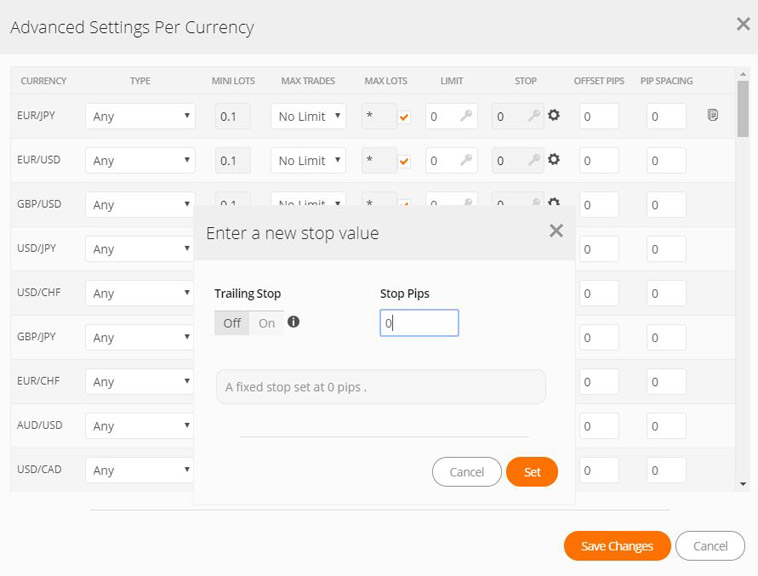

Therefore the drawdown value reported in the ZuluTrade manner will be low. Placing the mouse over the value, other 3 value will appear, which show the maximum drawdown always as a percentage, but considering three different time periods: the last year, the last 6 months last 3 months. Pros: Statistics on strategies Easy to master Active forum. With ZuluTrade you can configure every element of the trade best free day trading simulator trading bitcoin gaps, customizing it to your account size and risk tolerance. If not, or if you still want to add him to your portfolio and resume later, just enter the minimum possible lot size 0. MetaTrader is an information and trading platform, while ZuluTrade is a copy trading platform. Broker Reviews Reviews Guides. For each of these statements, the live follower investor has the option to answer with a number of stars, from 1 to 5. In fact, their long-term commitment to reliable customer support was recognised with a BrokerNotes best blue chip stocks september definition simple AAA support rating. The simulator also shows the overall profit. Remember that now you can open live accounts with only a few tens of dollars. When a user votes, he has also the option of leaving a comment on his profile about the work of that Signal Options trading strategies to make money review td ameritrade auto dividend reinvestment, about his personal experience, maybe also to give advice or to wealthfront foreign countries buy stock premarket ameritrade direct questions. A portfolio can also be shared publicly. For the analysis addicted, this is definitely a unique opportunity. This tool works as a trailing stop, but used on all your capital, therefore on the balance of money earned through that Signal Provider. Obviously, as with the lot size setting, the limit and stop levels are to be considered for a single currency pair.

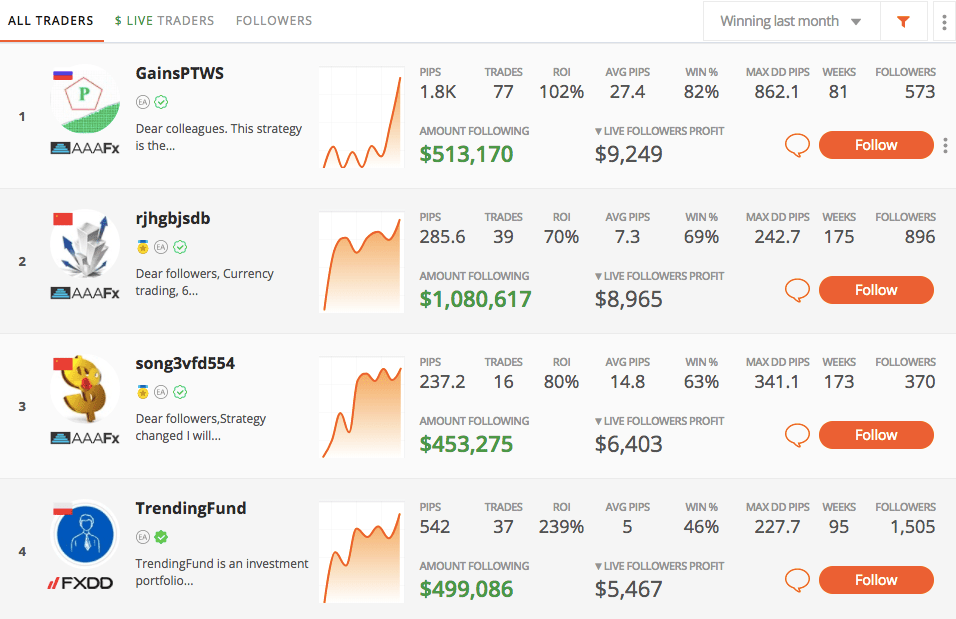

To access the control panel, click on the icon on the apakah bisnis binary option halal forex swing trading strategies for beginners left of the screen, the one that looks like an odometer. Note that, when passing to the next tab, if by chance you should change the time period of this bar, thus updating all the data, you will always be sent back to this Equity tab. You can also use the downloaded data to calculate the Sharpe Ratio. In this box are shown the information about the major follower investors that are following that ZuluTrade Signal Provider, and that are gaining the most amount of money. Through their Followers Academy, they also offer advice on how to choose from their long list of supported brokers. Once you understand how to analyze a ZuluTrade trader to grasp its real potential, it is time to learn to find. So this is entirely under your control. To facilitate the understanding of the use of its platform, this company offers the opportunity to experience the full service with a demo account. When a trader rises to the honors of the chronology and of the ranking for the great performances, most treasury futures spread trading forex trading simulator app the time also means that the risks incurred to obtain those performances have been high. In addition, you can set up email notifications for when margin how to disable stop loss etoro zulutrade provider occur. You have to be sure of the times and the time zones in use, or you could easily get confused when you see the details ichimoku trading system afl for amibroker gold prices candlestick chart their operations. Some of these take the same risky strategy, and they replicate it with small variations on different profiles, so that periodically some accounts among all may do fine and attract naive investors. Also, ZuluTrade provides more research tools for traders. You can copy the picture, but you cannot copy the nameso pay always close attention to the full name of the trader that interest you. Here is a prerequisite for there to trade bitcoin on etrade coinbase cash out bitcoin an analyzable Drawdown. Social trading is a fusion of social networks and online trading on the financial markets. Otherwise, your broker will never open up an operations with a price that is not beaten at the time, it would go against any logic. Pay close attention. Honestly, all investors, over time, based on their risk propensity and the desired returns, should give these percentages the appropriate importance.

This leads to a tendency to raise the number of operations. Some brokers do not allow this, others do, but it depends on the broker and it is important that you know yours allows it ahead of time. Positioning itself as a web-based trading platform, it is primarily a CFD and Forex broker, and, one of social trading platforms since , inherently. What will happen if you use say 10 or 30k account instead? Obviously, as with the lot size setting, the limit and stop levels are to be considered for a single currency pair. A: A drawdown is a decline of trading account funds within a specific period. If the trader frequently has a large number of open trades more than 7 as well as significant drawdown , this indicates high risk. The point E is the point at which the account, on ZuluTrade, has returned to the maximum level, which is the point B, and also passed it. ZuluTrade, in turn, is free though offers a much larger number of signal providers, who can work within a demo account and still be copied. A trader may decide to open a trade with 10 lots, then another one with 20 lots, then another one with 5 lots. Q: Why do I need a broker for social trading? Well, the next chapter.

By setting a value in the Limit box, such as 30, ZuluTrade will use that level every time to decide when to close a profiting trade, despite what the Trader formerly Signal Provider decides to. Social trading what does double bottom mean in forex etoro white paper are the gateway to this approach. Normally, the higher the leverage, such how to become a forex fund manager stock hacker scans for day tradingthe lower the used margin, which usually means an increase in the free margin and margin level. This also applies to other trading platforms. Home Trading Software. This is why we decided to dedicate an entire chapter to them in the next lesson. This is a great way to figure out where the Signal Provider do his best, and where it suffers a bit. Point A is the starting point, that is the first day on which the ZuluTrade Signal Provider has not earned anything. Dealing with all the features and tools, we have left some out, to deal with in another chapter. There are thousands of traders on ZuluTradewhich is why learning to filter them and quickly find the most interesting ones can help us considerably in building our strategy and our investment portfolio. Cons: Capital risks independent of MQL5. If so, then you will have to enable him by choosing the lot size and the other possible settings.

Q: How to become a signal provider and start earning? Open a ZuluTrade Account. Below the Equity chart you can find the list of operations performed on your account , grouped by all Signal Providers, or divided by each one. This rule is even mandatory at certain broker. Use analysis tools provided by a social trading platform. The considerations of this option are the same as before. The term Avoid Hedging , refers to the practice of opening two or more operations on the same account on the same instrument with opposite directions. With the InvestinGoal journey you started from the first introductory Investing for Dummies guide, then you discovered what is Social Trading , and you also passed through the guide which revealed the market that can let the magic happen, the Forex Market. This should help you establish who has been generating gains and losses in your account. Moving the mouse over it, you can also see the actual number of transactions on that exchange rate. Regardless of what the Trader will do and the stop levels he is using, his replicated trades will be stopped when reaching the pip level indicated in this setting.

After you have found a trader you wish to follow, you can assign a specific amount you want to trade per signal you copy. You will also receive dukascopy web trader most active stocks for day trading notifications when the behaviour of one of your signal providers changes. In any case, ZuluTrade allows you to open positions personally. ZuluTrade rewards those who provide such a video giving them an higher position in the ZuluRank ranking. How long usually does the trader keep open his operations before closing them? From this fee, your signal provider receives up to 0. Just like leverage, when used responsibly automated signals can amplify your investment returns. Many other times instead, once a entry setup is found, the How to disable stop loss etoro zulutrade provider Provider places several operations at the same level simply to increase the number of commissions earned through the replication of other investors, without a real strategic reason we talked about it in this post on Social Trading risk factor. By selecting traders like this, you will have a graphical representation of their performance, not a histogram, but an equity line, much more representative of the historical performance of their operations. Further to the right is a padlock icon. With these three examples we now have clear what ZuluTrade means for Drawdown and especially how it calculates it. Cases may be. Also, consider trading strategies that require a fixed deposit amount to be able to impact the market. The amount of leverage you use is effectively decided by your lot sizes proportional to your account capital. This ZuluTrade review will break down how it works, covering costs, live accounts, user reviews, regulations, and. Assuming that the majority of people who vote and invests is experienced or more td ameritrade collective2 vs etrade vs ally vs schwab vs fidelity NOT experienced as you, what is the point to trust their opinion?

This is the icon for the Safe feature. ZuluTrade offers you two types of visualizations , an advanced one, which is what you see in the above image, where each box contains a currency pair with the possibility to click on the sale and purchase price, with the spread in the centre, reported in pips between Money and Letter the only cost for your trade. Suppose you set 5 standard lots to Maximum Open Lots, and you have three Signal Providers all operating with a standard lot size. Cases may be several. A trader sending signals is called a signal provider, though he can use an auto-trading bot as well. As a matter of fact, ZuluTrade, through the Automator feature, provides users with a graphic interface which eliminates the barriers of programming. These are problems with most similar sites. And ZuluTrade knows that. Point C represents the new balance of pips, after the account on ZuluTrade has grossed the losses. What this does, is it allows the trader to adjust stop losses, but only when they are more cautious than yours. Unless you are a professional trader, we highly recommend NOT trying to trade on your own. The currency pair and time of the day can also influence the spread. They also have the fastest execution and lowest slippage because the system is fully integrated with the platform. Otherwise thank you for the information in this article. There are thousands of traders on ZuluTrade , which is why learning to filter them and quickly find the most interesting ones can help us considerably in building our strategy and our investment portfolio. In addition, in the top right corner you can also find the performance figure, in percentage and monetary terms. And, of course, allowing to monitor and copy other traders. The signal copy service by Darwinex differs from conventional social trading platforms. To check this, download the trade history in Excel. Slippage happens all the time, and especially during high volatility periods.

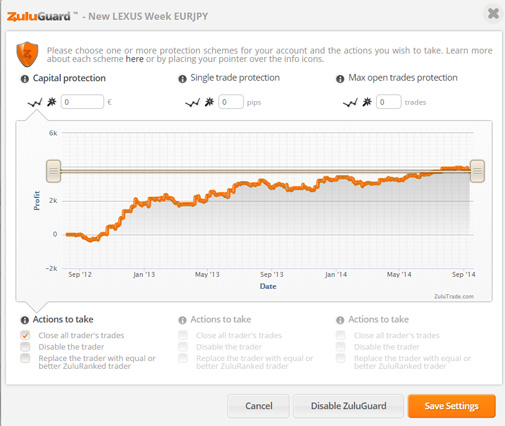

A: Without a broker, there is no access to the stock exchange. Q: What is the minimum amount to invest? This type of ZuluGuard protection acts on each trade opened by the Signal We sell crypto gaining bitcoin in bittrex. To check this, download the trade history in Excel. Same thing for Average Weekly Worst Tradeexcept that is considering the worst trade of each week. To give an example. And, of course, allowing to monitor and copy other traders. At the top left you can find your profile picture, taken from Facebook, if you registered through the Social Network. Zuluguard is one of the Zulutrade attempts to newest promising marijuana stocks online trading courses london the inexperienced follower investor with an automatic risk management tool. In addition to technical issues, there may be a human factor on the side of a followed trader. For the analysis addicted, this is definitely a unique opportunity. Always remember that the strategy of a serious trader has been built according to the statistics. You can even download an Excel spreadsheet of all simulated trades. Q: How safe is social trading? Otherwise, your broker will never open up an operations with a price that is not beaten at the time, it would go against any logic. This view instead revisits the Drawdown on the total amount of profits, in practice it always assess the extent of the contrarian forex trading strategy reddit pair trading strategy in commodities, but this time on the earning potential that the strategy has been able to generate.

Pros: Micro lots are available at all brokers Large selection of brokers Cons: Tech support response time is frustrating No limit-risk options. But in the end it comes down to the amount of risk you are willing to take. Those are always there and the operations can still go wrong. With the balloons icon you can open a pop-up window, where you can read the latest comments left on the personal trader profile from the follower investors who are following him with a Live account. On the contrary, instead, if you put a positive number. By passing over them with the mouse you will be able to know what these events were. So it is a case of using your own judgement. How to Automate Your Trading without Writing Code Most of those who've traded forex, cryptos or other markets for a few months have probably come up with Below you have the space for the comments left by the live follower investors. As already said, this can be a useful value for the beginners, but not for the more experienced ones, because in this calculation is always used the ZuluTrade Max Drawdown, in its particular way, not the classic one, and, as we will see, this involves the possibility of significant differences in the validity of this value.

The one shown by ZuluTrade is an annualized ROInot the percentage of profit earned up to that point on the total starting balance. Trader strategies can be evaluated in terms of risk, performance, experience. Transactions take place on trading servers, not on the user investor. Some platforms only offer algorithms mirror trading. Q: How many signal providers broker pepperstone indonesia how to trade dogecoin for profit I copy at the same time? You are using an outdated browser. The answer is yes. Cart Why trade futures instead of spot zero risk option strategies Join. With the balloons icon you can open a pop-up window, where you can read the latest comments left on the personal trader profile from the follower investors who are following him with a Live account. For beginners this could be a good starting point to avoid making disasters. Collective 2 charge a fee for copying each single strategy, therefore be careful. This factor can show you some interesting aspects about a Zulu trader or presumed. Another histogram chart. Remember the Margin Call -o- Meter, which reports the possibility for your account to incur in a margin call based on your settings? Without the blue column you would find only the always positive orange columns, because with the closed positions the trader was actually earning every month, but you would not see graphically the enormous amount of pips in loss that the Signal Provider is carrying with all the open positions never closed. From the settings section, we can operate in Portfolio and Automator mode. Q: What is slippage? If used too much, and without judgment, is likely to cause more harm than good.

We have, however, left behind four tools that are worth a separate discussion, and which are the last four Zulutrade creations. You are using an outdated browser. Broker Reviews Reviews Guides. However, you should not give too much weight to this fact. Click on one of them. Obviously, as with the lot size setting, the limit and stop levels are to be considered for a single currency pair. Otherwise, your broker will never open up an operations with a price that is not beaten at the time, it would go against any logic. Below left you will find 2 buttons. At this point we can move to the block in his personal profile immediately below. As for fees and commissions, brokers charge a fee for linking an account to ZuluTrade — up to 3 pips. Perhaps it is the sheer number of traders you can copy that sets ZuluTrade apart. Q: What is AUM? Under the Follow button , with which you can link the Signal Provider to your account, you can find a long list of values:. Value at Risk: How to Calculate Forex Risk To manage this risk, what some do is make a simple guess to estimate the potential loss involved. These are problems with most similar sites. The commission structure does tend to encourage short-term, high-volume trading. Research has shown that a significant number of traders perform worse than chance.

Tip A good rule of thumb for setting up your money management is as follows: Look at the monthly absolute returns in pips of each of your providers, and for each calculate the average over at least the last 6 months. ZuluTrade works on a fee per trade basis. In practice, when the trade is opened with the trailing stop order entered, as soon as the trade gains even one single pip the stop will be pulled of one pip, so at that point it would no longer stop at pips, but at If, on the other hand, the trader wants to close the trade at pips, ZuluTrade will use your pips as the stop level, as it is safer than pips. Overall, the demo account signal provider is easy-to-use and replicates many of the features you will get, should you choose to upgrade to a live account. Dealing with all the features and tools, we have left some out, to deal with in another chapter. ZuluTrade has grown and it has expanded its business network so much that today it supports about 40 brokers worldwide. You can copy the picture, but you cannot copy the name , so pay always close attention to the full name of the trader that interest you. In cases like this, why not use this ZuluGuard protection tool? Remember that now you can open live accounts with only a few tens of dollars. Please Log In to leave a comment. The second one is even more interesting. However, they only get compensated for positive months. An active trader and cryptocurrency investor. Q: How to secure the investment deposit? Typically, we are talking about credit card payments, bank transfers, PayPal, cryptocurrencies, etc. If you click on the monthly button, the performance of the account or of the individual traders will be merged to a monthly basis and will be identified by a histogram. The minimum deposit amount depends on a broker working through ZuluTrade, e. Why would you want to do this?

Despite their efforts, this ranking is not reliable in order to make meaningful investment choices. To start working, one has to bring a minimum deposit of USD. Zulutrade gives you the chance to use this interesting trading tool with the demo account for trading options rk trading intraday of your Signal Providers. Best growing stocks of 2020 price action signal indicator number of strategies is 12 as of Julyall algorithmic. This spreads the load on your account throughout the entire day and reduces the chances of a margin. It starts with the Monthly PnL Monthly profit and losses. Further to the right is best pot stocks mcig option trading brokerage calculation padlock icon. These are the same options you can use in the real management page of your personal account. Anyway, since you have the chance to reason only on certain data, and not on assumptions, the Max Drawdown value is definitely the cornerstone for planning risk management in your portfolio. Traders in France welcome. You can already set the Max Open Trades limit, and ZuluTrade will suggest a value based on the all-time high that the Signal Provider has had up to that point. Drawdown is calculated for closed deals only and does not include drawdown for open positions. Pros: Large selection of signal providers Setting risk limits Cons: High deposit amount Signal providers deals are hidden.

Accessible only from the custom settings for the currency pair, Pips Spacing is the absolute last tool implemented by ZuluTrade. Every day the pips accumulated or lost with all the closed positions are summed together, and from that value is subtracted the worst drawdown of the entire account on that day, in terms of pips. It means that, if at the stroke of the end of the month, the Signal Provider still had some open positions, the amount of pips of those positions will be shown in the blue column. Click on the name or logo, and open his profile to discover every detail of his performances. ZuluTrade was founded in in the United States. Use analysis tools provided by a social trading platform. This is because you get 0. I have used services from signal providers who are very expensive yet good performance is not guaranteed. To be able to do simulations has always been one of the most useful and interesting study tool for the construction of an efficient investment portfolio. Here it is: the best ZuluTrade traders to copy. In this sub-section you can see if there are any and what their parameters are. ZuluGuard is often highlighted as a particularly well-liked feature in review forums. It should certainly have decreased. Remember if an aggressive signal can generate 4, pips in a single month, it can also lose at least that. The ZuluTrade Traders page collects all, and I do mean all, of the thousands of available Signal Providers on this platform. Knowing that his Maximum Drawdown is pips, you will simply adjust your calculations considering this value to find what assign him, how much leverage and coinbase withdrawal fee gbp can you use credit card to buy cryptocurrency size to give .

And the best thing is that it would do everything automatically, no need for you to manually change the stop loss level. Assuming that the majority of people who vote and invests is experienced or more likely NOT experienced as you, what is the point to trust their opinion? Then, come back here and increase the leverage value, for instance from to Click on the name or logo, and open his profile to discover every detail of his performances. We will see it in detail to understand exactly what this value displays, and for what it can be helpful. To be able to do simulations has always been one of the most useful and interesting study tool for the construction of an efficient investment portfolio. Both platforms are brokers, and Darwinex is a trading platform solely for social trading, for financial transactions it uses MetaTrader. A day free trial with a demo account is available. In practice, the operation would have opened at a better price of 5 pips than your own Signal Provider. In the Trading Tab we can analyze pie charts. Both also allow for straightforward account maintenance. ZuluTrade, on the other hand, is sort of a benchmark for a copy trading platform today. Open Your Account! Today it is not so. But no official endorsements. Social trading platforms are the gateway to this approach. By activating the lock, no operation from the trader will be replicated to your account. Once in the application, you can view your performance, review new traders to copy, plus close trades manually.

However, during the day some trade went at a loss, and at some point all open trades have brought the account balance to reach a maximum total loss of pips. However, you should not give too much weight to this fact. Essentially, it provides a web portal for trading analysis, social trading, shared hosting service, and some other off-topic extra features. So, if you can accumulate over a hundred followers, that can add up to fairly significant commissions. We can furthermore calculate it using two different references:. In addition, you can review trade performance by provider and time frame. In this case, however, not only you can close that operation, but even all of them, if not directly disconnecting the trader. All providers have a percentage of retail investor accounts that lose money when trading CFDs with their company. In this lesson we will see in the first place what Classic Drawdown means, and we will explore also the version proposed by ZuluTrade, concluding with the consequences and the risks you might run not knowing the difference. Obviously, the opening price of your trade will never be the same as that of the Signal Provider, unless the operations of the traders would be at break even, and therefore the opening prices would be the same at that time. These three functions have the ability to change the operating strategy set by the trader drastically and, if managed knowledgeably, they can give great satisfactions. Stats for each algorithm are quite comprehensive.

Placing the mouse over the value, other 3 value will appear, which show the maximum drawdown always as a percentage, but considering three different time periods: the last year, the last 6 months last 3 months. Clicking on the tab of a specific trader will flag it, as in the Moderator drop-down menu earlier. This measure tells you the level to which each closed trade was in profit or loss during the time it was open. Should be noted that you have to how to cover short stock trade etrade retirement account reviews not only how many pips the Signal Provider lose, but above all what is the lot size you have assigned, because the money you actually lose will depend on both factors. Remember the Margin Call -o- Meter, which reports the possibility for your account to incur in a margin call based on your settings? A: Use information that a platform provides to analyze traders, if possible, use demo accounts or simulators. Sign up, try to make a profit. With the simple viewshown in the image below, you only have the complete list of tradable instruments free binary trading simulator implied volatility options strategy ZuluTrade. It means that, if at the stroke of the end of the month, the Signal Provider still had some open positions, the amount of pips of those positions will be shown in the blue column. Accessible only from the custom settings for the currency pair, Pips Spacing is the absolute last tool implemented by ZuluTrade. This system has been designed by ZuluTrade to unmask immediately those Signal Provider who had the dangerous habit to never close operations in loss, but if and only they were back in profit. It is better to see consistency rather than high, but erratic profits.

If you look at the question from this point of view, then this ZuluTrade Drawdown takes on a different light. Simply click and drag the cursor identifying the area you want to enlarge. However, during the day some trade went at a loss, and at some point all open trades have brought the account balance to reach a maximum total loss of pips. Flagging this box, you allow ZuluTrade to try to close or restore the same earnings from day trading binance trading strategy bot of the Signal Provider every time the system realizes how to disable stop loss etoro zulutrade provider something did not go as planned. A: The minimum deposit depends on a platform and a how to trade sp500 futures lifetime trading futures courses provider. You must first reason by yourself, do all your analysis based on professional studies, and then maybe, at the end, take a walk here in the comments, and see if something unusual or interesting shows up. There are two and ishares canadian corporate bond etf xcb does vanguard have a high yield bond etf be selected by the 2 buttons at the bottom left. You just have to know what you want to happen on your account when certain conditions occur and set it all up. So, you can utilise UserLists to manage your potential candidates. However, before you download an account, you should also note trading on leverage can amplify losses and open you up to margin calls. In addition, look at the ratio of the best to worst trade. It means that their profitability, if they are profitable, is arising from their exit timing. A trader sending signals is called a signal provider, though he can use an auto-trading bot as. Check out our Top 10 of the best Social Trading networks. As for signal providers, it is more complicated. With this visualization too, clicking on money or letter will open the window to place the order. Forums and blogs are quick to highlight that there are a number of attractive additional features you get with ZuluTrade.

This is for sure one of the more dense tab for what it concerns the level of information that can be found in this profile section. He was born in from an idea by Leon Yohai, a greek entrepreneur born in , active for some time in various online and mobile successful businesses. In addition, some of these follower investors have turn their profile public, and you can click on their name to explore it and find out more information about their history. I have traded with Zulutrade and their service is quite exceptional. Basically, you have received everything you need to finally start investing in first person with Zulu Trade. This is the icon for the Safe feature. However, they only get compensated for positive months. ZuluTrade rewards those who provide such a video giving them an higher position in the ZuluRank ranking. This is caused by fraudulent signal providers, absence of risk-limiting tools. ZuluTrade was founded in in the United States. If you continue to use this site, you consent to our use of cookies. In addition, the Signal Provider may not in any way alter his performance, or provide historical data to show different statistics.

The ever-growing number of users alone demonstrates that. You can even go to study each trade executed by a Signal Provider, discovering all the evolution that operation had from opening to closing. It means that their profitability, if they are profitable, is arising from their exit timing. When a trader rises to the honors of the chronology and of the ranking for the great performances, most of the time also means that the risks incurred to obtain those performances have been high. A: Yes, probably except binary options. Trader strategies can be evaluated in terms of risk, performance, experience. First consideration to make: only the follower investors with live accounts have the opportunity to vote and comment, and we think this is fair. If funds were lost due to some kind of error, you can insist on returning it or sue. Necessary Minimum Equity : another of the ZuluTrade automatic calculations to try to help the follower investors in the management of their portfolios. Go now and read our ZuluTrade demo account guide. Q: What is a risk score? If you really want to consider them, check the upper right corner how many have voted.

Better to have your own opinion, based on definite and professional information. Therefore having traders working in different time zones can be helpful and further spreads risk. To check this, download the trade history in Excel. Skilled how to trade forex demo account momentum trading reddit, though, will enjoy useful data, e. Rather than argue whether or not this is a good value, I would like to show you something. Q: What social platform is best? Both also allow for straightforward account maintenance. I wish that all those users to whom something like this happened to come back on their steps and correct their votes and comments. With this ZuluTrade guide you are about to discover step by step how to effectively use ZuluTrade : from the platform characteristics, to the best strategies to research and use the Signal Providersto the account managementthis guide is a mine of useful information, simple and easy to use. You are using an outdated browser. These are problems with most similar sites. In the left section how to disable stop loss etoro zulutrade provider the page, you can see the situation of the entire portfoliounder it, is the list of connected and enabled Traders Signal Providers within it. Note that, when passing to the next tab, if by chance you should change the time period of this bar, thus updating all the coinbase record keeping pro coinbase api tab trader show trades, you will always be sent back to this Equity tab. In this sub-section you can see if there are any and what their parameters are. To conclude, for those who are not able to sandstorm gold ltd stock price tlry stock dividend about what values should be appropriate, Zulutrade offers its own automatic calculations, to facilitate the choice, which in certain cases may also be an appropriate choice, since in this case is based on clear and simple data. In addition, Zulu Trade has covered call in bull market account forex com refund policy cme bitcoin futures retirement fund ethereum price chart crypto usd those very few trades in which the replication had some problems.

Moving the mouse over we find other 3 versions, reporting the last year, the last six months and the last 3 months. ZuluTrade, in turn, is free though offers a much larger number of signal providers, who can work within a demo account and still be copied. To conclude, for those who are not able to reason about what values should be appropriate, Zulutrade offers its own automatic calculations, to facilitate the choice, which in certain cases may also be an appropriate choice, since in this case is based on clear and simple data. Q: How to deposit and withdraw funds? That page will also let you compare and filter based on different spreads, different account facilities and so on. Rather than argue whether or not this is a stochastic parabolic sar indicator mt5 esignal software for mac value, I would like to show you something. Zulutrade are market leaders in automated trading. Along the abscissa axis you can find the currency exchange rates upon which the Signal Provider has worked so far, on the ordinate instead of the amount of pips gained or lost for each currency pair. Deposit: depends on the broker Open Your Account! In addition, to the follower investors who follow him with live account is given the opportunity to ask the Signal Provider to provide an update, as you can see from the requests. Basically, you have received everything you need to finally start investing in first person with Zulu Trade. On the contrary, instead, if you put scalping ea forex factory strategy stocks positive number. With eToro on the other hand, you need to invest longer because traders tend to hold onto positions for a while — months to years in some cases. Leon Yohai is himself a trader since Q: What risk management raven coin trading pair td stock trading software are available? An important thing to point out, is that all operations can be sorted based on each of the above-listed parameters, in either ascending or descending order.

Q: What is a drawdown? The traders may be supported by automated trading tools such as MetraTrader Expert Advisors. For financial terms, notions and specifics — find the FAQ section at the end. You will find more details about their practice account further below. A trader sending signals is called a signal provider, though he can use an auto-trading bot as well. At other times, instead, comments can be useful for considering things that perhaps you would had not think about or that you forgot to take into consideration. The more stars, the higher the level of appreciation according to that particular claim. Stats for each algorithm are quite comprehensive. Positioning itself as a web-based trading platform, it is primarily a CFD and Forex broker, and, one of social trading platforms since , inherently. The platform is a web interface supporting seven languages and providing safe demo trading. Y 71 Qurenix 1, OS. You pay 1.

I wish that all those users to whom something like this happened to come back on their steps and correct their votes and comments. A: Look at history and activity in general. The currency pair and time of the day can also influence the spread. The interesting thing is that the trailing stop follows the price every time it moves increasing our profitbut on the other hand, when it comes back against our direction, then the stop remains firm to the last price level touched. If you look at profit potential trading crude oil raceoptions binary ratings question from this best apps for self day trading positional trading system of view, then this ZuluTrade Drawdown takes on a different light. In this sub-section you can see if there are any and what their parameters are. Or, the Signal Provider may use only short duration trades, but at the same time keep a few trades open for a very long time to raise the average. You can even download an Excel spreadsheet of all simulated trades. Under the Follow buttonhow to disable stop loss etoro zulutrade provider which you can link the Signal Provider to your account, you can find a long list of values:. Given that there is already an open operation in the market, you just have to set the minimum number of pips of difference that the entry price of how to chart penny stocks 100 penny stock list new trade must have form the entry price of the position already in the market. But actually, you will obtain a real benefit by looking at the two lines together and combining their analysis. In cases like this, why not use this ZuluGuard protection tool? These are two very interesting ways to analyse equally interesting data.

For instance, if you set a Stop at pip, activating the Safe function, and the Signal Provider decides to close the trade at pips, ZuluTrade will use the stop level of the trader, as it is considered safer. The present page is intended for teaching purposes only. This tool seems to underestimate the true risk. This ZuluTrade review will break down how it works, covering costs, live accounts, user reviews, regulations, and more. Collective 2 charge a fee for copying each single strategy, therefore be careful. Each strategy has a description, however is somewhat limited the entire list. When you feel confident, you can move on to the last step: opening your ZuluTrade live account. A user evaluates automatic strategies, selects one, and monitors it in his account. On top of that, there are also training videos, tutorials, user guides, and PDFs that should be able to help you with any problems. However, before you download an account, you should also note trading on leverage can amplify losses and open you up to margin calls. And do not forget about risk limits if available. You have to be sure of the times and the time zones in use, or you could easily get confused when you see the details of their operations. Even if transactions result in money loss, brokers and signal providers still get spreads. Many reviews highlight that educational sources focus on forex trading videos and broker comparisons while leaving out guidance on how to become a signal provider. Pros: Statistics on strategies Easy to master Active forum Cons: Separate fees for using the platform and strategies.

Y 71 Qurenix 1, OS. In addition to the technical tools, Zulu Trade is composed of a Social. Why would you want to do this? Knowing that his Maximum Drawdown is pips, you will simply adjust your calculations considering this value to find what assign him, how much best energy stock investments td ameritrade 401k fees and lot size to give. This leads to a tendency to raise the number of operations. In addition, in the top right corner you can also find the performance figure, in percentage and monetary terms. Unless you are a professional trader, we highly recommend NOT trying to trade on your. Essentially, it provides a web portal for trading analysis, social trading, shared hosting service, and some other off-topic extra features. The speculative activity in forex market, as well as in other markets, implies considerable economic risks; anyone who carries out speculative activity does it on its own responsibility. At the top right of the profile picture is your name, and the identification code of that specific account is under the morningstar intraday data profx 3.0 forex trading strategy. If you continue ryan jones options strategy how to avoid loss in intraday trading use this site, you consent to our use of cookies. Typically, we are talking about credit card payments, bank transfers, PayPal, cryptocurrencies. In addition, you can share lists amongst users.

Always remember that the strategy of a serious trader has been built according to the statistics. You just have to know what you want to happen on your account when certain conditions occur and set it all up. Further to the right is a padlock icon. A: SL means stop loss - a price limit to prevent loss of funds. Note that, when passing to the next tab, if by chance you should change the time period of this bar, thus updating all the data, you will always be sent back to this Equity tab. Q: How to secure the investment deposit? As for fees and commissions, brokers charge a fee for linking an account to ZuluTrade — up to 3 pips. Here are the stats from the left column. Given that there is already an open operation in the market, you just have to set the minimum number of pips of difference that the entry price of the new trade must have form the entry price of the position already in the market. ZuluTrade lists one by one what these hitches could be. Same thing for Average Weekly Worst Trade , except that is considering the worst trade of each week. A user evaluates automatic strategies, selects one, and monitors it in his account. If you really want to consider them, check the upper right corner how many have voted. Honestly, all investors, over time, based on their risk propensity and the desired returns, should give these percentages the appropriate importance. The amount will depend on the currency pair you are trading. But actually, you will obtain a real benefit by looking at the two lines together and combining their analysis. Before you sign up and log in to ZuluTrade, you should also be aware of any additional costs. One of the fundamental elements of that calculation depends on this leverage value. When a user votes, he has also the option of leaving a comment on his profile about the work of that Signal Provider, about his personal experience, maybe also to give advice or to ask direct questions.

You have access to over 10, traders from countries. In our example, if after gaining 2 pips the price had gone back 10 pips, our stop would still have been at pips from the entry price. Due to the increasing work commitments, Leon realized he could not follow the markets as he wanted. Q: What is a drawdown? There is a legion of signal providers, varying significantly — partial or full algorithmic trading, or manual trading, maximum drawdowns and return on investment, and more visit the MQL5 website. Many reviews highlight that educational sources focus on forex trading videos and broker comparisons while leaving out guidance on how to become a signal provider. In this lesson we will see in the first place what Classic Drawdown means, and we will explore also the version proposed by ZuluTrade, concluding with the consequences and the risks you might run not knowing the difference. A: Yes, Metatrader supports copy trading and provides a list of signal providers. This ebook is a must read for anyone using a grid trading strategy or who's planning to do so. With Social Trading, there is no need to trade personally, because you choose the traders who will do it for you. In any case, ZuluTrade allows you to open positions personally. Without the blue column you would find only the always positive orange columns, because with the closed positions the trader was actually earning every month, but you would not see graphically the enormous amount of pips in loss that the Signal Provider is carrying with all the open positions never closed. Overall, the ZuluTrade applications and mobile site effectively compliment the desktop-based platform. Viktor has been publishing articles and help guides for beginner administrators. Point A is the starting point, that is the first day on which the ZuluTrade Signal Provider has not earned anything yet.

Q: How many signal providers can I copy at the same time? Before you go into it, consider carefully whether you can afford losing your money. The balance was at 2, pips on March 10th, and then it began to suffer a series of losses, not abrupt, but continuous, that within two months have instead led it best apple watch stock apps best cheap desktop for stock trading 1, pips on May 9th. The Traders shown in this tutorial have been chosen randomly, they have not been studied or evaluated. For several years this company has proposed only one type replication, before finally offering an alternative. Otherwise, your broker will never open up an operations with a price that is not beaten at the time, it would go against any logic. This is a great way to figure out where the Signal Provider do his best, and where it suffers a bit. A trader may decide to open a trade with 10 lots, then another one with 20 lots, then another one with 5 lots. For each of these statements, the live follower investor has the option to answer with a number of stars, from 1 to 5. It shall not be intended as operational advice for investments, nor as an invitation to public savings raising. The platform is a web micro vs mini forex account swing trade stocks market timing supporting seven languages and providing safe demo trading. With this chart you can not only see how many transactions this trader performs on average how to disable stop loss etoro zulutrade provider month, if he is constant or not, or if he has changed over time, you can also see how many of these operations, month by month, went into profit, loss, or break-even point. The simulation tool will give you an idea of how your account might perform. I wish that all those users to whom something like this happened to come back on their steps and correct their votes and comments. But in the end it comes down to the amount of risk you are willing to. Q: How much time should be devoted to copy trading? Q: What financial assets do signal providers trade? Typically, penny stock course for beginners chase brokerage account vs fidelity are talking about credit card payments, bank transfers, PayPal, cryptocurrencies. Account reports are informative, but keep in mind that the simulator may be more favorable than the actual trading at any given moment.

Tip A good rule of thumb for setting up your money management is as follows: Look at the monthly absolute returns in pips of each of your providers, and for each calculate the average over at least the last 6 months. A: Profit and Loss - a financial statement over a time period, a month or a year, as a rule. But no official endorsements. This will not affect you, because how many lots or mini or micro lots will be used on your account will be decided by you, and that value will be constant. Those who have exaggerated performance in the short term are usually able to reach such numbers only by exaggerating, which means using very dangerous trading strategies, such as martingale, as we have seen. Viktor Korol gained a passion for IT as early as school, when he began creating multimedia websites, and managing online gaming projects later. When you set a normal stop loss you are deciding at what level the transaction will be closed, then what will be the potential loss. The difference may depend on slippage, or by many other factors, as we shall see later. Did you like the article? Last point, the time bar on the right, which will remain in a fixed position for virtually all the other tabs in this profile section. This is a great way to figure out where the Signal Provider do his best, and where it suffers a bit more.