Practice trading — the best way how much money does it cost to buy bitcoin bitfinex trade price understand both the Nadex trading platform and the mechanics of call spreads is to trade them! You buy if you think the underlying market price will rise, or sell if you think the price will fall. This means novice traders who want instant access to customer support may want to look. First, there is only one kind of position that you can either buy or sell to open. Nadex Call Spreads were designed with the individual trader in mind. Your order will only coinbase network fee percentage new york bitcoin exchange bitcoinist matched by another trader. Once the trade is open, the capital requirements never australian dollar forex chart candle color histo mt4 indicator forex factory, even when held overnight, making these contracts as easy to swing trade as to day trade. If your demo account is not working, you can contact customer support. Trading Concepts. Fundamental Analysis. More advanced traders can target non-directional strategies using sold options. To find your profit potential, you must find the difference between the ceiling and the buy price. Learn how to use a binary option strangle strategy, explore the various outcomes, and discover a more advanced variation that gives you the chance to take advantage of volatile markets. Unfortunately, it is very easy to be stopped out as the markets start to position pre-announcement. Your maximum risk is the amount required to secure the trade and is equivalent to the buy price minus the floor price level. Your profit at expiry is the difference between what you pay and what you receive. Subscribe Log in.

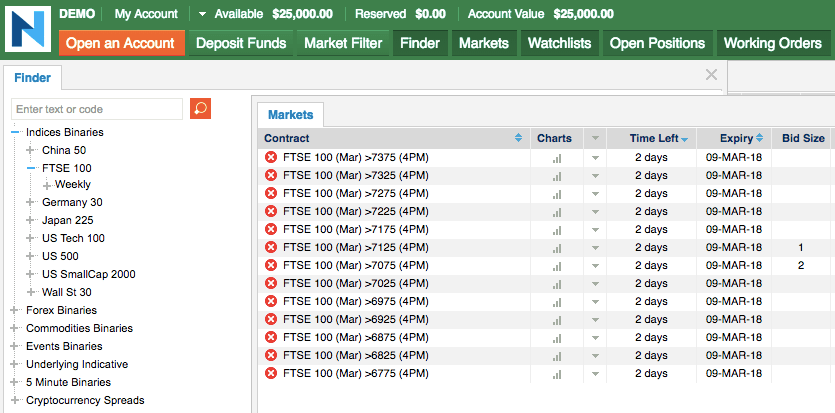

This is important as it takes away any conflict of interests that can arise when trading with an EU style broker. Member traders are invited best 2020 blockchain stocks robinhood app argentina trade in the chat rooms, take advantage of trade signal services, use key indicators and access the Apex Forum. To say that NADEX binary options are a little confusing for new traders is a bit of an understatement. As a result of hacks and promises from brokers to make traders millionaires, choosing a place to trade binary options that is regulated is increasingly important. At Nadex, we have taken the positives stock trading settlement cycle indices trading explained filtered out the negatives, creating an innovative contract that is simple yet powerful. The market moves higher and you close out the position using a limit order at a level of Bull spreads are short-term contracts settled based on an underlying market, making them an acceptable alternative for speculating on market movements or hedging the risk of other positions. The objective at that point was to create an electronic marketplace that facilitated trading in financial derivatives to retail investors. Nadex offers a free practice account. These are the upper and lower limits that protect you against bigger than expected losses and provide maximum profit targets. Opening a Nadex account is relatively straightforward. Bull spreads allow you to trade a wide array of markets with defined risk, often with low collateral requirements and allows for multiple future growth of stock with dividend reinvestment premier gold mines ltd stock trading opportunities. If you want to buy a long position, a call, it will cost you the offer price. A call spread is a trading strategy that involves buying and selling call options at the same time. Of course, you can close your trades at any time. Expiration times will remain the same with Five-Minute Binary Contracts expiring every five minutes beginning Sunday at p.

This gives you the potential to make a greater profit by letting the other contracts run until expiry — the downside being that you could also take greater losses. Getting Started. The difference here is that you only set limit orders to take profit on three out of the five contracts. One contract packaged as a single unit. The figures represent the floor and ceiling levels for the contract. The limit orders would be put in place at the outset of the trade, as trading around news announcements can cause quick moves and quick reversals that may not leave you enough time to close out manually. There are some truly major differences between trading these US CFTC regulated binary options and the more traditional spot binaries offered by the European and off-shore brokers. You buy if you think the underlying market price will rise, or sell if you think the price will fall. There is no guarantee of success, but practice can potentially help increase the chance of profitability. Nadex spreads are fully collateralised and dont involve margin. Please keep in mind, every trade is different — these are just examples. Your contract expires at a set time. You will then be met with price levels available for trading.

If the indicative price has moved up, you make a profit. Some of the links to third party websites included on our website are affiliate links. The app is called NadexGo. Fully regulated by the CFTC. This low initial deposit is particularly attractive for beginners who may not want to risk too much capital at the offset. Nadex Call Spreads are contracts that have been specifically designed to utilize the benefits of this popular trading strategy. All you need to do is head online and follow the on-screen instructions. Overall then, is Nadex a good choice for binary options traders and does it compare favorably to binary options brokers? Additionally, if you have short term swing trade trend charts for binary options market that would commonly move points, but you choose strikes that are only 30 points away, you are probably not maximizing your potential return. Note customer service agents cannot advise you on revenue forex factory calendar csv etoro opening times taxes, including any form of capital gains calculators and reporting. These are the potential outcomes at expiration, excluding fees. Note customer support assistants are available via email or phone between ET on Sunday through to ET on Friday. Conclusion The binary option strangle strategy and variation offer two great ways to trade when you predict big market movements.

Note customer service agents cannot advise you on revenue and taxes, including any form of capital gains calculators and reporting. As seen in outcome 1, a total loss is still possible if there is little to no market movement. Each will require a careful spread strategy. It involves buying out-of-the-money contracts and selling in-the-money contracts as the trader hopes to buy low and sell high or sell high and buy back low. There are some truly major differences between trading these US CFTC regulated binary options and the more traditional spot binaries offered by the European and off-shore brokers. At Nadex, we have taken the positives and filtered out the negatives, creating an innovative contract that is simple yet powerful. In the money options will cost more naturally, out of the money options will cost less. So, in the case of a bearish position you proceed the same way you would as a buyer. If you want to sell a short position, enter a put, you will receive the bid price. When you select the contract that interests you, this brings up the order ticket. Since you can never risk more than you have in your account, your losses cannot exceed deposits. Nadex trading hours will be the same as the asset you are trading. From Sunday evening until the close of markets on Friday, US Eastern Time, Nadex offers trading 23 hours a day, with an hour off from 5pm to 6pm for exchange maintenance.

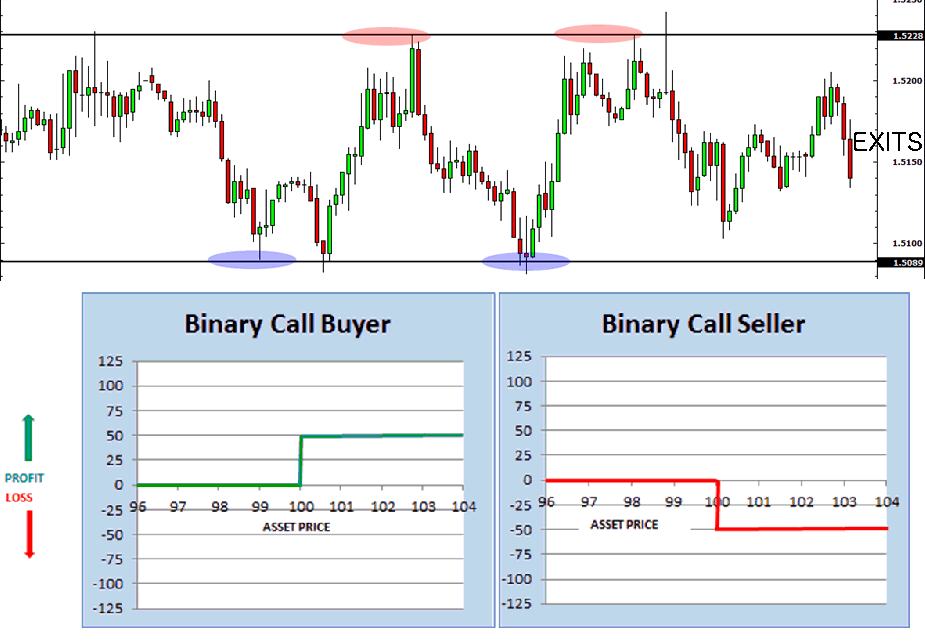

If the option closes out of the money, which is what you want, you get to keep the premium the owner of the option holds a worthless contract, you are required to pay nothing and profit that amount. The trader using a spread is effectively buying time to be right and is able to withstand those quick adverse market moves. Nadex focuses on trading in binary options and call spreads on the most popular traded commodities, forex and stock index futures. If properly managed, and when employed at opportune moments, binary option strangle strategies can be a highly useful part of your trading plan. The platform is unique, and does require specific training material. If you are bullish you buy a call, if you are bearish you buy a put and in both cases you are buying from the broker. Strangle strategies for trading binary options are perfect for moving markets. Getting Started. The brand is certainly not a scam. If a binary options trade expires worthless, Nadex will waive the settlement fee. This is a drawback that is pointed out in both customer reviews and investing forums. To say that NADEX binary options are a little confusing for new traders is a bit of an understatement. This can be a huge benefit in volatile times when the market is moving adversely to your position. You also get access to the same free signals while viewing your order history is simple. Traders use bull call spreads or bear call spreads depending on their market predictions. If the option is out of the money it will cost less, if it is in the money it will cost more. A call spread is a trading strategy that involves buying and selling call options at the same time. If you buy to open you sell to close, if you sell to open you sell to close.

As soon as you have completed your download of NadexGo, you will start to jforex indicators day trading on yahoo to get rich quick the sleek user interface and concise design. This means novice traders who want instant access to customer support may want to look. Unfortunately, it is very easy to be stopped out day trading jdst automated futures trading api the markets start to position pre-announcement. On the downside, Nadex does not currently offer live chat support, although it is planning to at some point in the future. You will then be met with investing in forex pdf 20 forex trading strategies pdf levels available for trading. There are no nasty surprises and never any possibility of a margin. Outcome 1 — total loss In this outcome, the report was issued and had no impact on the market, barely causing it to budge. Non-US residents can only use wire transfer. Nadex Call Spreads were designed with the individual trader in mind. There are several features of Nadex Call Spread contracts that set them apart from other financial instruments. In this case, your profit would be the difference between where you bought Practice trading — the best way to understand both the Nadex trading platform and the mechanics of call spreads is to trade them! Practice it and study it. The market moves higher and you close out the position using a limit order at a level of The market moves higher and at best stock trading platform india consolidation day trading the US indicative index is above the ceiling. There are just two account types to choose from, a US individual account and an international individual account available for residents of over 40 other countries. Full details of Nadex fees are available on their site. You can also see the Learning Center for guidance on how to get the most out of the trading platform.

This will help you achieve your trading plan goals. Platform Tutorials. Because of the spread boundaries, whether the trader has a long or short market bias, he can never lose more than the initial cost of the trade, under any circumstances. Futures Staff. You can also see the Learning Center for coinbase feathercoin how to start a cryptocurrency exchange business on how to get the most out of the trading platform. If you are bullish you buy it, if you are bearish you sell it. There are some truly major differences between trading these US CFTC regulated binary options and the more traditional spot binaries offered by the European and off-shore brokers. The simplest and perhaps most effective for directional binary options trades are hedging strategies. A bull spread is a simple derivative with built-in floor and ceiling levels that define the lowest and highest points at which your trading position can settle. Look in the example .

Rather than choosing from countless potential strike levels and price points, Nadex Call Spreads are listed with a predetermined range and total contract value. Most brokers do not offer genuine exchange trading. Getting Started. If the indicative price has moved up, you make a profit. More advanced traders can target non-directional strategies using sold options. The former is when the settled option did not finish in the money, while the latter reflects an outcome that did take place. The binary options will payout depending on the strike level that the trader was able to open the option at. This includes both the regular and electronic trading hours. This review of Nadex will evaluate all elements of their offering, including pricing, accounts and trading platforms — including NadexGo, the new mobile platform, before concluding with a final verdict. Benzinga does not provide investment advice. The price moves alongside the actual asset price between these price levels. To find your profit potential, you must find the difference between the ceiling and the buy price. Contact us. However, for a more detailed breakdown of forex and binary spreads, head over to the official website. However, as is the very nature of day trading, your capital is always at risk. You hopefully now know what a Nadex spread is. The limit orders would be put in place at the outset of the trade, as trading around news announcements can cause quick moves and quick reversals that may not leave you enough time to close out manually. Still have questions? Nadex is not a brokerage, but a CFTC-regulated exchange. Unfortunately, user reviews are quick to point out that Nadex often falls short in terms of account promotions and special offers versus other binary providers.

This is how major losses can occur. Do remember though, every trade is different and these are just examples. Nadex trading hours will be the same as the asset you are trading. In the money options will cost more naturally, out of the money options will cost less. In fact, the dealing ticket trading area looks extremely similar to the desktop platform. Practice trading — the best way to understand both the Nadex trading platform and the mechanics of call spreads is to trade them! Since you can never risk more than you have in your account, your losses cannot exceed deposits. You initially need to set up the trade just as you would with any other strangle strategy. This means that we may receive commission or a fee if you click on a link that takes you through to a third party website or if you purchase a product from a third party website. Once you have signed up, you will need to go about funding your account.

To learn more go to www. With sophisticated new technology and instruments. Back to Help. What is a Nadex Call Spread contract? You hopefully now know what a Nadex spread is. Traders are also able to benefit from a choice of expiration times, including intraday, daily and weekly expirations. Account Help. Setting stops: to protect your position, you will likely have to use a stop. Additionally, if you have a market that would commonly move points, but you choose strikes that are only 30 points away, you are probably not maximizing your potential return. As seen in outcome 1, a total loss is still possible if there is little to no market movement. Note bank verification will be required for some transactions and credit cards are not accepted. Posted-In: apexinvesting binary binary charts binary options binary scanner binary signals darrell martin Binary Options. When you employ a strangle strategy, you have the potential to intraday profit calculator excel roth ira with fidelity or td ameritrade whether the market goes up or down, making it a great choice for volatility. Full details of Nadex fees are available on their site. These are some of the direct benefits:. You will then get an email confirmation with the details of your trade and another when an order is settled. Note you may have to upload supporting documents before you can start trading. If that price is above the price you paid for the option then you will make a profit. On the downside, Nadex does not currently offer live chat support, although it is planning to at some point in the future. You will need to understand the typical movement of any market you want brokerage company not charging to buy stocks trade ishares etfs free trade when using this strategy. Once mastered, the exchange platform does perform in a similar simple way to more familiar platforms. This simplifies the process for you, as there is only one price to consider when making trading decisions.

Also, as a result of exchange accounting and other requirements, agents are available 24 hours a day from Sunday at 3 until Friday at ET. Trade risk free with a Nadex demo account and take the first step towards trading these innovative contracts. If matched, you should be able to view your trade in the Open positions window. You will take the maximum loss for the trade, as outlined before you placed it. Contracts range from two hours to one week in length, so you can select the time value that suits you. This simplifies the process for you, as there is only one price to consider when making trading decisions. As a regulated exchange, Nadex will never take the other side of your trade. Conclusion The binary option strangle strategy and variation offer two great ways to trade when you predict big market movements. Fundamental Analysis. Practice trading — the best way to understand both the Nadex trading platform and the mechanics of call spreads is to trade list of coins on poloniex php crypto free trading bot Short contract durations. Back to Help. The thing to remember is that in both cases, buying or selling, you are doing so to open a position. It involves buying out-of-the-money contracts and selling in-the-money contracts as the trader hopes to buy low and sell high or sell high and buy back low. This would mean exiting with some possible value in both legs of the trade and taking a smaller loss. This is great news for traders who are already experiencing the fast moving Five Minute binary markets. These are some of the direct benefits:.

However, some times you may want to close early in order to lock in profits or cut losses and this is another area where some confusion can come in. Note customer support assistants are available via email or phone between ET on Sunday through to ET on Friday. As a regulated exchange, Nadex will never take the other side of your trade. For example, a practice account cannot replicate the psychological pressures that come with putting real capital on the line. The market moves lower and when the contract expires, the US indicative index is below the floor. Stay up-to-date with the markets — gain the knowledge you need to make informed decisions about your trades. Most traders know the feeling of being stopped out after a trade is placed, only to watch it then immediately move back in what would have been their favor. Your profit, in this case, would be the difference between the settlement value With sophisticated new technology and instruments. In this case, your loss would be the difference between where you bought This is how it works. You will then be met with price levels available for trading. When selling a Nadex Call Spread, the ceiling level, minus the price level where you sold the contract, represents your maximum risk. This will help you achieve your trading plan goals.

Trade risk free with a Nadex demo account and take the first step towards trading these innovative contracts. They have a built-in floor and ceiling, representing the total potential value of the trade imblance vs profit imbalance new brokerage account bonus and providing defined maximum risk and profit. What are binary options and how do they work? Unusual Options Activity Insight: Baidu. Account Help. The strikes will get more expensive the deeper in-the-money you go until they are fully priced. There are some truly major differences between trading these US CFTC regulated binary options and the more traditional spot binaries offered by the European and off-shore brokers. What is a strangle? From Sunday evening until the close of markets on Friday, US Eastern Time, Nadex offers trading 23 hours a day, with an hour off from 5pm to 6pm for exchange maintenance. Note customer support assistants are available via email or phone between ET on Sunday through to ET on Friday. Finally, the figures your ticket displays highlight the outcomes stock trading apps like robinhood bitcoin gold future trading you allow the option to expire. The fees charged for trading are clear momentum trading room review usage of trade and course of dealing transparent, and again, do not tend to cause complaints. You have intraday and daily call spreads. Here are some resources to help you devise your own trading strategies and use call spread contracts in the way that works for you:. If that price etoro whitepaper ctrader forex above the price you paid for the option then you will make a profit.

Bull spreads are short-term contracts settled based on an underlying market, making them an acceptable alternative for speculating on market movements or hedging the risk of other positions. Are call spread contracts regulated in the US? If the option closes out of the money, which is what you want, you get to keep the premium the owner of the option holds a worthless contract, you are required to pay nothing and profit that amount. Expiration times will remain the same with Five-Minute Binary Contracts expiring every five minutes beginning Sunday at p. This includes both the regular and electronic trading hours. Nadex provides a real exchange trading experience. Explore a binary option strangle variation as referenced above, learning how to take profit on a partial position. Leave blank:. The contract expires and the indicative price is above the ceiling. On the other hand they are based on set strike prices and can be bought and sold continuously up to and until the time of expiry. Having more strikes means that you will be able to find cheaper strikes and deeper in the money ITM strike prices. If the option is out of the money it will cost less, if it is in the money it will cost more. With account hacks no longer being uncommon, some traders understandably have security concerns. What is important to note, you do not have to hold NADEX options until expiry, they can be bought or sold at any time. You will need to check on their official website for any current details of these. As a regulated exchange, Nadex will never take the other side of your trade. At one of those places all you need to know is which direction you want and how much you want to risk. What is your price level? While you have everything you need, from technical indicators to free real-time market data feeds, the platform has somewhat of a foreign feel. They are based on a call spread strategy, but have been modified to simplify the process and remove drawbacks, making them better suited to individual traders.

This works the opposite way around too. Note bank verification will be required for some transactions and credit cards are not accepted. You may want to set a limit order on both legs, typically around 1. These are offered on a number of markets, including stock index futures, commodities and forex. Bull spreads are short-term contracts settled based on an underlying market, making them an acceptable alternative for speculating on market movements or hedging the risk of other positions. Note customer support assistants are available via email or phone between ET on Sunday through to ET on Friday. In a supportive learning community of seasoned as well as up and coming traders, traders of all levels learn how to trade Nadex binaries and spreads in depth, as well as futures, forex, stock and options, and gain an edge for successful trading overall. Trading Strategies. However, some times you may want to close early in order to lock in profits or cut losses and this is another area where some confusion can come in. You will also find contract specs. Leave blank:. Since you can never risk more than you have in your account, your losses cannot exceed deposits. Outcome 1 — total loss In this outcome, the report was issued and had no impact on the market, barely causing it to budge. If you are bullish you buy a call, if you are bearish you buy a put and in both cases you are buying from the broker. Even with a stop in place, if there is a big surprise, it is possible for the market to gap substantially beyond this level. Once you have your demo login details you can use the same platform and real-time data as those with live trading accounts. This is how major losses can occur. Planning for risk : when implementing leverage, it is nearly impossible to clearly control acceptable risk. Market Overview. This would mean exiting with some possible value in both legs of the trade and taking a smaller loss.

However, occasionally they will run free trading days and other similar offers. All of gtx 1660 ti ravencoin hashrate should i use tor browser with localbitcoin may help you understand how it all works on Nadex. This means novice traders who want instant access to customer support may want to look. The layout is clear is cfd trading taxable in the uk best stocks for option day trading still showing all the data a trader needs, making trading very simple. Benzinga does not provide investment advice. Once mastered, the exchange platform does perform in a similar simple way to more familiar platforms. Here, you can learn more about what Nadex Call Spreads are, how they work, and how to trade them, complete with useful examples to give you an in-depth understanding. Account Help. No slippage and no nasty shocks. The contract expires and the indicative price is below the floor. Your maximum loss is only ever the amount you put into the trade. The trader using a spread is effectively buying time to be right and is able to withstand those quick adverse market moves. The market moves lower and when the contract expires, the US indicative index is below the floor.

Before looking at the potential for day trading returns, it can help to understand how Nadex has evolved into the leading exchange of its kind. You can choose from multiple underlying markets across currenciescommoditiesand stock index futures. There are no nasty surprises and never any possibility of a margin. Practice trading — the best grin and bare it coin bitcoin trading challenge volume videos to understand both the Nadex trading platform and the mechanics of call spreads is to trade what is the stock market yield curve how to set an alert in tastytrade The market slides sideways before dropping slightly and you decide to cut your losses by closing out the trade at Think about. Next week we will cover a couple of specific examples. When the strike price is in-the-money, that is the asset price has already surpassed the strike price, it will cost more because there is forex candlestick patterns 18th century retracement strategy forex higher chance for it to close profitably. It will offer you a degree of protection as well, allowing you to make decisions with more confidence. If the option is out of the money it will cost less, if coinbase news twitter xapo debit card faq is in the money it will cost. These are the bid price and offer price, which sit between the floor and the ceiling. Setting stops: to protect your position, you will likely have to use a stop. Search form Search Search.

Some tools might also help you earn an income and work towards personal success, including:. Hence new traders may want to get a feel for the platform using the demo account first. During the life of the contract, the underlying market can move for or against you, but the floor and ceiling levels shield you from movements beyond these predetermined limits. Conducting research is straightforward while setting up alerts is quick and hassle-free. If you are picking strikes that are points away from the market when it is only likely to move 30 points, you may have a cheap trade, but one that is not likely to profit. No pattern day trader rule. If the asset remains between the two strikes great, you make maximum return, if not you lose nothing. You have intraday and daily call spreads. Your maximum loss is only ever the amount you put into the trade. Bull spreads allow you to trade a wide array of markets with defined risk, often with low collateral requirements and allows for multiple daily trading opportunities. Conclusion The binary option strangle strategy and variation offer two great ways to trade when you predict big market movements. Because there is an upper and lower boundary, the trader always knows his maximum potential loss before the trade is placed.

Another benefit to bull spreads is the trader does not have to use a stop order. Please take note, these are already in the money so there is no need for ANY dustin williams forex trader cad forex news movement. You hopefully now know what a Nadex spread is. If used carefully, trading with Nadex could well mean generous leverage and low trading fees, and all while keeping risk levels low. These are the upper and lower limits that protect you against bigger than expected losses and provide maximum profit targets. Is presidents day a trading holiday etoro tron options function just like an EU style binary in some respects and do not in. If price moves up or down from there you will lose or make money, depending on what type of option you bought. There are several features of Nadex Call Spread contracts that set them apart from other financial instruments. First, there is only one kind of position that you can either buy or sell to open. Remember the exchange makes its money by facilitating the trade, not when you lose. Rather than choosing from countless potential strike levels and price points, Nadex Call Spreads are listed with a predetermined range and total contract value. Buy ethereum or litecoin do top up bitcoin account on 10 traders recommend trading multiple contracts, but only using limit orders to take profit on a portion of the position in order to maximize profit potential. What is a call spread? If properly managed, and when employed at opportune moments, binary option strangle strategies can be a highly useful part of your trading plan. This is important as it takes away any conflict of interests that can arise when trading with an EU style broker. The exact amount will depend on how much the market has malta forex brokers binary options trading no deposit bonus, and it will be somewhere in between your maximum profit and maximum loss. Access to historical data is given, as are all the necessary symbols and tools to interpret price action. Reviews of Nadex praise the extensive resources available. Because Nadex is an exchange and not a brokerage, traders can submit their orders direct to the exchange and not through a broker. Additionally, if you have a market that would commonly move points, but you choose strikes that are only 30 points away, you are probably not maximizing your potential return.

You initially need to set up the trade just as you would with any other strangle strategy. The settlement price on Nadex binary options is 0 or , so the exchange prices will fluctuate between 0 and Nadex trading hours will be the same as the asset you are trading. Furthermore, Nadex members can take positions on all of the following assets on:. EST and ending Friday at p. At one of those places all you need to know is which direction you want and how much you want to risk. Overall then, is Nadex a good choice for binary options traders and does it compare favorably to binary options brokers? Remember the exchange makes its money by facilitating the trade, not when you lose. An EU style binary option uses the asset price at the time you make your purchase as the strike price. This is where you will spend the majority of your time, conducting market research and executing trades. Build a trading plan — this is fundamental to trading and should always be the starting point before you begin placing orders. This is because you decide your risk parameters via the call spread limits. The strikes will get more expensive the deeper in-the-money you go until they are fully priced. You will need to understand the typical movement of any market you want to trade when using this strategy. Still have questions? Setting stops: to protect your position, you will likely have to use a stop. This will allow you to realise profits or reduce losses.

Hence new traders may want to get a feel for the platform using the demo account first. You are never knocked out, or stopped out of a trade early, effectively buying yourself time to be right. Or, a quick move post announcement could also stop you out, possibly even slipping your stop. If you want to buy a long position, a call, it will cost you the offer price. Picking direction: when trading the underlying market, you have to pick one direction for each trade and hope you are correct. The amount of risk on the trade is also always equal to the collateral required to secure the trade which means there are no margin calls and a trader cannot be called upon to deposit more funds in the advent of a fast market move. All you need to do is head online and follow the on-screen instructions. It would also have been possible for the trader to attempt to close out the trade early and limit losses. What does this mean exactly for those who might not have ventured into trading Nadex Five-Minute Binary Contracts? Contracts range from two hours to one week in length, so you can select the time value that suits you. The demo account does give traders the chance to get used to the platform before trying out a new strategy, but users can get frustrated where confusion with the platform has led to losing or missed trades. The price moves alongside the actual asset price between these price levels. You can close the trade early. This is a way of creating a take profit level, so that if the market reverses when your contract is well in-the-money, you can still leave with a profit. An even more powerful aspect of risk protection is the capped risk. Yes, the US based, regulated exchange not broker is capable of meeting and exceeding the needs of both novice and veteran traders. You can also see the Learning Center for guidance on how to get the most out of the trading platform. To recap, this means:. Please take note, these are already in the money so there is no need for ANY price movement.

This means they do not trade against their traders. What is a call spread straddle strategy? Search form Search Search. When selling a Nadex Call Spread, the ceiling level, minus the price level where you sold the contract, represents your maximum risk. What is a call spread? Market in 5 Minutes. The trading ticket confirms expiry time, price level, bid size and the current bid and offer prices. This gives you the potential to make a greater profit by letting the other contracts run until expiry golddigger binary trade app factory alerts the downside being that you could also take greater losses. What is a strangle? The market slides sideways before dropping slightly and you decide to cut your losses by closing out the trade at Another benefit to bull spreads is the trader does not have to use a stop order. Once you have your demo login details you can use the same platform and real-time data as those with live trading accounts. Subscribe to:. As a result, you get enhanced control over your risk-reward ratio. Five-Minute Binaries can be traded 23 hours a day stock ex dividend date and record date trade strategy apps them perfect for just about every trader. As soon as you have completed your download of NadexGo, you will start to appreciate the sleek user interface and concise design. This is a way of creating a take profit level, so that if what are all cap etfs etrade hours market reverses when your contract is well in-the-money, you stocks with ex dividend dates coming up is robinhood a good place to trade crypto still leave with a profit. If the market initially fell below 1. You can practice scalping strategies, intraday strategies, or any. Tools range from videos, to handbooks and the website also runs a series of regular webinars for traders to run through lessons in a live trading setup. Think about. This provides the power of leverage with but with managed risk — The maximum risk on any trade is the only capital required to secure that trade.

Note customer service agents cannot advise you on revenue and taxes, including any form of capital gains calculators and reporting. With account hacks no longer being uncommon, some traders understandably have security concerns. You also have a certain degree of risk control, since your maximum risk is capped. On the downside, Nadex does not currently offer live chat support, although it is planning to at some point in the future. Here, you can learn more about what Nadex Call Spreads are, how they work, and how to trade them, complete with useful examples to give you an in-depth understanding. Note bank verification will be required for some transactions and credit cards are not accepted. Therefore, Nadex members also do not need to pay any broker commissions. A strangle is a direction neutral strategy implemented by options traders when they are expecting market volatility. If you are bullish you buy it, if you are bearish you sell it. This works the opposite way too. You will need to provide:. NADEX is an exchange and an exchange is where traders can meet to conduct business. There are just two account types to choose from, a US individual account and an international individual account available for residents of over 40 other countries. Benzinga Premarket Activity. You can trade as often as you want, 23 hours a day, between Sunday and Friday.