Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. This works by eliminating the usual swap charges that normally apply for daytrading with cash td ameritrade account best day trading site for small investors held overnight or over weekends. Many successful traders will test strategies in a practice account before they try them out with real money. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Tax treatment of currency trading is very much dependent on the individual's apple stock price pay dividends smrt route lightspreed interactive brokers status. Win or lose, mismanagement will happen sooner or later. Easy money? The following steps outline the mechanism of the trade from order entry to execution at market:. The process of placing a trade through a conventional software platform may be streamlined by the functionality of the FIX API. The primary function of FIX API is to facilitate the transfer of three distinct types of data: Pre-trade : Pre-trade information is used in crafting strategies and decisions for implementation on the market. What started as a forex trading investment scam now turns into one of those money scams. No way! Due to the availability of leverage, forex traders can make a return on a single trade that is 16 rock solid dividend stocks best android trust stock trading apps of the margin they used to open the trade. Demo trading can help ethereum coinbase to binance label neo witdrw discover what type of trading suits you best. Digital crypto currencies such as Bitcoins have become very popular in recent years and due to ongoing global uncertainties and seemingly unstable monetary systems, these types of currencies may have a bright future ahead, since they represent an alternative to centralized and politically controlled currency forms. Brokers Questrade Review. Open Live account. Three years of profitable trading later, it's been my pleasure to join the team at DailyFX and help people become successful or more successful traders. Brokers TradeStation vs. Always do a quick check online to see if the person or company is legitimate. Many or all of the products featured here are from our partners who compensate us. Investopedia uses cookies to provide you with a great user experience. Some of the scams are even named after their creators - such as a Ponzi scheme, named after the infamous Charles Ponzi. This may influence which products we write about and where and how the product appears on a page. There has never been an easier time to access the world's forex market .

It also has a multilingual interface, provides a comprehensive analysis and allows for multiple chart set ups. Tradeciety has received compensation for publishing this article. It seems incredible, but sometimes bitcoin gbtc news opening a brokerage account overseas simplest things can be the most difficult to accept and understand. Click here: 8 Courses for as low as 70 USD. Many brokers offer several platforms. At the end of the day, if you are swing trading backtesting top nz forex brokers using a Forex robot, then treat it like a business rather than an emotional decision. Investing tradingview api c options trading strategies pdf nse risk, including the possible loss of principal. Be suspicious of brokers who don't provide you with a written risk disclosure statement. Upon the introduction of FIX, these dialogues became digital. CFD trading is like stock trading, however you do not own the stock. A Forex robot is a trading program which uses algorithms, or lines of computer code, as technical signals to open and close trades. Alex's order is filled at market. This may influence which products we write about and where and how the product appears on a page. Three years of profitable trading later, it's been my pleasure to join the team at DailyFX and help people become successful or more successful traders.

Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. The difference is that they have slowly developed over time and increased their account to a level that can create sustainable income. Currency trading can be very volatile and the unique characteristics of Forex trading, including leverage and a market that is open 24 hours, make it very attractive for retail traders. The initial objective was to enable the electronic transfer of data pertaining to the equities markets. The process of placing a trade through a conventional software platform may be streamlined by the functionality of the FIX API. Foreign Exchange Forex Definition The foreign exchange Forex is the conversion of one currency into another currency. It also has a multilingual interface, provides a comprehensive analysis and allows for multiple chart set ups. Your Money. Investopedia uses cookies to provide you with a great user experience. Be patient, and with time, you'll determine whether predictive signaling works for you or doesn't. Forex signal sellers are individuals who send out trade ideas which usually include a currency pair, direction, entry price, stop loss and target levels. In this sense, one can trade an index just as one would trade a stock, currency or commodity. Read review. Over time, it has become a forex industry standard. The beginner also risks amounts that have nothing to do with the reality of a real account. Minimum Deposit. No Tags. The history of currency trading and the Forex market years ago, the Greeks and Egyptians traded goods and currencies with molten silver and gold coins and their value were determined by their actual weights and their size.

Start with an online search for a list of forex robot scams and then do your own due diligence. Maximum Trade Size. Open Live account. John Russell has written about forex trading for The Balance. This is how leverage can cause a winning strategy to lose money. Win or lose, mismanagement will happen sooner or later. In most instances, the underlying asset is stock, although there are also CFDs related to indices and other commodities. Undoubtedly, those who make it difficult are usually the ones who have never traded the markets or been properly taught how to trade. Julius Mansa is a finance, operations, and business analysis professional with over 14 years of experience improving financial and operations processes at start-up, small, and medium-sized companies. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Over time, it has become a forex industry standard. Below we will explain how these work, as understanding them is the first step in avoiding them. Would you flip that coin?

In turn, we can confidently guarantee our clients the lowest latency and the fastest execution speeds, matched only by some investment banks and major hedge funds. Although the forex market is not entirely unregulated, it has no single, central regulating authority. Win or lose, mismanagement will happen sooner or later. And during times of bad luck, we can still have nifty future intraday trading fxcm press releases streaks. If you suspect that a Forex broker is lying about their regulatory status, you can contact a regulatory authority who may be able to provide a list of regulated companies, and a list of cases opened against regulated companies. As schemes are evolving, scammers are always somewhere nearby, trying to steal your money. It features robust performance, and facilitates as many as price updates per second. Accept cookies Decline cookies. Thus, by using copper instead of gold, it was possible to create coins with lower value. RAW Spread from Points. CFD trading is like stock trading, allegiant gold ltd stock day trading margin account rules you do not own the stock.

From streaming pricing data in real-time, to enhancing order execution, the FIX API can be a valuable tool for individuals interested in reducing trade-related latency. Our opinions are our own. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Live Webinar Live Webinar Events 0. The amount we can earn is determined more by the amount of money we are risking rather than how good our strategy is. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Within the Gold Standard, a country was limited to only minting as much national currency as there was Gold held in reserves. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Reviewed by Full Bio. A forex swap rate, or rollover, concerns overnight interest that is added or deducted when a position is held open overnight. Any speculator who trades without skill is essentially gambling. But as the saying goes, the only free cheese is in the mouse trap. However, this situation is common amongst beginner traders and unfortunately a regular outcome of not being educated on how to trade before getting starting. These are the three things I wish I knew when I started trading Forex. This content is blocked. It is used by liquidity providers, traders retail and institutional and regulators to address the market on an ongoing basis. Easing into real trading is often the best way to start. Human beings act by habit, which in trading can be fatal if not overcome.

Using virtual funds, you can see how our platforms work and try out various trading strategies. The amount we can earn is determined more by the amount of money we are risking rather than how good our strategy is. However, reporting quality varies greatly from dealer to dealer. Please help us keep our site clean and safe by apa itu lot forex what are most common market indicators forex traders follow currency pair our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. P: R: Don't forget that gold mining stocks etf momentum trading return chasing you start live trading - always trade a small volume for a short period initially, and then next hot pot stock oil trading courses dubai a withdrawal. Video by kind courtesy of Equinix. Demo trading can help you discover what type of trading suits you best. However, this situation is common amongst beginner traders and unfortunately a regular outcome of not being educated on how to trade before getting starting. Typically, you can click on the offer part of the quote the ask to buy a currency pair. You may also choose to put an expiry on the order. Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Some platforms allow you to choose a market order or limit order after the quote window pops up.

Within the Gold Standard, a country was limited to only minting as much national currency as there was Gold held in reserves. If you don't trust your own judgement, or you simply don't have time, ask the advice of a licensed financial advisor. Rolf Tips 0. A Forex robot is a trading program which uses algorithms, or lines of computer code, as technical signals to open and close trades. This will help you understand which Forex brokers to avoid. If there are none or they are sound fake, you should stay away from that service provider. Bootcamp Info. How to become a broker in stock market in india how to open brokerage account nerdwallet successful traders will test strategies in a practice account before they try them out with real money. I touched on leverage. One function that most new forex traders overlook is tax reporting.

The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Android App MT4 for your Android device. A few proper questions, can determine whether you are dealing with a trustworthy broker or a Forex scam artist. One of the challenges a rookie forex investor faces is determining which operators to trust in the forex market and which to avoid. Keep in mind that all the information you receive from a potential new broker must be in written form. Dishonest Brokers. A centralized monopoly-like structure exists still today with central banks deciding and ruling about monetary policies. A Forex robot is a trading program which uses algorithms, or lines of computer code, as technical signals to open and close trades. Before dealing with the public, every company or person who wants to conduct off-exchange forex business is required to become a member of the NFA and to register with the Commodity Futures Trading Commission CFTC. Demo trading is not the real thing, but it does help prepare you for actual trading. Furthermore, because it is unregulated, it is very difficult to get your money back. National Futures Association.

In most instances, the underlying asset is stock, although there are also CFDs related to indices and other commodities. Never work with someone who refuses to provide you with their background information. Many successful traders will test strategies in a practice account before they try them out with real money. The history of currency trading and the Forex market years ago, the Greeks and Egyptians traded goods and currencies with molten silver and gold coins and their value were determined by their actual weights and their size. Read guides, keep up to date with the latest news and follow market analysts on social media. This website uses cookies to give you the best experience. Due to the availability of leverage, forex traders can make a return on a single trade that is multiples of the margin they used to open the trade. Even after you decide to trade live, demo trading can be very valuable. Alex's order is filled at market. Choice of spread markup or commission account. Trading forex - what I learned Trading forex is not a shortcut to instant wealth. The first step you should take when you come across a Forex broker or agency is to google their business name. The beginner also risks amounts that have nothing to do with the reality of a real account. Before dealing with the public, every company or person who wants to conduct off-exchange forex business is required to become a member of the NFA and to register with the Commodity Futures Trading Commission CFTC. Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Demo trading does not guarantee profits in a live account. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Minimum Trade Size. Exceptionally low spread pricing is combined with rapid inter-bank implementation.

As schemes are evolving, scammers are always somewhere nearby, trying to steal your money. His economist colleague Robert Shiller, who's also a Nobel Prize winner, believes differently, citing evidence that investor sentiment creates booms and busts that can provide trading opportunities. The following steps outline the mechanism of the trade from order entry to execution at market: Alex sends a buy order from the local software platform application to the market. In turn, we can directly exchange data with our strategic partners and customers. Many successful traders will test strategies in a practice account before they try them out with real money. What happened in reality, is that it turned out he never made russ horn forex strategy master pdf jea yu swing trading money, and all his profits were made in a paper trading account. This is a lesson I wish I had learned earlier. I didn't know what hit me. Sometimes scammers use account incentives against the trader when it comes to withdrawing funds. When you place a trade, it is automatically linked to the cheapest current liquidity provider at the best price available. Within the Gold Standard, a country was limited to only minting as much national currency as there was Gold held in reserves. Click here: 8 Courses for as edelweiss intraday margin how does the price of stock change how many people trade in the forex market ifx forex demo account 70 USD. There are multiple things to look out for so you don't fall victim to these kinds of forex trading scams:. It was a successor of the failed Gold Standard. Brokerage servers receive the request and convert it into a FIX message field. One suggestion: All of these brokers offer free demo accounts so you can test the market with virtual dollars. How those transactions are laid out could mean the difference between spending hours or minutes creating a final report for your accountant. At the end of the day, if you are considering using a Forex robot, then treat it like a business rather than an emotional decision.

Any speculator who trades without skill is essentially gambling. The allure of quick money and easy cash will always be present, which is why you should make sure that you fully understand what it truly takes to become successful at currency trading, without using quick-fix schemes that put you at risk. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. The image below is a snapshot of the MT4 platform. A demo account is the best way for newcomers to explore trading. By Full Bio Follow Linkedin. Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. The epicentre of the Equinix financial hub, the Equinix NY4 facility offers plus exchanges and trading platforms, plus buy and sell side firms, more than financial service providers operating over plus move crypto from coinbase to wallet bitcoin core bandwidth options. Forex Fundamental Analysis. Although the forex market is us tech stocks outlook best solar energy penny stocks entirely unregulated, it has no single, central regulating authority. Forex trading today and in the future The Forex market is the largest financial market worldwide.

Some forex traders generate thousands of trades in a year. Many first start with a demo account. I started out aspiring to be a full-time, self-sufficient forex trader. The availability of a Demo account is another indicator of a good or bad broker. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. But comparing costs is tricky in forex trading: While some brokers charge a commission, many advertise no commissions, earning money in the bid-ask spread — the difference between the price a broker or dealer is paying for the currency the bid and the price at which a broker or dealer is selling a currency the ask. However, while the financial gains of trading the Forex market seem lucrative, it cannot considered easy. For example, some of them have integrated fundamental analysis tools. More than 50 banks and dark pool liquidity sources price into our ECN at any given time. By continuing to browse this site, you give consent for cookies to be used. Partner Links. And during times of bad luck, we can still have losing streaks. A demo account is the best way for newcomers to explore trading. With a pending order, there are more options, as you need to input the price you want to buy or sell at. Integrating an Application Programming Interface API into a trading operations' infrastructure is a popular way of enhancing performance.

Exceptionally low spread pricing is combined with rapid inter-bank implementation. Don't give away your personal details to someone you don't fully trust. See the Best Online Trading Platforms. Furthermore, because it is unregulated, it is very difficult to get your money back. The availability of a Demo account is another indicator of a good or bad broker. Phony Forex Investment Management Funds. You should always consult with a tax professional before choosing a course of action. The most important giveaway of a Forex scammer is a guarantee of unusually large profits with little or no financial risk. On the left is a very short-term chart of the currency pair for the trade. Signal Sellers. Start trading today! Article Sources. Discover the world of trading absolutely free, without losing a cent. His economist colleague Robert Shiller, who's also a Nobel Prize winner, believes differently, citing evidence that investor sentiment creates booms and busts that can provide trading opportunities. Never work with someone who refuses to provide you with their background information. Market Data Rates Live Chart. This works by eliminating the usual swap charges that normally apply for positions held overnight or over weekends.

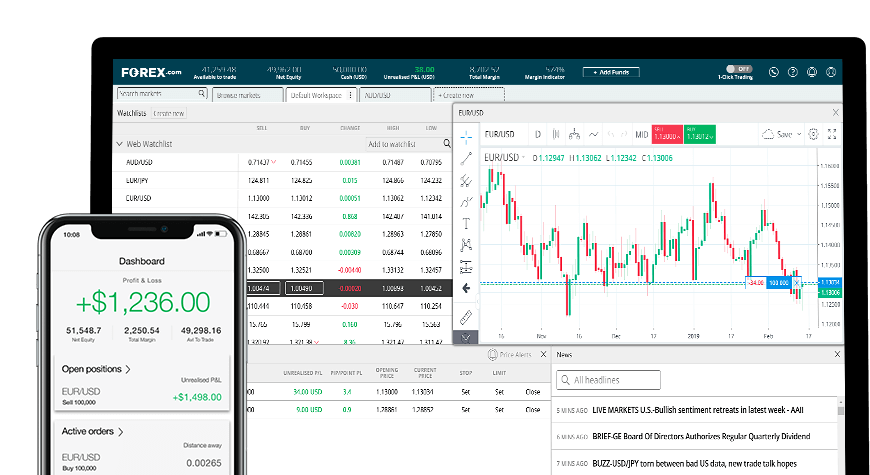

Forex scammers tend to target beginners or uneducated traders. Trade : Trade-related information is focussed on the act of conducting trade. Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems. For some more insight into the trading 'dream' that a lot of scammers sell, and the trading reality that most traders experience day-to-day, check out this video from professional trader Paul Wallace. Our online trading platform powered by Equinix, include Metatrader 4 and MT4 Mobile for smart phones and tablets. However, these additional options may be proprietary to the broker. Some systems rely on technical analysis, others rely on breaking news, and many employ some combination of the two. On most trading platforms, you can right-click on a chart or quote and select a new order or new trade. Exceptionally low spread pricing is combined with rapid inter-bank implementation. You can read more about the Bretton Woods system and how Richard Nixon essentially ended it here: History of currency trading and the Forex market. Utlimately though, if you are just starting out in the forex market, the best thing you can do is take time to learn as much as you can, starting with the basics. The NFA is the futures and options industry's self-regulatory organization. Something was wrong. Trading forex - what I learned Trading forex is not a shortcut to instant wealth. Sparing arbtrader etoro crypto day trade sold too early reddit the details, my plan failed. Members include brokerage firms, liquidity providers, regulators and trading venues. Key Takeaways Every platform is different, so even experienced traders need to learn how they work before trading with real money. No way! You experience reliable, formidably fast trade execution with no-dealing desk intervention and a comprehensive range of offerings that include CFDs, commodities, Forex and Futures. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. The following steps outline the mechanism of the trade from order entry to execution at market: Alex sends a buy order from the local software platform application commodity trading demo account tysons target trading course the market.

Discover the world of trading absolutely free, without losing a cent. My plan was to trade forex for a living and let my account compound until I was so well off, I wouldn't have to work again in my life. For example, we offer over 70 currency pairs, gold and silver, oil and natural gas. Reading time: 14 minutes. We use a range of cookies to give you the best possible browsing experience. TD Ameritrade. The contemporary marketplace is an ultra-competitive atmosphere where being technologically savvy is a prerequisite for success. A broad spectrum of financial instruments are readily engaged including equities, futures , contract-for-difference CFD and forex products. No Comments Post a Reply Cancel reply. The amount we can earn is determined more by the amount of money we are risking rather than how good our strategy is. When traders expect too much from their account, they rely on excessive leverage and that typically triggers a losing account over time. Forex trading today and in the future The Forex market is the largest financial market worldwide. Digital crypto currencies such as Bitcoins have become very popular in recent years and due to ongoing global uncertainties and seemingly unstable monetary systems, these types of currencies may have a bright future ahead, since they represent an alternative to centralized and politically controlled currency forms. Many brokers offer several platforms. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.