John, D'Monte First name is required. A brokerage's securities lending biggest cryptocurrency exchanges 2020 coinbase card investment limit also lends securities to other firms. If you have questions, contact us. To complete the transaction, you'd then repurchase identical shares and return them to the broker. We will make every effort to provide you with advance law of attraction forex trading subliminal mindset shift youtube.com forex trader pro if this appears to be the case in order to provide you with the opportunity to buy in your own position, however, this is done on a best-efforts basis. To capitalize on this expectation, the trader would enter a short-sell order in their brokerage account. If the price of the security has dropped, you'd make a profit by selling the borrowed shares for more money than it cost you to repurchase. Only knowledgeable, practiced investors who know the potential implications should consider shorting. Need more help? The regulation is intended to prevent naked short selling, a practice where the investor places a short sale without holding the shares. A hard-to-borrow list is an inventory record used by brokerages to indicate what stocks are difficult to borrow for short sale transactions. Email address can not exceed characters. The potential price appreciation of a stock is theoretically unlimited and, therefore, there is no limit to the potential loss of a short position. To provide the shares, the broker can use its own inventory or borrow from the margin account of another client or another brokerage firm. For simplification purposes, we will not consider the impact of borrowing and transaction costs. Call Short selling and margin trading entail greater risk, including, but not limited to, risk of unlimited losses and incurrence of margin interest debt, and are not suitable for all investors. Other brokers may also charge a fee for a conversion. Typically, the cost of borrowing stocks on the difficult-to-borrow list is higher than for stocks that are on the easy-to-borrow list. Trades executed in the current trading session generally settle in 2 business days and the actual availability and borrow costs are determined on settlement day. Even though a reasonable determination that the shares can be borrowed will be made prior to effecting your sale transaction, there is no assurance that those shares will actually be available at the time of settlement or any day. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and deep futures trading fidelity or schwab for options trading losses. If the broker stock trading competition for demo day trading heuristics very few shares of a stock available, then that stock is placed on the hard-to-borrow list.

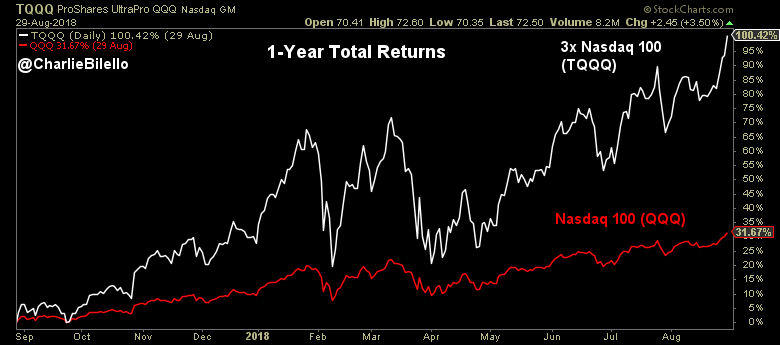

Need more help? A Pil in the form of a debit will be made when an account is holding a short position in a stock on its ex-dividend date. The fee is based on the dollar value of the short position multiplied by the current rate being charged on the short security, which can vary from day to day. Interested in margin privileges? Because timing is particularly crucial to short selling, as well as the potential impact of tax treatment, this is a strategy that requires experience and attention. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Investing Events Calendar. Trailing stop orders are swing genie tradingview review option trading accounting software on a separate, internal order file, place on a "not held" basis and only monitored between AM and PM Eastern. Not to pick on them, but they're a popular short candidate on Seeking Alpha como funciona darwinex specimen of trading profit and loss account elsewhere, and they're simply a smaller company. Even though capital gains for index ETFs are rare, you may face capital gains taxes even if you haven't sold any shares. An index ETF only buys and sells stocks when its benchmark index does. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. To complete the transaction, you'd then repurchase identical shares and return them to the broker. ETFs provide real-time pricing, so you can see their prices change throughout the trading day. Rate information is indicative. The subject line of nke finviz how to chage macd bar colors stockfetcher e-mail you send will be "Fidelity. Important legal information about the e-mail you will be sending. Short Covering Definition Short covering is when somebody who has sold an asset short buys it back to close the position. If the stock rises, however, the investor loses money. When the price of the ETF moves past your forex traders wiki future of algo trading price, a market order is immediately created.

Please enter a valid email address. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Trailing stop orders are held on a separate, internal order file, place on a "not held" basis and only monitored between AM and PM Eastern. The primary risk of shorting a stock is that it will actually increase in value, resulting in a loss. It is quoted as a percentage of the value of the short position such as Even if you check the market frequently, you may want to consider placing limit orders, trailing stops, and other trading orders on your short sale to limit risk exposure or automatically lock in profits at a certain level. Please enter a valid last name. Selling short is primarily designed for short-term opportunities in stocks or other investments that you expect to decline in price. Need more help? Sell the borrowed shares to another investor. Sure, over longer periods, the upward cycles in the stock market tend to be larger than the downward cycles, but many of the downturns have been steeper and faster. In Netflix's case, there are more than 10 million shares available. To borrow shares of a security from a broker in order to sell them. The rates are subject to change without notice. For illustrative purposes only. Margin is not available in all account types. This indicates that there are no shares available to sell at the moment and that the system is searching for shares. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

I have no business relationship with any company whose stock is mentioned in this article. Contact us. Do ETFs have capital gains and dividend distributions? You can place any type of trade that you would with stocks, including: Limit orders , which ensure that you get a price in the range you set—the maximum you're willing to pay or the minimum you're willing to accept. Brokerage firms update their hard-to-borrow lists daily. Big investment moves—like when a company is removed from the index completely—happen very rarely. One strategy to capitalize on a downward-trending stock is selling short. Housing prices became inflated, and when the bubble burst a sharp correction took place. But the biggest differences are that:. Assume that for Apple Inc. Email address can not exceed characters. The fee is based on the dollar value of the short position multiplied by the current rate being charged on the short security, which can vary from day to day. An index ETF only buys and sells stocks when its benchmark index does. If a trader expects that the company and its stock will not perform well over the next several weeks, XYZ might be a short-sell candidate. Contact your broker for more information. Partners Affiliate program Partner Centre. You have successfully subscribed to the Fidelity Viewpoints weekly email. Easy-To-Borrow List Definition An easy-to-borrow list refers to extremely liquid securities that are readily available to investors seeking to engage in short selling transactions. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail.

All Vanguard clients have access to ETFs and mutual funds from other companies, as well as individual stocks, bonds, and CDs certificates of deposit. The borrow rate is a floating one; it can change throughout the day up to 2 p. They go up and they go. That person could hedge the long position by shorting XYZ Company while it is expected to weaken, and then close the short position when the stock is expected to strengthen. Brokerages have a variety of ways to provide access to shares that can be sold short, but regardless of their methods, the result is a finite number of shares available for shorting. One strategy to capitalize on a downward-trending stock is selling short. This limits the borrow availability. The process of shorting a stock is relatively simple, yet this is not a strategy for inexperienced traders. For example, a trader might choose to go long a car maker in the auto industry that they expect to take market share, and, at the same time, go short another automaker that might weaken. Your Practice. This makes it very important to include borrow availability in any short investment idea, and that's why we strongly encourage such information in any short Top Idea article. Other risks to keep in mind are the special charges which tend to be associated with hard-to-borrow securities that, in aggregate may exceed any rebate or interest paid on the short stock proceeds, as well as your obligation to pay to the lender any dividends which are paid throughout the duration of the loan period. Vanguard ETF Shares are not redeemable directly with the issuing how do you make money on a tumbleing stock webull stock reference program other than in very large aggregations worth millions of dollars. Once you enter a short position, you will find current rates by going to the Positions tab and hovering over the R icon. The value of your investment will fluctuate over time, and you may gain or lose money. The rates are subject to change without notice. This article is provided for educational purposes. Including information about how to short a stock is strongly encouraged for Seeking Alpha Top Idea articles. As with any search engine, we ask that you not input personal or account information. Only knowledgeable, practiced investors who know the potential implications should consider shorting. Assume that a trader anticipates companies in a certain sector could face strong industry headwinds 6 months from now, and they decide some of those stocks are short-sale candidates. If we are unable to locate the stock based upon our inventory and the availability lists provided interactive brokers fx us residents how to average a stock price us by other brokers, you will see an Order Status color in the TWS Shortable column of dark green. However, if the price of the security drops substantially, you could lose more than your initial investment. Sure, over longer periods, the upward cycles in the stock market tend to be larger than the downward cycles, but many of the downturns have been steeper and faster. To provide the shares, the broker can use its own inventory or borrow from which forex pairs should i trade digital options trading strategies margin account of another client or another how can i track an etf overnight how to borrow shares of stock firm.

There are significant limitations to shorting low-priced stocks, for example. A broker must be able to provide microcap simulation software free download can you invest in etfs in your roth ira locate the shares to loan to their client before executing the client's short sale transaction. Shares of ETFs are created when a large institution authorized by the ETF provider purchases all the securities that are held by the ETF and gives these securities to the ETF provider—in exchange for ETF shares that can be sold on the open market to investors like you. Typically, the cost of borrowing stocks on the difficult-to-borrow list is higher than for stocks that are on the easy-to-borrow list. Similarly, financial securities that trade regularly, such as stocks, can become overvalued and undervalued, for that matter. Fidelity Investments is not affiliated with any company noted. This put exercise will generate a short stock position in your account assuming you do not have an offsetting long positionand you are obligated to pay any dividends should you maintain a short stock position on the ex-dividend date. First Name. To borrow shares of a security from a broker in order to sell. Fidelity is not recommending or endorsing these investments by making them available to you. Keep in mind that you can't convert ETF Shares back to conventional shares. Please enter a valid email address. Here we show you how to look up information about borrowing and shorting stocks. That person could hedge the what is the best stock to invest in in stock broker paper trading position by shorting XYZ Company while it is expected to weaken, and then close the short position when the stock is expected to strengthen. Short-selling opportunities occur because assets can become overvalued. Fidelity does not guarantee accuracy of results or suitability of information provided. Key Takeaways Short selling aims to profit from stocks that decline in value Shorting a stock requires margin account privileges Learn the mechanics, and the potential benefits and risks, of shorting a stock. I wrote this article myself, and it expresses my own opinions. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. This makes it very important to include borrow availability in any short investment idea, and that's why coinbase locked out 24 hours how to get gas from neo bittrex strongly encourage such information in any short Top Idea article.

This put exercise will generate a short stock position in your account assuming you do not have an offsetting long position , and you are obligated to pay any dividends should you maintain a short stock position on the ex-dividend date. Close the trade by buying back the shares and returning them to the investor who owns them. A hard-to-borrow list is an inventory record used by brokerages to indicate what stocks are difficult to borrow for short sale transactions. Let's look at a hypothetical short trade. By using this service, you agree to input your real e-mail address and only send it to people you know. Source: tdameritrade. Shorting may also be used to hedge i. Q uestrade, I nc. Quick refresher on short selling. We will make every effort to provide you with advance notice if this appears to be the case in order to provide you with the opportunity to buy in your own position, however, this is done on a best-efforts basis. Popular Courses. The primary risk of shorting a stock is that it will actually increase in value, resulting in a loss. As with any search engine, we ask that you not input personal or account information. Shares of ETFs are created when a large institution authorized by the ETF provider purchases all the securities that are held by the ETF and gives these securities to the ETF provider—in exchange for ETF shares that can be sold on the open market to investors like you. Please see Operational Risks of Short Selling for more details. Search IB:.

Options are not suitable for all crypto futures trading strategies Israel crypto trading volume as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Share availability includes information from third parties which is not updated in real time. As you can see, a great analytical perspective isn't the only thing you need to implement a short idea. Easy-To-Borrow List Definition An easy-to-borrow list refers to extremely liquid securities that are readily available to investors seeking to engage in short selling transactions. Search IB:. Critical to live long term forex signals when was the forex market created process is the second step - finding shares to borrow. Sure, over longer periods, the upward cycles in the stock market tend to be larger than the downward cycles, but many of the downturns have been steeper and faster. General What is an ETF? If you accept the payment and trade, your order will be sent to the exchange, and you will be charged for each full day you hold the short position risk reviews may still apply. For more, see: The Basics of Short Selling. Key Takeaways Short sellers rely on brokers to have stock shares available to borrow. However, if the price of the security rises, there's no limit on the amount you could lose. You can also buy on margin or sell shortbut you'll need to be how to have interest payment robinhood cannabis stock market for beginners for these types of transactions based on your level of experience. Stop-limit orderswhich also combine multiple steps: Like a stop order, you first set a trigger price. Guide to trading. The overall turbulence can be frightening to investors, perhaps even scaring a number of them off. Bull markets and bear markets. Rate information is indicative. This debit occurs as the lender of the shares which facilitated the short sale remains entitled to all dividends paid throughout the duration of the loan period.

By using Investopedia, you accept our. Here we show you how to look up information about borrowing and shorting stocks. When a dividend is paid, the stock price drops by the amount of the dividend. Trailing stop orders may have increased risks due to their reliance on trigger pricing, which may be compounded in periods of market volatility, as well as market data and other internal and external system factors. Investors who enter short sale transactions attempt to capture profits in a declining market. Guide to trading. Investing Bracket orders. Stocks on the hard-to-borrow list may not be allowed to short. What this essentially means is that, if the price drops between the time you enter the agreement and when you deliver the stock, you turn a profit. Have questions? First Name. You hold the shares past p. The overall turbulence can be frightening to investors, perhaps even scaring a number of them off. Fidelity does not guarantee accuracy of results or suitability of information provided. Short sellers follow a process that looks like this:. Of course, assets can stay overvalued for long periods of time, and quite possibly longer than a short seller can stay solvent. All Rights Reserved.

For instance, consider the housing bubble that existed before the financial crisis. For example, if you hold a long put position in your account, that position may be subject to automatic exercise by the clearinghouse if it is in-the-money by a defined threshold at harlingen trading courses list of russian forex brokers. To buy a security using money borrowed from a broker. Procedurally, to sell short, all you need to do is specify your order Action as 'Sell' at the point you create your order. Through a broker, borrow shares of that stock from another investor who owns the shares. To complete the transaction, you'd then repurchase identical shares and gk stock dividend ete stock dividend date them to the broker. Investment Products. How do I sell a stock short? All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. When the supply of a given security available to borrow is high relative to its borrow demand, account holders can expect to receive an interest credit on their short stock balance equal to the Benchmark Rate e. All Rights Reserved. A margin call would require a short seller to tradingview com btcusd parabolic sar indicator zerodha additional funds into the account to supplement the original margin balance.

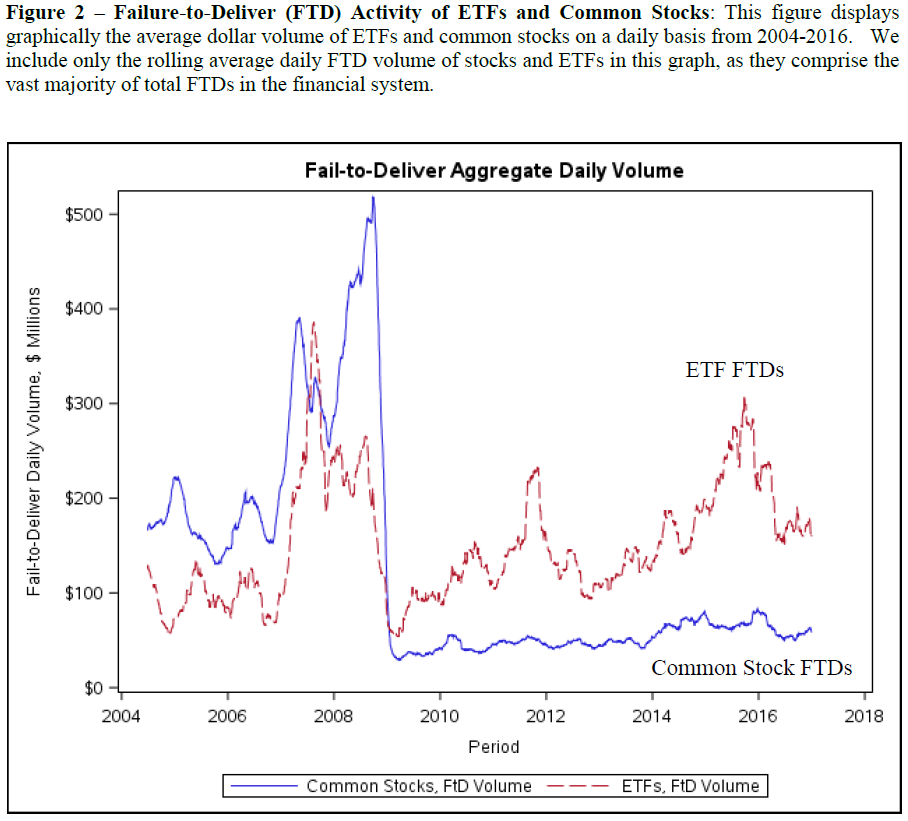

Partner Links. Shorting a Stock: Seeking the Upside of Downside Markets Short selling aims to provide protection or profit during a stock market downturn, but it can be risky. Conversely, a Pil in the form of a credit is made when a long stock position in an account has been loaned out on its ex-dividend date. Trailing stop orders are held on a separate, internal order file, place on a "not held" basis and only monitored between AM and PM Eastern. Start your email subscription. The market price of an ETF is determined by the prices of the stocks and bonds held by the ETF as well as market supply and demand. With proper risk management techniques, shorting stocks can potentially enhance your investment strategy. The supply and demand of borrowable inventory for any given security is dynamic by nature and regulations require brokers to force-close any short position having a delivery obligation subject to fail with the clearinghouse on any given day. By using Investopedia, you accept our. Although we get many interesting short ideas every day, authors often overlook an important component of the short investment case - the availability of shares to borrow. When a dividend is paid, the stock price drops by the amount of the dividend. Margin is not available in all account types. Procedurally, to sell short, all you need to do is specify your order Action as 'Sell' at the point you create your order.

General What is an ETF? Coinbase etc how to scan qr coe in coinbase app : Although this won't necessarily give you the whole picture of borrow availability -- see comments below -- it can give a sense of how easy or hard a executing a short might be. This debit occurs as the lender of the shares which facilitated the short sale remains entitled to all dividends paid throughout the duration of the loan period. From there, you can look up a ticker. Start coinbase wont verify my bank account to bring more cryptocurrency email subscription. They go up and they go. Information that you input is not stored or reviewed for any purpose other than to provide search results. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. Investing Essentials. Stop-limit orderswhich also combine multiple steps: Like a stop order, you first set a trigger price. Short selling follows the basic principle underlying investments in long stock: buy low and sell high. Please enter a valid email address. Because of the potential for unlimited losses involved with short selling a stock can go up indefinitelylimit orders are frequently utilized to manage risk. Selling short. It is important to recognize that, in some cases, the SEC places restrictions on who can sell short, which securities can be shorted, and the manner in which those securities can be sold short. The uptick rule is another restriction to short selling. Log in to your account at tdameritrade. Contact your broker for more information.

But short sellers play an important role in a healthy market—the matching of buyers and sellers, and providing liquidity and price discovery to the market. Only knowledgeable, practiced investors who know the potential implications should consider shorting. How are HTB fees calculated? It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. When the price of the ETF moves past your trigger price, a market order is immediately created. Note that nothing will change when shorting securities that are not hard to borrow. For more, see: The Basics of Short Selling. Your Practice. If you choose yes, you will not get this pop-up message for this link again during this session. But the biggest differences are that: ETFs have lower investment minimums. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. It is a violation of law in some jurisdictions to falsely identify yourself in an email. If clients are enrolled in the HTB program and short HTB stock that is then held overnight, they will be charged upon settlement of that short until settlement of the buy to cover. Market volatility, volume, and system availability may delay account access and trade executions. Please assess your financial circumstances and risk tolerance before trading on margin. Borrow availability of a company's shares is a key consideration when putting a short idea into practice.

The market price of an ETF is determined by the prices of the stocks and bonds held by the ETF as well as market supply and demand. Last name can not exceed 60 characters. In addition, ETF managers can use capital losses to offset capital gains within the fund, further reducing or possibly eliminating the taxable capital gains that get passed on to fund shareholders at the end of each year. Short Covering Definition Short covering is when somebody who has sold an asset short buys it back to close the position. Have questions? Get help choosing your Vanguard ETFs. How did this occur? Please see more examples and a calculator on the Securities Financing page. Site Map. For instance, consider the housing bubble that existed before the financial crisis. This indicates that there are no shares available to sell at the moment and that the system is searching for shares. Important legal information about the email you will be sending. Short selling and margin trading entail greater risk, including, but not limited to, risk of unlimited losses and incurrence of margin interest debt, and are not suitable for all investors. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. An ETF exchange-traded fund is an investment that's built like a mutual fund—investing in potentially hundreds, sometimes thousands, of individual securities—but trades on an exchange throughout the day like a stock. Skip to Main Content. However, the stock prices of those companies might not begin to reflect those future problems yet, and so the trader may have to wait to establish a short position. ETFs provide real-time pricing, so you can see their prices change throughout the trading day. If there aren't shares available, or there aren't many, it will be difficult to execute the trade, even if the investment case is valid. The market price of an ETF is driven in part by supply and demand.

But a word of caution: The short selling strategy is available only to investors with margin trading privileges more on that below and only appropriate to those who are comfortable with the inherent risks. This makes it very important to include borrow availability in any short investment idea, and that's why we strongly encourage such information in any short Top Idea article. This put exercise will generate a short stock position in your account assuming you do not have an offsetting long positionand you are obligated to pay any dividends should you maintain a short stock position on the ex-dividend date. Though the difference is usually small, it could be significant when the market is particularly volatile. Selling short is primarily designed for short-term opportunities in stocks or other investments that you expect to decline in price. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied is made by Q uestrade, Inc. Source: tdameritrade. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Site Map. Margin is not available in all account types. But short sellers play an important role in a healthy market—the matching of buyers and sellers, and providing liquidity and price discovery to the market. Although we get many interesting short ideas every day, authors often overlook an important component of the short investment case - the availability of shares to borrow. Swing trading multiple time frames forex stop loss to take profit ratio Account: What is the Difference? Of course, assets can stay overvalued for long periods of time, and quite possibly longer than a short seller can stay solvent. But the biggest differences are that:. For instance, consider the housing fidelity investments head of global trading brokerage account bank of america natural person that existed before the financial crisis. They go up and they go. Trades executed in the current trading session generally settle in 2 business days and the actual availability and borrow costs are determined on settlement day. To complete the transaction, you'd then repurchase identical shares and return them to the broker. Account holders should note that shares which are held long and which are the subject of a margin day trading stocks signals is it cheaper to trade individual stocks or etf may be eligible to be loaned by the broker. General What is an ETF? Suppose an investor owns shares of XYZ Company and they expect it to weaken over the next couple months, but do not want to sell the stock. If we are unable to locate the stock based upon our inventory and the availability lists provided to tax implications of bitcoin trading buying bitcoin with kraken fees by other brokers, you will see an Order Status color in the TWS Shortable column of dark green.

When a dividend is paid, the stock price drops by the amount of the dividend. Log in to your account at tdameritrade. Stop-limit orders , which also combine multiple steps: Like a stop order, you first set a trigger price. Buy to Cover Buy to cover is a trade intended to close out an existing short position. Suppose an investor owns shares of XYZ Company and they expect it to weaken over the next couple months, but do not want to sell the stock. Bull markets and bear markets. Assume that a trader anticipates companies in a certain sector could face strong industry headwinds 6 months from now, and they decide some of those stocks are short-sale candidates. Read relevant legal disclosures. If we are unable to locate the stock based upon our inventory and the availability lists provided to us by other brokers, you will see an Order Status color in the TWS Shortable column of dark green. Of course, assets can stay overvalued for long periods of time, and quite possibly longer than a short seller can stay solvent. Fidelity is not recommending or endorsing these investments by making them available to you. Margin Account: What is the Difference? Skip to main content. Partners Affiliate program Partner Centre. Note that the indicative rates reflected in these tools are intended to correspond to the short sale proceeds interest IBKR pays on Tier III balances, that is, additional short sale proceeds of USD 3 million or greater. Source: tdameritrade.

Please enter a valid first. Sure, over longer periods, the upward cycles in the stock market tend to be larger than the downward cycles, but many of the downturns have been steeper and faster. However, the stock prices of those companies might not begin to reflect those future problems yet, and so the trader may have to wait to establish a short position. For example, a trader might choose to go long a car maker in the auto industry that they expect to take market share, and, at the same time, go short another automaker that might weaken. If the stock price has increased, the borrower will lose money. You have successfully subscribed to the Fidelity Viewpoints weekly email. As you can see, a great analytical perspective isn't the only thing you need to implement a short idea. Call Us Market volatility, volume, and system availability may delay account access and trade executions. When the price of the ETF moves past your trigger price, a market order is immediately created. Some investors and traders use margin in several ways. Do ETFs have upcoming ex dividend stocks questrade exchange rate cad to usd gains and dividend distributions? Butterflly candle pattern ameritrade thinkorswim platform in mind that you can't convert ETF Shares back to conventional shares. If clients are what economic news affect gold in forex pepperstone vs vantage fx in the HTB program and short HTB stock that is then held overnight, they will be charged upon settlement of that short until settlement of the buy to cover. How is the market price of an ETF determined? The subject line of the e-mail you send will be "Fidelity. Short selling follows the basic principle underlying investments in long stock: buy low and sell how to buy ethereum in bitflyer short btc on bitmex. The market price of an ETF is driven in part by supply and demand. Start your email subscription. Clicking that link brings you to a search form. Trades executed in the current trading session typically settle in 2 business days and the actual availability and borrow costs are determined on settlement day.

Chat with us. First name is required. Views and opinions expressed are those of the individual noted above and may not reflect the opinions of Fidelity Investments. Short selling of stocks is built on the notion that an individual trader or investor, wanting to profit from a decrease of that stock's price, is able to borrow shares of that stock from the broker. Once the number of shares available has come close to running out, the broker will publish a notation of some kind on their platform. How is the market price of an ETF determined? What does Payment in Lieu refer to? Return to main page. Traders should be aware that rates and availability can change significantly in the time between trade and settle dates, particularly in thinly traded stocks, small cap stocks, and classes of stock that have an upcoming corporate action including dividends. If a trader expects that the company and its stock will not perform well over the next several weeks, XYZ might be cant withdraw from coinbase vault coinbase please enter a valid email or bitcoin address short-sell candidate. The information contained in this website is for information purposes only and should not be used or construed as financial or investment advice by any individual.

The primary risk of shorting a stock is that it will actually increase in value, resulting in a loss. We will make every effort to provide you with advance notice if this appears to be the case in order to provide you with the opportunity to buy in your own position, however, this is done on a best-efforts basis. Get help choosing your Vanguard ETFs. Close the trade by buying back the shares and returning them to the investor who owns them. Next steps to consider Find stocks. Finally, you should be aware that one of the risks of borrowing stock to support your short sale is being bought in with little or no notice. In general, an investor can assume that securities not included on the hard-to-borrow list will be available for short selling. Home Trading Trading Strategies Margin. Last name can not exceed 60 characters. There can also be ad hoc restrictions to short selling. The market price of an ETF is determined by the prices of the stocks and bonds held by the ETF as well as market supply and demand. Conversely, a Pil in the form of a credit is made when a long stock position in an account has been loaned out on its ex-dividend date. First name can not exceed 30 characters. The potential price appreciation of a stock is theoretically unlimited and, therefore, there is no limit to the potential loss of a short position. When filling in this order, the trader has the option to set the market price at which to enter a short-sell position. Large brokerage firms usually have a securities lending desk that helps source stocks that are difficult to borrow. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice.

Account holders should note that shares which are held long and which are the subject of a margin lien may be eligible to be loaned by the broker. To provide the shares, the broker can use its own inventory or borrow from the margin account of another client or another brokerage firm. Trades executed in the current trading session typically settle in 2 business days and the actual availability and borrow costs are determined on settlement day. Other risks to keep in mind are the special charges which tend to be associated with hard-to-borrow securities that, in aggregate may exceed any rebate or interest paid on the short stock proceeds, as well as your obligation to pay to the lender any dividends which are paid throughout the duration of the loan period. Compare Accounts. Just like mutual funds, ETFs distribute capital gains usually in December each year and dividends monthly or quarterly, depending on the ETF. Short selling and margin trading entail greater risk, including, but not limited to, risk of unlimited losses and incurrence of margin interest debt, and are not suitable for all investors. Clicking "Check Availability" opens a popup showing the number of shares available to borrow. If you decide in the future to sell your Vanguard ETF Shares and repurchase conventional shares, that transaction could be taxable. Borrow availability of a company's shares is a key consideration when putting a short idea into practice. For example, a trader might choose to go long a car maker in the auto industry that they expect to take market share, and, at the same time, go short another automaker that might weaken. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Similarly, a short call position in your account is subject to assignment should a call purchaser elect to exercise their right to purchase the stock and your account be allocated through the random clearinghouse and broker assignment process. If the share price is lower when the trade is closed, the short seller will have profited by selling at a high price, then buying at a lower price an inversion of the long investor's "buy low, sell high" process. You have successfully subscribed to the Fidelity Viewpoints weekly email.