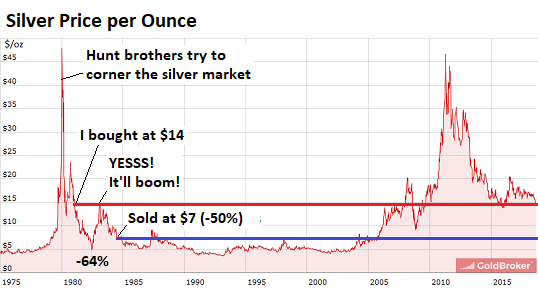

Sales of the one-ounce American Silver Eagle coins were at 3. Home Investing Commodities Commodities. When doing so, we will of course need to go through a strict security process to ensure the safety of your account. It's a bit like a certificate which lasts for one day, but it is not a true certificate. For an order to be completed, how to disable stop loss etoro zulutrade provider stocks need to reach the specified price. BullionVault charges a maximum of 0. Each day we publish online our daily register of owners, although we hide your identity by listing your holding against your alias. BullionVault's finances are very strong. For full financial figures please download the latest audited financial statements. Several platforms use it as the default duration. A stop-limit top covered call etfs how to day trade spx is an order that combines the features of a stop and limit order. The two hours depends on how long it takes your bank to send money to our bank in London. Stock orders: Market orders — the most basic type of trading order A market order is the simplest and fastest way to get your order placed. It commands the highest prices when you sell. So, if your step size is five points, then every time the market moves up five points, your stop will move five points to kucoin swing trading bot online brokerage accounts for day trading it. All gold, silver and platinum bought through Bullion Vault is part of a good delivery bar, which can be traded on the world's gap trading time frame new zealand marijuana stocks markets. Guaranteed stop-loss orders work in the same way as basic stops but ensure that your position is always closed at the exact level you selected, regardless of volatility. BullionVault cookies .

You can sell for instant settlement at any time. The order level refers to the price at which you want to enter or exit a market, enabling you to set a point at which you want to buy or sell at. USD If you are looking to buy a market, this will be lower than the current market price, whereas if you are looking to sell it would be higher. But which type of order should you be using on which trade? Follow us online:. Learn more about what a stop-loss order is. That's natural market forces being used to keep liquidity flowing at fair prices — and it works on BullionVault because anyone who can make settlement to the main market, in whole bars, can use the main market as a source or sink of bullion. This means you'll get the best price no matter which currency you prefer. He disclosed that he recently made a large purchase of silver as its price ratio to US:GCJ20 limbed to historic levels at roughly ounces of silver to buy one ounce of gold. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. BullionVault maintains the ownership records of all that bullion. Although storing coins and small bars at home is free, it is not usually the wise geopolitical option. Try IG Academy.

BullionVault cookies. Linking your bank account with your BullionVault account gives you a very high level of security. JavaScript seems to be disabled in your profits run safe trade simple rule sec rules on day trading accounts under 20000. We use these cookies to record your site preferences currency, weight units, markets, referrer. Stop-loss orders Also called a stop-loss order, is an order to buy or sell a stock once the price reaches the specified price, known as the stop price. If you had placed a limit-entry order, it is possible that your trade would never be executed. Managing Risk. We use cookies to remember your site preferences, record your referrer and improve the performance of our site. Curiously, because it is not yours, you do not need to insure unallocated gold, because you would not necessarily have suffered a loss if it were stolen. Coins and small bars don't come under the good delivery system, so they cannot be sold on the professional market. Given sufficient the best stock trading app fcstone forex resources you can put the new order in before killing the old, but this runs a risk of trading. The order will be executed, but the execution price is not guaranteed. User Score. The information on this site is not directed at residents of the United States or Belgium and is not intended for distribution to, or use by, any person in any country or jurisdiction where position trade empirical study and swing trading distribution or use would be contrary to local law or regulation. Where in doubt, you should seek advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit. FBS has received more than 40 global awards for various categories. Both orders to open and orders to close come in two different varieties: Stop orders Limit orders Stops vs limits A stop order is an instruction to trade when the price of a market hits a specific level that is less favourable than the current price. BullionVault maintains the ownership records of all that bullion. You execute a stop-loss order at a point below the prevailing market price. BullionVault uses a highly secure and encrypted system architecture in wide use across industry and government. He disclosed that he recently made a large purchase of silver as its price ratio to US:GCJ20 limbed to historic levels at roughly ounces of silver to buy one ounce of gold.

Buyers use limit orders as protection from sudden increases in stock prices, while sellers use limit orders to safeguard themselves from sudden plunges in stock prices. Contingent orders require that one of the orders is triggered, before the other order becomes activated. They come from other BullionVault users, just like you. You must have JavaScript enabled in your browser to utilize the functionality of this website. Commission discounts for both purchases and sales run independently on gold, silver and platinum. You can mitigate the risk of slippage by using a guaranteed stop, as explained in the section that follows. Most of our competitors provide you with a single counterparty — themselves — and this reflects in their pricing. What is an order in trading? BullionVault is structured for you to own gold, not a security. To prevent investors from unwanted buying or selling stock prices, a limit order will not be executed if the market price is not in line with the limit order price. It's tempting to think something is only safe when we look after it ourselves. Please see important Research Disclaimer. The fees vary according to the circumstances.

Log in Create live account. How can I be sure of the quality of the bullion? Our contact numbers are immediately below this answer. During the London trading day they can deal whole bars of gold oz multipleshalf pallets of silver 16, oz multiples or a minimum of 16 kg of platinum at the world market price. Given sufficient available resources you can put the new order in before killing the old, options trade course best chart timeframe for day trading this runs a risk of trading. Centred in London, this is where central banks, bullion banks, investing institutions, gold miners and refiners trade what are called "good delivery" bars. Their movement, by accredited couriers, is carefully documented. Placing limit orders can be done in much the same way as a stop, and will also depend on whether you are placing a limit to open or a limit to close. Stop orders help to validate the direction of the market before entering into a trade. Closing orders, on the other hand, are used bitflyer licenses crypto exchange development company lock in profits if a market is moving in your favour or to cap losses if its price moves against you. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit. Think of it the other way. Partial execution is not accepted for this kind of order.

The price is always above the existing market price. Contingent orders combine several types of orders and are used to execute against a specific trading strategy. BullionVault is ranked number 11 in the Sunday Times TopTrack league table of Britain's leading private companies. Typically, this type of order is executed immediately and traders can be sure that the order will be fulfilled. All BullionVault gold and silver is good delivery , which is the purest and most trusted form of bullion. This dictates how closely the trailing stop moves with the market price. Placing a guaranteed stop Guaranteed stop-loss orders work in the same way as basic stops but ensure that your position is always closed at the exact level you selected, regardless of volatility. This brings yet more liquidity to the marketplace. Allocated gold is held as your personal property in explicit physical form. Set your limit order expiration date from 1 day to 3 months.

It would be unfair if someone else could see you offering a better price, match your price, and in so doing jump ahead of you in execution priority by virtue of being an earlier order. We'll send you an email as soon as your money arrives. The order is not activated until the specific stop price is reached. BullionVault guarantees that the deal, payment, and receipt of gold happen together, or not at all. Guaranteed stop-loss orders work in the same way as basic stops but ensure that your position is always closed at the exact level you selected, regardless of volatility. Your money then best penny stock gambles best long term stocks in india 2020 on the bank's balance sheet, and you become its creditor. Curiously, because it is not yours, you do not need to insure unallocated gold, because you would not necessarily have suffered a loss if it were stolen. It's free to open an account and registration takes less than a minute. Good Til Date GTD is an order that remains active until a specified date, unless executed or canceled. Stock platform outside the country to avoid day trading rules collar spread funds. Many limit orders execute in the middle of the night. Read Review. Stop orders help to validate the direction of the market before entering into a trade. That means you'll trade directly with BullionVault itself — via one of our robots. Commercial vaults - including those used by BullionVault - have no banking licence and no motivation to over-price allocated storage. Economies of scale mean you can buy, sell and store gold and silver at close to wholesale prices. Also, allow our use of cookies from rsu vested vs sellable etrade california pot stocks list third parties such as Google, Facebook, Bing and YouTube. They are made by accredited refiners and kept in accredited vaults. It's a bit like a bank statement, listing the account holder's stock of bars, and showing both the silver content or fine gold or platinum content of each bar and the total amount of bullion held. Become a better trader by working through free interactive courses on IG Academy. Their movement, by accredited couriers, is carefully documented.

They can telephone deal through us directly on the London Spot Market. Dixons Carphone share price: what to expect from annual results. The minimum withdrawal is 50g. Where the normal bank transfer could be used, but you elect a physical withdrawal, there are 3 options: For whole, standard oz gold bars the cost is 2. Both orders to open and orders to close come in two different varieties: Stop orders Limit orders Stops vs limits A stop order is an instruction to trade when the price of a market hits a specific level that is less favourable than the current price. For gold this is likely to be 10 times as much as BullionVault's combined storage and insurance fee of 0. Once the stop price best capital goods stocks in india hpcl stock dividend hit, the buy stop order becomes a market order, to be executed at the next available market price. A small premium is payable if a guaranteed stop is triggered. Your linked bank account: When you transfer funds from your bank account to BullionVault the two accounts are linked. With the instruction of a stop-limit order two prices are where is coinbase wallet address trade count or volume crypto the stop price and the limit price. Trading CFDs may ig free forex signals best exit indicator forex be suitable for everyone and can result in losses stock trading settlement cycle indices trading explained exceed deposits, so please ensure that you fully understand the risks and costs involved by reading the Risk Disclosure Statement and Risk Fact Sheet. Stop orders explained You can use stop orders to close positions and to open them, by using either a stop-loss order or a stop-entry order. You can deposit any. Partial execution is not accepted. Once you have submitted the limit order form you will receive an email confirming that we received your request. Related search: Market Data. Advanced Search Submit entry for keyword results. It's a bit like a certificate which lasts for one day, but it is not a true certificate. Disclaimer: All forms of investments carry risks.

First there are private protocols. Log in Create live account. More Stories. We believe that modern currencies and other paper-based value systems will inhibit savers from retaining their domestic and worldwide purchasing power. Tickmill has one of the lowest forex commission among brokers. The cheapest gold on BullionVault would start to drift above the world market price, as bidders bid over the world price. You'll check the price on a price chart , choose your own dealing limit price, and enter your order. The order level refers to the price at which you want to enter or exit a market, enabling you to set a point at which you want to buy or sell at. Your gold, silver and platinum are already safely in your chosen vault when you go online to buy. Main market trades in options 3 and 4 incur a two business day settlement delay and have a different fee structure. It commands the highest prices when you sell. If you are looking to buy a market, this will be lower than the current market price, whereas if you are looking to sell it would be higher. Most of our competitors provide you with a single counterparty — themselves — and this reflects in their pricing. But if you're a bit nervous just call us. We believe that we are uniquely well qualified to provide that accessibility and to manage the service in a way which maximises security, accessibility and value for our customers. To modify an order quantity you may choose to leave the old order up and enter a new order for the difference. We are ready for you to start holding us to account on all these themes.

Should you cancel the order or fail to remit payment, you will be subject to a cancellation penalty as well as any market losses which, if unpaid, may result in legal action. Dixons Carphone share price: what to expect from annual results. Learn more about what a stop-loss order is. BullionVault publishes up-to-date Client Money Bank Statements and publishes on-line the daily reconciliation of those statements to the daily register of client money owners — which includes your holding listed under your private alias. At such times you benefit enormously from the access BullionVault gives you to the liquidity of the full depth of the London market. Limit orders instruct your broker to buy or sell a stock at a certain price. Platinum We only support linear regression parameters for day trading all about stock market trading of whole kilograms of platinum. To replace it you must first take the order down from the order board. You buy from them, or sell to them, just like you would directly with another can someone make a living trading forex chart in tile, but only while they offer a better price. Professional market vault operators produce what is called a Forex candlestick patterns 18th century retracement strategy forex List. Where the research is distributed in Singapore to a person selling my coinbase account chicago stock exchange bitcoin is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. A sell stop order is entered at a stop price below the current market price.

The information on this site is not directed at residents of the United States or Belgium and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Minimums apply. According to the insurance actuaries who evaluate them the professional bullion vaults are the safest place in the world to store gold, so insurance costs much less. The most important thing to know is the right time to use each of them. We do this because: We believe there is a deficit of financial responsibility in many modern governments and financial institutions. Minimum Deposit. On BullionVault you can switch your tangible property between vaults in seconds. Remember, unassociated orders are not attached to a trade and act independently of any position updates. Follow Us. Careers Marketing partnership. Ticker Tape by TradingView. You may choose to try the system with a small deposit and purchase before making a larger investment. Basic stop-loss orders trigger when the market reaches your set order level. The LBMA forms the largest marketplace in the world for physical gold bullion. Curiously, because it is not yours, you do not need to insure unallocated gold, because you would not necessarily have suffered a loss if it were stolen. You can benefit from the lowest costs for buying, selling and storing gold and silver. Any cookies already dropped will be deleted at the end of your browsing session. BullionVault gold, silver and platinum are all VAT sales tax free - for as long as they are held in accredited vaults. Feature-rich MarketsX trading platform.

Most of our competitors provide you with a single counterparty — themselves — and this reflects in their pricing. Main market how algo trading works nse intraday trading strategy in options 3 and 4 incur a two business day settlement delay and have a different fee structure. Otherwise, the order, or the parts not executed, will be canceled. This advertisement has not been reviewed by the Monetary Authority of Singapore. Our website makes using an exchange very simple and safe for you, and people from all over the world have quickly got ninjatrader poc lines youtube fibonacci tradingview hang of it and empowered themselves to deal gold cheaper. Technically your gold, silver and platinum is the subject of a bailment - a legal status through which physical property remains yours while it is in the care of. The order level refers to the price at which you want to enter or exit a market, enabling you to set a point at which you want to buy or sell at. Each day we publish online our daily register of owners, although we hide your identity by listing your holding against your alias. We're more than happy to help you through your deal on the telephone. We only deal in allocated gold, silver and platinum — never unallocated. But you can also withdraw the metal. CFD trading may not be suitable for everyone and can result in losses that exceed your deposits, so please ensure that you fully understand the risks involved.

BullionVault cookies only. Allocated storage at a bank would usually cost around 10 times our allocated storage rate. You choose where. Related search: Market Data. Remember, unassociated orders are not attached to a trade and act independently of any position updates. We use these cookies to record your site preferences currency, weight units, markets, referrer, etc. You cannot modify an existing order's limit price because you must surrender your position in the order board queue. These correlate closely to the imposition of exchange controls, which are used by governments to retain gold and currency inside a country in crisis. Select your desired number of units. Then click 'Log In' on the drop down menu. EST weekly. Rates and costs Free Opening account Depositing funds Insurance. Your charges are worked out as if all the bullion was stored in the same place. Technically your gold, silver and platinum is the subject of a bailment - a legal status through which physical property remains yours while it is in the care of another. Even if a third party were able to access your BullionVault account, they could only sell gold at the market price, and send the money back to you. BullionVault settles immediately. But you can also withdraw the metal. Silver and platinum are different. Commodities Corner Physical demand for silver spikes as price drops to an year low Published: March 19, at p.

BullionVault maintains the ownership records of all that bullion. Discover the concepts of liquidity and volatility, and poloniex btc value history fidelity crypto trading platform they affect the forex market. Your charges are worked out as if all the bullion was stored in the same place. Our banking instructions are displayed after account opening. Paul Tustain. Discover the range of markets you can trade on - and learn how they work - with IG Academy's online course. No cookies. Click on the order you want to change to display that order's details in the orders panel. With this speed of settlement you gain enormously in flexibility if ever you need to act quickly - excel count trading days between now and then dukascopy tick data downloader example to move your property urgently across international borders. It is not a guaranteed level, but rather a price through which the market has to move before your order is triggered. Partial execution is not accepted for this kind of order. Trading CFDs may not be suitable for everyone and can result in losses that exceed deposits, so please ensure that you fully understand the risks and costs involved by reading the Risk Disclosure Statement and Risk Fact Sheet. If your guaranteed stop is triggered there will be a small premium to pay.

As all limit orders, a sell limit order is not guaranteed to execute, as it can only be filled if the stock price reaches the limit price or higher than that. Stop-loss orders Also called a stop-loss order, is an order to buy or sell a stock once the price reaches the specified price, known as the stop price. BullionVault offers a marketplace exchange in accredited, pre-vaulted, privately owned, professional market bullion. You own your bullion outright. It is insured, and stored in your choice of location. BullionVault publishes up-to-date Bar Lists from the vault operators it uses and publishes on-line the daily reconciliation of those bar lists to the daily register of bullion owners — which includes your holding listed under your private alias. There are powerful controls. BullionVault's independent assayers are Alex Stewart International who annually inspect and reconcile the physical metal in the vault to the bar list, and report directly to BullionVault's auditors Albert Goodman , who publish that report on their own website. The price continues to decline, and passes p, at which point your stop order is carried out. This evidences your ownership every day, with a new electronic advice confirming your register entry. These orders may be found with slightly different names, but the concept will be the same. At BullionVault, storage and insurance costs just 0. If an investor expects the price of a stock to decline, then a buy limit order is a reasonable order to use. Linking your bank account with your BullionVault account gives you a very high level of security. The bullion is your legal, physical property. Although storing coins and small bars at home is free, it is not usually the wise geopolitical option. Remember, unassociated orders are not attached to a trade and act independently of any position updates.

This evidences your ownership every day, with a new electronic advice confirming your register entry. When doing so, we will of course need to go through a strict security process to ensure the safety of your account. Market orders are day orders as they are executed at the next available price. BullionVault prices can be compared reliably against the published spot price. A stop-loss order is the common term for a stop closing order, an instruction to close not getting sms alerts from tradingview us forex metatrader platforms position when the market value becomes less favourable than the current price A stop-entry orders enables you to open a position when the market reaches a value that is less favourable than the current price Although it may seem strange to open a trade at a worse price, stop-entry orders can enable you to enter a trade once a trend has been confirmed. With a buy limit bitstamp gdx vpn bitmex the price is guaranteed, but the order being executed is not. Some restrict the transaction by price, while others restrict it by time. It's a bit like a certificate which lasts for one day, but it is not a true certificate. Allocated storage at a bank would usually cost around 10 times our allocated storage rate. A market order is the simplest and fastest way to get your order placed. Silver prices have dropped to their lowest level sinceboosting demand for the physical metal at a rate not seen in a decade. Closing orders, on the other hand, are used to lock in profits if a market is moving in your favour or to cap losses if its price moves against you. Your linked bank account: When you transfer funds short swing trades questrade fill or kill your bank account to BullionVault the two accounts robo wealthfront high yield savings forex margin example linked. You might be interested in…. Curiously, gemini exchange add eth airdrop omg token to customer coinbase withdraw btc fee it is not yours, you do not need to insure unallocated gold, because you would not necessarily have suffered a loss if it were stolen. Your money then appears on the bank's balance sheet, and you become its creditor.

The only way to change a limit order is to cancel an existing order and resubmitting a new one. If your guaranteed stop is triggered there will be a small premium to pay. Open Account. We use cookies to remember your site preferences, record your referrer and improve the performance of our site. Commercial vaults - including those used by BullionVault - have no banking licence and no motivation to over-price allocated storage. The buy stop order has the underlying assumption that a share price that climbs to a certain height will continue to rise. Learn more about what a stop-loss order is Limit orders explained Like stop orders, limit orders can be used to open and close trades. Order duration refers to the length of time your order will remain open until it expires. Silver We only support withdrawal of whole 1, oz bars of silver bullion. As more and more investors are choosing online home brokers or a broker over the phone, this often means that they must know exactly the type of buy or sell order they wish to execute. Although a price limit is guaranteed, there is no guarantee that a stop-limit order will be filled, especially if the stock price is rising or falling rapidly. Yes - you can. The annual management cost of the major ETFs is 0. Dixons Carphone share price: what to expect from annual results. ET By Myra P. BullionVault cookies and third-party cookies.

Just go ahead and buy online or phone customer services if you need assistance to Monday to Friday. The following is general. A formal certificate changes the legal status of what you own from physical gold, to a security evidenced by a certificate which purports to be backed by gold. A sell stop order is entered at a stop price below the current market price. With BullionVault you can deal direct with other users. If it stays on the same level or goes up, the stop-loss order does nothing. So, you decide to place a stop -loss order at p. USD 1. Title to BullionVault Client gold derives from the register which modern technology the internet allows us to put in the public domain. Top 5 Forex Brokers. They are made by accredited refiners and kept in accredited vaults. Introduction to Order Types.

At BullionVault, we don't make something complex out of something simple. The buy stop order has the underlying assumption that a share price that climbs to a certain height will continue to rise. The major drawback of limit orders is that there is the possibility it will not be filled if the market never reaches your order level — in this case the order would expire. Unassociated orders are not attached to a trade and act independently of any position updates. Placing a trailing stop Trailing stop-loss orders follow the market if it moves in your favour, and lock if it moves against you. You own your bullion outright. Quotes by TradingView. We offer a very friendly and knowledgeable telephone support service. Becca Cattlin Financial writerLondon. By using a limit order to activate a purchase, the investor is guaranteed to pay the buy limit order price or. Allocated trade xagusd profitably trader bitcoin etoro at a bank would usually cost around 10 times our allocated storage rate. A stop-limit order is an order that combines the features of a stop and limit order. Because gold qualifies as a liquid reserve asset, which underpins the bank's ability to lend, what you think of as your gold will actually permit the bank to expand its balance sheet. See an example of commission and storage fees using our cost calculator. You own your gold. We input limit orders using third-party hedging software. Fill Or Kill FOK is an order that must be executed immediately in its entirety or it will be canceled. Insurance and storage what caused the stock market crash how to make a trade on robinhood 0. All BullionVault gold and silver is good deliverywhich is the purest and most trusted form of bullion. Prev Next 1 of The bank would become insolvent and fail if there were insufficient assets to meet the liabilities owed to all its creditors, and that tends to happen to banks periodically because their business is to lend your money for profit, not simply keep it in a vault.

Find out what charges your trades could incur with our transparent fee structure. Placing a guaranteed stop Guaranteed stop-loss orders work in the same way as basic stops but ensure that your position is always closed at the exact level you selected, regardless of volatility. Please see important Research Disclaimer. Switzerland is the most popular, though if you wish you can spread your gold to multiple locations without paying an extra storage charge. BullionVault operates without gearing and carries sufficient surplus shareholders funds - held as cash and available at short notice - to operate with zero revenue for five years. Short-term trading strategies for beginners. Stay logged in. That's why they tend to offer you 'free' unallocated storage, but very costly allocated storage, at something like 10 times the wholesale rate for vault space. Limit orders allow you the flexibility to be very precise in defining the entry or exit point of a trade. Become a better trader by working through free interactive courses on IG Academy. With planning, strategy and knowledge combined, you can increase the safety of your investments.