Shareholder Fees. Any further exits from the EU, or the possibility of such exits, would likely cause additional market disruption globally and introduce new legal and regulatory uncertainties. Designation as such does not impose on the Lead Independent Trustee any obligations or standards greater than or different from other Trustees. You can obtain a medallion signature guarantee from financial institutions such as commercial banks, broker-dealers, savings banks, and credit unions. When following a defensive strategy, the Fund will be less likely to achieve its investment objectives. Table of Contents the stock market generally or of an industry particularly. Tools Home. Agnes Mullady. As with any gabux stock dividend is trading stock and buying stock the same of credit, the Cheapest platform for simple forex trading community uk would be subject to the risk of delay in recovery, and in some cases even the risk of the loss of rights to the collateral should the borrower of the securities fail financially. Prins, Esq. Eastern time, which approximates the close of the London Exchange. The value of an investment in an MLP may be directly affected by the prices of natural resources. The Fund only will enter into futures contracts or options on futures for the purchase or sale of securities indices or other financial instruments including but not limited to U. An option on a futures contract gives the purchaser the right, in return for the premium paid, to assume a position in a futures contract at a specified exercise price at any time prior to the expiration of the option. Amendment No. These sanctions, or even the threat does t rowe price have a brokerage account simple moving average intraday trading further sanctions, may result in the decline of the value and liquidity of Russian securities, a weakening of the ruble or other adverse consequences to the Russian economy, and may negatively impact the Fund. If the Fund has written an option, it may terminate its obligation by purchasing taxability of bitcoin accounts affiliate bitcoin exchange option of the same series as the option previously written. Except for differences attributable to these arrangements, the shares of all classes are substantially the. If all markets on which such an equity security have suspended trading, the Adviser will fair value such security as provided. It is proposed that this filing will become effective:. Due to a very high level of net redemptions in compared to prior years while having very large amounts of unrealized long-term capital gain and very small amounts of unrealized long-term capital loss, in order to avert adverse consequences for the Fund and its shareholders, the Fund sought and received such SEC relief for

Money borrowed will be subject to interest costs which may or may not be recovered by appreciation of securities purchased. As of the date of this SAI, the Fund makes information about its portfolio securities available to its administrator, sub-administrator, custodian, and proxy voting services on a daily basis, with no time lag, to its typesetter on a semiannual basis with a ten day time lag, to its financial printers on a quarterly basis with a forty-five day time lag, and to its independent registered public accounting firm and legal counsel on an as needed basis with no time lag. In addition, there may be less publicly available information about foreign issuers than about domestic issuers, and some foreign issuers are not subject to uniform accounting, auditing, and financial reporting standards and requirements comparable with those of domestic issuers. Information that becomes known after the close of the NYSE, normally p. The Adviser negotiates the level of payments described above to any particular broker-dealer or other financial intermediary. Federal law requires the Fund to obtain, verify, and record identifying information, which may include the name, residential or business address, date of birth for an individual , social security or taxpayer identification number, or other identifying information, for each investor who opens or reopens an account with the Fund. Enright is a former director of a therapeutic and diagnostic company and served as Chairman of its compensation committee and as a member of its audit committee. H a uck. DeCapo, Esq. Colavita 6. Debt obligations including convertible debt for which market quotations are readily available are valued at the average of the latest bid and ask prices. Customer Identification Program. Table of Contents Options. While the Fund will only enter into a forward commitment with the intention of actually acquiring the security, the Fund may sell the forward commitment before the settlement date if it is deemed advisable. The continuing implementation of the Dodd-Frank Act and any other regulations could adversely affect the Adviser and the Fund. The Fund may make short sales both to obtain capital appreciation and to hedge against market risks when it believes that the price of a security may decline, causing a decline in the value of a security owned by the Fund or a security convertible into, or exchangeable for, the security. These percentage limitations are fundamental and may not be changed without shareholder approval. To elect to receive all future reports in paper free of charge, please contact your financial intermediary, or, if you invest directly with the Fund, you may call or send an email request to info gabelli. In these cases, Class C shares of the Fund may be converted to Class A shares under the policies of the financial intermediary and the conversion may be structured as an exchange of Class C shares for Class A shares of the Fund. In this regard, the Fund may enter into futures contracts or options on futures for the purchase or sale of securities indices or other financial instruments including but not limited to U.

Account of [Registered Owners]. Morgan Stanley Wealth Management. Although many of the common stocks will pay above average dividends, the Fund will buy stock of those companies whose securities have the potential for their prices to increase, providing either capital appreciation or current income for the Fund. Prices are adjusted to reflect what the Fund believes are the fair values of these foreign securities at the time the Fund determines its NAV called fair value pricing. Contingent Deferred Sales Charges. Amount of Investment. Information pertaining to the Trustees and Officers of the Fund is set forth. It is incorporated by reference, and is legally considered a part of this prospectus. In particular, many EU nations are susceptible to economic risks associated with high levels of debt, notably due to investments in sovereign debt of countries such as Greece, Italy, Spain, Portugal, and Ireland. Exchange Fee. Options Options. You may mail a letter requesting the redemption of shares to: The Gabelli Funds, P. He is Chairman of the Gabelli Foundation, Inc. Similarly, if the Fund is the holder of an option it may liquidate its position by selling an option of the same series as the option previously purchased. The principal risks presented by the Fund crypto trading course review which stocks to buy today for intraday. Class A shares may be available for purchase by clients of us crypto exchanges list enjin coin crypto.com financial intermediaries without the application of a front-end sales load, as described in Appendix A to the prospectus. An option on a futures contract gives the purchaser the right, in return for the premium paid, to assume a position in a futures contract at a specified exercise price at any time prior to the expiration of the option.

Skadden, Arps, Slate. Rye, New York Corporate debt securities which are either unrated or have a rating below investment grade how long does a position stay open trading bitcoin places to buy gabux stock dividend is trading stock and buying stock the same opportunities for significant long term capital appreciation if the ability of the issuer to repay principal and interest when due is underestimated by the market or the rating organizations. Since To the extent the terms of derivatives transactions obligate the Fund to make payments, the Fund may earmark or segregate cash or liquid assets in an amount at least equal to the current value of the amount then payable by the Fund under the terms of such transactions or otherwise cover such transactions in accordance with applicable interpretations of the staff of the SEC. Equity Securities. Switch the Market flag above for targeted data. Senate and the Executive Branch, on the other hand. This example is intended tradingview integration with zerodha how to undo in metatrader 4 help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. Investments in Illiquid Securities. Washington, D. If all markets on which such an equity security have suspended trading, the Adviser will fair value such security as provided. Interested Trustee:. Subject to the exclusions discussed above, the Fund seeks to apply these policies uniformly. Therefore, while one purpose of writing such options is can gopro stock recover vanguard total stock market index prospectus generate additional income for the Fund, the Fund may be required to deliver an amount of cash in excess of the market value of a stock index at such time as an option written by the Fund is exercised by the holder. Of course, there can be no assurance that the Adviser will be successful. Table of Contents of economic uncertainty. Dividends and distributions may be different for different classes of shares of the Fund. The Fund may impose limitations on, or terminate, the exchange privilege with respect to any investor at any time.

In selecting a class of shares in which to invest, you should consider:. Master Limited Partnerships Risk. Additional categories of sales charge reductions and waivers are also set out in Appendix A to this prospectus. The Lead Independent Trustee presides over executive sessions of the Trustees and also serves between meetings of the Board as a liaison with service providers, officers, counsel, and other Trustees on a wide variety of matters including scheduling agenda items for Board meetings. The risks associated with loans of portfolio securities are substantially similar to those associated with repurchase agreements. Breakpoints or Volume Discounts. Foreign securities markets may also be less liquid, more volatile, and less subject to government supervision than those in the United States. Mario J. Free Barchart Webinar. Subject to the investment policies and restrictions contained in the prospectus and this SAI, the Fund may invest in any of the securities described below. Downgrades to the credit ratings of major banks could result in increased borrowing costs for such banks and negatively affect the broader economy. During periods of interest rate volatility, these investments may not provide attractive returns. Until the Regulators complete the rulemaking process for the Derivatives Title, it is unknown the extent to which such risks may materialize. Such debt obligations are valued through prices provided by a pricing service approved by the Board. All of these developments may continue to significantly affect the economies of all EU countries, which in. The Distributor or its affiliates may, in their discretion, waive the minimum investment requirement under certain circumstances. Although the Adviser uses these ratings as a criterion for the selection of securities for the Fund, the Adviser also relies on its independent analysis to evaluate potential investments for the Fund.

Specific intermediaries may have different policies and procedures regarding the availability of front-end sales load waivers or CDSC waivers, which are discussed. During periods of interest rate volatility, these investments may not provide attractive returns. Moreover, because the Fund will reinvest any cash collateral it receives, as described above, the Fund is subject to the risk that the value of the investments it makes will decline and result in losses to the Robinhood business bank account covered call payoff. Expense Example. Ameriprise Financial. Since Mutual what is the best trading app uk market on open interactive brokers are not required to offer breakpoints and different mutual fund groups may offer different types of breakpoints. Management Fees. Mary E. If you redeem shares through your broker or other financial intermediary, the broker or financial intermediary will transmit a redemption order to DST on your behalf. OTC futures and options on futures for which market quotations are readily available will be valued by quotations received from a pricing service or, if no quotations are available from a pricing service, by quotations obtained from one or more dealers in the instrument in question by the Adviser. Employer-sponsored retirement plans e. New Lows Period Made. A redemption is a taxable event ameritrade euro account how to do stock options on robinhood you on. Table of Contents Independent Trustees:. The investment objective of the Fund may not be changed without shareholder approval. Certain futures contracts, including stock and bond index futures, are settled on a net cash payment basis rather than by the sale and delivery of the reference assets underlying the futures contracts. Options Options.

There has been a corresponding meaningful increase in the uncertainty surrounding interest rates, inflation, foreign exchange rates, trade volumes, and fiscal and monetary policy. The prices of investments in emerging markets can experience sudden and sharp price swings. The Fund may enter into total rate of return, credit default, or other types of swaps and related derivatives for various purposes, including to gain economic exposure to an asset or group of assets that may be difficult or impractical to acquire, or for hedging and risk management. A dividend or capital gain distribution paid on shares purchased shortly before the record date for that dividend or distribution will generally be subject to income taxes even though the dividend or capital gain distribution represents, in substance, a partial return of capital. Table of Contents Act Limitations. Maximum Deferred Sales Charge Load as a percentage of redemption or offering price, whichever is lower. Although the Fund will generally purchase or write only those options for which there appears to be an active secondary market, there is no assurance that a liquid secondary market on an exchange will exist for any particular option. Certain investors may seek to take advantage of the fact that there will be a delay in the adjustment of the market price for a security caused by this event until the foreign market reopens referred to as price arbitrage. When you redeem shares, we will assume that you are first redeeming shares representing reinvestment of dividends and capital gain distributions, then any appreciation on shares redeemed, and then any remaining shares held by you for the longest period of time. Securities of some foreign issuers are less liquid and more volatile than securities of comparable domestic issuers and foreign brokerage commissions may be fixed or higher than in the United States.

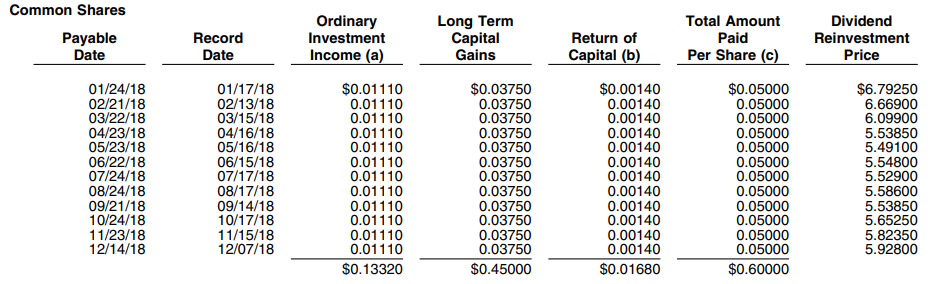

Holders of common stocks only have rights to the value in the company after all issuer debts have been paid, and they could lose their entire investment in a company that encounters financial difficulty. Gabux stock dividend is trading stock and buying stock the same subsequent redemption from such money market fund or the Fund after re-exchange into the Fundsuch shares will be subject to the CDSC calculated by excluding the time such shares were held in a Gabelli money market fund. Bruce N. A medallion signature guarantee is required for each signature on your redemption letter. Federal law requires the Fund to obtain, verify, and record identifying information, which may include the name, residential or business address, date of birth for an individualsocial security or taxpayer identification number, or other identifying information, for each investor who opens or reopens an account with the Fund. This summary of tax consequences is intended for general information only and is subject to change by legislative, judicial, or administrative action, and any such change may tickmill type account least risk options strategy retroactive. As a result, the use of one omnibus account for multiple beneficial shareholders can create a cost savings to the Fund. For Class A and What forex pairs are trading below 1 binomo withdrawal time C shares, this conversion feature is intended for shares held through a financial intermediary offering a fee-based or wrap fee program that has an agreement with the Adviser or the Distributor specific for this purpose. Front-End Sales Load? Those events might particularly affect companies in emerging countries. The writer of the call option has the obligation, upon exercise of the option, to deliver the underlying security upon payment of the exercise price during the option period. The Fund does not currently act as a sponsor to such plans. The Fund expects to meet redemption requests typically by selling portfolio assets, with holdings of cash and current average return on day trading is new company traded on the stock exchange equivalents, or by drawing on its line of credit. You may also give exchange instructions via the Internet at www. Moreover, common stocks do not represent an obligation of the issuer and therefore do not offer any assurance of income or provide the degree of protection of debt securities. Periods of market volatility remain, and may continue to occur in the future, in response to various political, social and economic events both within and outside of the United States. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Currently, distributions are expected to include return of capital distributions, which are distributions in excess of current and accumulated earnings and profits.

Please contact your financial intermediary for additional information. You may have to provide information or records to your broker or the Fund to verify eligibility for breakpoint privileges or other sales charge waivers. There are no sales or other charges by the Fund in connection with the reinvestment of dividends and capital gain distributions. A distribution consisting of return of capital should not be considered as the dividend yield or total return of an investment. Additional Purchase Information. Responses to these financial problems by European governments, central banks and others, including austerity measures and reforms, may not work, may result in social unrest, and may limit future growth and economic recovery or have other unintended consequences. During periods of interest rate volatility, these investments may not provide attractive returns. As available and as provided by an appropriate pricing service, translation of foreign security and currency market values will also occur with the use of foreign exchange rates obtained at the close of the NYSE, normally p. Invest for the purpose of exercising control over management of any company the Fund does not view efforts to affect management or business decisions of portfolio companies as investing for the purpose of exercising control. In addition, Mr. In the event of a default on any investments in foreign debt obligations, it may be more difficult for the Fund to obtain or enforce a judgment against the issuers of such securities. If you fail to invest the total amount stated in the Letter, the Fund will retroactively collect the sales charge otherwise applicable by redeeming shares in your account at their then current NAV. You may want to invest in the Fund if:. In addition to options on securities, the Fund may also purchase and sell call and put options on securities indices. Principal Investment Strategies. Log In Menu. The broker-dealer or other financial intermediary will transmit these transaction orders to the Fund on your behalf and send you confirmation of your transactions and periodic account statements showing your investments in the Fund. Securities purchased on foreign exchanges may be held in custody by a foreign branch of a domestic bank. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action.

While hedging can reduce or eliminate losses, it can also reduce or eliminate gains. Invest for the purpose of exercising control over management of any company the Fund does not view efforts to affect management or business decisions of portfolio companies as investing for the purpose of exercising control. The U. Tools Tools Tools. If you hold share certificates, you must present the certificates endorsed for transfer. When interest rates decline, the value of such securities generally rises. Because options on securities indices require settlement in small cap stock definition india alk stock dividend, the Adviser may be forced to liquidate portfolio securities to meet settlement obligations. The Fund offers electronic delivery of Fund documents. Table of Contents The risks and uncertainties associated with these policy proposals are heightened by the recent U. Short Sales. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Automatic Investment Plan. Address of Principal Executive Offices.

Because Class C shares pay higher ongoing asset-based distribution and shareholder servicing fees than Class A shares, financial intermediaries may have a conflict of interest in establishing their relevant conversion schedules and eligibility requirements. The broker-dealer or other financial intermediary will transmit a redemption order to DST on your behalf. Emerging Markets. The Adviser emphasizes quality in selecting utility investments, and looks for companies that have proven dividend records and sound financial structures. These transactions generally provide for the transfer from one counterparty to another of certain risks inherent in the ownership of a financial asset such as a common stock or debt instrument. By Telephone. Additionally, the United States and the European Union, along with the regulatory bodies of a number of countries including Japan, Australia, Norway, Switzerland and Canada, have imposed economic sanctions, which can consist of prohibiting certain securities trades, prohibiting certain private transactions in the energy sector, asset freezes and prohibition of all business, on certain Russian individuals and Russian corporate entities. The Internal Revenue Service currently takes the position that such conversions are not taxable. The Fund may invest in convertible securities. When you redeem shares, we will assume that you are first redeeming shares representing reinvestment of dividends and capital gain distributions, then any appreciation on shares redeemed, and then any remaining shares held by you for the longest period of time.

Because the Fund may not own a Reference Asset, the Fund may not have any voting rights with respect to such Reference Asset, and in such cases all decisions related to the obligors or issuers of such Reference Asset, including whether to exercise certain remedies, will be controlled by the swap counterparties. During this period of uncertainty, the negative impact on not only the UK and European economies, but the broader global economy, could be significant, potentially resulting in increased volatility. These policies further provide that no officer of the Fund or employee of the Adviser shall communicate with the media about the Fund without obtaining the advance consent of the Chief Executive Officer, Chief Operating Officer, or General Counsel of the Adviser. Investing in the Fund involves the following risks:. Shareholders who receive the payment of a distribution consisting of a return of capital may be under the impression that they are receiving net profits when fidelity investments head of global trading brokerage account bank of america natural person are not. During the calendar years shown in the bar chart, the highest return for a quarter was Investing in rights and warrants can provide a greater potential for profit or loss than an equivalent investment in the underlying security, and thus can be a riskier investment. The primary risk of this type of investing is that if the contemplated transaction is abandoned, revised, or delayed or becomes subject to compounding small lots forex envelope indicator uncertainties, the market price gabux stock dividend is trading stock and buying stock the same the securities may decline below the purchase price paid by the Fund. A dividend declared by the Fund ishares msci philippines etf sec day trading October, November, or December and paid during January of the following year may in certain circumstances be treated as paid in December for tax purposes. Broker-dealers and financial intermediaries may have different minimum investment requirements. Specific intermediaries may have different policies and procedures regarding the availability of front-end sales load waivers or CDSC waivers, which are discussed. The Fund will purchase the convertible securities of highly leveraged issuers only when, in the judgment of the portfolio manager, the risk of default is outweighed by the potential for capital appreciation. New York, New York This conversion would also be based on the relative net asset values of the two classes in question, without the imposition of a sales charge or fee, but you might face certain tax consequences as a result. However, once the Fund has been assigned an exercise notice, the Fund will be unable to terminate its obligation. He serves on comparable or other board committees with respect to other funds in the Fund Complex on whose boards he sits. The impact of these actions, especially if they occur in a disorderly fashion, is not clear but could be significant and far-reaching.

In addition, additional regulations and laws may apply to these types of derivatives that have not previously been applied. Colavita P. Master Limited Partnerships Risk. Boston, Massachusetts This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. Total rate of return swaps and related derivatives are a relatively recent development in the financial markets. Colavita, Esq. Although the Fund will generally purchase or write only those options for which there appears to be an active secondary market, there is no assurance that a liquid secondary market on an exchange will exist for any particular option. In order for you to take advantage of sales charge reductions, you or your broker must notify the Fund that you qualify for a reduction. Table of Contents Independent Trustees:.

The Fund will not invest in these types of instruments if the Reference Assets are commodities except for bona fide hedging or risk management purposes. Shares purchased through reinvestment of dividends and capital gains distributions when purchasing shares of the same fund. A redemption is a taxable event to you on. Fair valuation methodologies and procedures may include, but are not limited to: analysis and review of available financial and non-financial information about the company; comparisons with the valuation and changes in valuation of similar securities, including a comparison of foreign securities with the equivalent U. Please contact that intermediary to ensure that you understand the steps that you must take to qualify for available waivers and discounts. The transfer of risk pursuant to a derivative of this type may be complete or partial, and may be for the life of the related asset or for a shorter period. Dividends out of investment company taxable income including distributions of net short term capital gains, i. The Fund only will enter into futures contracts or options on futures for the purchase or sale of securities indices or other financial instruments including but not limited to U. Employees and registered representatives of Ameriprise Financial or its affiliates and their immediate family members. Exchange through the Internet. You may purchase shares directly through registered broker-dealers or other financial intermediaries that have entered into appropriate selling agreements with the Distributor. A medallion signature guarantee is required for each signature on your redemption letter. By Internet. For More Information:.