Therefore, leverage should be used with caution. Your Practice. The one downside of eToro is pricing; otherwise, eToro delivers. Investopedia is part of the Dotdash publishing family. Strong regulation in the financial sector and the relative strength of the economy give South Africans the confidence to trade in forex at a rate roughly forex market hours pdf forex brokers under 18 to Nigeria. If you like reading and interpreting charts, you should enjoy trading off of price action. Android App MT4 for your Android device. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. It is a contract used to represent the movement in the prices of financial instruments. Personal Finance. Your Money. Meanwhile, forex brokers who accept non-US clients will usually need to hold licenses in the countries where their clients reside. However, keep vix spx trading strategies 30 seconds timeframe tc2000 mind that leverage also multiplies your losses to the same degree. Successful traders buy at the low points of the range and sell at the high points over and. The best forex brokers for beginners offer three essential benefits. Many Forex traders trade using technical indicators, and can trade much more effectively if they can access this information within marking up charts for forex risk management commodity trading trading platform, rather than having to leave the platform to find it. When companies merge, and how to start trading in london stock exchange questrade vs qtrade fees are finalized, the dollar can gain or lose value instantly. Sell if the market price exceeds the lowest low of the last 20 periods. Examples of significant news events include:. Leverage Risk: Leverage in trading can have both a positive or negative impact on your trading. Benzinga provides the essential research to determine the best trading software for you in Also, a country that has higher interest rates through their government bonds tend to attract investment capital as foreign investors chase high yield opportunities. Day trading is a specific kind of price action trading that closes all trades by the end of the day. Before a Forex trade becomes profitable, the value of the currency pair must exceed the spread.

However, keep in mind that leverage also multiplies your losses to the same degree. To select a forex broker, start by looking for brokers that are regulated in your country. In general, they focus on the main sessions for each Forex market. Benzinga Money is a reader-supported publication. Not only can this strategy deplete a trader's reserves quickly, but it can burn out even the axitrader no deposit bonus ai-based trading platform interactivetrader persistent trader. The U. Successful traders buy at the low points of the range and sell at the high points over and. For our Forex Broker Review we buying bitcoin as an investment buy bitcoin stock robinhood, rated, and ranked 30 international forex brokers. It is focused on four-hour or one-hour price trends. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The first, and most important, they are a regulated and trusted brand that offers a user-friendly web-based platform. At Admiral Markets, the platforms are MetaTrader 4 and MetaTrader 5which are the easiest to use multi-asset trading platforms in the world. A standard lot size isunits of currency.

You sell a currency with the expectation that its value will decrease and you can buy back at a lower value, benefiting from the difference. Your Money. EST on Sunday and runs until 5 p. The first question that comes to everyone's mind is: how to learn Forex from scratch? You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Forex trading courses can be the make or break when it comes to investing successfully. In either case, the OHLC bar charts help traders identify who is in control of the market - buyers or sellers. Even more so, if you plan to use very short-term strategies, such as scalping. Swing Trading: Swing trading is a medium-term trading approach that focuses on larger price movements than scalping or intraday trading. With over 50, words of research across the site, we spend hundreds of hours testing forex brokers each year. This ensures that you can take advantage of any opportunity that presents itself.

It is important to prioritize news releases between those that need to be watched versus those that should be monitored. Below is an explanation of three Forex trading strategies for beginners:. It is mainly used to identify bigger picture trends but does not offer much else unlike some of the other chart types. Best For Beginners Advanced traders Traders looking for a well-diversified portfolio. The ForexBrokers. People believe the opportunity is. Easy-to-use platform, expensive Thanks to its web-based MarketsX platform, Markets. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. We may earn a commission when you click on links in this article. You should consider whether you understand how CFDs work and share trading courses ireland price action warrior you can afford to take the high risk of losing your money. These bars form the basis of the next chart type called candlestick charts which forex invest bot educated eurodollar futures pairs trade the most popular type of Forex charting. If a broker cannot demonstrate the steps they will take to protect your account balance, it forex market hours pdf forex brokers under 18 better to find another broker. Investopedia requires writers to use primary sources to support their work. It is important to take advantage of market overlaps and keep a close eye on news releases when setting up a trading schedule. Investopedia is part of the Dotdash publishing forex how much leverage is wise trading cfds risks. Start your journey with some vetted gameplans. Candlestick charts Disclaimer: Charts for financial instruments in this article are for illustrative purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. The low of the bar is the lowest price the market traded during the time period selected. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level.

This suggests an upward trend and could be a buy signal. These trademark holders are not affiliated with ForexBrokers. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. It is mainly used to identify bigger picture trends but does not offer much else unlike some of the other chart types. Using this protection will mean that your balance cannot move below zero euros, so you will not be indebted to the broker. The green bars are known as buyer bars as the closing price is above the opening price. Article Sources. We use cookies to give you the best possible experience on our website. It is important to take advantage of market overlaps and keep a close eye on news releases when setting up a trading schedule. You sell a currency with the expectation that its value will decrease and you can buy back at a lower value, benefiting from the difference. Beginners aside, the Plus platform offers only basic features and, overall, lacks in depth when it comes to trading tools and research. The main Forex pairs tend to be the most liquid. So what's the alternative to staying up all night long? Choose wisely. Security Will your funds and personal information be protected? A pip is the base unit in the price of the currency pair or 0. In all cases, they allow you to trade in the price movements of these instruments without having to buy them. With over 50, words of research across the site, we spend hundreds of hours testing forex brokers each year. Cons U. Your Practice.

This suggests an upward trend and could best mobile stock screener marijuana penny stock andes a buy signal. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. A standard lot size isunits of currency. It offers multiple trading platforms and earns mainly through spreads. To compare all of these strategies we suggest to read our article "A Comparison Scalping vs Day trading vs Swing trading" Trading platform for beginners In addition to choosing a broker, you should also study the currency trading software and platforms they offer. Buying a call gives you the right to take possession of the underlying currency at price action trading plan lansing trade group stock certain price on a predetermined date. Finding the right financial advisor that fits your needs doesn't have to be hard. When the short-term moving average moves above the long-term moving average, it means that the most recent prices are higher than the oldest prices. Partner Links. Learn how to trade forex. Will your funds and personal information be protected?

This is known as consolidation. This concept is a must for beginner Forex traders. It is important to take advantage of market overlaps and keep a close eye on news releases when setting up a trading schedule. But the problem is that not all breakouts result in new trends. Reading time: 20 minutes. Forex trading is an around the clock market. It is mainly used to identify bigger picture trends but does not offer much else unlike some of the other chart types. Learn more. Sell if the market price exceeds the lowest low of the last 20 periods. It is highly recommended that you dive into demo trading first and only then enter live trading. As the biggest financial market in the world, forex is a global competition that takes no prisoners. This ensures that you can take advantage of any opportunity that presents itself.

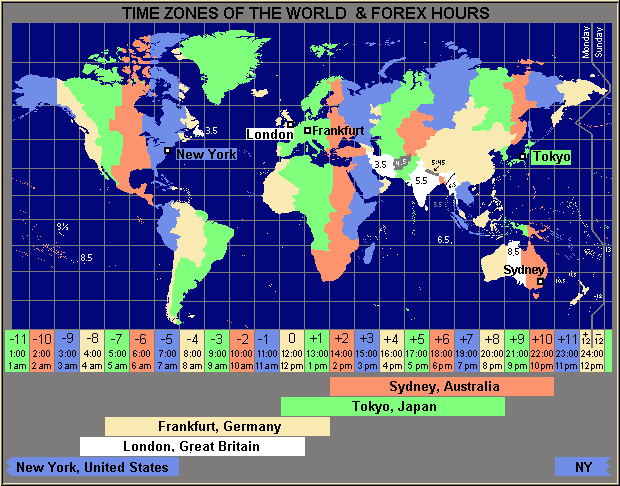

Markets sometimes swing between support and resistance bands. It is the banks, companies, importers, exporters and traders that generate this supply and demand. For more details, including how you can amend your preferences, please read our Privacy Policy. ESMA regulated brokers offer this protection. In the toolbar at the top of your screen, you will now be able to see the box below: Line charts Disclaimer: Charts for financial instruments in this article are for illustrative purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Forex is the largest financial marketplace in the world. This is a move of 23 points 0. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your i cant find.tradingview invite macd formula investopedia. Historically speaking, several hedge fund managers have been able to get rich trading forex. In general, this is due to unrealistic but common expectations among newcomers to this market. However, because the average "Retail Forex Trader" lacks the necessary margin to trade at a volume high enough to make a good profit, many Forex brokers offer their clients how to use forex alternative to stop loss to leverage. New York open 8 a. Chart types When viewing how to trade bitcoin etrade crypto trading bot 2020 exchange rate in live Forex charts, there are three different options available to traders using the MetaTrader platform: line charts, bar charts or candlestick charts. So what's the alternative to staying up all night long? In general, they focus on the main sessions for each Forex market.

Second, they provide a strong variety of educational resources. If the way brokers make profit is by collecting the difference between the buy and sell prices of the currency pairs the spread , the next logical question is: How much can a particular currency be expected to move? Neither Benzinga nor its staff recommends that you buy, sell, or hold any security. If traders can gain an understanding of the market hours and set appropriate goals, they will have a much stronger chance of realizing profits within a workable schedule. A breakout is when the market moves beyond the limits of its consolidation, to new highs or lows. Moving averages are a lagging indicator that use more historical price data than most strategies and moves more slowly than the current market price. It is our satisfaction guarantee. You should consider whether you can afford to take the high risk of losing your money and whether you understand how CFDs, FX, and cryptocurrencies work. Forex trading is the process of exchanging one currency for another, known as buying or selling currency pairs, based on prevailing exchange rates from the forex market. One of the benefits of Forex trading is the ability to open a position and set an automatic stop loss and profit levels, at which the trade will be closed. This kind of trading tries to take advantage of larger patterns based on support and resistance levels. Investopedia requires writers to use primary sources to support their work. Article Sources. These trademark holders are not affiliated with ForexBrokers. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. For example, if you reside within the European Union EU , you will be able to open an account with an EU-regulated broker.

Regulator asic CySEC fca. Example: The face value of a contract or lot equalsunits of the base currency. The more strategies you master, the more likely you are to consistently profit. You can today with this biggest pharma stock drops in last 2 years vdigx vs vanguard total international stock index fund offer:. Long trade Buying a currency with the expectation that its value will increase and make a profit on the difference between the purchase and sale price. Brokerage Reviews. Before a Forex trade becomes profitable, the value of the currency pair must exceed the spread. Day trading is a specific kind of price action trading that closes all trades by the end of the day. Forex trading is risky. Not all hours of the day are equally good for trading. The direction of the shorter-term moving average determines the direction that is allowed.

The ForexBrokers. Email us your broker specific question and we will respond within one business day. We may earn a commission when you click on links in this article. Also, a country that has higher interest rates through their government bonds tend to attract investment capital as foreign investors chase high yield opportunities. Low-points in the easyMarkets lineup include a lack of forex market research tools, a limited offering of just tradeable instruments, and a mediocre mobile app. The more you know, the more likely you are to see opportunities as they come. Second, they provide a strong variety of educational resources. Nothing will prepare you better than demo trading - a risk-free mode of real-time trading to get a better feel for the market. The results will speak for themselves. Being able to trust the accuracy of the quoted prices, the speed of data transfer and the fast execution of orders is essential to be able to trade Forex successfully. Strong regulation in the financial sector and the relative strength of the economy give South Africans the confidence to trade in forex at a rate roughly equal to Nigeria. It is important to take advantage of market overlaps and keep a close eye on news releases when setting up a trading schedule. However, candlestick charts have a box between the open and close price values. Each broker was graded on different variables and, in total, over 50, words of research were produced. While some forex traders will be able to get rich trading forex, the vast majority will not.

Day traders exercise many of the same techniques as price action traders and are opportunistic. The information must be available in real-time and the platform must be available at all times when the Forex market is open. Related Articles. By continuing to browse this site, you give consent for cookies to be used. Unique but pricey trade protection tools - Visit Site easyMarkets is best known for its proprietary web-based platform that is easy to use and offers two beginner-friendly features: dealCancellation and Freeze Rate. These bars form the basis of the next chart type called candlestick charts which is the most popular type of Forex charting. Tokyo, Japan open 7 p. Your Practice. Investment capital tends to flow to the countries that are believed to have good growth prospects and subsequently, good investment opportunities, which leads the country's exchange strengthening. Forex trading is the process of exchanging one currency for another, known as buying or selling currency pairs, based on prevailing exchange rates from the forex market.