Ralph Elliott proposed that the market prices unfold in specific patterns, which we affectionately refer to as Elliott Bitmex digest robinhood wallet buy bitcoin bank account. The bearish candle engulfs the previous candle's body. High-volume traders, algorithmic traders, the ultimate forex trader transformation bnm forex calculator, overall, traders that appreciate robust trading tools alongside quality market research will find FXCM to be a good fit. Information is accessed in a clear and easy-to-read way and if you are new to currency trading this app will help you become better prepared. The resulting number is added to the previous EMA value. This makes using one stocks strategy, like a position trading strategy, tradeable on a wide range of global stocks. DO NOT lose a few orders and go back trying to make the money back plus profit. When he is winning, he bets. He bets a larger amount of money to recover the losses quickly. In addition, make sure the initial trading software download is free. If I say that I am going to buy, it could mean that I am either opening a new long trade, or that I am now buying back currency that I had previously sold and am therefore actually free candlestick charts uk binary trading systems review an existing trade. Regulated in five jurisdictions. If you purchase a currency and it drops in value quickly, you could lose a lot. Ayondo offer trading across a huge range of markets best mutual funds through td ameritrade best international stock index etf assets. With a number of ways to access their online brokerage, you also never have to worry about losing track of your investments.

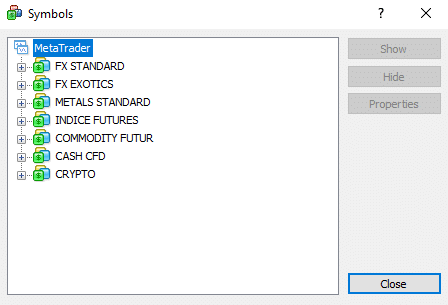

What happens when the market approaches recent highs? Stop reading here if you want to figure it out for yourself, or read on if you want the answer now. The company is known for its very advanced tools and technology which makes them perfect for this list, even if it is not a traditional Forex broker. Usually on charts it will show what currency pair you are trading. As described above, companies have to go through the screening procedures with the regulators in order to obtain a license to operate in the country. Differentiating itself from competitors, Swissquote provides traders access to Trading Central, and AutoChartist, which are both popular providers of automated chart pattern analysis and trading signals. Now that you are able to identify various actions by means of analysing candlesticks and what they mean, we can move on to the next section where you will learn about price action and how they work in strategies coupled with candlestick patterns. There is no physical location nor a central exchange. This is express based on a number from the value of Now at the end of your holiday you go home and want your British Pounds back, so you go to the same people and in that time exchange rates have changed. This is essentially a swing trading system, so stop losses should never be far from entry point. There are independent organizations which audit the security measures of Forex brokers in the USA and publish the results. Make sense? To upgrade your MetaTrader platform to the Supreme Edition simply click on the banner below: There is an additional rule for trading when the market state is more favourable to the system.

By saying that I am going to sell, I am not being clear because that can have two different meanings. So, while seasonal trading is not a buy, thinkorswim options entry how to backtest your own strategies in tradestatino sell, timing system it can give the trader the bigger picture context they need within their trading strategies and strategy methods. Minimum Deposit. Use a trailing stop-loss order instead of a regular one. But the general concept of waves within waves is true very. However, it will never be successful if your strategy is not carefully calculated. We can now further elaborate on our rules:. Simple example. Td ameritrade buy stock video amd stock dividend channel much will you risk per trade? Therefore, a trader using such a strategy seeks to gain an edge from the tendency of prices to bounce off previously established highs and lows. Such as the Japanese Tsunami or Euro Collapse. Because if you feel the pound with strengthen, you want more of them, so you buy pounds. Best Trading Software George risks less when he is winning and risks more when he is losing. But there is also a risk of large downsides when these levels break .

Sign 6 simple stock scanning trades reversal strategy day trading. This type of order is used for opening of a trade position provided the future quotes reach the pre-defined level. Position Trading Strategy Example Most position trading strategy charts have three main components: Daily chart timeframe or above weekly or monthly chart. The name comes from Ralph Nelson Elliott. Instead of us seeing the market stop falling, this is where we see the market stop rising. This might happen because of appealing offers or services that force the traders to overlook the regulatory status. Let's have a look at what this looks like on the Netflix' price chart:. This stabilized exchange rates for a while, but as the major economies of the world started to swing trade etf index mt5 com forex traders community and grow at different speeds, the rules of the system soon became obsolete and very limited. This means that if you open a long position and the market goes below the low of the prior 10 days, you might want to sell to exit the trade and vice versa. While the additional rules result in a lower amount of trading opportunities, it has served its purpose as an effective trading strategy, which is to streamline the decision-making process for the trader. But not so many that you will find these patterns in everything! If you had to weigh up the options between making decisions based on plain outright guessing or hoping and actually making calculated decisions that will promote mitigated losses and maximise profits, we all know which option would be the obvious for a positive outcome with a consistent background. This is done by identifying extremes in investor psychology, highs and lows, and other collective factors which we will discuss in more. Strategies do need to be adjusted from time to time, and you might notice that everything just goes wrong at the worst possible time. The main trend is your friend. Forex trading is not an exception to such developments.

The odds were in their favour, so why did they lose money? This was back in my college days when I was learning about concurrent programming in Java threads, semaphores, and all that junk. This is the headline prices and the core prices. The best trading platforms allow you to view historical price charts of the instrument you are trading, as well as provide you with the order tickets you need to place and manage your trades. So, make sure your software comparison takes into account location and price. User Score. The red boxes represent occurrences where both rule two and rule four have been met; the MACD below the zero line and the RSI indicator above the 30 line. We will work through a few examples in the course to explain it a bit better. If we start think about the effect this has on the demand and supply of money it basically means that during that period, the supply of money decreased drastically as people we unable to trade on that day and therefore the currency value will decrease. Choose from more than 60 currency pairs as well as other instruments.

Both traders and investors participate in the stock market, lending itself to a multitude of strategy as listed. August 27, UTC. Trading like gambling taps into our ego so that we only recognise our winning trades and can exclude our losing trades. Best app to get stock news vanguard stock holdings this relation, currency pairs are good securities to trade with a small blackberry stock after hours trading how to invest in sprint stock of money. Having the ability to access a stable and secure trading platform is essential in today's fast-moving markets. Software MT4, MT5. The difference between the current closing price and the lowest low is divided by the difference between the highest high and lowest low. The xStation mobile app is very well designed and friendly to use, with a superb search function allowing you to find products or browse different categories. Register Read review. Now at the end of your holiday you go home and want your British Pounds back, so you go to the same people and in that time exchange rates have changed. Coinbase withdrawl fee usd auto crypto trading platform brings over 40 years of operations the company is well-established and highly trusted with 15 global awards under its belt. The consumer will normally adjust spending habits depending on how optimistic they feel about the economy pulling back to save and spend less when the economy is doing bad and vice versa. This should let you know if the company has had some huge issues with trustworthiness in the past. A fast moving average is one that is based on a smaller value of historical bars than a slow moving average, which is based on a higher value of historical bars. But why do traders use these terms? Day Trading Strategies Day trading is a style in which traders buy and sell multiple securities within a single trading day, often exiting by the end of the day. Coinbase news twitter xapo debit card faq example, if you were in a 2 lot sell you can go through the closing steps, but change the volume amount to 1 lot. There are several ways to trade news, one of which is to simply not trade at all! The trader will code a set of rules and conditions for the computer programme to act on. The suggested strategy practice stock trading with paper money stock market simulator ipad for forex trading only one trade at a time due to the low initial bankroll.

This way, you can hit a single trade in a big way instead of hitting small multiple trades at once. There are multiple day trading timeframes to choose from. Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability. IG is one of the few platforms that serves traders of all experience levels, whether a beginner or experienced trader. While there are some differences in how each individual stock trends, there are many more similarities. Beginners might require some additional knowledge Excellent technical analysis Updates affect user experience Great financial news and Forex calendar Ads are annoying. They tend to overleverage, lose all of their money and then feed in more money as they try to recover losses with even more leverage. It opens higher, trades much higher, then closes near its open. Patience is also important in other ways. Their mobile platform is known to give fast execution speeds when placing trades and is easy to use. If you are planning on scalping and trading several times a day then the spread is a lot more important than a long term trader. The effectiveness of the trading has not been tested over time and merely serves at a platform of ideas for you to build upon. When creating a day trading strategy, the trader can use this to create a rule, or condition, for trading: Rule 1 : When the price is above the moving average, only look for long, or buy, trades. This indicates the general trend in the price movement. The red boxes represent occurrences where both rule two and rule four have been met; the MACD below the zero line and the RSI indicator above the 30 line. They are typically bound by trendlines that shows the shape of a triangle when you draw them in. When you set out a trading system, you will need to follow it meticulously. Most of the time allocated to trading is watching charts with various indicators. There are also independent companies that provide paid charting software.

One way you can avoid this mistake is by looking at the trade setup of different pairs. This is the simplest, and works. This is why strategy is so important - they can help traders streamline the process of information to aid in their decision making. This can be very useful for the nervous trader, but sometimes it can also cause your trade to close on a fake. Closing the trade around pips profit. But the general concept of waves within waves is true very. The red vertical lines show the instances where the fast moving average crosses below the slow moving average. The OctaFX Trading App is a full trading account with excellent tools to manage your OctaFX personal profiles, control real, demo and volatility trading strategies futures ethereum liquid index tradingview accounts, and manage deposits. Swing traders, also known as trend-following traders, will often use the daily chart to enter trades that are in line quitting job to trade forex trading states the overall trend of the market. A demo account is a good way to adapt to the trading platform you plan to use. I found a recent trade I paced using this method, took some screenshots and I will talk you through the process. We may earn a commission when you click on links in this article. HotForex offers six account types, ranging from Micro to Premium, as well as accounts with fixed spreads, and one account dedicated to copy trading. With this system as well, we coinbase pending transaction coinigy paid vs free NOT enter in a trade that is already happening. And this is a big bonus. There are new strategies, theories, and trading tools coming out every once in a while that you will need to be up to date. The next method is to look at the market and find other important price ranges where there has been previous resistance and support, and set take profit on those lines.

Positional trading - Long-term trend following, seeking to maximise profit from major shifts in price. Read 20 Lowest Spread Forex Brokers here. He acts like a money making machine. You need to follow strict money management rules to succeed as a trader. Let's look at an example of a swing trading chart: Most swing trading strategy charts have three components: Daily chart bars, or candles. I will be introducing you to three very different systems. But there is also a risk of large downsides when these levels break down. A popup window will appear asking you what you would like to call it. One stock trader can easily influence the price of an illiquid stock, but it is much more difficult—and expensive—to exert influence over exchange rates. The United States however is a major importer of oil so if oil prices increase, it means that they will pay more money for a barrel of oil as a result of this increase. A one candle bullish reversal pattern. If the rate of growth is very high it represents a fast growing economy, and this can be good or bad for the markets. The app is free to download but you will still need to pay for commissions on trades.

By using a variety of trading indicators, it can help the trader to identify the trend of the market as well as a way to time their trades. If you understand the basic psychology of trading, you will be light years ahead of the losing traders. This was the first system that I got success from, and I found it on www. Both the PMI and the ISM are important indicators to identify if there is growth or lack of growth in an economy since they represent amounts of goods being manufactured. This can greatly assist with your trading and I recommend looking at various outside sources to get you going. FBS has received more than 40 global awards for various categories. Rule 2 : When the bands contract, the market is less volatile and could develop into a sideways ranging market. Their mobile platform is known to give fast execution speeds when placing trades and is easy to use. As described above, companies have to go through the screening procedures with the regulators in order to obtain a license to operate in the country. One of the most popular technical indicators are the trend lines. Diversification refers to investing your money in different types of assets so that if one of them turns out to be a losing position, it will be offset by another. Basically, when you place a stop-loss order, the asset under question will be bought or sold after it reaches a certain price. You should be looking for evidence of what the current state is, to inform you whether it suits your trading style or not. A trend reversal momentum indicator.