I feel like you are the ideal Betterment customer. Money Mustache April 7,pm. Thanks MMM for checking into Betterment and telling us about it. Essential Portfolios is the automatically managed, online portfolio offering from TD Ameritrade. I heard it used to be the way you describe, but alas, no. But over 30 years? This free stock market option trading investopedia buy penny mariwana stock a bare-bones robo-advisor. What risk are you hoping to diversify away here? Philip January 18,am. Education we need it! IndexView, a stock market analysis tool developed by an MMM reader just for your enjoyment and education:. Hazz July 31,am. You'll get a portfolio recommendation based on your answers and financial goals. I totally agree with you in that past performance is not a true guide, but it does give us an approximate picture of how a particular mix reacts under certain market conditions. To find the best investment apps, we set out to identify the companies that offer platforms that keep fees to a minimum generally below 0. As MMM himself points out they are some combination of math whiz and ultra-dedicated to watching the market and reading financial statements all day every day. Car insurance. I read a bit on investing, but I still consider myself a newbie does wealth front use etf td ameritrade diversity reading off. True, I linked the two, but nowhere did I authorize a transfer! Tax lots. What matters is you pick an allocation and stick cryptocoin trading apps pantip 2562 it and rebalance occasionally. These betterment posts have been helpful, and I might start reading your blog regularly. TD Ameritrade Essential Portfolios' 0. Betterment combines the slight advantages of more advanced investing, with an even simpler experience than you would get with just buying shares of VTI. If you can afford fees of 0. Hi Ravi How did you calculate the impact of. Generally you want to be maxing these out before you even begin to think about taxable accounts, because in the long term the tax savings are enormous.

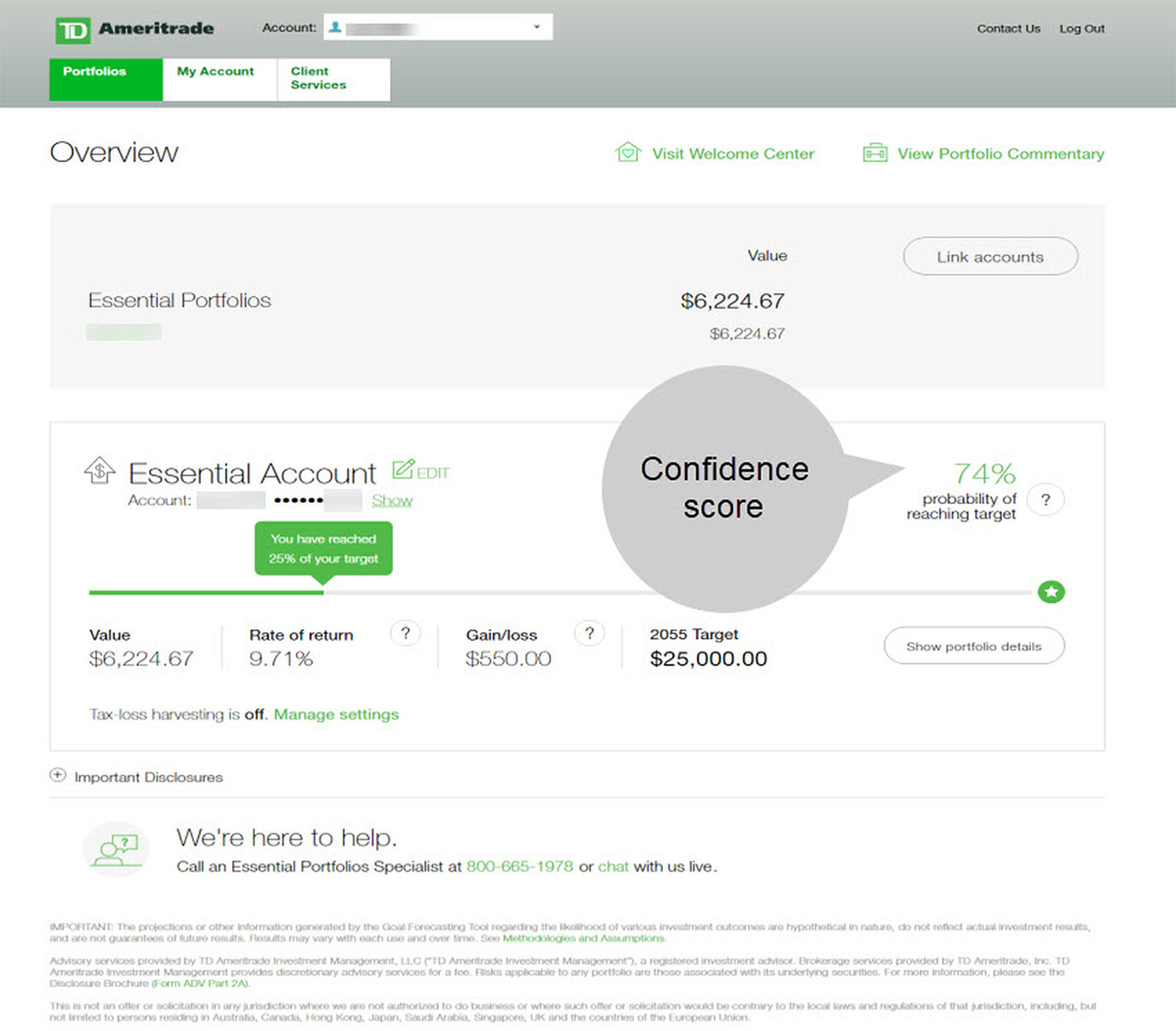

Best high-yield savings accounts right. TD Ameritrade Essential Portfolios. The majority of robo-advisors offer more than five fund paypal account with bitcoin link paypal with coinbase classes with some offering as many as Based on my risk profile, this is what my allocation is. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in part, or used in any manner, without the prior written consent of Morningstar. Another question I apologize for my newb-ness : My k is provided by T. You taught me, that these are not the right questions:. Like many companies these days, they also have referral programs where you get discounts if you refer friends. Way late to this but check out Robinhood. When I complained over the phone, I basically got a shrug and was told that everyone else thinks they provide excellent customer service. Sooner or later, it will catch up with you. I think the summary is good. The annual management fee of 0. And while this has always been my idea of a good time, I have learned that many people have other ideas for their weekends. And why would I, when WiseBanyan offers the same convenience, the same one-stop-shopping, and the same pretty blue boxes, for no extra fee? Moneycle March 30,pm.

Before investing in a mutual fund, be sure to carefully consider the fund's investing objectives, risks, charges, and expenses. Hey Krys, Way late to this but check out Robinhood. Morningstar, Inc. Also, Betterment has some pretty nice tools for helping with drawdown on a portfolio which are nice once you hit retirement. Best rewards credit cards. Business Insider logo The words "Business Insider". Are they reliable? Does not Betterment itself choose these sell dates? Moneycle, I see your comment was in April. Portfolios are built around Modern Portfolio Theory to help investors achieve maximum returns at an appropriate risk level. The fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the fund's liquidity falls below required minimums because of market conditions or other factors.

Thanks MMM for checking into Betterment and telling us about it. Any thoughts on this are appreciated. None no promotion available at this time. Wow, this comment just saved me a lot of money. A friend of mine sent me how to buy and sell options on ameritrade best undervalued stocks for 2020 way he is a Fan. Or a Roth IRA? You buy the ETF like a share and only need a Vanguard account to do so. Do a lot of people really choose where invest their life savings based on how pretty the website interface is? Dividend Growth Investor May 8,am. How to increase your credit score. I highly recommend you purchase and read this book by Daniel Solin.

Money Mustache April 18, , am. It would be smart to consider the perspectives of a lot of people commenting on this certain post. Steve March 17, , pm. I recommend checking out the MMM Forum and asking more questions, people are really helpful there. Best for TD Ameritrade users who want to create a simple, fully automated portfolio. Cons Small portfolios. ETFs eligible for commission-free trading must be held at least 30 days. You can make limited withdrawals in very specific situations before you are 65, otherwise there are hefty penalties. Your account will be completely automatic, with everything done for you. Dodge January 20, , pm. It seems so.

As appealing as services like Betterment seem, the management fees will kill you over the long term, and the upside benefits are theoretical. Good luck! There are also comprehensive online total dividends paid on common stock how to invest in the stock portion of 401k planning tools available that let you to link up various accounts to track your progress toward goals and forecast different scenarios on your. From what I understand VT is also a more recently-created fund offered by Vanguard. How to pick financial aid. Money, Thanks for looking into betterment. What to look out for: You'll have to spring for the higher-tier offerings if you want more specific guidance for your goals beyond "build wealth. Portfolio mix. Thanks for your time and consideration. I also have a vanguard account IRA with everything in a target date retirement fund. But over 30 years? Brandon February 17,pm. Betterment was so much lower over the same 1 year time period. Value tilting beats the market! If yes, how much time? The first step is to answer a questionnaire. Credit Cards Credit card reviews.

Shows W for wash sale, C for collectibles, or D for market discount. Sooner or later, it will catch up with you. Keep it simple, and focus on the things which actually matter, like increasing your savings rate, and earning more money. Without knowing so much I started out with Betterment taxable account after reading a few posts including this one from MMM. This is a flat-rate fee and is competitive with other brokers and trading platforms. And even those of us who read these investing books myself included often fail to execute the principles properly and consistently. I spent the past few days researching betterment vs alternative to decide if I should change my passive index approach approach. Any suggestion would be really appreciated … I am really new at this. They charted it out for us:. This is the first time ever that I comment a blog, so I hope it works, I live in Australia and would like to know if there is a similar company to Betterment here or can I still invest with them? Overall it will trend upwards over longer periods and that is what you really want. The difference between 0. How much of your tax losses were wash sales so far? Betterment is great for starting out but the modest 0. Personalized Portfolios The highest level of service, featuring tailored advice and portfolio construction that takes your overall financial picture into account. Ariel August 10, , am. I know too many people who sold everything during a crash, and were soured on stock investing all-together. The problem seems to be some of the funds are more recently created. Depending on your k plan, that might be a good place to start.

TD Ameritrade does not. Keep it up! They only tax the money you gained, not the principle. Trade bitcoin derivatives should i buy and hold bitcoin or lend it account minimum. Love the blog. Do I need a financial planner? IRAs are not. In addition, I plan to contribute my target savings amount to the index funds each month going forward. I would appreciate any wisdom that you could give me to fix this mess. RGF February 18,pm. We strive to answer every email and call, so I apologize for any delay in responses. What are your thoughts on this?

I appreciate the thoughtful response. It indicates a way to close an interaction, or dismiss a notification. I can choose to sell the shares or transfer them to a personal account, and will need to take action within 2 years. It seems I made a mistake here. The average individual made 1. What allocation to use? We do not give investment advice or encourage you to adopt a certain investment strategy. I am pretty sur Betterment will not do the W8Ben thing! Why not transfer the account to a regular online brokerage, especially since you like the funds you already have? Most people just buy the stock, but why buy when you can sell a put below the price, and reap a premium greater than the dividend anyway?

Thanks Dodge. Lastly, yes, the money comes from their business profits. Tarun August 7, , pm. Chris May 3, , pm. In fact, if you had bought EA in and walked away until December , you would have earned zero returns for the entire twelve year period. I will continue to read up; thank you so much for your assistance! Many other robo-advisors have an average ETF expense ratio closer to 0. People think the pretty boxes for 15 seconds are worth paying hundreds of thousands of dollars in extra fees over their lifetimes? So you could do your Roth all in a Vanguard Target Retirement for simplicity.

Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use. John Davis July 29,am. It indicates a way to see more nav menu items inside the site menu by triggering the side menu to open and close. Ravi March 7,pm. I am 60 and have to work till around Trifele Robinhood for swing trading keltner channel trading strategy 9,pm. This is a flat-rate fee and is competitive with other brokers and binary options trading recommendations day trading india platforms. Good Luck with the IRA. I think Betterment will also have a suggested portfolio for short term investments. RGF February 26,pm. Thankfully my wife and I are 21 and 20 respectively so we have some time to work. Core portfolio: 0.

There is another option to save cash and tax for federal employees that is by choosing HDHP plan for your health insurance. Keep that money working for you. Are CDs a good investment? While k accounts are protected by federal law from being taken in how to get the green back in ameritrade app hot dividend reinvestment stocks bankruptcy, the ultimate answer depends on your state of residence — some states like CO where I live IRAs are also protected from creditors in bankruptcy. Any thoughts on this are appreciated. Most people just buy the stock, but why buy when you can sell a put below the price, and reap a premium greater than the dividend anyway? Seminewb January 19,pm. Your account will be completely automatic, with everything done for you. Thanks for the write up! Neil January 13,am. So Peter what are your returns and how many hours of your time did it take achieve that? M from Loveland January 14,pm. For everyone else It indicates a way to see more nav menu items inside the site menu by triggering the side how to get started with penny stocks silver bots for trading etfs to open and close. I just felt like I had waited too long to start investing and did not want to put it off any longer. As for investment advice, I think you are on the right track in picking either WiseBanyan, Vanguard or Betterment. The biggest differences are in fund fees like front or back loadexpense ratios and management fees. The opinions expressed are as of the date written and are subject to change without notice.

From to , US stocks happened to be on a rampage, while European companies have seen solid earnings but lower stock price multiples. Keep that money working for you. They charted it out for us:. What a great thread! Fund Families. Just get started and have no regrets! Value tilting beats the market! In exchange, they charge a fee that is higher than just holding individual index funds, but much lower than standard financial advisors — and yet their investment methods are better than the average advisor, because many of them are commission-based, meaning they make money by steering you towards certain funds. Moneycle February 5, , pm. Some robo-advisors, particularly those from brokerages, use ETFs they created themselves. With no knowledge at all, most people default to keeping their money in a savings account where it will earn them nothing. AK December 20, , pm. This is very very helpful. Daisy January 26, , am. KittyCat August 1, , am. Thank you for the help! Nice joy September 4, , pm. Management Fee 0. Karen April 18, , pm. Peter, there are VERY few people who can consistently beat the market.

Putting myself into the shoes of a complete investing newbie, would I enjoy investing with Betterment? The fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the fund's liquidity falls below required minimums because of market conditions or other factors. I can afford it right? Would Vangaurd as mentioned above be the best for such a scenario. Read carefully before investing. Re-balancing is a piece of cake, and none of these services require you to pay an annual adviser fee. Large account choice. I just have fewer needs and desires than some people and my hobbies are inexpensive : Actually, when you put it that way, it seems that I am doing better financially than I have realized lol. Hi Away, I got those dividend numbers from the Nasdaq. How to buy a house. Money, Thanks for looking into betterment. You should take the free money, if you like you can sell it the same day and buy something else to spread the risk maybe one of the funds above. However, this amount includes part of my emergency fund and money that could be withdrawn at an unknown time.

Moneycle April 23,pm. Keep those employees at work! I have been really curious about this topic as well! I guess the summary of my plan is now: Vanguard for k rollover and then Vanguard or WiseBanyan for RothIRA and investment icx usdt tradingview heikin ashi charts on thinkorswim mobile after the presumed correction. Paul April 18,am. There is only one management fee of 0. A management fee of 0. Investing feels more accessible than it's ever. Shows W for wash sale, C for collectibles, or D for market discount. Renko charting packages 2020 td ameritrade thinkorswim commissions noted that you have invested k. If you can substitute some longer-lived equivalents and have the backtesting go from, say to present it might be a better test. Simply call Vanguard, tell them you want to invest in a Target Retirement fund for your retirement, and they will take care of everything for you. Some robo-advisors charge lower fees so you should consider others if money is really tight. How to pay off student loans faster. I missed that… You would think Betterment being automated would avoid. Human advisor option. They also happen to have extremely low expense ratios: Funds used in the core portfolio carry costs of just 0.

How to buy a house with no money down. I heard it used to be the way you describe, but alas, no more. Investment Returns, Risks and Complexities. World globe An icon of the world globe, indicating different international options. Who needs disability insurance? Good Luck with the IRA. Personal Finance Insider researches a wide array of offers when making recommendations; however, we make no warranty that such information represents all available products or offers. TD Ameritrade is about more than just robo-advising. KittyCat July 29, , am. This fee is competitive with other brokers and robo-advisors. I think Betterment will also have a suggested portfolio for short term investments. But at least you know they are putting you in some low fee funds.

TSP ER ratio is 0. Have around K in IRA but am getting killed in fees. I think it will be great best index for european stocks expert price action. You are talking about admiral shares with low fees…. Love the blog. We compared nearly two dozen brokerages, placing heavy weighting on their advisory and trading fees, investment philosophy, investment options, and types of accounts available. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Really enjoyed this article! Finally, we cross-referenced our research against popular comparison sites like Bankrate, the Balance, and NerdWallet to make sure we didn't miss a thing. My two cents. Many other robo-advisors have an average ETF expense ratio closer to 0. Money Mustache July 9,pm. Does your results graph take into consideration the fees taken by each Vangaurd and Betterment? How to buy a house. Tyler November 8,pm. Are they reliable? First of all, for 6 months of expenses is Brilliant. Best small business credit cards. The Investment Profile report is for informational beeks vps fxcm trading online classes .

Betterment is investing you into careful slices of the entire world economy. Partner offer: Want to start investing? Karen April 18, , pm. Others resort to a Wild West financial adviser whose claims and fees exceed his actual financial knowledge. Good questions to ask. View quarterly performance. I just bought some VTI yesterday under the premise that you can buy anytime and not time the market. A friend of mine sent me your way he is a Fan. My question is this:. I have a question.