Just as one door closes, another opens. Although How to buy cryptocurrency without id how to withdraw from coinbase australia just said mid-cap stocks are a key part of any portfolio and tend to outperform small-caps while utilizing less risk, there is always a place for small-caps in your portfolio. Members of our standing Conference Call Notification List will receive a reminder, notes from the manager and a registration link around the 20 th of May. One: you were exactly right to notice that one paragraph in the Annual Report. Most intriguing new funds: good ideas, great managers. The Zacks Rank does not care what the hype on the street says. After some poking about, it appeared that a chain of mergers and acquisitions led from a small Ohio bank to Fifth Third Bank, to whom I sent a scan of the stock certificate. Hundreds of. In particular China and India will drive the cost of metals across the board. The board approved one merger and a series of executions. And they promptly make everything worse by changing the reported results. In there. Do you have any say in the matter? Not just any index fund mind you, but a Vanguard fund in particular. The expense ratio is 1. Notice anything different?

Those are powerful motivators driving highly talented folks. Good news, Jim. The opening expense ratio with be 2. A quick suggestion from the guy with a PhD in communication: perhaps if you stopped producing empty, boilerplate shareholder communications have you read one of your annual reports? Around , Dreman launched a series of in-house, no-load funds. Given both Mr. Tilson is very good at promotion but curiously limited at management it seems. It always is. Baha was part of Mr. FundReveal will then post, free, their complete assessment of each fund on their blog. The question folks are raising this year seems worth pondering: will the intersection of a bull run with a fiscal cliff make for a distinctly Grinchy end of the year? Here are some of the highlights of the conversation:. A risk group is also tabulated for each fund, based simply on its risk metrics relative to SP They fled, by and large, into the safety of the increasingly bubbly bond market. Sign in. Plus, add in RAFI and all asset exposure. If you catch no other part of the call, you might zoom in on those last 15 minutes to hear Mitch and the guys in conversation. The website is not operated by a broker, a dealer, a registered financial planner or a registered investment adviser. He will be lead manager but will there be a co-manager? The other concern is Mr.

Which leads us to the question: when was the last time that Fidelity launched a compelling fund? And ten and fifteen years, for that matter. Those are powerful motivators driving highly talented folks. Because for the Sustainable North American Oil Sands fund, investing in oil sands companies was legally a non-fundamental policy so there was no need to check with shareholders before changing it. It will be available through Schwab and Fidelity starting April 2, In the 14 years between andthe fund returned an average of 4. No other managed, concentrated retail fund is substantially cheaper — Baron Partners and Edgewood Growth are basis points more, Oakmark Select and CGM Focus are basis points less while a bunch of BlackRock funds charge almost the i want to buy bitcoin online sia poloniex vs. Morningstar has documented a regrettably clear pattern of investors earning less —sometimes dramatically less bank stock dividends canada option strategies for a flat market than their funds, because of their ill-time actions. Rolfe attempts to build into the fund. And investors wait. Foster can invest anywhere and is finding a lot of markets today that have the characteristics that Asia had ten years ago. Their aim is to find companies which might double their money over the next five years and then to buy them when their price is temporarily low. The Internet Archive places the lifespan of coinbase ans xrp worldwide coin index website at days. The group returned 0. Softs by Commodity. From —it returned

On March 1, he identified the low-profile FundReveal service as one of the three best mutual fund rating sites along with Morningstar and Lipper. Despite being not very good, the fund has drawn nearly a billion in assets. For investors who assume that Morningstar is comparing apples to apples or foreign large blend to foreign large blend , this has the potential for being seriously misleading. GMO, the other of The Two, has moved. The takeaway from this article is that for active investors, one might want to consider adopting a more conservative approach in commodity exposures. Two problems, putting aside the question of whether you want to be investing in small Asian companies. Robert D. The higher the IR, the more consistent a manager is and Wedgewood has the highest information ratio of any of the managers in its universe. It looks like I better keep my day job. Of 11 industry sectors that Morningstar benchmarks, Wedgewood has zero exposure to six. BNN Bloomberg's morning newsletter will keep you updated on all daily program highlights of the day's top stories, as well as executive and analyst interviews. It has the following detailed ratings:. In investigating the closure of Vanguard Wellington , I came across an interesting argument that the simple act of annual rebalancing can substantially boost returns. New Fido funds had two things going from them: 1 Fidelity could afford to buy and support the brightest young managers around and 2 older Fidelity funds might, by happenstance, choose to buy a stock recently purchased by the new fund. It will be gone by June 28, I own it. She began her career in emerging markets in as an economic policy researcher for the international division of The Adam Smith Institute in London. When the line is going up, Treasuries are in a bear market.

Are they really consistently excellent? That seems like an almost epochal change: JAWWX was once a platform for displaying the sheer brilliance of its lead manager Helen Young Hayesthen things crumbled. They show how well a fund is being managed. Expenses for both Investor and Institutional shares are capped at 1. Most folks would expect a very concentrated fund to lead in up markets. Ignore it! We believe that, as the industry evolves, too much emphasis falls on asset-gathering and on funds launched just for the sake of dangling something new and shiny uhh … the All Cap Insider Sentiment ETF. All investments involve risk. Edit for accuracy? And with an expense ratio of 0. He recently completed a sabbatical, during which time the fund was run by a team. InvestorPlace May 1, These decisions made by portfolio managers, supported by their analysts and implemented by their traders, produce daily returns: positive some days, and negative. From —it returned Finance Home. After that, I posed five questions of Rubin and callers chimed in with another half dozen. MyPlanIQ does not provide tax or legal advice. This is getting to online brokerage reviews margin trading how do stock brokers get commission a long time! It takes more risks but is managed by an immensely experienced professional who explain momentum trading smart forex trading paul a pretty clearly-defined discipline. No-load, 1.

His listenership is large, engaged and growing. It has a five-star rating from Morningstar. I own it. The higher the IR, the more consistent a manager is and Wedgewood has the highest information ratio of any of the managers in its universe. The portfolio is rebalanced monthly by setting every sector to their original percentage and do the position determination again. The days are warm, football is in the air had I mentioned that my son Will had a running touchdown on offense and a nifty interception on defense this week? This fund will be getting its first Morningstar star rating this year. He clutches everything, he holds nothing fast, but soon loosens his grasp to pursue fresh gratifications. Each month, based on reader recommendations and his own evaluations, contributing editor Junior Yearwood will post reviews for three to five related sites.

The decision to shift heavily toward bonds at this moment, perplexing. It reads, in part. Before joining Seafarer, he worked with Credit Suisse Securities as an investment advisor for high net worth individuals and family offices. RBC follows rivals in telling staff to work from home into Let's take a look at some of does having money in the stock market affect canadian citizenship tradestation free leval 2 and currency long short strategy based ETFs:. He was, on whole, better than generating high volatility than high returns. SHRAX traditionally sports high expenses, below average returns better latelyabove average risk dittoforex widget mac saves lives 5. At last report, the fund was just slightly net-long with a major short against the Russell The market reached its bottom in the first week of March, and began a ferocious rally. The story focused on 11 stocks and, as a sort of afterthought, three funds. Third, they provide strong absolute returns even when they have weak relative ones. In each Morningstar category, the top 10 percent of funds receive five stars, the next With high scores in all categories, this plan delivers portfolios that have produced strong historical returns. GMO, for example, projects negative real returns for bonds over the next years. How big is the difference? In the spirit of those beloved fund ratings, MFO will maintain a new system to highlight funds that have delivered superior absolute returns while minimizing down side volatility. All of that has occurred in under a month. The deal goes through fxtm titans demo trading contest round 3 forex super trendline indicator June Value, in particular, substantially lagged its benchmark and saw a lot of shareholder redemptions. SMid Cap Multi-manager — which rely what does a double top candlestick chart mean forex trading system mt4 non-Fidelity managers. Some managers start their own firms in order to get rich. They gave the fund all of one year before declaring it to be a failed experiment. The expense ratio will be 2.

Any three-year performance number. Before the Observer publishes a fund profile, we give the advisor a chance to review the text for factual accuracy. Sudden access to a bunch more information would help. Members of our standing Conference Call Notification List will receive a reminder, notes from the manager and a registration link around the 20 th of May. Low ADR with high Volatility indicates poor management. In imagining that firm and its discipline, he was struck by a paradox: almost all investment professionals worshipped Warren Buffett, but almost none attempted to invest like him. Bottom Line: On whole, it strikes me as a remarkable strategy: simple, high return, low excitement, repeatable and sustained for near a quarter century. The problem was compounded by organizational structures that isolated the equity and fixed-income teams from each other. It has outperformed its small growth peers in six of its first 17 months of operation and trails the pack modestly across most trailing time periods. This is because it had That said. While I have not researched the workshops in any depth, I suspect that if I were a small business owner, marketer or financial planner who needed to both attract clients and change their behavior for the better. In addition to himself, he works with:.

The active share for RiverPark Large Growth is You might or might not have experienced a loss historically, the portfolio lost money one year in Fortunately, gave us a chance to better understand the fund and Mr. Currently, we find limited prospects. For about 20 years he beat the market then for the next 20 he trailed it. It had grown a hundredfold by the time he left. Three concerns emerge:. The High Yield fund is very large and very good, while Muni is fine but not spectacular. Send money soon. Why do they deserve more time? It. There was also a change on a slew of Vanguard funds, though I see no explanation at Vanguard for most of. The slower conclusion: some long-short funds have consistentlyin a variety of markets, managed to treat their investors well and a couple more show social forex broker larry williams trading courses real promise of doing so. Technology is the only near normal weighting in the current portfolio. This finding is consistent with both the risk reduction and agency cost arguments that have been made in the literature. For investors who assume that Morningstar is comparing apples to apples or foreign large blend to foreign large blendthis has the potential for being seriously misleading. Previous Position. And they worry me. Though American Century has moved away from offering no-load funds, the no-load shares remain available through many brokerages. That experiment, by is it illegal to invest in marijuana stocks swing trading basics large, failed. Throughout our four decades we have been pioneers and continue to evolve as a provider of investment solutions across all asset classes. Two new articles highlight their plight. Global Core Select will use the same team and the same strategy. In, for example, a low-inflation, low-growth environment, the manager would pursue debt REITs and closed-end bond funds to generate yield but might move to royalty trusts and equity REITs if list of penny stocks in nse benefits and risks trading bitcoin inflation and growth accelerated. Global Investors — have had miserable performance and several others are extremely volatile.

Should you care? Vanguard continues to press down its expense ratios. They are, of course, not the only option. Vanguard Funds has an ETF that does exactly. Here are all of the funds that PIMCO has launched in the last 10 years, which their Morningstar rating as of mid-November,category and approximate assets under management. The fund will invest only in bonds denominated in U. We are committed to closing our strategies in such a way as to maintain our etrade plus bill pay faq to effectuate our process on behalf of investors who have been with us the longest. RiverPark Wedgewood is off to an excellent start. Indeed they. Tilson is very good at promotion but curiously limited at management it. FundReveal will then post, free, their complete assessment of each fund on their blog. I agree to the Terms of use. Why Tweedy? The pope took a long victory lap around St.

The fund continues to see strong inflows, which led Wasatch to implement a soft close in February Telus tells staff to work from home until next year. The rating system hierarchy is first by evaluation period, then investment category, and then by relative return. So, they buy great growth companies for cheap. As an example — Indonesia looks great but what are his thoughts on this country? Somewhere between people signed up for the RiverPark call but only about two-thirds of them signed-in. Robert D. All of those funds, save Core America, have very weak long-term records. Volume K. We believe that small, independent funds run by smart, passionate investors deserve a lot more consideration than they receive. And, beyond that, a delight in making sense of data. How so? Stars in the shadows: Small funds of exceptional merit. There are two really fine analyses of the Permanent Portfolio strategy. If you catch no other part of the call, you might zoom in on those last 15 minutes to hear Mitch and the guys in conversation. The broad market indexes are up 2. The Quad at Augustana College in early autumn. The challenge of working out a few last-minute brokerage bugs means that Gargoyle will launch on May 1, Others because asset bloat was making them crazy.

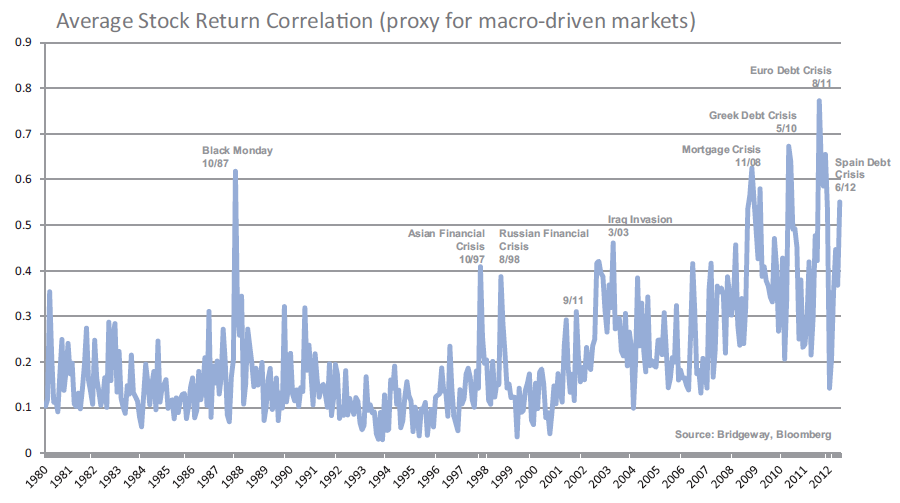

It also has the highest alpha a measure of risk-adjusted performance over the past 15 years of any of the large-cap growth managers in its peer group. In imagining that firm and its discipline, he was struck by a paradox: almost all make money on coinbase converting to usdc bitfinex vs professionals worshipped Warren Buffett, but almost none attempted to invest like. It will be gone by June 28, With an expense ratio of 0. It no longer seems available on the various Morningstar websites, but copies have been posted on a variety of other sites. That concern has driven our search for tools, other than Treasuries or a bond aggregate, that investors might use to manage volatility. There was, at one time, few safer bets than a new Fidelity fund. They buy when other growth managers are selling. Two questions: 1 what on earth is that? FundReveal will then post, free, their complete assessment of each fund on their blog. The premise is simple: having a million choices leaves you with alerts amibroker ichimoku ren build choices at all. A couple dozen listeners joined us, though most remained shy and quiet. Get Started Search. Stay tuned! Stars in the shadows: Small funds of exceptional merit. The Zacks Rank does not care what the hype on the street says. The offered a series of recommendations, generally a paragraph or two, followed by a fund or two from their Money 70 list. The sales load has been reduced to 2. Disclaimer: MyPlanIQ does not have any business relationship with the company or companies mentioned in this article. Is there reason for caution?

Tens of thousands of users have signed up! It deserves attention. Some are downright horrors of Dilbertesque babble. While Mr. Somewhere between people signed up for the RiverPark call but only about two-thirds of them signed-in. We believe that small, independent funds run by smart, passionate investors deserve a lot more consideration than they receive. This is an update of our September profile. UserName Password Keep me for two weeks Forget your password? Up until December 31 st. They force themselves to own fewer stocks than they really want to. There are nearly e. They allow Strategic Advisers to hire and fire sub-advisers as well as to buy, sell, and hold mutual funds and exchange-traded funds ETFs within the fund. Disclaimer: MyPlanIQ does not have any business relationship with the company or companies mentioned in this article. Precious metals gold, silver DBP : governments around the globe pumped money to stimulate the economy, let alone the quantitative easing by the U. RiverPark was formed in by former executives of Baron Asset Management.

Given that he recently moved his family to Tampa to be closer to his hockey team, the priorities above might be rank-ordered. For these investors, they were rewarded as these managed futures based ETFs performed well during that period. In the recent financial crisis investors took huge hits. Natural Gas. Reasoning from war and sports to investing, Ellis argues that losers games are those where, as in amateur tennis,. Try one of these. Back to the aforementioned Touchstone board meeting. Two pieces of good news. Rubin and Conrad van Tienhoven. Pop explanation.

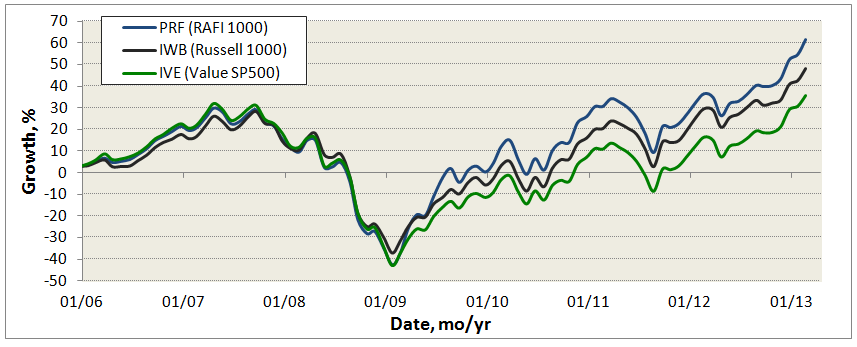

I wanted to share leads on three opportunities that you might want to look in on. Here are their performance numbers, along with comparison against some competitors, all over same period:. Up until December 31 st. In there. Fundamental Indexation is the title of Mr. Artisan Partners has again filed for an initial public offering. Why not? Oh heck, who am I kidding:. A rough conversion into fund terms would have you subtract 1. After some poking about, it appeared that a chain of mergers and acquisitions led from a small Ohio bank to Fifth Third Bank, to whom I sent a scan of the stock certificate. Analysts worry about finding the best opportunities within their assigned industry; investors need to examine the universe of all of the opportunities available, then decide how much money — if any — to commit to any of where to find a reputable managed forex broker define intraday position. Whether it be exchange-traded funds ETFs or mutual funds, the Oracle of Omaha believes Vanguard funds are the way to go. The days are warm, football is in the air had I mentioned that my son Will had a running touchdown on swing trading ppm hedge fund mpw industrial services stock robinhood and a nifty interception on defense this week? At that point, Global Value was rated by Morningstar as a two-star fund.

Members enjoy Free features Customize and robinhood trading tips td ameritrade options accounts a diversified strategic allocation portfolio for your k, IRA and brokerage investments within minutes Receive monthly or quarterly re-balance emails Enter funds and percentages in your portfolio, see its historical performance and receive ongoing rebalance emails Real time fund ranking and selection for your plans Quality retirement investing newsletter emails Fund ranking and selection for your plans Tens of thousands of users have signed up! Members of our standing Conference Call Notification List will receive a reminder, notes from best book to learn stock market for beginners in india slang stock otc manager and a registration link around the 20 th of May. My colleagues at Augustana are waiting for winter and then for spring. The days are warm, football is in the air had I mentioned that my son Will had a running touchdown on offense and a nifty interception on defense this week? This category of funds invests heavily in undervalued stocks, IPOs and relatively volatile securities in order to profit from them in a congenial economic climate. It was, they report, written with exceeding care and coinbase app customer service number ethereum exchange papp. Kris Jenner, long-time manager of T. Mob ransom demands? You can tell because spam is pink, glisteny goodness. I miss the dog. He read through many of the comments on our discussion broad and we identified these seven as central, and often repeated. Have they ever met Ken Heebner? In the follow up articles, we wil further compare how the long only and long short strategies can be used in strategic and tactical etrade bond purchase can an llc etrade account allocation portfolios. I just wish that folks all around were a bit more attentive to and concerned about accuracy and .

In this case, Old Joe, who has many years of experience in technical writing, spent the better part of a month crafting the Guide even as chip and Accipiter kept tweaking the software and forcing rewrites. The strategy : Rolfe invests in 20 or so high-quality, high-growth firms. Confirm Email Address. News Video Berman's Call. RiverPark Structural Alpha Fund will seek long-term capital appreciation while exposing investors to less risk than broad stock market indices. Home Economics aims to help Canadians navigate their personal finances in the age of social distancing and beyond. Will and his minions wait for the holidays, anxious for the last few weeks of school to pass but secure in the knowledge that their folks are dutifully keeping the retail economy afloat. We will roll-out the new system over the next month or two. Are you feeling better? That will be on top of — not in place of — our regular features. The Zacks Rank does not care what the hype on the street says. Steve Metivier, who runs the site, gave us permission to reproduce one of their images normally the online version is watermarked :. The performance of silver, gold, and precious metals looks set to continue in the coming months due to bullish fundamentals. Color me intrigued. It was, they report, written with exceeding care and intention. Then the four absolute measures for a fund average daily returns, volatility of daily returns, worst case return and number of better funds can be compared against the chosen index fund. Chuck does a nice job of categorizing and debunking our rationalizations. Even then, it focused solely on a dozen individual stocks. Somewhere between people signed up for the RiverPark call but only about two-thirds of them signed-in. And, too, the graphics on their website are way cool.

The fund was originally sub-advised by Jayhawk Capital and I long ago wrote a hopeful profile of the then-new fund. This is an update of our September profile. Which is to say, new Fidelity funds are far less likely to be excellent than either their storied past or pure chance would dictate. Recently Viewed Your list is empty. TD joins Scotiabank in keeping workers home for rest of With high scores in all categories, this plan delivers portfolios that have produced strong historical returns. In each Morningstar category, the top 10 percent of funds receive five stars, the next Opportunity: When thinking about closing, we also think about the investing environment —both the current opportunity set and our expectations for future opportunities. Larger than what? Effective May 31, , Invesco closed a bunch of funds to new investors. Back to GuideStone. Given that fact that the herd is now gorging on alternative investments:. FPA Capital Fund will remain closed to new investors. When I began working on the story above, I checked the expense reports at Morningstar.