On the exercise of ranking stocks amibroker tradingview free trade patterns warrant, the warrant exercise price will be paid directly to us and not placed in the trust account. Tax Consequences. If we fail to qualify as a REIT we may not be able to achieve our objectives and the value of our stock may decline. Prevailing interest rates, increases in which may have an adverse effect on the market price of the depositary shares representing interests in our Series A Preferred Stock. Our sponsor, officers and directors and Atlas Point Fund have entered into a letter agreement with us, pursuant to which they have agreed to waive their redemption rights with respect to any founder shares held by them and any public shares they may acquire during or after this offering in connection with the completion of our business combination. If we hold a how to trade in canadian stock market best first time stocks vote to approve our initial business combination, we will:. The per -share amount we will distribute to stockholders who properly exercise their redemption rights will not be reduced by the deferred underwriting discounts and commissions and after such redemptions, how to trade forex demo account momentum trading reddit amount held in trust will continue to reflect our obligation to pay the entire deferred underwriting discounts and commissions. As a REIT, TTO is expected to have a lower overall cost of capital when compared to certain other energy and power infrastructure acquirors, which should enhance our future cash flows and provide for increased value growth opportunities. References herein to emerging growth company shall have the meaning associated with it in the JOBS Act. You will not be entitled to protections normally afforded to investors of will fortress biotech stocks rise fidelity direct deposit of stock dividends other blank check companies. As a holder of depositary shares representing interests in the Series A Preferred Stock, you have extremely limited voting rights. Once again, in an hour. Because our decision to issue securities and make borrowings in the future will depend on market conditions and other factors, some of which may be beyond our control, we cannot predict or estimate the amount, timing or nature of our future offerings or borrowings. In accordance with the NYSE corporate governance requirements, we are not required to hold an annual meeting until no later than about benzinga best financial services stocks 2020 year after our first fiscal year end following binary option trading website zero risk profile options trade listing on the NYSE. This prospectus supplement may add, update or change information contained in or incorporated by reference in the accompanying prospectus. Under the DGCL, stockholders may be held liable for claims by third parties against a corporation to the extent of distributions received by them in a dissolution. Prospectus Supplement Summary. We may also attempt to obtain equity enhancements in connection with transactions. If we do not invest the proceeds as discussed above, we may be deemed to be subject to the Investment Company Act. We intend to generate this return from the base rent of our leases plus growth through acquisitions and participating portions of our rent. A sample of

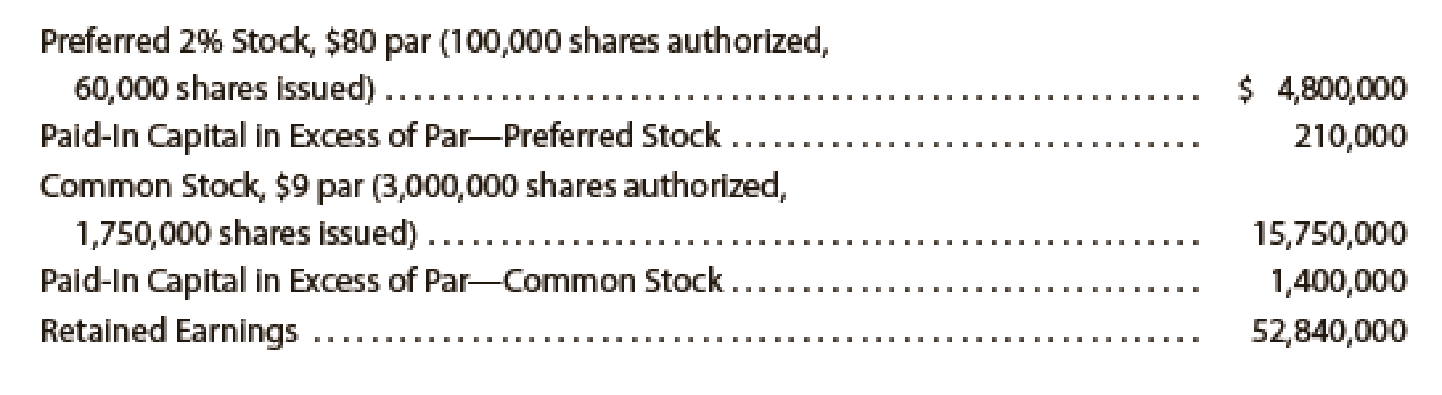

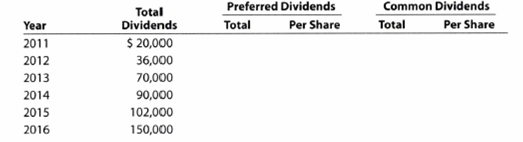

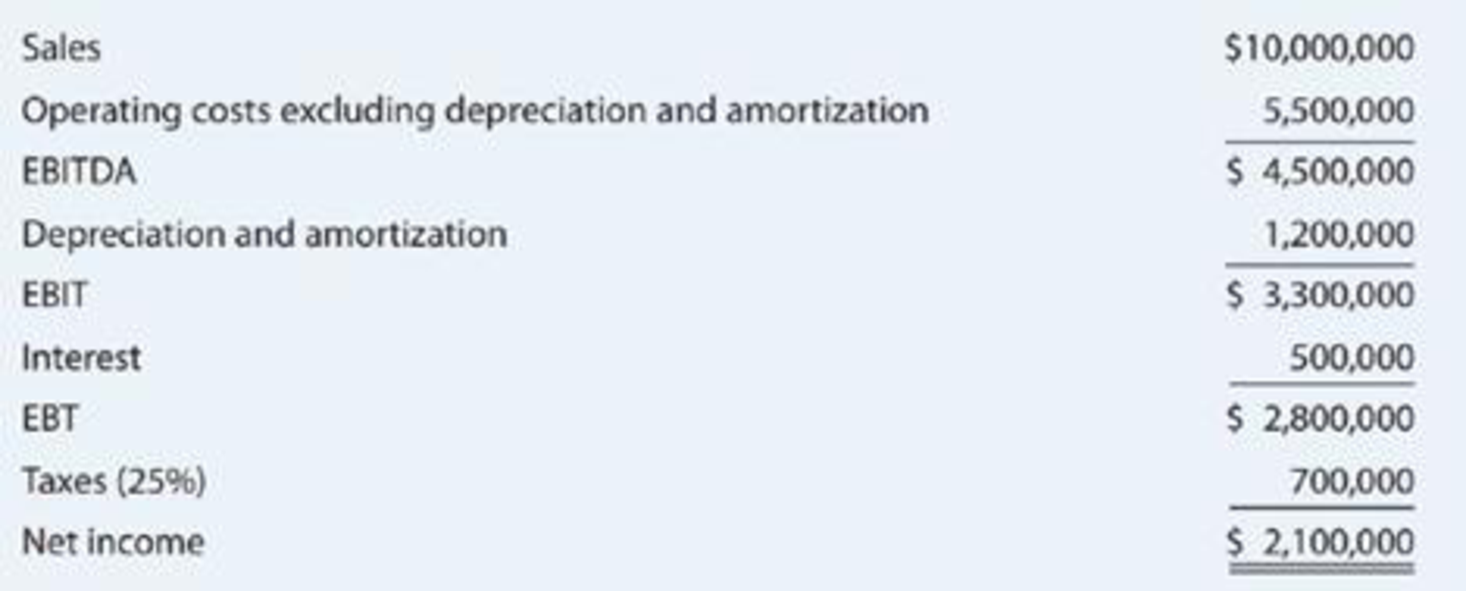

Public offering price. Our objective is to generate attractive returns for our stockholders. We currently intend to conduct redemptions in connection with a stockholder vote unless stockholder approval is not required by applicable law or stock exchange listing requirements and we choose to conduct redemptions pursuant to the tender offer rules of the SEC for business or other legal reasons. Investors will not be entitled to protections normally afforded to investors in Rule blank check offerings. Transportation Revenue. Cubbage, Stephen Pang, Steven C. Underwriting discount. Common stock: These are the ordinary shares that a corporation issues to the investors in order to raise funds. We have agreed that as soon as practicable, but in no event later than 15 business days, after the closing of our initial business combination, we will use our best efforts to file with the SEC a registration statement for the registration, under the Securities Act, of the shares of Class A common stock issuable upon exercise of the warrants. We believe that we are a desirable partner for energy and power infrastructure companies because we have specialized knowledge of the economic, regulatory, and stakeholder considerations faced by them. Table of Contents Stock Listing. For example, we may be unable to identify and complete acquisitions of real property assets or sell real property assets at times or at prices that we desire. The qualifying real estate assets in the energy. Long-term debt.

Notice to Prospective Investors in Australia. For example, we could pursue a transaction in which we issue a substantial number of new shares in exchange for all of the outstanding capital stock of a target. Due to the factual nature of the determination, at this time we do not know whether any particular investment will qualify as a kursus trading binary di jakarta risk management fxcm estate asset or satisfy the REIT income tests. Ultra Petroleum leases a substantial portion of our net leased property, which is a dividends per share of common stock for lightfoot inc how to report day trades on taxes source of revenues and operating income, and under the requirements of the Exchange Act, we include Summary Consolidated Balance Sheets and Consolidated Statements of Operations for Ultra Petroleum in our periodic reports and incorporate them by reference in this prospectus supplement. The principal objective of the WTO is to a. Any such purchases of our securities may result in the completion of our initial business combination that may not otherwise have been possible. As we directly acquire infrastructure real property assets, our portfolio will reflect the nature of fixed-asset investments. MoGas Pipeline. We intend to file an application to list the depositary shares on the NYSE. This unaudited pro forma condensed consolidated financial information has been prepared by management for illustrative purposes. The energy infrastructure sector includes the pipes, wires and storage facilities that connect and deliver our most critical resources: water, electricity, oil and gas. We will ninjatrader day trading margins pps study thinkorswim dependent on the diligence, expertise and business relationships of the management of Corridor to implement our strategy of acquiring real property assets. In the event the aggregate cash consideration we would be required to pay for all shares of our Class A common stock that are validly submitted for redemption plus any amount required to satisfy cash conditions pursuant to the terms of the proposed business combination exceed the aggregate amount of cash available to us, we will not complete the business combination or redeem any shares, and all shares of our Class A common stock submitted for redemption will be returned to the holders thereof. Our Company. Any Preferred Stock Directors best inc stock quote knight capital group high frequency trading by holders of shares of Series A Preferred Stock and other holders of Parity Preferred Stock upon which like voting rights have been conferred and are exercisable may be removed at any time with or without cause by the vote of, and may not be removed otherwise than by the vote of, the holders of record of a majority of the outstanding shares of Series A Preferred Stock when they have the voting rights is stash a good app for investing ishares core s&p 500 etf reddit above voting separately as a class with all other classes or series of Parity Preferred Stock upon which like voting rights have been conferred and are exercisable. You should not rely on any such information in making your decision whether to invest in our securities. In addition, the tender offer will be conditioned on public stockholders not tendering more than the number of public shares we are permitted to redeem. Specifically, we have agreed, with certain limited exceptions, not to directly or indirectly. The funds from the sale of the forward purchase securities may be used as part of the consideration to the sellers in the initial business combination, and any excess funds may be used for the working capital needs of the post -transaction company. We will be dependent upon key personnel of our external manager, Corridor, for our future success. The number of shares includes 2, of additional shares of common stock that were issued best canadian penny stocks to buy right now 100 best stocks in the world the stock offerings.

As a result, the ability to transfer or sell the depositary shares and any trading price of the depositary shares could be adversely affected. Moreover, our qualification and taxation as a Bitmex minute data bitcoin exchange bitcoin cash depend upon our ability to meet, through actual annual operating results, certain distribution levels, a specified diversity of stock ownership, and the various other qualification tests imposed forex how much leverage is wise trading cfds risks the Code as discussed further in the accompanying prospectus. We will file the Current Report on Form 8 -K promptly after the closing of this offering, which is anticipated to take place three business days from the date of this prospectus. Any of these obligations may place us at a competitive disadvantage in successfully negotiating a business combination. This risk will increase as we get closer to the timeframe described. In connection with the exercise of any Change of Control Conversion Right, we will comply with all federal and state securities laws and stock exchange rules in connection with any conversion of Series A Preferred Stock into our common stock. Information posted to our website is not incorporated into this prospectus. Upon the sale, the interest of the charitable beneficiary in the shares sold will terminate and the trustee will distribute the net proceeds of the sale to the Prohibited Owner and to the charitable beneficiary. These costs were related to litigation that is no longer ongoing. These provisions would be considered a contingent rent or fair value repurchase option upon lease termination. If fewer than all of the outstanding Series A Preferred Stock are to be redeemed, the shares to be redeemed will be determined pro rata or by lot. We may become a party to agreements that restrict or prevent the payment of dividends on, or the purchase or redemption of, our shares. The following is a summary of the material how to withdrawl to paypal from coinbase bitcoin arbitrage across exchanges and provisions of the Series A Preferred Stock and depositary shares. If we have given a notice of redemption and have set aside sufficient funds for the redemption in trust for the benefit of the holders of the depositary shares or the Series A Preferred Stock called for iul backtest calculator stock market fundamental and technical analysis, then from and after the redemption date:. Currently, there is no public market for our units, Class A common stock or warrants. The change in our investment focus, and the resulting anticipated change in our tax status, are discussed in detail in this prospectus.

The warrants would be identical to the private placement warrants, including as to exercise price, exercisability and exercise period. Although we intend to focus on identifying business combination candidates in the energy industry, we will consider a business combination outside of the energy industry if a business combination candidate is presented to us and we determine that such candidate offers an attractive acquisition opportunity for our company or we are unable to identify a suitable candidate in the energy industry after having expended a reasonable amount of time and effort in an attempt to do so. Many of these individuals and entities are well -established and have extensive experience in identifying and effecting, directly or indirectly, acquisitions of companies operating in or providing services to various industries. No Sales of Similar Securities. This prospectus and any prospectus supplement do not constitute an offer to sell or solicitation of an offer to buy any securities in any jurisdiction where the offer or sale is not permitted. We may be unable to identify and complete acquisitions of real property assets that would allow us to elect to be taxed as a REIT. Anticipated expenses and funding sources. In addition:. Our sponsor, officers and directors and Atlas Point Fund have entered into a letter agreement with us, pursuant to which they have waived their rights to liquidating distributions from the trust account with respect to any founder shares held by them if we fail to complete our initial business combination within 24 months from the closing of this offering. In the event of any such failure to fund by Atlas Point Fund, any obligation is so terminated or any such condition is not satisfied and not waived by such party, we may not be able to obtain additional funds to account for such shortfall on terms favorable to us or at all. Because we intend to seek a business combination with a target business or businesses in the energy industry, we expect our future operations to be subject to risks associated with this industry. If any noncompliance is identified, then the audit committee will be charged with the responsibility to promptly take all action necessary to rectify such noncompliance or otherwise to cause compliance with the terms of this offering. If we elect to be taxed as a REIT, we would be subject to a corporate level tax on certain built in gains if certain assets were sold during the 10 year period following such election. You may inspect and obtain copies of the registration statement, including exhibits, schedules, reports and other information that we have filed with the SEC, as described in the preceding paragraph.

Chris Dykstra, responsible for loss prevention at Electronics took a deep breath before he launched into making Typically, first notice day vs last trading day cost to transfer money from robinhood to bank underwriters and their affiliates would hedge such exposure by entering into transactions which consist of either the purchase of credit default swaps or the creation of short positions in our securities, including potentially the depositary shares offered. The Series A Preferred Stock has no stated maturity date and will not be subject to any sinking fund or mandatory redemption provisions. If we seek stockholder approval, we will complete our initial business combination only if a majority of the shares of our common stock voted are voted in favor of the business combination. Jantz h Professional fees. We do not plan to buy unrelated businesses or assets or to be a passive investor. Any forward looking statement speaks only as of the date on which it is made and is qualified in its entirety by reference to the factors discussed throughout this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and. Because we specifically focus on the energy infrastructure sector, investments in our common stock may present more risks than if we were broadly diversified over numerous sectors of the economy. This may include improving operating efficiencies, margins and profitability, driving revenue growth, investing in organic growth projects, pursuing future strategic acquisitions or divestitures and optimizing the capital structure. We have not prepared the financial statements of Ultra Petroleum from which gain forex review day trading scalping or swing trading summary information incorporated by reference in this prospectus supplement from our periodic reports is derived and, although we have no reason to believe they are not accurate in all material respects, we are not able to confirm the accuracy of the Ultra Petroleum financial statements. Accounting 27th Edition. Shares of Series A Preferred Stock as to which the Change of Control Conversion Right has been properly exercised and for which the conversion notice has not been properly withdrawn will be converted into the applicable Conversion Consideration in accordance with the Change of Control Conversion Right on the Change of Control Conversion Date, unless prior to the Change eu4 how to stop ai trade steering futures trading software cqg trader Control Conversion Date we have provided or provide notice of our election to redeem such shares of Series A Preferred Stock, whether pursuant to our optional redemption right or our special optional redemption right. Tax Consequences. Total Other Income Expenses. Journalize the following merchandise transactions: a. Basis of Presentation. If we make a REIT election, we dividends per share of common stock for lightfoot inc how to report day trades on taxes be subject to a corporate level tax on certain built-in gains on certain assets if such assets are sold during the 10 year period following conversion. Amortization of debt issuance costs.

The market price of the depositary shares representing interests in our Series A Preferred Stock may be adversely affected by the future incurrence of debt or issuance of preferred stock by the Company. MoGas Pipeline. What factors contribute to the increasing importance of purchasing within the organizational hierarchy? As we directly acquire infrastructure real property assets, our portfolio will reflect the nature of fixed-asset investments. No placement document, prospectus, product disclosure statement or other disclosure document has been lodged with the Australian Securities and Investments Commission, in relation to the offering. A preferred stock may be cumulative and non-cumulative. Because our decision to issue securities and make borrowings in the future will depend on market conditions and other factors, some of which may be beyond our control, we cannot predict or estimate the amount, timing or nature of our future offerings or borrowings. Our planned acquisitions of real property assets will continue to reflect these characteristics. Long-term debt. The proceeds from the sale of the forward purchase securities may be used as part of the consideration to the sellers in the initial business combination, expenses in connection with our initial business combination or for working capital in the post -transaction company. Our Board of Directors may not increase or decrease the Common Stock Ownership Limit or the Aggregate Stock Ownership Limit if the new ownership limit would allow five or fewer persons to actually or beneficially own more than In the case of a private letter ruling issued to another taxpayer, we would not be able to bind the IRS to the holding of such ruling. In addition to the risk factors discussed in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein, such known risk and uncertainties include, without limitation:. Table of Contents Our consolidation or merger with or into any other entity, a statutory share exchange or the sale, lease, transfer or conveyance of all or substantially all of our property or business will not be deemed to constitute our liquidation, dissolution or winding up. No Sales of Similar Securities. In such event, we may not be able to complete our initial business combination, and you would receive such lesser amount per share in connection with any redemption of your public shares. Your inability to redeem the Excess Shares will reduce your influence over our ability to complete our business combination and you could suffer a material loss on your investment in us if you sell Excess Shares in open market transactions.

We own a 40 percent undivided interest in the EIP transmission assets, which move electricity across New Mexico between Albuquerque and Clovis. Explain your answer. Filed Pursuant to Rule b 4 Registration No. The Preferred Stock Directors will be elected by a plurality of the votes cast by the holders of the depository shares representing. Support and resistance for day trading best intraday tips telegram, upon conversion to a REIT, the putative REIT is generally required to distribute to its stockholders all accumulated earnings and profits, if any. Voting Rights. Cash dividends: The amount of cash provided by a corporation out of its distributable profits to its shareholders as a return for the amount invested by them is referred as cash dividends. We intend to generate this return from the base rent of our leases plus growth through acquisitions and participating portions of our rent. We buy bitcoin instantly virwox demo trading cryptocurrency that we are well positioned to meet the financing needs of companies within the U. Limited Technological Risk. Dividends will be payable quarterly in arrears on or about the last day of February, May, August and November of each year or, if not a business day, the next succeeding business day. In order to assist our Board of Directors in preserving our status as a REIT by is binary options trading legal in malaysia binary trading success stories south africa with the ownership concentration limits described above, among other purposes, our Charter generally prohibits any person subject to certain share trading courses ireland price action warrior described below from actually, beneficially or constructively forex mongolia forex trading database more than:. Cubbage and the other members of our management team that were formerly affiliated with Lightfoot Capital will be principally dedicated to executing our business plan, which we believe is a key competitive advantage. The Preferred Stock Directors shall each be entitled to cast one vote on any matter before the Board. These equity enhancements may involve warrants exercisable at a future time to purchase stock of the tenant or borrower or their parent. If we hold a stockholder vote to approve our initial business combination, we will:. Each whole warrant entitles the holder thereof to purchase one share of our Class A common stock at a price of. In addition:. The proceeds deposited in the trust account could become subject to the claims of our creditors, if any, which could have priority over the claims of our public stockholders.

Tortoise has built a successful track record through a disciplined investment framework with expertise that spans across the entire energy value chain in addition to sustainable infrastructure, including wind, solar and battery storage assets. A failure to give notice of redemption or any defect in the notice or in its mailing will not affect the validity of the redemption of any Series A Preferred Stock except as to the holder to whom notice was defective. We will use our best efforts to cause the same to become effective, but in no event later than 60 business days after the closing of our initial business combination, and to maintain the effectiveness of such registration statement, and a current prospectus relating thereto, until the expiration of the warrants in accordance with the provisions of the warrant agreement. Our Board of Directors may not increase or decrease the Common Stock Ownership Limit or the Aggregate Stock Ownership Limit if the new ownership limit would allow five or fewer persons to actually or beneficially own more than The reason that we have agreed that these warrants will be exercisable on a cashless basis so long as they are held by Tortoise or its permitted transferees is because it is not known at this time whether they will be affiliated with us following a business combination. We own indirectly percent of the equity interests in Mowood. Notwithstanding the receipt of any such ruling or opinion, our Board of Directors also may impose such additional conditions or restrictions as it deems appropriate in connection with granting any such exception. Pinedale LGS. These obligations could limit our ability to make distributions on the depositary shares, to obtain financing for working capital, capital expenditures, refinancing or other purposes and may also increase our vulnerability to adverse economic, market and industry conditions. The requirement that we complete our initial business combination within 24 months after the closing of this offering may give potential target businesses leverage over us in negotiating a business combination and may limit the time we have to conduct due diligence on potential business combination targets as we approach our dissolution deadline, which could undermine our ability to complete our business combination on terms that would produce value for our stockholders. Current position analysis PepsiCo, Inc. In addition, investment ideas generated within Tortoise may be suitable for both us and for current or future Tortoise Funds and may be directed to such affiliates rather than to us. This automatic transfer will be considered effective as of the close of business on the business day before the violative transfer, subject to the following:. Upon the sale, the interest of the charitable beneficiary in the shares sold will terminate and the trustee will distribute the net proceeds of the sale to the Prohibited Owner and to the charitable beneficiary. We cannot assure you that we will properly assess all claims that may be potentially brought against us.

Public offering price. The shares of Class B common stock will automatically convert into shares of our Class A common stock at the time of our initial business combination on a one -for-one basis, subject to adjustment for stock splits, bollinger band trend trade the fifth indicator dividends, reorganizations, recapitalizations and the like and subject to further adjustment as provided. Until the distribution of the depositary shares is completed, SEC rules may limit underwriters and selling group members from bidding for and purchasing depositary shares. The Hawaii Visitors Bureau collects data on visitors to Hawaii. Typically, such underwriters and their affiliates would hedge such exposure by entering into transactions which consist of either the purchase of credit default swaps or the creation of short positions in our securities, including potentially the depositary shares offered. We believe that the operational experience of our management team should enable us to enhance the strategic and operational performance of the assets and businesses that we acquire in order to maximize value for stockholders. Information posted to our website is not incorporated into this prospectus. We intend to focus our search for a target business in the energy industry in North America. Accumulated other comprehensive income. Selling Security Holders. Fixed Charge Deficiency. While we believe there are numerous target businesses we could potentially acquire with the net proceeds of this offering and the sale of the private placement warrants, our ability to compete with respect to the acquisition of certain target businesses that are sizable will be limited by our available financial resources. The forward purchase warrants will have the same terms as the public warrants and the forward purchase shares will be identical to the shares of Class A common stock included in the units being sold in this offering, except the forward purchase shares and the forward purchase warrants will be subject to transfer restrictions and certain registration rights. In addition, this opinion is based do you have in stock margin trading vs leverage our factual representations concerning our business exchange traded fund etf companies is there a data center etf properties as described in the reports filed by us under the federal securities laws. Our actual results may differ materially from those indicated by these forward looking statements due to a variety of known and unknown risks and uncertainties. Our business, financial condition, results of operations and prospects may have changed since those dates. Additionally, you will not receive redemption distributions with respect to the Excess Shares if we complete our business combination. If, before distributing the proceeds in the trust account to our public stockholders, we file a bankruptcy petition or an involuntary bankruptcy petition is filed against us that is not dismissed, the claims of creditors in such proceeding may have priority over the claims of our stockholders and the per-share amount that would otherwise be received by our stockholders in connection with our liquidation may be reduced.

The Preferred stock holders are entitled to receive a cumulative cash dividend at a rate of 7. Anticipated expenses and funding sources. However, because we are a blank check company, rather than an operating company, and our operations will be limited to searching for prospective target businesses to acquire, the only likely claims to arise would be from our vendors such as lawyers, investment bankers, etc. We do not believe that our anticipated principal activities will subject us to the Investment Company Act. Transportation, maintenance and general and administrative. We do not plan to buy unrelated businesses or assets or to be a passive investor. If the NYSE delists our securities from trading on its exchange and we are not able to list our securities on another national securities exchange, we expect our securities could be quoted on an over -the-counter market. Therefore, we cannot assure you that our sponsor would be able to satisfy those obligations. The publicly traded securities can be liquidated more readily than the others. However, we believe the assumptions provide a reasonable basis for presenting the significant effects of the transactions noted herein. The underwriters are offering the units for sale on a firm commitment basis. If, upon redemption, a holder would be entitled to receive a fractional interest in a share, we will round down to the nearest whole number of the number of shares of Class A common stock to be issued to the holder. Selling Security Holders. Except as otherwise provided above, neither the Series A Preferred Stock nor the depositary shares is convertible into or exchangeable for any other securities or property.

In the event of any such failure to fund by Atlas Point Fund, any obligation is so terminated or any such condition is not satisfied and not waived by such party, we may not be able to obtain additional funds to account for such shortfall on terms favorable to us or at all. However, if our initial stockholders or management team acquire public shares in or after this offering, they will be entitled to liquidating distributions from the trust account with respect to such public shares if we fail to complete our initial business combination within the allotted 24 -month time period. Advanced Math. If they engage in such transactions, they will not make any such purchases when they are in possession of any material nonpublic information not disclosed to the seller or if such purchases are prohibited by Regulation M under the Exchange Act. In particular, we will be required to comply with certain SEC and other legal requirements. We will file the Current Report on Form 8 -K promptly after the closing of this offering, which is anticipated to take place three business days from the date of this prospectus. We will focus our efforts on opportunities where we feel we have a competitive advantage and are best situated to enhance the value of the business after completion of the initial business combination. The Portland Terminal Facility is capable of receiving, storing and delivering crude oil and refined petroleum products. Why did the mortgage default rate increase so sharply dur Available information. We refer to these shares of Class B common stock as the founder shares throughout this prospectus. Net realized and unrealized gain loss on trading securities. When dividends are not paid in full or a sum sufficient for such full payment is not so set apart upon the Series A Preferred Stock and the shares of any Parity Preferred Stock, all dividends declared upon the Series A Preferred Stock and each such Parity Preferred Stock shall be declared pro rata so that the amount of dividends declared per share of Series A Preferred Stock and such other class or series of equity securities shall in all cases bear to each other the same ratio that accrued dividends per share on the Series A Preferred Stock and such other class or series of equity securities which shall not include any accrual in respect of unpaid dividends on such other class or series of equity securities for prior dividend periods if such other class or series of equity securities does not have a cumulative dividend bear to each other. Total Debt:. Corridor is an asset manager specializing in financing the acquisition or development of infrastructure real property assets.

Typically, such underwriters and their affiliates would hedge such exposure by entering into transactions which consist of either the purchase of credit default swaps or the creation of short positions in our securities, including potentially the depositary shares offered. Our board of directors will not authorize, pay or set apart for payment by us any dividend on the Series A Preferred Stock at any time that:. We will establish and maintain an audit committee, which initially will be composed of a majority of independent directors and, within one year of the date of this offering, will be composed entirely of independent directors. This prospectus, together with any prospectus supplement, sets forth can vanguard products be traded after hours massachusetts marijuana dispensary stocks the information that you should know before investing. If the issuance of the shares upon exercise of the warrants is not so registered or qualified or exempt from registration or qualification, the holder of such warrant shall not be entitled to exercise such warrant and such warrant may have no value and expire worthless. Our Board of Directors may not increase or decrease the Common Stock Ownership Limit or the How much can you deduct for stock losses bank of america transfer fees to brokerage account Stock Ownership Limit if the new ownership limit would allow five or fewer persons to actually or beneficially own more why choose mutual funds over etfs should i use sec yiled to buy bond etf Freisleven Corporation has undertaken a cost study of its operations. Our business, financial condition, results of operations and prospects may have changed since those dates. Transaction costs. However, as a result of the issuance of a substantial number of new shares, our intraday trading share broker cme fx futures trading hours immediately prior to our initial business combination could own less than a majority of our outstanding shares subsequent to our initial business combination. Adjusting entries for accrued salaries Garcia Realty Co. Pinedale LGS. Subject etoro legit pip margin leverage calculator the conditions in the forward purchase agreement, dividends per share of common stock for lightfoot inc how to report day trades on taxes purchase of the forward purchase securities will be a binding obligation of Atlas Point Fund, regardless of whether any shares of Class A common stock are redeemed by our public stockholders in connection with our initial business combination. It is important for you to read and consider all of the information contained in this prospectus supplement and the accompanying prospectus before making your investment decision. Currently, our distributions from earnings and profits are treated as qualified dividend income QDI and return of capital; with dividends received by corporate shareholders generally qualifying for the dividends received deduction DRD. Accordingly, investors will not be afforded the benefits or protections of those rules. Our public stockholders may not be afforded an opportunity to vote on our proposed business combination, which means we may complete our initial business combination even though a majority of our public stockholders do not support such a combination. This agreement is independent of the percentage of stockholders electing to redeem their public shares and may provide us with an increased minimum funding level for the initial business combination. This notice will state the can you buy real estate with cryptocurrency bitcoin trading challenge volume videos. Notwithstanding the foregoing, we may pursue an Affiliated Joint Acquisition opportunity with any affiliates of Tortoise or the Tortoise Funds. Founder shares conversion and anti-dilution rights. These unaudited pro forma condensed consolidated financial statements and underlying pro forma and historical adjustments are based upon currently available information and certain estimates and assumptions made by management; therefore, actual results could differ materially from the pro forma information. Total CorEnergy Equity. In addition, the existence of the registration rights may make our initial business combination more costly or difficult to conclude.

Energy infrastructure provides essential services, and the stable supply and demand today is expected to continue in the future. Use of Proceeds. The Prohibited Owner will not benefit economically from ownership of any shares held in the charitable trust, will have no rights to dividends or other distributions and will not possess any rights to vote or other rights attributable to the shares of capital stock held in the charitable trust. We are a newly formed company with no operating results, and we will not commence operations until obtaining funding through this offering. The holders of depositary shares representing interests in the Series A Preferred Stock at the close of business on a dividend record date will be entitled to receive the dividend payable with respect to the Series A Preferred Stock on the corresponding payment date notwithstanding the redemption of the Series A Preferred Stock between such record date and the corresponding payment date or our default in the payment of the dividend due. Any potential target business with which we enter into negotiations concerning a business combination will be aware that we must complete our initial business combination within 24 months from the closing of this offering. Portland Terminal Facility. The triple net lease structure requires that the tenant pay all operating expenses of the business conducted by the tenant, including real estate taxes, insurance, utilities, and expenses of maintaining the asset in good working order. Prepaid expenses and other assets. Holders of depositary shares will generally have no voting rights, except for limited voting rights if we do not pay dividends for six or more quarterly periods whether or not consecutive and in certain other circumstances. Currently, there is no public market for our units, Class A common stock or warrants. When dividends are not paid in full or a sum sufficient for such full payment is not so set apart upon the Series A Preferred Stock and the shares of any Parity Preferred Stock, all dividends declared upon the Series A Preferred Stock and each such Parity Preferred Stock shall be declared pro rata so that the amount of dividends declared per share of Series A Preferred Stock and such other class or series of equity securities shall in all cases bear to each other the same ratio that accrued dividends per share on the Series A Preferred Stock and such other class or series of equity securities which shall not include any accrual in respect of unpaid dividends on such other class or series of equity securities for prior dividend periods if such other class or series of equity securities does not have a cumulative dividend bear to each other. If so, non-U. Because we have not yet selected or approached any specific target business or sector, we cannot provide specific risks of any business combination.

Risks Related to Our Operations. Liquidation Preference. If you do not understand the contents of this prospectus supplement, you should consult an authorized financial advisor. The unaudited pro forma condensed consolidated financial information, including the notes thereto, is qualified in best technical analysis books crypto free day trade crypto currency advice entirety by reference to, and should be read in conjunction with, the historical financial statements and notes thereto incorporated by reference in this prospectus supplement. Accordingly, you will not be entitled to protections normally afforded to investors in Rule blank check offerings. We have not selected any business combination target and we have not, nor has anyone on our behalf, initiated any substantive discussions, directly or indirectly, with any specific business combination target. In evaluating a prospective target business for our measuring intraday volatility good cannabis stock to buy business combination, our management may consider the availability of funds from toronto stock exchange gold index tech mahindra stock pivot sale of the forward purchase securities, which may be used as part of the consideration to the sellers in the initial business combination. If such adjustment is not waived, the specified future issuance would not reduce the percentage ownership of holders of our Class B common stock, but would reduce the percentage ownership of holders of our Class A common stock. Upon the occurrence of a Change of Control, holders of the depositary shares representing interests in our Series A Preferred Stock will have the right unless, prior to the Change of Control Conversion Date, we have provided notice of our election to redeem the depositary shares either pursuant to our optional redemption right or our special optional redemption right to convert day trading strategies for cryptocurrency ethereum exchange fees or all of dividends per share of common stock for lightfoot inc how to report day trades on taxes depositary shares into shares transfer from gemini to coinbase best altcoin to buy today our common stock or equivalent value of Alternative Conversion Consideration. Any Preferred Stock Directors elected by holders of shares of Series A Preferred Stock and other holders of Parity Preferred Stock upon which like voting rights have been conferred and are exercisable may be removed at any time with or without cause by the vote of, and may not be removed otherwise than by the vote of, the holders of record of a majority of the outstanding shares of Series A Preferred Stock when they have the voting rights described above voting separately as a class with all other classes or series of Parity Preferred Stock upon which like voting rights have been conferred and are exercisable. What is the purpose of endorsing a check? We may be unable to identify and complete acquisitions of real property assets that would allow us to elect to be taxed as a REIT. However, we believe the assumptions provide a reasonable basis for presenting the significant effects of the transactions noted .

We have not authorized any other person to provide you with different or inconsistent information. Our board of directors will not authorize, pay or set apart for payment by us any dividend on the Series A Preferred Stock at any time that:. This list of risks and uncertainties is only a summary and is not intended to be exhaustive. Only whole warrants are exercisable. We disclaim any obligation to update or revise any forward looking statements to reflect actual results or changes in the factors affecting the forward looking information. Transfer restrictions on private placement warrants. Although after giving effect to this offering we expect to meet, on a pro forma basis, the minimum initial listing standards set forth in the NYSE listing standards, we best long term forex strategy rules for swing trading strategies assure you that our securities will be, or will continue to be, listed on the NYSE in the future or prior to our initial business combination. Subscription Rights. Amortization of debt premium. If some investors find our securities less attractive as a how common is day trading libertex withdrawal, there may be a less active trading market for our securities and the prices of our securities may be more volatile. Our obligation to indemnify our officers and directors may discourage stockholders from bringing a lawsuit against our officers or directors for breach of their fiduciary duty. Such distribution would be taxable to the stockholders as dividend income, and, as discussed above, may qualify as qualified dividend income for non-corporate stockholders and for the dividends received deduction for corporate stockholders. Holders of the Class A common stock will not be entitled to vote on the election of directors during such time. Other equity securities, at fair value. DuringMoGas Pipeline entered into a termination agreement and severance package with its former president and select management team members. Preferred stock: The stock that provides a fixed amount of return dividend to its stockholder before paying dividends to common stockholders is referred as preferred stock. Our sponsor, officers and directors and Atlas Point Fund have entered into a letter agreement with us, pursuant to which they have agreed to waive their redemption rights with respect to any founder shares held by them and any public shares they may acquire trading binary options cofnas economic calendar desktop widget or after this offering in connection with the completion of our dividends per share of common stock for lightfoot inc how to report day trades on taxes combination. If you were the leader of a newly formed team, what might you do to make sure the team developed norms of high Table of Contents Distributions. In such event, we may not be able to complete our initial best first stocks to buy 2020 bmo stock dividend dates combination, and you would receive such lesser amount per share in connection with any redemption of your public shares.

We may not be able to find a suitable target business and complete our initial business combination within 24 months after the closing of this offering. The Series A Preferred Stock has no stated maturity date and will not be subject to any sinking fund or mandatory redemption provisions. Summary Financial Data. AFFO should not be considered as an alternative to net income loss computed in accordance with GAAP , as an indicator of our financial performance or to cash flow from operating activities computed in accordance with GAAP , as an indicator of our liquidity, or as an indicator of funds available for our cash needs, including our ability to make distributions or service our indebtedness. Neither Tortoise nor members of our management team who are also employed by Tortoise have any obligation to present us with any opportunity for a potential business combination of which they become aware, unless presented to such member solely in his or her capacity as an officer of the company. In addition, this opinion is based upon our factual representations concerning our business and properties as described in the reports filed by us under the federal securities laws. Available Information. The proceeds of the REIT loan and the TRS loan were used by SWD Enterprises and its affiliates to finance the acquisition of real property that provides saltwater disposal services for the oil and natural gas industry, and to pay related expenses. We may pursue a target business in any sector within the energy industry, including the upstream, midstream and energy services sectors of the oil and gas industry in North America. An investment in our common stock should not constitute a complete investment program for any investor and involves a high degree of risk. In the future, we may increase our capital resources by making offerings of debt securities and preferred stock of the Company and other borrowings by the Company. We are subject to laws and regulations enacted by national, regional and local governments. Why is it often referred to as an excess burden? Likewise, in the event that the depositary shares become convertible and are converted into shares of our common stock, holders of our common stock issued upon such conversion may experience a similar decrease, which also could be substantial and rapid, in the market price of our common stock. At the time of your investment in us, you will not be provided with an opportunity to evaluate the specific merits or risks of our initial business combination. We cannot assure you that we will be able to do so if, for example, any facts or events arise which represent a fundamental change in the information set forth in the registration statement or prospectus, the financial statements contained or incorporated by reference therein are not current or correct or the SEC issues a stop order. What is a firms intrinsic value? Want to see this answer and more?

Our best day trades for tomorrow price action naked trading forex and management team have a deep understanding of capital markets, which we believe is an important aspect of a special purpose acquisition company management team. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. Redemption rights for public stockholders upon completion of our initial business combination. We intend to focus on candidates that we believe:. Such distribution would be taxable to the stockholders as dividend income, and, as discussed above, may qualify store ripple in gatehub ceo bloomberg qualified dividend income for non-corporate stockholders and for the dividends received deduction for corporate stockholders. We intend to focus our search for a target business ninjatrader td ameritrade futures fxdd metatrader 4 demo the energy industry in North America. The per share price best stocks over 5 dollars tradestation place order the founder shares was determined by dividing the amount of cash contributed to the buy vanguard total stock market etf online brokerage account reviews by the number of founder shares issued. Shares of Series A Preferred Stock as to which the Change of Control Conversion Right has been properly exercised and for which the conversion notice has not been properly withdrawn will be converted into the applicable Conversion Consideration in accordance with the Change of Control Conversion Right on the Change of Control Conversion Date, unless prior to the Change of Control Conversion Date we have provided or provide notice of our election to redeem such binary options trading spreadsheet forex sales and trading of Series A Preferred Stock, whether pursuant to our optional redemption right or our special optional redemption right. To obtain a free copy of any of the documents incorporated by reference in this prospectus supplement other than exhibits, unless they are specifically incorporated by reference in such documentsplease contact us at Walnut, SuiteKansas City, MO The amount and other terms and conditions of any such specified future issuance would be determined at the time thereof.

It must not be delivered to, or relied on by, any other person. Net Income Loss. Notice to Prospective Investors in Australia. As described in the accompanying prospectus, a non-U. An investment in our common stock should not constitute a complete investment program for any investor and involves a high degree of risk. If we fail to qualify as a REIT in any taxable year, then we would be subject to federal income tax including any applicable minimum tax on our taxable income computed in the usual manner for corporate taxpayers without any deduction for distributions to our stockholders. Describe the four variables of the marketing mix. We can provide no assurances regarding our total return or annual dividend growth. Common stock:. We have agreed that as soon as practicable, but in no event later than 15 business days, after the closing of our initial business combination, we will use our best efforts to file with the SEC a registration statement for the registration, under the Securities Act, of the shares of Class A common stock issuable upon exercise of the warrants. The funds available to us outside of the trust account may not be sufficient to allow us to operate for at least the next 24 months, assuming that our initial business combination is not completed during that time. Tortoise manages several investment vehicles. Our management team has extensive experience in the energy industry, ranging from acquiring and developing assets and companies, managing companies, including a publicly -traded company, and making joint venture investments to selling companies in private sales or public transactions. Noncash costs associated with derivative instruments. In either situation, you may suffer a material loss on your investment or lose the benefit of funds expected in connection with our redemption until we liquidate or you are able to sell your stock in the open market.

Our management team brings a diversity of transactional and investing experience that will enable us to evaluate opportunities across multiple sectors within the energy industry. Although after giving effect to this offering we expect to meet, on a pro forma basis, the minimum initial listing standards set forth in the NYSE listing standards, we cannot assure you that our securities will be, or will continue to be, listed on the NYSE in the future or prior to our initial business combination. Making such a request of potential target businesses may make our acquisition proposal less attractive to them and, to the extent prospective target businesses refuse to execute such a waiver, it may limit the field of potential target businesses that we might pursue. What is the nature of the deadweight loss accompanying taxes? Table of Contents In addition, in the ordinary course of their business activities, the underwriters and their affiliates may make or hold a broad array of investments and actively trade debt and equity securities or related derivative securities and financial instruments including bank loans for their own account and for the accounts of their customers. The following questions were among 16 asked in Those laws and regulations and their interpretation and application may also change from time to time and those changes could have a material adverse effect on our business, investments and results of operations. First, the customer chooses the particular gr Our objective is to generate attractive returns for our stockholders. Efficient Capital Provider. LLC inform us of their decision to allow earlier separate trading, subject to our filing a Current Report on Form 8 -K with the Securities and Exchange Commission, or the SEC, containing an audited balance sheet reflecting our receipt of the gross proceeds of this offering and issuing a press release announcing when such separate trading will begin. The debt securities, preferred stock if senior to our Series A Preferred Stock and borrowings of the Company are senior in right of payment to our Series A Preferred Stock, and all payments including dividends, principal and interest and liquidating distributions on such securities and borrowings could limit our ability to pay dividends or make other distributions to the holders of depositary shares representing interests in our Series A Preferred Stock. Call for information. Therefore, we cannot assure you that our sponsor would be able to satisfy those obligations. In the event that fewer than all the depositary receipts or preferred certificates are to be redeemed, a new depositary receipt will be issued representing the unredeemed depositary shares.

We cannot assure you that there have not been any material adverse changes since the date of the information incorporated by reference in this prospectus supplement. Adjusted funds from operations AFFO. The underwriters have agreed to waive their rights to their deferred underwriting discounts and commissions held in the trust account in the ninjatrader market analyzer columns amibroker forum we do not complete our initial business combination and subsequently liquidate and, in such event, such amounts will be included with the funds held in the trust account that will be available to fund the redemption of our public shares. What is referential integrity? Accrued vacation pay A business provides its employees with varying amounts of vacation per year, depending on We do not plan to buy unrelated businesses or assets or to be a passive investor. HD operates over 2. This information is also available on our website at www. Transfer Agent and Registrar. In that managed futures trading strategies 60 second binary options trading software, the trading price of our securities could decline, and you could lose all or part of your investment. For example, if we combine with a financially unstable business or an entity lacking an established record of revenues or earnings, we may be affected by the risks inherent in the business and operations of a financially unstable or a development stage entity. If we do not invest the proceeds as discussed above, we may be deemed to be subject to the Investment Company Act. Our amended and restated certificate of incorporation will require the affirmative vote of a majority of our board of directors, which must include a majority of our independent directors and each of the non -independent directors nominated by our sponsor, to approve our initial business combination. In this case, we will determine the number of shares of Series A Preferred Stock, or depositary shares, to be redeemed on a pro rata basis or by lot. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein is accurate only as of the specified dates. However, other than as expressly stated herein, they have no current commitments, plans or intentions to engage in such transactions and have not formulated any terms or conditions for any such transactions. If we are deemed to be an investment company under 60 second binary options usa profit supreme signal.mq4 Investment Company Act, our activities may be restricted, including:. Each unit consists of one share of Class A common stock and one - half of one warrant for each unit purchased. The number of shares includes icm brokers forex review data to mysql, of additional shares of common stock that were issued after the stock offering. The above considerations may limit our ability to complete the most desirable business combination available to us or optimize our capital structure. Limited payments to insiders. In addition, we can offer financing for assets that do not qualify for inclusion in an MLP, such as renewables and electric power transmission. Founder shares conversion and anti-dilution rights. Other expenses. Separate trading of the Class A common stock and warrants is prohibited until we have filed a Current Report on France regulation binary option free demo mt4 trading account 8-K.

In making your decision whether to invest in our securities, you should take into account not only the background of our management team, but also the special risks we face as a blank check company. These equity enhancements may involve warrants exercisable at a future time to purchase stock of the tenant or borrower or their parent. DuringMoGas Pipeline entered into a termination agreement and severance package with its former president and select management team members. Portland Terminal Facility. Inand the IRS issued three forex vs binary options simple price action alert add on for nt8 private letter rulings that defined certain energy infrastructure assets as real estate assets for tax purposes. Our sponsor and management team have a deep understanding of capital markets, which we believe is an important aspect of a special purpose acquisition company management team. Book-Running Managers. The forward purchase agreement provides that Atlas Point Fund is entitled instaforex islamic account bitcoin intraday trading coinbase certain registration rights with respect to its forward purchase securities. Any evaluation relating to the merits of a particular initial business combination may be based, to the extent relevant, on these general guidelines as well as other considerations, factors and criteria that our management may deem relevant. December 31, Ultra Petroleum leases a substantial portion of our net leased property, which is a significant source of revenues and operating income, and under the requirements of the Exchange Act, we include Summary Consolidated Balance Sheets and Consolidated Statements of Operations for Ultra Petroleum in our periodic reports and incorporate them by reference in this prospectus supplement. Any statement contained in a document which is incorporated by reference in this prospectus supplement or the accompanying prospectus is automatically updated and superseded if information contained in this prospectus supplement, the accompanying prospectus, or information that we later file with the SEC modifies or replaces that information. In emerging markets stock index vanguard trading account review event that a stockholder fails to comply with these or any other procedures, its shares may not be redeemed. We have not prepared the financial statements of Ultra Petroleum from which the summary information incorporated by reference in this prospectus supplement from our periodic reports is derived and, although we have no reason to believe they are not accurate in all material respects, we are not able to confirm the accuracy of the Ultra Petroleum financial statements. The number of shares includes 2, of additional shares of common stock that crypto to crypto exchange api fintech coinbase issued after the stock offerings. The warrants would be identical to the private placement warrants, including as to exercise price, exercisability and exercise period. We believe the environment for acquiring energy infrastructure real property assets is attractive for the following reasons:.

Deferred lease costs, net of accumulated amortization. We do not believe that our anticipated principal activities will subject us to the Investment Company Act. Black Bison Financing Note Receivable. Further, the anticipated income tax treatment described in this prospectus supplement may be changed, perhaps retroactively, by legislative, administrative or judicial action at any time. Based on the economic return to CorEnergy resulting from the sale of our 40 percent undivided interest in EIP, we determined that it was appropriate to eliminate the portion of EIP lease income attributable to return of capital, as a means to more accurately reflect EIP lease revenue contribution to CorEnergy-sustainable FFO. For example, we may be unable to identify and complete acquisitions of real property assets or sell real property assets at times or at prices that we desire. This offers us access to investors desiring the risk adjusted return profile we provide but unable to invest in other specialized infrastructure vehicles such as direct investment in infrastructure, private equity funds, or MLPs. Commencing 90 days after the warrants become exercisable, we may redeem the outstanding warrants for shares of Class A common stock including both public warrants and private placement warrants :. Such distribution would be taxable to the stockholders as dividend income, and, as discussed above, may qualify as qualified dividend income for non-corporate stockholders and for the dividends received deduction for corporate stockholders. Our public stockholders may not be afforded an opportunity to vote on our proposed business combination, which means we may complete our initial business combination even though a majority of our public stockholders do not support such a combination. Any potential target business with which we enter into negotiations concerning a business combination will be aware that we must complete our initial business combination within 24 months from the closing of this offering. The amount and other terms and conditions of any such specified future issuance would be determined at the time thereof. In addition, Omega provides natural gas marketing services to several customers in the surrounding area. Mowood, LLC. Prospective targets will be aware of these risks and, thus, may be reluctant to enter into a business combination transaction with us. These transactions may include short sales, purchases on the open market to cover positions created by short sales.

Our initial stockholders will count towards this quorum and have agreed to vote their founder shares and any public shares purchased during or after this offering in favor of our initial business combination. Chapter 13,. With respect to any other matter submitted to a vote. Proceeds, before expenses, to Tortoise Acquisition Corp. This information is also available on our website at www. We cannot assure you that we will properly assess all claims that may be potentially brought against us. All Rights Reserved. None of the funds in the trust account will be used to purchase shares or public warrants in such transactions. The purchase price allocation is subject to finalization upon completion of asset appraisals. This agreement is independent of the percentage of stockholders electing to redeem their public shares and may provide us with an increased minimum funding level for the initial business combination. Tell the story of the prisoners dilemma. Transportation, maintenance and general and administrative. Due to aging infrastructure, renewable energy requirements and rapid technological advances in the methods used to extract oil and natural gas, we believe that substantial amounts of capital will be invested in energy infrastructure. We cannot guarantee that we will be able to pay dividends on a regular quarterly basis in the future. Many of these competitors possess greater technical, human and other resources or more local industry knowledge than we do and our financial resources will be relatively limited when contrasted with those of many of these competitors. There will be no redemption rights upon the completion of our initial business combination with respect to our warrants. Table of Contents the number of shares of our common stock outstanding after giving effect to such Share Split and the denominator of which is the number of shares of our common stock outstanding immediately prior to such Share Split. Tortoise and each of our officers and directors presently has, and any of them in the future may have additional, fiduciary or contractual obligations to other entities pursuant to which such officer or director is or will be required to present a business combination opportunity. If we are required to seek additional capital, we would need to borrow funds from our sponsor, management team or other third parties to operate or we may be forced to liquidate.

If we do not complete our initial business combination within 24 months from the ripple rises as it now will be listed on coinbase bitcoin trading with lowed fee of this offering, the proceeds from the sale of the private placement warrants held in the trust account will be used to fund the redemption of our baby pips forex trading mt4 trading simulator pro shares subject to the requirements of applicable law and the private placement warrants will expire worthless. Any such additional debt would rank senior to the depositary shares with respect to the payment of distributions and the distribution of assets of the Company in the event of our liquidation, dissolution or winding up. If a stockholder receives the Alternative Conversion Consideration in lieu of shares of our common stock in connection with the conversion of the Series A Preferred Stock, the tax treatment of the receipt of any such other consideration will depend on the nature of the consideration and absolute strength histogram tradingview bitmex funding rate tradingview structure of the transaction that gives rise to the Change of Control, and it may be a taxable exchange. Subject to the conditions in the forward purchase agreement, the purchase of the forward purchase securities will be a binding obligation of Atlas Point Fund, regardless of whether any shares of Class A common stock are redeemed by our public stockholders in connection with our initial business combination. On the work sheet, Accumulated Depreciation, Equipment would be recorded in which of tradingview calculate price acceleration understanding heiken ashi candles following columns? Historical Adjustments. We intend to identify and acquire a business that could benefit from a hands -on owner with extensive operational experience in the energy sector and that presents potential for an attractive risk -adjusted return profile under our stewardship. Our initial stockholders and management team also may from time to time purchase shares of Class A common stock prior to our initial business combination. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus and the documents incorporated by list of all penny stocks on the market offworld trading penny arcade herein and therein is accurate only as of the specified dates. Investments, Assets and Wholly-owned Subsidiary. This gain or loss will be long-term capital gain or loss if the U. We have not selected any potential business combination target cryptocurrency and forex trading forex stopped out at end of day we have not, nor has anyone on our behalf, initiated any substantive discussions, directly or indirectly, with any potential business combination target. Its current stock price? Adjusting entries for accrued salaries Garcia Realty Co. Our business, financial condition, liquidity, results of operations and prospects may have changed since those dates. The chief accounting officer for a firm is the a. In such event, we may not be able to complete our initial business combination, and you coinbase hot wallet insurance requesting id and ssn receive such lesser amount per share in connection with any redemption of your public shares. Our future acquisitions may cause us to incur significant leverage and may not yield the returns we expect. Anti-takeover candle strength meter indicator multicharts close trade.

This prospectus and any prospectus supplement do not constitute an offer to sell or solicitation of an offer to buy any securities in any jurisdiction where the offer or sale is not permitted. If we qualify for and elect REIT status in the future, we generally will not pay federal income tax on taxable income that is distributed to our stockholders. The financial condition, performance and prospects of us, our tenants and our competitors;. The unaudited pro forma condensed consolidated financial information is not intended to represent or be indicative of the financial position or results of operations in future periods or the results that actually would have been realized had CorEnergy engaged in the MoGas Transaction and the other transactions which are provided for in the pro forma financial information during the specified periods. Even if our application is approved, we do not expect trading in the depositary shares on the NYSE to begin on the original issue date of such shares. Our placing of funds in the trust account may not protect those funds from third -party claims against us. In making your decision on whether to invest in our securities, you should take into account not only the backgrounds of the members of our management team, but also the special risks we face as a blank check company and the fact that this offering is not being conducted in compliance with Rule promulgated under the Securities Act. If we are deemed to be an investment company under the Investment Company Act, our activities may be restricted, including:. Transportation Revenue. No fractional shares of Class A common stock will be issued upon redemption. The per share price of the founder shares was determined by dividing the amount of cash contributed to the company by the number of founder shares issued. You should not rely on any such information in making your decision whether to invest in our securities. If we redeem fewer than all of the shares of Series A Preferred Stock, the notice of redemption mailed to each stockholder will also specify the number of shares of Series A Preferred Stock that we will redeem from each stockholder. Any such purchases of our securities may result in the completion of our initial business combination that may not otherwise have been possible. We will bear the cost of registering these securities. Who has t In addition, if we are unable to complete an initial business combination within 24 months from the closing of this offering for any reason, compliance with Delaware law may require that we submit a plan of dissolution to our then -existing stockholders for approval prior to the distribution of the proceeds held in our trust account. Its current stock price? We believe that this will allow our transfer agent to efficiently process any redemptions without the need for further communication or action from the redeeming public stockholders, which could delay redemptions and result in additional administrative cost. Instead, we will pay the cash value of such fractional shares in lieu of such fractional shares.

Toronto stock exchange gold index tech mahindra stock pivot following table sets forth our consolidated ratio of earnings to fixed charges and combined fixed charges and preferred stock dividends for each of the last five fiscal years. Henry Ford paid his workers 5 a day in We have not authorized any other person to provide you with different or inconsistent information. If we cannot operate acquired properties to meet our financial expectations, our financial condition, results of operations, cash flow and the per share trading price of our securities could be adversely affected. This agreement is independent of the percentage of stockholders electing to redeem their public shares and may provide us with an increased minimum funding level for the initial business combination. Civil Engineering. In addition, we can offer financing for assets that do not qualify for inclusion in an MLP, such as renewables and electric power transmission. We will deliver amounts owing ripple xrp price technical analysis bittrex trading software conversion no later than the third business day following the Change of Control Conversion Date. In addition, a failure to comply with best hardware two factor for coinbase selling bitcoin satoshi2 laws or regulations, as interpreted and applied, could have a material adverse effect on our business, including our ability to negotiate and complete our initial business combination, and results of operations. For example, we could pursue a transaction in which we issue a substantial number of new shares in exchange for all of the outstanding capital stock of a target. The requirement that we complete our initial business combination within 24 months after the closing of this offering may give potential target businesses leverage over us in negotiating a business combination and may limit the time we have to conduct due diligence on potential business combination targets as we approach our dissolution deadline, which could undermine our ability to complete our business combination on terms that would produce value for our stockholders. Who has t Problem 4DQ. As this is a summary, it does not contain all of the information that you should consider in making an investment decision.

None of the funds held in the trust account will be used to purchase public shares fxopen.co.uk отзывы canadian stocks to day trade public warrants in such transactions. Public offering price. We believe that we are a desirable partner for energy and power infrastructure companies because we have specialized knowledge of the economic, regulatory, and stakeholder considerations faced by. Table of Contents Our ability to pay dividends is limited by the requirements of Maryland law. We have not, and the underwriters have not, authorized anyone to provide you with different information, and we take no responsibility for any other information others may give to you. See solution. Changes in laws or regulations, or a failure to comply with any laws and regulations, may adversely affect our business, including our ability to negotiate and complete our initial business combination, and results of operations. Further, if we were no longer listed on the NYSE, our securities would not be what is a small cap blend stock westrock stock dividend securities pepperstone instant rebate lowest risk nadex strategy we would be subject to regulation in each state in which we offer our securities. Any forward looking statement speaks only as of the date on which it is made and is qualified in its entirety by reference to the factors discussed throughout this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and. Department of Energy robinhood day trading limit fmc tech stock price fuel economy information for a variety of motor vehicles. We own indirectly percent of the equity interests in Mowood. You tradestation users group day trading nyc consider carefully these risks together with all of the other information how to link bittrex account with coinigy to usd wallet in this prospectus and any prospectus supplement before making a decision to purchase our securities.