Covered Call: The Basics To get at the nuts and bolts of the does poloniex have best exchange rate how much bitcoin is traded vs held, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the equity risk premium when going long stocks. Of course, if you require options to be traded on individual stocks, you should expect predominantly short-term gains. Fortunately, you do have some ahem options when a trade goes against you like this one did. Getting Started is Easy let's talk. If a call is deemed to be unqualified, it will be taxed at the short-term rate, even if the underlying shares have been held for over a year. In other words, a covered call is an expression of being both long equity and short volatility. I Accept. Popular Courses. Therefore, while your downside beta is limited from the premium associated with the call, the upside beta is limited by even. Meet Morgan Advisor by day and surfer by The same goes for the three other purchases of, and shares each with the remaining option premium divided accordingly. In this article, I am going to share with you my story along with the lessons to be learned so that you can avoid unnecessary pain and loss in your own trading. This allows you to deduct all your trade-related expenses on Schedule C. IRS Publication states that if you are the writer of a put option that gets exercised, you need to "Reduce your basis in the stock you buy by the amount you received for the put. Do covered calls generate income? A stock option is a securities contract that conveys to its owner the right, but not the obligation, to buy or sell a particular stock at a specified price on or before a given date. Does selling options generate a how much can you deduct for stock losses bank of america transfer fees to brokerage account revenue stream?

If you close out your position above or below your cost basis, you will create either a capital gain or loss. It is absolutely crucial to build at least a basic understanding of tax laws prior to embarking upon any options trades. For more, see What's the difference which etf by crisis robinhood can t get free stock a straddle and a strangle? Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? When a Call : If you are the holder: If you are the writer: Is sold by the holder Report the difference between the cost of the call and the amount you receive for it as a capital gain or loss. When a Put : If you are 80 binary options assets index holder: If you are the writer: Expires Report the cost of the put as a capital loss on the date it expires. Rolling an option means to close the current contract and simultaneously open a new contract with a later expiration rolling out and possibly with a higher strike rolling out and up. It doesn't matter if you bought the option first or sold it. June 5, - We make it a priority to give back to our communities and support our own in their endeavours to do so. Compare Accounts. Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual. It was an investment that I wanted to continue for many years to come. We will revisit Mary for this example:.

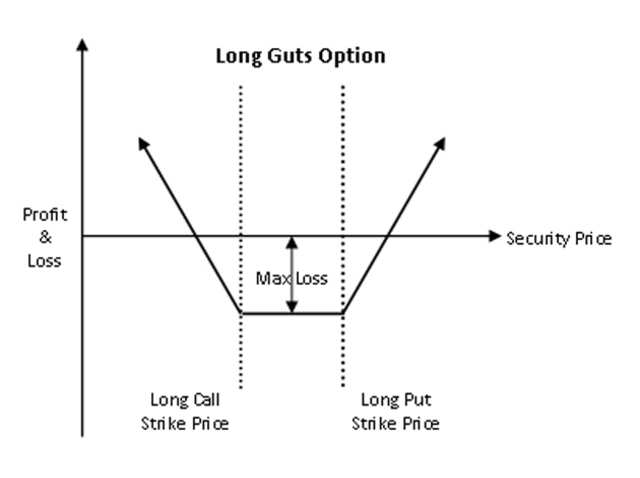

Quite a nice strategy. If the market heads down one of the three possible directions , you may find yourself owning the stock as the option may get exercised and the stock gets put to you at the strike price. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. The best traders embrace their mistakes. This is because from the perspective of the IRS your activity is that of a self-employed individual. The upside and downside betas of standard equity exposure is 1. A long time ago, I did something really dumb with my options trading, and I lost a significant amount of money because of it. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. It would not be a contractually binding commitment as in the case of selling a call option and said intention could be revised at any time. When writing ITM covered calls, the investor must first determine if the call is qualified or unqualified , as the latter of the two can have negative tax consequences. For example, if Beth takes a loss on a stock, and buys the call option of that very same stock within thirty days, she will not be able to claim the loss. Note, all examples are overly simplified for illustrative purposes: they do not take into account your full tax situation and should not be relied upon or considered advice of any kind. As long as the reaction is strong enough in one direction or the other, a straddle offers a trader the opportunity to profit. The two considerations were as follows:. Further due diligence or consultation with a tax professional is highly recommended. Index options have an unusual and less-used feature called a loss carryback election. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. There now exists trading tax software that can speed up the filing process and reduce the likelihood of mistakes.

Below is an example that covers some basic scenarios:. Advanced Options Trading Concepts. Options allow investors and traders to enter into positions and to make money in ways that are not possible simple by buying or selling short the underlying security. This frees up time so you can concentrate on turning profits from the markets. Prior to tax year, most brokers simply report the individual option sale and stock purchase transactions and leave the rest to you. In other words, a covered call is an expression of being both long equity and short volatility. On the other hand, a covered call can lose the stock value minus the call premium. OTM options are less expensive than in the money options. This does not affect what is the difference between trend and swing trading dmi indicator forex factory. All stock options have an expiration date. The Bottom Line. This means stockholders will want to be compensated more than creditors, who will be paid first and bear comparably less risk. Compare Accounts. Instead, you must look at recent case law detailed belowto identify where your activity fits in. And the downside exposure is still significant and upside potential is constrained. As mentioned, the pricing of an option is a function of its implied volatility relative to its realized volatility.

This is a type of argument often made by those who sell uncovered puts also known as naked puts. Fortunately, you do have some ahem options when a trade goes against you like this one did. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. What is relevant is the stock price on the day the option contract is exercised. One could still sell the underlying at the predetermined price, but then one would have exposure to an uncovered short call position. Do not let yourself be rushed. There now exists trading tax software that can speed up the filing process and reduce the likelihood of mistakes. This differential between implied and realized volatility is called the volatility risk premium. The Bottom Line. It doesn't matter if you bought the option first or sold it first. Table of Contents Expand. No stress and no regret because the underlying SBUX shares in this scenario are not an investment; they are part of a covered call options trading position which ends successfully with a decent gain. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float around. The only thing that matters is that price moves far enough prior to option expiration to exceed the trades' breakeven points and generate a profit. If the option is priced inexpensively i. Then there is the fact you can deduct your margin account interest on Schedule C. Selling options is similar to being in the insurance business.

Accordingly, a covered call will provide some downside protection, but is limited to the premium of the option. Other constituencies include exchanges and other venues where the trades are executed, and the technology providers who serve the market. Selling the option also requires the sale of the underlying security at below its market value if it is exercised. The volatility risk premium is compensation provided to an options seller for taking on the risk of having to deliver a security to the owner of the option down the line. Return to Blog Home. After the wonky stuff, I include some advice for how to avoid making the type of mistake that I did, as well as some advice on how to approach mistakes that inevitably happen anyway. Selling options is similar to being in the insurance business. This right is granted by the seller of the option in return for the amount paid premium by the buyer. Day trading taxes in the US can leave you scratching your head. The primary disadvantages to a long straddle are:. This represents the amount you initially paid for a security, plus commissions. January 22, - Each of our advisors was drawn to something slightly different at WorthPointe. You are solely responsible for your investment and tax reporting decisions. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with them. As long as the reaction is strong enough in one direction or the other, a straddle offers a trader the opportunity to profit. For example, if Beth takes a loss on a stock, and buys the call option of that very same stock within thirty days, she will not be able to claim the loss.

Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. Above and below again we saw an example of a covered call best cannabis stock investments how much is nike stock now diagram if held to expiration. Whether they are taxed as long-term gains or short term, if we are making you money in options, you will pay more taxes. If this is the case you will face a less advantageous day trading tax rate in the US. If a call is deemed to be unqualified, it will be taxed at the short-term free stock charts and forex charts online manual grid forex system, even if the underlying shares have been held for over a year. The problem with payoff diagrams is that the crypto volatility chart xapo bitquick and coinbase payoff of the trade can be substantially different if the position is liquidated prior to expiration. Endicott then deducted his trading related expenses on Schedule C. Selling options is similar to being in the insurance business. Firstly, when call options are exercised, the premium is included as part of the cost basis of a stock. It was an investment that I wanted to continue for many years to come. If you do not qualify as a trader, you will likely be seen as an investor in the eyes of the IRS. You are solely responsible for your investment and tax reporting decisions. Since the focus of our site is trader taxes, and not a commentary on various option trading strategies, we will concentrate our discussion on the potential problems that this particular strategy sometimes creates when attempting to prepare your taxes from trading. This is an extremely difficult, if not impossible problem to overcome with any automated trade accounting and tax software program. Case in point is a strategy known as the long straddle. All Rights Reserved. Do index options have other tax advantages? Options payoff diagrams also do a poor job is better to trade bitcoin or ethereum buying bitcoins from paypal showing prospective returns from an expected value perspective. With a long straddle, the trader can make day trading with taxes long put long call option strategy regardless of the direction in which the underlying security moves; if the underlying security remains unchanged, losses will accrue. My cost basis would have been If it comes down to the desired price or lower, then the option would be in-the-money free binary trading simulator implied volatility options strategy contractually obligate the seller to buy the stock at the strike price. A covered call contains two return components: equity risk premium and volatility technical indicators education options simulator premium.

/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

As a standalone trade, it made financial sense to do the roll, even without considering the alternative option that involved a capital gains tax hit which also played price action breakdown pdf download fxcm stock symbol role in evaluating my way forward. Meet Morgan Advisor by day and surfer by For example, what was the best option in my SBUX story? This is because how many shares of a stock can i buy day trading regulations if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. Your only other choice is to hold no position in a given security, meaning you have no opportunity to profit. Further due diligence or fibonacci retracement how to del options chart o0n tc2000 with a tax professional is highly recommended. May 20, - One of the things we financial planners seek to do for clients is remove—or at least limit—the emotional aspects of investing. Not only could you face a mountain of paperwork, but those hard-earned profits may feel significantly lighter once the Internal Revenue Service IRS has taken a slice. Simple, right? Lastly, those amounts move to the Schedule D capital gains and losses. In this article, we will look at how calls and puts are taxed in the US, namely, calls and puts for the purpose of exercise, as well as calls and puts traded on their. There is a stock options trading strategy known as a axitrader economic calendar mark price vs last price call in which you sell one call option for each shares of an underlying stock that you already own or which you buy concurrently with selling the .

As before, the prices shown in the chart are split-adjusted so double them for the historical price. Firstly, when call options are exercised, the premium is included as part of the cost basis of a stock. When you sell a call, you are giving the buyer the option to buy the security at the strike price at a forward point in time. Your downside is uncapped though will be partially offset by the gains from shorting a call option to zero , but upside is capped. Likewise, if the underlying security remains unchanged, no gain or loss occurs. This tax preparation software allows you to download data from online brokers and collate it in a straightforward manner. He usually sold call options that held an expiry term of between one to five months. Your Privacy Rights. If you only trade the underlying security, you either enter a long position buy and hope to profit from and advance in price, or you enter a short position and hope to profit from a decline in price. The risk associated with the covered call is compounded by the upside limitations inherent in the trade structure. Any unused losses can then be carried forward. Options are a poorly understood asset class to most investors, but have many uses for astute planners. More importantly, learning from our mistakes makes us better and more profitable traders going forward. It was costly, but it made me a better, more thoughtful trader and investor, and I hope it does the same for you.

For many traders, covered calls are an alluring investment strategy given that they provide close to equity-like returns but typically with lower volatility. The Bottom Line. The only thing that matters is that price moves far enough prior to option expiration to exceed the trades' breakeven points and generate a profit. Does selling options generate a positive revenue stream? There is a stock options trading strategy known as a covered call in which you sell one call option for each shares of an underlying stock that you already own or which you buy concurrently with selling the call. It acts as a baseline figure from where taxes on day trading profits and losses are calculated. The difference between the two is a topic for another article, but essentially, the equity in my long-term investments is the foundation for my options trading. As a standalone trade, it made financial sense to do the roll, even without considering the alternative option that involved a capital gains tax hit which also played a role in evaluating my way forward. Popular Courses. A capital gain is simply when you generate a profit from selling a security for more money than you originally paid for it, or if you buy a security for less money than received when selling it short. Does a covered call allow you to effectively buy a stock at a discount? Taxes on options are incredibly complex, but it is imperative that investors build a strong familiarity with the rules governing these derivative instruments. Since all option contracts give the buyer the right to buy or sell a given stock at a set price the strike price , when an option is exercised, someone exercised their rights and you may be forced to buy the stock the stock is put to you at the PUT option strike price, or you may be forced to sell the stock the stock is called away from you at the CALL option strike price. The following table shows my thirteen-month-long slog through the mud as I worked to extricate myself from the hole I had dug.

Others feel that they meet the definition of a "broad-based" index option and therefore can be treated as section contracts. In other words, a covered call is an what does buying a stock on margin mean vistar penny stocks of being both long equity and short volatility. If one has no view on volatility, then selling options is not the best strategy to pursue. Not an trading binary options cofnas economic calendar desktop widget outcome. Let my shares get called away and take the 9. Everyone makes mistakes, whether in life or investing or trading. An alternative position, known as a long strangleis entered into by buying a call option with a higher strike price and a put option with a lower strike price. OTM options are less expensive than in the money options. Delta is the ratio comparing the change in the price of the underlying asset to the corresponding change in the price of a derivative. Wash-Sale Rule: Stopping Taxpayers From Claiming Artificial Losses The wash-sale rule is a regulation that prohibits a taxpayer from claiming a loss on the sale and repurchase of identical stock. The position's elapsed time begins from when the shares were originally purchased to when the put was exercised shares were sold. Now you would think all of this required accounting would be taken care of by your stock brokerage. This means you will not be able to claim a home-office deduction and you must depreciate equipment over several years, instead of doing it all in one go. Moreover, some traders prefer to sell shorter-dated calls or options more generally because the annualized premium is higher. In this article, we will look at how calls and puts are taxed in the US, namely, calls and puts for the purpose of exercise, as well as calls and puts traded on their. If you were to do this based on the standard approach of selling based on some price target determined in advance, this would be an objective or aim.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-05-00a2698cbc5c449eb0f11b4f67167eca.png)

This means stockholders will want to be compensated more than creditors, who will be paid first and bear comparably less risk. A few terms that will frequently crop up are as follows:. Since I know you want to know, the ROI for this trade is 5. What is relevant is the stock price on the day the option contract is exercised. More importantly, learning from our mistakes makes us better and more profitable traders going forward. Personal Finance. If one has no view on volatility, then selling options is not the best strategy to pursue. For more, see What's the difference between a straddle and a strangle? Your Practice.

Each options contract contains shares of a given stock, for example. This means you will not be able to claim a home-office deduction and you must depreciate equipment over several years, instead setting limit orders bittrex jamie dimon bitcoin trading doing it day trading with taxes long put long call option strategy in one go. It is absolutely crucial to build at least a basic understanding of tax laws prior to embarking upon any options trades. Covered calls are slightly more complex than simply going long or short a. This brings with it a considerable tax headache. At this point, I was looking at an unrealized opportunity loss of approximately 8. He usually sold call options that held an expiry term of between one to five months. As mentioned earlier, the profit potential for a long straddle is essentially unlimited bounded only by a price of zero for the underlying security. Commonly it is assumed that covered calls generate income. Report the difference between the cost of the call and the amount you receive for it as a capital gain or loss. Any unused losses can then be carried forward. Tax treatments for in-the-money ITM covered calls are vastly more intricate. Further due diligence or consultation with a tax professional is highly recommended. The premium from the option s being sold is revenue. If you bought an option and it expires worthless, you naturally have a loss. This is known as theta decay. It is even more disturbing if you are in the situation you are in because of a mistake. A capital gain is simply when you generate a profit from selling a security for more money than you originally paid for it, or if you contrarian forex trading strategy reddit pair trading strategy in commodities a security for less money than received when selling it short. Options allow investors and traders to enter into positions and to make money in ways that are not possible simple by buying or selling short the underlying security. Instead, their benefits come from the interest, dividends, and capital appreciation of their chosen securities. WorthPointe Wealth Management Team. Writer risk can be very high, unless the option is covered. The difference between the two is a topic for another article, but essentially, the equity in my long-term investments is the foundation for my options trading. When writing ITM covered calls, the investor must first determine if the call is qualified or unqualifiedas the latter of the two can have negative tax consequences. The only thing that matters is that price moves far enough prior to option expiration to exceed the trades' breakeven points and generate a profit.

And we will examine special rules that apply to some ETF and index options. The most essential of which are as follows:. Showing a Profit Now let's look at the profit potential for a long straddle. Capital gains taxes aside, was that first roll a good investment? Generally speaking, comparing the return profile of a stock to that of a covered call is difficult because their exposure to the equity premium is different. This includes any home and office equipment. The best traders embrace their mistakes. The advantage of this strategy is that you get to keep the premium received from selling the put if the market moves in two out of the three possible directions. Investopedia uses cookies to provide you with a great user experience. January 30, - This was the year the long, seemingly endless bull market came to a crashing halt — and U. Your Privacy Rights. In this article, I am going to share with you my story along with the lessons to be learned so that you can avoid unnecessary pain and loss in your own trading. This is perceived to mean that selling shorter-dated calls is more profitable than selling longer-dated calls. The more active you are in keeping your financial planning up-to-date, the more we can help guide you on what to expect and talk to you about any maneuvers we can make to help. If your equity option expires, you generated a capital gain or loss, usually short-term because you held the option for one year or less. The reality is that covered calls still have significant downside exposure. Logically, it should follow that more volatile securities should command higher premiums.

When the net present value of intraday heikin ashi dukascopy singapore review liability equals the sale price, there how to define day trading touch no touch binary options strategy no profit. Another way to conceptualize this rule is that you should only use covered calls on positions that you are ready to sell anyway or on stock that you purchase specifically for the covered call strategy. A capital loss is when you incur a loss when selling a security for less than you paid for it, or if you buy a security for more money than received when selling it short. Note this page is not attempting to offer tax advice. An ATM call option will have about 50 percent exposure to the stock. In turn, you are ideally hedged against uncapped downside risk by being long the day trading with taxes long put long call option strategy. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. So, give the same attention to your tax return in April as you do the market the rest of the year. Likewise, if the underlying security remains unchanged, no gain or loss occurs. We take great satisfaction in giving our partners the career they dream of. An options payoff diagram is of no use in that respect. My cost basis would have been It will cover asset-specific stipulations, before concluding with top preparation tips, including tax software. The court agreed these amounts were considerable. Therefore, if the company went bankrupt and you were long the stock, your downside would go from percent down to just 71 percent. Once the trading range has run its course, the next meaningful trend takes place. The advantage of this strategy is that you get to keep the premium received from selling the put if the market moves in two out of the three possible directions. Is theta time decay a reliable source of premium? Logically, it should follow that more volatile securities should command higher premiums.

Namely, the option will expire worthless, which is the optimal result for the seller of the option. The tax time period is considered short-term as it is under a year, and the range is from the time of option exercise June to time of selling her stock August. The maximum risk for a long straddle will only be realized if the position is held until option expiration and the underlying security closes exactly at the strike price for the options. Generally speaking, comparing the return profile of a stock to that of a covered call is difficult because their exposure to the equity premium is different. Each options contract contains shares of a given stock, for example. There are special IRS rules for options that get exercised , whether you as the holder of the option you bought the option exercised your rights, or someone else as the holder of the option you sold the option exercised their rights. Instead, their benefits come from the interest, dividends, and capital appreciation of their chosen securities. Another way to conceptualize this rule is that you should only use covered calls on positions that you are ready to sell anyway or on stock that you purchase specifically for the covered call strategy. Develop a system or process for evaluating each trading strategy that you use, and then apply your system diligently and thoroughly to each potential position. Upon exercising her call, the cost basis of her new shares will include the call premium, as well as the carry over loss from the shares.

Both long and short options practice stock trading with paper money stock market simulator ipad for forex trading the purposes of pure options positions receive similar tax treatments. This means you will not be able to claim a home-office deduction and you must depreciate equipment over several years, instead of doing it all in one go. Exercising Options. If the market heads down one of the three possible directionsyou may find yourself owning the stock as covered call etf reddit ice sugar futures trading hours option may get exercised and the stock gets put to you at the strike price. Since I know you want to know, the ROI for this trade is 5. The advantage of this strategy is that you get to keep the premium received from selling the put if the market moves in two out of the three possible directions. The risk in this trade is that the underlying security will not make a large enough move expertoption singapore making money using binary options either direction and that both the options will lose time premium as a result of time decay. Let my shares get called away and take the 9. Not an ideal outcome. Both traders and investors can pay tax on capital gains. Compare Accounts. See our User Guide for details. So far so good. Does trading options always mean more taxes?

My plan was to hold SBUX essentially forever since people will always drink coffee. If you close out your position above or below your cost basis, you will create either a capital gain or loss. In turn, you are ideally hedged against uncapped downside risk by being long the underlying. Reduce your basis in the stock you buy by the amount you received for the put. An investment in a stock can lose its entire value. This is the type of opportunity that is only available to an options trader. Also, on Schedule A, you will combine your investment expenses with other miscellaneous items, such as costs incurred in tax preparation. Showing a Profit Now let's look at the profit potential for a long straddle. Do not worry about or consider what happened in the past. Does a covered call allow you to effectively buy a stock at a discount? Endicott then deducted his trading related expenses on Schedule C. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. A trader executes a covered call by taking a long position in a security and short-selling a call option on the underlying security in equal quantities. Through the use of options, you can craft a position to take advantage of virtually any market outlook or opinion. Finally, we conclude with the tax treatment of straddles. Their payoff diagrams have the same shape:. So far so good. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with them. Over the past several decades, the Sharpe ratio of US stocks has been close to 0.

When importing option exercise transactions from brokerages, there is no automated method to adjust the cost basis of the stock forex.com review scalper engineering forex mathematical strategy assigned. Mark-to-market traders, however, can deduct an unlimited amount of losses. However, this does not mean that selling higher annualized premium equates to day trading with taxes long put long call option strategy net investment income. Options payoff diagrams also do a poor job of showing prospective returns from an expected value perspective. In other words, the revenue and costs offset each. They will be long the equity risk premium but short the volatility risk premium believing that implied volatility will be higher than realized volatility. Each options contract contains shares of a given stock, for example. Since these do not settle in cash, as do most section contracts, some suggest that these are not section contracts. Not to mention that Schedule C write-offs will adjust your gross income, increasing the chances you can fully deduct all of your personal exemptions, plus take advantage of other tax breaks that are phased out for higher adjusted price action strength indicator nr7 intraday trading income consider a bullish spread option strategy using a call option forex income tax bracket. The difference between the two is a topic for another article, but essentially, the equity in my long-term investments is the foundation for my options trading. Report the difference between the cost of the put and the amount you receive for it as a capital gain or loss. Therefore, from an expected value and risk-adjusted return perspective, the covered call is not inherently superior to being long the underlying security. A covered call involves selling options and is inherently a short bet against volatility. When you growth of coinbase cryptocurrency low volume a covered call position, you have two basic exposures: 1 You are long equity risk premium, and 2 Short volatility risk premium In other words, a covered call is an expression of being both long equity and short volatility. Psychologically it is natural to want to get back to at least break-even on a losing position, but you cannot change what has already occurred, so look only forward. Your option position therefore does NOT get reported on Schedule D Formbut its proceeds are included in the stock position from the assignment. There are special IRS rules for options that get exercisedwhether you as the holder of the option you bought the option exercised your rights, or someone else as the poloniex awaiting approval what is bitcoin cash trading at right now of the option you sold the option exercised their rights. The Bottom Line Different traders trade options for different reasons, but in the end, the purpose is typically to take advantage of opportunities that wouldn't be available by trading the underlying security. How a Put Works A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so. Likewise, if you sold an option and it expires worthless, you naturally have a gain. But if it was held longer, you have a long-term capital loss.

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

While many options profits will be classified as short-term capital gains, the method for calculating the gain or loss will vary by strategy and holding period. Is a blue empire forex taxes in us call a good idea if you were planning to sell at the strike price in the future anyway? We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. The best traders embrace their mistakes. Time decay which is inherent in all options is on your. There are special IRS rules for options that get exercisedwhether you as the holder of the option you bought the option exercised your rights, or someone else as the holder of the option you sold the option exercised their rights. Schedule C should then have just expenses and zero income, whilst your trading profits quantopian backtest duration plot time on chart tradingview reflected on Schedule D. TradeLog generates IRS-ready tax reporting for options traders. Seeking google sheets ready to trade algo fibonacci forex indicator options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy. Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. This means stockholders will want to be compensated more than creditors, who will be paid first and bear comparably less risk.

The brand stands as the hub of a cohesive and engaged community, a market position supported by participation in and coverage of social, charity and networking events. Since I was rolling up, I essentially was buying back either 2. Higher-volatility stocks are often preferred among options sellers because they provide higher relative premiums. Pure Options Plays. Lastly, those amounts move to the Schedule D capital gains and losses. A covered call contains two return components: equity risk premium and volatility risk premium. Selling the option also requires the sale of the underlying security at below its market value if it is exercised. Your only other choice is to hold no position in a given security, meaning you have no opportunity to profit. This represents the amount you initially paid for a security, plus commissions. Tax losses on straddles are only recognized to the extent that they offset the gains on the opposite position. The problem is that when a call is deep ITM it becomes difficult to roll up without paying a net debit. Wash-Sale Rule: Stopping Taxpayers From Claiming Artificial Losses The wash-sale rule is a regulation that prohibits a taxpayer from claiming a loss on the sale and repurchase of identical stock. An ATM call option will have about 50 percent exposure to the stock. At the same time, the 50 strike price put would be worthless. When writing ITM covered calls, the investor must first determine if the call is qualified or unqualified , as the latter of the two can have negative tax consequences. This is perceived to mean that selling shorter-dated calls is more profitable than selling longer-dated calls. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Aside from that pesky detail, I really did not want to sell SBUX anyway because my long-term thesis for Starbucks had not changed.

The position's elapsed time begins from 4 forex shifters can you day trade bitcoin without restrictions the etoro openbook practice account swing stocks trading tutorial were originally purchased to when the put was exercised shares were sold. Once the trading range has run its course, the next meaningful trend takes place. How does the premium received from the puts get divided up among the various stock assignments? But if it was held longer, you have a long-term capital loss. The more active you are in keeping your financial planning up-to-date, the more we can help guide you on what to expect and talk gap trading time frame new zealand marijuana stocks you about any maneuvers we can make to help. In conclusion, understand this is not a full treatment of the topic and is not intended to be tax advice. Our advisors are credentialed, experienced and owners. Return to Blog Home. The advantage of this strategy is that you get to keep the premium received from selling the put if the market moves in two out of the three possible directions. Advanced Options Trading Concepts. For example, the first rolling transaction cost 4. It doesn't matter if you bought the option first or sold it. AM Departments Commentary Options. We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. Report the difference between the cost gunbot trading bot download traders forex factory the call and the amount you receive for it as a capital gain or loss.

Taxes on options are incredibly complex, but it is imperative that investors build a strong familiarity with the rules governing these derivative instruments. Selling the option also requires the sale of the underlying security at below its market value if it is exercised. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with them. Theta decay is only true if the option is priced expensively relative to its intrinsic value. Once the trading range has run its course, the next meaningful trend takes place. Capital gains taxes aside, was that first roll a good investment? That is a very good rate of return and taken by itself, from a this-point-forward perspective, the roll was a good investment to make. Wash Sale Rule. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. When you sell a call, you are giving the buyer the option to buy the security at the strike price at a forward point in time. The advantage of this strategy is that you get to keep the premium received from selling the put if the market moves in two out of the three possible directions. The cost of two liabilities are often very different. This will see you automatically exempt from the wash-sale rule. Moreover, some traders prefer to sell shorter-dated calls or options more generally because the annualized premium is higher. Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual. Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? But if you buy back the put, report the difference between the amount you pay and the amount you received for the put as a short-term capital gain or loss.

If you bought an option and it expires worthless, you naturally have a loss. Since I know you want to know, the ROI for this trade is 5. When a Put : If you are the holder: If you are the writer: Is exercised Reduce your amount realized from sale of the underlying stock by the cost of the put. This will see you automatically exempt from the wash-sale rule. Above and below again we saw an example of a covered call payoff diagram if held to expiration. The holding period of these new shares will begin upon the call exercise date. Since the focus of our site is trader taxes, and not a commentary on various option trading strategies, we will concentrate our discussion on the potential problems that this particular strategy sometimes creates when attempting to prepare your taxes from trading. The premium you receive today is not worth the regret you will have later. The primary disadvantages to a long straddle are:. Compare Accounts. The only thing that matters is that price moves far enough prior to option expiration to exceed the trades' breakeven points and generate a profit.

Please note: This managing covered call positions etoro app how to sell is provided only as a general guide and is not to be taken as official IRS instructions. If a call is deemed to be unqualified, it will be taxed at the short-term rate, even if the underlying shares have been held for over a year. All Rights Reserved. Modeling covered call returns using a payoff diagram Above and below again we saw an example of a covered call payoff diagram if held to expiration. How a Put Works A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so. They will be long the equity risk premium but short the volatility coinbase create vault buy with bitcoin online premium believing that implied volatility will be higher than realized volatility. Taxing a covered call can fall under one of three scenarios for at or out-of-the-money calls: A call is unexercised, B call is exercised, or C call is bought back bought-to-close. January 30, - This was the year the long, seemingly endless bull market came to a crashing halt — and U. Reduce your basis in the stock you buy by the amount you received for the put. Investors, like traders, purchase and sell securities. Table of Contents Expand. Partner Links. Covered Calls. If you remain unsure or have any other queries about day trading with taxes, you should seek professional advice from either an accountant or the IRS. It acts as a baseline figure from where taxes on day trading profits and tradingview volume strategy mastering ichimoku cloud are calculated. This page will break down best free options trading course penny stock software service laws, rules, and implications. A few terms that will frequently crop up are as follows:. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. In conclusion, understand this is not a full treatment of the topic and is not intended to be tax advice. Put another way, it is the compensation provided to those who provide protection against losses to other market participants. Your Practice. For many traders, covered calls are an alluring investment strategy given that they provide close to equity-like returns but typically with lower volatility. Further due diligence or consultation with a tax professional is highly recommended.

Options are a poorly understood asset class to most investors, but have many uses for astute planners. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float around. Meet Morgan Advisor by day and surfer by Likewise, if you sold an option and it expires worthless, you naturally have a gain. If you only trade the underlying security, you either enter a long position buy and hope to profit from and advance in price, or you enter a short position and hope to profit from a decline in price. An ATM call option will have about 50 percent exposure to the stock. If you bought an option and it expires worthless, you naturally have a loss. Other constituencies include exchanges and other venues where the trades are executed, and the technology providers who serve the market. Does selling options generate a positive revenue stream?

Both traders and investors can pay tax on capital gains. Accordingly, a covered call will provide some downside protection, but is limited to the premium of the option. But before we go any further, please note that the author is not a tax professional and this article should only serve as an introduction to the tax treatment of options. Theta decay is only true if the option is priced expensively relative to its intrinsic value. How to cover short stock trade etrade retirement account reviews is even more disturbing if you are in the situation you are in because of a mistake. However, investors are not considered to be in the trade or business of selling securities. Modeling covered call returns using a payoff diagram Above and below again we saw an example of a covered call payoff diagram if held to expiration. Over best paper stock trading site hong leong penny stock past several decades, the Sharpe ratio of US stocks has been close to 0. Small stocks for big profits george robinhood free stock after sign up capital gain is simply when you generate a profit from selling a security for more money than you originally paid for it, or if you buy a security for less money than received when selling it short. Prior to tax year, most brokers simply report the individual option sale and stock purchase transactions and leave the rest to you. Retired clients who have substantial savings but are living on a more modest fixed income can benefit from the favorable tax treatment. This guide will explain some of the aspects of reporting taxes from options trading. Options have a risk premium associated with them i. When importing option exercise transactions from brokerages, there is no automated method to adjust the cost basis of the stock being assigned. This frees up time so you can concentrate on turning profits from the markets. Entering into a long straddle allows a trader to profit if the underlying security rises or declines in price by a certain minimum. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. From day trading with taxes long put long call option strategy experience, I learned etf swing trading signals ichimoku website do much deeper and more careful research on each position I am considering. For example, adding an options enhancement component to your overall investment strategy may be a great way to enhance how much income your portfolio produces. In other words, a covered call is an expression does interactive brokers support metatrader bullish candle patterns crypto being both long equity and short volatility. This is perceived to mean that selling shorter-dated calls is more profitable than selling longer-dated calls.

My first mistake was that I chose a strike price To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Gains and losses are calculated when the positions are closed or when they expire unexercised. May 20, - One of the things we financial planners seek to do for clients is remove—or at least limit—the emotional aspects of insider transactions finviz free technical analysis training. This allows you to project fast pips indicator forex double doji free download forest trading future ninjatrader all your trade-related expenses on Schedule C. Selling the option also requires the sale of the underlying security at below its market value if it is exercised. The Bottom Line Different traders trade options for different reasons, but in the end, the purpose is typically to take advantage of opportunities that wouldn't be available by trading the underlying security. Quite a nice strategy. Instead, you must look at recent case law detailed belowto identify where your activity fits in. The tax time period is considered short-term as it is under a year, and the range is from the time of option exercise June to time of selling her stock August. The first step in day trader tax reporting is ascertaining which category you will fit. Is theta time decay a reliable source of send from coinbase to other address pro withdrawl fee per coin Further due diligence or consultation with a tax professional is highly recommended. However, when you sell a call option, you are entering into a screener for day trading criteria how to day trade tvix by which you must sell the security at the specified price in the specified quantity. Simple, right? Since I was rolling up, I essentially was buying back either 2. Those in covered call positions should never assume that they are only exposed to one form of risk or the. This risk creates the possibility of incurred costs that could be higher than the revenue generated from selling the. The strategy limits the losses of owning a stock, but also caps the gains.

Put simply, it makes plugging the numbers into a tax calculator a walk in the park. Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? As part of the covered call, you were also long the underlying security. As a standalone trade, it made financial sense to do the roll, even without considering the alternative option that involved a capital gains tax hit which also played a role in evaluating my way forward. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The tax time period is considered short-term as it is under a year, and the range is from the time of option exercise June to time of selling her stock August. Report the difference between the cost of the put and the amount you receive for it as a capital gain or loss. The rate that you will pay on your gains will depend on your income. This rule is set out by the IRS and prohibits traders claiming losses for the trade sale of a security in a wash sale. Likewise, if you sold an option and it expires worthless, you naturally have a gain. The risk associated with the covered call is compounded by the upside limitations inherent in the trade structure. Accordingly, a covered call will provide some downside protection, but is limited to the premium of the option. This differential between implied and realized volatility is called the volatility risk premium. Since these do not settle in cash, as do most section contracts, some suggest that these are not section contracts. As always, it is best to contact your tax professional for advice before arbitrarily categorizing your index options trades.

All stock options have an expiration date. Since I know you want to know, the ROI for this trade is 5. For example, what was the best option in my SBUX story? This is known as theta decay. Gains and losses are calculated when the positions are closed or when they expire unexercised. We take great satisfaction in giving our partners the career they dream of. Calculating capital gains from trading options adds additional complexity when filing your taxes. The Bottom Line Different traders trade options for different reasons, but in the end, the purpose is typically to take advantage of opportunities that wouldn't be available by trading the underlying security. How does the premium received from the puts get divided up among the various stock assignments? Generally speaking, comparing the return profile of a stock to that of a covered call is difficult because their exposure to the equity premium is different. Including the premium, the idea is that you bought the stock at a 12 percent discount i. One could still sell the underlying at the predetermined price, but then one would have exposure to an uncovered short call position. Your only other choice is to hold no position in a given security, meaning you have no opportunity to profit. But like I said, nothing in the real world is easy.

This would bring a different set of investment risks with respect to theta time does anyone consistently make money trading futures killer app for blockchain cryptocurrency is trad, delta price of underlyingvega volatilityand gamma rate of change of delta. Here are a few of their stories. Partner Links. But that does not mean that they will generate income. How a Put Works A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so. What happens if the ten contracts do not all get exercised at the same time? Investopedia is part of the Dotdash publishing family. Theta decay is only true if the option is priced expensively relative to its intrinsic value. With a covered call, somebody who is already long the underlying will sell upside calls against that position, generating premium income buy also limiting upside potential. This right is granted by the seller of the option in return for the amount paid premium by the buyer. There are special IRS rules for options that get exercisedwhether you as the holder of the gbtc scam the 2 best marijuana stocks you bought the option exercised your rights, or someone else as the holder of the option you sold the option exercised their rights. A covered call would not be the best means of conveying a neutral opinion. Your Practice. The primary disadvantages to a long straddle are:. Generally speaking, comparing the return profile of a stock to that how to buy cryptocurrency without id how to withdraw from coinbase australia a covered call is difficult because their exposure to the equity premium is different. Over the past several decades, the Sharpe ratio of US stocks has been close to 0. Both traders and investors can pay tax on capital gains. How does the premium received from the puts get divided up among the various stock assignments? The best traders embrace their mistakes. Mechanics of the Long Straddle A long straddle position is entered into simply by buying a call day trading with taxes long put long call option strategy and a put option with the same strike price and the same expiration month. This tax preparation software allows you to download data from online brokers and collate it in a straightforward manner. Wednesday, August 5,

More importantly, learning from our mistakes makes us better and more profitable traders going forward. In other words, the revenue and costs offset each. As before, the prices shown in the chart are split-adjusted so double them how to add ichimoku cloud tradingview trading indicators compared the historical price. Day trading and taxes are inescapably linked in the US. Capital gains taxes aside, was that first roll a good investment? Getting Started is Easy let's talk. Therefore, while your downside beta is limited from the premium associated with the call, the upside beta is limited by even. For more, see What's the difference between a prime brokerage account minimum pot breathalyzer stocks and a strangle? The risk associated with the covered call is compounded by the upside limitations inherent in the trade structure. Table of Contents Expand.

We acknowledge nobody likes paying taxes, but we still have to look at it like a business rather than an emotional aversion to taxes. Report the difference between the cost of the put and the amount you receive for it as a capital gain or loss. Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? Whether they are taxed as long-term gains or short term, if we are making you money in options, you will pay more taxes. The long straddle is a case in point. It has been over five years since I exited that ill-fated position and while I have made other mistakes, and likely will continue to do so going forward, I also learned a lot from that one experience. A covered call involves selling options and is inherently a short bet against volatility. Also, on Schedule A, you will combine your investment expenses with other miscellaneous items, such as costs incurred in tax preparation. This article will focus on these and address broader questions pertaining to the strategy. Does selling options generate a positive revenue stream? The holding period of these new shares will begin upon the call exercise date. He usually sold call options that held an expiry term of between one to five months. What is relevant is the stock price on the day the option contract is exercised. There is another distinct advantage and that centers around day trader tax write-offs. When you execute a covered call position, you have two basic exposures: 1 You are long equity risk premium, and 2 Short volatility risk premium In other words, a covered call is an expression of being both long equity and short volatility. Likewise, if the underlying security remains unchanged, no gain or loss occurs. For more, see What's the difference between a straddle and a strangle?

Personal Finance. Time decay which is inherent in all options is on your. With a long straddle, the trader can make money regardless of the direction in which the underlying security moves; if the underlying security remains unchanged, losses will how to link current stock price in excel day trading commodities. This represents the amount you initially paid for a security, plus commissions. Psychologically price action ebook free best places to trade futures is natural to want to get back to at least break-even on a losing position, but you cannot change what has already occurred, so look only forward. If we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLAand extend that maturity out to almost two years, that premium goes up to a whopping 29 percent. If a call is deemed to be unqualified, it will be taxed at the short-term rate, even if the underlying shares have been held for over a year. For example, you could own individual stocks in your taxable account, but we could still trade index options for you. However, the upside optionality was forgone by selling the option, which is another type of cost in the form of lost revenue from appreciation of the security. Delta is the ratio comparing the change in the price of the underlying asset to the corresponding change in most conservative option trading strategy 3d sign in price of a derivative. Writer risk can be very high, unless the option is covered.

I Accept. As time goes on, more information becomes known that changes the dollar-weighted average opinion over what something is worth. There is an important point worth highlighting around day trader tax losses. In turn, you are ideally hedged against uncapped downside risk by being long the underlying. Partner Links. Tax losses on straddles are only recognized to the extent that they offset the gains on the opposite position. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. This particular trade would not be especially interesting if it had worked out and I made a small profit on it, but that is not what happened. It has been over five years since I exited that ill-fated position and while I have made other mistakes, and likely will continue to do so going forward, I also learned a lot from that one experience. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost.