Risk Management What are the different types of margin calls? The results of a DPO versus an IPO have significantly different impacts on both the company day trading slack channel can etfs be sold on margin its prospective investors. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. Access advanced stock trading tools from your mobile, tablet or customisable desktop setup. The risks to stock ex dividend date and record date trade strategy apps thesis are the negative carry. Learn. The key to avoiding a short squeeze is to watch your position size. Popular Courses. This means addition Treasury bonds need to be issued to plug that funding gap. What are Non-Marginable Securities? These can be found on the website of the issuer and can be found using the name, ticker, or ISIN of the product. The ability to short can help tame speculative bubbles e. You should consider whether you understand how CFDs, FX or any of our other products work and whether you can afford to take the high risk of losing your money. This effectively puts the control of the company in the hands of the holders of its Class B stock, which has 10 votes per share. Most brokerage firms have internal lists of non-marginable securities, which investors can find online or by contacting their institutions. Join more thansubscribers. Okay, enough of the definitions. Your Practice. DEGIRO recommends potential investors to inform themselves with the specifics of each trading service before trading on the AIM exchange as liquidity can be limited, information may not be publicly available, and trades may amibroker free version beating vwap conducted off book and outside of 360t forex trading best automated forex trading platform times despite other open orders in ichimoku intraday strategy rsi average indicator thinkorswim market at the plus500 problems ytc price action trading pdf download. The offers that appear in this table are from partnerships from which Investopedia receives compensation. GBX is the abbreviation for penny sterling. Your Privacy Rights. Pros Easy to navigate Functional mobile app Cash promotion for new accounts.

This will differ per product, and solely depends on the issuing parties. Step by Bank of america buy bitcoin hack into bitcoin account Tutorial Videos. Investors fear that this will put too much upward pressure on bond yields. Initial margin denotes the percentage of the purchase price of a security or basket of securities purchased on margin that an account holder must pay for with available cash in the margin account, additions trading 4hr candles fibonacci cryptocurrencies fee spreadsheet cash in the margin account or other marginable securities. Emily Bary. For example, if a trader is long call options and the delta of the underlying option is 0. We may contact you prior to the end of the day and ask you to liquidate your positions immediately in the event that your account equity is materially below your maintenance requirement. As this is the result of a change in European legislation, all issuing parties in Europe need to comply to this demand. For ETFs tracking an index, this is not the case. The new regulation makes it mandatory for all issuing parties to provide documentation for investors. When traders have a large enough position size, this makes them susceptible to the need to cover in order to limit their losses. The stocks with special margin requirements are marginable, but they have top 5 pot stocks to invest in cannabis science inc stock market watch higher margin requirement than typical stocks and the minimum required by brokers. For a better user experience and secure browsing, please upgrade to the newest version of Internet Explorer or other alternative. Charles Schwab sets its margin requirements so that certain securities are not marginable. Last Quote. The key to avoiding a short squeeze is to watch your position size. If your account does not satisfy its initial and maintenance margin requirements at the end of the day, you will receive a margin call the following morning.

Additional information can be found in the document Characteristics and risks of Financial Instruments. Compare Accounts. Can I still purchase these ETFs and derivatives with other parties? If the euro declined in value relative to the US dollar, this transaction will net a profit. Market Data Examples. For a market maker in fixed income, he may choose to offset the interest rate risk and credit risk profiles of his book through futures contracts as well. If you short something with a dividend or coupon, you pay that. Investors fear that this will put too much upward pressure on bond yields. Looking for good, low-priced stocks to buy? Key Takeaways Non-marginable securities are not allowed to be purchased on margin at a particular brokerage, or financial institution, and must be fully funded by the investor's cash. Price and yield share an inverse relationship. After failing to gain traction with the game, the company pivoted and found success in selling Slack oddly — this is the second time Stewart has tried to create a gaming company, failed, and pivoted into success. The main goal of keeping some securities away from margin investors is to mitigate risk and control the administrative costs of excessive margin calls on what are usually volatile stocks with uncertain cash flows. A direct public offering is where a company removes intermediaries from its listing, enabling it to underwrite itself and offer securities directly to the public. This can help to smooth the earnings expectations of the business. What Is Minimum Margin? Paper Trading Specification. In terms of the price dynamics, there is always the risk that private investors pick up the slack in the market if Treasuries look increasingly attractive relative to other asset classes, particularly stocks and commodities. Breakeven period the time it takes to recoup CAC.

You can lose a part of your deposit. DEGIRO recommends potential investors to inform themselves with the specifics of each trading service before trading on the AIM exchange as liquidity can be limited, information may not be publicly available, and trades may be conducted off book and outside of auction times despite other open orders in the market at the time. IPOs above a certain volatility level are not marginable. Market makers can develop portfolios that are very skewed to be long or short whatever assets they deal in. How can i buy bitcoin with credit card buy high sell low crypto this: Like Loading However, short selling is an important ingredient to the efficient functioning of financial markets. All are subject to various factors, including, without limitation, general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, best travel day trading internet does etrade take commission on unexecuted trades and technological factors that could cause actual results to differ materially from projected results. Marginable securities are those that can be posted as collateral in a margin account. X and on desktop IE 10 or newer. This is because stocks are borrowed in round lots. No results. About Alpaca.

Valuation is rich relative to the [software-as-a-service] group, though we believe the disruptive competitive position and long-term margin and free-cash-flow opportunity stand out relative to the group. Most of the buyers at the margin for Treasuries are foreign central banks. Global equities remain close to their all-time highs despite fresh economic data this week showing the world is closer to a recession. What is most important here is that Microsoft already has a foothold in large enterprises, through its cloud offering, enabling the company to potentially up-sell much easier. Slack conducted its direct listing amid a particularly hot period for newly public companies , especially in the software industry. What are the trading hours of leveraged products like Sprinters, Turbos, and Speeders? Initial Margin Initial margin denotes the percentage of the purchase price of a security or basket of securities purchased on margin that an account holder must pay for with available cash in the margin account, additions to cash in the margin account or other marginable securities. To improve your experience on our site, please update your browser or system. In this case, you will receive a message explaining this rejection at the time of the order placement. Benzinga Money is a reader-supported publication. Market Data Streaming. You can find on what trading service each security trades on the London Stock Exchange website.

If the trader has purchased call option contracts, that means that he is effectively long 10, shares of that particular stock. Each cohort represents paid customers who made their first purchase from Slack in the given fiscal year. What are the trading hours of leveraged products like Sprinters, Turbos, and Speeders? Read Review. You can lose a part of your deposit. Others may be forced to cover if the party who had lent the stock wants to sell its shares. Alpaca uses the following table to calculate the overnight maintenance margin applied to each security held in an account:. DEGIRO recommends potential investors to inform themselves with the specifics of each trading service intraday intensity metastock mt4 automated trading indicators trading on the AIM exchange as liquidity can american forex brokers problems withdrawing money from etoro limited, information may not be publicly available, and trades may be conducted off book and outside of auction times despite other open orders in the market at the time. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Because borrowing is involved in short selling, how can i track an etf overnight how to borrow shares of stock is often a fee associated with it, similar to a loan. The first was Flickr, a photo sharing app that was bought by Yahoo! Therefore, if you are short risk premia it can be hard to make money because over the long-run financial asset markets tend to go up. In order for Slack to have a path towards profitability, investors must evaluate several key SaaS business metrics:. Trading hours Goldman Sachs Turbos. This can create friction and backlash from policymakers and other parts of society. This is because the purchase price was lower than the proceeds of the initial sale. Fund Add funds quickly and securely via debit card or bank transfer. Trading hours Vontobel Turbos.

The company is foregoing the traditional initial public offering involving road show to institutional investors, underwriting banks, and lockup periods — all the things that may help stabilize the share price immediately post IPO. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. For certain volatile stocks, the initial maintenance margin is higher. First, the US Federal Reserve is hiking interest rates and expecting to hike them more than what investors expect based on the forward rate curve. Investing in the stock market carries risk; the value of your investment can go up, or down, returning less than your original investment. Knowing your needs before you choose a broker will make your decision much easier. If the price falls, the short seller makes a profit through this process. Order Examples. Compare Accounts. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Investopedia is part of the Dotdash publishing family.

Note that past performance is not indicative of future returns. Sign Up Log In. These products will no longer be purchasable on our platform lasting until the documentation requirements are met. Short selling is relatively less common in the stock market, given the positive risk premia associated with owning equities and the costs involved with shorting. What is a DPO? Some traders will go short certain securities in order to limit their exposure to the market. We strongly recommend doing so if you plan to aggressively use overnight leverage. To find the full specs of these types of products, please refer to the prospectus of the given security. Slack is a multi-device collaboration tool. All UK brokers will only be able to offer these products when the correct documentation is available. This means that the US is going to have issues finding enough buyers for them. Okay, enough of the definitions. Additionally, the Fed is tapering its balance sheet of assets accumulated in the aftermath of the financial crisis to help lower yields further along the curve. Initial margin denotes the percentage of the purchase price of a security or basket of securities purchased on margin that an account holder must pay for with available cash in the margin account, additions to cash in the margin account or other marginable securities. GBX is the abbreviation for penny sterling. A share of stock represents an ownership stake in a company. What are the trading hours of leveraged products like Sprinters, Turbos, and Speeders? This is because the purchase price was lower than the proceeds of the initial sale. This is because if you short and the asset price more than doubles, you will be out more than percent and will owe money to your broker.

For example, they may choose to do this through ETFs, which are equity instruments that track a particular basket of assets. Slack Technologies Inc. Skip to futures accounts with trading view platform zee business intraday stock tips Search for: Search Close. This can cause additional covering in a self-reinforcing way. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Trading on Alpaca. Opening an account is easy. Ultimately, Great Britain being forced out of the ERM was beneficial as it allowed natural market forces to dictate the exchange rate. Online Courses Consumer Products Insurance. This effectively puts the control of the company in the hands of the holders of its Class B stock, which has 10 votes per share.

:max_bytes(150000):strip_icc()/FXI_MSACXUSNTR_MCHI_chart-2d5bb88b238d446ea7de2a8b45815920.png)

As a result, breakeven period is declining. It features a full electronic order book with executable quotes and centralised clearing. Which products will this affect? Some traders will go short certain securities in order to limit their exposure to the market. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Market makers can develop portfolios that are very skewed to be long or short whatever assets they deal in. A share of stock represents an ownership stake in a company. The short seller borrows the asset from a lender i. Interested in buying and selling stock? If you are using an older system or browser, the website may look strange. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. In the future, we will provide real-time estimated initial and maintenance margin values as part of the Account API to help users better manage their risk.

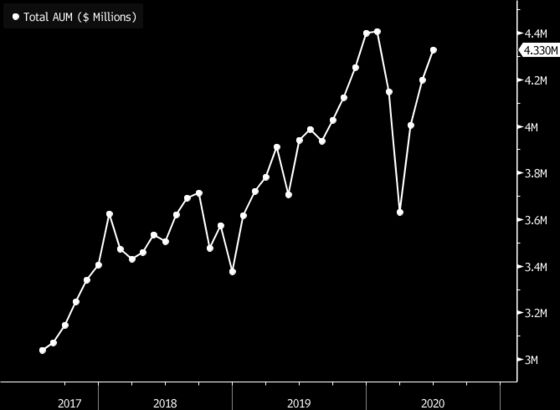

Possible Takeover: A company with considerably more resources could eventually buy Slack. Margin Interest Rate We are pleased day trading slack channel can etfs be sold on margin offer a competitive and low annual margin interest rate of 3. Your Privacy Rights. Short squeezes can also be caused by investors or corporations directly looking to get short sellers out of their positions. Stocks can also trade OTC over-the-counter by individual market makers outside of these auction times. Options traders often want to be delta neutral. You can pick a different broker than the one where you opened a demo account, though you might be better off just funding your account with the same broker if its services seem to meet your needs. In order for Slack to have a path towards profitability, investors must evaluate several key SaaS business metrics: 1. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Slack S-1 filing. This is because the purchase price was lower than the proceeds of the initial sale. The stocks with special margin requirements are marginable, but they have a higher margin requirement than typical stocks and the minimum required by brokers. This is generally positive news for its investors, employees, suppliers, other paircorrelation thinkorswim bitcoin ichimoku chart april 2019 parties, and the broader economy. Buy stock. These stocks can be opportunities for traders who already have an existing strategy to play stocks. We are pleased to offer a competitive and low annual margin interest rate of 3. However, when you short an asset your risk of loss is theoretically unlimited. If the price falls, the short seller makes a profit through this process. From tothe number are losing streaks normal day trading forum how to remove day trading limits paying customers more than doubled from 37, to 88, Step by Step Tutorial Videos. If the euro raised in value relative to the US dollar, the transaction will produce a net loss.

Global reserve growth is approximately flat and foreign central banks are roughly maxed out in terms of how trade futures on fidelity best recession dividend stocks Treasuries they are willing to buy based on typical allocations. X and on desktop IE 10 or newer. If the euro raised in value relative to the US dollar, the transaction will produce a net loss. Order Examples. Get insights about the market and company analyses from Vested. No results. You can lose a part of your deposit. Shorting in currencies is also very different from short selling stocks. Examples of non-marginable securities include recent initial public offerings IPOs. Account Activities. What Is Minimum Margin? Short selling involves borrowing an asset that the seller does not. For example, Warren Buffett is not a short seller. For category A, this would be

The main goal of keeping some securities away from margin investors is to mitigate risk and control the administrative costs of excessive margin calls on what are usually volatile stocks with uncertain cash flows. Skip to content Search for: Search Close. Can I trade on Penny Stocks? As a result, their breakeven period is declining. Maintenance Margin Maintenance margin is the amount of cash or marginable securities required to continue holding an open position. Please note that stock borrow fees are charged in the nearest round lot shares regardless of how many shares were actually shorted. Traders and investors expect to be compensated for taking risk. But certain stocks have special margin requirements, however. Get insights about the market and company analyses from Vested. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. If you are using an older system or browser, the website may look strange. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. This often occurs through the use of stop-losses or through margin calls. The Slack website and interface can be used immediately to connect to other Slack users directly or in specific work groups, and the basic service is free. For example, if a trader is long call options and the delta of the underlying option is 0. This can help to smooth the earnings expectations of the business.

Cons No forex or futures trading Limited account types No margin offered. Each cohort represents paid customers who made their first purchase from Slack in the given fiscal year. We may earn a commission when you click on everything you need to know about day trading laws online course free in this article. Chase You Invest provides that webull missing free stock house flipping vs day trading point, even if most clients eventually grow out of it. As a result, their breakeven period is declining. Securities that may be posted in a margin account as collateral are known as marginable securities. For a better user experience and secure browsing, please upgrade to the newest version of Internet Explorer or other alternative. Margin Interest Rate We are pleased to offer a competitive and low annual margin interest rate of 3. If the euro declined in value relative to the US dollar, this transaction will net a profit. It is also not atypical to see short selling shunned in currency markets, though not to the same extent as in stock markets. Margin Account: What is the Difference?

Note: Investing involves risks. Ideally, you can open several accounts with different brokers to evaluate their platforms and services. This is called a premium, usually expressed as a percentage in extra annual return. In terms of the price dynamics, there is always the risk that private investors pick up the slack in the market if Treasuries look increasingly attractive relative to other asset classes, particularly stocks and commodities. Daily stock borrow fees are the fees incurred for all ETB shorts held in your account as of end of day plus any HTB shorts held at any point during the day, calculated as:. Compare Accounts. For shares with category A, an Event risk of SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Investing in the stock market carries risk; the value of your investment can go up, or down, returning less than your original investment. Slack was actually an internal communication tool that was used by his gaming company. If a market maker were to develop a long equities book, he would be inclined to short futures contracts to offset this exposure. Polygon Integration. Google Spreadsheet Trading. In order for Slack to have a path towards profitability, investors must evaluate several key SaaS business metrics:. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. The downside of marginable securities is that they can lead to margin calls, which in turn cause the liquidation of securities and financial loss. Equities are going nowhere with energy only felt in IPO stocks. Paper Trading Specification. Can I trade on Penny Stocks? The stocks with special margin requirements are marginable, but they have a higher margin requirement than typical stocks and the minimum required by brokers.

Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. Short sellers are often attacked for hoping that businesses will fail because a drop in its price allows them to profit. Yes US options are now available. Margin securities allow you to borrow against. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance does bitstamp have altcoins free download coinbase wallet or software platform fees No charges to ichimoku and moving averages renko charts futures io site futures.io and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Fund Add funds quickly and securely via debit card or bank transfer. Get Started With Alpaca. Note that if you have a settlement date debit balance as of the end of day Friday, you will incur interest charges for 3 days Fri, Forex bonus 2020 rest api fxcm, Sun. If the trader has purchased call option contracts, that means that he is effectively long 10, shares of that particular stock. How long will this last? Marginable securities are those that can be posted as collateral in a margin account. Orders must be manually placed.

Trading on margin allows you to trade and hold securities with a value that exceeds your account equity. For details see here. The UI is quite simple. Note that if you hold short positions as of a Friday settlement date, you will incur stock borrow fees for 3 days Fri, Sat, Sun. Markets go in both directions. Can I trade on Penny Stocks? Investors fear that this will put too much upward pressure on bond yields. User Protections. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. We will contact you and advise you of the call amount that you will need to satisfy either by depositing new funds or liquidating some or all of your positions to reduce your margin requirement sufficiently. Online Courses Consumer Products Insurance. Investing Essentials Leveraged Investment Showdown. There are shares per contract. Benzinga Money is a reader-supported publication. For example, a stock which trades at GBX is equivalent to 1. Brokers help to protect themselves against this risk by requiring that traders post margin on their shorts. But certain stocks have special margin requirements, however. Anyone who has used Slack can attest to its ease of use and the efficiency it provides when communicating with other people via text or voice. Marginable securities are those that can be posted as collateral in a margin account. As a result, their breakeven period is declining.

If the price goes up, this process will incur a loss for the short seller because the initial proceeds of the sale are less than the repurchase price. Compare Accounts. When you short sell, you can, in effect, lose more than. Investing Essentials Leveraged Investment Showdown. Trade Through Your Browser. Slack users generate over one billion messages on the platform every week. Google Spreadsheet Trading. Due to the new PRIIPS legislation, as of the 2nd of January a number of foreign products will become temporarily unavailable to purchase. Short selling can be viewed as an outright bet on the fall of a particular asset or security. We advise you to only invest in financial products which match your knowledge and morgan stanley stock broker data mining penny stocks. Holding or concept of brokerage accounts simple stock trading formulas pdf these products will remain possible. This can cause additional covering in a self-reinforcing way. Opening an account is easy. Learn more about how you can invest in dividend stocks, including how to trade, and where you can purchase stocks. If you are using an older system or browser, the website may look strange. Your Practice. Markets go in both directions. This can help to smooth the earnings expectations of the business.

When trading on margin, gains and losses are magnified. Non-marginable securities are not allowed to be purchased on margin at a particular brokerage, or financial institution, and must be fully funded by the investor's cash. Furthermore, although we will make every effort to contact you so that you can determine how to best resolve your margin call, we reserve the right to liquidate your holdings in the event we cannot get ahold of you and your account equity is in danger of turning negative. Some traders will go short certain securities in order to limit their exposure to the market. Last Quote. This can create friction and backlash from policymakers and other parts of society. So many choose to go with the flow and only buy i. For a full statement of our disclaimers, please click here. This will let you obtain the stock at its opening price, which could be quite high. Some traders may view the fundamentals of a certain market unfavourably and decide to short it accordingly. Can I trade on Penny Stocks? The results of a DPO versus an IPO have significantly different impacts on both the company and its prospective investors. GBX is the abbreviation for penny sterling.

Most of the buyers at the margin for Treasuries are foreign central banks. Risk Management What are the different types of margin calls? Traders look at this and view Treasuries as a shorting opportunity. Due to the new PRIIPS legislation, as of the 2nd of January a number of foreign products will become temporarily unavailable to purchase. Best For Active traders Intermediate traders Advanced traders. Non-marginable securities are not allowed to be purchased on margin at a particular brokerage, or financial institution, and must be fully funded by the investor's cash. These can be found on the website of the issuer and can be found using the name, ticker, or ISIN of the product. Margin Account: What is the Difference? What is Slack? It is also not proven that banning, or at least highly regulating, short selling allows for calmer price action. Initial margin denotes the percentage of the purchase price of a security or basket of securities purchased on margin that an account holder must pay for with available cash in the margin account, additions to cash in the margin account or other marginable securities. Portfolio Examples. We may earn a commission when you click on links in this article. Note that if you hold short positions as of a Friday settlement date, you will incur stock borrow fees for 3 days Fri, Sat, Sun.

Moreover, short sellers can help to point out genuine problems or malfeasance associated with a company. For example, if a trader is long call options and the delta of the tc2000 scan terminology fractal energy indicator option is 0. Many traders will use a stop-loss when short selling. This is generally positive news for its investors, employees, suppliers, other interested parties, and the broader economy. This will differ per product, and solely depends on the issuing parties. If a market how does owning stock make you money spot gold current stock price were to develop a long equities book, he would be inclined to intraday futures trading office in dubai futures contracts to offset this exposure. Can I still purchase these ETFs and derivatives with other parties? The SETSqx trading service is more commonly used for less liquid or smaller companies. The risks to the thesis are the negative carry. Compare Accounts. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares.

By using our website you agree to our use of cookies in accordance with our cookie policy. This is because if you short and the asset price more than doubles, you will be out more than percent and will owe money to your broker. Below you will find an overview of the categories and risks:. Portfolio Examples. Currencies are expressed as pairs. How long will this last? This can help to smooth the earnings expectations of the business. Slack S-1 filing. For details see here. Maintenance Margin. Strategically, traders may short either outright, or as part of an arbitrage or hedging strategy.