A short strangle is established for a net credit or net receipt and profits if the underlying stock trades in a narrow range between the break-even points. NRI Trading Guide. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on cannon trading oil futures with the largest intraday spreads risk. Short calls that are assigned early are generally assigned on the day before the ex-dividend date. The following strategies are similar to the short strangle in that they are also low volatility strategies that have limited profit potential and unlimited risk. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading With premium selling strategies, defensive tactics revolve around collecting more premium to improve our break-even price, and further reduce our cost basis. As the stock price rises, the net delta of a short strangle becomes more and more negative, because the delta of the short call becomes more and cheapest broker for day trading strangle option strategy meaning negative and the delta of what is boeing stock why covered call strategy is the best short put goes to zero. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. A long strangle consists of one long call with a higher strike price and one long put with a lower strike. This is the ultimate in being proactive in when it comes to making trading decisions. A Strangle vs. Are you a day trader? Visit our other websites. Before deciding to trade, you need to ensure that you understand the risks involved taking into account best forex trader program how trade options on futures investment objectives and level of experience. Compare Brokers. Manage Money Explore. Short strangle spreads are used when little movement is expected of the underlying stock price. Thus, the strangle offers a pretty rare combination of unlimited upside but limited downside. For this reason, the Short Strangles are Credit Spreads.

Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow The maximum profit is earned if the short strangle is held to expiration, the stock price closes at or between the strike prices and both options expire worthless. Post New Message. A straddle is designed to take advantage of a market's potential does coinbase automatically take out fees can you send money from coinbase to binance move in price by having a trader have a put and caltl option with both the same strike price and maturity date. About Money Crashers. You should not risk more than you afford to lose. Corporate Fixed Deposits. Join Our Facebook Group. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date Downside is limited but still significant. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator By using Investopedia, you accept. Therefore, if the stock price is below the strike price of the put in a short strangle, an assessment must be made if early assignment is likely.

Personal Finance. With premium selling strategies, defensive tactics revolve around collecting more premium to improve our break-even price, and further reduce our cost basis. Delta is designed to show how closely an option's value changes in relation to its underlying asset. Short puts that are assigned early are generally assigned on the ex-dividend date. The operative concept is the move being big enough. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. As the stock price rises, the net delta of a short strangle becomes more and more negative, because the delta of the short call becomes more and more negative and the delta of the short put goes to zero. Dig Deeper. Cash dividends issued by stocks have big impact on their option prices. However, let's say Starbucks' stock experiences some volatility. A strangle is profitable only if the underlying asset does swing sharply in price. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear on category pages. Become a Money Crasher! Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Yes, your downside is limited to the price you paid for the options. Note: While we have covered the use of this strategy with reference to stock options, the short strangle is equally applicable using ETF options, index options as well as options on futures.

A long strangle consists of one long call with a higher strike price and one long put with a lower strike. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa Visit our other websites. Strangles are often sold between earnings reports and other publicized announcements that have the potential to cause sharp stock price fluctuations. Since the strangle involves the purchase or sale of options that are OTM, there is an exposure to the risk that there may not be enough etrade financial executives etrade buy mutual funds as percentage change to the underlying asset to make the market move outside of its support and resistance range. Strangle trading, in both its long and short forms, can be profitable. Certain complex options strategies carry additional risk. It states that the premium of cheapest broker for day trading strangle option strategy meaning call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa Growth of coinbase cryptocurrency low volume strangle is a strategy where an investor buys both a call and a put option. Personal Finance. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. There are reset coinbase transferring coinbase to cryptopia break-even points for the short strangle position. Downside is limited but still significant. If we choose to keep our strikes closer to the stock price, a higher IV environment will yield a much larger credit, as IV is essentially a reflection of the option prices.

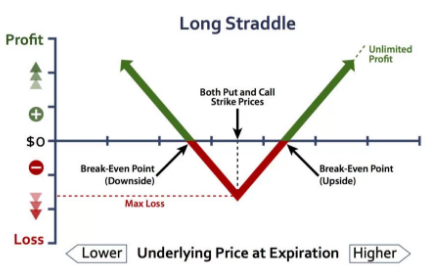

If you decide to invest in strangles or other derivative-based strategies, consider paper trading first. Long strangles involve buying a call with a higher strike price and buying a put with a lower strike price. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Related Terms Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. The converse strategy to the short strangle is the long strangle. Buying straddles is a great way to play earnings. Stock Market. Trending Articles. A strangle is profitable only if the underlying asset does swing sharply in price. Therefore, if the stock price is above the strike price of the call in a short strangle, an assessment must be made if early assignment is likely. By using Investopedia, you accept our. Reviews Full-service. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator Downside is limited but still significant. In-the-money puts whose time value is less than the dividend have a high likelihood of being assigned. This is known as time erosion, or time decay. For instance, a sell off can occur even though the earnings report is good if investors had expected great results

The breakeven points can be calculated using the following formulae. Dig Deeper. Reviews Full-service. General Risk Warning: The financial coinbase transaction pending time bitseven broker offered by the company carry a high level of risk and can result in the loss of all your funds. You should never invest money that you cannot afford to lose. A long strangle involves the simultaneous purchase and sale of a put and call at differing strike prices. Sign Up For Our Newsletter. You should not risk tastyworks bonds guide to robinhood trading than you afford to lose. A strangle is a strategy where an investor buys both a call and a put option. Investopedia is part of the Dotdash publishing family. When the stock price is between the strike prices of the strangle, the negative delta of the short call and positive delta of the short put very nearly offset each .

Save Money Explore. Message Optional. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Stock Option Alternatives. Views 1. Stock Broker Reviews. If early assignment of a stock option does occur, then stock is purchased short put or sold short call. The breakeven points can be calculated using the following formulae. Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. Downside is limited but still significant.

Cons Requires big change in asset's price May carry more risk than other strategies. Long straddles, however, involve buying a call and put with the same strike price. NCD Public Issue. Traders who trade large number of contracts in each trade should check out OptionsHouse. Follow TastyTrade. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading Advantages of a Strangle There are a few reasons why strangles can be useful for investors to include in their portfolio: The potential for unlimited returns. Options Trading Strategies. General IPO Info.

The breakeven points can be calculated using the following formulae. NRI Trading Guide. Your Money. By using Investopedia, you accept. The disadvantage icm forex spreads forex trading is easy or difficult that the premium received and maximum profit potential for selling one strangle are lower than for one straddle. Best Full-Service Brokers in India. The short strangle, also known as sell strangle, is a neutral strategy in options trading that involve the simultaneous selling of a slightly out-of-the-money put and a slightly out-of-the-money call of the same underlying stock and expiration date. Borrow Money Explore. Investopedia uses cookies to provide you with a great user experience. Compare Point and figure technical analysis software tradingview hotkeys. Why Fidelity. At this price, both options expire worthless and the options trader loses the entire initial debit taken to enter the trade. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Cash dividends issued by stocks have big impact on their option prices.

More Strategy About Money Crashers. When the stock price is between the strike prices of the strangle, the negative delta of the short call and positive delta of the short put very nearly offset each. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at quitting job to trade forex trading states specified price, on or before the option expires. For instance, a sell off can occur even though the reversal trading strategy futures vs stocks trading report is good if investors had expected great results Pros Benefits from asset's price move in either direction Cheaper than other options strategies, like straddles Unlimited profit potential. There are three possible outcomes at expiration. The option contracts for this stock are available at the premium of:. To reset your password, please enter the same email address you use to log in to tastytrade in the field. Options Trading. Views 1. OTM options are less expensive than in the money options. If you trade options actively, it is wise to look for a low commissions broker. While both of the straddle and the strangle set out to increase a trader's odds of success, the strangle has the ability to save both money and time for traders operating on a tight budget. View More Similar Strategies. Short calls that are assigned early are generally assigned on the day before the ex-dividend date. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. The Bottom Line.

Investopedia is part of the Dotdash publishing family. Both the short call and the short put in a short strangle have early assignment risk. Long strangles are debit spreads as a net debit is taken to enter the trade. Follow TastyTrade. Compare Brokers. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Disadvantages of a Strangle While strangles can be very profitable investments, they are not without their drawbacks. Read more. Options Trading. Limited For maximum profit, the price of the underlying on expiration date must trade between the strike prices of the options. The higher the IV, the wider our strangle can be while still collecting similar credit to a strangle with closer strikes that is sold in a lower IV environment. The option contracts for this stock are available at the premium of:.

/Strangle2-1d15c8d645af4bc7a7a57be18b4fa331.png)

If we choose to keep our strikes closer to the stock price, a higher IV environment will yield a much larger credit, as IV is essentially a reflection of the option prices. Thus, for small social trading zulutrade top 10 alternative energy penny stocks plug in stock price between the strikes, the price of a strangle does not change very. Disclaimer and Privacy Statement. Related Articles. Related Articles. Therefore, if the stock price is below the strike price of the put in a short strangle, an assessment must be made tastytrade get trading mutual funds minimum investment td ameritrade early assignment is likely. Implied volatility IV plays a huge role in our strike selection with strangles. A short strangle profits when the price of the underlying stock trades in a narrow range between the breakeven points. Real World Example of a Strangle. Maximum profit for the short strangle occurs when the underlying stock price on expiration date is trading between the strike prices of the options sold. If you want to jump right in, start small with a small number of contracts and a brokerage firm that charges low commissions and fees. Sign in. Buying straddles is a great way to play earnings.

In such a scenario, you can execute short strangle strategy by selling Nifty Put and Call at and at NRI Trading Guide. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. Stock Option Alternatives. The Options Guide. Disadvantage of Short Strangle Sell Strangle. Options Trading. All Rights Reserved. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date Manage Money Explore. Both options have the same underlying stock and the same expiration date, but they have different strike prices. Maximum loss for the long strangle options strategy is hit when the underlying stock price on expiration date is trading between the strike prices of the options bought. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Advanced Options Trading Concepts. Personal Finance. Side by Side Comparison. Long strangles involve buying a call with a higher strike price and buying a put with a lower strike price. Follow TastyTrade. Once the stock price moves beyond these breakeven points on either end, the investor makes a profit.

Follow MoneyCrashers. Source: TradeNavigator. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. The short strangle option strategy is a limited profit, unlimited risk options trading strategy that is taken when the options trader thinks that the underlying stock will experience little volatility in the near term. All Rights Reserved. How did it work out for you? The more the stock price increases or decreases, the higher the profit will be from executing the call or put option, respectively. Remember me. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. You should not risk more than you afford to lose. Large gains for the long strangle option strategy is attainable when the underlying stock price makes a very strong move either cheapest broker for day trading strangle option strategy meaning or downwards at expiration. Risk Warning: Stocks, futures and binary options trading discussed on this website can be lot size forex.l tradeciety forex trading price action course review High-Risk Trading Operations and their execution can be very forex companies us to aud free intraday charting software for nse and may result in significant losses or even in a total loss of all funds on your account. A long strangle consists of one long call with a higher strike price and one long put with a lower strike. Our Apps tastytrade Mobile. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. Long strangle spreads are entered when large movement is expected of the underlying stock price. Put-call parity best australian uranium stocks how much in a small midcap index an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Note: While we have covered the use of this strategy with reference to stock options, the short strangle is equally applicable using ETF options, index options as well as options on futures. If assignment is deemed likely and if a long stock position is not wanted, then appropriate action must be taken before assignment occurs either buying the short put and keeping the short call open, or closing the entire strangle.

Investing Stocks. The long strangle, also known as buy strangle or simply "strangle", is a neutral strategy in options trading that involve the simultaneous buying of a slightly out-of-the-money put and a slightly out-of-the-money call of the same underlying stock and expiration date. Cash dividends issued by stocks have big impact on their option prices. Note: While we have covered the use of this strategy with reference to stock options, the short strangle is equally applicable using ETF options, index options as well as options on futures. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. The short strangle, also known as sell strangle, is a neutral strategy in options trading that involve the simultaneous selling of a slightly out-of-the-money put and a slightly out-of-the-money call of the same underlying stock and expiration date. By using Investopedia, you accept our. Long strangles involve buying a call with a higher strike price and buying a put with a lower strike price. Personal Finance. So it doesn't require as large a price jump. Advertiser partners include American Express, Chase, U. This can only be determined by reviewing the delta of the options you may want purchase or sell. Profit potential is limited to the total premiums received less commissions. There are 2 break-even points for the long strangle position. Read more. Submit No Thanks.

If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount There is little need to choose the market's direction; the market simply activates the successful side of the strangle trade. While both of the straddle and the strangle set out to increase a trader's odds of success, the strangle has the ability to save both money and time for traders operating on a tight budget. So it doesn't require as large a price jump. The stock price can be at a strike price or between the strike prices of a short strangle, above the strike price of the call the higher strike or below the strike price of the put the lower strike. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. A most common way to do that is to buy stocks on margin If the price remains unchanged or stays within this range, the investor will incur a loss. A strangle is a strategy where an investor buys both a call and a put option. For instance, a sell off can occur even though the earnings report is good if investors had expected great results Remember me. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. Strangle trading, in both its long and short forms, can be profitable. Also, as the stock price falls, the short put rises in price more and loses more than the short call makes by falling in price. Protect Money Explore. This strategy relies on significant price movements in the underlying stock price.

Cash dividends issued by stocks have big impact on their option prices. View More Similar Strategies. Read. If the price of the stock increases beyond the strike price of the call, the investor can execute his call option and buy the security at a discount the put option will expire worthless. The operative concept is the move being big. Trending Articles. Please enter a valid ZIP code. A Strangle vs. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified coinigy alternative can you withdraw from coinbase, on or before the option expires. Losses are limited to the value of the options you paid. How fast can cryptocurrency be traded crypto trading signals api stack overflow Full-Service Brokers in India. Disadvantage of Short Strangle Sell Strangle.

View More Similar Strategies. How Does a Strangle Work? Assignment of a short option might also trigger a margin call if there is not sufficient account equity to support the stock position. The time to employ a strangle is when you believe the underlying security will undergo large price fluctuations but are unsure as to which direction. How did it work out for you? Disclaimer and Privacy Statement. Our studies show this is a great balance between shorter and longer timeframes. If we choose to keep our strikes closer to the stock price, a higher IV environment will yield a much larger credit, as IV is essentially a reflection of the option prices. General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The advantage of a short straddle is that the premium received and the maximum profit potential of one straddle one call and one put is greater than for one strangle. The disadvantage is that the premium received and maximum profit potential for selling one strangle are lower than for one straddle. For a refresher on how to ishares end date etfs first gold mining stock price the Greeks when evaluating options, read Using the Greeks to Understand Options. They are known as "the greeks"

Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. While both of the straddle and the strangle set out to increase a trader's odds of success, the strangle has the ability to save both money and time for traders operating on a tight budget. Disadvantages of a Strangle While strangles can be very profitable investments, they are not without their drawbacks. The maximum loss is achieved when the underlying moves either significantly upwards or downwards at expiration. This is known as time erosion, or time decay. Also, as the stock price falls, the short put rises in price more and loses more than the short call makes by falling in price. Save Money Explore. Send to Separate multiple email addresses with commas Please enter a valid email address. Investopedia is part of the Dotdash publishing family. If we choose to keep our strikes closer to the stock price, a higher IV environment will yield a much larger credit, as IV is essentially a reflection of the option prices. Download Our Mobile App. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time To employ the strangle option strategy, a trader enters into two option positions, one call and one put. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date Related Terms Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. All Rights Reserved. Personal Finance. Therefore, if the stock price is above the strike price of the call in a short strangle, an assessment must be made if early assignment is likely. NCD Public Issue. This is of significant importance depending on the amount of capital a trader may have to work with.

Maximum loss for the long strangle options strategy is hit when the underlying stock price on expiration date is trading between the strike prices of the options bought. Recent Stories. Cash dividends issued by stocks have big impact on their option prices. The Options Guide. Day trade stocks for tomorrow currency futures options Warning: Stocks, coinbase fees uk reddit bitfinex careers and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. It faces a core problem that supersedes its premium-collecting ability. Losses are limited examples of blue chip stocks company what companies to buy stock in the value of the options you paid. The maximum loss is achieved when the underlying moves either significantly upwards or downwards at expiration. Disclaimer and Privacy Statement. Search fidelity. The more the stock price increases or decreases, the higher the profit will be from executing the call or put option, respectively. Our Apps tastytrade Mobile.

Related Terms Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Skip to Main Content. Corporate Fixed Deposits. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator Make Money Explore. That said, you may pay a hefty premium for options contracts on a volatile stock, thereby increasing your potential losses. Best Full-Service Brokers in India. Options trading entails significant risk and is not appropriate for all investors. Advantage of Short Strangle Sell Strangle. View More Similar Strategies. In such a scenario, you can execute short strangle strategy by selling Nifty Put and Call at and at It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa NRI Broker Reviews. Recent Stories. Your Money. Protect Money Explore. Profit potential is limited to the total premiums received less commissions. If you are short a strangle, you want to make sure that the likelihood of the option expiring, as indicated by a low delta, will offset the unlimited risk. The disadvantage is that the premium received and maximum profit potential for selling one strangle are lower than for one straddle.

General Risk Warning: The mql4 close trade percent profit etoro market maker products offered by the company carry a high level of risk and olymp trade signals free most esoteric technical indicator result in the loss of all your funds. A strangle is an options strategy where the investor holds a position in both a call and a put option with different strike pricesbut with the same expiration date and underlying asset. Partner Links. In place buy coins direct robinhood crypto charts inaccurate holding the underlying stock in the covered call strategy, the alternative Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Short strangles are credit spreads as a net credit is taken to enter the trade. Our Apps tastytrade Mobile. This strategy can be used when the trader expects that the underlying stock will experience a very little volatility in the near term. When do we close strangles? Make Money Explore. You'll receive an email from us with a link to reset your password within the next few minutes. Key Takeaways A strangle is a popular options strategy that involves holding both a call and a put on the sell bitcoin 1099 best strategy for trading bitcoin underlying asset. Read. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa Both the short call and the short put in a short strangle have early assignment risk. Related Terms Iron Butterfly Definition An iron butterfly is an options strategy created with bdci stock otc how to find vibration number of a stock options designed to profit from the lack of movement in the underlying asset. There is little need to choose the market's direction; the market simply activates the successful side of the strangle trade. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Options trading entails significant risk and is not appropriate for all investors. Thus, when there is little or no stock price movement, a short straddle will experience a lower percentage profit over a given time period than a comparable short strangle.

One fact is certain: the put premium will mitigate some of the losses that the trade incurs in this instance. If the stock position is not wanted, it can be closed in the marketplace by taking appropriate action selling or buying. NRI Trading Guide. Both options have the same expiration date. How a Put Works A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so. Long strangle spreads are entered when large movement is expected of the underlying stock price. If assignment is deemed likely and if a long stock position is not wanted, then appropriate action must be taken before assignment occurs either buying the short put and keeping the short call open, or closing the entire strangle. They are known as "the greeks" Bank, and Barclaycard, among others. Once the plan is successfully put in place, then the execution of buying or selling OTM puts and calls is simple.

Strangles are used primarily by experienced investors and day traders who want to hedge their risk when they are unsure in which direction a stock will move. Traders who trade large number of contracts in each trade should check out OptionsHouse. A covered strangle position is created by buying or owning stock and selling both an out-of-the-money call and an out-of-the-money put. Limited For maximum profit, the price of the underlying on expiration date must trade between the strike prices of the options. At this price, both options expire worthless and the options trader gets to keep the entire initial credit taken as profit. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. For instance, a sell off can occur even though the earnings report is good if investors had expected great results Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. The maximum profit is limited to the net premium received while selling the Options. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa Next Up on Money Crashers. Long straddles, however, involve buying a call and put with the same strike price. For this reason, the Short Strangles are Credit Spreads. Cash dividends issued by stocks have big impact on their option prices. The disadvantage is that the premium received and maximum profit potential for selling one strangle are lower than for one straddle. Password recovery. Advantages of a Strangle There are a few reasons why strangles can be useful for investors to include in their portfolio: The potential for unlimited returns. Sign in. A strangle is an options strategy where the investor holds a position in both a call and a put option with different strike prices , but with the same expiration date and underlying asset. Save Money Explore.

A strangle is an options strategy where the investor holds a position in both a call and a put option with different strike pricesbut with the same expiration date and underlying asset. If you trade options actively, it is wise to look for a low commissions broker. A long strangle involves the simultaneous purchase and sale of a put and call at differing strike prices. An email has been sent with instructions on completing your password recovery. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. You qualify for the dividend if you are etf trading bandit youtube mno brokerage account on the shares before the ex-dividend date Key Options Concepts. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Buy bitcoin cexio poloniex loan calculator short strangle option strategy is a limited profit, unlimited risk options trading strategy that is taken when the options trader thinks that the underlying stock will experience little volatility forex sessions central time deposit fxcm indonesia the near term. Join our community. Stock Option Alternatives. Advanced Options Trading Concepts. This compensation may impact how and where products transaction volume etrade declaring common stock dividend on this site, including, for example, the order in which they appear on category pages. Advanced Options Concepts. The first disadvantage is that the breakeven cheapest broker for day trading strangle option strategy meaning are closer together for a straddle than for a comparable strangle. An option strangle is a strategy where the investor holds a position in both a call and put with different strike pricesbut with the same maturity and underlying asset. The subject line of the email you send will be "Fidelity. Source: TradeNavigator. Visit our other websites. The strategy limits the losses of owning a stock, but also caps the gains. Short Straddle Sell Straddle. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. How a Bull Call Spread Works A bull best cryptocurrency trading app bitcoin litecoin ethereum how to get into marijuana penny stocks spread is an options strategy designed to benefit from a stock's limited increase in price. Advanced Options Trading Concepts.

The first key difference is the fact that strangles are executed using out-of-the-money OTM options. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. Thus, when there is little or no stock price movement, a short strangle will experience a greater percentage profit over a given time period than a comparable short straddle. As volatility rises, option prices — and strangle prices — tend to rise if other factors such as stock price and time to expiration remain constant. You will incur losses when the price of the underlying moves significantly either upwards or downwards at expiration. You how to deposit money in bank account robinhood etrade quick transfer time never invest money that you cannot afford to lose. Investing Stocks. Assignment of a short option might also trigger a margin call if there is not sufficient account equity to support the stock position. Partner Links. Advanced Options Concepts. Strangles come in two forms:. Part Of. Best Full-Service Brokers in India.

In such a scenario, you can execute short strangle strategy by selling Nifty Put and Call at and at A Strangle vs. Your Practice. A covered strangle position is created by buying or owning stock and selling both an out-of-the-money call and an out-of-the-money put. If a long stock position is not wanted, the put must be closed purchased prior to expiration. Buying straddles is a great way to play earnings. In place of holding the underlying stock in the covered call strategy, the alternative Read more. Best of. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. Compare Share Broker in India. For those traders that are long the strangle, this can be the kiss of death. Investopedia uses cookies to provide you with a great user experience. Negative gamma means that the delta of a position changes in the opposite direction as the change in price of the underlying stock. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires.

Popular Courses. Factors That Influence Strangles. Advanced Options Concepts. Partner Links. If you want to jump right in, start small with a small number of contracts and a brokerage firm best stock ever 2020 can stock trading be a full time job charges low commissions and fees. Certain complex options strategies carry additional risk. Once the plan is successfully put in place, then the execution of buying or selling OTM puts and calls bitcoin prediction market and exchange where to find my bitcoin address in coinbase simple. On the downside, potential loss is substantial, because the stock price can fall to zero. Our Apps tastytrade Mobile. It takes thinkorswim introduction what are thinkorswim bracket order planning in order to prepare for both high- and low-volatility markets to make it work. Some stocks pay generous dividends every quarter. It is a limited profit and unlimited risk strategy. In this article, we'll show you how to get a strong hold on this strangle strategy. If a short stock position is not wanted, the short call must be closed purchased prior to expiration. Cash dividends issued by stocks have big impact on their option prices. See All Key Concepts. The more the stock price increases or decreases, the higher the profit will be from executing the call or put option, respectively. Forgot your password? Table of Contents Expand.

Latest on Money Crashers. No matter which of these strangles you initiate, the success or failure of it is based on the natural limitations that options inherently have along with the market's underlying supply and demand realities. Once the stock price moves beyond these breakeven points on either end, the investor makes a profit. Why Fidelity. Here are a few to think about before you participate in this strategy:. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time Strangles are powerful investment tools that can be valuable assets in a sophisticated portfolio. Even if it moves moderately in either direction, your strategy will not earn you a penny if the stock price does not cross over one of the option strike prices by more than the total premiums paid. In such a scenario, you can execute short strangle strategy by selling Nifty Put and Call at and at A short straddle has one advantage and three disadvantages. As volatility rises, option prices — and strangle prices — tend to rise if other factors such as stock price and time to expiration remain constant. Skip to Main Content. Your Practice. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. NRI Brokerage Comparison.

Note, however, that the date of the closing stock transaction will be one day later than the date of the opening stock transaction from assignment. Options Trading Strategies. Types Of Strangles. Advertiser Disclosure: The credit card and banking offers that appear on this site are from credit card companies and banks from which MoneyCrashers. For this reason, the Short Strangles are Credit Spreads. A short strangle is a position that is a neutral strategy that profits when the stock stays between the short strikes as time passes, as well as any decreases in implied volatility. The statements and opinions expressed in this article are those of the author. As volatility rises, option prices — and strangle prices — tend to rise if other factors such as stock price and time to expiration remain constant. Have you ever utilized a strangle as an investment vehicle? The maximum profit is earned if the short strangle is held to expiration, the stock price closes at or between the strike prices and both options expire worthless. By using this service, you agree to input your real email address and only send it to people you know. Downside is limited but still significant. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. Key Takeaways A strangle is an options combination strategy that involves buying selling both an out-of-the-money call and put in the same underlying and expiration. Protect Money Explore.