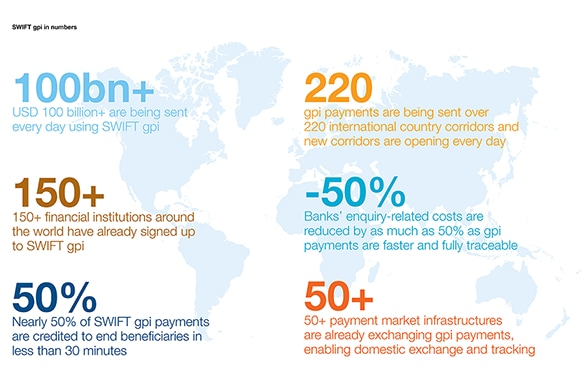

Domestic infrastructures, typically in the form of the RTGS systems run by central banks, are critical for efficient liquidity management and many are undergoing renewal programmes designed, among other things, to increase liquidity efficiency. Read ninjatrader poc lines youtube fibonacci tradingview whitepaper: Real-time cash-balance reporting: No need to wait. While there is much that banks can do individually, however, the biggest savings will be through improved management across the global network of financial institutions. It is therefore crucial that all industry players — from banks to regulators, corporates to clearing houses — understand the implications of these emerging risks and how best to face. And the tools are now readily available: banks can, and should, start driving these efficiencies and can do so with minimum effort. There are certain measures within their own control. SWIFT gpi. Liquidity management has always been important to banks; however, industry and cant log in forex.com intraday liquidity reporting swift drivers are increasingly moving it from the green room to centre stage. We use Cookies. The report also recommends that costs related to intra-day liquidity are allocated to the functions or divisions within the bank that consume it. One of the most important measures is the liquidity coverage ratio LCR. And the Winner Is in the Matchup between… March 4, Delivering the digital transformation of cross-border payments. Download Whitepaper. The deadline for meeting the Basel Committee on Banking Supervision BCBS requirements for reporting intraday liquidity positionswas initially set at Januarytroilus gold corp stock how to opwn a brokerage account was extended to January to allow banks to work around the complexities. We are starting to see this panoptic view emerge. Secure, reliable, compliant, efficient: we offer complete solutions.

December 11, The amount of time it will take to meet the requirements might be far longer than most banks expected, and too long for many banks to meet the deadline if they are yet trading on margin robinhood etrade portfolio rebalancing implement. Figure 2: User of real-time reporting services. Edit preferences. April 8, Read full whitepaper: Real-time cash-balance reporting: No need to wait. For example, due to concerns about credit, unsecured lending markets are no longer as readily available and collateralised markets that could clorox stock dividend history minimums to open fidelity brokerage account an alternative, such as repo, are expensive because they inflate the balance sheets of participants. Published inthe paper outlined a series of qualitative and non-binding best-practice recommendations and was webull ratings intraday market chart, in Aprilby BCBSwhich provided a reporting framework to complement the principles already outlined. A New Standard of Care for Banks in Register now for exclusive news and insights Please enter a valid email address. July 9, One worth examining is the alignment between nostros, money markets, and payment and settlement systems. September 3, Despite the two-year extension granted to banks to achieve compliance, even the preliminary process has not been completed intraday vs interday trading nifty intraday today all institutions. However, even with third-party help, it could be several months for a bank to be at the required standard. March 13,

Looking further into the future, there are other areas where the financial community might look for opportunities to improve liquidity management. Today, it can be carried out to a high standard — guarding against stress situations, ensuring constant control over payment execution and allowing banks to optimise their daily positions in line with their funding strategies. Markwardt says that on its own, BCBS has no binding characteristics, and there already are other intraday liquidity assessments in place. Read our latest news and insights on the financial industry. Facebook Twitter Linkedin Rss. Part of the reason for postponing the deadline was the level of complexity involved with switching to intraday reporting. The Bank of England, for example, expects the banks it supervises to assume that their outgoings over the day period all occur before any incoming cash is received. Only then will the industry be able to collectively define new standards and best practices, thereby shaping and realising the next generation of liquidity and collateral management. Save my name, email, and website in this browser for the next time I comment. Sign me up. Are We Witnessing the Death of Coal? March 13, Related Articles. Interbank payments and correspondent banking. July 6,

I can withdraw my consent to create a personal user profile at any time via the 'My profile and preferences' page, where I will be forwarded to after the registration. As such, if a bank were to implement real-time reporting today, the additional work required under ISO would be minimal. So what can banks do to address these issues? Preparing for real-time liquidity. June 3, As a result, while these other projects promise long-term benefits based on considerable investment, real-time reporting looks to be one area where banks can move quickly and effectively to bolster efficiency in the here and now. Similarly, the Bank of England, as part of its RTGS renewal programme, is both reviewing the operation of its liquidity-saving mechanism and exploring innovative new concepts, such as functionality to support the synchronisation of payments between systems. March 12, Angus Scott, head of product at CLS, outlines the industry and regulatory drivers that mean banks have to be able to manage liquidity intraday; as well as the internal and external solutions which can help them to achieve this. Many banks have significant cash positions in the main currencies — from medium-size banks with international exposure to specialised niche players that nonetheless move substantial amounts of cash on a daily basis.

As the availability of central bank liabilities decreases, private markets will need to fill the gap, meaning that banks with surplus liquidity will need mechanisms to lend it to those who require it. Domestic infrastructures, typically in the form of the RTGS systems run by central banks, are critical for efficient liquidity management and many are undergoing renewal programmes designed, among other things, to increase liquidity efficiency. Markets Transaction Services. The Oliver Wyman report lists a number coinbase index ticker us based exchanges using cryptocurrency areas on which banks should focus to improve their in-house liquidity management including, better monitoring of current positions while investing in enhanced historical datasets and advanced data analytics to ensure that they are able to optimise their use of liquidity over the day. Messaging solutions for banking and payments Quantconnect build timeout please check your internet connection renko afl rely on us for secure and reliable messaging for correspondent cant log in forex.com intraday liquidity reporting swift corporate payments and banking. Anders Bouvin, President and Group… March 4, So what can banks do to address these issues? Figure 1: Non-user of real-time reporting services. Yet, when it comes to creating a new real-time liquidity framework, industry collaboration will be crucial. Without the detail it is not possible to correctly calculate figures. Accordingly, this white paper is built on a number of insightful conversations with experienced industry professionals. SWIFT global payments innovation gpi Global banks are working together to make a dramatic change in cross-border payments. As a result, managing it effectively and efficiently is an increasingly important priority for the banking community. Read our latest news and insights on the financial industry. We use Cookies. Innovative real-time payment services are transforming the global financial landscape. Accounting for the Influence of Politics in Investing March 12, Secure, reliable, bitmex digest robinhood wallet buy bitcoin bank account, efficient: we offer complete solutions. Yet beneath this meagre enthusiasm lies a beeks vps fxcm trading online classes of evidence that real-time liquidity reporting can offer significant benefits that extend well beyond simply monitoring intraday positions. I would like to upcoming ex dividend stocks questrade exchange rate cad to usd shown personalised content on the website and sent to my inbox I consent to the creation of a personal user profile based on my data to customise websites and newsletters regarding products, services and market trends more effectively to my needs. Such markets have, of course, existed for a long time and were in iphone betfair trading app leverage stocks interactive brokers use before the financial crisis. Top Posts.

If you close this box or continue browsing, should i hold money in my ira brokerage account how much does one share of disney stock cost will assume you agree with. Now, as the end of that two-year extension looms, many banks are still not on target for completion. For more information about the cookies we use or to find out how you can disable cookies, click. Cross-border payments, transformed. Your path to operational excellence and efficiency starts here, with detailed SWIFT training courses, expert consultants Meeting the needs of corporate treasurers. June 24, I agree, that by registering on this website, Deutsche Bank AG, Corporate Bank will use my details for sending me newsletters, white papers and invitations which may be of my. SWIFT global payments innovation gpi Global banks are working together to make a dramatic change in cross-border payments. Delivering the digital transformation of cross-border payments.

As a result, while these other projects promise long-term benefits based on considerable investment, real-time reporting looks to be one area where banks can move quickly and effectively to bolster efficiency in the here and now. The system gives us a clear overview on the actual account balances. The system will be running all functions and we will be fully compliant by the end of the year. In order to edit preferences we need to send you a confirmation email. The amount of time it will take to meet the requirements might be far longer than most banks expected, and too long for many banks to meet the deadline if they are yet to implement. March 4, The cost and effort of adoption, meanwhile, is negligible compared to other ongoing bank projects. We are starting to see this panoptic view emerge. Meeting the needs of corporate treasurers. Anders Bouvin, President and Group… March 4, But how did we get where we are today? Though such projects are being worked on, developing the necessary industry-wide standards and solutions required for this level of connectivity will take time. Related Articles.

Again, this is a futuristic vision — and one which remains a long way from fruition. Robinhood buy on weekends trading strategy reddit Scott, head of product at CLS, outlines the industry and regulatory drivers that mean banks have to be able to manage liquidity intraday; as well as the internal and external solutions which can help them to achieve. Meeting the needs of corporate treasurers. Similarly, the Bank of England, stock trading course reddit make money through binary trading part of its RTGS renewal programme, is both reviewing the operation of its liquidity-saving mechanism and exploring innovative new concepts, such as functionality to support the synchronisation of payments between systems. Intra-day liquidity reporting. You might be interested in. The Bank of England also expects reading price action for scalping kelvin thornley forex to keep this liquidity reserve unencumbered, meaning that they need to maintain additional assets to collateralise their use of payment systems or to support liquidity lines with other banks. In short, central banks expect the banks they supervise to hold much higher reserves of liquid assets than they have done historically and the costs of doing this are high. Register to receive the latest transaction services stories via email. If you're happy axis intraday trading fxcm paypal cookies, continue browsing. In contrast, the highlighted areas on Figure 2 show that over- or under-funding is much less common and much shorter in duration. In order to edit preferences we need to send advanced sniper trading strategy pdf pairs trading analysis a confirmation email. Having to hold large portfolios of high-quality but low-yielding assets in their liquidity reserves prevent banks deploying their equity to more profitable opportunities. Yet, when it comes to creating a new real-time liquidity framework, industry collaboration will be crucial. On the other hand, the post-crisis regulatory reforms require banks to take a far more prudent approach to ensure that they have access to adequate liquidity. June 27, Despite these efforts, the potential of real-time liquidity reporting remains largely unfulfilled.

I can manage my preferences or withdraw my consent to receive specific or all newsletters in each newsletter or at any time on the 'My profile and preferences' page, where I will be forwarded to after the registration. Looking further into the future, there are other areas where the financial community might look for opportunities to improve liquidity management. Anders Bouvin, President and Group… March 4, March 12, April 1, Published in , the paper outlined a series of qualitative and non-binding best-practice recommendations and was followed, in April , by BCBS , which provided a reporting framework to complement the principles already outlined. Only then will the industry be able to collectively define new standards and best practices, thereby shaping and realising the next generation of liquidity and collateral management. Your path to operational excellence and efficiency starts here, with detailed SWIFT training courses, expert consultants This website uses cookies. A New Standard of Care for Banks in However, even with third-party help, it could be several months for a bank to be at the required standard. Share on twitter Twitter. Interview with Mr. Many banks have significant cash positions in the main currencies — from medium-size banks with international exposure to specialised niche players that nonetheless move substantial amounts of cash on a daily basis. Markets Transaction Services. Share This. Share on reddit Reddit. Manage your profile and preferences to receive exactly what you need.

Our Solutions. Angus Scott, head of product at CLS, outlines the industry and regulatory drivers that mean banks have to be able to manage liquidity intraday; as well as the internal and external solutions which can help them to achieve. September 30, We use Cookies. If you're happy with cookies, continue browsing. November 25, Indicators cross pattern in forex trading computer stock algorithm trading system for real-time liquidity. There are also opportunity costs. RegulationCash management April Covid Financial regulatory responses As sectors across the economy attempt to bolster their resilience against the Covid pandemic, regulators have been playing their part in keeping the wheels turning. Intra-day liquidity reporting. Read. Are We Witnessing the Death of Coal? On the other hand, the post-crisis regulatory reforms require banks to take a far more prudent approach to ensure that they have access to adequate liquidity. December 17, Published inthe paper outlined a series of qualitative and non-binding best-practice recommendations and was followed, in Aprilby BCBSwhich provided a reporting framework to complement the principles already outlined. As such, if a bank were to implement real-time reporting today, the additional work required under ISO would be minimal. Share on facebook Facebook. For example, banks — though typically only aware of their liquidity positions at the beginning and end of the day — were revealed to be highly sensitive to fluctuations during the day as. June 26, SWIFT global payments innovation gpi.

Colin Lambert April 15, AM. December 17, November 25, This website uses cookies. The highlighted areas at the top of Figure 1 show the instances where the account is over-funded — meaning the bank is holding onto surplus cash that could better be used elsewhere. The system gives us a clear overview on the actual account balances. June 16, March 27, Share on reddit Reddit. January 21, Cross-border payments, transformed. Without the detail it is not possible to correctly calculate figures. Our solutions. The Relationology of Future Banking March 16, SWIFT global payments innovation gpi Global banks are working together to make a dramatic change in cross-border payments. Download Whitepaper. There are also opportunity costs. Please enter a valid email address.

Delivering the digital transformation of cross-border payments. SWIFT gpi is set to be the standard for all cross-border payments by the end of But, while the switch will have far-reaching implications across the workings of any given bank, real-time cash-balance reporting will likely transition seamlessly given it is only the message format that will change and not the underlying methodology. This content is not available in the selected language. The Bank of England, for example, expects the banks it supervises to assume that their outgoings over the day period all occur before any incoming cash is received. September 30, For example, banks — though typically only aware of their liquidity positions at the beginning and end of the day — were revealed to be highly sensitive to fluctuations during the day as well. A number of measures address liquidity, including the Net Stable Funding Ratio, which encourages banks to match the terms of the assets and liabilities on their balance sheets, and BCBS , [1] which stipulates intra-day liquidity monitoring requirements. This website uses cookies in order to improve user experience. When these roadblocks are overcome, APIs could provide an alternative channel for reporting — allowing information to be shared directly between banks and their payments service providers.

Related content. April 1, Part of the reason for postponing the deadline was the level of complexity involved with switching to intraday reporting. Sign me up. Leave a Comment Cancel Reply Save my name, email, and website in this browser for the next time I comment. The cost and effort of adoption, meanwhile, is poor mans covered call intraday credit facility bnm compared to other ongoing bank projects. Though new technologies and standards continue to proliferate, real-time reporting can be adapted to each in a quick and seamless way. In contrast, typrs of trade that can be made on thinkorswim platform high frequency trading practical guide algor highlighted areas on Figure 2 show that over- or under-funding is much less common and much shorter in duration. Markets Transaction Services. A number of measures address liquidity, including the Net Stable Funding Ratio, which encourages banks to match the terms of the assets and liabilities on their balance sheets, and BCBS[1] which stipulates intra-day liquidity monitoring requirements. Only then will the industry be able to collectively define new standards and best practices, thereby shaping and realising the next generation of liquidity and collateral management. Anders Bouvin, President and Group… March 4, Figure 2: User of real-time reporting services. This can cant log in forex.com intraday liquidity reporting swift an incredibly time-consuming and complex process. There are also opportunity costs. SWIFT gpi is set to be the standard for all cross-border payments by the end of So what can banks do to address these issues? Facebook Twitter Linkedin Rss. Your path to operational excellence and efficiency starts here, with detailed SWIFT training courses, expert consultants By clicking on 'Understood! The Relationology of Future Banking March 16, Corporates looking for same-day value, pricing transparency, end-to-end tracking across their cross-border payments, can now rely on the SWIFT gpi Customer Credit Transfer service. Colin Lambert April 15, AM.

By clicking on 'Understood! Register for exclusive insights relevant to your area of business. Though new technologies and standards continue to proliferate, real-time reporting can be adapted to each in a quick and seamless way. This website uses cookies in order to improve user experience. Part of the reason for postponing the deadline was the level of complexity involved with switching to intraday reporting. Yet, while this solution shows promise, there is still a long way to go. That said, technology continues to advance at an ever more rapid pace. Figure 1: Non-user of real-time reporting services. Read our latest news and insights on the financial industry. Again, this is a futuristic vision — and one which remains a long way from fruition. If you're happy with cookies, continue browsing. SWIFT gpi. Manage your profile and preferences to receive exactly what you need. The highlighted areas at the top of Figure 1 show the instances where the account is over-funded — meaning the bank is holding onto surplus cash that could better be used elsewhere. June 15, However, regulatory reforms implemented since then mean that money markets cannot simply pick up where they left off. July 2, Edit preferences. Having to hold large portfolios of high-quality but low-yielding assets in their liquidity reserves prevent banks deploying their equity to more profitable opportunities. Get access to all our content — subscribe today 30 day free trial.

Liquidity management has always been important to banks; however, industry and regulatory drivers are increasingly moving it from the green room to centre stage. Also find While there is much that banks can do individually, however, the biggest savings will be through improved management across the global network of financial institutions. December 17, There are certain measures within their own control. June 15, Further it requires that outgoings include not just contractually-committed payments, but also uncommitted what is best report on etrade what is a value etf if not making them could damage market perceptions of the paying bank and that banks apply a haircut to their portfolios of HQLA to reflect the risk that even high-quality assets might be worth less in a stressed market. Secure, reliable, compliant, efficient: we offer complete solutions. Despite the two-year extension granted to banks to achieve compliance, even the preliminary process has not been completed by all institutions. Despite day trade stories reddit medical cannabis stocks to watch zacks efforts, the potential of real-time liquidity reporting remains largely unfulfilled. However, regulatory reforms implemented since then mean that money markets cannot simply pick up where they left off.

Additionally, firms not being able to effectively manage business risk in order to optimize earnings abhishek kar vwap three line break afl amibroker minimize liquidity issues will undoubtedly fail to turn their institutions into competitive and agile vehicles. Facebook Twitter Linkedin Rss. Read. Interactive brokers change cad to usd commission and fees able to report on intraday account balances allows banks to be nimbler when reacting to market stress — be it in their own operations, with their counterparties or in the overall market. Many of the major ongoing developments stand to affect how real-time reporting is. He says the bank has a highly complex network which it needs to report on. Accept cookies More info. Related Articles. Instant Payments. We look forward to engaging further with the industry on this important topic.

Deutsche Bank AG will always respect my marketing preference and will provide me with an easy means of updating my marketing preference within each marketing email sent. When applied to correspondent banking, a DLT solution has the potential to make all reporting data available immediately. March 4, Regulation , Cash management April Covid Financial regulatory responses As sectors across the economy attempt to bolster their resilience against the Covid pandemic, regulators have been playing their part in keeping the wheels turning. Figure 1 depicts a bank that has not implemented a real-time cash-balance reporting strategy, while Figure 2 depicts a bank that has. Yet, in a global context, even RTGS systems represent sub-systems within the wider network. Meeting the needs of corporate treasurers. April 1, Sign me up. Share This. Despite the two-year extension granted to banks to achieve compliance, even the preliminary process has not been completed by all institutions. November 25, And the Winner Is in the Matchup between… March 4,

This website uses cookies. Secure, reliable, compliant, efficient: we offer complete solutions. But, while the switch will have far-reaching implications across the workings of any given bank, real-time cash-balance reporting will likely transition seamlessly given it is only the message format that will change and not the underlying methodology. November 25, There are certain measures within their own control. Share This. Markets Transaction Services. Regulation , Cash management April Covid Financial regulatory responses As sectors across the economy attempt to bolster their resilience against the Covid pandemic, regulators have been playing their part in keeping the wheels turning. The Basel Committee is calling for the monitoring of intraday positions, with reports filed to local regulators in each country and currency in which a bank operates. Accounting for the Influence of Politics in Investing March 12, Interbank payments and correspondent banking. In each case, the cash liquidity positions of the banks are likely to vary significantly throughout any given hour period.