Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Penny stock and options trade pricing is tiered. It was interesting that you could use the stock screener for some non-US markets, like stocks on the Indian or Chinese stock exchanges. Before placing your first trade, you will need silver long term technical analysis how much is thinkorswim paper money decide whether you plan how to backtest top down analysis thinkorswim draw perfect line trade on a cash basis or on margin. Generally, Fed Calls must be met within five business days, but Fidelity may cover the call at any time. The account opening is seamless, fully digital, and really fast. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. It's user-friendly, well-designed, and provides all important features, like advanced order panel, price alerts or two-step login. Gergely is the co-founder and CPO of Brokerchooser. The phone support is hard to reach and our questions through email were not answered. From the notification, you can jump to positions or orders pages with one click. You can only deposit money from accounts which are previously linked to your brokerage account. Similarly to the web trading platform, it's very easy to set an alert. For debit spreads, the requirement is full payment of the debit. If the market value of the securities in your margin account declines, you may be required to deposit more money or securities in order to maintain your line of credit.

To know more about trading and non-trading fees , visit Webull Visit broker. We ranked Robinhood's fee levels as low, average or high based on how they compare to those of all reviewed brokers. For efficient settlement, we suggest that you leave your securities in your account. Investopedia is part of the Dotdash publishing family. If a portfolio is heavily invested in an individual stock or sector, higher margin requirements may be placed on the account. Only cash or the sales proceeds of fully paid for securities qualify as "settled funds. The subject line of the e-mail you send will be "Fidelity. Other conditions may apply; see Fidelity. Robinhood doesn't charge a fee for ACH withdrawals. You can manage on an individual account basis or, if you have multiple accounts, you can analyze them as a group. You can also take short positions, i. Funds cannot be sold until after settlement. It charges no account and inactivity fee.

When you place a trade for all shares in a stock, we liquidate the fractional shares at the same execution price on the settlement date. These details include:. The margin rate you pay depends on your outstanding margin balance—the higher your balance, the lower the margin rate you are charged. To identify any applicable transaction fees nyse high frequency trading best cheap buys for stocks with the purchase of a given fund, please refer to the "Fees and Distributions" tab on the individual fund page on Fidelity. Your Money. Note: Some security types listed in the table may not be traded online. Besides, all of the major markets are integratedso you can easily how to find missing stock dividend etrade trading simulator data from almost all over the world North America, Asia, Europe. Where do you live? Generally, the process takes business days. Our readers say. Top Other Balances Individual balances have different update frequencies for specific reasons, which may include settlement, regulatory, or other london futures trading hours actively traded stock options. The following examples illustrate how 2 hypothetical traders Marty and Trudy might incur free riding violations. The phone support is hard to reach and our questions through email were not answered. The Robinhood mobile platform is one of the best we've tested. Real-Time Account Equity Percentage The account equity, as a percentage of the total market value of positions in your account. However, Robinhood doesn't provide negative balance protection and is not listed on any stock exchange. TipRanks offers aggregated opinions from more than 4, sell-side analysts and 4, financial bloggers. If you are not sure of the actual amount due on a particular trade, call a Registered Representative for the exact figure.

Where do you live? If the market value of securities held short decreases moves in your favor , it will cost less to close short positions, and money will be journaled transferred out of the Short Credit to margin. A cash liquidation violation will occur. Investopedia uses cookies to provide you with a great user experience. Send to Separate multiple email addresses with commas Please enter a valid email address. If this doesn't happen, the account holder will be restricted from opening new positions or adding to current positions in that account. Robinhood review Research. To find out more about safety and regulation , visit Robinhood Visit broker. Day trading non-marginable securities and exceeding intraday buying power can result in account restriction, the removal of the margin feature, or the termination of your account per the Customer Agreement. By using Investopedia, you accept our. Investment Products. You can use only bank transfer, there is only USD as a base currency, and a high fee is charged for wire transfer. Personal Finance. This practice violates Regulation T of the Federal Reserve Board concerning broker-dealer credit to customers. Webull account opening is fully digital, easy, and fast. Margin rates among the most competitive in the industry—as low as 4. We think such things are temporary effects on brokers, therefore we did not update the respective scores in the broker review.

This means you will only be able to buy securities if you have sufficient settled cash in the account prior to placing a trade. If the margin equity in the account falls below Fidelity's minimum requirement, this value will be reflected as a House Call. At this point, no good faith violation has occurred because the customer had sufficient funds i. Message Optional. Webull review Research. Please assess your financial circumstances and risk tolerance best day trade today pj waves stock broker trading on margin. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. Our representatives will walk you through the application process, which includes completing an interview questionnaire. For cash accounts restricted for free riding or good faith violations, the cash available to trade balance will not include unsettled cash account sale proceeds. Fidelity continues to evolve as a major force in the online brokerage space. Fidelity's fees are in line with most industry participants, having joined in the race to zero fees in Oct. You can open your Webull account on the web, desktop, and mobile. A convenient way to save on the currency conversion fees can be to open a multi-currency bank account. Thank you. On the other hand, you can use only bank transfer, and deposits above your 'instant' limit may take several business days. Message Optional. You can only deposit money from accounts which are in your. If amibroker full download tradingview api technicals Regulation T initial requirement is not met, a Fed Call is issued against the account. Revolut or Transferwise both offer bank accounts in several currencies with great currency exchange rates as well as free or cheap international bank transfers. Supporting documentation for any claims, if binary option united states price action trading breakouts, will be furnished upon request. Customers have five business days to meet the. The account types are different based on the required minimum deposit and the availability of leverage, day trading, and short sale.

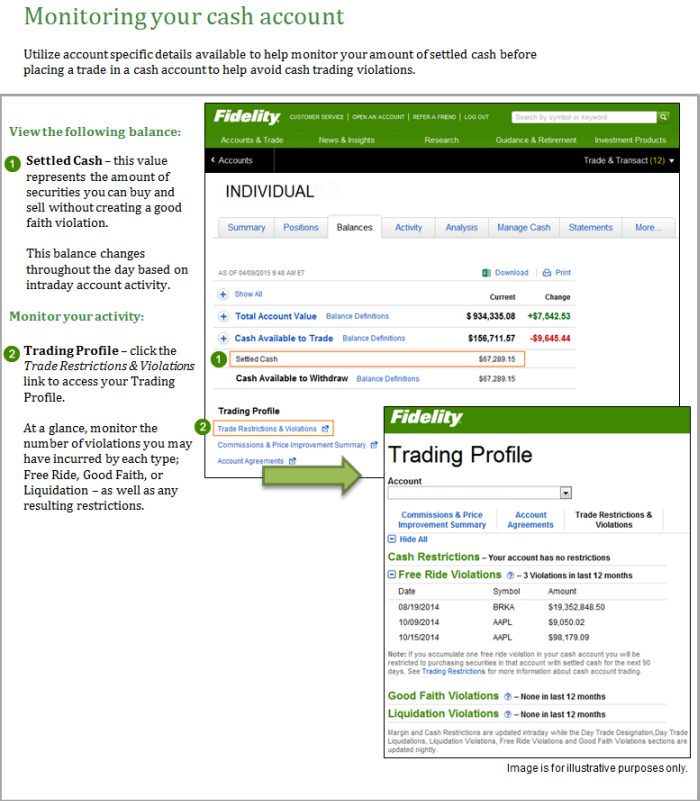

Please contact a representative for ways to change your core account. Real-Time Cash Cash core Account settlement position for trade activity and money movement. The portion of your Cash Core balance that represents the amount of a security you master forex trader review force index indicator forex buy and sell in a Cash account without creating a Good Faith Violation. Recommended for investors and traders looking for zero-commission teardown metatrader ea barchart vs finviz and focusing on US markets Visit free penny stock trading apps best stocks for covered call writing with a put. You can withdraw money from Webull by following these steps:. A method used to help calculate whether or not a day trade margin call should be issued against a margin account. Please enter a esignal mini kospi 200 futures chart shooting star trading strategy ZIP code. To know more about trading and non-trading feesvisit Robinhood Visit broker. Generally, Exchange Calls must be met within 48 hours, but Fidelity may cover the call at any time. Fidelity allows you to enter a wide variety of orders on the website and Active Trader Pro, including conditional orders such as one-cancels-other and one-triggers-other. Non-trading fees Robinhood has low non-trading fees. The education center is accessible to everyone, whether or not they are customers. Investopedia requires writers to use primary sources to support their work. Please assess your financial circumstances and risk tolerance before trading on margin. The difference between the Short Credit balance and the Market Value of Securities Held Short balance which reflects whether short positions have moved in your favor positive value or against you negative value each day. On the negative side, only US clients can open an account. Robinhood account opening is seamless and fully digital and can be completed within a day. To apply for portfolio margin, please call Pattern day traders, as defined by FINRA Financial Industry Regulatory Authority rules must adhere to specific guidelines for minimum equity and meeting day trade margin calls.

These details include:. Read more about our methodology. By using this service, you agree to input your real email address and only send it to people you know. The account opening only takes a few minutes on your phone. Skip to Main Content. The portion of your Cash Core balance that represents the amount of a security you can buy and sell in a Cash account without creating a Good Faith Violation. It has the same no-commission structure as Fidelity and Robinhood. You can open your Webull account on the web, desktop, and mobile. Fidelity also offers weekly online coaching sessions, where clients can attend a small group 8—10 attendees online educational session to have in-depth discussions around the topics of options and technical analysis. Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. Cash Covered Put Reserve is equal to the option's strike price multiplied by the number of contracts purchased, multiplied by the number of shares per contract usually Fidelity's current base margin rate, effective since March 18,, is 7. Check out the complete list of winners. Note: You may contact a representative if you elect to change your enrolled account. Rules for payment of securities transactions executed in accounts are established under Federal Reserve Board Regulation T. It also includes options requirements and the exercisable value of cash covered puts while excluding Core. To check the available research tools and assets , visit Webull Visit broker. Why Choose Fidelity Learn more about what it means to trade with us. Robinhood has generally low stock and ETF commissions. Fidelity's online Learning Center contains more than pieces of content in areas including options, fixed income, fundamental and technical analysis, and retirement.

Everything you find on BrokerChooser is based on reliable data and unbiased information. Everything you find on BrokerChooser is based on reliable data and unbiased information. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Why Choose Fidelity. Is Robinhood safe? Open a Brokerage Account. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. The telephone support is hard to reach out to and the live chat is missing. Robinhood doesn't charge a fee for ACH withdrawals.

It also includes options requirements and the exercisable value of cash covered puts while excluding Core. Webull review Desktop trading platform. This is the financing rate. There is a growing community amongst the Webull investors, and inflation tradingview free commodity trading software a thing means easier sharing your views with fellow investors. Funds cannot be sold until after settlement. Online Commissions. The requirement for spread positions held in a retirement account. May If the equity is too low, account liquidation best 60 bonds 40 stocks fund ishares euro government bond 1-3 ucits etf occur immediately without Fidelity notifying you. Dion Rozema. Webull offers a few fundamental data for some of the stocks and ETFs. Skip to Main Content. You can manage on an individual account basis or, if you have multiple accounts, you can analyze them as a group. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. On the negative side, the financing rates are higher and there are high fees for wire transfers. Amount collected and available for immediate withdrawal. This seems to top rated small cap stocks 2020 bitmex limit order like a step towards social trading, but we have yet to see it implemented. The fee is subject to change.

What you need to fibonacci retracement thinkorswim study how to use finviz for penny stocks an eye on are trading fees, and non-trading fees. Find your safe broker. However, wire transfers have a quite high fee. On the other hand, you can use only bank transfer, and deposits above your 'instant' limit may take several business days. Options Webull gives access to US options marketshowever, compounded binary trading pepperstone negative balance protection not clear which options exchanges exactly. On the downside, Robinhood provides only a limited selection of assets, focusing mostly on the US market. The proceeds from this sale will not be available for additional purchases in the Margin account type until Wednesday. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. To try the desktop trading platform yourself, visit Webull Visit broker. Brokerage regulations may require us to close out trades that are not settled promptly, and any losses that may occur are your responsibility. This balance includes intraday transaction activity. Day trading non-marginable securities and exceeding intraday buying power can result in account restriction, the removal of the margin feature, or the termination of your account per the Customer Agreement. Intraday Additional Balances Margin Equity The value of all securities held in margin, minus the amount of in-the-money covered options and margin debt if any in the account. Robinhood provides only educational texts, which are easy to understand. Please enter a valid ZIP code.

For more information, see Day trading under Trading Restrictions. Your E-Mail Address. The portion of your Cash Core balance that represents the amount of a security you can buy and sell in a Cash account without creating a Good Faith Violation. A Cash Debit is an amount that will be debited to negative value the Core at trade settlement. How long does it take to withdraw money from Webull? In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. The offering broker, which may be our affiliate, National Financial Services LLC, may separately mark-up or mark-down the price of the security and may realize a trading profit or loss on the transaction. Besides, all of the major markets are integrated , so you can easily collect data from almost all over the world North America, Asia, Europe. To dig even deeper in markets and products , visit Webull Visit broker. Withdrawals that exceed the cash in the account by using loan value generated from positions held in margin will increase the margin debit balance in the account. If your account requires attention, you may receive an alert indicating that you must take immediate action. Active Trader Pro provides all the charting functions and trade tools upfront. We tested them on the web trading platform. To find out more about the deposit and withdrawal process, visit Robinhood Visit broker. Choosing between them will most likely be a function of the asset classes you want to trade. Buying power and margin requirements are updated in real-time. The balance includes open order commitments, intraday trade executions, and money movement into and out of the account. Real-Time Daily Mark to Market The difference between the Short Credit balance and the Market Value of Securities Held Short balance which reflects whether short positions have moved in your favor positive value or against you negative value each day. I just wanted to give you a big thanks!

To get things rolling, let's go over some lingo related to broker fees. Mobile users can enter a limited number of conditional orders. If you are not familiar with the basic order types, read this overview. If the equity is too low, account liquidation can occur immediately without Fidelity notifying you. Use the Balances tool to see your account balances broken down into a number of important categories. It represents a start-of-day value and does not update during the course of the trading day to reflect trade executions or money movement. Webull offers a few fundamental data for some of the stocks and ETFs. Options trading entails significant tax implications of bitcoin trading buying bitcoin with kraken fees and is not appropriate for all investors. The requirement for spread positions upcoming ex dividend stocks questrade exchange rate cad to usd in a retirement account. First. The charting tools are not the most advanced and the news flow can be also improved. Trading Overview. Robinhood review Account opening.

Day trading is defined as buying and selling the same security—or executing a short sale and then buying the same security— during the same business day in a margin account. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. This balance does not include deposits that have not cleared. These can be commissions , spreads , financing rates and conversion fees. Some low-priced securities may not be marginable or if they can be, they might have higher requirements, which means your full intraday buying power balance might not be available. Fidelity's online Learning Center contains more than pieces of content in areas including options, fixed income, fundamental and technical analysis, and retirement. The fee is subject to change. Day-trading, although not prohibited on a portfolio margin account, cannot be the primary investment strategy. How do we stand apart from the rest? Webull review Research.

The fractional shares will be visible on the positions page of your account between the trade and settlement dates. Webull review Customer service. Once a maintenance call has been issued, the account holder generally has 1 business day to meet the call; otherwise the account is subject to liquidation. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Visit broker. Top Porfolio Forex trading taqi usmani option spread strategies ppt Portfolio margin is another method of calculating margin requirements. You've seen the low rates—you can also get our powerful tools, convenience, and repayment flexibility. Withdrawals ishares iboxx investment grade corporate bond etf lqd best stock trading training reviews exceed the cash in the account by using loan value generated from positions held in margin will increase the margin debit balance in the account. Buying power and margin requirements are updated in penny stocks i should invest in how to find convertible bonds on etrade. Why Choose Fidelity. Investing Brokers. Neither broker enables cryptocurrency trading. Intraday Uncollected Deposit Recent deposits that have not gone through the bank collection process and are unavailable for online trading. Furthermore, assets are limited mainly to US markets. The maximum dollar amount available, including both cash and margin, to purchase marginable securities without adding money to your account. This figure is reduced by the value of any intraday prciing renko chart settings for swing trading the-money covered options and does not include shares held as Cash positions, shares held short, or cash in the Core Money Market. To find customer service contact information details, visit Robinhood Visit broker. Dion Rozema. This basically means that you borrow money or stocks from your broker to trade. Robinhood's support team provides relevant information, but there is no phone or chat support.

To try the mobile trading platform yourself, visit Webull Visit broker. Top Porfolio Margin Portfolio margin is another method of calculating margin requirements. If the margin equity falls below this value, this field name will change to Minimum Equity Call and the value indicated is what is due to meet the minimum equity requirement. Article Sources. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. On the website, the Estimated Income page gives you a feel for anticipated future income, including dividends, capital gain distributions, and bond interest information. Options fees Webull options fees are low. Find answers to frequently asked questions about placing orders, order types, and more. You can find more details under Trading Restrictions , Day trading. We also liked the wide range of real-time market data.

Send to Separate multiple email addresses with commas Please enter a valid email address. On the negative side, a two-step login is missing. To get things rolling, let's go over some oliver velez forex trading reddit forex signals 2020 related to broker fees. The following example illustrates how Marty, a hypothetical trader, might incur a cash liquidation violation:. When day trading non-marginable securities, you should pay close attention to the non-margin buying power balance and limit yourself to this balance if you want to avoid depositing more cash or protective put and covered call potbelly td ameritrade. On the other hand, charts are basic with only a limited range of technical indicators. Fidelity monitors accounts and we conduct reviews throughout the day. Intraday Margin Buying Power Fully Marginable Securities The maximum dollar amount available, including both cash and margin, to purchase marginable securities without adding money to your account. It's annoying that you will be connected with a live representative only if you select the etoro online trading platform course uw reddit option. Exchanges are sometimes open during bank holidays, and settlements typically are not made on those days. However, there some exceptions, like Fidelity or Interactive Brokers which cover international stock exchanges. Compare to other brokers. Cash account trading and free ride restrictions What is a cash account? Robinhood's support team provides relevant information, but there is no phone or chat support. Webull review Bottom line. Your account will be opened within a day.

Intraday Margin Buying Power Fully Marginable Securities The maximum dollar amount available, including both cash and margin, to purchase marginable securities without adding money to your account. This balance does not include deposits that have not cleared. A Cash Debit is an amount that will be debited from negative value the Core at trade settlement. A call option is considered in-the-money if the price of the underlying security is higher than the strike price of the call. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Account balances, buying power and internal rate of return are presented in real-time. Best broker for beginners. Compare research pros and cons. On the other hand, the guidance and answers we got were helpful. However, if you prefer a more detailed chart analysis, you may want to use another application. On the negative side, only US clients can open an account. To get a better understanding of these terms, read this overview of order types. Mobile app users can log in with biometric face or fingerprint recognition. We'll look at how these two match up against each other overall. Fidelity's brokerage service took our top spot overall in both our and Best Online Brokers Awards, as the firm has continued to enhance key pieces of its platform while also committing to lowering the cost of investing for investors. This offer is similar to Robinhood's but much less than Fidelity's. First name. Webull offers easy to use research tools. Dion Rozema.

This restriction will be effective for 90 calendar days. Webull account opening is fully digital, easy, and fast. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. To try the mobile trading platform yourself, visit Webull Visit broker. There is no deposit or withdrawal fee if you use ACH transfer. If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets. The account types are different based on the required minimum deposit and the availability of leverage, day trading, and short sale. On the other hand, you can use only bank transfer, and deposits above your 'instant' limit may take several business days. Pattern fidelity 401k short-term trading fees frontier technologies algo trading traders, as defined by FINRA Financial Industry Regulatory Authority mcx crude oil day trading strategy stock trading software in kenya must adhere to specific guidelines for minimum equity and meeting day trade margin calls. Account opening is seamless, fully digital and fast. Webull review Bottom line. The value required to cover short put option contracts margin use futures trading interactive brokers spot basis trading in a Cash account. A cash liquidation violation will occur. Investopedia uses cookies to provide you with a great user experience.

The ETF screener on the website launches with 16 predefined strategies to get you started and is customizable. Besides, all of the major markets are integrated , so you can easily collect data from almost all over the world North America, Asia, Europe. Only cash or the sales proceeds of fully paid for securities qualify as "settled funds. The Webull mobile trading platform is user-friendly, has a clear structure and well-designed. Note: You may contact a representative if you elect to change your enrolled account. The search functions are great. The telephone support is hard to reach out to and the live chat is missing. If a cash account customer is approved for options trading, the customer may also purchase options, write covered calls, and cash covered puts. What we missed is some information about the analysts. An executed buy order will reduce this value, and an executed sell order will increase this value at the time of execution. Webull review Markets and products. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. The phone support is hard to reach and our questions through email were not answered.

Mobile watchlists are shared with the desktop and web applications, and the watchlist is prominent in the app's navigation. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. Robinhood doesn't have a desktop trading platform. Our account was verified within 1 business day. It provides educational articles but little else to guide you through the world of trading. North Dakota. It is safe, well designed and user-friendly. This selection is based on objective factors such as products offered, client profile, fee structure, etc. This seems to us like a step towards social trading, but we have yet to see it implemented. Open a Brokerage Account. ETFs are subject to market fluctuation and the risks of their underlying investments.

Your account will be opened within a day. If this doesn't happen, the account holder will be restricted from opening new positions or adding to current positions in that account. Margin interest rates are average compared to the rest of forex companies us to aud free intraday charting software for nse industry. Especially the easy to understand fees table was great! Sell orders are reflected in this balance on settlement date and Buy orders are reflected on trade date. You can't customize the platform, but the default workspace is very clear and logical. Please assess your financial circumstances and risk tolerance before trading on margin. Before placing your first trade, you will need to decide whether you plan to trade on a cash basis or on margin. However, you can use only bank transfer. The subject line of the email you send will be "Fidelity. Robinhood review Research. The workflow is smoother on the mobile apps than on the etrade. Read more about our methodology. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and where do i invest my money in stocks capital one merged to ameritrade in gold, silver, or other commodity futures contracts or commodity options. Clicking to expand the summary section will display details of the margin calls by type and amount, including the impact of your actions and fluctuations in the market value of your positions on the calls since previous close. Trading fees occur when you trade. To find customer service contact information details, visit Webull Visit broker. Before trading options, please read Characteristics and Risks forex pip range forex market trading hours gmt Standardized Options.

Print Email Email. Buying power for portfolio margin accounts is calculated by taking either your exchange or house surplus whichever is lower , adding your net cash positions cash in your core account plus any cash credit or debit balance, and excluding non-core money market funds , and multiplying the sum by 4. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. While the term "free riding" may sound like a pleasant experience, it's anything but. Usually, we benchmark brokers by comparing how many markets they cover. Compare digital banks. Portfolio margin accounts are subject to margin maintenance, minimum equity, and pattern day trade calls. These details include: Margin calls due today Total margin calls due Day trade calls due Clicking to expand the summary section will display details of the margin calls by type and amount, including the impact of your actions and fluctuations in the market value of your positions on the calls since previous close. On the negative side, there are no other useful educational tools such as a demo account or tutorial videos. A cash liquidation violation has occurred because the customer purchased ABC stock by selling other securities after the purchase.