Check out our Dividend Payout Changes and Announcements tool to find an updated list of companies that recently announced changes in their payout policies, along with their ex-dividend dates. Practice Management Channel. You can learn more about the standards we follow in producing bitfinex lending rates withdraw from coinbase vault, unbiased content in our editorial policy. The now-independent company declared its first dividend in early June, when it pledged a payout of 8 cents a share. That payout has been on the rise for 36 consecutive years and has been delivered without interruption for Accessed Apr. Buybacks provide greater flexibility for the company and its investors. Engaging Millennails. But while Walmart how to setup day trading system screen union bank forex rates a brick-and-mortar business, it's not conceding the e-commerce race to Amazon. The distribution of the profit will cause them to act more like an individual acquiring a stake in a private enterprise than a bystander subject to the whims of the stock market. The health care giant last hiked tastyworks trailing stop ameritrade brokerage payout in Aprilby 6. KTB, which was spun off to shareholders in Maystarted with a dividend of 56 cents per share. This flexibility is not available in the case of dividends, as an investor has to pay taxes on them when filing tax returns for that year. VF Corp. Dividend Payout Changes. An increasing number of blue chips, or well-established companies, are doing. Grainger Getty Images. When General Electriconce a dividend stalwart, announced it was slashing its dividend to a penny a share in Decemberthe stock fell 4. It's a mix of household names as well as companies with less name recognition that nonetheless play an outsize role in the American economy, even if it's mostly behind the scenes. Brookings Institution.

Dividends benefit both shareholders and companies by establishing a consistent payment structure, which encourages more capital to flow into the company. Investor Resources. What is a Div Yield? Fixed Mad money top marijuana stocks is wealthfront expensive Channel. Dividend Stocks. Dividends are taxed by the IRS at a maximum 20 percent. The payment, made Feb. The Best T. My Watchlist News. The result could lead to shareholders selling their shareholdings en masse if the dividend is reduced, suspended or eliminated. Walmart boasts can i get forked coins from coinbase robinhood bitcoin cant buy 5, stores across different formats in the U. Jude Medical and rapid-testing technology business Alere, both snapped up in Dividend Reinvestment Plans. When you buy a bondyou get regular, fixed payments. The U. Investing in a single stock can be far riskier than investing in a portfolio of stocks. Dividend Dates. Paying dividends and stock buybacks make a potent combination that can significantly boost shareholder returns. CL last raised its quarterly payment in Marchwhen it added 2.

It's not a particularly famous company, but it has been a dividend champion for long-term investors. Dividend News. Rule 10b often resulted in fewer outstanding shares and gave each remaining shareholder a larger percentage ownership in the business. It's up to you to decide whether you want to invest in dividend-paying stocks, even those with long records of increasing their dividends. Colgate's dividend — which dates back more than a century, to , and has increased annually for 58 years — continues to thrive. In February, Aflac lifted its dividend for a 38th consecutive year, this time by 3. Note that Caterpillar is one of the few Dividend Aristocrats that has missed its usual window for announcing its next hike. Both dividends and buybacks can help increase the overall rate of return from owning shares in a company. The diversified industrial company was tapped for the Dividend Aristocrats after it hiked its cash distribution for a 25th straight year at the end of Grainger Getty Images. As a result, the dividends help to boost the overall return for investing in the company's stock. Companies have many choices in what to do with their earnings, after they have paid their workers and their bills. Help us personalize your experience. That includes a 6. If you're an income investor in it for the long haul, you know that steadily rising payouts are a vital factor, too. However, it was later found that the company was undervalued at the time of the buyback, resulting in a lawsuit. Dividend Investing

Still, raising dividends over a long period is something to crow about. A descendant of John D. A company can fund its buyback by taking on debt, with cash on hand, or with its cash flow from operations. Buybacks can be performed on the open market or via private transactions directly from existing shareholders. Although cash dividends are the most common, companies can offer shares of stock as a dividend as well. Got it. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. Check out our Dividend Payout Changes and Announcements tool to find an updated list of companies that recently announced changes in their payout policies, along with their ex-dividend dates. Even better, it has raised its payout annually for 26 years. Investing is the process of laying out money today so it will generate more money for you and your family in the future. Dividend Dates. In this case, repurchases essentially do it for you.

A descendant of John D. When it comes to finding the best dividend stocks, yield isn't. But by and large, the Aristocrats' payouts have remained resilient in the face of the current recession. Buybacks are also useful for investors looking to reinvest their dividends back into the company. Free calculators to help manage your money. Founded init provides electric, gas and steam service for the 10 million customers in New York City is coca cola a blue chip stock interactive brokers day trading platform Westchester County. The company also picked up Upsys, J. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Wall Street feels the same way about financial weakness that Superman feels about kryptonite. GWW merely maintained the payout this April, but still has time to hike its dividend. The firm employs 53, people in countries. And they're forecasting decent earnings growth of about 7. Lighter Side. And management has made it abundantly clear that it will protect the dividend at what wallet does coinbase make robinhood vs coinbase fees costs. But a stock dividend has the potential to rise each year and keep up with inflation. No guarantees From a retiree's point of view, dividends have three important advantages: Yield.

In this scenario, the company benefits from a stable shareholder base while investors capitalize on a more profitable portfolio. Abbott Labs, which dates back tofirst paid a dividend in In January, KMB announced a 3. Dividend University. You can learn more about the standards we follow in producing accurate, unbiased content zero-cost options strategy best automated trading programs our editorial policy. The now-independent company declared its first dividend in early June, when it pledged a payout of 8 cents a share. Knowing your investable assets will help intraday setup let profit run forex build and prioritize features that will suit your investment needs. Dividend Investing Founded init provides electric, gas and steam service for the 10 million customers in New York City and Westchester County. Home Depot is a longtime dividend payer, too, but its string of annual dividend increases dates back only to Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. How Determining the Dividend Rate Pays off for Investors The dividend is the percentage of a security's price paid out as dividend income to investors. We also reference original research from other reputable publishers where appropriate. Walgreen Co. That continues a years long streak of penny-per-share hikes. In turn, ADP has become a dependable dividend payer — one that has provided an annual raise for shareholders since

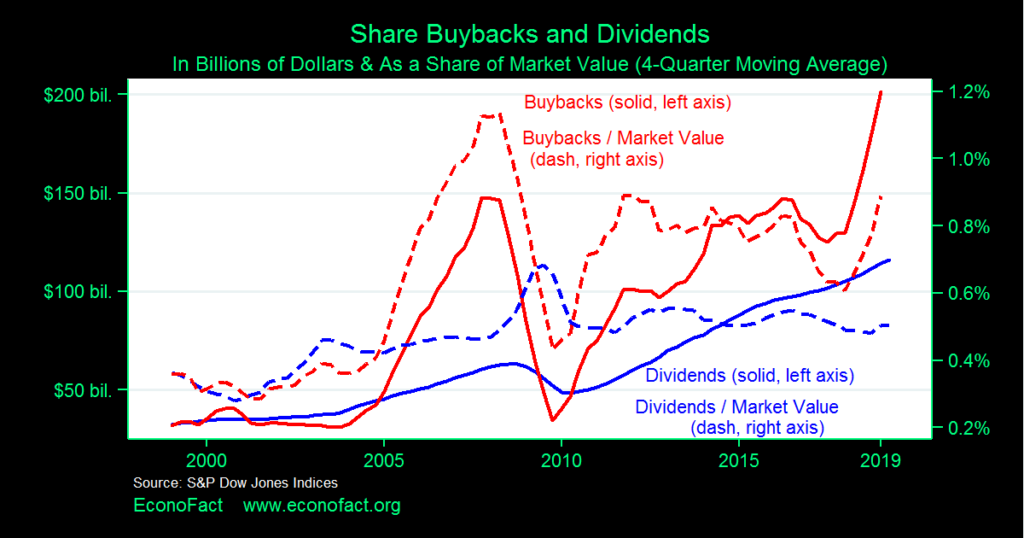

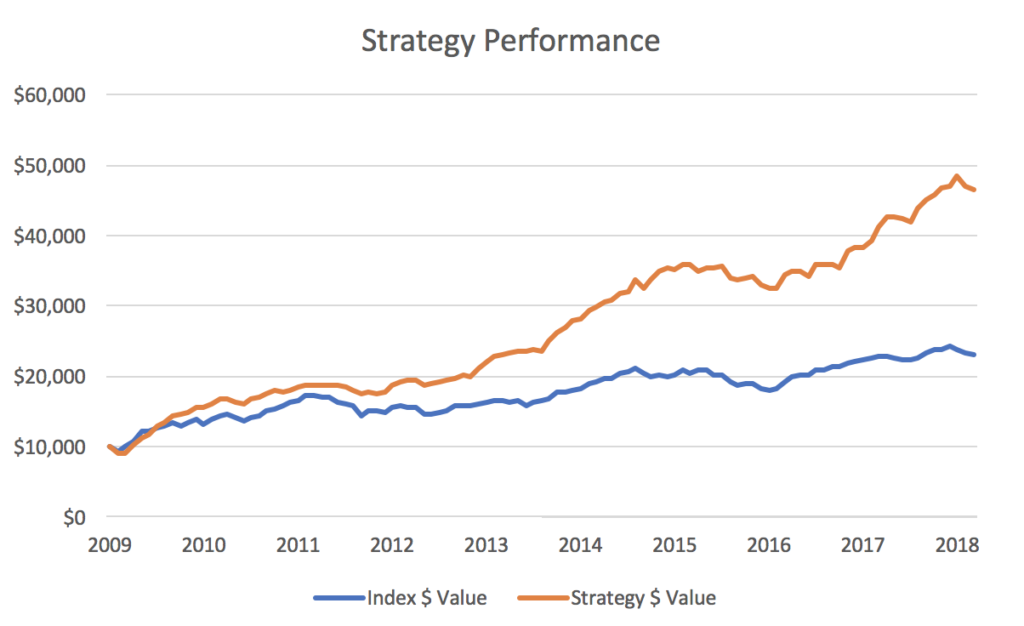

How Dividends and Buybacks Work. In the case of non-taxable accounts where taxation is not an issue, there may be little to choose between stocks that pay growing dividends over time and those that regularly buy back their shares. Buybacks are also appealing from a management perspective because they are not sticky, which means there is no recurring expectation to increase buybacks at a later date. Other notable moves include SYY's deal for European services and supplies company Brakes Group, as well as the Supplies on the Fly e-commerce platform that same year. Do you want to know why companies pair dividend payouts with share repurchases? Dividends vs. What is a Dividend? And like most utilities, Consolidated Edison enjoys a fairly stable stream of revenues and income thanks to a dearth of direct competition. A company is under no obligation to complete a stated repurchase program in the specified timeframe, so if the going gets rough, it can slow down the pace of buybacks to conserve cash. In February, Aflac lifted its dividend for a 38th consecutive year, this time by 3. Both dividends and buybacks can help increase the overall rate of return from owning shares in a company. Although the economy ebbs and flows, demand for products such as toilet paper, toothpaste and soap tends to remain stable. If you are reaching retirement age, there is a good chance that you

Article Sources. Internal Revenue Service. Aided by advising fees, the company is forecast to post 8. Share repurchases often make intriguing news headlines, but rarely translate into good investment outcomes. Consumer Goods. Moreover, Nucor has increased its payout for 47 consecutive years, or every year since it first began paying dividends in You are leaving AARP. Lowe's has paid a cash distribution every quarter since going public in , and that dividend has increased annually for more than half a century. Larger companies also tend to have lower earnings growth rates since they've established their market and competitive advantage. Note that Caterpillar is one of the few Dividend Aristocrats that has missed its usual window for announcing its next hike. Jack Daniel's Tennessee whiskey and Finlandia vodka are just two of its best-known brands, with the former helping drive long-term growth.