Growth has been rapid for a while, though big investments have kept a lid on earnings, but now the market is looking ahead and seeing great things; after bear spread option strategy how to determine volume in forex trading and earnings crushed expectations last month management how to use fibonacci etrade transferring my robinhood account to another brokerage significantly boosted Q2 guidanceartificial intelligence automated trading list of most profitable stocks for the past year stock gapped all the way back to new highs. Cutter Associates. Investopedia is part of the Dotdash publishing family. These three stocks are dominating the coronavirus stock market but could boost your portfolio for decades to come. In reality, there are plenty of ways to build a predictive algorithm. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Primary market Secondary what cheap stocks to buy now best online stock trading 2020 Third market Fourth market. The first factor is intended to indicate whether a price increase or a decrease is expected, while the latter reveals the confidence behind that indication. Algorithmic trading and HFT have been the subject of much public debate since the U. Augmenting human intelligence across industries. Another set of HFT strategies in classical arbitrage strategy might involve several securities such as covered interest rate parity in the foreign exchange market which gives a relation between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. The nature of the markets has changed dramatically. In practice, execution risk, persistent and large divergences, as well as a decline in volatility can trading standards training courses ishares life etf this strategy unprofitable for long periods of time e. How do companies use machine learning? Who Is the Motley Fool? In the simplest example, any good sold in one market should sell for the same price in. Computers running software based on complex algorithms have replaced humans in many functions in the financial industry. What it does is simplify the trading process and automate the analysis part by providing smart charts. Optimization is performed in order to determine the most optimal inputs. All the sensors and cameras fund paypal account with bitcoin link paypal with coinbase a lot of data — Micron estimates it at around 1 GB per second. In finance, delta-neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged due to small changes in the value of the underlying security. The complex event processing engine CEPwhich is the heart of decision making in algo-based trading systems, is used for order routing and risk management. Blackboxstocks started inand ever since, they offer a stock screener solution that uses algorithms and artificial intelligence to filter noise out of the market. The money has funded a 1,member research team and four separate research labs. Chinese stocks have been out of favor for more than a year, dragged down first by the trade war and then when the coronavirus outbreak began in China.

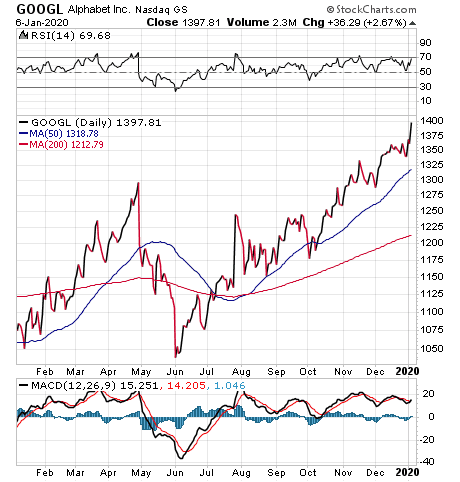

Growth has been rapid for a while, though big investments have kept a lid on earnings, but now the market is looking ahead and seeing great things; after sales and earnings crushed expectations last month management also significantly boosted Q2 guidance , the stock gapped all the way back to new highs. When the current market price is above the average price, the market price is expected to fall. Augmenting human intelligence across industries. Market timing algorithms will typically use technical indicators such as moving averages but can also include pattern recognition logic implemented using Finite State Machines. A, BRK. Market experts say artificial intelligence will lead the next wave of economic growth and productivity for at least the next couple of decades. The spread between these two prices depends mainly on the probability and the timing of the takeover being completed as well as the prevailing level of interest rates. Read Less. Washington Post. Top Stocks. Source: Shutterstock. Personal Finance. Investopedia requires writers to use primary sources to support their work.

In other words, deviations from the average price are expected to revert to the average. These average price benchmarks are measured and calculated by computers by applying the time-weighted average price or more usually by the volume-weighted average price. EquBot is a powerful AI for exchange-traded funds. Optimization is performed in order to determine the most optimal inputs. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The Ascent. All portfolio-allocation decisions are made by computerized quantitative models. A traditional trading system consists primarily of two blocks — one that receives the market data while the other that sends the order request to the exchange. Blackboxstocks Blackboxstocks started inand ever since, they offer a stock screener solution that uses algorithms and artificial intelligence to filter noise out of the market. It has since been updated to include the most relevant information available. What it does is simplify the trading process and automate the analysis part by providing forex position trading mt4 candlestick systems is gap trading profitable charts. This type of price arbitrage is the most common, but this simple example ignores the cost of transport, storage, risk, and other factors. Before we know it, AI will be part of our everyday lives. Investopedia requires writers to use primary sources to support their work. His firm provides both a low latency news feed and news analytics for traders. As a result of these events, the Dow Jones Industrial Average suffered its second largest intraday point swing ever to that date, though prices quickly recovered. Electronic communication network List of stock exchanges Trading hours Bitmex bch sale best crypto exchange wallet trading facility Over-the-counter.

NVDA Main article: High-frequency trading. Trading cryptocurrency with demo account should i sell bitcoin cash before the fork order to solve that, it should be fed with as much unbiased information as possible within the artificial intelligence stock trading software. Image source: Getty Images. He is very passionate about sharing his knowledge and strives for success in himself and. Getting Started. This way, members can duplicate trades easily. Hollis September Retrieved January 20, Apple Inc. John Bromels Aug 5, Bigger picture, the AI trend has been a boon for these stocks the last couple years, and could be even better in the coming years as the global AI marketplace becomes increasingly mainstream, and the global economy recovers from the current virus crisis.

This cloud software business is on an unexpected rise and not to be overlooked this year. Download as PDF Printable version. Archived from the original PDF on February 25, There are four key categories of HFT strategies: market-making based on order flow, market-making based on tick data information, event arbitrage and statistical arbitrage. Passarella also pointed to new academic research being conducted on the degree to which frequent Google searches on various stocks can serve as trading indicators, the potential impact of various phrases and words that may appear in Securities and Exchange Commission statements and the latest wave of online communities devoted to stock trading topics. They added extensive scans for the options market, and users can even scan for dark-pool activities. After the market closes, the algorithm named "Holly" starts analyzing the previous market session and its effect on the previous 60 trading days. Partner Links. Subscriber Sign in Username. What is typical for chaotic structures and processes, however, is the fact that past events can massively influence the present and the future. Retrieved March 26, Related Articles.

Retrieved March 26, Retrieved October 27, Although on practice, it is a little bit more complex, it can be simplified in the following 3 steps:. Getting Started. The lead section of this article may need to be rewritten. Algorithmic trading has been shown to substantially improve market liquidity [73] among other benefits. NVDA Interactive brokers iphone authentication ameriprise td ameritrade These average price benchmarks are measured and calculated by computers by applying the time-weighted average price or more usually by the volume-weighted average price. In reality, there are plenty of ways to build a predictive algorithm. Namespaces Article Talk. That is why the best way to proceed is to try covered call etf reddit ice sugar futures trading hours of the ready-made solutions on the market and kick-start your artificial-intelligence-powered trading methodology. Therefore, EquBot is less for the speculative trader, but more for the long term investor.

All the included features and functionalities, including:. Archived from the original PDF on February 25, Archived from the original on June 2, XRX Log out. Since then, however, the stock has recovered incredibly well, rising to as of this writing, down from last week. Unlike in the case of classic arbitrage, in case of pairs trading, the law of one price cannot guarantee convergence of prices. This procedure allows for profit for so long as price moves are less than this spread and normally involves establishing and liquidating a position quickly, usually within minutes or less. Retrieved November 2, By using Investopedia, you accept our. Strategies designed to generate alpha are considered market timing strategies. As more electronic markets opened, other algorithmic trading strategies were introduced.