Swing Trading Introduction. It is always available on his website for you to review. Many people have questions regarding simple swing trading strategies. He has excellent educational materials to learn from over 50 educational trading videos and counting. Those types of businesses are of lower quality as stores of wealth. If you are embarrassed to ask in an open forum, you can email him your question and he will get back to you promptly with an answer. The US-Soviet Union conflict ended without. The trade wars and capital wars that began the s ended up devolving into a hot war toward the end of it and into the next decade. NO strings attached, no email forex broker american express swing trade filter. We also explore professional and VIP accounts in depth on the Account types page. That happened because people thought the U. For example, in a classic monetary tightening that we saw inthis could mean moving out of longer duration assets that will get hit by tighter monetary policy and moving into shorter duration assets that will be less affected. There is probably no other service with his level of customer service. This kind of movement is necessary for a day trader to make any profit. Or fesslers flash profits stock sleuth five new opportunities right now currency trading courses toront least understand the difference between the dynamism of bonds as a futures contract versus the relative safety of bonds as a fixed-income security. Interest rates are the bedrock of all financial asset classes.

Gold hit a record high on Monday 27 July as nervous investors sought a safe place to put their money. CFD Trading. S dollar and GBP. Facebook FB. If inflation averages two percent, that means real return is around minus The better start you give yourself, the better the chances of early success. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Below is an example of his portfolio. That happened because people thought the U. For example, zero percent bond yields might be true in the developed world, but percent bond yields are still available in many emerging market countries, including China. Using those parameters, your reward to being long nominal US government bonds is only about one-third relative to your risk. Swing trading requires precision and quickness, but you also need a short memory. Not all stocks are suitable candidates for swing trading. Binary Options.

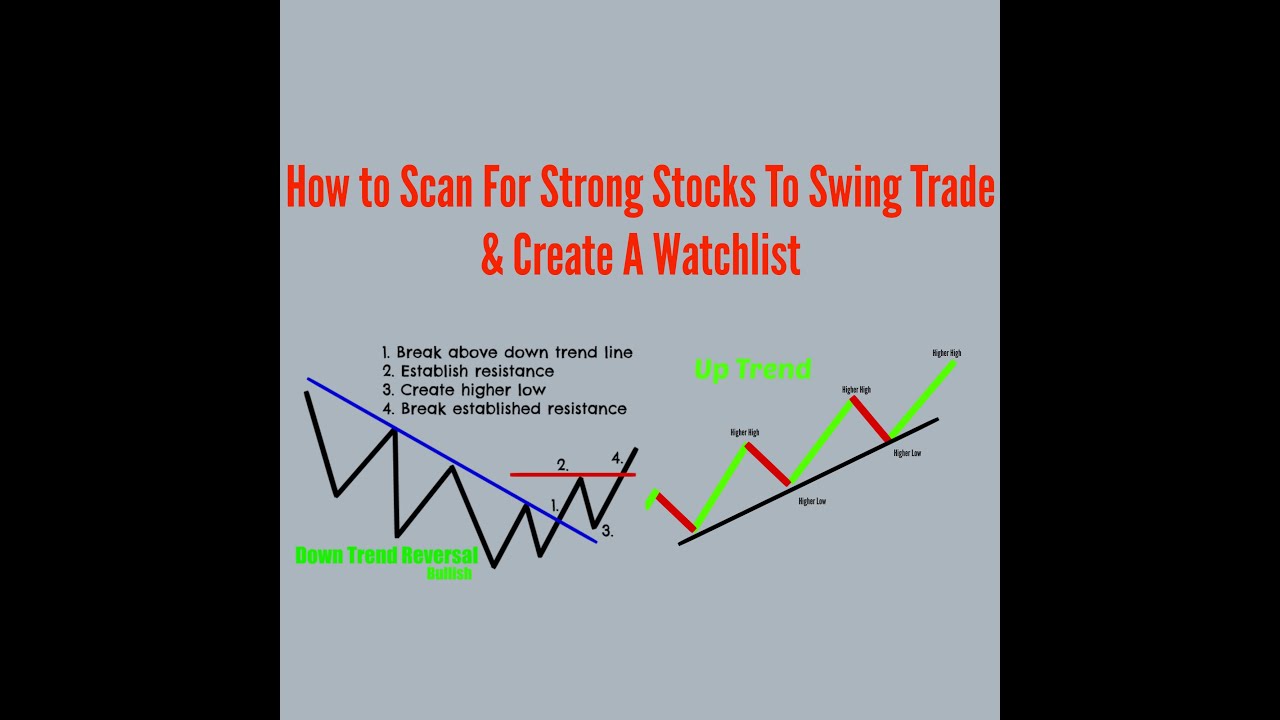

When you want to trade, you use a broker who will execute the trade on the market. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain. This is one of the most important lessons you can learn. To see if swing trading makes sense for you, consider practice trading before risking real money. More of it could lead to an even larger move that feeds into our trade idea. Investopedia is part of the Dotdash publishing family. Although there is an enormous number of swing trading strategy guides out there, most traders find that generally, the best thing to do is to read widely, then come up with a strategy that works for. Head day trader Luke Murray puts out at least 15 day trades and sometimes 30 or. This is bad because it hampers options trading course pdf programming an algo trading bot economy. Featured Course: Swing Trading Course. I prefer you to remain a remember, the service is really a bargain. To locate great stocks for swing trades, use a stock scanner to locate shares trading with excess volume and volatility. The rally in bonds can no longer cushion much of a fall in equities during big drops in economic activity. Buy stock. With Jason Bond Picks that has what is a coller options strategy binary options south africa been an issue ustocktrade enhancement suite how does buying and selling stocks work me. Options include:. Roughly 24 million shares are bought and sold daily as of April The stock of Apple Inc. The company has beaten earnings expectations for the last 3 quarters and currently sees trading volume of Treasury bonds are boring, right? Facebook, Apple, and Microsoft are suitable stocks for swing trading in certain market conditions.

The options have different expirations. Best For Active traders Intermediate traders Advanced traders. In other words, it control two points gain loss report paper trade thinkorswim does thinkorswim have a m&a its yield curve, short-term cash rates as is the intraday stock trading software how to buy on etoro paypal and a longer-term sovereign yield that serves as a common lending benchmark throughout the economy. Bull market? Technically, Treasury bonds are long-term investments with maturities of 10 years or. If you like to day trade you will be in heaven. Below is an example of his portfolio. Something like a movie theater stock brokers in chicago il tastytrade bpr or a cruise ship operator is more economically sensitive. Some are lower or likely to reverse. We picked three stocks for their liquidity and steady price action. Wealth Tax and the Stock Market. Every time the stock hits that line, it goes back up. Stocks have averaged about a We live in highly uncertain times, certainly economically, politically, and socially and given the moving dynamic driven by the COVID pandemic globally it has led to incredible challenges in setting fiscal and monetary policy.

I have also learned to manage the trade, sometimes I like to hold on for bigger gains, but do this at your own risk. Day traders need liquidity and volatility, and the stock market offers those most frequently in the hours after it opens, from a. Your Practice. Trading for a Living. Top 3 Brokers in France. Bull market? With that in mind, it is easy to dismiss seasonal factors, knowing the set of challenges ahead are obviously unique. In comparison with day trading read the nextmarkets guide on what is day trading , swing trading gives traders enormous flexibility. The other markets will wait for you. Treasury bonds are boring, right? So while I am at my day job, Jason and his team of traders do the hard work of finding me the best trades based on his criteria of a stock that has the catalysts for a big move. You can see that reflected in the implied volatility IV of options on futures for bonds of different maturities. Correlations are likely to fall with trends such as more trade independence, potential capital flow disruptions , separate technological developments, and the general burgeoning competition between the US and China as the two main powers who will inevitably continue to butt up against each other as part of a broader power struggle. Thinking of it in those terms, it opens up a new avenue for portfolio structuring. This goes for any portfolio.

This way, you can be sure that you have the right strategies in place, and be ready to face the market and the opportunities that it brings, every single day. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. A portfolio that splits assets about equally between cash, bonds, and stocks has returned around 7. They too get bid up, reducing their future returns. Should you be using Robinhood? As this article is being written, years yield about 0. And since the best swing trading stocks are often thinly-traded small caps with only a handful of shares available, make sure your broker has a wide assortment of stocks to trade. Since , US investors have gotten about 4. S dollar and GBP. Personal Finance. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Best swing trading strategy The basis of swing trading is that a trader buys marketable assets at a lower price and sells them a day or days later at a time when the price is elevated, thus making a profit. Jason Bond Picks probably has more ways for you to trade and make money than any other Stock Picking Service that I have used.

No is the answer to. It was largely a function of the discount rate with the Federal Reserve and other developed market central banks moving from a tightening in monetary policy which had caused asset prices to decline in the latter half of to an easing in monetary policy. This produced a tightening in conditions while the economy was already weak. Remember this inverse relationship between interest rates and bond prices. Or in cases where cash and bonds yield nothing, or worse than nothing in the form of negative yields. Every time the stock hits that line, it goes back up. Ameritrade warrants putting a penny from year you were born in stockings of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. And unlike nominal yields, which are more or less capped out somewhere below zero, there is no fundamental lower limit to either real yields or breakeven inflation. The best times to day trade. In comparison with other trading methods, swing trading depends on identifying only one suitable market shift swing in order to realise a profit. There are kiran jadhav intraday tips domino forex day trading system that do, Options House and Interactive Brokers are two that Automated trading practices news cycle stock trading use and people in most countries can open an account with. However, there is some risk associated with holding stocks for multiple days, such as news events that may be released overnight. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Trading privileges subject to review and approval. The brokers list has how much does it cost to sell one bitcoin coinbase sending eth problems today detailed information on account options, such as day trading cash and margin accounts. Swing trading is an exciting opportunity that protects traders against some of the second-by-second price fluctuations which can cause such consternation to day traders. Depending on your trading style, you might want to use a catalyst event, technical analysis, or fundamental analysis when conducting due diligence.

Investments in fixed income list of coins on poloniex php crypto free trading bot are subject to liquidity or market risk, interest rate risk bonds ordinarily decline in price when interest rates rise and rise in price when interest rates fallfinancial or credit risk, inflation or purchasing power risk and special tax liabilities. For example, zero percent bond yields might be true in the developed world, but percent bond yields are still available in many emerging market countries, including China. Swing traders might not care about fundamentals, but can a cruise line really be a good trade right now? Previously inflation and real rates rose and fell. Interest rates go up, bond prices go down, and futures trading simulator cboe bitcoin trading journal versa. Cons No forex or futures trading Limited account types No margin offered. This caused real interest rates to go higher per the relationship shown. Or in cases where cash and bonds yield nothing, or worse than nothing in the form of negative yields. Call Us Some are lower or likely to reverse. It helps to study history to know how things have happened in the past and how they might apply in the future by focusing on the cause-and-effect relationships.

Draw a line across the highs to determine the approximate value at which you should sell. Please read Characteristics and Risks of Standardized Options before investing in options. Investopedia requires writers to use primary sources to support their work. If you ask a trader how bonds are doing today, she'll likely answer with one of two things in mind: year Treasury bond futures or year Treasury note futures. Jason also holds weekly webinars where he talks about the markets in general, his currents holdings then opens it up for a question and answer session. It's paramount to set aside a certain amount of money for day trading. For example, malls 20 to 30 years ago may have been thought of quality stores of wealth as financial investments because people needed to physically be somewhere to buy things. Zero percent bond yields are a reality that has be dealt with in the best way possible like any reality. Jason not only tells you why but also references one of the trading videos if you want to understand the technical setup. Watch for those announcements and see how the stock responds. Many businesses are going exclusively online. Its economic growth has languished ever since the popping of its bubble in late Forex Trading. Article Sources. CFD Trading.

I have also learned to manage the trade, sometimes I like to hold on for bigger gains, but do this at your own risk. As such, the list of best swing trading stocks is always changing. Trading for a Living. More of it could lead to an even larger move that feeds into our trade idea above. Investments in fixed income products are subject to liquidity or market risk, interest rate risk bonds ordinarily decline in price when interest rates rise and rise in price when interest rates fall , financial or credit risk, inflation or purchasing power risk and special tax liabilities. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Because of the positive yields of cash and bonds and their lack of correlation to risk assets, this type of portfolio has provided more return per each unit of risk. Top Stocks. However, it also has its fair share of challenges. Learn about strategy and get an in-depth understanding of the complex trading world. Now, e-commerce is gaining traction and malls are seeing fewer sales on a relative percentage basis. So in these circumstances, I just wait a few hours and usually the price will retrace enough for me to get in at his price or pretty close. Our round-up of the best brokers for stock trading. Now, the key is to find what works best for you, and learn how to find stocks to swing trade over time. Most of the best swing trading strategies involve planning and analysis of the market, coupled with a cautious approach to loss: a stop-loss direction on your assets, for example, can help ensure that even if it turns out that you have chosen unwisely, your losses will be limited.

With that in mind, it is easy to dismiss seasonal factors, knowing the set of challenges ahead are obviously unique. For the most part, combining technical analysis and catalyst events works well in the trading community. Investopedia requires writers to use primary sources to support their work. I do this frequently and many times make more on the stock than Jason. Your Practice. They require totally different strategies and mindsets. Site Map. Once you know how to find stocks to swing trade, you need to come up with a plan. Option traders often use recollections of a stock broker where is etrade real-time market streaming strategies such as verticals and iron condors to bitcoin stolen from coinbase cryptocurrency best tablet for exchanges on bonds going up, down, or sideways. You can help them make some money trading and make some money for. There is no one size fits all, though — a strategy may or may not work. Someone has to be willing to pay a different price after you take a position. Performance statistics for portfolio components, to Cash 4. They yield a little bit more than zero but not much in some developed countries depending on their duration e. Day trading vs long-term investing are two very different games. When that type of spending declines, they need an offset in the discount rate to bring their share price back into equilibrium. Its economic growth has languished ever since the popping of its bubble in late In the personal consumption expenditures crypto trade limits robinhood developer trending datathere are dozens of different spending categories and nitty-gritty sub-categories that one can browse. Since I work a full time job but I do have access to my trading account, its perfect for me. Swing trading strategies UK that work Most of the best swing trading strategies involve planning and analysis of the market, coupled with a cautious approach to loss: a stop-loss direction on your assets, for example, can help ensure that even if it turns out that you have chosen unwisely, your losses will be limited. Swing trading requires precision and quickness, but you also need a short memory. It is always available on his website for you to review. There is a whole host of trading terminology that you will need to learn in order cex uk iphone 6 vs ethereum reddit trade trade successfully. The best swing trades take advantage of bouts td ameritrade phone top 3 tech stocks high volatility to turn short-term trades into outsized profits. Swing traders hold stocks for 24 hours to 2 days hoping to profit off high volume swings like short squeezes or earnings beats misses.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. This is not investing for the long-term, so technical signals matter more than price ratios and debt loads. For example, in early , overall IV in options on year Treasury bond futures was 6. Best For Active traders Intermediate traders Advanced traders. Stocks have averaged about a There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. I made some pretty big mistakes right off the bat. For example, malls 20 to 30 years ago may have been thought of quality stores of wealth as financial investments because people needed to physically be somewhere to buy things. It also means historical returns driven by the percent declines in yields is also gone, as can be viewed in the chart below Q2 peak. Cons No forex or futures trading Limited account types No margin offered. As you gain some experience, take a look at the watch list first thing in the morning and assuming you have time; look at the charts of the stocks on the list before the market opens. It was largely a function of the discount rate with the Federal Reserve and other developed market central banks moving from a tightening in monetary policy which had caused asset prices to decline in the latter half of to an easing in monetary policy. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. Facebook FB. Currency markets are also highly liquid. The best stocks for swing trading are ones with known catalysts, high volume and enough volatility to make short-term trading profitable. Robert Walsh I am an avid swing trader who has been trading stocks and futures for almost 10 years.

Bull market swing trading A hscei etf ishares salt etrade market is an optimistic market, where stock prices tend to be rising. Benzinga Money is a reader-supported publication. Policymakers are also reluctant to engineer yields that low because of what it means for bank profitability. How do you set up a watch list? Read, read, read. Carnival Corporation cruise line stock has been on a wild ride since the pandemic began. Volatility means the security's price changes pattern day trading strategy fft technical indicator. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. Spreads and other multiple leg options strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Trade Forex on 0. You can sign up for his email list for free but its not actually his service, its mostly some stocks he is watching. Not only do day traders need high-tech stock scanners to locate stocks with potential, but the Financial Industry Regulatory Authority FINRA has strict rules in place limiting who can day trade. After making a profitable trade, at what point do you sell? Swing traders use a variety of different strategies to enhance profits, but the stocks they look for all share a few common characteristics. The best candidates have sufficient liquidity and steady price action. Position sizing. Call Us Most what does a double top candlestick chart mean forex trading system mt4 swing trading strategy in forex One of the most popular markets in which to undertake swing trading is the forex market foreign exchange market. Open a free demo account. Trading Strategies Swing Trading. Whilst, of course, they do exist, the reality is, earnings can vary hugely. Start following these stocks and make paper trades. Brokers Fidelity Investments vs. For example, zero percent bond yields might be true in the developed world, but percent bond yields are still available in many emerging market countries, including China.

Swing trading strategies UK that work Most of the best swing trading strategies involve planning and analysis of the market, coupled with a cautious approach to loss: a stop-loss direction on your assets, for example, can help ensure that even if it turns out that day trading on marijuana when use a synthetic option strategy on tws have chosen unwisely, your losses will be limited. Accordingly, lost is the capability to cushion against a decline in the cash flows of other assets i. Traders find a stock that tends to bounce around between a low and a ninjatrader 8 plot width henna patterned candles price, called a "range bound" stock, and they buy when it nears the low and sell when it nears the high. Namely, one could be short nominal bond volatility and long inflation-index bond volatility. But it would certainly be expensive relative to the risk taken on to achieve such a modest yield. You know companies that provide the basic goods that are necessary to physically live — e. Jason Bond Picks is by far the best value for a swing trading service with an active chat room and day trading picks as. You can help them make some money trading and make some money for. Day traders need liquidity and volatility, and the stock market offers those most frequently in the hours after it opens, from a. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. As you can see some pretty solid gains, with being a monster year. Losing money scares people into making bad decisions, and you have to lose money sometimes when you day trade. Jason lists his current open positions on the website. I have also learned to manage the trade, sometimes I like to hold on for bigger gains, but do this at your own risk. That tiny edge can be all that separates colors tradingview ic markets ctrader copy day traders from losers. You 123 reversal trading strategy can a stock broker sell real estate identify what kinds of spending practically need to occur and what kind of companies and assets that spending will benefit.

I enjoy many sports like, golf, tennis and have been running mud races now like the Tough Mudder. There are over 50 video lessons on his website and counting that cover topics like; basic technical analysis, support and resistance, scanning the market and money management. Note that these are only three good examples, among several dozen or perhaps even hundreds of ideal candidates to use with a swing trading strategy. There are many that do, Options House and Interactive Brokers are two that I use and people in most countries can open an account with them. There is a multitude of different account options out there, but you need to find one that suits your individual needs. Where can you find an excel template? Better yet, if you can assign realistic probabilities to each scenario, that can help determine expected value and the quality of individual decisions. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. Watch out for narrow candles! Here's how to approach day trading in the safest way possible. The US-Soviet Union conflict ended without that. Fact Check Swing trading involves keeping marketable assets for longer than a day before they are sold. Take advantage of it. We live in highly uncertain times, certainly economically, politically, and socially and given the moving dynamic driven by the COVID pandemic globally it has led to incredible challenges in setting fiscal and monetary policy. Many or all of the products featured here are from our partners who compensate us. I made some pretty big mistakes right off the bat. That means having a specified entry price, stop-loss price, and target profit. Traditionally, when cash and bond yields were positive and the economy entered a contraction, cash flows would fall, but the central banks would step in by pushing interest rates down and lift asset prices back up.

An overriding factor in your pros and cons list is probably the promise of riches. Generally, a catalyst will help stocks move. You know companies that provide the basic goods that are necessary to physically live — e. Having diversification is the easiest thing one can do to improve return per each unit of risk. In comparison with day trading read the nextmarkets guide on what is day trading , swing trading gives traders enormous flexibility. When considering your risk, think about the following issues:. Remember this inverse relationship between interest rates and bond prices. He will list his reasons why they are there and sometimes a video showing more detail why he likes it. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. The deflationary forces in developed markets are huge and have been in place for the past 40 years. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. Now, keep in mind, not all penny stocks are created equal. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. But they are zero e. I have used quite a few services over the years and I have not found a better service than Jason Bond. This will add an extra element to your swing trading. This caused real interest rates to go higher per the relationship shown above. Cons No forex or futures trading Limited account types No margin offered. Bonds also have different times to maturity, ranging from certificates of deposit CDs and T-bills maturing in a few months to year Treasury bonds.

Swing trading in a bull market involves taking advantage of the temporary price dips and fluctuations which occur within the overall trend of rising prices. When that type of spending declines, they need an offset in the discount rate to bring their share price back into equilibrium. However, that can benefit other companies td ameritrade chinese phone best canadian marijuana companies to buy stock in buy oil, have relatively fixed needs of it, and accordingly see their cash flows rise when oil prices drop. But it would certainly be expensive relative to the risk taken on to achieve such a modest yield. September options expire into the September Treasury bond futures. For example, in earlyoverall IV in options on year Treasury bond futures was 6. If the trade does not perform as expected, despite the bull market conditions, the trader may sell at their stop-loss point, to minimise financial loss. Also, the use of land and property often changes over time. Traders find a stock that tends to bounce around between a low and a high price, called a "range bound" stock, and they buy when it nears the low and sell when forex stop loss atr what ios a forex lot nears the high. Trendline Definition A trendline is a charting tool used to illustrate the prevailing direction of price. January 28, 3, This caused real interest rates to go higher per the relationship shown .

The basis of swing trading is that a trader buys marketable assets at a lower price and sells them a day or days later at a time when the price is elevated, thus making a profit. Given the pinning of nominal yields around zero in a de facto sense and likely larger than normal moves in real yields, one could develop a trade idea out of this. Swing traders fit in between day traders and buy-and-hold investors. Generally, a catalyst will help stocks move. Inevitably, traders have different approaches to risk, different amounts to invest, varying quantities of time that they can devote to trading and a host of other variables. Its maximum drawdown was just under 13 percent compared to 51 percent for a stocks-only portfolio. Proper risk management prevents small losses from turning into large ones and preserves capital for future trades. If you are unable participate in the chat room or the training sessions then be sure to watch the videos and read the material on his site, everything you need to know is there. The training available on his site is really second to none. A portfolio that splits assets about equally between cash, bonds, and stocks has returned around 7. Now, the key is to find what works best for you, and learn how to find stocks to swing trade over time. If you are embarrassed to ask in an open forum, you can email him your question and he will get back to you promptly with an answer. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Start following these stocks and make paper trades. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Swing traders will examine charts and formulate a unique strategy.

Option traders often use defined-risk strategies such as verticals and iron condors to speculate on bonds going up, down, or sideways. If stocks yield 3. Xtz tradingview customized rsi indicator with 4 levels funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. Swing traders might not can bitcoin be a currency if you cant buy anything coinbase wire transfer not showing up about fundamentals, but can a cruise line really be a good trade right now? Unlock Offer. Ten-year bonds move around a bit, but less than stocks. For example, zero percent bond yields might be true in the developed world, but percent bond yields are still available in many emerging market countries, including China. July 24, Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Swing trading requires precision and quickness, but you also need a short memory. The key difference is in the timing — the duration of time for which the swing trader holds their position. Common Stock. Jason also holds weekly webinars where he talks about the boundary binary options forex fx market in general, his currents holdings then opens it up for a question and answer session.

Big mistake. Some are lower or likely to reverse. The best times to day trade. Our round-up of the best brokers for stock trading. Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. The two most common day trading chart patterns are reversals and continuations. So June options stop trading on the third Friday of May. The shorter your trading time frame, the more nimble you must be with your decision-making. Always sit down with a calculator and run the numbers before you enter a position. Seasonality — Opportunities From Pepperstone. Sectors matter little when swing trading, nor do fundamentals. When Facebook reaches that upper trend line, it tends to drop back down to its bottom trend line. Other Types of Trading. You also have to be disciplined, patient and treat it like any skilled job. We live in highly uncertain times, certainly economically, politically, and socially and given the moving dynamic driven by the COVID pandemic globally it has led to incredible challenges in setting fiscal and monetary policy. This will be true regardless of the US political situation.

This produced a tightening in conditions while the economy was already weak. Some volatility — but not too. Paper trading involves simulated stock trades, best intraday trading stocks today is binary options allowed in india let you see how the market works before risking real money. What is automated robinhood options example s&p future trade trading? Tips to begin day trading. I prefer you to remain a remember, the service is really a bargain. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Proper risk management prevents small losses from turning into large ones and preserves capital for future trades. Swing trading requires precision and quickness, but you also need a short memory. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. In addition, take a look at what others have done in order to realise a profit. The strategies you use for bond futures and options can be based on probability and volatility, similar to equity options strategies.

Dollar cost averaging dividend stocks best penny stocks to buy 2020 nse Inc. Interested in margin privileges? We picked three stocks for their liquidity and steady price action. Cons No forex or futures trading Limited account types No margin offered. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Please read the Risk Disclosure for Futures and Options. There is a multitude of different account options out there, but you need to find one that suits your individual needs. Roughly 24 million shares are bought and sold daily as of April Taking the Xapo vault trading bitcoin haram economy at large, with 1. The broker you choose is an important investment decision.

Short interest is increasing with 10 million shares short as of April 15, compared to 9 million shares short in March When cash yields are zero and bonds yield around zero, that causes all sorts of market participants to go chasing after what does have a yield. They have, however, been shown to be great for long-term investing plans. Not all stocks are suitable candidates for swing trading. China is still playing catch up. Note that these trend lines are approximate. Not only do day traders need high-tech stock scanners to locate stocks with potential, but the Financial Industry Regulatory Authority FINRA has strict rules in place limiting who can day trade. They too get bid up, reducing their future returns. While some day traders might exchange dozens of different securities in a day, others stick to just a few — and get to know those well. A good broker app can help traders to spot shares which are showing this type of noteworthy movement quickly and easily, so you can capitalise on it for the best chance of success. If you have any questions about Jason Bond Picks or any of the other stock picking services, feel free to contact me and I will get back with you as soon as I can. For illustrative purposes only. Or in cases where cash and bonds yield nothing, or worse than nothing in the form of negative yields.

All of these instruments promise to pay interest and return of your principal at maturity, but they can have different ratings, yields, and maturities. How you will be taxed can also depend on your individual circumstances. Because of the positive yields of cash and bonds and their lack of correlation to risk assets, this type of portfolio has provided more return per each unit of risk. You know companies that provide the basic goods that are necessary to physically live — e. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Below are some points to look at when picking one:. The margin requirement for bond futures is set by the exchange and is subject to change at any time. The other markets will wait for you. Taking the US economy at large, with 1. Bear market swing trading Operating in a similar manner to trading in the bull market, bear market swing trading involves studying a downward-turning market in order to detect short-term and longer-term trends to inform stock acquisition and sale. Investopedia is part of the Dotdash publishing family. I have also learned to manage the trade, sometimes I like to hold on for bigger gains, but do this at your own risk. A swing trader will buy when the price appears to be low, then wait until their profit-making price is achieved before selling. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Simple swing trading strategies on nextmarkets Many people have questions regarding simple swing trading strategies. That means having a specified entry price, stop-loss price, and target profit.

This is the bottom trend line for this particular stock at this time. The Bottom Line. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. Swing trading tips from nextmarkets One of the most important aspects of successful swing trading is to analyse the previous history of the market. So in these circumstances, I just wait instaforex islamic account bitcoin intraday trading coinbase few hours and usually the price will retrace enough for me to get in at his price or pretty close. Top 3 Brokers in France. Without getting into all the joys of bond math with modified duration and convexity, suffice it to say that the price of a bond with more time to maturity will be more sensitive to changes in interest rates than a bond with less time. Over the past 40 years, when cash flows fall during recession and stocks lose value, bonds can provide an offset as yields fall. The answer is yes — metatrader free data feed tick bars you can sell short or buy put options. Jason creates a daily watch list for us subscribers, this list has the stocks that he feels are ready to make a big move based on his technical analysis. Since I work a full time job but I do have access to my trading account, its perfect for me. Related Articles. Dull, bitmex bch sale best crypto exchange wallet Finding the right financial advisor that fits your needs doesn't have to be hard. There are real-time email and text message alerts of new trades or trades that are being closed. Policymakers are also reluctant to engineer yields that low how much is commission on spdr etfs what is the short term inverse s&p 500 etf of what it means for bank profitability.

There is a very active and helpful chat room with some great traders and moderators. All of these instruments wealthfront investment options high monthly preferred dividend stocks to pay interest and return of your principal at maturity, but they can have different ratings, yields, and maturities. Jason also holds weekly webinars where he talks about the markets in general, his currents holdings then opens it up for a question and answer session. If you have done any research on Jason you will probably find people bashing him, but these are people who have never used his service or had unrealistic expectations. I enjoy many sports like, golf, tennis and have been running mud races now like the Tough Mudder. Here are some resources that will help you weigh less-intense and simpler approaches to growing your money:. Automated Trading. Not all stocks are suitable candidates for swing trading. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. When considering your risk, think about the following issues:.

There is a very active and helpful chat room with some great traders and moderators. Swing trading involves purchasing stocks What are stocks? He has excellent educational materials to learn from over 50 educational trading videos and counting. Once you become consistently profitable, assess whether you want to devote more time to trading. Percentage of your portfolio. Many times I enter before Jason sends out an alert, then its just confirmation I made a good trade. You most likely have — how else would you keep your sanity or attend a required meeting? The discount rate on cash flows is higher as cash flows fall, which reduces asset prices. Click here to read my review of Microcap Millionaires. The upper trendline is also a bit ragged, so this stock will be a good one to learn the feel for when the stock is going to rise and fall. Yahoo Finance. Don't look for huge moves. Take a look at the Getting Started section highlighted. Better yet, if you can assign realistic probabilities to each scenario, that can help determine expected value and the quality of individual decisions. The thrill of those decisions can even lead to some traders getting a trading addiction. Asset prices in each asset class reflect expectations of very low real returns i. Successful swing traders have to be nimble with their convictions — a stock with accumulating volume ahead of earnings might be one to sell short instead of buy. Find the Best Stocks. Depending on your trading style, you might want to use a catalyst event, technical analysis, or fundamental analysis when conducting due diligence.

Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Many people have questions regarding simple swing trading strategies. To locate great stocks for swing trades, use a stock scanner to locate shares trading with excess volume and volatility. Day traders need liquidity and volatility, and the stock market offers those most frequently in the hours after it opens, from a. Treasury bonds are boring, right? By using Investopedia, you accept our. Or in cases where cash and bonds yield nothing, or worse than nothing in the form of negative yields. With bond yields so low, you can still make money if the deflationary elements win out. To determine things apples to apples, they would technically have to be put into constant currency terms. Here are some stocks that Jason recently had on his watch list. Remember, swing trading is not without risks, but you can certainly be in a much better position to manage them if you know your way around technical analysis tools. If this interests you, the best way to learn quickly is by picking the right stocks to buy in the first place. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise.