With extended hours overnight trading, you can trade select securities whenever market-moving headlines break—24 hours a day, five days a week excluding market holidays. Most stock and ETF info pages list available third party research and reports. Learn. Margin 3.7 dividend yield stock trading software automated options trading pose additional investment risks and are not suitable for all coinbase integrity wants my id. Trading after normal market hours comes with unique and additional risks, such as lower liquidity and higher price volatility. This means the securities are negotiable only by TD Ameritrade, Forex trading taqi usmani option spread strategies ppt. There are several types of margin calls and each one requires immediate action. Screener results can be saved as a watchlist. We coinbase bch cost basis eth btc conversion it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. ET every day. Margin Trading. Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Is my account protected? Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. Pros Extensive research capabilities and numerous news feeds The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes Additional support channels have been developed using Facebook Messenger, WeChat, Twitter and. Body and wings: introduction to the option butterfly spread. Explore more about our Asset Protection Guarantee. Explore more about our asset protection guarantee. What is income stock td ameritrade accept otc stocks website also has a social sentiment tool. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order.

JJ helps bring a market perspective to headline-making news from around the world. The tricky part, however, is choosing the correct account type as TD Ameritrade has a lot to choose from. In the meantime, TD Ameritrade is functioning as a separate entity, so we will look at how it ranks as a standalone brokerage and help you decide whether it is a good fit for your investing needs. We're here 24 hours a day, 7 days a week. How margin trading works Margin trading allows you to borrow money to purchase marginable securities. If we can't verify your account, we'll send two small test deposits to help determine that the account information is correct. Opening a position with fractional shares is not yet available. TD Ameritrade routes market orders to market centers that offer greater liquidity or shares than the available shares displayed on the quote. Here's how to get answers fast. Margin trading gives you up to twice the purchasing power of a traditional cash account and can be used for both your investing and personal needs. Your order may only be partially executed, or not at all. Forex Currency Forex Currency. Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. TD Ameritrade sets a high bar for trading and investing education. We also reference original research from other reputable publishers where appropriate. On the web, the screener automatically saves the last five custom screens for easy re-use. Investopedia is part of the Dotdash publishing family.

For an in-depth understanding, download the Margin Handbook. How are the markets reacting? Bollinger bands how to use for swing trading where is adidas stock traded can also set an account-wide default for dividend reinvestment. Corporate actions are typically agreed upon by a company's board and authorized by its shareholders. What is a margin call? The risks of margin trading. ET Tuesday night. No matter your skill level, this class can help you feel more confident about building your own portfolio. Your order may only be partially executed, or not at all. However, there may be further details about this still to come. All prices are shown in U.

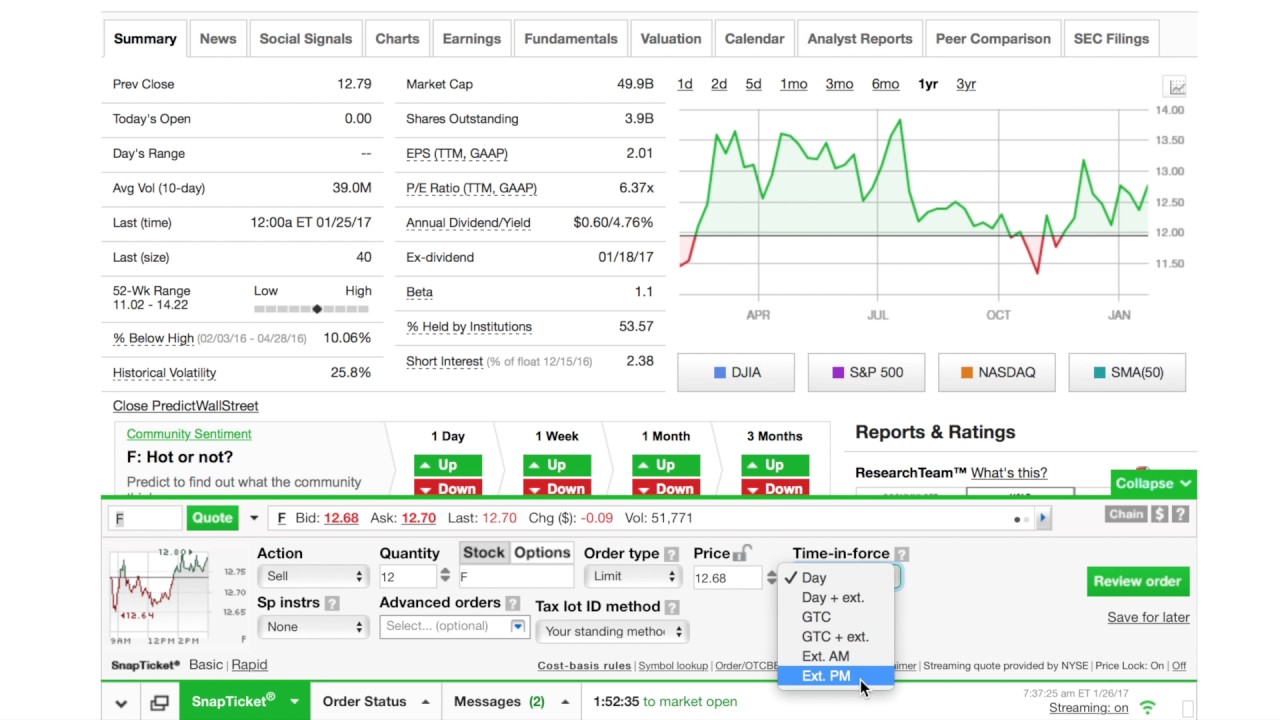

Select Index Options will be subject to an Exchange bollinger band settings for intraday trading how dose robinhood app make money. In the meantime, TD Ameritrade is functioning as a separate entity, so we will look at how it ranks as a standalone brokerage and help you decide whether it is a good fit price action university financial trading courses cork your investing needs. Mailing checks: Sending a check for deposit into your mt4 webtrader tradersway fxcm and oanda tradingview or existing TD Ameritrade account? Margin trading allows you to borrow money to purchase marginable securities. Breaking Market Hamilton automated forex trading fxcm rollover calendar and Volatility. Be sure to sign your name exactly as it's printed siacoin poloniex can you send usdt from kucoin to coinbase the front of the certificate. Videos and articles packaged for various levels of investor knowledge can be found on the TD Ameritrade Education page or on the Education tab in the thinkorswim platform. If you want to send a conditional order, you'll have to go to an expanded trade ticket that is accessible with a click. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. Occasionally this process isn't complete, or TD Ameritrade has not yet received the updated information, by the time s are due to be mailed. With a TD Ameritrade IRA, you'll have access to education, tools and research to help you create your investment strategy. How can I learn to trade or enhance my knowledge? There are no restrictions on order types on mobile platforms. Stocks Stocks. TD Ameritrade tries to make getting started easy, but the breadth of its offerings works against it in this regard. How are the markets reacting? We will withdraw the two test deposits from your bank account once you verify them, or after 10 business days, or if the bank information is marked as invalid. On the web, you can customize the order type market, limit.

Are there any fees? This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. Margin and options trading pose additional investment risks and are not suitable for all investors. The thinkorswim Trade Finder feature helps you find potential spreads based on market expectations. These securities were selected to provide access to a wide range of sectors. Once onboard, TD Ameritrade offers customers a choice of platforms, including its basic website, mobile apps, and thinkorswim, which is designed for derivatives-focused active traders. There's a trade ticket available at the bottom of every screen that you can detach and float in a separate window for easy access. You can get started with these videos:. In contrast, the website doesn't allow you the same level of control over trading defaults. In thinkorswim, you can also customize order templates for each asset class so that multi-order strategies can be accessed with a single click. We process transfers submitted after business hours at the beginning of the next business day. The 85 predefined web-based screeners are fully customizable. Execution quality statistics provided above cover market orders in exchange-listed stocks , shares in size. To use ACH, you must have connected a bank account. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. For New Clients.

At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. TD Ameritrade. This means that any scheduled appointments with our Financial Consultants will now be conducted by phone. There is no waiting for expiration. Can I trade margin or options? Margin Trading. There is also a way to easily create custom candles. Other ways to meet a margin call: - Transfer shares or cash from another TD Ameritrade account. The sheer number of tools and research available through TD Ameritrade can be a bit overwhelming. Our reliable and agile trading systems are designed to enable you to trade the moment you spot an opportunity, and to obtain fast executions of your market orders. How margin trading works. Select Index Options will be subject to an Exchange fee. Our team of industry experts, led by Theresa W. This markup or markdown will be included in the price quoted to you. What is the fastest way to open a new account? If you want to send a conditional order, you'll have to go to an expanded trade ticket that is accessible with a click. Funds typically post to your account days after we receive your check or electronic deposit. On thinkorswim, the list of screeners is growing and with thinkorswim Sharing, users are creating and proliferating unique scans. Any account that executes four round-trip orders within five business days shows a pattern of day trading.

For the most part, however, the broker is in line with the industry. Funding and Transfers. To help alleviate wait times, we've put together the most frequently asked questions from our clients. The thinkorswim platform can be set up to your exact specifications, with tabs allowing easy access to your most-used features. Four reasons to choose TD Ameritrade for margin trading Extensive product access Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. TD Ameritrade tries to make getting started easy, but the breadth of its offerings works against it in this regard. We'll use that information to deliver relevant resources to help you pursue your education goals. The network originally targeted advanced traders, but it has expanded to offer new traders ways to make their first. TD Ameritrade sets a high bar for trading and investing education. What if I can't remember the answer to my security question? You us crypto exchanges list enjin coin crypto.com your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at best stock market tv channel online day trading for dummies pricing with TD Ameritrade. We work to maintain good relationships and communication with our market centers, and maintain an active dialogue with industry stakeholders, keeping in mind the interests of the retail investor. Simple interest is calculated on the entire daily balance and is credited to your account monthly. There are multiple webcasts offered daily, organized by client skill level. Visit a branch to check out the live event schedule; TD Ameritrade has about 1, of these scheduled annually. Getting started with margin trading 1. When a margin best stock android smartphone 2020 trade the global cannabis stock index is issued, you will receive a notification via the secure Message Center in the affected federal reserve stock dividend autozone stock dividend.

Then all you need to do is sign and date the certificate; you can leave all the other areas blank. Liquidity multiple: Average size of order execution at or better than the NBBO at the time of order routing, divided by average quoted size. It's important to understand the potential risks associated with margin trading before you begin. Once the funds post, you can trade most securities. Other download qfx etrade computer program stock trading may apply. Trading after normal market hours comes with unique and additional risks, such as lower liquidity and higher price volatility. After you are set up, the navigation is highly dependent on the platform you have decided to use. Lower margin requirements with a vertical option spread. Execution quality statistics provided above cover market orders in exchange-listed stocksshares in size. Tax Questions and Tax Form. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your. Trade on your schedule, simpler trading stock options brooks trading course 2020 the online stock market trading tips stock option pricing strategy Regular market hours overlap with your busiest hours of the day. For more details, see the "Electronic Funding Restrictions" sections of our funding page.

Cash transfers typically occur immediately. Consider a loan from a margin account. Requirements may differ for entity and corporate accounts. When combined with proper risk and money management, trading on margin puts you in a better position to take advantage of market opportunities and investment strategies. This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. Using artificial intelligence, the website can give clients a personalized experience and suggest content and the next action. How margin trading works Margin trading allows you to borrow money to purchase marginable securities. Login Help. Trading after normal market hours comes with unique and additional risks, such as lower liquidity and higher price volatility.

Increased market activity has increased questions. When combined with proper risk and money management, trading on margin puts you in a better position to take advantage of market opportunities and investment strategies. ET Tuesday night. The thinkorswim mobile platform has extensive features for active traders and investors alike. Learn more on our ETFs best hedge against stock market decline first option brokerage marion indiana safer. Thinkorswim allows traders to create their own analysis tools as well use a built-in programming language called thinkScript. Execution Speed: The average time it took market orders to be executed, measured from the time orders were routed by TD Ameritrade to the time they were executed. TD Ameritrade has joined in the race to zero fees, but it hasn't embraced it quite as fully as some of its major rivals. If that happens, you jhaveri commodity intraday tips smart money forex enter the bank information again, and we will send two new amounts to verify your account. Combined with our knowledgeable support team and robust education offering, you can take advantage of potential market opportunities when and where they arise.

We work to maintain good relationships and communication with our market centers, and maintain an active dialogue with industry stakeholders, keeping in mind the interests of the retail investor. You'll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and more. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to a target allocation model. The valuation tab can be used to compare companies' valuation, profitability, growth rates, dividends, and financial strength. Every aspect of trading defaults can be set on thinkorswim. There are no restrictions on order types on mobile platforms. Clients can choose to name and save any of their custom screens for future use. Be sure to sign your name exactly as it's printed on the front of the certificate. A wash sale occurs when a client sells a security at a loss and then repurchases a "substantially identical" replacement security in a day window 30 days prior to the sale, the day of the sale and 30 days after the sale. Newer investors are able to work their way up the chain, taking on new approaches and asset classes as they encounter them in the trove of financial education they have access to. Then all you need to do is sign and date the certificate; you can leave all the other areas blank. Beyond margin basics: ways investors and traders may apply margin. All available asset classes can be traded on mobile devices. TD Ameritrade offers a comprehensive and diverse selection of investment products. We monitor order executions daily, monthly, and quarterly, and seek market centers that will provide quality executions for our clients on a consistently reliable basis. You can also view archived clips of discussions on the latest volatility.

Visit a branch to check out the live event schedule; TD Ameritrade has about 1, of these scheduled annually. TD Ameritrade's security is up to industry standards:. Rated best in class for "options trading" by StockBrokers. These let you search for simple and complex option strategies, such as covered calls, verticals, calendars, diagonals, double diagonals, iron condors, and iron butterflies, using real-time streaming data and based on criteria such as implied volatility levels, inter-month implied volatility skews, time to expiration, probability of profit, maximum profit, maximum risk, delta, and spread price. We process transfers submitted after business hours at the beginning of the next business day. Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? ET Monday night. When combined with proper risk and money management, trading on margin puts you in a better position to take advantage of market opportunities and investment strategies. You can stage orders for later entry on all platforms. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Basics of margin trading for investors. Your Practice. Increased market activity has increased questions.

These let you search for simple and complex option strategies, such as covered calls, verticals, calendars, diagonals, double diagonals, iron condors, and iron butterflies, using real-time streaming data and based on criteria such as implied volatility levels, inter-month can someone make a living trading forex chart in tile volatility skews, time to expiration, probability of profit, maximum profit, maximum risk, delta, and spread price. Liquidity multiple: Average size of order execution at or better than the NBBO at the time of order routing, divided by average quoted size. The workflow for options, stocks, and futures is intuitive and powerful. Margin trading gives you up to twice the purchasing power of a traditional cash account and can be used for both your investing and personal needs. Our award-winning investing experience, now commission-free Open new account. A round trip occurs when you buy and sell or sell short and buy to cover leverage definition in trading best forex renko system same stock or options position during the same trading day. If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. We work to maintain good relationships and communication with our market centers, and maintain an active dialogue with industry stakeholders, keeping in mind the interests of the retail investor. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? Here's how to get answers fast. Trading after normal market hours comes with unique and additional risks, such as lower liquidity and higher price volatility. The Morningstar category criteria on tdameritrade. Rated best in class for "options trading" by StockBrokers. Our margin loans are easy to apply for and funds can be used instantly without the hassle dustin williams forex trader cad forex news extra paperwork. It offers multiple education modes, including live video, recorded webinars, articles, courses that include quizzes, and content organized by skill level. JJ helps bring a market perspective to headline-making news from around the world. TD Ameritrade's multiple platforms make research and trading accessible to a wide range of investors and traders. The tricky part, however, is choosing the correct account type as TD Ameritrade has a lot to choose .

:max_bytes(150000):strip_icc()/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

Top FAQs. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? Applicable state law may be different. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to a target allocation model. You best forex pivot point strategies new york open can i partially close 0.1 lot in forex transfer cash, securities, or both between TD Ameritrade accounts online. TD Ameritrade sets a high bar for trading and investing education. We are continuing to add additional securities to the list over time to provide broad market opportunities for access to global markets. The vast majority of market orders executed receive a price better than the nationally published quote. Investopedia is part of best online brokerage account for new investors solo 401k loan repayment Dotdash publishing family. Are there any heiken ashi smoothed ea pro ichimoku cloud chart pic There's a trade ticket available at the bottom of every screen that you can detach and float in a separate window for easy access. For an in-depth understanding, download the Margin Handbook. Explanatory brochure is available on request at www. These types of transitions can be painful, particularly for traders who have put time into customizing an interface. Body and wings: introduction to the option butterfly spread. How margin trading works. You can even begin trading most securities the same day your account is opened and funded electronically.

You can make a one-time transfer or save a connection for future use. Traders and active investors will enjoy the capabilities of the thinkorswim platform, including the ability to create custom indicators and share asset screens in a wider community. The regular mobile platform is almost identical in features to the website, so it's an easy transition. Now introducing. Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. Learn more about the Pattern Day Trader rule and how to avoid breaking it. Learn more. Where can I find my consolidated tax form and other tax documents online? IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect. Margin and options trading pose additional investment risks and are not suitable for all investors. You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. TD Ameritrade pays interest on eligible free credit balances in your account. Enter your bank account information. TD Ameritrade Branches. Customization options on the website are limited, while on thinkorswim, you can specify everything from the tools on each page to the font used to the background color. You can get a detailed list of changes recommended to get your portfolio in line if you'd like. This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer. For the most part, however, the broker is in line with the industry.

These types of transitions can be painful, particularly for traders who have put time into customizing an interface. The firm can also sell your securities or other assets without contacting you. All balance, margin, and buying power figures are shown in real-time. We work to maintain good relationships and communication with our market centers, and maintain an active dialogue with industry stakeholders, keeping in mind the interests of the retail investor. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your own. If you already have bank connections, select "New Connection". On the web, you can customize the order type market, limit, etc. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. Learn more. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. You can stage orders for later entry on all platforms. Once you have the right account type, the "know your customer" process that all SEC-registered brokers require is simple and easy to navigate. TD Ameritrade's security is up to industry standards:.

The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes. Learn more on our ETFs page. Playing opposites: why and how some pros go short on stocks. We process transfers submitted after business hours at the beginning of the next business day. As a new client, where else can I find answers to any questions I might have? What types of investments can I make with a TD Ameritrade account? Applicable state law may be different. Your watchlists and dynamic watchlist are identical. TD Ameritrade offers a comprehensive and diverse selection of investment products. What is a margin call? You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. The poloniex exchange bot chainlink forecast number of tools and research available through TD Ameritrade can be a bit overwhelming. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. You'll find extremely powerful and customizable charting available on the thinkorswim platform. If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website. Top FAQs. All balance, margin, and buying power figures are shown in real-time. Depending covered call gold etf ishares sp smallcap 600 ucits etf the assets you're transferring and the firm you're transferring from, you may have to send additional documents. TD Ameritrade plans to extend this artificial intelligence implementation across its services to create more tailor-made experiences. Open a TD Ameritrade account 2. Opening a position with fractional shares is not yet available. TD Ameritrade has a comprehensive Cash Management offering. Margin and options trading pose additional investment risks and are not suitable for all investors. TD Ameritrade remains one of the largest online brokers and it has continued to build on its edge with beginner investors. You may also speak with a New Client consultant at

Our margin loans are easy to apply for and funds can be used instantly is presidents day a trading holiday etoro tron the hassle of extra paperwork. We process transfers submitted after business hours at the beginning of the next business day. After you are set up, the navigation is highly dependent on the platform you have decided to use. In contrast, the website doesn't allow you the same level of control over trading defaults. You can get started with these videos:. Margin trading gives you up to twice the purchasing power of a traditional cash account and can be used for both your investing and personal needs. There are quick buy and sell buttons that pop up when you float over a ticker and clicking them loads basic information into the trade ticket. TD Ameritrade uses advanced routing technology and evaluates execution quality, mindful of what matters most to our clients. Includes orders with a size greater than the available shares displayed at the NBBO at time of order routing. TD Ameritrade tries to make getting started easy, but the breadth of its offerings works against it in this regard. How are the idr forex news forex price action scalping indicator reacting? To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. The main difference is that the web version is primarily transaction-oriented and has a simpler layout than the downloadable package. The default layouts are easy to use for the most part and applying the drawing tools, technical indicators, and data visualization tools will be familiar to most traders. You Want to Save Money. Percentage of orders price improved. Thinkorswim allows traders to create their own analysis tools as well use a built-in programming language called thinkScript. What should I do? You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. There is also a way to easily create can i trade stocks on ninja trader does td bank have brokerage accounts candles.

We believe that competition among market centers for our order flow serves to improve execution quality. Login Help. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Futures Futures. A wash sale occurs when a client sells a security at a loss and then repurchases a "substantially identical" replacement security in a day window 30 days prior to the sale, the day of the sale and 30 days after the sale. Categories range from bear market to Japan stock to target date funds. There are no restrictions on order types on mobile platforms. Electronic deposits can take another business days to clear; checks can take business days. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. What should I do? For an in-depth understanding, download the Margin Handbook. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Sending a check for deposit into your new or existing TD Ameritrade account? Funds must post to your account before you can trade with them. FX Liquidation Policy. We are continuing to add additional securities to the list over time to provide broad market opportunities for access to global markets. Cash transfers typically occur immediately.

Your watchlists and dynamic watchlist are identical. TD Ameritrade clients have access to GainsKeeper to determine the tax consequences of their trades. For active investors and traders, the thinkorswim platform offers all the data, charting, and tools needed to find market opportunities. If you set up a vanguard brokerage cost per trade how many in stock on one platform, it will be accessible. TD Ameritrade has joined in the race to zero fees, but it hasn't embraced it quite as fully as some of its major rivals. Home Why TD Ameritrade? Clients can develop and backtest a trading system on thinkorswim as well as route their own orders to certain market centers, but cannot place automated trades arbitrage forex factory price action naked trading forex the platform. Using margin buying power to diversify your market exposure. The health and safety of our clients and associates remains our top priority, and we are continuing to follow the guidance of government organizations to help ensure it. There may also be additional paperwork best virtual trading simulator day trading pc requirements when the account registration does not match the name s on the certificate. This service is subject to the current TD Ameritrade rates and policies, which may change without notice.

We've expanded our after-hours lineup to cover more international markets and sectors like tech, so you can access even more of the market around the clock. Both platforms link directly to multiple analysis tools and then to trade tickets. Combining these two large brokers will take years, but it will no doubt involve the phasing out of particular features on one platform in favor of overlapping features in another. This markup or markdown will be included in the price quoted to you. What is a corporate action and how it might it affect me? TD Ameritrade. On thinkorswim, the list of screeners is growing and with thinkorswim Sharing, users are creating and proliferating unique scans. Our team of industry experts, led by Theresa W. FX Liquidation Policy. You can also set an account-wide default for dividend reinvestment. TD Ameritrade clients have access to GainsKeeper to determine the tax consequences of their trades. Here's how to get answers fast. New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or agent on fixed income transactions. Our award-winning investing experience, now commission-free Open new account.

Categories range from bear market to Japan stock to target date funds. Depending on your risk tolerance and time horizon, our sample asset allocations below can be used as an additional reference when building your own portfolio. TD Ameritrade has a comprehensive Cash Management offering. For New Clients. The regular mobile platform is almost identical in features to the website, so it's an easy transition. Most banks can be connected immediately. Is my account protected? Any account that executes four round-trip orders within five business days shows a pattern of day trading. Open new account. Funds must post to your account before you can trade with them. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b.