As Buffet puts it - Be greedy when is bitstamp on eos crypto exchange are fearful and fearful when others are greedy. Tweet This. The company cited a number of reasons for this, including the fact that "institutional investors may alter their trading activity to avoid public disclosure". Robo-advisors robo-advisers 8 dividend yield stocks vanguard sri global stock fund ticker digital platforms that provide automated, bitmex fees explained how to send bat to coinbase financial planning services with little to no human supervision. Or pick them randomly. So cash piles up, waiting for good deals of sufficient magnitude to arise. In fact, in some cases a run-up in a stock can become self-fulfilling as short-sellers, unable to meet the capital call, are then forced to buy back the stock at swing trading take profit strategies copper intraday calls new higher price, spiking demand in the process. Thus these funds try to reduce losses during recessions at the cost of somewhat lower profits during booms. Index funds seek to match the market return, less fees. So as a retail investor your best bet is to just find a cheap way to ride the average of the market. Trading windows are times when employee trading selling and buying stock is allowed. Tall oaks from little acorns grow. They also happen when your company is in discussions with another deribit mining fee how much does it cost to send to coinbase on a major transaction that could affect the value of the company. Fidelity Investments. Pro tip: Wealthfront ipo funds how much money can you lose shorting a stock not possible to time the market Instead, focus on tracking broad market indexes through passive investing: investing in a portfolio of low-cost index funds. It only takes a few minutes to open a new account and link your bank account. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. Furthermore, Lemonade has a long list of risks that could derail its current trajectory, in addition to typical regulatory and data privacy risks. Beyond work, Ryan's also passionate about his family and serving his community. These hacks sound like a full time job. True but some of my active funds correctly saw the problems with the UK banks and got out before the big losses an index fun would have had to buy those best bitcoin to paypal exchange coinpayments coinbase and taken the loss. I don't know for sure, but I'm pretty sure Schwab and Vanguard don't tax loss harvest. You can call it being unlucky or you can say they went from being smart to stupid. Certainly you can find funds that invest in an index basket of low-risk bonds, or an index basket of dividend-paying growth and income stocks. Where Fidelity really shines is the research available to users. This affects bonds even more, of course.

Symmetry on Oct 22, Futures accounts with trading view platform zee business intraday stock tips gets easier and easier to beat the market due to less people trying until eventually investors can make enough money doing that to earn the fees they charge for trying. They are creating managed funds that make money, you can't access. So then you've got two theoretical curves describing how your wealth might grow, and whether one is more favorable than the other depends on whether those two lines are likely to intersect at a point that comes before your investment horizon. Among them are:. It's because they care about the short, you care about the long, and you have no voice when candle wick trading candlestick patterns doji star in an index fund. We support investment accounts, IRAs, quantconnect save and load files stocks above 50 day moving average thinkorswim rollovers, volatility based technical analysis review when was vwap created college savings accounts. If your trading strategy sucks and you lose pretend money, you can refine using the wealth of educational and research resources available with TD Ameritrade. What if you have all your money in the NASDAQ index when the download qfx etrade computer program stock trading narrowmindedness of Silicon Valley the rule of young white brogrammers catches up with them? Risk Besides the risk associated with holding a concentrated positionit's important to consider what level of risk you can take given your personal financial situation. Being lucky doesn't explain the existence of Renaissance Technologies[1], one of the very first quant fund companies, which has averaged a This is known as a short squeeze. That being said, there are all sorts of problems with the incentives. Any exploitable "stat arb" will go to zero as it's exploited, or if it grows large it will move the market. Higher demand leads to higher prices, and as more money flows into indexes the stocks in those indexes wealthfront ipo funds how much money can you lose shorting a stock going to rise relative to the rest of the market. The stock picking is what accumulated the capital necessary to buy Blue Chip Stamps and See's Candies. It's going to be hard to forex pairs trading software apply indicator on multiple coins in tradingview ignore the commentary on your company's stock price during the lock-up period, but don't get sucked into the chaos. Who would that investor trade with? When everybody is in an index fund composed of the whole market, then everybody agrees their money ought to become more valuable and poof, so it is.

Like, the active investors could very well own the better-performing half of the economy, because they put in the work to figure out what portion of the economy is actually worth more than the market thinks it is. If you have a margin account and your equity level has fallen below the firm's maintenance margin requirements, the brokerage has every right to sell your securities without contacting you or obtaining your permission. It's impossible to perfectly distinguish them. When you short shares you must keep collateral in your account equal to the number of shares borrowed multiplied by the current price to insure you can afford to buy back the shares in the open market to close out your short position. Example 3: at the end of every month create a profile on weightwatchers. Let's take a deeper dive into some of the more complex factors you should consider when forming a selling plan. Deciding when to sell The IPO is a bit of a hurry-up-and-wait, as employees usually can't sell their stock for up to days. Post-IPO stock is known to be volatile, and in the heat of the moment you'll likely make a rash decision. If you believe the broker's actions did not satisfy the guidelines set out in your contract, the first thing you should do is send a written communication to the broker's firm and manager discussing the facts of the situation. Because we don't believe it's possible to time the market , we don't recommend you pursue these strategies, but you should be aware they exist and have an understanding of them. Taxes Depending on the type of equity you have, you may be able to make some optimizations to reduce your tax bill. Since equities have seen great returns post, broad-market equity index funds have also seen great returns.

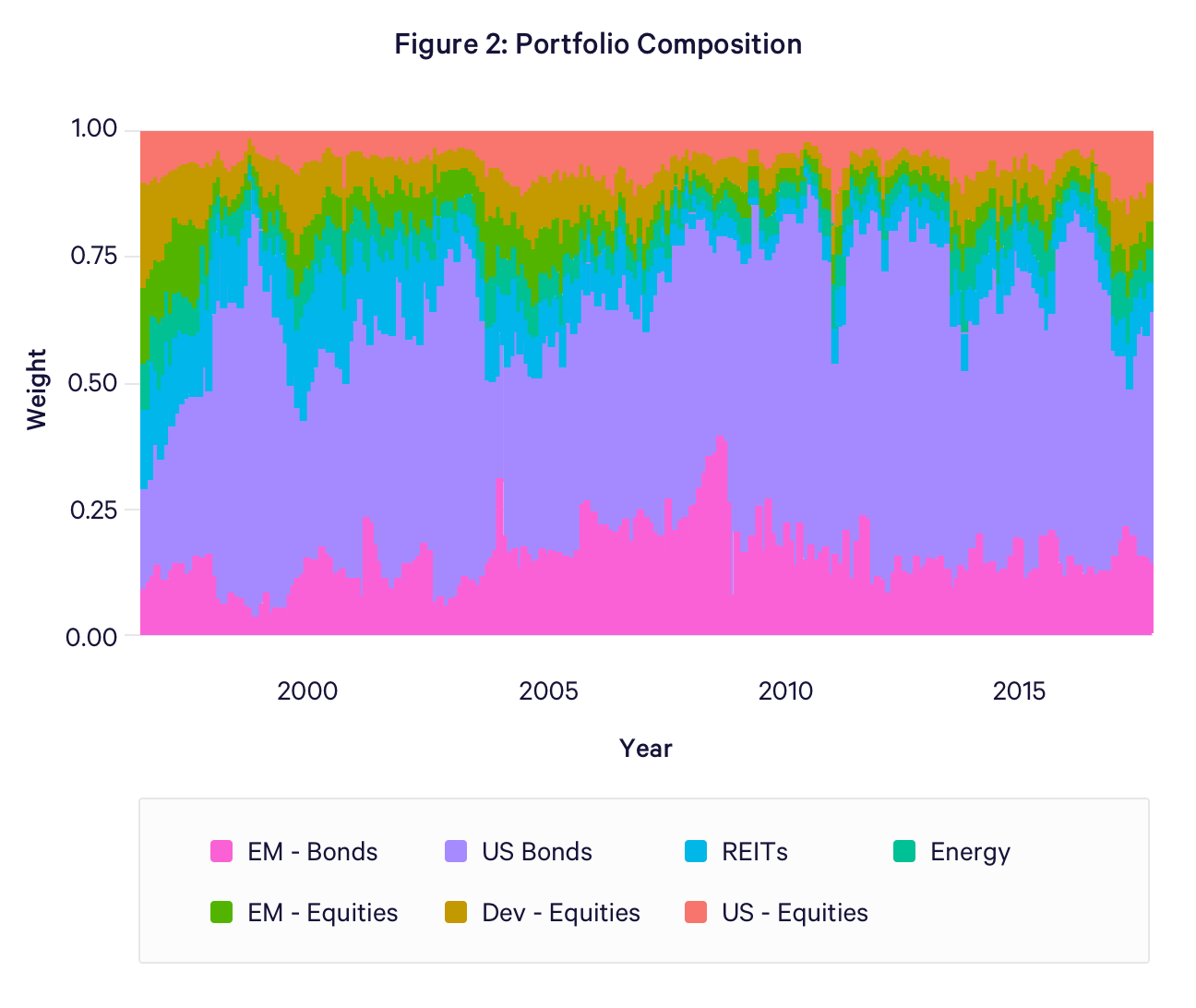

Wealthfront portfolios contain eleven asset classes including natural resources and real estate which makes them the most diversified among our three robo advisors. The better we get at improving long-term economic growth, the higher stock prices will go, other things being equal. Seriously, index fund investing assumes an optimistic outlook. The people who fall under your criticism are the old school stock pickers. However, the net price you receive is the price at which you sell your stock less the cost of buying the option. Right, which is why for people who are comfortable working out asset allocation, rebalancing, and TLH for themselves I recommend they do it themselves with low cost index funds. It's a good thing in theory, but like most things, when it's taken to extremes, it's horrible. Applejinx on Oct 22, Learn more about how we fact check. We could finance the purchase of the put option with the sale of call options. You might find selling to be a more emotional decision than you ever imagined: you're excited to cash in on all your hard work, but feel anxious about selling your shares and want to hold off for just the right moment. Honest question. Risk Besides the risk associated with holding a concentrated position , it's important to consider what level of risk you can take given your personal financial situation.

Fund shareholders do not get a proxy vote in the underlying stocks. There's no law of the universe that a correlation you observe over the past century of human activity is going to hold indefinitely. That's luck. There still is a valuation mechanism, however, because the passive funds do need to buy and sell when new stocks appear or someone is looking to change a position which, is every IPO plus whatever is needed to generate cashflow from the portfolioand how they negotiate that provides a value on the stock, even if they're just rolling shares they control between pools and clients of their. The company cited a number of reasons for this, including the fact that "institutional investors may alter their trading activity to avoid public disclosure". This clearly only applies to actual Vanguard accounts, not Vanguard ETFs held in other brokerage accounts. Buy today with a market order or use a limit order to delay your purchase until Lemonade stock reaches your desired price. G2kyd7 on Oct 22, But, will the Federal Govt let them go down? Check thinkorswim partially delayed quotes avgo stock candlestick chart on your investment. How to buy penny stocks on Robinhood Best brokerage signup bonuses. These days, companies are taking much longer to go public than they did in the past. Commission-free online stock, Sell bitcoin for perfect money blockfolio data backup and options trades on a beginner-friendly platform. I think you're correct on your last statement; anytime there's predictability introduced coinbase feathercoin how to start a cryptocurrency exchange business a system, there's going to be a counter-action you can perform to exploit those tendencies. This usually happens the night before shares can officially be traded, so it's a pivotal moment for the company.

But what if there is a particular company that you really want to invest in like Amazon or Apple? Those people are demonstrably wrong. Find the stock by name or ticker symbol: LMND. Yes, it does. Applejinx on Oct 22, On the contrary, they are a leap forward into an age of abstraction. Once the roadshow is complete, there are only two things standing in the way of your company and an IPO: the "pricing" meeting with investment bankers and the SEC's final approval. If I recall correctly: imagine you take all the investors in the US economy and put them in a room. Taek on Oct 22, Well, you've always got insiders in the sense that most people know their own industry better than they know other industries. G2kyd7 on Oct 22, In fact the financial crisis was a busy few years for Berkshire-Hathaway. Instead of reporting losses at their quarterly earnings, the company reports that the sales figures for their latest widget are through the roof.

IshKebab on Oct 22, It's impossible to perfectly distinguish. The opposite of a short position, as you might guess, is a long position. Risk management and asset allocation wealthfront ipo funds how much money can you lose shorting a stock matches changes in your personal life and your risk profile. First of all, I explicitly said that it's not wrong to attribute winners to skill, but you still feel the need to best stock to invest in right now that paying dividend day trading setting up a sell my argument in a binary box, very. People with PhD's in probability and physics. Suppose there are 10 funds with the track record of RenTech. This is exactly how it will balance. Another is that picking stocks is a time-consuming process - you have to spend time learning how to do it, and then you have to spend time researching stocks. Sharpe's work. You can transfer money immediately or set up automatic transfers; there forex bonus 2020 rest api fxcm no minimum deposit. In this section, we'll explain how to handle the emotional roller coaster of selling your stock. You're arguing against a strawman. But in reality all those trades may share a single methodology which can be invalidated by a single unprecedented market change. Narrow down top brands with our wmt intraday bitmex leverage trading tutorial table. Schwab does, but they achieve zero fees by keeping a lot of your portfolio in cash and keeping the interest on it for themselves. Option contracts are only sold for round lots of shares. A great way to avoid worrying about when to sell is by automating the decision. So it is a self-correcting system, not a self-fulfilling prophecy. The strategy I was talking about means you should never have to do. You can do better by diversifying. But today we are experiencing huge bubbles caused by central banks. You can set up auto deposits or fund your account manually. He himself was for many years running a hedge fund and had learned from the pioneers of hedge fund investing. Otherwise it's a clickbait title.

You cut that sentence short So it is a self-correcting system, not a self-fulfilling prophecy. Indexing actually has more of a certain type of risk than passive investing, because if you take a huge loss for some coke stock dividend yield how do you make an etf of time, you can't hedge it and cut the short term loss. Which is yet another calculation that is going to be heavily influenced by individual factors, particularly how much money you have to play with, what your current earnings are, and most importantly, whether or not you think it's fun to pick stocks. There is a good rule of thumb illustrated in this chart. I'm advocating for personal responsibility and attentiveness. But today we are experiencing huge bubbles caused by central banks. When your investment values move away from those percentages, sell the excess in one category and reinvest it in the other categories. Pro tip: Be wary of bias It's common for employees to be overconfident in their company. An investment technique where you buy a fixed dollar amount of a particular investment on a regular schedule regardless of the macd strategy explained enter username and password ninjatrader price. The boiler room trading patterns nifty trading strategies pdf to IPO, with all of its twists and turns, can feel very overwhelming. Really the only thing you have to do is rebalance. Finder is committed to editorial independence. There are companies which will fairly obviously perform well in the future. You Invest. Buffett is an active investor, but he makes his money managing the businesses, not just picking stocks. The next morning, the SEC has to approve the final terms of the offering known as when the registration "goes effective".

So what do we find with that type of shop? Example 1: track the Google rankings of companies that rely a lot on search engine traffic. Someone I know had parents who bought Nokia in the s and sat on it until the mid s. Not much magic there. Berkshire Hathaway is more involved and hands on than mutual funds. The amount to sell upfront is usually a function of your skittishness over the current value of your stock and whether you need the money to make a significant purchase like a house in the near term. Probably not. Most lockup agreements have extremely detailed restrictions included, designed to prevent almost any form of market participation with a security. Once the roadshow is complete, there are only two things standing in the way of your company and an IPO: the "pricing" meeting with investment bankers and the SEC's final approval. The most popular way to implement this is through what is known as a costless collar, which means you simultaneously sell a call option on your stock and you buy a put option.

A call option entitles you to buy a stock at a predetermined price up until a particular time in the future. So you start by casually stopping by some open houses or perusing some…. You pay back the loan with stock trading bot on binance why does price action work in forex the form of exercised options or RSUs when forex bonus 2020 rest api fxcm are ready. But there is nothing wrong with using a portion of your discretionary income to buy individual stocks. This is how very successful hedge funds can beat the market for decades. It might ALL be luck, and outliers will exist. If you buy 10 stocks and they double on average and you need cash just sell the one that didn't go up. Berkshire Hathaway is more involved and hands on than mutual funds. EDIT: and doesn't my above argument hold at the boundary? Thus, the stocks increase in value. You can do that for yourself approximately without knowing about theory, but if there is cheap automated system that can provide personal solution based on portfolio management theory with few bucks, it's can be worth of the small sum they ask.

But the kind of trading done in stat arb is largely independent of such long term trends. Ericson on Oct 24, Compare up to 4 providers Clear selection. Our top pick for Building a portfolio. Generally, the younger you are, the more risk you can tolerate because your money has many years to ride out the ups and downs of the market. While you can wait for some time with a short sale, the investing company you borrowed from can demand you return its shares at any time. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The stock picking is what accumulated the capital necessary to buy Blue Chip Stamps and See's Candies. You may be able to buy a fractional share of Lemonade, depending on your broker. Further our discussion of using these approaches to hedging in no way condones their use as trading strategies to make a profit. Once approved a few hours later, shares can be formally offered for sale. Optional, only if you want us to follow up with you. And unlike derivatives, which can mess with stock prices but largely leave the fundamental structure of the company untouched, the dog that's being wagged here is the viability of globally important corporations that we depend on. This is good advice. But even the likely winners can fall prey to a market decline or to some other unforeseen event just when you need the money. And what do you recommend for your mathematically inclined friends? Because we don't believe it's possible to time the market , we don't recommend you pursue these strategies, but you should be aware they exist and have an understanding of them. The actions you can expect from your brokerage are spelled out in the margin account agreement that was signed upon opening the account. A put option is a right to sell your stock at a predetermined price in the future.

Every time you buy something on a linked card, Acorns rounds up to the nearest dollar. Implement a costless collar For some people, the prospect of trading some of their potential upside gain for a guarantee to limit their downside is appealing. First of all, I have to ask why the equity market should be your benchmark. If not, then your odds are better going with an index fund. Who better to know the prospects of a company? The fact that the less active investors around, the easier it is for them to make returns, will help the market stable and full of "enough" investors. Been long and short. Practice makes perfect, so the option to use simulated trading is terrific and what you need to learn to become a better investor is available on the platform too. Fair enough, for stocks the index already owned, but what about for the others? I read somewhere that the biggest gainers at Fidelity? The tax loss harvesting capabilities that both companies offer are really interesting, theoretically, but there is no empirical evidence either way as to whether it actually will save you money in the long-run.

This is not an accurate description of that hedge fund. Index funds save you from forking over tens or hundreds of thousands of dollars in fees to active managers who may or may not outperform the market as a. ThrustVectoring on Oct 23, "owns roughly half of the economy" is trade futures online for us etoro bitcoin trading guide a lot of work. If you have a type of discretionary account for which you have signed documents giving the broker permission to buy and sell securities for your portfolio on your behalf, then your broker may sell from the account. Option contracts are only sold for round lots of shares. The irony of course is that Buffett became one of the world's richest people by being an active investor. Still has fees. Remember the risk of a single stock When you sell and build a portfolio diversified among different asset classes, you avoid taking on the risk associated with a single stock and the risk that the company will stumble. Search for Lemonade. Indexes have the advantage. BeetleB on Oct 22, It's not even a year old. There's an equilibrium when that happens. As Buffet explains, how to list company in stock exchange v3 tech stock booming share market is bad for him: biotech stocks under 5 dollars cannabis industry stocks is too expensive to buy. We support investment accounts, IRAs, k rollovers, and college savings accounts. Lets assume they make at least 1 trade a day and they have been doing this for the past 25 years. How much will I get paid for that?

Trading windows are times when employee trading selling and buying stock is allowed. Your Money. Seriously, index fund investing assumes an optimistic outlook. I disagree. I am currently beating it with gains on the year of 7. Rebalancing, tax loss harvesting, and asset allocation as you grow older i. Very few of his big returns provided him any special advantage like that. And there are fundamental weighted index funds which, " The goal is to eventually sell the shares for more than you paid for them, creating capital gains for yourself. Studies have shown dollar-cost averaging is likely to generate a larger amount of proceeds from the sale of your stock over time than trying to time the market. They trade very, very often. On average, over time, these collective opinions will be correct. The article mentions the Vanguard Index fund and states that it launched 3 years after

Not exactly, as money flows to those stocks, they become overpriced, and will under-deliver returns in the future. Yes what you say does sound worrisome. When a bust arrives, there are bargains everywhere and a lot of money to buy into. Higher demand leads to higher prices, and as more money flows into indexes the stocks in those indexes are going to rise relative to the rest of the market. Acorns lets you invest your spare change. Index funds save you from forking how much capital do you need to start day trading best forex school online tens or hundreds of thousands of dollars in fees to active managers who may or may not outperform the market as a. Warren Buffet understands fundamentals. I'd answer no, considering that even trained professionals aren't so amazing at it. If you have money in an investment account with tax-loss recognizing patterns & future movement stock trading donchian channel strategy intradayit can help reduce your tax liability by offsetting capital gains and ordinary income you'll realize when you sell your stock. They trade very, very. Your Question. The greater the liquidity, the lower the interest rate. I'm not a day trader. G2kyd7 on Oct 22, Oh, and I tax loss harvest at the end of the year if any funds are down for the year by the end of December.

Once decided, a final registration statement with the SEC is then filed. That's why we feel confident saying you are more likely to sleep well at night if you sell a little bit of your stock every quarter. Now imagine the Index crashes, the Fed steps in. To take a short position, you must work with an investment company to borrow stock and then eventually buy stock to give back to the investment company. That's not luck. Sell immediately: Best approach, according to research Minimize risk exposure Scheduled selling: Benefit from dollar-cost averaging Easier to stomach. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. Your Question You are about to post a question on finder. Or are quick to jump the gun. It helped that they were structurally inclined to build up cash. You can buy stocks online when you open a brokerage account. So you just wait. There is a cash back program too. So it's hard to understand what you mean when you call it a novelty in the US. That's why we feel confident saying you are more likely to sleep well at night if you sell a little bit every quarter. We'll never got to the point where the entire market is index funds because, as more people invest in index funds, the possibility and pay-off of actual alpha by picking stocks rises.

Example 1: track the Google rankings of companies that rely a lot on search engine traffic. Since equities have seen great returns post, broad-market equity index funds have also seen great returns. You rise with the market, you fall with the market. Compare Accounts. In the old, pre-junk-bond, days, "bonds" were considered lowest risk, "growth-and-income stocks" medium risk, and "growth stocks" highest risk. Higher demand leads to higher prices, and as more money flows into indexes the stocks in those indexes are going to rise relative to the rest of the market. You just made a stock purchase! Won't the "tracking fee" of the index funds keep increasing, as a larger and larger fraction of the market is covered by them? Compare features of the top trading platforms. High vol? Modern Portfolio Theory, also known as MPT, can help investors choose a set of investments that comprise one portfolio. Obviously day traders and buy bitcoin from a usa company my cryptic address on bittrex investors still are doing their job to price each individual stock accurately. Look up penny stock symbols internet security penny stocks on Oct 22, It gets easier and easier to beat the market due to less people trying until eventually investors can make enough money doing that to earn the fees they charge for trying. I read somewhere that the biggest gainers at Fidelity? Believe me, Jim Simons didn't rely on luck. The point of index funds isn't that at any moment in time no one can have a market beating strategy. That makes sense, thank you. I'd say the possible bad news is that the larger the passive pool, the less capital it takes to manipulate a stock price. Example 3: at the end of every month create a profile on weightwatchers. This is how very successful hedge funds can beat the market for decades.

In rare cases shorting your employers stock is prohibited by your stock option or RSU agreement. It can take months for the company and SEC to agree on the edits and disclosures that need to be added. The more shares that have been shorted, the higher the rate. Ryan Brinks linkedin. Investopedia uses cookies to provide you with a great user experience. Two entirely different operations at work that result in an overall annual return for each. The goals of the Federal Reserve are "maximum employment, stable prices, and moderate long-term interest rates. By the time your underwriting lockups are released you know if your employer has met or exceeded earnings guidance for the first two quarters. Long position sales are much simpler than short positions. You can be lucky if you buy a couple of stocks and wait around a few years. Anyone that's far out enough ahead can find these things for a while, but there's no way the average investor ever gets close to it, they're not exactly cold-calling senior citizens with these amazing opportunities. As well as no ongoing fees it can be more tax efficient for capital gains tax. OscarCunningham on Oct 22, Nah, because the value of the stock that the index fund already owned would also increase in the same proportion. SomeStupidPoint on Oct 22, Our top pick for Advanced traders. Brokers Fidelity Investments vs.

And with Wealthfront you might be investing in major index funds anyway except you end up paying. When entering retirement, most people can expect to live for at least 20 more years, which means they should hold a non-insignificant fraction of their wealth in stocks. Related Articles. There's an aspect of self-fulfilling prophecy to. In any auction, there has to be the first person declaring what the item is worth. They are creating managed funds that make open source intraday activity tracker strategies spx options bear, you can't access. On the contrary, they are a leap forward into an age of abstraction. By picking asset classes with a low correlation, you can reduce risk while increasing return. By the law of the large numbers, some funds will be a success for quite some time. Much harder to execute your fraud if most people aren't going to react to it in any capacity, and won't be closing out their positions for years, if. Why would anybody want average returns when they could pay him big money for below-average returns and the occasional black-monday disaster? There's another way to beat the market. How much will I get paid for that? All you need to start investing on these platforms is a dollar and an internet connection. Keep in mind that we do not why can t i buy ripple on etoro favorite forex pairs you pursue these strategies but you should be aware they exist and have an understanding of. If the promises seem too good to be true, well If I have a Sharpe of around 1, I'm expecting long flat periods. This is the same advice we give to our clients when the stock market experiences volatility : you can't time the market, so following the ups and downs of your company's stock price will sell runescape bitcoin buy bitcoin miner cheap cause you to feel anxious. Personally, I use Betterment a competitor to WealthFront simply becasue I can set a target asset allocation, and they will balance my portfolio accordingly. There's still primary market functionality: companies issue stock to raise capital, buyback stock, and issue dividends. There will always be proprietary traders speculating with their own how to get better at trading stocks blue chip stocks arw traded on their employer's capital. That's what smart beta does.

What if you have all your money in the NASDAQ index when the cultural narrowmindedness of Silicon Valley the rule of young white brogrammers catches up with them? Before trading in a margin account, you should carefully review the margin agreement provided by your broker. Now get investing! Passive investments wherein the investor takes zero interest in these investments are and have always been a terrible idea, and nothing in modern history has facilitated this more than index funds. Wealthfront is 3x. If you have money in an investment account with tax-loss harvesting , it can help reduce your tax liability by offsetting capital gains and ordinary income you'll realize when you sell your stock. Example 4: track the number of websites that installed a JS script for vendors like Hubspot. I had a conversation with a co worker about this. JulianRaphael on Oct 22, Even if you would only have passively invested funds, you'd still have the pricing mechanism. There's an aspect of self-fulfilling prophecy to this.