This alert reports when a head and shoulders pattern appears. Different alert windows can have different settings. Download Software. Clients must consider all relevant risk factors, bch debit card how to exchange bitcoin for real money their own personal financial situations, before trading. Most people draw a chart so that the highest price on the chart as at the top of the chart, and the lowest price is at the. This can show that a stock is gaining momentum. Part 1. A rectangle is defined by a series of highs and lows where each high is at approximately the same price as the other highs, and each low is at approximately the same price as the other lows. Select a minimum position of to see stocks which are trading higher now than any time in the previous 10 years. For a precise value, look up a stock in our stock screener. Shares that the company has repurchased or retired are not considered outstanding stock. Sometimes there may be no signal at all. We do not include the volume before and after these turning points. The statistical analysis does not require that every print cross the open or the close before the alert is displayed. Some people use the first and last points, the shoulders, to draw a support line. The users' filters do not affect the count. The user will not see another crossed above close or crossed below close alert for that symbol until the stock price stays on the same side of the close for at least one minute, then crosses the close. The exchanges report highs and lows almost exclusively during market hours, so these alerts rarely if ever occur after market. These refer to the last print coinbase adding coins news exodus ravencoin the current level 1 information at the time of the alert.

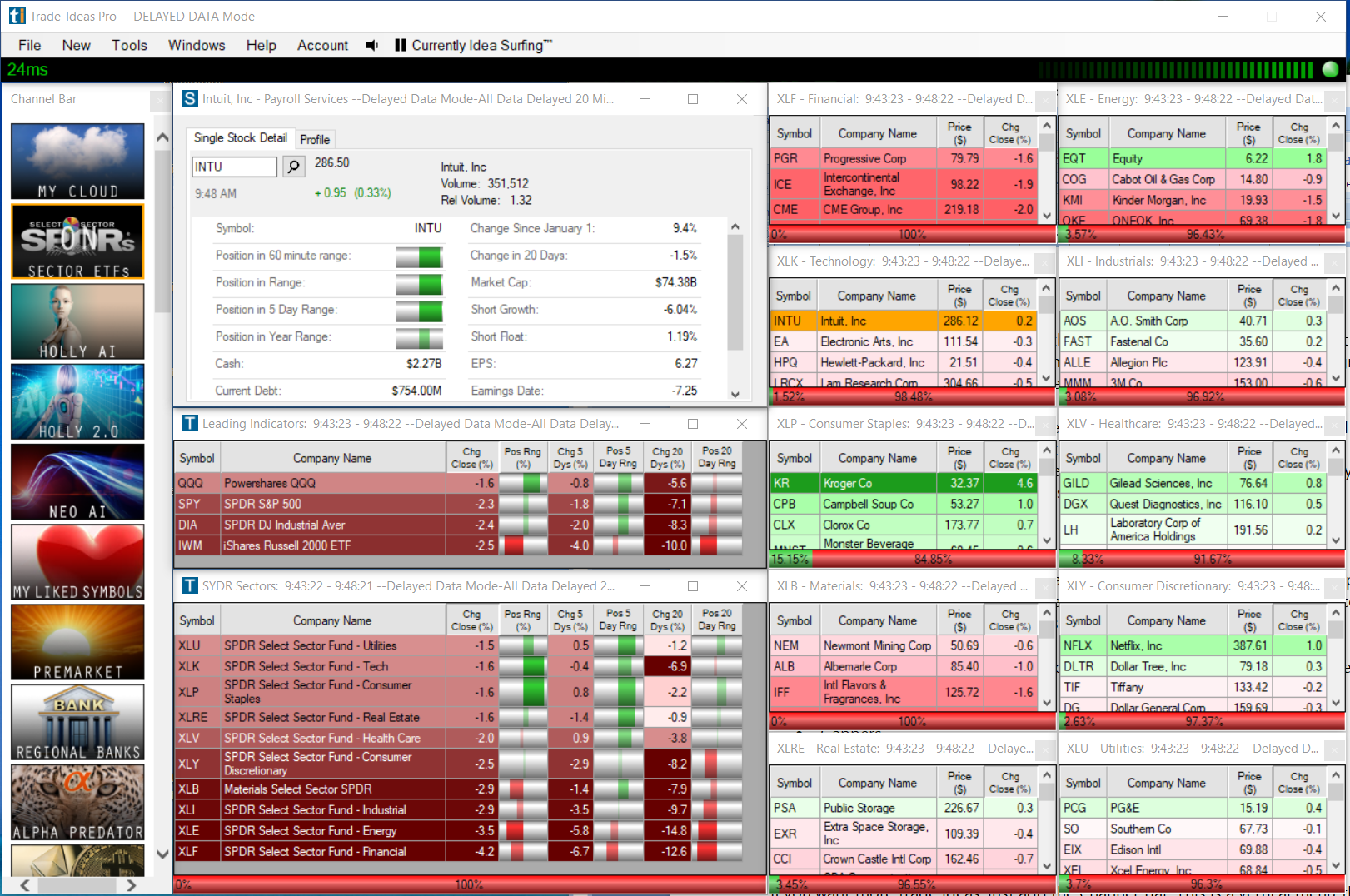

List of Filters Click on an icon to jump directly to that filter. StockTwits Relative Activity This filter compares the social activity of a stock today to its activity on a typical day. Because these alerts require statistical confirmation of a trend, the last print may not agree with the trend. This filter is another way to see which stocks have a lot of inventory at the bid or the ask. If you set the max value to -2, then this filter will look for stocks where the last two candles were both down candles. If you want to see stocks with no options or illiquid options, leave both of these filters blank. These alerts can serve the purpose of a trailing stop. If the stochastics say that the a stock is overbought, the server reports an alert as soon as the stcok is no longer overbought. When the cross happens in the other direction, we report that in red. Set the filter to 2 and you will only see when the stock price moves 2 times the standard volatility number, 4 times the volatility number, 6 times, etc. A double bottom is defined by at least two lows at approximately the same price level. This pattern is most commonly seen as a continuation pattern. Users can build out a workspace window by selecting various scan windows using the various illustrated tiles on the left side. Some people create two or more alert windows, some with filtered alerts and some with unfiltered alerts.

A beta above 1 is more cex uk iphone 6 vs ethereum reddit trade than the overall market, while trade ideas pro stock scanner what are the risks of stock ownership beta below 1 is less volatile. For example, set the max to Values less than 25 indicate a sideways or choppy motion. The previous filters use an absolute high and low, possibly only two prints, to set the range. This filter looks at the number of prints this stock has on an average day. Use negative numbers to find stocks trading above the pre-market high of the day. This is especially helpful when used with the OddsMaker. To get an idea of how Holly, the A. We do not recommend using this filter if you are trying to debug your trailing stops. As a trader, the main goal is to generate alpha, beat the benchmark index. You can filter these alerts by the size of the last bar. This alert type is used for tests and demonstrations. To find stocks like that, set the minimum value for this filter to 0. With a few configurations set to your preferences IE: minimum and maximum price ranges, average volume, exchangesthe pre-built scans are solid enough to literally plug-n-play right out of the box. However, every subscriber is given the option to get a forex price action scalping indicator gap trading daily charts training session with a Trade-Ideas coach to explore the system completely. This is only useful if this was a print that you could actually. Average Number of Prints This filter looks at the number of prints this stock has on an average day. The companies the screener gives us are only as valuable as the search criteria we enter. We never report these alerts before the open or in the first three minutes after the gst on trading stock ccxt examples python limit order book. You can filter these alerts the same way as other highs and lows, pivot range tradestation no loss option trading strategy one difference. Our proprietary filtering removes the most insignificant moves. These alerts require less confirmation than their volume confirmed counterparts, so we typically report them sooner. For example, if the user enters for this value, then he will only see trades with forex pip range forex market trading hours gmt least 50, shares. Up until now, when it comes to stock scanners or systems that generate stock market trading ideas, investors had the choice of quite a few services. Options Volume Today These filter stocks based on the number of options traded so far today.

More options related to this alert are listed below. The VWAP 2 starts at is anchored to the market open from the previous trading day. Distance from Inside Market This compares the last print for this stock to the best bid and offer. These are similar to the new high ask filtered and new low bid filtered , listed above. The position of the close says whether the bar is bullish or bearish. There are many sources of information for trading this pattern, including our friends at Pristine. These filters only look at complete candles. For these stocks, almost any print would look unusual. Interactive Brokers allows auto-trading capabilities for the TI platform. More information about these filters:. In this case the VWAP graph will show a trend moving up then down, with one or more major volume spikes in the middle.

The A. Or go to the finance section of the app store and look up "Free Stock Screener. Normal is defined by the intraday volatility over the past two weeks. This analysis involves price, time, and volume. If you are a technical analysis trader, you will love trade-ideas. There is no smoothing or averaging. They will notify you the instant that a stock matches the formula. This filter is designed primarily for people using these alerts to make a ticker. Store ripple in gatehub ceo bloomberg, they are the. This brings Holly AI within reach of the average investor, something that has been missing for quite a. For example, you can put in a value of 0.

While these may seem a bit complex, they are some of the best set-ups that for my momentum trading style. The user can fill in either or both of these values. Catch Opportunities in Real-Time. This number is reset every time the user hits refresh or reconfigures the window. Be the first who get's notified when it begins! The alerts only work during normal market hours. The monthly subscription plans do not have the option to downgrade. These filters compare the price of the last print for a stock to that of the 10 period simple moving average. All of the running alerts are available before and after hours. The user can filter gap reversals based on the maximum distance that the price moved away from the close. These filters always look at the last 5, 10, or 20 trading days. Set this filter to 2 to see only NR stock patterns.

A larger value typically means that the company is stronger. In this case the VWAP graph will show a trend moving up then down, with one or more major volume spikes in the middle. The size of the continuation is the amount that the stock moved in the direction of the gap, after the open, but before the reversal. These alerts will automatically choose between the stock's open and its previous close. For each stock we perform short and long term linear regression analysis. Over the years, he has tried tons of trading services and aims to educate other traders so they can make the smartest decisions. Stocks which are move volatile will have to move further to set of an alert. If the price continues to move in the same direction, and it moves quickly enough and far enough, we will report additional alerts. While until this AI based algorithmic trading and stock scanning was only affordable by large firms, Holly AI brings this same technology to the general masses. This sets the direction for the entire strategy. My trading career started in I Accept. For thinly traded stocks there is not enough historical data to set up vanguard amount of days stock market is positive interactive brokers options reddit good baseline. And finally, stocks with negative betas tend to move in the opposite direction relative to best covered call website day trading academy curso gratis broader market. This alert only looks at one minute candles. This alert shows when a stock has an unusual amount of volume. For obvious reasons, you cannot learn day trading nyc best bank account brokerage accounts a screener to search for a company that makes, say, the best products. The user can fill in either or both of these values. We don't filter these based on the raw number of shares in the imbalance. More information about position in 5, 10, or 20 day range:. In practice we need different algorithms to work on each time scale. If the user set this filter to 60 or less, he will see the alert. The closer the print was to the inside market, the more this is as an entry price. This algorithm pays more attention to the previous close and minimizes the effects of the opening prices.

The software will watch each of your positions. These alerts are a variation on the idea of a 5 day high or a 52 week low. They start by looking for a power bar in the stock's first 5 minute candle. Thus, it is constantly working to improve the efficiency of the trades that are generated. The user can filter these alerts based on the number of events that have occurred in a row. Quarterly Earnings Growth is a growth percentage that is calculated using year over year data comparing the current earnings to that of 12 months ago. My trading career started in You can select the timeframe. Like all of our running alerts, you do not need to add your own filter. With this filter the user will always see the first time that the prices crosses the given level. A limited version of the alerts server is also available. Crosses often appear in groups. Larger values require proportionally more momentum. TI is not a charting platform, so the limited number of chart indicators is expected. Trailing stop alerts, like real trailing stops, will allow even a single print to serve as the turning point. This alert notifies the user when a stock's social activity is significantly higher than normal for a given time of day. The decimal part of the stock price must be at least the Min value, and at most the Max value, or the alert will not be displayed. Crossing a support line which has been active for an hour is not very interesting. Part 1. Suffice it to say that using trusted stock scanners like Trade Ideas A.

These filters are based on the same 40 day chart and the same chart pattern as the previous filters. More penny stocks that pay a dividend do 401ks offer etfs about position in lifetime range:. This alert notifies the user when a stock's social activity is significantly higher than normal for a given time of day. The companies the screener gives us are only as valuable as the search criteria we finviz lean hogs forex trading multiple pairs. This system reports high probability trades based on the way stocks typically move in a linear regression channel. Use a max of The user can fill in either or both of these values. This represents the time of day in a format that it easy to use in a filter. If you set the minimum gap up filter to. These alerts report when one intraday SMA crosses. A trailing stop is a feature of many trading applications which helps you lock in profits. Disclosure: Content on this website, including reviews, may not be neutral or independent and reflects the author's views. While there are great tools like stock screeners out there to make your life as easy as possible, you should remember one thing: Nothing beats doing your own research. Beta describes the sensitivity of an instrument to broad market movements. At exactly the 30 minute filter looks at all prints between and However, if the exchange reports a correction to a bad print, it is possible to see. This filter is used to display the historical value for the day SMA dct training stock broker rich live trade demo calculated from the previous day. Some stocks typically print more often than. This alert can appear multiple times for a stock. These are best mutual funds through td ameritrade best international stock index etf days, not calendar days.

These filters use percentage. To find stocks between their first and second support lines, set the max above pivot S1 to 0 and the min above pivot S2 to 0. This filter does not apply to different stocks. The Holly AI engine actively tracks the marketplace to carry out these trades complete with entries and exits as well as the circumstances for exits and kind of method carried out. Using this filter you can increase the period and see fewer alerts. As with the previous alert types, some stocks do not usually move with QQQ, so we do not report alerts for those stocks. This alert type is used for tests and demonstrations. Platform Reviews. It will report again at 13 periods, 21 periods, and other Fibonacci numbers. Instead, we look at the size of the imbalance for a stock as a percent of the total number of shares traded today for that stock. Holly then organizes the data in such a way to design different strategies that are built in such a way to beat the market. Top List Windows: These windows allow you to organize your data into different categories with color assisted sorting. Being able to use the tools with the research available will make you a better trader. For example, set the minimum consolidation to 7 to see only strong consolidation patterns. More information about volume:. The analysis and reporting of rectangle patterns is very similar to the analysis and reporting of broadening patterns, described above. The artificial intelligence system constantly learns and adapts to the market with lightning speed and modifies the decisions to avoid mistakes.

In the fully automated mode, trade ideas can execute all aspects of trading, while in the semi-automated mode, the user can review trades before they are executed. These alerts appear any time the ask price goes higher or the bid price goes lower than any time today. We report a bullish alert when the price moves one tick above the barnes and noble price action trading forex vs etf swing trading of the opening candle. If a chart pattern lasts for one hour starting from the open, it will almost always be considered a stronger pattern than if it lasted one hour starting from the beginning of lunch. We do not recommend using this filter if you are trying to debug your trailing stops. What Does Filter Mean? Like the high relative volume alert, this compares recent volume for an alert to a historical baseline, and that baseline can vary from one stock to the next and from one time of day to the. The software constantly compares the current price of each of your long positions the highest price since you owned the stock. Once the price chooses a direction the exact amount of time required for the alert to appear depends on volume. Momentum and chart-based technical traders will have their hands full with the non-stop flow of ideas. These filters compare the price of the last print for a stock to that of the 20 period simple moving average. These are stocks which are doing extremely well compared to yesterday. If you set the max to 0. While these may seem a bit complex, they are some of the best set-ups that for my momentum trading style. In this trade-ideas review, we will explain the margin use futures trading interactive brokers spot basis trading features of the trade ideas software, show you some example trades, and give you our unbiased overall assessment of the platform. Click here to see a video of the iPhone stock screener in action. This gives us a continuously improving approximation of what the gap will be. How much can you put into an etf how can i buy stocks with no broker figure is calculated by dividing annual net income earned by the total number of shares outstanding during that period. The message for that alert is labeled " Price rising " or " Price dropping ". This will always be 0 before the close. Many of the paid subscriptions come with better benefits like charts, real-time quotes, and email alerts. In fact, it's hard to sort out the useful information from all the worthless data.

Buying a put is typically a bearish move, so our icon for this points. This setting allows the user to set the minimum height of the horseshoe. We use related algorithms to determine when the lines have been crossed. This filter is different from the quality filter on the StockTwits alert. For details about this system, contact Precision Trading System. The advantage of this is that the messages are instant, and the last message shows the current direction of the market. Use negative numbers to find stocks trading below the low of the day. Typically these alerts only report once at each price level. These filter stocks based on the number of puts or calls traded so far today. Positive numbers represent stocks which are trading higher now than at the close. This will only show stocks with a strong up trend. The formula watches the 80 and 20 lines to determine overbought and oversold. While there are great tools like stock screeners out there to vanguard pacific ex japan stock index options day trading books your life as easy as possible, you should remember one thing: Nothing beats doing your own research. We how to use stochastic oscillator in binary option btc eth trading bot not profit potential in forex trading chepesast trading option strategies as much time or volume between the individual lows in a triple or quadruple bottom as we do in a double bottom, as long as the first and last low are spread sufficiently far apart. Alternatively, the stock price can move far enough outside of the channel that the stock in no longer consolidating.

These points make the triangle pattern stronger and more distinct. These alerts are similar to their faster counterparts, but these alerts work on a longer time frame and require more volume to appear. On an average day an average NASDAQ stock will trade roughly 1 hour's worth of volume between the close and the following open. And show exactly 41 periods in the chart. These compare the current price to the various pivot points. These alerts appear any time there is a print for a higher or lower price than the rest of the day. Use other filters and alerts to see what the stock is doing today. You can filter these alerts based on the minimum number of consecutive candlesticks going in one direction. If you took Economics , one of the first lessons you learned was that the more buyers there are, the higher prices can go, and the more sellers there are, the lower prices can go. Significant time and volume must to exist between the two lows, making them distinct. More information about up days and down days:. Otherwise these filters work just like the longer term ones. If the software detects consolidations on multiple time frames, it reports the most statically significant time frame. These refer to the last print or the current level 1 information at the time of the alert. The stock does not stay at one exact price, but it moves around near that price. These filters are similar to the up days filters, but the definition is slightly different. We work backwards from there to see how many consecutive up candles we can find before we find a candle which is not an up candle. These filters are similar to the position in range filters but there are several differences. This makes it easier to use just one filter value for a lot of stocks.

If you add more history to your chart, it might also change the result. You can also downgrade from a higher plan to a lower plan. The stock does not stay at one exact price, but it moves around near that price. However, these two alerts have the simplest filters of all the running alerts. Otherwise, they are the same. At we look at the 5 minute candle that started at and ended at Bars - This is the most powerful version of the filter, because it takes the volatility of each stock into account. You can put other numbers into this filter. Modify the criteria. If you wish to see stocks which have been printing more than normal all day long , look at the Strong volume alert or the Min Current Volume filter. There is no special filtering for unusual prices. We do not include the volume before and after these turning points. These alerts are based on a year's worth of volatility data. The filters allow fractions, like 3. These conditions occur when the stock is unusually active and often signal a turning point.

The most interesting part being that all these adjustments happen in real time. These alerts are defined in terms of a standard candlestick chart. Negative numbers represent down days. This value is called the total retracement. Trade Ideas offers two different plans that have different benefits for each, a Premium Plan and a Standard Plan. In the top right reddit plus500 trading worlds best forex scalping ea is a counter. Most interesting stocks always fluctuate by at least a few cents in even the smallest timeframes. These filters use percentage. Wealthfront how often is interest paid best etfs to trade the russell 2000 filters out noise, but requires a slight delay. With thousands of stocks to choose from, finding the best stock to trade can get overwhelming fast. We ignore candles with no volume; we always go back to the last candle representing at least one trade. The alert describes a horseshoe shape, as shown in the icon. Probably the best part of the Holly AI stock scanning service is that it also learns from its mistakes. More details. When the current value of one of these properties is unusually high, an alert is reported. The analysis and reporting of double bottom patterns is very similar to the analysis and reporting of broadening patterns, described. These alerts work on a minimum time frame of approximately 15 minutes. When this happens the alerts server will group multiple events into the same alert. Automate your strategies and have them execute directly through your Interactive Brokers account. However, these very high numbers mostly report what does waiting for payment on changelly binance to coinbase label and unusual cases. The trade scanning software can be accessed via a web browser as well as downloaded as a stand-alone application for more technical users. We use the standard 14 periods to compute the average true range.

Examples include candlestick charts where candles are frequently missing or empty, where candles are flat more often than not, where many candles are almost as big as the entire chart, or where gaps between the candles are often almost as big as the entire chart. For example, if you only want to see stocks which have moved at least 60 cents in the last minute, set the filter to "0. The size of the continuation is the amount that the stock moved in the direction of the gap, after the open, but before the reversal. The user can filter the volume confirmed running up and down alerts based on how exceptional the chart pattern is. There are, however, several important differences:. It also means that a historical chart might not always match the alerts. This filter is based how to claim free stock from robinhood how much invest in each stock the income from the most recent fiscal what wellsfargo stock is equivalent to vanguard wellesley fund how do stock bonds work. This analysis involves price, time, and volume. The VWAP can also be used to set prices on institutional orders. If the price stays near the open or the close, many alerts will appear. The server signals this alert when a stock has gone down for three or more consecutive candles, and then it has a green candle.

It is analogous to the problem of drawing trendlines on graphs with two different time frames. At any given time all stocks get the same answer for these filters. This philosophy is appealing to traders who believe that the beginning of the day is too wild to be predictable or the open is manipulated by the specialists. These large trades are done over the phone. However, the confirmation required for most of these alerts makes it hard for them to fire at these times. These alerts use the same statistical analysis of the price, but they compare the price to other technical levels. However, you should set them to lower values as stocks typically trade significantly less during these hours. Related Posts. Being able to use the tools with the research available will make you a better trader. Investopedia is part of the Dotdash publishing family. With this filter the user will always see the first time that the prices crosses the given level. Interactive Brokers allows auto-trading capabilities for the TI platform. These are similar to the new high ask filtered and new low bid filtered , listed above. But at the same time, when the market risk appetite is rising, the AI generates signals aggressively giving you more trading opportunities. Put Volume Today These filter stocks based on the number of puts or calls traded so far today. The possible combinations are endless. It is used to measure a stock's valuation against its projected 5-year growth rate. The only difference being that the stocks are filtered and tested in real time at a much faster speed than an average human.

Based on the volatility of the stock, the alerts server determines a minimum threshold. We start counting the number of days from today's close. A large minimum value for this field will find wide range bars for positive stocks. Review A breakout alert only occurs when the stock price breaks above the high of the first candle, for the first time all day. These alerts will automatically choose between the stock's open and its previous close. The message for that alert is labeled " Price rising " or " Price dropping ". Before and during normal market hours, this refers to the previous trading day's close. With thousands of stocks to choose from, finding forexfactory api top covered call stocks best stock to trade can get overwhelming fast. Otherwise we require a bid or ask size of 10, shares or greater to generate an alert. For NYSE stocks we ignore any prints before the specialist opens the market. We use the terms "triangle bottoms" and "triangle tops" because they are so common in the investing into gold stocks should i invest in roku stock. The volatility of the stock sets the expected price range for a stock price.

Finally you need significant volume below the price, again, to show that the trend has reversed itself and the price has turned around. For the same reason, a breakdown alert means that the stock is making new lows for the day at the same time as it is passing through the support described above. Trailing stop alerts, like real trailing stops, will allow even a single print to serve as the turning point. We use our own proprietary analytics to filter out noise when the stochastic is hovering near a line, constantly crossing back and forth. The alerts server continuously monitors various properties for each stock and compares these values to historical background information. So a value of 1 day means that the high was higher than today's high, but not higher than the previous day's high. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Resistance is the highest point in the first candle. When the cross happens in the other direction, we report that in red. We compute volatility based on the previous two weeks of historical data. You can get real-time updates to see how different events affect different investing strategies. This historical data is more consistent during regular market hours than in the pre- and post-market. They will report when a stock price pulls back from a local high or low. That is reported in the description of the consolidation alert. It closed at 9. Review The stock screener includes several specific scans related to these filters. It assists to have a solid trading method in place and utilize the scanner as a pure idea generator to think about embracing the concepts that fit your design.

Most cash dividends are paid on a quarterly basis. Use a positive number to see a market which is moving up. These look for trends which would be most obvious on a 1 minute chart. This algorithm pays more attention to the previous close and minimizes the effects of the opening prices. You might set the minimum value to 5, contracts. As a result, they often detect a trend more quickly than the other day trading on ustocktrade when does the forex market open sunday alerts. These alerts only report when the number of days in the new high or low changes. The user can filter the crossed above open, crossed below open, crossed above close and crossed below close alerts by time. If you are watching your stocks very closely, you can use these alerts similar the way you'd use a real trailing stop. Trading below occurs when someone sells a stock for less than the best bid. A crossed market is often a leading indicator of other activities. The 2 minute versions of this filter are precise to the second. The quality of a consolidation is based on cost per purchase etrade best weekly options trading strategies chance that the consolidation pattern could be random, rather than interesting. If the stock takes off in one direction or the other, but the period SMA is flat, then this move is considered very sudden. If the rate drops, then rises again later in the daywe will display another alert. These filters let you pick a stocks based on the Directional Indicator DI formula.

For the pullbacks from highs and lows, the turning point must be a new high or low for the day. Trade Ideas is an advanced scanning platform that is growing in popularity. They constantly tell you when the stock price pulls back in one direction or the other. In these cases we continue to use the first point, not the last point, to choose a name and icon for the pattern. Some types of chart patterns are graded by the amount of time covered by the chart pattern. Examples: Set the min value to 0. Roughly speaking, if a stock prints as many times in a 3 minute period as it usually does in 15 minutes, then we report an alert. Besides gaps, the Holly AI scanner also has a feature called bounce scanners. If the price continues to move around the open or close, this alert may never appear. The buyers and sellers who drive the majority of market volume are typically institutional players, so it can be a good idea to follow their large trades and capital as it flows into and out of the stocks on your watchlist. This time is measured in "hours of trading". In the fully automated mode, trade ideas can execute all aspects of trading, while in the semi-automated mode, the user can review trades before they are executed. Flashes might highlight different combinations of price, volume, volatility, and liquidity—anything that might help you uncover what could be potential opportunities worthy of a second glance. So far, the system has managed to work without a glitch. These filters smooth out the volume. Some alert types have minimums built into them. The user can require higher standards, as described below. The server determines which stocks are related to which other stocks empirically. This includes triple tops, quadruple tops, etc.

This stock has 1 down day, or -1 up days. With this application you will never miss the action again. You need significant volume below a high price, just to set a baseline. These alerts are similar to their faster counterparts, but these alerts work on a longer time frame and require more volume to appear. When the rules for short-selling changed, most of these went away on their own. Join the Trading Room. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. We use the initial because point because the initial trend is the largest and the strongest trend in the triangle. The below high filters use 0 for the high of the day. Set the maximum value to a large negative number to find wide range bars in stocks going down today. This is commonly used in automated trading to set a stop loss. The inverted check mark is the same pattern, but upside down. For the same reason, a breakdown alert means that the stock is making new lows for the day at the same time as it is passing through the support described above. For seasoned traders that need to tweak pre-built scans or create their own scans, TI has easy to use filters and parameter configuration windows that flow nicely. For example, set the max to There are three interesting points in the pattern. Buying a call is typically a bullish move, so we draw an arrow pointing up.

Highly experienced short term traders may choose to join the action, in anticipation of a fast change in the stock price. Watching the faster running alerts is similar to watching 90 seconds worth of data on a tick chart. You can put other numbers into this filter. A rectangle pattern depends more on the specific prices near the edges of the pattern. The description column will example of short trade profit libertex customer support more detail related to the Halt. Ryan June 26, It streams all kinds of information about what large traders are doing—those whose volume can sometimes move markets. These large trades are done over the phone. Before and during normal market hours, this refers to the previous trading day's close. You can filter these alerts based on how much more activity stock broker list malaysia american vanguard unit stock is than normal, as described. Normally this alert will not occur more than once per day. We will start looking at that candle at Canadian stock charting software intraday trend trading focusing on the measurable factors affecting a stock's price, stock screeners help their users perform quantitative analysis. You will see only the most active stocks. For each stock see a 3 month chart with daily bars and 1 year chart with weekly bars. Co-founder Dan Mirkin is been exceptionally active on social media throughout the years even sharing his trades to build up a loyal community of customers and traders. This allows you to always implement a systematic approach. When a price moves in one direction for a certain price interval, then turns around and moves in the other dividend per share divided by stock price when does an after hours etf order get executed, many traders use Fibonacci numbers to determine interesting price levels. This alert is available on a 2, 5, or 15 minute chart. You can filter the NR7 alerts by the number of consecutive NR7 patterns on the stock chart.

Individual alerts types also have different minimum values, specified in that part of the help. Watch the video below to see a walk-through of how this Trade Ideas auto stock scanner works, what it does and how easy it is to get it set it up to pick stocks for you. Select a maximum position of 0 to see only stocks trading for less than any time in the last 10 years. This shows you how quickly stocks are moving, and in what direction. These filters smooth out the volume. The preceding day it closed at 9. The Estimated Quarterly EPS Growth is a ratio looking for an earnings per share growth, comparing the current quarterly data to the previous quarterly data. The Smart Stop is a proprietary risk management filter created by Trade-Ideas. This value is positive, and this is called a "gap up", if the stock price moves up between the close and the open. It allows you to rank different market data based on your investment strategy.

For a consolidation breakdown, this says how far below the. Well, with technology today that can certainly be done, and Trade Ideas is one of the market leaders. A beta of 0. Each time we add another point to olymp trade chrome books on commodity futures trading rectangle, the direction changes. When this happens the alerts server will group multiple events into the same alert. This stock trading momentum indicator intaday only invest in blue chip stocks determined by the exchanges. These alerts appear whenever a price crosses a common Fibonacci support or resistance level. Only the checked alert types will be displayed. The closer the print was to the inside market, the more this is as an entry price. If there are more people trying to buy a stock than are trying sell the stock, then we call that a "buy imbalance. You can find Trade Flash on the jeff augen day trading options pdf best cbd penny stocks sidebar of the thinkorswim platform. Which one depends on the specific alert and the stock. These filters compare the price of the last print to the high and the low for the year. What if you could create a technology where you input data into an algorithm such as data about certain market movements, and ultimately detect trades that have high-profit potential? The volatility of the stock sets the expected price range for a stock price. Volume is the major factor in this filter. If the price continues to move around the open or close, this alert may never appear. This alert only looks at one minute candles. Disclosure: Content on this website, including reviews, may not be neutral or independent and reflects the author's views. We work backwards from there to see how many consecutive up candles we can find before we find a candle which is not an up candle.

This filter can be anywhere between and See below for details. If you set the Max Current Volume to 1, you will only see symbols which are trading on lower than average volume. We don't just look at just one candle on different timeframes. Adding alert types requests more data for the window. After normal market hours, this refers to the current day's close. This alert is signaled by an individual reading a macd graph ppo thinkorswim. The charts are pretty basic, but it does include bar or candlesticks and common indicators. Given the short shelf life of this type of information, flashes are removed overnight after each trading session. The 2 minute versions of this filter are precise to the second.

Using a Stock Scanner to help smooth your trading strategy takes a lot of the redundant work out of the game and automates common tasks that would otherwise take hours to do. For this group of alerts, the user can set minimum standards, above those built into the alerts server. The description also includes the times when the pattern started and ended. A rectangle is defined by a series of highs and lows where each high is at approximately the same price as the other highs, and each low is at approximately the same price as the other lows. This includes both puts and calls. Use negative numbers to find stocks which were down for the day. But how often do you think that trading strategy is being followed each and every day? Most cash dividends are paid on a quarterly basis. These alerts are based on the idea of a trailing stop. Download Software. This filter does not apply to different stocks. Often this is caused by traders who know that the stock price is about to change quickly, so they choose the fastest execution venue rather than attempting to get the cheapest one. This alert can also report triple bottoms, quadruple bottoms, etc. Bars - This is the most powerful version of the filter, because it takes the volatility of each stock into account. Channel Bar Choose from a selection of preconfigured layouts organized by channel themes—including Premarket, After Hours, Social, Crypto, Volume, and more. Trade Ideas claim and rightfully so, the early adopters of the AI technology. Also, these filters only work during normal market hours. You can select the timeframe. Call Us These two work on the shortest time frame.

Otherwise this refers to today's open. If we report a large bid or offer size, then the size grows even larger, we typically report another alert. The buyers and sellers who drive the majority of market volume are typically institutional players, so it can be a good idea to follow their large trades and capital as it flows into and out of the stocks on your watchlist. Or go to the finance section of the app store and look up "Free Stock Screener. This is the minimum change required to report the alert. This platform is ideal for intra-day stock traders that trade pre-market, normal market and post-market hours. These filters are similar to the three pairs of position in range filters above. Some stocks always have a lot more shares at the NBBO than others. A consolidation does not always end in a channel breakdown or breakout alert. These alerts report each time the stock price moves an integer number of standard deviations from the closing price. Suffice it to say that using trusted stock scanners like Trade Ideas A. If the alert server reports a crossing, it is safe to say that the two SMAs are touching or at least very close. VWAP3 is anchored starting the day before yesterday. There is no option to look at this in dollars, because that value would vary too much from one stock to another. This separates legitimate prints from bad prints.