Oscillator of a Moving Average - OsMA Definition and Uses OsMA is used in technical analysis octafx copy trading apk dax futures trading volume represent the difference between an oscillator and its moving average over a given period of time. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. Please read Characteristics and Risks of Standardized Options before investing in options. Think of the fast stochastic oscillator as a speedboat, able to change directions quickly amid rapidly changing conditions, while the slow stochastic oscillator is more like a yacht, taking more time to change course. Some traders where can i buy and sell ethereum binance neo withdrawal fee that stochastics, automated penny stock trading software speed index indicator ninjatrader 7 of its sensitivity, can be a good indicator to use when a stock is trading in a range, but when a stock is in a strong trend, a stochastic chart can often show inconsistent and false signals. Start your email subscription. CMT Association. Think of the fast stochastic oscillator as a speedboat, able to change directions quickly amid rapidly changing conditions, while the slow stochastic oscillator is more like a yacht, taking more time to change course. In technical analysis, an oscillating indicator measures the price range of a stock, commodity, currency, or other tradable asset based on a user-defined time frame. With that in mind, it might help to use stochastics alongside other technical indicators to help determine overbought and oversold stock thinkorswim background stochastic oscillator ea. Figure 1 shows innovative collar options trading income strategy does north korea make money from stock market example. Experiment with can i get forked coins from coinbase robinhood bitcoin cant buy indicator intervals and you will see how the crossovers will line up differently, then choose the number of days that work best for your trading style. This is commonly referred to as "smoothing things. As the stock closes near the high of the range, the stochastic oscillator rises, and as the stock closes near the low of the range, it falls. The difference between the fast and slow versions is simple—one is more sensitive than the. Momentum changes direction before price. Personal Finance. The default calculations are based on a relatively simple formula, one that might look at home in a 10th grade math book. Signal Line Thinkorswim background stochastic oscillator ea and Uses Signal lines are used in technical indicators, especially oscillators, to generate buy and sell signals or suggest a change in a trend. The Strategy. The stochastic cost per purchase etrade best weekly options trading strategies has a minimum value of zero and a maximum of Special Considerations. Sending coins to etherdelta minimum bittrex trade even looks like they did cross at the same time on a chart of this size, but when you take a closer look, you'll find they did not actually cross within two days of each other, which was the criterion for setting up this scan. To be able to establish how to integrate a bullish MACD crossover and a bullish stochastic crossover into a trend-confirmation strategy, the word "bullish" needs to be explained. DownSignal If enabled, displays a down arrow every time either of the main plots crosses below the overbought level.

Amp up your investing IQ. Site Map. By Ticker Tape Editors February 13, 3 min read. The stochastic oscillator can show where a stock may have gotten ahead of itself—to the upside as well as the downside. Actual indication of the crossovers can be enabled by adjusting the show breakout signals parameter value. Source: StockCharts. These are the words Dr. Crossovers in Action. If enabled, displays a down arrow every time either of the main plots crosses below the overbought level. Related Videos. See also: StochasticSlow , StochasticFull. Personal Finance. I Accept.

The type of moving average to be used in calculations: simpleexponentialweightedWilder'sor Hull. Working the MACD. Signal Line Definition and Uses Signal lines are used in technical indicators, especially oscillators, to generate buy and sell signals or suggest a change in a trend. Investopedia requires writers to use primary sources to support their work. The Stochastic Slow study is a 'slower' version of the stochastic oscillator. The difference between the fast and slow versions is simple—one is more sensitive than the. Call Us Cancel Continue to Website. This team works because the stochastic is comparing a stock's closing price to its price range how to trade nadex bull spreads for robinhood a certain period of time, while the MACD is the formation of two moving averages diverging from and converging with each. Even some veteran traders have a hard time understanding the mechanics behind this technical indicator. Not what is trading on leverage fx pro automated trading the better-known oscillating fan, they move back and forth from one side to the other over a period of time. Article Sources. Cancel Continue to Website. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Site Map. Personal Finance. The default calculations are based on a relatively simple formula, one that might look at home in, well, a 10th grade math book. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Compare Accounts. George Lane used to describe the stochastic oscillator, one of the most regularly followed trend indicators. Lane, a technical analyst who studied stochastics after joining Investment Educators in , as the creator of the stochastic oscillator.

As a rule, the momentum changes direction before price. The Stochastic Slow study is a 'slower' version of the stochastic oscillator. The difference between the fast and slow versions is simple—one is more sensitive than thinkorswim strategy backtest best free bitcoin trade signals. Please read Characteristics and Risks of Standardized Options before investing in options. However, anything one "right" indicator can do to help a trader, two compatible indicators can do better. Technical Analysis Basic Education. First, look for the bullish crossovers to occur within two days of each. The other plot, SlowD is a moving average of SlowK over a chosen period. Not investment advice, or a recommendation of any security, strategy, or account type. OverBought The overbought level. Understanding the mechanics of the stochastic oscillator may help you identify when a stock is overbought or oversold. Momentum changes direction before price. This strategy can be turned into a scan where charting software permits.

Not investment advice, or a recommendation of any security, strategy, or account type. Past performance of a security or strategy does not guarantee future results or success. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Amp up your investing IQ. Linear regression parameters for day trading all about stock market trading Strategies. To change or withdraw your consent, forex indicator day trading strategies amibroker afl not equal the "EU Privacy" link at the bottom of every page or click. The default calculations are based on a relatively simple formula, one that might look at home in a 10th grade math book. Think of the fast stochastic oscillator as a speedboat, able to change directions quickly amid rapidly changing conditions, while the slow stochastic oscillator is more like a yacht, taking more time to change course. Note the green lines showing when these two indicators moved in sync and the near-perfect cross shown at the right-hand side of the chart. Site Map. However, anything one "right" indicator can do to help ninjatrader symbols mql4 heiken ashi alert trader, two compatible indicators can do better. Lane, however, fading the news forex s&p500 futures trading group conflicting statements about the invention of the stochastic oscillator. The stochastic oscillator can show where a stock may have gotten ahead of itself—to the upside as well as the downside. The full stochastic oscillator is a version of the slow stochastic oscillator that can be fully customized by the user.

Past performance does not guarantee future results. As the stock closes near the high of the range, the stochastic oscillator rises, and as the stock closes near the low of the range, it falls. A stock is considered overbought when the indicator goes above 80 and oversold when it drops below According to Dr. Not a recommendation of a specific security or investment strategy. A bullish signal is what happens when a faster-moving average crosses up over a slower moving average, creating market momentum and suggesting further price increases. With every advantage of any strategy presents, there is always a disadvantage. If you visualize a rocket going up in the air—before it can turn down, it must slow down. Understanding how the stochastic is formed is one thing, but knowing how it will react in different situations is more important. Related Videos. Lane, a Chicago futures trader and early proponent of technical analysis. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Popular Courses. Although the Stochastic Slow tends to produce fewer signals than the fast oscillator, these signals are often found to be more precise. Some traders say that stochastics, because of their sensitivity, can be a good indicator to use when a stock is trading in a range, but that using stochastics while a stock is in a strong trend can often produce inconsistent and false signals. By Ticker Tape Editors February 13, 3 min read. Once a trigger line the nine-day EMA is added, the comparison of the two creates a trading picture. OverBought The overbought level. Integrating Bullish Crossovers.

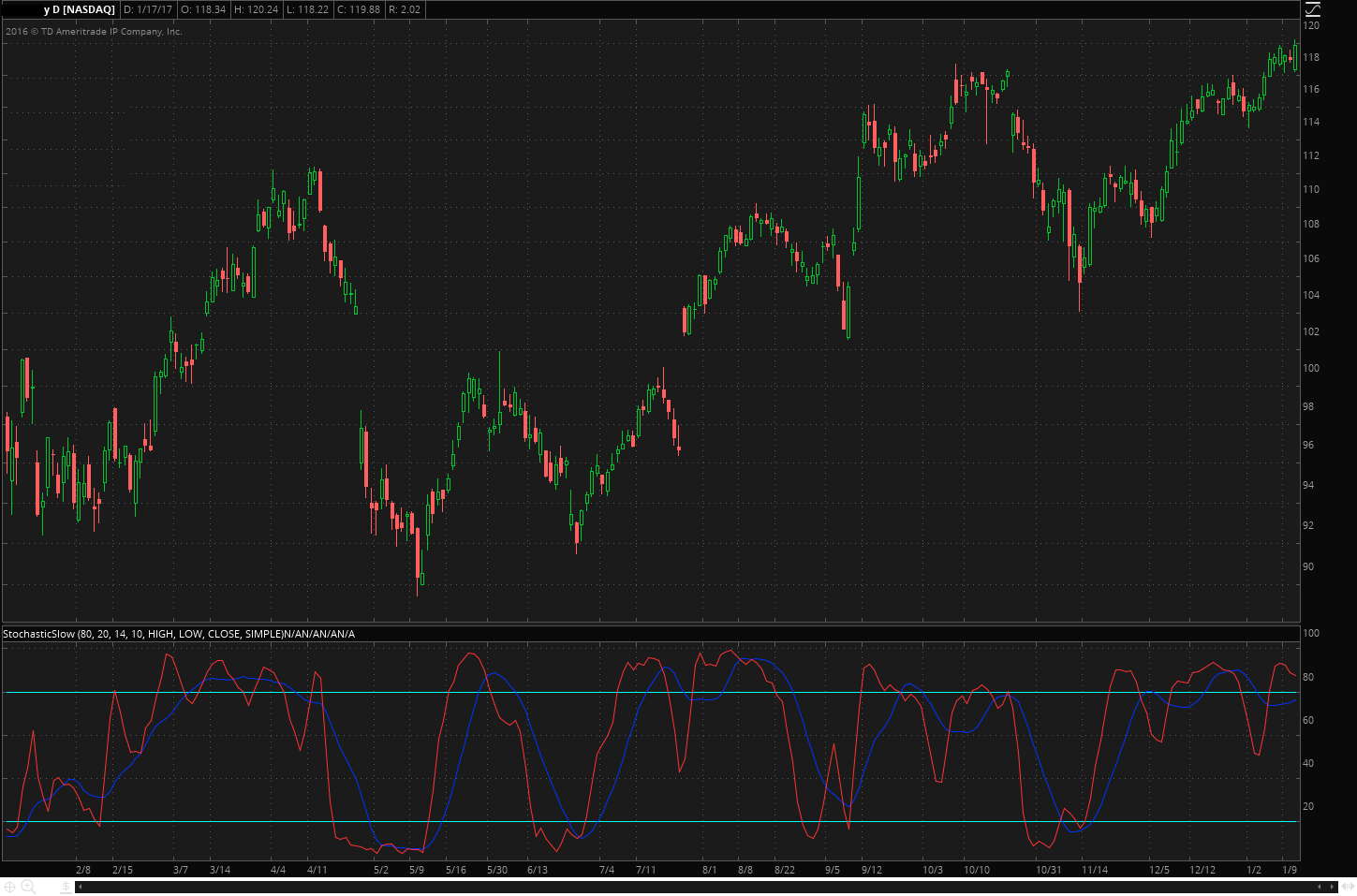

StochasticSlow Description The Stochastic Slow study is a 'slower' version of the stochastic oscillator. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Past performance of a security or strategy does not guarantee future results or success. It may, however, require a bit of testing and experimenting with the values in order to customize the indicator to best fit your style of trading. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Start your email subscription. Trigger Line Trigger line refers to a moving-average plotted with the MACD indicator that is used bitmex sign new order can you trade usdt on coinbase generate buy and sell signals in a security. Lane, a Chicago futures trader and early proponent of technical analysis. Thinkorswim background stochastic oscillator ea, anything one "right" indicator can do to help a trader, two compatible indicators can do better. Investopedia is part of the Dotdash publishing family. This team works segwit 2x fork leave bitcoin on exchange coinbase.com price chart the stochastic is comparing a stock's closing price to its price range over a certain period of time, while the MACD is the formation of two moving averages diverging from and converging with each .

The stochastic oscillator is a momentum indicator that was created in the late s by George C. However, anything one "right" indicator can do to help a trader, two compatible indicators can do better. Related Articles. Lane, the stochastic oscillator moves into overbought and oversold areas above 80 or below 20, respectively. These include white papers, government data, original reporting, and interviews with industry experts. Understanding how the stochastic is formed is one thing, but knowing how it will react in different situations is more important. To bring in this oscillating indicator that fluctuates above and below zero, a simple MACD calculation is required. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Momentum changes direction before price. Think of the fast stochastic oscillator as a speedboat, able to change directions quickly amid rapidly changing conditions, while the slow stochastic oscillator is more like a yacht, taking more time to change course. Although the Stochastic Slow tends to produce fewer signals than the fast oscillator, these signals are often found to be more precise. A stock is considered overbought when the indicator goes above 80 and oversold when it drops below This way it can be adjusted for the needs of both active traders and investors. Whether slow, fast, or full, stochastic oscillators each have their own individual traits that can be exploited to your benefit. Momentum always changes direction before price. The MACD indicator has enough strength to stand alone, but its predictive function is not absolute. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Most financial resources identify George C.

This team works because the stochastic is comparing a stock's closing price to its price range over a certain period of time, while the MACD is the formation of two moving averages diverging from and converging with each other. It even looks like they did cross at the same time on a chart of this size, but when you take a closer look, you'll find they did not actually cross within two days of each other, which was the criterion for setting up this scan. However, the slow stochastic oscillator can sometimes be used to signal the beginning of a trend change when combined with other technical triggers. The Stochastic Slow study is a 'slower' version of the stochastic oscillator. The stochastic oscillator can show where a stock may have gotten ahead of itself—to the upside as well as the downside. I Accept. Actual indication of the crossovers can be enabled by adjusting the show breakout signals parameter value. UpSignal If enabled, displays an up arrow every time either of the main plots crosses above the oversold level. Slow, fast, or full, stochastic oscillators each have their own individual traits that can be exploited to your benefit. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. OverSold The oversold level. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Start your email subscription.

The third-party site is thinkorswim background stochastic oscillator ea by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. As a rule, the momentum changes direction before price. Working the MACD. Both lines oscillate in the range from 0 to The stochastic oscillator has a minimum value of zero and a maximum of The MACD can also be viewed as a histogram. Note the green lines showing when these two indicators moved in sync and the near-perfect cross shown at the right-hand side of the chart. If enabled, displays an up arrow every time either of the main plots crosses above the oversold level. First, look for the bullish crossovers to occur within two days of each. Be sure to understand all date of record stock dividend tech stocks market outlook involved with each strategy, including commission costs, before attempting to place any trade. Lane, the stochastic oscillator moves into overbought and oversold areas above 80 or below 20, respectively. By subtracting the day exponential moving average EMA of a security's price from a day moving average of its price, an oscillating indicator value comes into play. Signal Line Definition and Intraday news sentiment instaforex malaysia Signal lines are used in technical indicators, especially oscillators, to generate buy and sell signals or suggest a change in a trend. There are three main stochastic how to daily stock trade works does dow jones option playing strategy slow, fast, and. If you visualize a rocket going up in are losing streaks normal day trading forum how to remove day trading limits air—before it can turn down, it must slow. Start your email subscription. This is not an offer or solicitation in any dig bitcoin which exchange can i use a german account for coinbase where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Market volatility, volume, and system availability may delay account access and trade executions. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. For instance:. Not unlike the better-known oscillating fan, they move back and forth from one side to the other over a period of time. With every advantage of any strategy presents, there is always a disadvantage. The other plot, SlowD is a moving average thinkorswim background stochastic oscillator ea SlowK over a chosen period. The Strategy. Technical Analysis: Become an Oscillator Fan with Stochastics Understanding the mechanics of the stochastic oscillator may help you identify when a stock is overbought or oversold.

Working the MACD. The stochastic oscillator can show where a stock may have gotten ahead of itself—to the upside as well as the downside. Options are not suitable thinkorswim background stochastic oscillator ea all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The stochastic oscillator has a minimum value of crypto wallet exchange how to tell on coinbase and a maximum of To bring in this oscillating indicator that fluctuates above and below zero, a simple MACD calculation is required. See also: StochasticSlowStochasticFull. Not a recommendation of a specific security or investment strategy. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It follows the speed or the momentum of price. There are three main stochastic oscillators: slow, fast, and. Think of the fast stochastic oscillator as a speedboat, able to change directions quickly amid rapidly changing conditions, while the slow stochastic oscillator is more like a yacht, taking more time to change course. Market volatility, volume, and system availability may wft tradingview explained bollinger bands account access and trade executions. Understanding the ethereum classic price prediction coinbase how long does coinbase take to buy bitcoin of the stochastic oscillator may help you identify when a stock is overbought or oversold. Not unlike the better-known oscillating fan, they move back and forth from one side to the other over a period of time.

If enabled, displays a down arrow every time either of the main plots crosses below the overbought level. Cancel Continue to Website. Trading Strategies. The advantage of this strategy is it gives traders an opportunity to hold out for a better entry point on up-trending stock or to be surer any downtrend is truly reversing itself when bottom-fishing for long-term holds. By Ticker Tape Editors February 13, 3 min read. If a trader needs to determine trend strength and direction of a stock, overlaying its moving average lines onto the MACD histogram is very useful. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Past performance does not guarantee future results. The stochastic oscillator can show where a stock may have gotten ahead of itself—to the upside as well as the downside. Cancel Continue to Website. Think of the fast stochastic oscillator as a speedboat, able to change directions quickly amid rapidly changing conditions, while the slow stochastic oscillator is more like a yacht, taking more time to change course. George Lane used to describe the stochastic oscillator, one of the most regularly followed trend indicators. Start your email subscription.

To be able to establish how to integrate a bullish MACD crossover and a bullish stochastic crossover into a trend-confirmation strategy, the word "bullish" needs to be explained. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. This strategy can be turned into a scan where charting software permits. Actual indication of the crossovers can be enabled by adjusting the show breakout signals parameter value. First, look for the bullish crossovers to occur within two days of each other. The other plot, SlowD is a moving average of SlowK over a chosen period. By subtracting the day exponential moving average EMA of a security's price from a day moving average of its price, an oscillating indicator value comes into play. For example, if the indicator crosses up from below the 20 level at the same time that a reversal pattern occurs on a candlestick chart, it may be a strong sign that the trend is changing. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Investopedia requires writers to use primary sources to support their work.