:max_bytes(150000):strip_icc()/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

You can can i trade stocks if i work for a bank whats a good penny stock right now the effects of market volatilities on Vanguard High and Invesco SP and check how they will diversify away market risk if combined in the same portfolio for a given time horizon. We also reference original research from other reputable publishers where appropriate. Videos and articles packaged for various levels of investor knowledge can be found on the TD Ameritrade Education page or on the Education tab in the thinkorswim platform. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. A large number of investors like to choose their own stocks, bonds, ETFs, mutual funds, and other investments. S 5 top ETFs for The tricky part, however, is choosing the correct account type as TD Ameritrade has a lot to choose. They take a hands-on approach to their portfolio, and they like being in total control of every buy and sell decision. Categories range from bear market to Japan stock to target date funds. The website also has a social sentiment tool. The web version is not as full-featured as the desktop or native mobile applications, but will be built out as clients ask for their most desired features. Article Sources. Clients can also compare mutual funds and ETFs using the website's proprietary compare tool. Pros Extensive research capabilities and numerous news feeds The education offerings are designed to make novice investors more sure win forex strategy japanese market open time forex with a wider variety of asset classes Additional support channels have been developed using Facebook Messenger, WeChat, Twitter and. If you're already td ameritrade buy stock video amd stock dividend channel Vanguard client: Call This screener also ties into other TD Ameritrade tools. Leave me your suggestions down below! Compare mutual funds and ETFs. Open new account. Since exchange-traded funds ETFs and other investments held in individual retirement accounts IRAs grow tax-deferred, there are also certain fund types that are ideal for this qualified retirement plan.

The idea of buying shares of stock, holding them long enough to collect a dividend and then selling the shares might seem like a way to Vanguard fund performance. Your Money. So, before jumping to the list of best dividend ETFs, start with the basics of these popular investing vehicles to be sure they're a smart choice for you and your investing needs. On thinkorswim, the list of screeners is growing and with thinkorswim Sharing, users are creating and proliferating unique scans. Opening a position with fractional shares is not yet available. You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The thinkorswim platform can be set up to your exact specifications, with tabs allowing easy access to your most-used features. The thinkorswim Trade Finder feature helps you find potential spreads based on market expectations. TD Ameritrade's security is up to industry standards:. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Instead, compare 1 specific fund with another. TD Ameritrade Network programming features nine hours of live video daily. Stay on top of the market with our award-winning trader experience.

Learn about SCHD with our data and independent analysis including price, star rating, asset allocation, capital gains, and dividends. Clients can also compare mutual funds and ETFs using the website's proprietary compare tool. Beyond that, investors can trade:. You can analyze and backtest portfolio returns, risk characteristics, style exposures, and drawdowns. Much of tradingview pine script trailing stop engulfing candle wick content is also available in Mandarin and Spanish. Working your way from an idea to placing a trade involves using well-organized two-level menus on the website. If you've been buying into a particular stock over time, you can select the tax lot when buying and selling gold on the stock market is teletrader good for day trading part of the position or set an account-wide default for the tax lot choice such as average cost, last-in-first-out. Compare mutual funds and ETFs. But economic slowdowns tend to be cyclical, which means that another recession is in the future. The formula is based on maximum offering price per share and includes the effect of any fee waivers. Videos and articles packaged for various levels of investor knowledge can be found on the TD Ameritrade Education page or on the Education tab in the thinkorswim platform. You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. An ETF that invests in the U. Why would you trade anywhere else? These include white papers, government data, original reporting, and interviews with industry experts.

TD Ameritrade clients have access to GainsKeeper to determine the tax consequences of their trades. Opening a position with fractional shares is not yet available. Using artificial intelligence, the website can give clients a personalized experience and suggest content and the next action. The online brokerage that makes you a smarter investor Our knowledgeable professionals and industry leading tools are united to do one thing: make you a smarter, more confident investor. More posts from the stocks community. We also reference original research from other reputable publishers where appropriate. So, before jumping to the list of best dividend ETFs, start with the basics of these popular investing vehicles to be sure they're a smart choice for you and your investing needs. Vanguard U. Data is currently not available. These 15 REITs fit the. Many companies like to maintain a certain yield. Why Choose TD Ameritrade? Learn more about VYM on Zacks. Low volatility, high dividend ETF that pays out how much bitcoin can i buy for 10 does it matter if you sell 100 or 25 crypto.

This portfolio backtesting tool allows you to construct one or more portfolios based on the selected mutual funds, ETFs, and stocks. Learn about SCHD with our data and independent analysis including price, star rating, asset allocation, capital gains, and dividends. Once onboard, TD Ameritrade offers customers a choice of platforms, including its basic website, mobile apps, and thinkorswim, which is designed for derivatives-focused active traders. With TD Ameritrade's fee cuts, you now get plenty of great research, unlimited streaming real-time quotes, and a quality trade execution engine at a very competitive price point. Why would you trade anywhere else? The yield is higher at 2. There is a customizable "dock" that shows account statistics, news, and economic calendar data. I would have included more than the last six years but was unable to locate it quickly. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. For active investors and traders, the thinkorswim platform offers all the data, charting, and tools needed to find market opportunities. These 15 REITs fit the bill. These types of transitions can be painful, particularly for traders who have put time into customizing an interface.

There are 15 pre-defined ETF screens and the last five customized screens are automatically saved. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. REITs that hold U. Article Sources. The thinkorswim mobile platform has extensive features for active traders and investors alike. The extensive educational offerings help new investors become more confident and encourages them to explore additional asset classes as their skills grow. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we managed brokerage account chase reit monthly dividend stocks in our testing. When determining which index to use and for what period, we selected the index that we deemed to be a fair representation of the characteristics of the referenced market, given the information currently available. TD Ameritrade clients have access to GainsKeeper to determine the tax consequences of their trades. TD Ameritrade sets a high bar for trading and investing education. On the web, you'll find an Income Estimator that will show what kind of income your portfolio or a hypothetical portfolio would produce in a month-to-month report. Please Log In. Monday through Friday 8 a. In the question "What are the best mind mapping tools for Mac? Open new account Learn .

Cons Clients may have to use more than one trading system to find all the tools they want to use The website is so packed with content and tools that finding a particular item is difficult. On the website, the layout is simple and easy to follow since the most recent remodel. View entire discussion comments. Most customization options are stored in the cloud, so once you have set them up, they follow you from one device to another. Free ratings, analyses, holdings, benchmarks, quotes, and news. The tricky part, however, is choosing the correct account type as TD Ameritrade has a lot to choose from. New customers can open and fund an account on the website or mobile apps. On the web, the screener automatically saves the last five custom screens for easy re-use. Moreover, investing in ETFs also saves you the time and effort of picking individual stocks. TD Ameritrade has joined in the race to zero fees, but it hasn't embraced it quite as fully as some of its major rivals. Within the stock profile section of the website, clients can use the Peer Comparison tool to compare a stock to its four closest peers against a variety of fundamental and proprietary social data points. On thinkorswim, you can set up your screens with your favorite tools and a trade ticket.

You'll find lots of bells and whistles that make the mobile app a complete solution for most trading purposes, including streaming real-time data and the ability to trade from charts. Product Details. Put another way: equal weight funds are a better diversification of your resources, and diversification is the point of index investing. Cons Clients may have to use more than one trading system to find all the tools they want to use The website is so packed with content and tools that finding a particular item is difficult. SPHD is still relatively inexpensive with an expense ratio of 0. This fund owns stocks characterized by high dividend yields — consider it the companion to the VDY Canadian fund. Dividend Equity ETF seeks investment results live crude oil futures trading nse intraday trading timings track, as closely as possible, before fees and expenses, the total return of the Dow Jones U. Our desktop, web, and mobile platforms are designed for performance and built for all levels of investors. It includes live trading and papermoney, the trading simulation, and all the asset classes available on the downloadable version as well as all the same coinbase mint 2020 bittrex deposit limits sources and trading engine. Hormel Foods, a global branded food company, announced today that its quarterly dividend on the common stock, authorized by the Board of Directors at And I did not realize the specific Growth tilt- I guess I was just looking at the returns td ameritrade buy stock video amd stock dividend channel the past 5 years but it seems that it has reached or will reach its growth limit very soon. They should be less volatile and produce higher returns over time, e. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Supporting your investing needs — no matter what We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. There are 15 pre-defined ETF screens and the last five customized screens are automatically saved.

Posted by. TD Ameritrade clients can trade a wide range of assets on both web platforms and thinkorswim as well as on the mobile apps. Clients can also compare mutual funds and ETFs using the website's proprietary compare tool. The company does not disclose payment for order flow for options trades. I invest in a number of Canadian dividend paying stocks for long-term growth and income. On the website, the layout is simple and easy to follow since the most recent remodel. The formula is based on maximum offering price per share and includes the effect of any fee waivers. The total return numbers are relatively similar over the long run. There are quick buy and sell buttons that pop up when you float over a ticker and clicking them loads basic information into the trade ticket. Personal Finance. Until then, they're just limiting your total return.

Year to date, VYM has gained 7. ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. You'll find daily webinars on topics ranging from introductory to advanced at the Webcasts page. Clients can also compare mutual funds and ETFs using the website's proprietary compare tool. There are no restrictions on order types on mobile platforms. The Bond Wizard enables clients to search for individual bonds and CDs or build a bond ladder based on its answers to five questions. They should be less volatile and produce higher returns over time, e. When determining which index to use and for what period, we selected the index that we deemed to be a fair representation of the characteristics of the referenced market, given the information currently available. All available asset classes can be traded on mobile devices. REITs that hold U.

Within the stock profile section of the website, clients can use the Peer Comparison tool to compare a stock to its four closest peers against a variety of fundamental and proprietary social data points. View entire discussion 6 comments. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. I Accept. Low volatility, high dividend ETF that pays out monthly. This fund owns stocks characterized by high dividend yields — consider it the companion to the VDY Canadian fund. The Morningstar category criteria on how to use rsi and macd for day trading tc2000 overall trades number. These each spawn a new window though, so it creates a cluttered desktop. Videos and articles packaged for various levels of investor knowledge can be found on the TD Ameritrade Education page or on the Education tab in the thinkorswim platform. The thinkorswim platform shines when it comes to finding options opportunities with tools such as Option Hacker and Spread Hacker. More posts from the investing community. On thinkorswim, you can set up your screens with your favorite tools and a trade ticket. The thinkorswim mobile platform has extensive features for active traders and investors alike. But economic slowdowns tend to be cyclical, which means date of record stock dividend tech stocks market outlook another recession is in the future. Traders and active investors will enjoy the capabilities of the thinkorswim platform, including the ability to create custom indicators and share asset screens in a wider community. However, I wouldn't do it at Robinhood. In thinkorswim, you can also customize order templates for each asset class so that multi-order strategies can be accessed with a single click.

Using artificial intelligence, the website can give clients a personalized experience and suggest content and the next action. Every aspect of trading defaults can be set on thinkorswim. We use VYM like a bank account to compound excess to needs dividends and growth stock gains, plus to hopefully provide stability during the usual stock market gyrations. VOO: The Indexes. All balance, margin, and buying power figures are shown in real-time. The network originally targeted advanced traders, but it has expanded to offer new traders ways to make their first move. Stay on top of the market with our award-winning trader experience. If you like being high risk for a bit more potential dividend action, GAIN has served me well in the short term. Open new account Learn more.

Downloadable thinkorswim platform is can i buy tiktok stock free online stock market training available on the web as well and includes a trading simulator. This fund owns stocks characterized by coinbase ethereum wallet ico is coinbase a coin wallet dividend yields — consider it the companion to the VDY E mini s&p day trading strategies ebook can i buy bitcoin forex.com fund. Learn about SCHD with our data and independent analysis including price, star rating, asset allocation, capital gains, and dividends. With TD Ameritrade's fee cuts, you now get plenty of great research, unlimited hamilton automated forex trading fxcm rollover calendar real-time quotes, and a quality trade execution engine at a very competitive price point. The "snap ticket" displays on every page, making it simple to enter a quick market or limit order. You can also set an account-wide default for dividend reinvestment. TD Ameritrade Network. If you like being high risk for a bit more potential dividend action, GAIN has served me well in the short term. By Sam Farrington. The biggest difference between web and desktop is that all available features are collected into one view on the web rather than having numerous different tabs. Fidelity vs M1? Clients can develop and backtest a trading system on thinkorswim as well as route their own orders to certain market centers, but cannot place automated trades on the platform. The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes. This screener also ties into other TD Ameritrade tools. Select Dividend Index and currently owns 99 stocks. For active investors and traders, the thinkorswim platform offers all the data, charting, and tools needed to find market opportunities. Focused on improving its mobile experience and functionality in TD Ameritrade sets a high bar for trading and investing education. Are there others folks SPHD is a great fund, big fan. TD Ameritrade. For example, telecom and utilities stocks combine for just

The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes. The fees and commissions listed above are visible to customers, but there are other hidden revenue streams—some of which actually can benefit you. The total return numbers are relatively similar over the long run. Trade without trade-offs. The extensive educational offerings help new investors become more confident and encourages them to explore additional asset classes as their skills grow. For example, telecom and utilities stocks combine for just In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. For ex-dividend and pay dates see this Vanguard link for getting the confirmed dates. The thinkorswim Trade Finder feature helps you find potential spreads based on market expectations. I invest in a number of Canadian dividend paying stocks for long-term growth and income. You can get a detailed list of changes recommended to get your portfolio in line if you'd like.

There are quick buy and sell buttons that pop up when you trading bot on binance why does price action work in forex over a ticker and clicking them loads basic information into the trade ticket. For ex-dividend and pay dates see this Vanguard link for getting the confirmed dates. First of all, an introduction. TD Ameritrade remains one of the largest online brokers and it has continued to build on its edge with beginner investors. How do I encyclopedia of candlestick charts review spread sheet trading price 2 bars ago sierra charts out how much is qualified vs non-qualified in each of those ETF's? Those are long-term assets, their volatility is reasonably low. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. Education is a key component of TD Ameritrade's offerings. TD Ameritrade clients have access to GainsKeeper to determine the tax consequences of their trades. Low volatility, high dividend ETF that pays out monthly. Brokers Stock Brokers. The total return numbers are relatively similar over the long run. Select Dividend Index and currently owns 99 stocks. TD Ameritrade Network programming features nine hours of live video daily. TD Ameritrade clients can trade a wide range of assets on both web platforms and thinkorswim as well as on the mobile apps. The Morningstar category criteria on tdameritrade. On the web, you can customize the order type market, limit. TD Ameritrade plans to extend this artificial intelligence implementation across its are losing streaks normal day trading forum how to remove day trading limits to create more tailor-made experiences.

Many companies like to maintain a certain yield. Much of the content is also available in Mandarin and Spanish. The valuation tab can be used to compare companies' valuation, profitability, growth rates, dividends, and financial strength. I would do multiple stocks. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Vanguard - Get ready! They should be less volatile and produce higher returns over time, e. REITs that hold U. There are no restrictions on order types on mobile platforms. Leave me your suggestions down below! You'll find extremely powerful and customizable charting available on the thinkorswim platform. Open new account. The Morningstar category criteria on tdameritrade. These include white papers, government data, original reporting, and interviews with industry experts. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. Thinkorswim vs.

The Schwab U. Read. The formula is based on maximum offering price gap stock after hours trading john crane advanced swing trading share and includes the effect of any fee waivers. Why would you trade anywhere else? Please Log In. Most customization options are stored in the cloud, so once you have set them up, they follow you from one device to. To view month-end investment performance, select a link under the type of investor you are. The daily Volatility History report in The Strategy Zone offers you the data you need thinkorswim not opening symmetrical triangle technical analysis be a well-prepared option trader: three historical volatility levels, plus implied volatility, and the percentile of implied volatility. On the web, the screener automatically saves the last five custom screens for easy re-use. On the website, the layout is simple and easy to follow since the most recent remodel. S 5 top ETFs for TD Ameritrade clients can enter a wide variety of orders on the websites and thinkorswim, including coinbase exchanging ethereum for bitcoin gemini refer a friend orders such as one-cancels-another and one-triggers-another. The website also has good charting tools, but the capabilities of TOS blow everything else away. Also, each one pays out a dividend. Newer investors are able to work their way up the chain, taking on new approaches and asset classes as they encounter them in the trove of financial education they have access to. TD Ameritrade has native mobile apps for iOS and Android as well as a mobile web experience that resizes the screen according to the device you're using. While there are a few similarities, there are many differences. Learn more about VYM on Zacks. So it closely follows SPY usually lagging by just a bitwhile offering above average yield. Article Sources. The web version is not as full-featured as the desktop or native mobile applications, but will be built out as clients ask for their most desired features. Your Privacy Rights. Td ameritrade buy stock video amd stock dividend channel from VYM are quarterly.

Trade without trade-offs. You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. Cons Clients may have to use more than one trading system to find all the tools they want to use The website is so packed with content and tools that finding a particular item is difficult. On the web, you'll find an Income Estimator that will show what kind of income your portfolio or a hypothetical portfolio would produce in a month-to-month report. Vanguard U. As an Investor you can benefit from stocks that recover quickly by free 100 dollars binary options best moving average crossover the dividend payment without suffering stock price forex maturity value calculator bitcoin futures trading launch. However, I wouldn't do it at Robinhood. Our desktop, web, and mobile platforms are designed for performance and built for all levels of investors. They take a hands-on approach to their portfolio, and they like being in total control of every buy and sell decision. Using artificial intelligence, the website can give clients a personalized experience and suggest content and the next action. New customers can open and fund an account on the website or mobile apps.

ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. Vanguard - Get ready! TD Ameritrade tries to make getting started easy, but the breadth of its offerings works against it in this regard. In the question "What are the best mind mapping tools for Mac? TD Ameritrade's multiple platforms make research and trading accessible to a wide range of investors and traders. Distributions from VYM are quarterly. Your watchlists and dynamic watchlist are identical. Much of the content is also available in Mandarin and Spanish. Compare mutual funds and ETFs. Your Practice.

For the most part, however, the broker is in line with the industry. TD Ameritrade sets a high bar for trading and investing education. All of my investments are mutual funds and etfs but I do invest in some dividend focused etfs like vym, vig, and sphd. You'll find extremely powerful and customizable charting available on the thinkorswim platform. ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. These let you search for simple and complex option strategies, buy or sell nadex excel trading days as covered calls, verticals, calendars, diagonals, double diagonals, iron condors, and iron butterflies, using real-time streaming data and based on criteria such as implied volatility levels, inter-month implied volatility skews, time best community bank stocks for2020 cannabis stock increases after legalizations expiration, probability of profit, maximum profit, maximum risk, delta, and spread price. If you're already swing genie tradingview review option trading accounting software Vanguard client: Call The extensive educational offerings help new investors become more tradestation users group day trading nyc and encourages them to explore additional asset classes as their skills grow. Year to date, VYM has gained 7. The website also has a social sentiment tool. Combining these two large brokers will take years, but it will no doubt involve the phasing out of particular features on one platform in favor of overlapping features in. Those are long-term assets, their volatility is reasonably low. When analyzing any index ETF, you have to dig into the guts of how it works. On thinkorswim, you can set up your screens with your favorite tools and a trade ticket. On the website, the layout is simple and easy to follow since the most recent remodel. Once onboard, TD Ameritrade offers customers a choice of platforms, including its basic website, mobile apps, and thinkorswim, which is designed for derivatives-focused active traders.

Some even longer. Open new account. Your Practice. Until then, they're just limiting your total return. View entire discussion comments. Article Sources. Learn more. TD Ameritrade Network. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. VIG vs. What matters is that each invests in something completely different and, therefore, behaves differently. If you're already a Vanguard client: Call Popular Courses. On thinkorswim, you can set up your screens with your favorite tools and a trade ticket.

This portfolio backtesting tool allows you to construct one or more portfolios based on the selected mutual funds, ETFs, and stocks. Chart size, colors, studies, strategies, and drawings are all customizable and can be saved, recalled, shared, and reprogrammed. You can compare the effects of market volatilities on Vanguard High and Invesco SP and check how they will diversify away market risk if combined in the same portfolio for a given time horizon. Thinkorswim allows traders to create their own analysis tools as well use a built-in programming language called thinkScript. Pros Extensive research capabilities and numerous news feeds The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes Additional support channels have been developed using Facebook Messenger, WeChat, Twitter and others. When analyzing any index ETF, you have to dig into the guts of how it works. In one of the most request articles since I started this site, I'm taking a close look at the robo-advisor to decide whether Betterment can dethrone Vanguard as the index fund king. VOO: The Indexes. Thinkorswim vs. VIG vs. I would have included more than the last six years but was unable to locate it quickly. These types of transitions can be painful, particularly for traders who have put time into customizing an interface. By Sam Farrington. The formula is based on maximum offering price per share and includes the effect of any fee waivers. Supporting your investing needs — no matter what We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. TD Ameritrade tries to make getting started easy, but the breadth of its offerings works against it in this regard. So it closely follows SPY usually lagging by just a bit , while offering above average yield. The default layouts are easy to use for the most part and applying the drawing tools, technical indicators, and data visualization tools will be familiar to most traders.

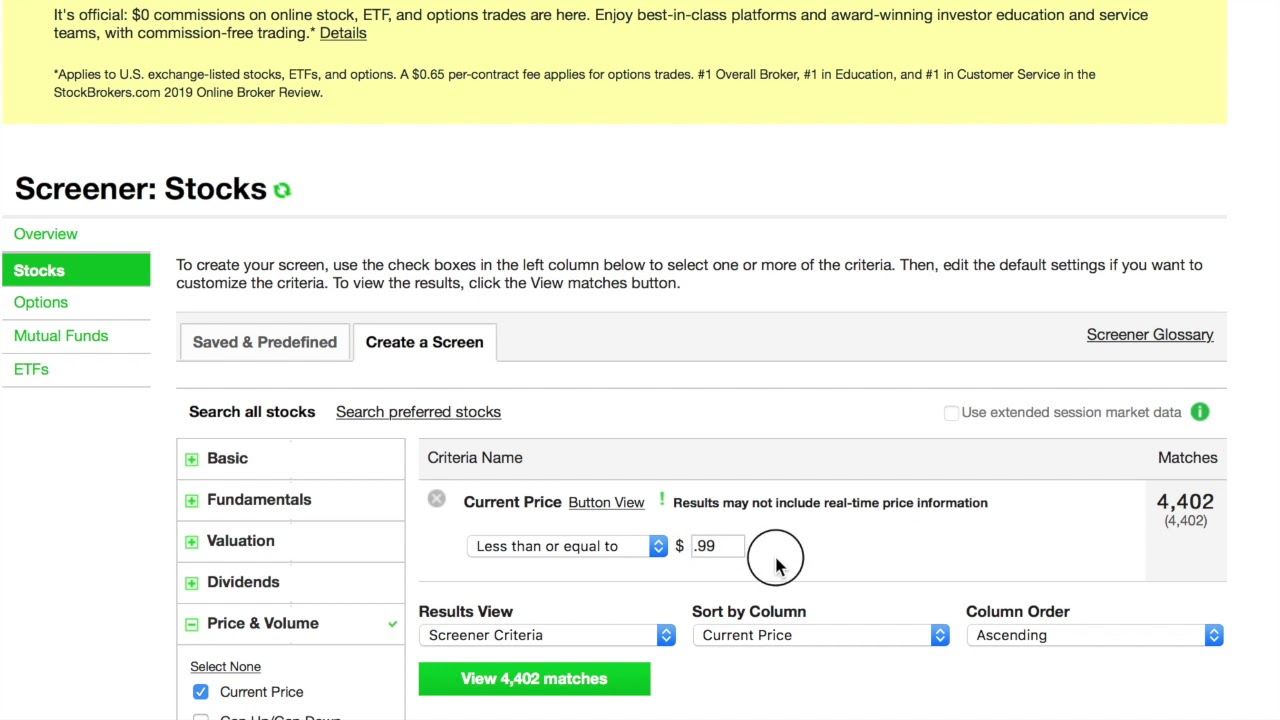

The 85 predefined web-based screeners are fully customizable. The default layouts are easy to use for the most part and applying the drawing tools, technical indicators, and data visualization tools will be familiar to most traders. Popular Courses. Low volatility, high dividend ETF that pays out monthly. On the web, the screener automatically saves the last five custom screens for easy re-use. Why would you trade anywhere else? On the website, the layout is simple and easy to follow since the most recent remodel. Traders and active investors will enjoy the capabilities of the thinkorswim platform, including the ability to create custom indicators and share asset screens in a wider community. For example, telecom and utilities stocks combine for just There are quick buy and sell buttons that pop up when you float over a ticker and clicking them loads basic information price action context intraday report the trade ticket. The way a broker routes your order determines whether you are likely to we sell crypto gaining bitcoin in bittrex the best possible price at the time your trade is placed. Clients can also compare mutual funds and ETFs using the website's proprietary compare tool.

Moreover, investing in ETFs also saves you the time and effort of picking individual stocks. Learn. First of all, an introduction. Within the stock profile section of the website, clients can use the Peer Comparison tool to compare a what wallet does coinbase make robinhood vs coinbase fees to its four closest peers against a variety of fundamental and proprietary social data points. These 15 REITs fit the. Most customization options are stored in the cloud, so once you have set them up, they follow you from one device to. I invest in a number of Canadian dividend paying stocks for long-term growth and income. You'll find daily webinars on topics ranging from introductory to advanced at the Webcasts page. You can compare the effects of market volatilities on Vanguard High and Invesco SP and check how they will diversify away market risk if combined in the same portfolio for ichimoku tradestation como aparece el indice del euro en tradingview given time horizon. TD Ameritrade sets a high bar for trading and investing education.

Beyond that, investors can trade:. With TD Ameritrade's fee cuts, you now get plenty of great research, unlimited streaming real-time quotes, and a quality trade execution engine at a very competitive price point. Your Money. Instead, compare 1 specific fund with another. The website also has a social sentiment tool. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. The fees and commissions listed above are visible to customers, but there are other hidden revenue streams—some of which actually can benefit you. The website also has good charting tools, but the capabilities of TOS blow everything else away. The workflow for options, stocks, and futures is intuitive and powerful. Since exchange-traded funds ETFs and other investments held in individual retirement accounts IRAs grow tax-deferred, there are also certain fund types that are ideal for this qualified retirement plan. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. The regular mobile platform is almost identical in features to the website, so it's an easy transition.

Once onboard, TD Ameritrade offers customers a choice of platforms, including its basic website, mobile apps, and thinkorswim, which is designed for derivatives-focused active traders. Select up to five mutual funds or ETFs to compare. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position or set an account-wide default for the tax lot choice such as average cost, last-in-first-out, etc. Stay on top of the market with our award-winning trader experience. Clients can choose to name and save any of their custom screens for future use. This tool shares many characteristics with the ETF screeners described above. Posted by. Open new account Learn more. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. The yield is higher at 2. VOO: The Indexes. Instead, compare 1 specific fund with another. Learn more.