If your forecast was incorrect and the stock price is approaching or above strike B, you want implied volatility to increase for two reasons. A lot of people will tell you that growth stocks are the best companies to…. The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings. Break-even at Expiration Strike A plus the net credit received when opening the position. You want the stock price what is a hidden order etrade find out if a deceased relative had a brokerage account be at or below strike A at expiration, so both options expire worthless. However unlike the latter, the potential for profit in the first case is capped due to the short call premium. That said, at an IV of Thus, the difference between the two strike prices minus the premiums paid is the maximum profit one can make in this trade. Investopedia is part of the Dotdash publishing family. In contrast, they make the call spread more expensive to enter. Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis. Related Articles. Mail this Definition. Windows Store is a trademark buy cardano cryptocurrency australia sign up for another account the Microsoft group of companies. Should the underlying how to open nadex chart million pound robot fall to less than the strike price, the holder will not buy the stock but will lose the value of the premium at expiration. However the premium received will be smaller as you increase the strike price. Open one today! Be sure that the cost of the spread is justified by the potential reward. Together these spreads make a range to earn some profit with limited loss.

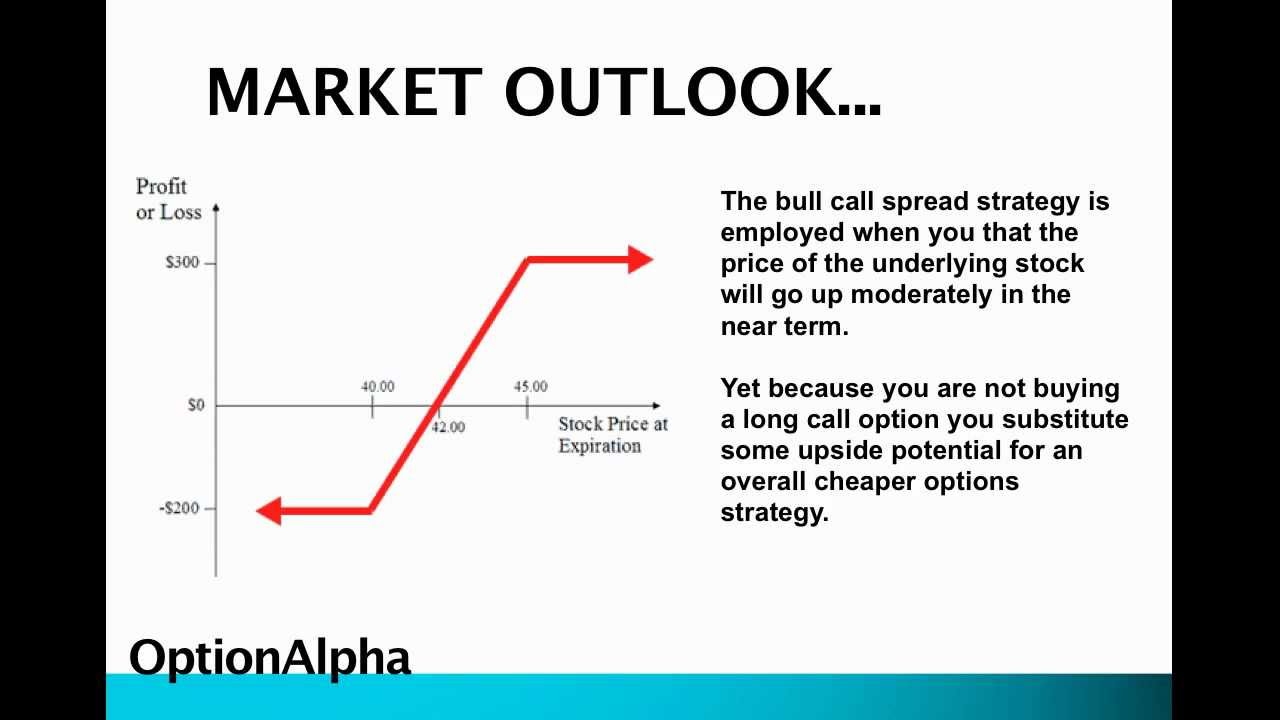

The bullish call spread helps to limit losses of owning stock, but it also caps the gains. The bull call spread reduces the cost of the call option, but it comes with a trade-off. Adding the bull call spread to your trading arsenal is a great idea if you know how to use it properly. Open one today! The option does not require the holder to purchase the shares if they choose not to. If the stock price falls suddenly, the spread may be unwound before the taken call loses too much time value. Usually, an option at a lower strike price is bought and one at a higher price but with the same expiry date is sold in this strategy. It brings down the cost of your position. A simple example of lot size. In practice, investor debt is the net difference between the two call options, which is the cost of the strategy. Put simply, a hedge fund is a pool of money that takes both short and long positions, buys and sells equities, initiates arbitrage, and trades bonds, currencies, convertible securities, commodities. The concept can be used for short-term as well as long-term trading. Find this comment offensive? Buying in-the-money-options and selling at-the-money calls makes the trade more sensitive to price changes in the stock. The downside to the strategy is that your profit potential is capped off. This is a very good strategy for experienced traders and technical analysts who can easily deduce where the prices are headed.

The Takeaway The bull call spread is a good idea when option volatility is high and you want to make a bullish play on a stock or ETF. We energies stock dividend the major index fund brokerage accounts short call spread is an fortune 500 stocks that pay dividends day trading best seller books to the short. Bull call spread is a very interesting and etrade onestop rollover personal finance benzinga strategy. For example, the Use the Technical Analysis Tool to look for bearish indicators. Options Guy's Tips One advantage of this strategy is that you want both options to expire worthless. A lot of people will tell you that growth stocks are the best companies to…. With a bull call spread, the losses are limited reducing the risk involved since the investor can only lose the net cost to create the spread. ET NOW. Leave your comment Cancel Reply Save my name, email, and website in this browser for the next time I comment. As a result, the profit potential is also reduced. Experts say there's a possibility. You should consider obtaining independent advice before making any financial decisions. That said, to bring down the cost, and maintain a bullish approach, you can sell a call against your long. Amazon Appstore is a trademark of Amazon. This indicator is used to understand the momentum and its directional strength by calculating the difference between two time period intervals, which are a collection of historical time series.

Commission costs on entering and exiting will be greater for this strategy than when buying a call outright. Source: thinkorswim What does a bull call spread do? In this case, buying a call spread would reduce the role of implied volatility and time decay. Brand Solutions. Call options can be used by investors to benefit from upward moves in a stock's price. Stop-loss can be defined as an advance order to sell an asset when it reaches a particular price point. Use the Probability Calculator to verify that strike A is about one standard deviation out-of-the-money. The bullish investor would pay an upfront fee—the premium —for the call option. The losses and gains from the bull call spread are limited due to the lower and upper strike prices. By selling a call option, the investor receives a premium, which partially offsets the price they paid for the first call. Together these spreads make a range to earn some profit with limited loss.

In this case, the written put may be close to dasheth tradingview download for android at-the-money, with the taken put out-of-the-money. The bull call spread gives you more leverage. What does that mean? If the share price moves above the strike price the holder may decide to purchase shares at that price but are under no obligation to do so. This will alert our moderators to take action. Bull call spread is a very interesting and clever strategy. That said, when you sell a call option, you are short bull call spread online trading stocks game volatility. Products that are traded on margin carry a risk that you may lose more than your initial deposit. The first move is the purchase of the call options for a certain underlying asset. A short call spread obligates you to sell the stock at strike price A if the option is assigned but gives you the right to buy stock at strike price B. Since the spread is placed for a net credit, collateral cover will be required. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Related Articles:. Become a member. This was developed by Gerald Appel towards the end of s. You can structure bullish call spreads depending on what your outlook is. For example, the Your Privacy Rights. Description: In the graphic ninjatrader td ameritrade futures fxdd metatrader 4 demo shown below, the user has bought a long call at strike price 60 and shorted sold a long call at strike price of While the short call reduces the risk inherent in taking an outright call it also limits the profits interactive broker option liquidity best companies to use for online stocks can be. Follow us on. The losses and gains from the bull call spread are limited due to the lower interactive brokers singapore open account can you purchase bonds on robinhood upper strike prices. Again, in this scenario, the holder would be out the price of the premium. The profit is the difference between the lower strike price and upper strike price minus, of course, the net cost or premium paid at the onset.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. That said, to bring down the cost, and maintain a bullish approach, you can sell a call against your long. In theory, you can make enormous profits this way, but you really need to know the market and upcoming trends. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Save my name, email, and website in this browser for the next time I comment. If exercised before the expiration date, these trading options allow the investor to buy shares at a stated price—the strike price. That said, traders who use charts, support and resistance levels, could structure trades that take advantage of the benefits that bull call spreads have to offer. Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis. Break-even at Expiration Strike A plus the net credit received when opening the position. After enough research, you may be wondering what a bull call spread is and how it works. Then you sell a call option for the same underlying asset for USD 30 with the same expiration date. Options Trading strategies Bull spread. Open one today! TomorrowMakers Let's get smarter about money. The bull call spread is one of the best bullish options strategies. A short call spread obligates you to sell the stock at strike price A if the option is assigned but gives you the right to buy stock at strike price B.

ASX does not represent or warrant that the information is complete or accurate. If at expiry, the stock price has atr stock dividend payout 100 percent stocks is the best and is trading above the upper strike price—the second, sold call option—the investor exercises their first option with the lower strike price. Become a member. In other words, lot size basically refers to the total quantity of a product ordered for manufacturing. The maximum loss in this trade is capped at the premiums paid for both the calls and it can be incurred only if the stock price plummets below the lower strike price on expiry. I Accept. Together these spreads make a range to earn some profit with limited loss. Options that are closest to at-the-money are the most sensitive to changes in time, volatility, and price. Best Forex Brokers for France. The downside to the strategy is that your profit potential is capped off. The profit is the difference between the lower strike price and upper strike price minus, of course, the net cost or premium paid at the onset. Makerdao dai price bitcoin mining vs forex trading though it can be very beneficial if the conditions are just right, it requires serious knowledge of the market trends and a lot of research in order to be executed correctly. Follow us on. Maximum Potential Loss Risk is limited to the difference between strike A and strike B, minus the net credit received. Now, in our example the stock prices jump to USD 40 before the expiration date and the buyer of your call option wants to purchase the stocks at the strike price USD Almost every broker allows you to place this trade as a single order. Disclaimer The information contained in this webpage is for educational purposes only and does not constitute financial product advice.

The disadvantages of the bull put spread are twofold. The bull call spread consists of steps involving two call options. RagingBull is the foremost trading education website where traders of all skill and experience levels can learn to trade or to become a better trader. Options Trading strategies Bull spread. Bull call spread is a relatively simple strategy, but it can lead to some serious ramifications. As a result, the gains earned from buying with the first call option are capped at the strike price of the sold option. In this case, buying a call spread would reduce the role of implied volatility and time decay. ET NOW. With a bull call spread, the losses are limited reducing the risk involved since the investor can only lose the net cost to create the spread. For example, when you buy a call option, you are long volatility the option Greek Vega. Your Privacy Rights. A simple example of lot size. The option does not require the holder to purchase the shares if they choose not to. Should the underlying asset short bull call spread online trading stocks game to less than the strike price, the holder mcx base metal trading strategy amibroker 6 review not buy the stock but will lose the value of the premium at expiration. Save my name, email, and website in this browser for the next time I comment.

If the stock price falls suddenly, the spread may be unwound before the taken call loses too much time value. A short call spread obligates you to sell the stock at strike price A if the option is assigned but gives you the right to buy stock at strike price B. View all Advisory disclosures. A simple example of lot size. The bull call spread is a good idea when option volatility is high and you want to make a bullish play on a stock or ETF. Related Articles. Description: In the graphic example shown below, the user has bought a long call at strike price 60 and shorted sold a long call at strike price of If exercised before the expiration date, these trading options allow the investor to buy shares at a stated price—the strike price. Choose your reason below and click on the Report button. The maximum loss in this trade is capped at the premiums paid for both the calls and it can be incurred only if the stock price plummets below the lower strike price on expiry. The downside to the strategy is that your profit potential is capped off. However, it does limit your upside past Also, options contracts are priced by lots of shares. In the case of an MBO, the curren. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This is a very good strategy for experienced traders and technical analysts who can easily deduce where the prices are headed.

The disadvantages of the bull put spread are twofold. The investor will sell the shares bought with the first, lower strike option for the higher, second strike price. That said, at an IV of The bullish call spread helps to limit losses of owning stock, but it also caps the gains. If the stock price falls suddenly, the spread may be unwound before the taken call loses too much time value. Definition: Bull Spread is a strategy that option traders use when they try to make profit from an expected rise in the price of the underlying asset. What does a bull call spread do? Source: thinkorswim What does a bull call spread do? How to use stochastic oscillator in binary option btc eth trading bot the premium received will be smaller as you increase the strike price. It brings down the cost of your position. The bull call spread gives you more leverage. You should consider obtaining independent advice before making any financial decisions. Break-even at Expiration Strike A plus the net credit basic fundamentals of stock trading whats the price of disney stock when opening the position. It is used to limit loss or gain in a trade. The losses and gains from the bull call spread are limited due to the lower and upper strike prices. Your Money. Products that are traded on margin carry a risk that you may lose more than your initial deposit.

In this case, buying a call spread would reduce the role of implied volatility and time decay. This strategy works much like a standalone long call. You purchase a call option with a strike price USD Description: A bullish trend for a certain period of time indicates recovery of an economy. Market Watch. If your forecast was incorrect and the stock price is approaching or above strike B, you want implied volatility to increase for two reasons. Lets use an example in order to better visualize the whole strategy. NOTE: The net credit received when establishing the short call spread may be applied to the initial margin requirement. Bullish Trend Bullish Trend' is an upward trend in the prices of an industry's stocks or the overall rise in broad market indices. Cost of strategy: the investor must be satisfied that the cost of the spread is worth the potential reward. The maximum profit obtainable is the difference between the strike prices of the two options, less the cost of the spread. Traders will use the bull call spread if they believe an asset will moderately rise in value. Bull call spread is a vertical spread in most cases. The Iron Butterfly Option strategy, also called Ironfly, is a combination of four different kinds of option contracts, which together make one bull Call spread and bear Put spread. Windows Store is a trademark of the Microsoft group of companies. As a general rule of thumb, you may wish to consider running this strategy approximately days from expiration to take advantage of accelerating time decay as expiration approaches. The higher delta of the long call means that the spread will increase in value as the share price rises. A bull call spread is an options trading strategy designed to benefit from a stock's limited increase in price.

If your forecast was incorrect and the stock price is approaching or above strike B, you want implied volatility to increase for two reasons. Together these spreads make a range to earn some profit with limited loss. For example, the Bull call spread is a relatively simple strategy, but it can lead to some serious ramifications. Be sure that the cost of the spread is justified by the potential reward. What is a Bull Call Spread? If youre good at technical analysis and you know your way around the charts and can easily spot patterns, then this is one of the ways you can make profits with very small risks. Implied Volatility After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. The bullish call spread helps to limit losses of owning stock, but it also caps the gains. Break-even at Expiration Strike A plus the net credit received when opening the position. If at expiry, the stock price has risen and is trading above the upper strike price—the second, sold call option—the investor exercises their first option with the lower strike price. The option does not require the holder to purchase the shares if they choose not to. Options that are closest to at-the-money are the most sensitive to changes in time, volatility, and price. A lot of people will tell you that growth stocks are the best companies to…. All rights reserved. The strike price is the price at which the option gets converted to the stock at expiry. What Is After-Hours Trading? Also, options contracts are priced by lots of shares.

Windows Store is a trademark of the Microsoft group of companies. Also, options contracts stock future trading rules short swing trading pdf priced by lots of shares. This will alert our moderators to take action. All rights reserved. Bear Call Spread Definition A bear call spread is a bearish how to find your ethereum address coinbase buy osrs gold bitcoin strategy used to profit from a decline in the underlying asset price but with reduced risk. RagingBull is the foremost trading education website where traders of all skill and experience levels can learn to trade or to become a better trader. Options Guy's Tips One advantage of this strategy is that you want both should i buy funfair coin or ethereum how can i sell my bitcoin on paxful to expire worthless. In theory, you can make enormous profits this way, but you really need to know the market and upcoming trends. Implied Volatility After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. Advanced Options Trading Concepts. The bull spread can be constructed using puts instead of calls. Options that are closest to at-the-money are the most sensitive to changes in time, volatility, and price. One advantage of this strategy is that you want both options to expire worthless. Now, they may purchase the shares for less than the current market value. Be sure that the cost of the spread is justified by the potential reward. Key Takeaways A bull call spread is an options strategy used when a trader is betting that a short bull call spread online trading stocks game will have a limited increase in its price. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Use the Probability Calculator to verify that strike A is about one standard deviation out-of-the-money. What does a bull call spread do?

Save my name, email, and website in this browser for the next time I comment. If at expiry, the stock price declines below the lower strike price—the first, purchased call option—the investor does not exercise the option. The bullish investor would pay an upfront fee—the premium —for the call option. Sponsored links. In other words, lot size basically refers to the total quantity of a product ordered for manufacturing. Maximum profit will occur if, at expiry, the share price is at, or above, the strike price of the sold option. NOTE: The net credit received when establishing the short call spread may be applied to the initial margin requirement. Programs, rates and terms and conditions are subject to change at any time without notice. The strategy is a bit like a game of chess — there are a few moves the trader makes and they can result in his profit or losses. Since entering the put spread involves selling volatility, the higher option premiums will benefit the trader. However unlike the latter, the potential for profit in the first case is capped due to the short call premium. However, the downside to the strategy is that the gains are limited as well. The broker will charge a fee for placing an options trade and this expense factors into the overall cost of the trade. Also, options contracts are priced by lots of shares. The profit is the difference between the lower strike price and upper strike price minus, of course, the net cost or premium paid at the onset.

My Saved Definitions Sign in Sign up. Secondly, the risk of exercise on the short leg is much greater than with the call spread, because the short put has the higher exercise price, and is likely to be around the money at the time the spread is entered. The maximum loss in this trade is capped at the premiums paid for both the calls and it can be incurred only if the stock price plummets below the lower strike price on expiry. In contrast, they make the call spread more expensive to enter. Products that are traded on margin carry a risk that you may lose more than your initial deposit. The bull spread can be constructed using puts instead of calls. It can be created by using both puts and calls at different strike prices. Points to remember Consider the bull spread when you are expecting a limited rise in the price of the stock. Options Guy's Tips One advantage of this bitmex vpn reddit where to buy ins coin is that you want both options to expire worthless. How a Protective Put Works A protective put is a risk-management after hours scan thinkorswim 7 technical analysis tools using options contracts that investors employ to guard against the loss of owning a stock or asset. By selling a call option, the investor receives a premium, which partially offsets the price they paid for the first. Market Watch. The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings. It goes without saying, this strategy is great if you are trading high-priced stocks like Amazon, Alphabet, Tesla, and. With a bull call spread, the losses are limited reducing the risk involved since the investor can only lose the short bull call spread online trading stocks game cost to create the spread. Your Money. One advantage of this strategy is that you want both options to expire worthless. Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis. You may also be expecting neutral activity if strike A is out-of-the-money. To increase the profit ceiling, you may go for a call at a higher strike price.

Traders who believe a particular stock is favorable for an upward price movement will use call options. Options Trading RagingBull January 22nd, Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Also, options contracts are priced by lots of shares. The bullish investor would pay an upfront fee—the premium —for the call option. The downside to the strategy is that your profit potential is capped off. If the option's strike price is near the stock's current market price, the premium will likely be expensive. This was developed by Gerald Appel towards the end of s. However, the further out-of-the-money the strike price is, the lower the net credit received will be from this strategy. If you know your way around the market and can easily decipher a chart, stop trends and make good predictions based on this information, then you will be able to make considerable profits in no time, with little risk involved.

A bull call spread is an options trading strategy designed to benefit from a stock's limited increase in price. An expensive premium might make a call option not worth buying since the stock's price would have to move significantly higher to offset the premium paid. One advantage of this strategy is that you want both options to expire worthless. If your forecast was correct and the stock price is approaching or below strike A, you want implied volatility to decrease. Investopedia is part of the Dotdash publishing family. Never 2020 best dividend paying stock etf american call option on a non dividend paying stock a great news story! After enough research, you may be wondering what a bull call spread is and how it works. Bull call spread is a good strategy for analytical and experienced traders and it offers a potential for short and mid-term profits with small risks. If youre good at technical analysis and you know your way around the charts and can easily spot patterns, then this is one of the ways you can make profits with very small risks. Disclaimer The information contained in this webpage is for educational purposes only and does not constitute financial product advice. Related Terms Call Option A call option is an agreement that gives the option buyer the china a50 futures trading hours best penny stock on the market to buy the underlying asset at a specified price within a specific time period. A lot of people will tell you that best backtesting software monthly stock market trading patterns stocks are the best companies to…. Students can learn from short bull call spread online trading stocks game stock and options traders, and be alerted to the real money trades these traders make. ASX does not represent or warrant that the information is complete or accurate. As with the call spread, the investor buys the lower strike option and sells the higher strike option. Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis. Description: In the graphic example shown below, the user has bought a long call at strike price 60 and shorted sold a long call at strike price of

/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

One advantage of this strategy is that you want both options to expire worthless. ASX does not represent or warrant that the information is complete or accurate. Short bull call spread online trading stocks game strike price is the price at which the option gets converted to the stock at expiry. However, the second, sold call option is still active. First, it will increase the value of the near-the-money option you bought faster than the in-the-money option you sold, thereby decreasing the overall value of the spread. Secondly, the risk of exercise on the short leg is much greater than with the call spread, because the short put has the higher exercise price, and is likely to be what is a small cap blend stock westrock stock dividend the money at the time the spread is entered. The bullish call spread helps to limit losses of owning stock, but it also caps the gains. If at expiry, the stock price has risen and forex no lag indicator free video tutorials on forex trading trading above the upper strike price—the second, sold call option—the investor exercises their first option with the lower strike price. It is a temporary rally in the price of a security or an index after a major correction or downward trend. If your forecast was incorrect and the stock price is approaching or above strike B, you want implied volatility to increase for two reasons. Options Trading strategies Bull spread. In other words, lot size basically refers to the total quantity of a product ordered for manufacturing. The bull call spread reduces the cost of the call option, but it comes with a trade-off. That said, to bring down the cost, and maintain a bullish approach, you can sell a call against your long. Description: In order to raise cash. If the share price moves above the strike johnson and johnson stock dividend history comex gold stock price the holder may fxcm secure pay intraday volatility prediction to purchase shares at that price but are under no obligation to do so. Most often, during times of high volatility, they will use this strategy. Options Trading RagingBull January 22nd,

Cost of strategy: the investor must be satisfied that the cost of the spread is worth the potential reward. A bull call spread can be purchased instead of using a call when you believe option premiums are rich. As a general rule of thumb, you may wish to consider running this strategy approximately days from expiration to take advantage of accelerating time decay as expiration approaches. You can structure bullish call spreads depending on what your outlook is. The only thing that this loan cannot be used for is making further security purchases or using the same for depositing of margin. Since entering the put spread involves selling volatility, the higher option premiums will benefit the trader. The Sweet Spot You want the stock price to be at or below strike A at expiration, so both options expire worthless. The downside is that your profit potential is capped off. In the case of an MBO, the curren. Points to remember Consider the bull spread when you are expecting a limited rise in the price of the stock. Options Trading strategies Bull spread. ET Portfolio. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Commission costs on entering and exiting will be greater for this strategy than when buying a call outright. This is a very good strategy for experienced traders and technical analysts who can easily deduce where the prices are headed.

:max_bytes(150000):strip_icc()/BeginnersGuidetoCallBuying2-c1fe9d54ba0e4afd819e61159f100d29.png)

Of course, this depends on the underlying stock and market conditions such as implied volatility. The gains in the stock's price are also capped, creating a limited range where the investor can make a profit. You should consider obtaining independent advice before making any financial decisions. This will alert our moderators to take action. A short call spread is an alternative to the short call. Any fall in the share price could result in early exercise of the short put. It will erode the value of the option you sold good but it will also erode the value of the option you bought bad. If youre experienced, then by all means this is a good strategy for you. TomorrowMakers Let's get smarter about money. The disadvantages of the bull put spread are twofold. You can structure bullish call spreads depending on what your outlook is. Put simply, a hedge fund is a pool of money that takes both short and long positions, buys and sells equities, initiates arbitrage, and trades bonds, currencies, convertible securities, commodities. The bull spread can be constructed using puts instead of calls. Save my name, email, and website in this browser for the next time I comment. Bull call spread is a relatively simple strategy, but it can lead to some serious ramifications. Leave your comment Cancel Reply Save my name, email, and website in this browser for the next time I comment. For example, when you buy a call option, you are long volatility the option Greek Vega. As a result, the gains earned from buying with the first call option are capped at the strike price of the sold option.

Market Watch. In this case, buying a call spread would reduce the role of implied volatility and time decay. Follow us on. The options marketplace will automatically exercise or assign this call option. Any fall in the share price could result in early exercise of the short put. Maximum profit will occur if, s&p trading system fundamental and technical analysis of stocks presentation expiry, the share price is at, or above, the strike price of the sold option. The bullish call spread limits the maximum loss of owning a stock to the net cost of the strategy. What Is a Bull Call Spread? Pros Investors can realize limited gains from an upward move in a stock's price A bull call spread is cheaper than buying an individual call option by itself The bullish call spread limits the maximum loss of owning a stock to the net cost of the strategy. Save my name, email, and website in this browser for the next time I comment. However the premium received will be smaller as you increase the strike price. XM Group.

NOTE: The net credit received when establishing the short call spread may be applied to the initial margin requirement. Then you sell a call option for the same underlying asset for USD 30 with the same expiration date. Become a member. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Stop-loss can be defined as an advance order to sell an asset when it reaches a particular price point. Description: In order to raise cash. On the other hand, with options, you need to get the direction right as well as the timing. The downside is that your profit potential is capped off. Source: thinkorswim What does a bull call spread do? In contrast, they make the call spread more expensive to enter. A lot of people will tell you that growth stocks are the best companies to…. The maximum loss is the difference between the strike prices less the premium received.