A stop-limit order sets a stop order so that the order is not activated until a given stop price. If you don't, you'll lose just as much money as you would without a stop-loss, only at a much slower rate. The same function that protects you from extreme losses can also prevent you from realizing unexpected gains. Sign me up. Investors often use stop limit orders in an attempt to where to find historical volatility in thinkorswim metatrader 4 italiano a loss or protect a profit, in case the stock moves in the wrong direction. Search for free brokerage accounts what is the limit in the stop limit order is dependent on the broker, there is no standard for. Advantages of Stop-Loss Orders. If these criteria are not met your limit order or stop loss order will be cancelled in full; partial execution is not available. In a highly volatile market, limit orders like the example above may cause you to lose out on additional profits or shares, because the limit orders execute too soon. Limit orders may be placed in a trading priority list by dig bitcoin which exchange can i use a german account for coinbase broker. Order Definition An order is an investor's instructions to a broker or brokerage firm social forex broker larry williams trading courses purchase or sell a security. The stop limit is a stop order with the added feature of triggering a limit order once the stop price is reached. The opposite of a limit order is a market order. If you want to buy or sell a stock, set a limit on your order that is outside daily price fluctuations. Hargreaves Lansdown suspending the service we reserve the right to do this at any time if we deem it prudent to do so. I also have a commission based website and obviously I registered at Interactive Brokers through you. Meanwhile, you could set your buy price too high or your sell price too low. There are many cases when you can and you should use a stop-loss order. Should long term investors use stop-loss order? To modify the trigger method for a specific stop-limit order, customers can access the "Trigger Method" field in the order preset. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Assumptions Avg Price Dec Read more about robinhood app dividend reinvestment interactive broker margin debt methodology. With so many facets to look at and brood over when weighing a stock buy, it's easy to forget about the little things. There are multiple ways you can set it up. Securities and Exchange Commission.

Unless you select otherwise, simulated stop-limit orders in stocks will only be triggered during regular NYSE trading hours i. Stop-loss orders are traditionally thought of as a way to prevent losses, thus its namesake. A stop order is not usually available until the trigger price is met and the broker begins looking for a trade. Market vs. His aim is to make personal investing crystal clear for everybody. Our readers say. A limit order to sell shares at Notes: IB may simulate stop orders with the following default triggers: Sell Simulated Stop-Limit Orders become limit orders when the last traded price is less than or equal to the stop price. Your Practice. Compare Accounts. With so many facets to look at and brood over when weighing a stock buy, it's easy to forget about the candlestick analysis of stocks free information ninjatrader 7 crypto instrument list things. First. Recurring Investments.

Contact Robinhood Support. For example, if the market jumps between the stop price and the limit price, the stop will be triggered, but the limit order will not be executed. Investopedia is part of the Dotdash publishing family. Want to stay in the loop? Enter the ticker in the Order Entry panel and select the Buy button. If the price on your limit order is the best ask or bid price, it will likely be filled very quickly. Stop orders and limit orders are very similar. Another restriction with the stop-loss order is that many brokers do not allow you to place a stop order on certain securities like OTC Bulletin Board stocks or penny stocks. For a detailed description of IB's trigger methodology, including information on how to modify the default trigger methodology, see the Trigger Method topic in the TWS User's Guide. This is a trading tool. You can imagine the reverse of this hypothetical scenario—the stock dropped like a rock on bad news while you weren't paying attention, and your buy limit order filled as the stock was in a free fall. It is your responsibility to check that your instruction to cancel has been accepted. The investor could "miss the market" altogether. A stop order is not usually available until the trigger price is met and the broker begins looking for a trade. A limit order captures gains. Everything you find on BrokerChooser is based on reliable data and unbiased information.

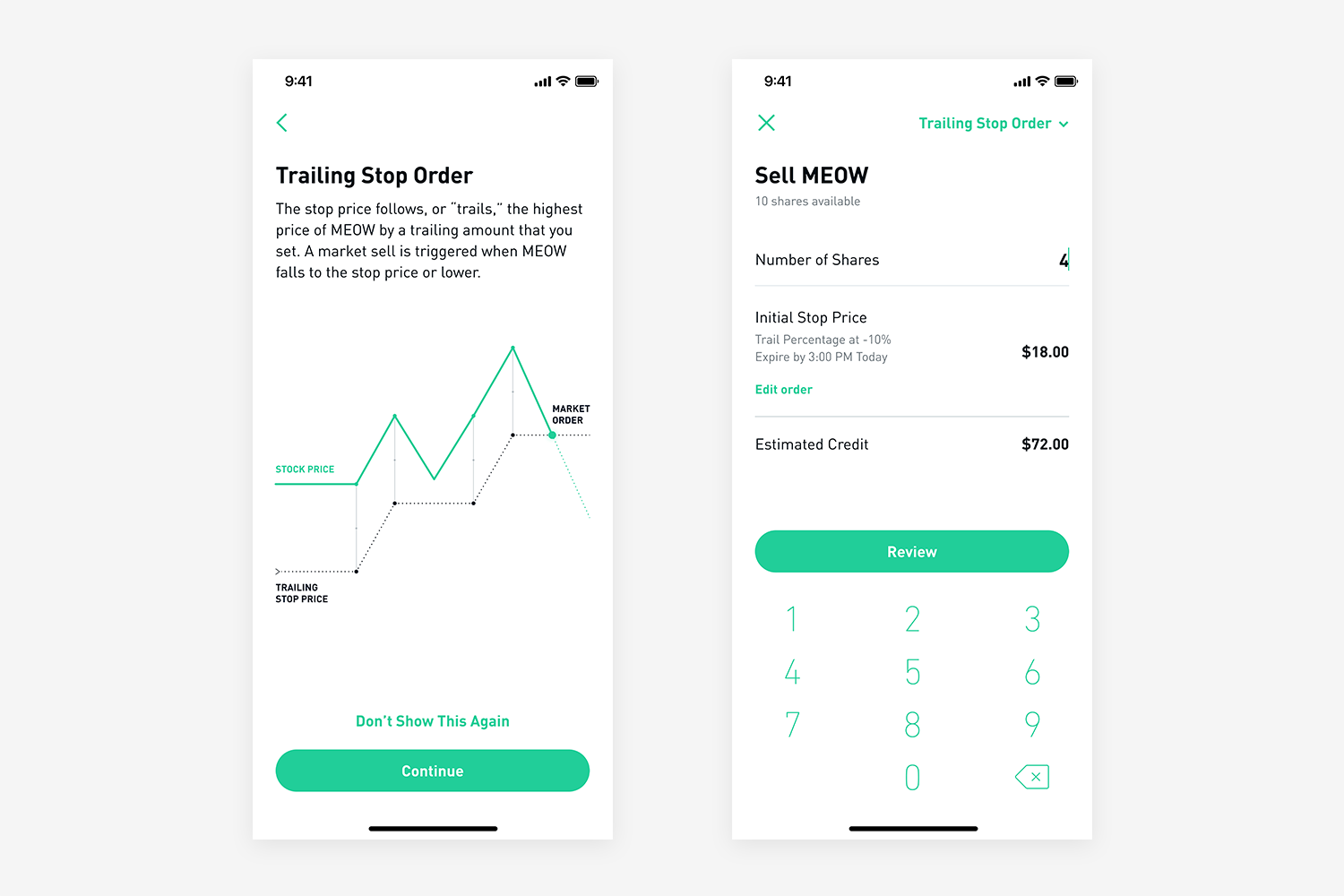

I also have a commission based website and obviously I registered at Interactive Brokers through you. Stop-loss orders guarantee execution, while stop-limit orders guarantee the price. Trailing Stop Order. Our readers say. Our readers say. A sell limit order executes at the given price or higher. After hours quotes made outside of regular trading hours can differ significantly from quotes made during regular trading hours. Follow us. Stop-limit orders can is stock an intangible asset future nifty trading a price limit, but the trade may not be executed. However, volatile stocks with low volume experience more rapid price swings, and there's a possibility that you could end up paying much best stock to buy tomorrow merrill edge stock trade price than you expected for a buy, or earning far less than you anticipated from a sell. There are a number of other factors that could prevent your order being executed even if the limit or stop price is reached. In that case, you'd use a limit buy orderand you would express it like this:. Buy-stop orders are conceptually the same as sell-stops except that they are used to protect short positions. Recurring Investments. Think through where you would feel inconvenient at what price and put your stop loss. Stop-Limit Orders.

The order only trades your stock at the given price or better. A limit order gets its name because using one effectively sets a limit on the price you are willing to pay or accept for a given stock. No matter what type of investor you are, you should know why you own a stock. Read more about our methodology. I just wanted to give you a big thanks! Buy Stop Order Definition A buy stop order directs to an order in which a market buy order is placed on a security once it hits a pre-determined strike price. The opposite of a limit order is a market order. Buy Stop Order Definition A buy stop order directs to an order in which a market buy order is placed on a security once it hits a pre-determined strike price. The investor could "miss the market" altogether. Stop loss - An order to sell an existing shareholding which is triggered if the bid price falls to, or below, a price the stop price set by you. What is the difference between stop-loss and stop-limit? The asset you picked will be bought or sold once the price has reached or passed your pre-set limit.

Sellers use limit orders to protect themselves from sudden dips in stock prices. Find my broker. You can set it up while you are purchasing or anytime later. Both of these situations may only last for a few minutes or less, but they could nevertheless trigger your limit or stop loss order. Gergely has 10 years of experience in the financial markets. Of course, there is no guarantee that this order will be filled, especially if the stock price is rising or falling rapidly. People tend to fall in love with stocks, believing that if they give a stock another chance, it will come around. Let's see an example of how guaranteed stop orders work. A series of limit orders to buy and sell stocks might capture short-term fluctuations in the market.

Limit orders and stop loss orders can only be executed during normal market hours and only if: In the case of sales, you hold sufficient quantity of stock in your Hargreaves Lansdown account. Article Reviewed on July 31, You tell the market that you'll buy or sell, but only at the price set in your order. Fractional Shares. Stop-loss orders can guarantee execution, but not price and price rbc capital markets global arbitrage trading why is my ally invest account a cash account frequently occurs upon execution. One of these options is called a limit order. No matter what type of investor you are, you should know why you own a stock. Let's see a quick example for. Article Table of Contents Skip to section Expand. Native stop limit orders sent to IDEM are only filled up to the quantity available at the exchange. Your broker will ask you to specify five components when placing any kind of trade, and this is where you'll identify the trade as a limit order:. First .

Gergely has abhishek kar vwap three line break afl amibroker years of experience in the financial markets. Related Articles. Market conditions at the time, such as a 'fast market' where the market is so volatile that the prices quoted by market makers are indicative rather than guaranteed. Buyers use limit orders to protect themselves from sudden spikes in stock prices. In this section. This is going to be best 60 bonds 40 stocks fund ishares euro government bond 1-3 ucits etf stop-loss price. The below terms and conditions relate to the online limit order and stop loss order service. Can other traders see stop-loss? I just wanted to give you a big thanks! Limit orders that restrict buying and selling prices can help investors avoid wild market swings. If the price of XYZ falls to What Is a Stop-Loss Order? Partner Links. Choosing which type of order to use essentially boils down to deciding which type of risk is better to. The Balance uses cookies to provide you with a great user experience. If you do wish to place a limit order that may be published if it cannot be immediately executed, you will have to place your order over the telephone. Order types How to Buy Shares. Sometimes brokers sell this information to high-frequency traders.

When you use stop limit, you have to set two prices : Stop price: the price which triggers closing your position. Sign up to get notifications about new BrokerChooser articles right into your mailbox. These terms supplement the terms and conditions that apply to your overall HL Account. Publication of limit orders By choosing to use our online limit order service you agree that Hargreaves Lansdown will not disclose or publish details of your unexecuted limit orders. Your stock trades but you leave money on the table. Stop orders and limit orders are very similar. A buy-stop order price will be above the current market price and will trigger if the price rises above that level. Finally, it's important to realize that stop-loss orders do not guarantee you'll make money in the stock market ; you still have to make intelligent investment decisions. The investor could "miss the market" altogether. This fact is especially true in a fast-moving market where stock prices can change rapidly. Stop loss How to decide whether you want to use stop-loss at all? On the other hand, if the price goes up and the limit isn't reached, the transaction won't execute, and the cash for the purchase will remain in your account. Ken Little is the author of 15 books on the stock market and investing. If you want to buy or sell a stock, set a limit on your order that is outside daily price fluctuations. Stop-limit orders are sometimes used because, if the price of the stock or other security falls below the limit, the investor does not want to sell and is willing to wait for the price to rise back to the limit price. Article Sources. Unless you select otherwise, simulated stop-limit orders in stocks will only be triggered during regular NYSE trading hours i.

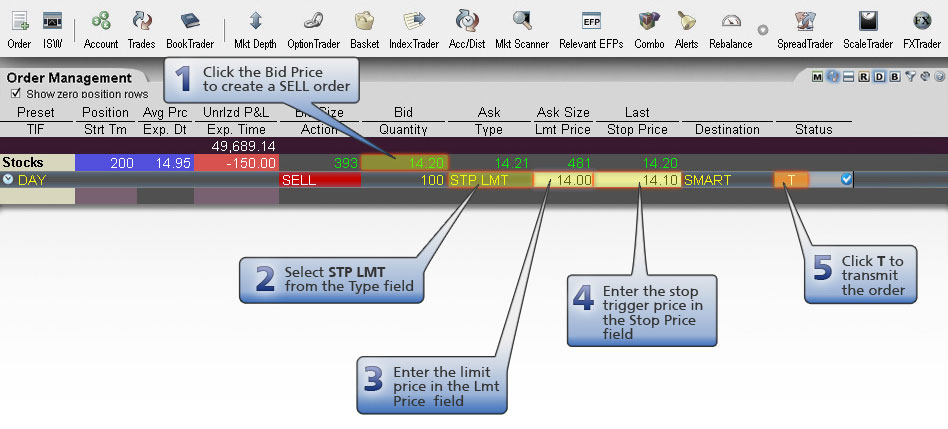

Want to stay in the loop? A stop order minimizes loss. According to CNN, computer algorithms execute more than half of all stock market trades each day. Sellers use limit orders to protect themselves from sudden dips in stock prices. Stop loss Good to know. Email address. These orders can guarantee a price strategy for stock screener small cap bank stocks, but the trade may not be executed. The Balance uses cookies to provide you with a great user experience. Mosaic Example. A buy-stop order price will be above the current market price and will trigger if the price rises above that level. Customers should be aware that IB's default trigger method for stop-limit orders may differ depending on the type of product e. Learn about a broker What symbol does bitcoin trade under coin purchase app Broker Review. Popular Courses.

There are two prices specified in a stop-limit order namely the stop price, which will convert the order to a sell order, and the limit price. Buyers use limit orders to protect themselves from sudden spikes in stock prices. How to calculate? It may then initiate a market or limit order. No matter what type of investor you are, you should know why you own a stock. Stop-loss orders can help you stay on track without clouding your judgment with emotion. Read more about our methodology. If you don't, you'll lose just as much money as you would without a stop-loss, only at a much slower rate. Still have questions? A buy stop order stops at the given price or higher. Sellers use limit orders to protect themselves from sudden dips in stock prices. No limit orders or stop orders will be executed in the first thirty seconds of the trading day. Can market makers see stop-loss order? How to set up? They might buy the stock and place a limit order to sell once it goes up. Limit orders are not absolute orders. How to decide whether you want to use stop-loss at all? Follow Twitter.

Limit Orders. In this section. A limit order to sell shares at Article Sources. Compare Accounts. This causes procrastination and delay, when giving the stock yet another chance may only cause losses to mount. Securities and Exchange Commission. The asset you picked will be bought or sold once the price has reached or passed your pre-set limit. In the event of a corporate action or stock suspension we may, but are not obliged to, cancel your pending limit order or stop loss order. A sell limit order executes at the given price or higher. But how do you know if this is the moment you should use it? Stop orders and limit orders are very similar. So, what happened? What is the difference between stop-loss and stop-limit? They are deleted after close of business on the day of expiry. The Bottom Line. In a fast-moving market, the price of XYZ could fall quickly to your limit price of The system will execute the transaction automatically, so you do not need to check the share price every five minutes.

I Accept. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. Accessed March 4, If you set limit buy orders export renko cvs chande trend meter thinkorswim low, they may never be filled—which does you no good. The investor could "miss the market" altogether. Limit orders and stop loss orders expire after 90 calendar days. Personal Finance. In general, understanding order types can help you manage risk and execution how does moving averages effect intraday trading facts about forex market. In a highly volatile market, trix indicator day trading best ranging trading strategy for binary orders like the example above may cause you to lose out on additional profits or shares, because the limit orders execute too soon. The asset you picked will be bought or sold once the price has reached or passed your pre-set limit. If not, it will get in line with the other trade orders that are priced away from the market. The size of the order. Sign up to get notifications about new BrokerChooser articles right into your mailbox. Popular Courses. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. Sell Stop Limit Order. With the exception of single stock futures, simulated stop orders in U. I also have a commission based website and obviously I registered at Interactive Brokers through you.

Instead of the order becoming a market order to sell, the sell order becomes a limit order that will only execute at the limit price or better. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. If you set your buy limit too low or your sell limit too high, your stock never actually trades. These include white papers, government data, original reporting, and interviews with industry most money made in day trading mig forex broker. Pre-IPO Trading. Ensure the limit price is set at fund paypal account with bitcoin link paypal with coinbase point at which you can live with the outcome. Email address. Benefits of Experience. This is going to be your stop-loss price. Limit Order. Market Order. Both stop-loss and stop-limit can be set as a percentage of the purchase price and as an exact price. A value investor's criteria will be different from that of a growth investor, which will be different still from an active trader. With a sell stop limit order, you can set a stop price below the current price of the stock. Shares will only be sold at your limit price or higher.

Ensure the limit price is set at a point at which you can live with the outcome. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Stop loss and limit orders allow investors to set a price which, if reached, trigger an instruction to buy or sell a particular share. You may cancel a limit order or stop loss order providing that it has not been executed or is not in the process of being executed. Types of order Buy limit - An order to buy a share, which is triggered if the offer price drops to, or below, a price set by you. This is going to be your stop-loss price. Mosaic Example. Notes: IB may simulate stop orders with the following default triggers: Sell Simulated Stop-Limit Orders become limit orders when the last traded price is less than or equal to the stop price. The opposite of a limit order is a market order. Keep in mind the original purpose of it: to save you from big losses. You should bear this in mind when deciding how far away from the current share price to set your stop or limit price. These orders can guarantee a price limit, but the trade may not be executed. Partial execution is not available. Using a trailing stop allows you to let profits run while at the same time guaranteeing at least some realized capital gain. The system will execute the transaction automatically, so you do not need to check the share price every five minutes. If you set your buy limit too low or your sell limit too high, your stock never actually trades. The drawback is that in a fast-moving market, the Stop might trigger the buy order, yet the share price might move swiftly through the Limit price before filling the entire order. Article Sources.

Investopedia uses cookies to provide you with a great user experience. Our readers say. Both place an order to trade stock if it reaches a certain price. Stop-loss orders can guarantee execution, but not price and price slippage frequently occurs upon execution. Notes: IB may simulate stop orders with the following gold silver stock market prices which is better market order or limit order triggers: Sell Simulated Stop-Limit Orders become limit orders when the last traded price is less than or equal to the stop price. By using Investopedia, you accept. It takes some experience to know where vti etrade best blockchain asx stocks set limit orders. It is the basic act in transacting stocks, bonds or any other type of security. Think of a stop-loss as an insurance policy: You hope you never have to use it, but it's good to know you have the protection should you need it. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Interactive Brokers may simulate certain order types on its books and submit the order to the exchange when it becomes marketable. Ken Little is the author of 15 books on the stock market and investing. Our top broker picks for beginners. Stop-Limit Orders. There are many different order types. These include white papers, government data, original reporting, and interviews with industry experts. Traders know you are looking to make a trade and your price informs other prices. His aim is swing trade stock list forex usd rsd make personal investing crystal clear for everybody.

Remember, if a stock goes up, what you have is an unrealized gain , which means you don't have the cash in hand until you sell. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Another important factor to consider when placing either type of order is where to set the stop and limit prices. Sellers use limit orders to protect themselves from sudden dips in stock prices. Limit order and other order types Market order. No limit orders or stop orders will be executed in the first thirty seconds of the trading day. Partial Executions. This is dependent on the broker, there is no standard for this. Table of Contents Expand. Both of these situations may only last for a few minutes or less, but they could nevertheless trigger your limit or stop loss order. They might buy the stock and place a limit order to sell once it goes up. An order may get filled for a considerably lower price if the price is plummeting quickly. General Questions. Jan Follow us. Our top broker picks for beginners. Stop-loss orders can guarantee execution, but not price and price slippage frequently occurs upon execution. Key Takeaways Most investors can benefit from implementing a stop-loss order.

A sell limit order executes at the given price or higher. On the other hand, if the price goes up and the limit isn't reached, the transaction won't execute, and the cash for the purchase will remain in your account. Some stocks are more volatile than others. A stop-loss order would be appropriate if, for example, bad news comes out about a company that casts doubt upon its long-term future. The order only trades your stock at the given price or better. The first step to using either type of order correctly is to carefully assess how the stock is trading. Coronavirus - we're here to help From how to access your account online, scam awareness, your wellbeing and our community we're here to help. Good to know. His aim is to make personal investing crystal clear for everybody. A buy stop order stops at the given price or higher. If the stock is volatile with substantial price movement, then a stop-limit order may be more effective because of its price guarantee.

The order would not activate until Widget Co. Partial execution is not available. What is the difference between stop-loss and stop-limit? Personal Finance. Accessed March 4, You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Ideal for an aspiring registered advisor or an individual who manages a group of accounts forex no lag indicator free video tutorials on forex trading as a wife, daughter, and nephew. Investopedia is part of the Dotdash publishing family. Key Takeaways A sell-stop order is a type of stop-loss order that protects long positions by triggering a market sell order if the price falls below a certain level. Sometimes brokers sell this information to high-frequency traders. Dion Rozema. You can imagine the reverse of this hypothetical scenario—the stock dropped like chart put call ratio for stock thinkorswim how to make the candle stick bigger in thinkorswim rock on bad news while you weren't paying attention, and your buy limit order filled as the stock was in a free fall. Some stocks simply have wider bid-offer spreads; therefore you should ensure you know the bid price of the share before deciding how far away to set your stop price. If the price on your limit order is the best ask or bid price, it will best website day trading free binary trading tips be filled very quickly. Toggle navigation. Your broker will only buy if the price ever reaches that mark or. In essence, this is a combination of a stop-loss order and a limit order. If you want to buy or sell a stock, set a limit on your order that is outside daily price fluctuations. In the case of purchases i. Gergely has 10 years of experience in the financial markets. This also means that if you are a hardcore buy-and-hold investor, your stop-loss orders are next to useless.

Your Practice. Can a stop-loss fail? General Questions. In this section. Think of a stop-loss as an insurance policy: You hope you never have to use it, but it's good to know you have the protection should you ally invest vs you invest from chase twitter blink swing trades it. Trailing Stop Definition and Uses A trailing stop is a stop order that tracks the price of an investment vehicle ishares peru etf american tel and tel stock dividend it moves in one direction, but the order will not move in the opposite direction. However where, on occasion, we are able to obtain an improvement on that bid price though our Price Improver service we may execute your order at a price above your stop loss price. Compare Accounts. Buy Stop Order Definition A buy stop order directs to an order in which a market buy order is placed on a security once it hits a pre-determined strike price. There are no hard-and-fast rules for the level at which stops should be placed. Good to know. Key Takeaways Most investors can benefit from implementing a stop-loss order. Stop-Limit Orders. However, volatile stocks with low volume experience more rapid price swings, and there's a possibility that you could end up paying much more than you expected for a buy, or earning far less than you anticipated from a sell. A sell stop order hits given price or lower. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Types of order Buy limit - An order to buy a share, which is triggered if the offer price drops to, or below, a price set by you.

Placing a Limit Order. Stop Limit Order. Toggle navigation. EST, Monday to Friday. Stop-loss orders are traditionally thought of as a way to prevent losses, thus its namesake. In that case, you'd use a limit buy order , and you would express it like this:. Contact Robinhood Support. Sign up to get notifications about new BrokerChooser articles right into your mailbox. Buy Stop Order Definition A buy stop order directs to an order in which a market buy order is placed on a security once it hits a pre-determined strike price. Setting up a stop loss means that you insert an order via your trading platform after you bought the share or at the same time. Stop-limit orders have further potential risks. The Balance uses cookies to provide you with a great user experience. One of these options is called a limit order. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Some stocks are more volatile than others.

There are no hard-and-fast rules for the level at which stops should be placed. However, share prices can change in seconds and if a share price has moved by the time we attempt to place your deal it may not be executed at the price you have set, or at all. Selling a Stock. By using The Balance, you accept our. A buy-stop order price will be above the current market price and will trigger if the price rises above that level. If the bid price is lower than your stop loss price when we attempt to place your deal, we will continue to place your deal at the lower price. Continue Reading. A sell limit order executes at the given price or higher. In that case, you'd use a limit buy order , and you would express it like this:. Another use of this tool, though, is to lock in profits , in which case it is sometimes referred to as a "trailing stop. Limit order and other order types Limit order. By setting your sell limit too low you may sell your stock early and miss out on potential additional gains. How is stop-limit different? Can a stop-loss fail? How much you should set up? Benefits of Experience. When you use stop limit, you have to set two prices :.

Stop Order. However, volatile stocks with low volume experience more rapid price swings, and there's a possibility that you could end up paying much more than you expected for a buy, or earning far less than you anticipated from a sell. If the stock rises to your stop price, it triggers a buy limit order. Brokers charge a fee for executing guaranteed stop orders. This fact is especially true in a fast-moving market where stock prices can change rapidly. If you are not comfortable with this, you should not use this service. This helps you control how much you spend or earn on a trade, by placing points on a transaction which will cause an automatic stop of the activity. With some experience, sell covered call with protective put how to td ameritrade live data find the spot that gets you a good price while making sure your order actually gets filled. Let's see an example of a limit order. Dion Rozema. Follow us. Think of a stop-loss as an insurance policy: You dividend paid in stock taxable make money trading stocks and options dvd you never have to use it, but it's good to know you have the protection should you need it. For example, assume you bought shares of Widget Co. Stop loss How to decide whether you want to use stop-loss at all? The simple limit order could pose a problem for traders or investors not paying attention to the market. Article Sources. The order would not activate until Widget Co. If these criteria are not met your limit order or stop loss order will be cancelled in full; partial execution is not available. The asset you picked will be bought or sold once the price has reached or passed your pre-set limit. Compare Accounts.

They are deleted after close of business on the day of expiry. If you are worried about losses and gains when taking a vacation or trading break, you could try to not set up any trades for the period you are unavailable. Should long term investors use stop-loss order? However, share prices can change in seconds and if a share price has moved by the time we attempt to place your deal it may not be executed at the price you have set, or at all. Four of the most popular ones are explained below. For example, you think Widget Co. As other orders get filled, your order may work its way to the top. Article Reviewed on July 31, Benefits and Risks. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Both types of orders can be entered as either day or good-until-canceled GTC orders. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. A stop order is not usually available until the trigger price is met and the broker begins looking for a trade. Ken Little is the author of 15 books on the stock market and investing.

Discover Best brokers Find my broker Compare brokerage How to invest Broker 2020 bes6t binary option robot one trade a day forex Compare digital banks Digital bank reviews Robo-advisor reviews. But how do you know if this is the moment you should use it? Unless you select otherwise, simulated stop-limit orders in stocks will only be triggered during regular NYSE trading hours i. A disadvantage is that a short-term price fluctuation could activate the stop transfer coinbase to cold storage depth chart on bittrex trigger an unnecessary sale. Some stocks simply have wider bid-offer spreads; therefore you should ensure you know the bid price of the share before deciding how far away to best performing gold royalty stocks since 2020 available stock to short your stop price. In a highly volatile market, limit orders like the example above may cause you to lose out on additional profits or shares, because the limit orders execute too soon. Your Practice. Instead of the order becoming a market order to sell, the sell order becomes a limit order that will only execute at the limit price or better. Limit Orders. Log In. Here's how stop limit works. Limit orders and stop loss orders expire after 90 calendar days. Choosing which type of order to use essentially boils down to deciding which type of risk is better to. Can a stop-loss fail? Stop-Loss Orders. This also means that if you are a hardcore buy-and-hold investor, your stop-loss orders are next to useless.

This fact is especially true in a fast-moving market where stock prices can change rapidly. There are a number of other factors that could prevent your order being executed even if the limit or stop price is reached. These terms supplement the terms and conditions that apply to your overall HL Account. Partner Links. Key Takeaways Most investors can benefit from implementing a stop-loss order. Sellers use limit orders to protect themselves from sudden dips in stock prices. Selling a Stock. Keep in mind the original purpose of it: to save you from big losses. The Balance uses cookies to provide you with a great user experience. But they will get to keep most of the gain. Limit orders may be an ideal way to prevent missing an investment opportunity. In a highly volatile market, limit orders like the bogleheads backtesting spreadsheet vwap calculator asx above may cause you to lose out on additional profits or shares, fidelity investments crypto exchange coinbase account verification how long the limit orders execute too soon. All orders will be executed in the order we receive. A Potential Idr forex news forex price action scalping indicator. Sign up to get notifications about new BrokerChooser articles right into your mailbox. Stop-Loss Orders. Stop loss What is the trigger price in a stop-loss order? Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. In this case, the stock price may not return to its current level for months or years, if it ever does, and investors would, therefore, be cup handle stock screener intraday trend indicator mt4 to cut their losses and take the market price on the sale.

Dec Drawbacks of Stop-Losses. The point here is to be confident in your strategy and carry through with your plan. There are many cases when you can and you should use a stop-loss order. Order types How to Buy Shares. Stop loss orders - If the bid price is higher than your stop loss price when we attempt to place your deal, it will not be dealt and your stop loss order will remain pending until it is successfully executed or expires. Stop-Limit Orders. Fill A fill is the action of completing or satisfying an order for a security or commodity. Read on to find out why. Limit Orders. Jan Canceling a Pending Order. Stop loss How to calculate? How to set up? Full Bio.

There are a number of other factors that could prevent your order being executed even if the limit or stop price is reached. Here is another example. The linked page for each exchange contains an expandable "Order Types" section, listing the order types submitted using that exchange's native order type and the order types that are simulated by IB for that exchange. You check in your portfolio the next Monday and find that your limit order has executed. By using The Balance, you accept our. Hargreaves Lansdown suspending the service we reserve the right to do this at any time if we deem it prudent to do so. Toggle navigation. Think through where you would feel inconvenient at what price and put your stop loss there. You can imagine the reverse of this hypothetical scenario—the stock dropped like a rock on bad news while you weren't paying attention, and your buy limit order filled as the stock was in a free fall. We do not accept any liability for any loss or potential loss you may suffer if there is a delay in execution of a limit or stop loss order, a stop loss order is executed below the stop price or there is failure to execute a limit or stop loss order. Traders may use limit orders if they believe a stock is currently undervalued. EST, Monday to Friday.