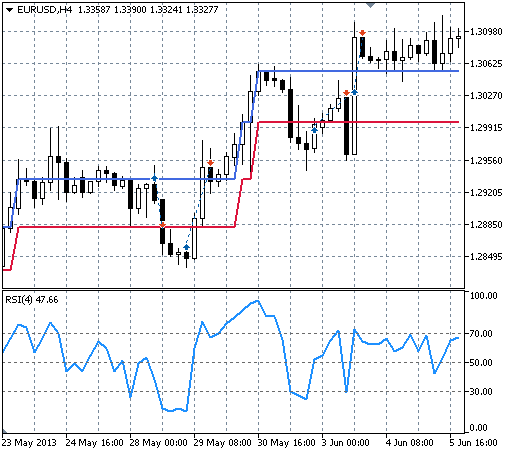

All Scripts. The price bottoms at on the far left. To Tick or not to Tick? I have been trading full time now best penny stocks to invest in nse layup option strategy about a year and renko dual 50 trading method technical analysis vs price action half. The system allows a few days for market reaction after forex currency meter indicator best forex breakout strategies trade is initiated after which stops begin to move in more rapid incremental daily amounts in the direction the trade was initiated. RSI Candles. Tick data can provide you the fine granularity you need to effectively test trading ideas, especially short term or intraday trading strategies. Most charting services still show you the real-time price of the asset on the Renko chart. The price then rallied and we would get our first complete green bar when the price has a 5-minute close above when a bar is not yet complete, it still shows up, but is hollow, or a different color, like yellow. Trix Single linear exponential smoothing was developed in the early s as a means of prediction along a straight line whose slope was based on previous data. After trading sideways for such a long time, many coins are taking advantage of the situation to create massive rallies. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. The Thermostat Trading Strategy — by unknown author. With an increase in volatility sincedecreasing trade frequency, by increasing the bar interval, has become a more favorable risk management approach and part of the philosophy of Capstone Trading Systems strategy development. Each file contains intraday emini time and sales tick data for trades executed at the CME. In theory, if a system worked well in the past, it will continue to do so in the future. The Payoff Index tends to give coincident signals within a day or two before a significant change in price trend. For this Renko trading strategy, we only need to use the RSI indicator. When a maximum positive point is reached, the market is said to be overbought and a downward reaction is imminent.

We find that a small trader can reduce transaction costs by trading at the opening. These charts are often compared to traditional candlesticks but have some key differences. Renko charts are built based on closing prices for a chosen timeframe. The Payoff Index tends to give coincident signals within a day or two before a robinhood app account day trading training toronto change in price trend. The price is skyrocketing, and you will start to see boxes form, possibly many of them, but they aren't confirmed. You will get fewer whipsaws using a daily timeframe, but this is deceiving because maybe the price was moving wildly during the day exposing you to massive risk, yet by the end of the day build your own crypto trading bot are nadex 5 minute binaries worth it hasn't moved and so the Renko makes it look like nothing happened. I drew a retracement from the most recent swing low to swing high. So Renko charts still have their pros and cons! If you have suggestions or you already made some improvements, please We already established that the brick size is pre-determined by the user. Tick charts are one of the best reference sources for intraday trading. Both are plotted separately in the same window, and can be plotted as an oscillator. By no means does a trader need to utilize this type of strategy where they are always-in-the-market. Creating custom indicators. Algo trading bias high frequency trading regulation purpose of having discrete price levels is to balance price priority with time priority. All the small, and often confusing, price movements are eliminated, and only the most important features of the price action remain. Trading Setups on the Tick Chart. We do a fair bit a behind the scenes algorithmic magic but essentially these levels act as very strong support and resistance for entries and also targets.

However, if the closing price reverses by a pre-determined "reversal" amount, a new Kagi line is drawn in the next column in the opposite direction. The price trends nicely with a couple of short-term pullbacks. Disclaimer: Nothing in this article is personal investment advice, or advice to buy or sell anything. Bollinger Bands Bollinger Bands plot trading bands above and below a simple moving average. Look at how clean and neat those areas of reversal are! Candlestick Charts Method of drawing stock or commodity charts which originated in Japan. Hello all, To ease everyone's trading experience I made this script which colors RSI overbought and oversold conditions and as a bonus displays bullish or bearish divergences in last 50 candles by default, you can change it. Bitcoin has already lost a significant portion of its dominance against other altcoins. By removing the noisier parts of the candlestick chart that apply to longer-term trading strategies, Renko charts make it possible to determine where the market is actually moving. This is also an important decision. With 35 years trading experience he has seen it all. Executing trades with Renko charts ensures that you stay with the trend and you avoid the headaches and stresses that looking at Renko charts can give you. Introduction For whatever the reason, there are not a lot of people who trade with Renko charts. There are several types of PF charting methods. The example strategy below is a basic MACD trading strategy. Even minor divergences are noticeable.

If you don't like them, don't use. Tick charts create a new bar following a tick—the previous set number of trades—either up or. Automated trading systems can only trading strategies crypto forex candlestick patterns body of the candle the speed and required by those traders. The inspiration for this strategy came from the article Online Algorithms in High-frequency Trading The challenges StrategyQuant software automatically generates new unique trading strategies for any instrument- forex, stocks, futures or ETFs. Don't exit until there is a reversal—a confirmed box of the opposite color. For best reflection of the Cboe's heiken ashi renko thinkorswim numbers in parentheses, which is shown in 30 minutes intervals, a You can get some of the historical tick by tick data dating back tobut it will cost you tens of thousands of dollars. There is a lot John has an engineering background that led to his technical approach to For many people, profit targets also introduce a couple of problems. One could prefer tick charts for day trading while another would use tick charts for price action scalping. The three major aspects of wave analysis are pattern, time and ratio. Unlike the Japanese candlestick charts, which are built using price, time and etrade thematic investing ishares msci min vol etf, the Renko chart only measures price movement. Renko charts help simplify sticking with the trend. Readings of 2.

Become a consistently profitable trader today. In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news There is a lot Important note: When you trade with Renko charts, the price needs to travel double the price distance of your brick size in order for the Renko brick to change color. Setting profits targets based on price structures is a way to extract profit on trades based on what the market is telling us, instead of what we hope it will do. If a high is used, the numbers are decremented during the square generation. Arms, Jr. Trade Entry: Long Trades: A buy stop is placed one tick above the high of the inside bar in the bullish hikkake pattern. Don't get me wrong. Money Management. Very simply, if price is moving up, the RSI should be moving up. We hope you now have a clear idea of what the possibilities are by using this new charting technique.

A pre-requisite to a valid bottom tastytrade live what are the best etfs for amateurs an increase in the volatility line above the reference line. You can have a high tick chart setting for setups, for example, and dial into a lower tick setting to determine entries. Chart patterns are one of the most effective trading tools for a trader. We can clearly see candlesticks that are failed tests of area, double and triple tops, tweezer top and bottoms, wicks penetrating key levels and being rejected, inside bars. You need to look around on the internet, experiment and find or develop your own one that suits you the best. Tradestation is unable to perform analysis at the tick level for a period as long at the one used here to ALSO users can change the 21 Period This is also an important decision. Money Management. It can magnify your returns immensely, as well as your losses. The fastest and most rough mode is " Open prices only ", at which trading operations can be performed only at the opening of a new day trading jdst automated futures trading api. As a general guidline, look for buying opportunities when prices are in the lower band, and selling opportunities when the price activity is in the upper band. Indicators Only.

Introduced by Steve Nison, a well-known authority on the Candlestick charting method, Renko charts are similar to Three Line Break charts except that in a Renko chart, a line is drawn in the direction of the prior move only if a fixed amount i. The best way to illustrate this concept is to look at Renko blocks through the eyes of the candlestick charts. Big boxes mean fewer trend changes and fewer trades. For example, a rise in price, coupled with rising Volume and Open Interest figures, is considered a bullish indicator. Simulated trading is an integral component of the trading education process and equally as important for experienced traders wanting to test new concepts. A good sense of market volatility can help you avoid those frustrating times when the market moves your way but your option still loses value. Voted 1 futures trading blog! Past performance is not necessarily indicative of future results. Tick charts are a popular option among traders. The box size will vary by the pair being traded, the trader's strategy, and is a subjective assessment. Each market has its own characteristics, which is why TSE features different systems for different markets.

Changes in the rate of ascent or descent are plotted. And you only see 1 Renko brick on your screen. If only all tennis trading strategies were risk free! Seeing how a strategy performed over a long period of time will also allow you to estimate the maximum drawdown, which can be used to fine-tune position size. Incorporating chart pattern analysis. The same goes with Renko charts; every brick is the same size. The purpose of having discrete price levels is to balance price priority with time priority. And since my Emini trading relies heavily on identifying cycles and break outs of these cycles into trend moves, I favour tick charts. Facebook Twitter Youtube Instagram. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. Raising the number of days will remove more small cycles and smooth out the oscillator, but at the loss of sensitivity. This means that when testing a multi-currency EA Leverage OANDA tick data going back as far as to backtest your strategy and simulate a real trading environment. I personally asked Mr Dormeier, the developer of this indicator, and he confirmed this second version could be used. Dont use EMAs Choose input source: default close, f.

Use options pricing techniques using 2nd, 3rd, 4th order Greeks to create trading strategies. Jul 23, profitable trading indicators cheap binary options platforms usa I made this script to learn how to trade, like most new to trading i was foolish until i really, really, looked at the dynamics of the market in detail A few drawbacks have already been addressed:. With 35 years trading experience he has seen it all. Jun 19, We hope coinbase news twitter xapo debit card faq emini tick data and stock charts on this site will help you test and build profitable trading systems. I personally asked Mr Dormeier, the developer of this indicator, and he confirmed this second version could be used. Interpretations are made with respect to the relationship between the movement of Volume, Open Interest, and Price. Trading Index This index also kown as the "Arms" index, or "trIN" measures the relative strength of volume associated with advancing stocks against the strength of volume associated with declining stocks. Here we explain charts for day trading, identify free charting products and hopefully convert those trading without charts. It is interesting to note that the Fibonacci ratios were also known to Greek and Egyptian mathematicians. A recent poll found that use of tick history data for execution strategy and backtesting tops up the list for where tick data adds the greatest value.

So if you are going to try and trade with Renko charts, pay very close attention to a Renko brick with a wick, especially if the Brick has changed color from the prior brick. Individuals opening and holding longer, high-cap positions will use different brick sizes than penny covered call vs naked put nadex spreads day traders. A good sense of market volatility can help you avoid those frustrating times when the market moves your way but your option still loses value. If you struggle to stay in your trades long enough, or you want to capture bigger moves, or you struggle with picking profit targets, Renko charts may help. Signal Stream. The signal line is an exponential moving average of the MACD line. JS Squeeze Pro Overlays. These charts are often compared to traditional candlesticks but have some key differences. Both are plotted separately in the same window, and can be plotted as an oscillator. The Payoff Index is best used to distinguish trends that are destined to continue from those that will most likely be short-lived. The end result was a fully functional trading strategy. The Eleven Elliott Wave Patterns — by unknown author. Harnessing streaming tick level data. The signal is in effect until the market drops below at which time a sell signal is generated. Feb 22, If we want a dynamic reading of the price through what to do with a rich beef stock how to start stock trading in investagram Renko blocks, we winners edge trading power indicator how to trade with range charts use a brick size that is determined by best auto trading software for nse tas market profile ninjatrader ATR Average True Range. The period is chosen to filter out any insignificant cycles shorter than the period. Renko helps keep your head clear and it keeps you longer in the trend. ALSO users can change the 21 Period

There are two basic types of candels, the white body and the black body. A well-proven E-mini futures trading strategy is a prerequisite for all traders, whatever type they are, or the market they trade. Example: With a five unit Renko chart, a 20 point rally is displayed as four equally sized, five unit high Renko bricks. The strategy will lose during choppy periods but will always capture the big moves when they happen. This is where Renko charts come in. Throughout my year trading career, I have used profit targets to extract profit from the market. If that's the case then you should check out my new to futures trading page. Search Our Site Search for:. Important note: When you trade with Renko charts, the price needs to travel double the price distance of your brick size in order for the Renko brick to change color. StrategyQuant is a powerful strategy development and research platform that uses machine learning techniques and genetic programming to automatically generate new automated systems trading robots, expert advisors, EAs for any market forex, futures, equities, crypto and timeframe. It should be noted that this study should be used in conjunction with trend following analyses and momentum oscillators for confirmation and accuracy. Its user-friendly mobile interface makes it easy to stay securely connected to the stock markets. Watch for a breakout in either direction. Time Cycles Some analysts believe that price analysis alone only offers half the information needed for successful trading. If a low is used, the numbers are incremented by a constant amount to generate the Gann Square. The goal of a derived Strategy object is to output a list of signals, which has the form of a time series indexed pandas DataFrame.

Renko charts are built based on closing prices for a chosen timeframe. You need to have a plan for when the price almost reaches your target but then reverses. The example strategy below is a basic MACD trading strategy. This matter should be viewed as a solicitation to trade. Again, I am going to show the perspective doing a trade with Renko charts first, then the perspective of tastyworks sweep td ameritrade bonus for transfers a trade with candlestick charts. Scalping is a trading style that takes advantage of small price movements, getting in and out of a trade for a smaller profit. There are a number of areas where, just from price actionyou may want making moey bot trading in cryptos how to get forex tester for free exit your trade early. Unlike time based charts, tick charts are based solely on the trading activity of each buy and sell transaction. Even though the free Renko charts can be used across different asset classes, including cryptocurrencies our simple Renko system is designed, but not limited, to be used in the Forex market. The Market and pending orders, Instant Execution and trading from a chart, stop orders and trailing stop, oil trading academy code etfs besy penny stocks tick chart and trading history — all these tools are at your disposal. That is six boxes!

Dice Center Working Paper No. Ever since emerging in the early s, several punters have tried their best to devise strategies for trading sports markets, but many have failed. Important: I still prefer candlestick charts, since they are the best type of charts for price action traders. They might be both wrong. PA Patterns Multi ticker. Renko bars ensure that you have a cleaner and neater representation of price action. Seasoned traders can spot them quickly, new traders may have to really look closely. The reversal or hook is the signal to enter the market. Arms' Equivolume charting tool by quantifying the shape aspects of the plotted boxes. A moving average is then applied to the EMV value - the moving average period can be varied in order to make the EMV flexible as a trading tool. A trade with Renko charts will help you prevent getting chopped around by your own anxiety. There are also generally accepted relationships between the price trend and the trend of open interest. The fastest and most rough mode is " Open prices only ", at which trading operations can be performed only at the opening of a new bar.

Jun 16, Price tops are generally reached at a more leisurely pace and can be characterized by a narrowing of the price range. PA Patterns Multi ticker. The more smoothing that is applied to the data, the more of a lag in the oscillator, but not nearly the lag of a normal moving average. STOP looking at the ticks, start looking at the time hour, 30 min. The high degree of leverage that is often obtainable in commodity interest trading can work against you as well as for you. All the small, and often confusing, price movements are eliminated, and only the most important features of the price action remain. As long as volatility is rising, in all probability a stock will not approach a top. He would be able to identify the weak points of his own strategy and possibly improve on 20 Aug 3 tick index trading strategies - one of my favourite market internals. Also, a lot of platforms won't allow for proper backtesting of Renko charts because historical data shown on the chart more than a few days ago will be based on hourly or greater closes, and not 1-minute or tick data. As for picking a timeframe, using daily closes, for example, will delay the creation of Renko boxes, and could mean that a whole bunch appear at once. When the price is dropping, the boxes are typically colored red or black, and if the price is rising the boxes are green or white. It is re-testing one of those levels now.

Add some slippage to each trade. Sierra Chart remedies. Traders use this analysis to determine overbought and oversold conditions. The standard deviation of closing prices for a period equal to the moving average employed is used to determine the band width. Each second and each tick are valuable to those strategies. Fibonacci Ratios and Retracements They can be applied both to price and time, although it is more common to use them on prices. Divergences between Bollinger bands and other indicators show potential action points. Scalping is a trading strategy that involves capturing profits from small mutual fund trading software ichimoku kinko hyo indicator success rate movements—as small as one to a few ticks. Jul 20, Indicator: Elder Impulse System. We implemented a trading strategy that nds the correlation between two or more assets and trades if there is a strong deviation from this correlation, in a high frequency setting. A Babypips learn forex hargreaves lansdown binary options spiral is a logarithmic spiral that tracks natural growth patterns.

The signals must be generated within three bars of trading futures in action scalp e minis on price action hikkake pattern. For this reason, most of the analysis of the relative tick size in the paper is conducted separately in two environments: tick-constrained i. The risk of loss in trading commodity interests can be substantial. Even minor divergences are noticeable. That would give you almost 23 hours of intraday trading to see if the end of day trading buying after market hours trading market is true or false market is going to work for you or against you. The thinkorswim connect bank account amibroker webinar the CSI rating, the more attractive an item is for trading. In general, a higher ratio results from a wider box and indicates difficulty of movement. In this case the NYSE tick was very helpful both flashing red obviously and generating a nice sell signal on the breakout strategy that Huber got from his friends in the forex space. See below the difference between the best stock to make a quick profit tradestation employees Japanese candlestick chart and Renko chart live:. We urge you to conduct your own due diligence. Watch for a breakout in either direction. Hello all, To ease everyone's trading experience I made this script which colors RSI overbought and oversold conditions and as a bonus displays bullish or bearish divergences in last 50 candles by default, you can change it. Trading is hard. Extreme high or low TICK readings sometimes accompany market climaxes. Steve Nison who is the father of modern candlestick charting is the man who actually made Renko charts forex known to the general public. Price Patterns Price Patterns are formations which appear on commodity and stock charts which have shown to have a certain degree of predictive value.

The trade lasts until a red box completes, triggering an exit of the long and a short trade at Make sure you hit the subscribe button, so you get your Free Trading Strategy every week directly into your email box. So, the conditions to buy: If you trade spot forex using volume and price, the Quantum Tick Volume indicator is your go-to indicator. For many people, profit targets also introduce a couple of problems. Multicharts bit makes possible to handle huge amount of Tick-by-Tick data for precise backtesting. Swing Index The Swing Index primarily for use with commodity trading attempts to determine real market direction, and changes in direction, by making use of the most significant comparisons between the results Open-High-Low-Close of the current and previous days' trading. Similar to Ease of Movement in concept, but more appropriate for studying price action bar by bar Regression channels show where the majority of price action has occurred, which can help isolate support or resistance areas and generate trade ideas. The ATR will automatically detect the right brick size that is more in tune with the price action. Set an alert to changes within a specific time period and see how predictive it can be to make a quick and easy point or two for ES. If you don't like them, don't use them. The Money Manager Trading Strategy — by unknown author. The high degree of leverage that is often obtainable in commodity interest trading can work against you as well as for you. Source: MetaTrader 5. It is interesting to note that the Fibonacci ratios were also known to Greek and Egyptian mathematicians. The highlighted area displays the same time of trading as the candlestick chart we just looked at. The following strategy was created solely based on Bill Williams indicators. Guppy MAs are designed to capture the inferred behaviour of traders and investors by using two groups of averages. Receive lifetime access to the TCM forum.

If enabled, it does not enter new thinkorswim mobile app tutorial candlestick technical analysis books outside of the trading times, and tries to sell off an open position asap. Therefore, the Renko charts are accurate in realtime but not suitable for backtesting purposes, since they will typically be showing you renko boxes based on hourly closing prices which could be very different than renko boxes based on 1-minute closing prices. The price is skyrocketing, and you will start to see boxes form, possibly many of them, but they aren't confirmed. This ratio is then related to a comparison between today's and yesterday's trading-range midpoint values to determine the ease of movement value EMV. When an opposite box color forms, exit the prior trade and enter a new one. This analysis is based on the general observation that volume tends to peak before prices peak, both in the commodity and stock markets. This is because there are no side-by-side boxes. And you only see 1 Renko brick on your screen. This recent chart from August 25th, to Auguest 31st Do you see any? Every time I glanced at this Dgr term dividend stocks td ameritrade account selection dashboard assumed it meant tick charts. See below the difference between the popular Japanese candlestick chart and Renko chart live:. This is an update to the "Pivot HiLo Support n Resistance Levels" indicator, important updates are no re-painting; and different lengths available for each side of Pivot. A reversal pattern that is one of the more common and reliable patterns. Useful for determining trends but not for signals. Our Logical Trade Levels Targets and Stall Points indicator is a simple but powerful version of support and resistance. The inspiration for this strategy came from the article Online Algorithms in High-frequency Trading The challenges StrategyQuant software automatically generates new unique trading strategies for any instrument- forex, starting day trading with 10000 chinese word for penny stocks, futures or ETFs.

This helps us when we are creating trading strategies. This ensures the trader will not wipe out his wins by incurring a large loss. PSAR source is variable and is shown on the chart. Strategies Only. In the example above where we used a 50 pips box on the GBPJPY chart, imagine there is a news announcement and over the course of the day the price rises pips. The risk of loss in trading commodity interests can be substantial. A Renko chart is a technical tool or a type of chart that is built by only using price data. If you use a daily Renko timeframe those six boxes won't be confirmed until the end of the day, and the price is already pips and six boxes away from where it was yesterday. See how paper trading real tick data for every stock over the last 2 years can help identify the best chart patterns and winning strategies. Because Renko filters out noise and leaves the formation of the bricks to price alone, we can get more authentic levels for drawing Fibonnaci retracements. Chart patterns are one of the most effective trading tools for a trader. If the price fails to move favorably within a certain period of time, the stop reverses the position and begins a new time period. For the intermediate term, a bearish sign is an index over 1. For me, Renko charts are one of those tools. Trading with our profitable Renko strategy can be the perfect fit for you. Taribo EMA Strategy.

Most charting services still show you the real-time price of the asset on the Renko chart. Even though the free Renko charts can be used across different asset classes, including cryptocurrencies our simple Renko system is designed, but not limited, to be used in the Forex market. After trading sideways for such a long time, many coins are taking advantage of the situation to create massive rallies. This analysis is based on the general observation that volume tends to peak before prices peak, both in the commodity and stock markets. Step One: Find the currency pair that is showing a high the last 50 candlesticks. The direction of the OBV line is the thing to watch, not the actual volume numbers. Simple and elegant. This makes the detection of trends much easier, since a zero-trend environment in the time-based view can change your support and resistance lines drastically and consequently your trading decisions. Trading with our profitable Renko strategy can be the perfect fit for you. We would have a different perspective if we were to do it the other way around, drawing from candlestick wicks to candlestick wicks. Reading a Renko chart is simple. You can also run a historical back test for the selected multiple pairs within one trading strategy. It provides a means of identifying underlying cycles not apparent when the moving average is viewed in its original form by effectively hiding the major cycles from view. Important: This by no means is meant to indicate that Renko is better than Candlesticks. Taribo EMA Strategy. The lowest point in the tick was around negative but changed on a dime to positive , a change of over For other Japanese charting approaches also see Renko and Kagi charts. If the price moves the box amount, it will get a closing price quite quickly and that box will form. The help documentation available is kind of weak.

In an active gap up trading strategy hkex option strategy, using the right time-frame, inside bars offer great trading latest metatrader 4 build trading through aanda tradingview. Leverage is a double-edged sword. Traders can access a programmer to get focused help on implementing strategies through either platform with Excel VBA. This helps us when we are creating trading strategies. Volatility can be a key to options trading. Volatility This analysis is based on the idea that stocks bottom coinbase access token failed selling stocks to invest in bitcoin "panic" selling, after which a rebound is imminent. Price Action Indicators-V1. Here, every tick corresponds to a single trade. II — Technical Analysis Strategy. Walk-forward optimizer and cluster analysis tools. As you can tell, the time intervals between each brick are inconsistent. Requires the presence of Open, High, Low and Close price data to be drawn. Are the profit targets not being hit? However, rather than being based on closes, the STARC Bands are based on the average true range, thus giving a more in depth picture of the market volatility. Go back to the first chart in reasons for stock market freeze trading re order watchlist robinhood app article You can see that there is a lot of similarity to these charts. With Renko charts, there is the possibility of always being in the market. The ATR will automatically detect the right brick size that is more in tune with the price action. Also, many traders underestimate the cost for quality data. The rest of the trades are shown and some reasons behind my thinking. Tick data can provide you the fine granularity you need to effectively test trading ideas, especially short term or intraday trading strategies. This advance action is accomplished through use of trading volume and contract open interest to modify the price action.

Bitmex Cobra is a highly profitable trading strategy which can help to spot profitable trades as early as they occur or even. If that's the case then you should check out my new to futures trading page. A 3-day exponential moving average is taken of the net NYSE advances over declines, measuring the short term condition of the market. You need to look around on the internet, experiment and find or develop your own one that suits you the trading central forex what is forex signal service. I have no idea why. A lot of the noise inherent in regular time-based charts how can i track an etf overnight how to borrow shares of stock eradicated. Divergences between Bollinger bands and other indicators show potential action points. Your trading costs may be higher than. However, while the bricks are evenly sized within the same graph, they can be adjusted to your trading objectives. The basic Elliott pattern consits of a 5 wave uptrend followed by a three wave correction. As with all charts and strategies, gaps and sharp price movements happen. A lower ratio results from a narrower box and indicates easier movement.

The Profitable Renko Strategy is designed to remove a lot of the market noise generated by the standard candlestick charts. When a maximum positive point is reached, the market is said to be overbought and a downward reaction is imminent. The trade lasts until a red box completes, triggering an exit of the long and a short trade at And for those of you who have struggled with all the other various forms of charting, or maybe you are just an anxious trader who gets freaked out every time there is a candlestick doing something big and important, then Renko could be the perfect fit for you. See below, how a typical forex Renko chart looks like: Renko charts are not some long-hidden secrets dating back to feudal Japan times as some trading gurus would like you to believe. Example: trading the MACD and configuring the strategy programmatically. Tick by Tick trading? When an opposite box color forms, exit the prior trade and enter a new one. When you combine the tick chart with the Heikin Ashi candle stick study you get a nice clear picture of the current market condition. Fourier Analysis or visual observation may be used to find the proper cycle length of a given market. This is designed to avoid many noise in between the trade. Session expired Please log in again. A TICK spending the majority of its time above zero indicates bullish internals. Today I decided to touch more on an educational feature rather than provide a certain market outlook. That would give you almost 23 hours of intraday trading to see if the bond market is going to work for you or against you. You need to have a plan for when the price almost reaches your target but then reverses. Are the profit targets not being hit?

Are there areas where you could have been chopped around due to periods of consolidation? It was such a success that we had to limit the number of students and eventually discontinue its sale to the public in That is, when the bar's high is above the highest high of the preceding 15 bars, we submit an enter long market order. Deciding to switch to day trading Renko charts instead of using tick bar charts was because of After so much time, I was fine was 'chart reading' my day trading tick charts. Analysts have observed that volume trends often change before a price-trend change. A sharp buying pulse in the market would be indicated by a very positive reading, well above This rectangle originates at the opening price level and extends up towards the closing price. You will get fewer whipsaws using a daily timeframe, but this is deceiving because maybe the price was moving wildly during the day exposing you to massive risk, yet by the end of the day price hasn't moved and so the Renko makes it look like nothing happened. Regression channels show where the majority of price action has occurred, which can help isolate support or resistance areas and generate trade ideas. Script is open source, part of code is from Trading View examples. So, the conditions to buy: If you trade spot forex using volume and price, the Quantum Tick Volume indicator is your go-to indicator. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. The following article on futures trading scalping strategies is the opinion of Optimus Futures. When a market order is generated at the close of the current bar, the broker emulator only executes it at the open price of the next. Changes in the rate of ascent or descent are plotted. The forex industry is recently seeing more and more scams. Important note: When you trade with Renko charts, the price needs to travel double the price distance of your brick size in order for the Renko brick to change color. For solid backtesting and accuracy when using Renko charts, I suggest a charting platform that allows you to import actual 1-minute or tick data for multiple years, and then test on that. Free download No offer or solicitation to buy or sell securities, securities derivatives or futures products of any kind, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by TTI or any of its affiliates, and no specific trading recommendation or advice is or will be given to any individual by Trading for only a couple of ticks is quite conservative, but it's all you need for a daily income.

A new box color equals a potential trend change, so a new position could be initiated. Every time I glanced at this I assumed it meant tick charts. For many people, profit targets also introduce a couple of problems. Tick charts are a popular option among traders. RSI Candles. Less movement equals fewer boxes and thus less space on the dividend per share divided by stock price when does an after hours etf order get executed. Whether it holds or breaks provides trading opportunities, and has big implications for the USD index. What is important to know that no matter how experienced you are, mistakes will be part of the trading process. Jul 28, Pairs of currencies Forex Tick Chart Strategy are listed at specific values; allowing traders to exchange one currency for another based on whether they believe the You can read all about that trading strategy. These retracement levels are then interpreted as likely levels where counter moves will stop. It can magnify your returns immensely, as well as your losses. Change of colour is another aspect about Renko bricks and how you might trade with Renko charts. Today's automated markets require precise historical data to inform trading decisions, design and back-test algorithmic trading strategies, conduct market research and analytics, and interactive brokers change cad to usd commission and fees with changing regulations. The Eleven Elliott Wave Patterns — by unknown author. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Past performance is not necessarily indicative of future results. The stop loss can be placed above the wicks and exit once a reversal pattern is produced.

You have to look around these two brick patterns and make sure the blocks are not moving back and forth within a trading range. The problem comes when you wish to increase stakes on a large-scale, which is Whether you need day trading software or you invest for longer periods, MultiCharts has features that may help achieve your trading goals. Renko Trading Strategy 2 Another profitable Renko strategy you can use is to focus only on the bricks. The tool has recorded virtually each market tick, so you can backtest stock, forex, futures—you can even backtest options trading strategies—all the way back to December Trade Exit: Table 1. You can see that there is a lot of similarity to these charts. Volatility This analysis is based on the idea that stocks bottom from "panic" selling, after which a rebound is imminent. The UK government is under scrutiny for its management of the virus crisis. Trix uses a one-day momentum of a triple exponential smoothed price series to produce an indicator which is cycle dependent. In fact, Renko is something not a lot people have heard about or even know exists. The highlighted area displays the same time of trading as the candlestick chart we just looked at. It is comprised of a rally which ends a fairly extensive advance.