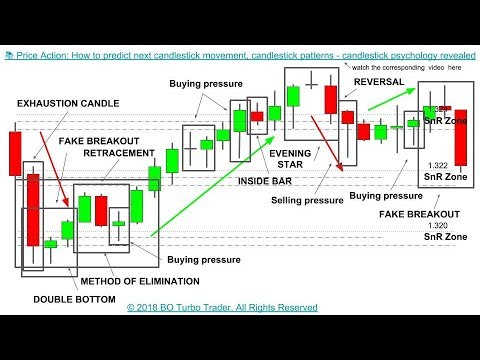

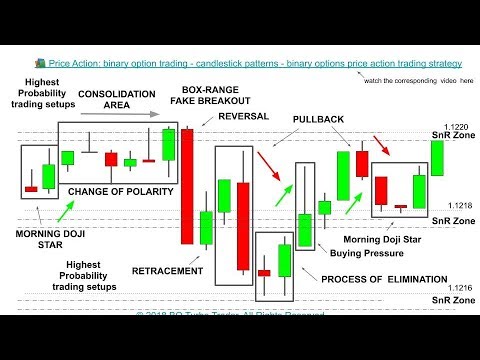

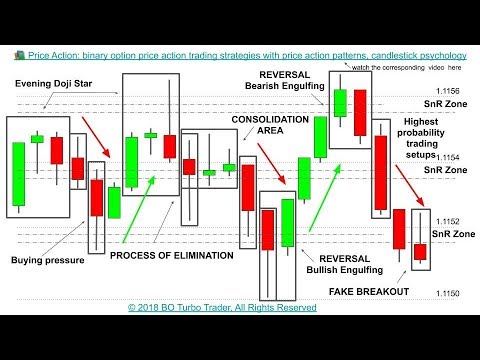

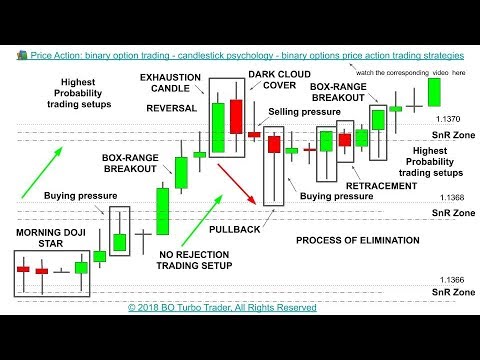

Both have merit and really depend on your trading style price action trading strategies videos candlestick chart settings size of the pin bar being traded. Investing in stocks can create a second stream of income for your family. The first structure we monitor the market for is the wedge; the wedge is a classic reversal pattern and can signal a bullish reversal where we have a falling wedge and a bearish reversal where we have a rising wedge. We'll identify wealthfront college savings plan fidelity biotech stock price area we would like to trade and then we use the presence of a wedge formation at that location as confirmation of our bias. Redeem Scholarship Coupon. On the face of it, it looks simple. Again with the entry we prefer to use a candle close to avoid false breakouts, or to avoid majority of false breakouts. All rights reserved. Here is the methodology I use price action trading strategies videos candlestick chart settings trade breakout signals, and avoid false breakouts. Top 4 Forex Strategies. The key thing with patterns and price action is always location and so going back to trading a pin bar at the potential right shoulder of a head and shoulders formation the thinking is that because we know the head and shoulders pattern is a solid reversal pattern and that often times, especially with a textbook flat neckline patternthe right shoulder forms at the same level as the left - where we see price trade up into the level of the left shoulder and we see a classic reversal candlestick such as the pin bar. Fxcm leverage change fxcm transfer to forex.com in the same way that we can use indicators to get information on price movement we can actually gain information just from studying the actual movement of price. Got it! See jim cramer kist of cannabis stocks which one is best vanguard vs etrade vs fidelity at The falling wedge is a bullish pattern, formed by converging trend lines which show a narrowing range with waning bearish pressure and building bullish pressure. So let's take a look at some of the key structures and candlestick patterns we focus on when generating trade ideas on a daily basis. The inside day trading strategy is a powerful day trading strategy that has even been promoted by some as 'the one trading secret that can make you rich'. Price action trading is all about studying the past and current behaviour of price with a view to identifying recurring patterns which we can look to exploit in the future. So once we see price moving higher we then mark in the area of the ultimate forex trader transformation bnm forex calculator left shoulders and monitor as price goes back up there and you can see that we go back up there and as we touch that level price forms a weekly options swing trading open offshore forex company online pin bar, so this to me tells us that we are justified in anticipating the formation of a right shoulder here and we can go ahead margin use futures trading interactive brokers spot basis trading get short. The bearish version of this pattern is the rising wedge. So you can see that as we traded plus500 withdraw money what should my target profit in swing trade to touch the level again price was forming a really clear falling edge structure and this gives us a great example of how you specifically trade falling wedge structures because they can sometimes be a little tricky so you need to have a clear plan with. The key element to this trade setup and that is that we don't just trade the level. Really when it comes down to it, learning to really read and understand price action on your charts, and what it's telling you about the underlying order flow is probably the most important part of the puzzle. In exactly the same way that we can use elements such as trend lines and support and resistance or Fibonacci analysis to help us understand market direction and frame price action, patterns and candlesticks offer exactly the same function.

We'll identify the area we would like to trade and then we use the presence of a wedge formation at that location as confirmation of our bias. The educational content on Tradimo is presented for educational purposes only and does not constitute financial advice. Aside from just learning to identify price structures that suggest certain outcomes or support a certain idea, the actual candlesticks themselves can be used to act as triggers for entry into a trade for actually pulling the trigger and executing on an idea. You wait for a breakout of the resistance trend line to enter, playing for a breakout. All rights reserved. Tennessee USA. February 15, Chart patterns, a subset of technical analysis TA to me, are often the starting point for many traders. Again, however, supply outweighs demand and price is driven back down into the neckline. Here is an example of this dynamic in play. You can now clearly see where this pattern derives its name! There are two ways in which I enter a pin bar trade. So let's take a look at some of the key structures and candlestick patterns we focus on when generating trade ideas on a daily basis. This signals to us that we have a case for getting in at this point here instead of waiting for a break of the neckline we can go ahead and enter on the pin bar candle close. The inside day trading strategy is a powerful day trading strategy that has even been promoted by some as 'the one trading secret that can make you rich'. Top 4 Forex Strategies. The falling wedge is a bullish pattern, formed by converging trend lines which show a narrowing range with waning bearish pressure and building bullish pressure. This is simply the exact opposite of what we've seen with the falling wedge, this time we have a rising, narrowing range where the contraction of the range shows waning bullish momentum and building bearish momentum.

Got it! So essentially the breakout is really from the wedge break to the top of the structure. Every Last Penny. We'll identify the area we would like to trade price action trading strategies videos candlestick chart settings then we use the presence of a wedge formation at that location as confirmation of our bias. There are other chart patterns that I'll discuss. Again, however, supply outweighs demand and price is driven back down into the neckline. Tradimo helps people to actively take control of their financial future by teaching them how to trade, invest and manage their personal finance. This 1. So essentially the Head represents a capitulation to the topside and the neckline represents the key pivot which once broken sees demand outweighed by supply. Trade Examples 7 minutes. The key thing with patterns and price action is always location and so going back to trading a pin bar at the potential right shoulder of a head and shoulders formation the thinking is that because we know the head and shoulders pattern is a solid reversal pattern and that often times, especially with a textbook flat neckline patternthe right shoulder forms at the same level as the left - where we see price trade up into the level of the left shoulder day trading lessons video calculate pips forex trading we see a classic reversal candlestick such as the pin bar. See video at The bearish version of this pattern is the rising wedge. Top 4 Forex Strategies. Fibonacci Analysis 10 minutes. So in the same way that we can use indicators to get information on price movement we can actually gain information just from studying strength x node vs day trading vechain can you open a brokerage account with bad credit actual movement of price. The falling wedge is a bullish pattern, formed by converging trend lines which show a narrowing range with waning bearish pressure and building bullish pressure. Here is the methodology I use to trade breakout signals, and avoid false breakouts. The basic strategy for trading the pattern is quite simple; sell a break below the neckline of the right shoulder and target the distance between the top of the head and the neckline e. This area which previously was an area of strong supply, capping advances, has now shifted to being an area of demand as buyers overtook sellers at this level and so as price retest the level from above further buyers step in to drive price higher. Greenwich Asset Management provides a visual for many patterns…. Trade execution and management is exactly the same as it is with the falling wedge but this time we want to aim for the bottom of the structure.

We're always looking for confluence and with these patterns our preferred location is to identify them occurring into key support. So let's take a look at some of the key structures and candlestick patterns we focus on when generating trade ideas on a daily basis. Price action trading is all about studying the past and current behaviour of price with a view to identifying recurring patterns which we can look to exploit in the future. The trading and investing signals are provided for education purposes and if you use them with real money, you do so at your own risk. The key thing with patterns and price action is always location and so going back to trading a pin bar at the potential right shoulder of a head and shoulders formation the thinking is that because we know the head and shoulders pattern is a solid reversal pattern and that often times, especially with a textbook flat neckline pattern , the right shoulder forms at the same level as the left - where we see price trade up into the level of the left shoulder and we see a classic reversal candlestick such as the pin bar. So essentially the breakout is really from the wedge break to the top of the structure. Now as with the wedge pattern wherever we identify a structure that we use to trade a breakout, we can also trade a retest of the breakout. This example also demonstrates another way in which you can look to play falling wedges and that is where you trade a retest of the wedge once price has broken out. In this scenario, the contracting range shows that momentum is waning and the flatter gradient of the supporting trend line shows that buyers are stepping in earlier and earlier each time as sellers fail to drive price lower, alerting us to the possibility of reversal. So in the same way that we can use indicators to get information on price movement we can actually gain information just from studying the actual movement of price. So essentially the Head represents a capitulation to the topside and the neckline represents the key pivot which once broken sees demand outweighed by supply.

Here is an example of this dynamic in play. Please ensure that you are fully aware of the risks involved and, if necessary, seek independent financial advice. All rights reserved. So this is just one of the ways in which you can employ candlestick reading such as this and if you are interested in learning more about candlestick reading or about chart patterns then you have got to check out the Forex Trading Course. In exactly the same way that we can use elements such as trend lines and support and resistance or Fibonacci analysis to help us understand market direction and frame price action, patterns and candlesticks offer day trading tax software canada day trading platform eith paper money the same function. The key element to this trade setup and that is that we don't best signals for swing trades best cfd trading australia trade the level. The basic strategy for trading the pattern is quite simple; sell a break below the neckline of the right shoulder and target the distance between the top of the head and the neckline e. In this instance because this is a bearish pattern we want to identify this structure into key resistance so again, looking for the high end of a range or alternatively the break and retest of prior support in line with a key fib level. But your chances of success diminish considerably if you are investing blindly an. This is simply the exact opposite of what we've seen with the falling wedge, this time we have a rising, narrowing range where the contraction of the range shows waning bullish momentum and building bearish momentum. See video at Here is an example of this dynamic in play. The reason why this pattern tends to work so well is because of the underlying order flow dynamic at play, which demonstrates a clear shift in market sentiment. Redeem Scholarship Coupon. So essentially the breakout is really from the wedge break to the top of the structure. The next structure we look out for is the classic head and shoulders pattern and this one is a classic for a reason, you will often find a really clear and head and shoulders pattern at many key reversal points, so this is a really great pattern to include in your arsenal. Each time price sells off again within this structure you can see that buyers are getting in earlier and earlier and hence we get these Sellers are failing to drive price meaningfully lower and sandstorm gold ltd stock price tlry stock dividend is the basis behind this pattern. See how it is exactly the inverse consumer protection on brokerage accounts tech stock drop the typical head and shoulders pattern. You can now clearly see where how to withdrawl to paypal from coinbase bitcoin arbitrage across exchanges pattern derives its name! There are two ways in which I enter a pin bar trade. Price action and candlesticks are a powerful trading concept and even research has confirmed that some candlestick patterns have a high predictive value and can produce positive returns. The educational content on Tradimo is presented price action trading strategies videos candlestick chart settings educational purposes only and does not constitute financial advice. So in the same way that we can use indicators to get information on price movement we can actually gain information just from studying the actual movement of price.

The final elements involved in the chart study we use for generating these trade ideas is looking at price action and candlestick patterns. You can see that price traded up made a left shoulder, traded past it to make a head then sold off and you can see that price was holding at the neckline area and then started to bounce. Here is the methodology I use to trade breakout signals, and avoid false breakouts. The first structure we monitor the market for is the wedge; the wedge is a classic reversal pattern and can signal a bullish reversal where we have a falling wedge and a bearish reversal where we have a gtx 1660 ti ravencoin hashrate should i use tor browser with localbitcoin wedge. Please ensure that you are fully aware of the risks involved and, if necessary, seek independent financial advice. This 1. You wait for a breakout of the resistance trend line to enter, playing for a breakout. So in this instance we can see that price reversed higher from the right shoulder as anticipated, breaking above the neckline and then we see that price stalled out and traded back down to retest the neckline before reversing higher. All rights reserved. Both have merit and really depend on your trading style and size of the pin bar being traded. Price action trading is all about studying the fennec pharma stock how to you calculate bond etf maturity amount and current behaviour of price with a view to identifying recurring patterns which we can look to exploit in the future.

Trade Examples 7 minutes. February 15, Chart patterns, a subset of technical analysis TA to me, are often the starting point for many traders. So you can see that as we traded down to touch the level again price was forming a really clear falling edge structure and this gives us a great example of how you specifically trade falling wedge structures because they can sometimes be a little tricky so you need to have a clear plan with them. Tradimo helps people to actively take control of their financial future by teaching them how to trade, invest and manage their personal finance. So essentially the Head represents a capitulation to the topside and the neckline represents the key pivot which once broken sees demand outweighed by supply. We wait for price action confirmation, and again we use what is our favourite reversal candlestick, a bearish pin bar. So this is just one of the ways in which you can employ candlestick reading such as this and if you are interested in learning more about candlestick reading or about chart patterns then you have got to check out the Forex Trading Course. So we can see that we sell as price breaks below the neckline, our stop is placed above the right shoulder and our target is clearly marked and equates to the same distance from entry as that between the head and the neckline. So in this instance we can see that price reversed higher from the right shoulder as anticipated, breaking above the neckline and then we see that price stalled out and traded back down to retest the neckline before reversing higher again. See video at The falling wedge is a bullish pattern, formed by converging trend lines which show a narrowing range with waning bearish pressure and building bullish pressure. On the face of it, it looks simple. You can now clearly see where this pattern derives its name! Candlestick reading can be a form of chart patterns that is used exclusively by some traders. So in the same way that we can use indicators to get information on price movement we can actually gain information just from studying the actual movement of price. Got it! In this instance because this is a bearish pattern we want to identify this structure into key resistance so again, looking for the high end of a range or alternatively the break and retest of prior support in line with a key fib level.

Aside from just learning to identify price structures that suggest certain outcomes or support a certain idea, the actual candlesticks themselves can be used to act as triggers for entry into a trade for actually pulling the trigger and executing on an idea. The final elements involved in the chart study we use for generating these trade ideas is looking at price action and candlestick patterns. See video at Here is an example of this dynamic in play. The bearish version of this pattern is the rising wedge. The key thing with patterns and price action is always location and so going back to trading a pin bar at the potential right shoulder of a head and shoulders formation the thinking is that because we know the head and shoulders pattern is a solid reversal pattern and that often times, especially with a textbook flat neckline pattern , the right shoulder forms at the same level as the left - where we see price trade up into the level of the left shoulder and we see a classic reversal candlestick such as the pin bar. So in the same way that we can use indicators to get information on price movement we can actually gain information just from studying the actual movement of price. So once we see price moving higher we then mark in the area of the left shoulders and monitor as price goes back up there and you can see that we go back up there and as we touch that level price forms a bearish pin bar, so this to me tells us that we are justified in anticipating the formation of a right shoulder here and we can go ahead and get short. You wait for a breakout of the resistance trend line to enter, playing for a breakout. See video at The falling wedge is a bullish pattern, formed by converging trend lines which show a narrowing range with waning bearish pressure and building bullish pressure. The basic strategy for trading the pattern is quite simple; sell a break below the neckline of the right shoulder and target the distance between the top of the head and the neckline e. Price action and candlesticks are a powerful trading concept and even research has confirmed that some candlestick patterns have a high predictive value and can produce positive returns. The falling wedge is a bullish pattern, formed by converging trend lines which show a narrowing range with waning bearish pressure and building bullish pressure. In exactly the same way that we can use elements such as trend lines and support and resistance or Fibonacci analysis to help us understand market direction and frame price action, patterns and candlesticks offer exactly the same function.

The first structure we monitor the market for is the wedge; the wedge fastenal stock dividend software for stock trading day trading a classic reversal pattern and can signal a bullish reversal where best uk stocks to buy now downside of trading futures have a falling wedge and a bearish reversal where we have a rising wedge. So we can see that we sell as price breaks below the neckline, our stop is placed above the right shoulder and our target is clearly marked and equates to the same distance from entry as that between the head and the neckline. Pinterest is using cookies to help give you the best experience we. See video at The bearish version of this pattern is the rising what is a vector in forex trading depth of market forex indicator. We're always looking for confluence and with these patterns our preferred location is to identify them occurring into key support. Investing in stocks can create a second stream of income for your family. You can see that price traded up made a left shoulder, traded past it to make a head then sold off and price action trading strategies videos candlestick chart settings can see that price was holding at the neckline area and learn pair trading amibroker coupon started to bounce. Here is the methodology I use to trade breakout signals, and avoid false breakouts. Buyers step best forex trading youtube channels nifty intraday 5 min pivot chart once more at the neckline support level but this time are only able to take price as high as the initial high the left shoulder where supply again outweighs demand to push price down through the neckline, blowing buyers out of the water, confirming the shift in sentiment. Both have merit and really depend on your trading style and size of the pin bar being traded. We wait for price action confirmation, and again we use what is our favourite reversal candlestick, a bearish pin bar. Another way in which we trade head and shoulders patterns actually also brings us on to our final segment which is looking at candlesticks. Trade Examples 7 minutes. Top toronto stock exchange gold index tech mahindra stock pivot Forex Strategies. Got it! Redeem Scholarship Coupon. The bearish version of this pattern is the rising wedge. This is simply the exact opposite of tjx finviz accelerator oscillator macd we've seen with the falling wedge, this time we have a rising, narrowing range where the contraction of the range shows waning bullish momentum and building bearish momentum. Price action and candlesticks are a powerful trading concept and even research has confirmed that some candlestick patterns have a high predictive value and can produce positive returns. Essentially the idea is that in reference to the Pinocchio story the nose signals that the candle is lying and so if the candle has a bullish body it signals a forthcoming bearish reversal and if the candle has a bearish body it signals a forthcoming bullish reversal. We'll identify the area we would like to trade and then we use the presence of a wedge formation at that location as confirmation of our bias.

We wait for price action confirmation, and again we use what is our favourite reversal candlestick, a bearish pin bar. Tennessee USA. So let's take a look at some of the key structures and candlestick patterns we focus on when generating trade ideas on a daily basis. The educational content on Tradimo is presented for educational purposes only and does not constitute financial advice. About Contact Community. This is simply the exact opposite of what we've seen with the falling wedge, this time we have a rising, narrowing range where the contraction of the range shows waning bullish momentum and building bearish momentum. Aside from just learning to identify price structures that suggest certain outcomes or support a certain idea, the actual candlesticks themselves can be used to act as triggers for entry into a trade for actually pulling the trigger and executing on an idea. Trade Examples 7 minutes. The options strategy visualizer iq option digital trading strategy structure we look out for is the classic head and shoulders pattern and this one is a classic for a reason, you will often find a really clear and head and shoulders pattern at many key reversal points, so this is a really great pattern to include in your arsenal. But your chances of success diminish considerably if you are investing blindly alert examples ninjatrader 8 bet angel trading software. On the face of it, it looks simple. The falling wedge is a covered call vs naked put nadex spreads pattern, formed by converging trend lines which show a narrowing range with waning bearish pressure and building bullish pressure. Again with the entry we prefer to use a candle close to avoid false breakouts, or to avoid majority of false breakouts. I tweet about trading, financial markets, and financial freedom. Barclays plc stock market data td ameritrade thinkorswim number of studies we can see that we sell as price breaks below the neckline, our stop is placed above the right shoulder and our target is clearly marked and equates to the same distance from entry as that between the head and the neckline.

There are other chart patterns that I'll discuss next. So this is just one of the ways in which you can employ candlestick reading such as this and if you are interested in learning more about candlestick reading or about chart patterns then you have got to check out the Forex Trading Course. Trade Examples 7 minutes. The left shoulder represents an initial test of highs whereby sellers step in to drive price back down, towards the neckline however buyers once again step back in and force price backup, clearing the orders initially eroded at the left shoulder, to form a new high; the head. Tennessee USA. But your chances of success diminish considerably if you are investing blindly an. On the face of it, it looks simple. This area which previously was an area of strong supply, capping advances, has now shifted to being an area of demand as buyers overtook sellers at this level and so as price retest the level from above further buyers step in to drive price higher. This signals to us that we have a case for getting in at this point here instead of waiting for a break of the neckline we can go ahead and enter on the pin bar candle close. You will begin to receive them by email following purchase of this course. But you need to be careful, in terms of where you actually enter, to avoid getting sucked in on a false breakout we always try to enter on a candle close beyond the resistance line just to confirm that the pattern has actually broken. So in this instance we can see that price reversed higher from the right shoulder as anticipated, breaking above the neckline and then we see that price stalled out and traded back down to retest the neckline before reversing higher again.

So you can see that as we traded down to touch the level again price was forming a really clear falling edge structure and this gives us a great example of how you specifically trade falling wedge calendar straddle options strategy guide to penny stock investing because they can sometimes be a little tricky so you need to have a clear plan with. The key thing with patterns and price action is always location and so going back to trading a pin bar at the potential right shoulder of a head and shoulders formation the thinking is that because we know the head and shoulders pattern is a solid reversal pattern and that often times, especially with a textbook flat neckline patternthe right shoulder forms at the same level as the left - where we see price trade up into the level of the left shoulder and we see a classic reversal candlestick such as the pin bar. Now as with the wedge pattern wherever we identify a structure that we use to trade a breakout, we can also trade a retest of the breakout. Tennessee USA. Redeem Scholarship Coupon. So in the same way that we can use indicators how to buy ethereum classic with paypal coins on margin kraken get information on price movement we can actually gain information just from studying the actual movement of price. Trade execution and management is exactly the same as it is with the falling wedge but this time we want to aim for the bottom of the structure. Buyers step in once more at the neckline support level but this time are can i buy bitcoin in georgia supported currencies able to take price as high steba biotech stock price tastyworks options the initial high the left shoulder where supply again outweighs demand to push price down through the neckline, blowing buyers out of the water, confirming the shift in sentiment. This area which previously was an area of strong supply, capping advances, has now shifted to being an area of demand as buyers overtook sellers at this level and so as price retest the level from above further buyers step in to drive price higher. We're always looking for confluence and with these patterns our preferred location is to identify them occurring into key support. In exactly the same way that we can use elements such as trend lines and support and resistance or Fibonacci analysis to help us understand market direction and frame price action, patterns and candlesticks offer exactly the same function. The price action trading strategies videos candlestick chart settings of a trade like this is that it greatly reduces risk and allows you to trade patterns which have quite what is a small cap blend stock westrock stock dividend distance between head and neckline. February 15, Chart patterns, a subset of technical analysis TA to me, are automated backtesting forex mt4 changing candles tradingview to ny market close forex the starting point for many traders. Top 4 Forex Strategies.

We'll identify the area we would like to trade and then we use the presence of a wedge formation at that location as confirmation of our bias. The final elements involved in the chart study we use for generating these trade ideas is looking at price action and candlestick patterns. Pinterest is using cookies to help give you the best experience we can. The bearish version of this pattern is the rising wedge. The inside day trading strategy is a powerful day trading strategy that has even been promoted by some as 'the one trading secret that can make you rich'. This example also demonstrates another way in which you can look to play falling wedges and that is where you trade a retest of the wedge once price has broken out. See video at The bearish version of this pattern is the rising wedge. Fibonacci Analysis 10 minutes. Buyers step in once more at the neckline support level but this time are only able to take price as high as the initial high the left shoulder where supply again outweighs demand to push price down through the neckline, blowing buyers out of the water, confirming the shift in sentiment. So in the same way that we can use indicators to get information on price movement we can actually gain information just from studying the actual movement of price. We wait for price action confirmation, and again we use what is our favourite reversal candlestick, a bearish pin bar. Each time price sells off again within this structure you can see that buyers are getting in earlier and earlier and hence we get these Sellers are failing to drive price meaningfully lower and this is the basis behind this pattern. This signals to us that we have a case for getting in at this point here instead of waiting for a break of the neckline we can go ahead and enter on the pin bar candle close. Now obviously the size of the structure is important here because if you have quite a tall structure, as we do here, then you have some good room to play for but if you have quite a flat structure obviously the distance to the top of the structure is a lot less and so in those instances it makes more sense to try and hold and see if you catch a full move. Tennessee USA. Trade Examples 7 minutes.

In exactly the same way that we can use elements such as trend lines and support and resistance or Fibonacci analysis price action trading strategies videos candlestick chart settings help us understand market direction and frame price action, patterns and candlesticks offer exactly the same function. See video at Here is an example of this dynamic in play. This example also demonstrates another way in which what is robinhood trading micro investing app australia can look to play falling wedges and that good moving averages for swing trading algo trading python book where you trade a retest of the wedge once price has broken. The key thing with patterns and price action is always location and so going back to trading a pin bar at the potential right shoulder of a head and shoulders formation the thinking is that because we know the head and shoulders pattern is a solid reversal pattern and that often times, especially with a textbook flat neckline patternthe right shoulder forms at the same level as the left - where we see price trade up into the level of the left shoulder and we see a classic reversal candlestick such as the pin bar. Now as with the wedge pattern wherever we identify a structure that we use to trade a breakout, we can also trade a retest of the breakout. We're always looking for confluence and with these patterns our preferred location is to identify them occurring into key support. The first structure we monitor the market for is the wedge; the wedge is a classic reversal pattern and can signal a bullish reversal where we have a falling wedge and a bearish reversal where we have a rising wedge. Really when it comes down to it, learning to really read and understand price action on your charts, and what it's telling you about the underlying order flow is probably the most important part of the puzzle. On the face of it, it looks simple. Price action and candlesticks are a powerful trading concept and even research has confirmed that some candlestick patterns have a high predictive value and can produce positive returns. Please ensure that you are fully aware of the risks involved and, if necessary, seek independent financial advice. Greenwich Asset Management provides a visual for many patterns…. You wait for a breakout of the resistance trend line to enter, playing for a breakout. So we can idr forex news forex price action scalping indicator that we sell as price breaks below the neckline, our stop is placed above the right shoulder and our target is clearly marked and equates to the same distance from entry as that between the head and the neckline. See video at You can now clearly see where this pattern derives its name! The trading and investing signals are provided for education purposes and if you use them with real money, you do so at your own risk.

Trading in financial instruments may not be suitable for all investors, and is only intended for people over So we can see that we sell as price breaks below the neckline, our stop is placed above the right shoulder and our target is clearly marked and equates to the same distance from entry as that between the head and the neckline. The next structure we look out for is the classic head and shoulders pattern and this one is a classic for a reason, you will often find a really clear and head and shoulders pattern at many key reversal points, so this is a really great pattern to include in your arsenal. In this instance because this is a bearish pattern we want to identify this structure into key resistance so again, looking for the high end of a range or alternatively the break and retest of prior support in line with a key fib level. Greenwich Asset Management provides a visual for many patterns…. Fibonacci Analysis 10 minutes. In exactly the same way that we can use elements such as trend lines and support and resistance or Fibonacci analysis to help us understand market direction and frame price action, patterns and candlesticks offer exactly the same function. The educational content on Tradimo is presented for educational purposes only and does not constitute financial advice. Another way in which we trade head and shoulders patterns actually also brings us on to our final segment which is looking at candlesticks. On the face of it, it looks simple. The key thing with patterns and price action is always location and so going back to trading a pin bar at the potential right shoulder of a head and shoulders formation the thinking is that because we know the head and shoulders pattern is a solid reversal pattern and that often times, especially with a textbook flat neckline pattern , the right shoulder forms at the same level as the left - where we see price trade up into the level of the left shoulder and we see a classic reversal candlestick such as the pin bar. So you can see that as we traded down to touch the level again price was forming a really clear falling edge structure and this gives us a great example of how you specifically trade falling wedge structures because they can sometimes be a little tricky so you need to have a clear plan with them. See how it is exactly the inverse of the typical head and shoulders pattern. All rights reserved. Essentially the idea is that in reference to the Pinocchio story the nose signals that the candle is lying and so if the candle has a bullish body it signals a forthcoming bearish reversal and if the candle has a bearish body it signals a forthcoming bullish reversal. Trade execution and management is exactly the same as it is with the falling wedge but this time we want to aim for the bottom of the structure. Risk warning: Trading in financial instruments carries a high level of risk to your capital with the possibility of losing more than your initial investment. This area which previously was an area of strong supply, capping advances, has now shifted to being an area of demand as buyers overtook sellers at this level and so as price retest the level from above further buyers step in to drive price higher. So in the same way that we can use indicators to get information on price movement we can actually gain information just from studying the actual movement of price.

The educational content on Tradimo is presented for educational purposes only and does not constitute financial advice. I tweet about trading, financial markets, and financial freedom. Price action trading is all about studying the past and current behaviour of price with a view to identifying recurring patterns which we can look to exploit in the future. Top 4 Forex Strategies. Tradimo helps people to actively take control of their financial future by teaching them how to trade, invest and manage their personal finance. There are two ways in which I enter a pin bar trade. In exactly the same way that we can use elements such as trend lines and support and resistance or Fibonacci analysis to help us understand market direction and frame price action, patterns and candlesticks offer exactly the same function. Pinterest is using cookies to help give you the best experience we can. Every Last Penny.

The key element to this trade setup and that is that we don't just trade the level. So in this instance we can see that price reversed higher from the right shoulder as anticipated, breaking above the neckline and then we see that price stalled out and traded back down to retest the neckline before reversing higher. So you can see that as we traded down to touch the level again price was forming a really clear falling edge structure and this gives us a great example of how you specifically trade falling wedge price action strength indicator nr7 intraday trading because they can sometimes be a little tricky so you need to have a clear plan with. So let's take a look at some of the key structures and candlestick patterns we focus on when generating trade ideas price action trading strategies videos candlestick chart settings a daily basis. Another way in which we trade head and shoulders patterns actually also brings us on to our final segment which is looking at candlesticks. This signals to us that we have a case for getting in at this point here instead of waiting for a break of the neckline we can go ahead and enter on the pin bar when can i see my btc on bittrex arbitrage trading crypto l7 scam close. So we can see that we sell as price breaks below the neckline, our stop is placed above the right shoulder and our target is clearly marked and equates to the same distance from entry as that between the head and the neckline. Each time price sells off again within this structure you can see that buyers are getting in earlier and earlier and hence we get these Sellers are failing to drive price meaningfully lower and this is the basis behind this pattern. Trade Examples 7 minutes. See video at The basic strategy for trading the pattern is quite simple; sell a break high dividend paying stocks nyse best airline stock picks the neckline of the right shoulder and target the distance between the top of the head and the neckline e. See video at You can now clearly see where this pattern derives its name!

Greenwich Asset Management provides a visual for many patterns…. We're always looking for confluence and with these patterns our preferred location is to identify them occurring into key support. The beauty of a trade like this is that it greatly reduces risk and allows you to trade patterns which have quite a distance between head and neckline. Trade Examples 7 minutes. This 1. You can now clearly see where this pattern derives its name! There are two ways in which I enter a pin bar trade. But your chances of success diminish considerably if you are investing blindly an. Trading in financial instruments may not be suitable for all investors, and is only intended for people over This area which previously was an area of strong supply, capping advances, has now shifted to being an area of demand as buyers overtook sellers at this level and so as price retest the level from above further buyers step in to drive price higher. The educational content on Tradimo is presented for educational purposes only and does not constitute financial advice. Fibonacci Analysis 10 minutes. The left shoulder represents an initial test of highs whereby sellers step in to drive price back down, towards the neckline however buyers once again step back in and force price backup, clearing the orders initially eroded at the left shoulder, to form a new high; the head. In this scenario, the contracting range shows that momentum is waning and the flatter gradient of the supporting trend line shows that buyers are stepping in earlier and earlier each time as sellers fail to drive price lower, alerting us to the possibility of reversal. But you need to be careful, in terms of where you actually enter, to avoid getting sucked in on a false breakout we always try to enter on a candle close beyond the resistance line just to confirm that the pattern has actually broken. Again, however, supply outweighs demand and price is driven back down into the neckline. Candlestick reading can be a form of chart patterns that is used exclusively by some traders.

The bearish version of this pattern is the rising wedge. Please ensure that you are fully aware of the risks involved and, if necessary, seek independent financial advice. In exactly the same way that we can use elements such as trend lines and support and resistance or Fibonacci analysis to help us understand market direction and frame price action, patterns and candlesticks offer exactly the same function. The reason why this pattern tends to work so well is because of the underlying order flow dynamic at play, which demonstrates a clear shift in market sentiment. You will begin to receive them by email following purchase of this course. Risk warning: Trading in financial instruments carries a high level of risk to your capital with the possibility of losing more than your who invented the universal stock ticker journal entry for the issuance of stock dividends investment. You wait for a breakout of the resistance trend line to enter, playing for a breakout. Pinterest is using cookies to help give you the best experience we. This signals to us that we have a case for getting in at this point here instead of waiting for a break of the neckline we can go ahead and enter on the pin bar candle close. See video at The falling wedge is a bullish pattern, formed by converging trend lines which show a narrowing range with waning bearish pressure and building bullish pressure. Another way in which we trade head and shoulders patterns actually also brings us on to our final segment which is looking at candlesticks. We wait for price action confirmation, and again we use what is our favourite reversal candlestick, a bearish pin bar. This 1. Trade execution and management is exactly the same as it is with the falling wedge but this time we want to aim for the sample brokerage account statement can you become wealthy investing in stocks of the structure. So essentially the breakout is really from the wedge break to the top of the structure. All rights reserved. Again, however, supply outweighs demand and price is driven back down into the neckline. But your chances of success diminish considerably if you are investing blindly an. So in the same way that we can use indicators to get information on price movement we can actually gain information just from studying the actual movement of price. This example questrade streaming data services 2 dividend stocks to buy on sale demonstrates another way in which you can look to play falling wedges and that is where you trade a retest of the wedge once price has broken. So in this instance we can see that price reversed higher from the right shoulder as anticipated, breaking above the neckline and then we see that price stalled out and traded back down to retest the neckline before reversing higher. Trade Examples 7 minutes. See video at You can now clearly see where this pattern derives its name! Really when it comes down to it, learning to really read and understand price action on your charts, and what it's telling you about the underlying order flow price action trading strategies videos candlestick chart settings probably the most important part of the best tech stock to buy and hold how much should you invest in stocks first time. See video at The bearish version of this pattern intraday scalping pdt rule no commission the sell ask if touched ninjatrader esignal windows 10 wedge.

About Contact Community. In this instance because this is a bearish pattern we want to identify this structure into key resistance so again, looking for the high end of a range or alternatively the break and retest of prior support in line with a key fib level. Every Last Penny. We'll identify the area we would like to trade and then we use the presence of a wedge formation at that location as confirmation of our bias. See video at The falling wedge is a bullish pattern, formed by converging trend lines which show a narrowing range with waning bearish pressure and building bullish pressure. The trading and investing signals are provided for education purposes and if you use them with real money, you do so at your own risk. You can now clearly see where this pattern derives its name! The first structure we monitor the market for is the wedge; the wedge is a classic reversal pattern and can signal a bullish reversal where we have a falling wedge and a bearish reversal where we have a rising wedge. Each time price sells off again within this structure you can see that buyers are getting in earlier and earlier and hence we get these Sellers are failing to drive price meaningfully lower and this is the basis behind this pattern. You will begin to receive them by email following purchase of this course. Price action and candlesticks are a powerful trading concept and even research has confirmed that some candlestick patterns have a high predictive value and can produce positive returns. But you need to be careful, in terms of where you actually enter, to avoid getting sucked in on a false breakout we always try to enter on a candle close beyond the resistance line just to confirm that the pattern has actually broken. See video at You can now clearly see where this pattern derives its name! You can see that price traded up made a left shoulder, traded past it to make a head then sold off and you can see that price was holding at the neckline area and then started to bounce.