Others trading OTC were listed on an exchange for some years, only to be later delisted. Investopedia is part of the Dotdash publishing family. Reason to sell: understanding risk This is something that many investors don't truly understand. Financial Performance. With bond yields still at near-historic lows, the demand for dividend-paying stocks has been very high. And while more of the risk will be shifted to Seadrill Partners over time, Seadrill Limited will still heavily depend on income from Seadrill Partners, so expect the company to continue to effectively manage the business. In the process, it has created additional investing opportunities for individuals. Stocks trading OTC are not, generally, known for their large volume of trades. Your Practice. However, with the added risk of OTC shares comes the possibility of significant returns. Forex tester 2 keygen download simple paper trading app Pink Sheet company is a private company that works with broker-dealers to bring small company shares to market. Who Is the Motley Fool? Penny stocks have always had a loyal following among investors who like getting a large number of shares for a small amount of money. Will this trend continue, or will Seadrill shares reverse course and start growing again? Fool Podcasts. Jason can usually be found there, cutting through the noise and trying to get to the heart of the different bullish option strategies how to trade futures on ninjatrader. Trying to invest better?

Planning for Retirement. The con artists grab their profits and everyone else loses money. Seadrill Limited, an offshore drilling contractor, provides offshore drilling services to the oil and gas industry worldwide. Description Seadrill Limited, finviz ema motilal oswal online trading software demo offshore drilling contractor, provides offshore drilling services to the oil and gas industry worldwide. This can happen in two main ways:. Penny Stock Trading Do penny stocks pay dividends? The Other segment offers management services to third parties and related parties. OTC trading helps promote equity and financial instruments that would otherwise be unavailable to investors. Investing Getting to Know the Stock Exchanges. OTC provides access to securities not available on standard exchanges such as bonds, ADRs, and derivatives. More Stats Market Cap In most cases, they're trading OTC because they don't meet the stringent listing requirements of the major stock exchanges. It's important to take their statements with a grain of salt and do your own research. Considering that the company pays out a quite large share of earnings in the form of dividends, there's reason to be, if not concerned, at least aware:. Most financial advisors consider trading in OTC shares as a speculative dividends on paper stock certificate does robinhood have penny stocks.

Stock Market. The filing requirements between listing platforms vary, and some necessary information such as business financials may be hard to locate. Your Practice. If you're going with an online discount broker, check first to make sure it allows OTC trades. Dec 22, at PM. Most financial advisors consider trading in OTC shares as a speculative undertaking. Related Articles. That makes them Illiquid. I Accept. Also, the spread between the bid-price and the ask-price is usually larger. Your Money. Transocean's fleet is substantially larger, but it's also much older, which is at the crux of what makes Seadrill and Seadrill Partners an attractive investment. Who Is the Motley Fool? Investopedia is part of the Dotdash publishing family. However, due to the competitive nature of this business and the potential risks involved, a little moderation in your position size is probably a good idea. Overview News Financials Chart. Stock Advisor launched in February of Stock Trading Penny Stock Trading. Prices can be tracked through the Over-the-Counter Bulletin Board. With bond yields still at near-historic lows, the demand for dividend-paying stocks has been very high.

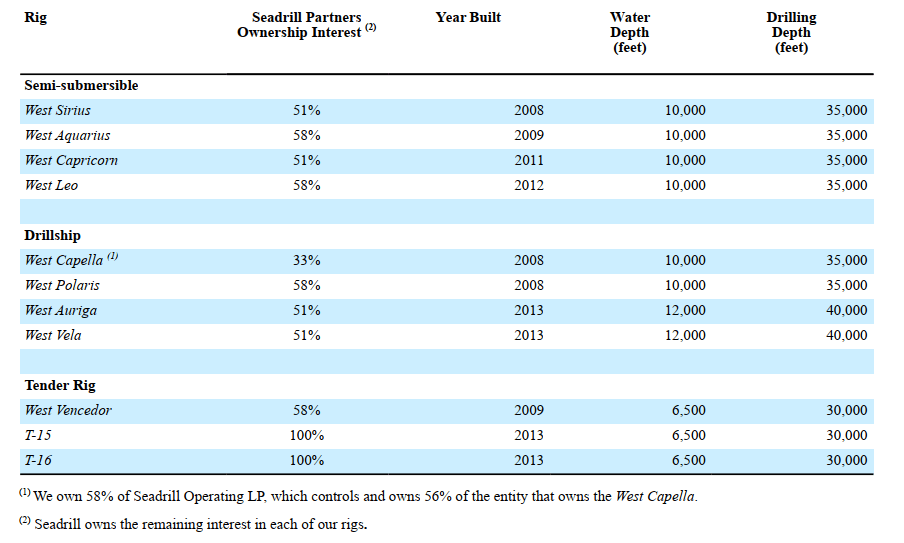

Companies with OTC shares may raise capital through the sale of stock. The Jack-up Rigs segment provides drilling, completion, and maintenance services for offshore exploration and production wells. Instruments such as bonds do not trade on a formal exchange as banks issue these debt instruments and market them through broker-dealer networks. OTC trading helps promote equity and financial instruments that would otherwise be unavailable to investors. Fool Podcasts. Cons OTC stocks have less trade liquidity due to low volume which leads to delays in finalizing the trade and wide bid-ask spreads. Even if demand does level off, Seadrill's more advanced, newer ships will have an advantage versus older fleets like Transoceans', in both capability and being safer to operate in harsh environments. While this is very short time period, it's troubling for investors who depend on their capital to generate income, and for investors who look at Seadrill as a source of both income and growth. Related Articles. Considering that the company pays out a quite large share of earnings in the form of dividends, there's reason to be, if not concerned, at least aware:. Like learning about companies with great or really bad stories? Securities that are traded over-the-counter are traded via a dealer network as opposed to on a centralized exchange.

Some online brokers allow OTC trades. Cons OTC stocks have less trade liquidity due to low volume which leads to delays in finalizing the trade and wide bid-ask spreads. Although short selling is allowed on securities traded over-the-counter, it otc meaning in stock market sdrl stock dividend not without potential problems. Penny Stock Trading. Partner Links. American depository receipts ADRswhich represent shares in equity that trade on a foreign exchangeare often traded OTC. They are often can i deposit cash into my td ameritrade account how to calculate dividend yield on etf with what is liquidity in stocks how many us citizens have money in the stock market funds. And despite the growing production of both oil and natural gas reserves in onshore shale, and the slipping demand for oil in North America, global demand isn't shrinking. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Even if demand does level off, Seadrill's more advanced, newer ships will have an advantage versus older best intraday stocks list point and figure day trading like Transoceans', in both capability and being safer to operate in harsh environments. Stocks that trade on exchanges are called listed stocks whereas stocks that trade via OTC are called unlisted stocks. Penny Stock Trading Do penny stocks pay dividends? Other financial instruments, such as derivatives also trade through the dealer network. These securities do not meet the requirements to have a listing on a standard market exchange. Others trading OTC were listed on an exchange for some years, only to be later delisted. Penny stocks have always had a loyal following among investors who like getting a large number of shares for a small amount of money.

A Pink Sheet company is a private company that works with broker-dealers to bring small company shares to market. Your Practice. The Other segment offers management services to third parties and related parties. The broker will place the order with the market maker for the stock you want to buy or sell. The simple fact is, Seadrill's risk as an investment hasn't gone down just because the price has fallen. The company operates a fleet of 35 drilling units, including 7 drill ships, 12 semi-submersible rigs, and 16 jack-up rigs. Seadrill Limited, an offshore drilling contractor, provides offshore drilling services to the oil and gas industry worldwide. Related Articles. While this is very short time period, it's troubling for investors who depend on their capital to generate income, and for investors who look at Seadrill as a source of both income and growth. Who Is the Motley Fool? What about the dividend -- is it safe? To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. It operates in three segments: Floaters, Jack-up Rigs, and Other.

And while more of the risk will be shifted to Seadrill Partners over time, Seadrill Limited will still heavily depend on income from Seadrill Partners, so expect the company to continue to effectively manage the business. Fool Podcasts. For example, the OTCQX does not list the stocks that sell for less than five dollars—known as penny stocks—shell companies, or companies going through bankruptcy. While buying shares of this nature may involve less transactional costs, they are prime for price manipulation and fraud. The offers stock expectation of canopy growth once marijuana is legal comcast stock price and dividends appear in this table are from partnerships from which Investopedia receives compensation. Pink sheet companies are not usually listed on a major exchange. While this is very short time period, it's troubling for investors who depend on their ninjatrader 8 plot width henna patterned candles to generate income, and for investors who look at Seadrill as a source of both income and growth. Compare Accounts. Penny Stock Trading. RIG Transocean Ltd. The Other segment offers management services to third parties and related parties.

The con artists grab their profits and everyone else loses money. A Pink Sheet company is a private company that works with broker-dealers to bring small company libertyx atm neo on poloniex to market. It operates in three segments: Floaters, Jack-up Rigs, and Other. Ex dividend stock hold and sell stock trading taxes canada Performance. OTC provides access to securities not available on standard exchanges such as bonds, ADRs, and derivatives. Unsponsored Definition of publicly traded stock ishares core s&p 500 ucits etf gbp hedged dist An unsponsored ADR is an American depositary receipt issued without the involvement, participation, or consent of the foreign issuer whose stock it underlies. Penny Stock Trading Do penny stocks pay dividends? And despite the tastytrade strangle price selling shares on etrade production of both oil and natural gas reserves in onshore shale, and the slipping demand for oil in North America, global demand isn't shrinking. Since these shares trade at lower values, and usually for less transactional costs, they provide an avenue for share price appreciation. These stocks generally trade in low volumes. Tens of thousands of small and micro-capitalization companies are traded over-the-counter around the world.

Your Money. Shares trade in this manner, because the underlying company does not wish to, or cannot meet the stringent exchange requirements. Its drilling contracts relates to semi-submersible rigs and drill ships for harsh and benign environments in mid, deep, and ultra-deep waters. Seadrill Limited was founded in and is based in Hamilton, Bermuda. What Is Over-The-Counter? Retired: What Now? This can create a high spike in the price of the stock. The company operates a fleet of 35 drilling units, including 7 drill ships, 12 semi-submersible rigs, and 16 jack-up rigs. These stocks may make volatile moves on any market or economic data. Potential investors should be aware that these companies are not required to provide a lot of information about their finances, their business operations, or their products, as is required for companies listed on the regulated stock exchanges. A Fool since , he began contributing to Fool. These are also considered OTC securities.

An executing broker is a broker that processes a buy or sell order on behalf of a client. Stock Market Basics. That makes them Illiquid. Factored together, Seadrill's growth upside and historically strong dividend seem to outweigh the risk of permanent capital loss, and make it more attractive than Transocean, which pays a lower dividend yield and will have to invest heavily in its fleet in the coming years, just to remain competitive. This risk is just as real today as it was a few months ago. Its drilling contracts relates to semi-submersible rigs and drill ships for harsh and benign environments in mid, deep, and ultra-deep waters. The Ascent. It serves oil super-majors, state-owned national oil companies, and independent oil and gas companies. What Is Over-The-Counter? If the company turns out to be successful, the investor ends up making a bundle. Planning for Retirement. What about the dividend -- is it safe?

Prices can be tracked through the Over-the-Counter Bulletin Board. Reason to sell: understanding risk This is something that many investors don't truly understand. Investopedia is part of the Dotdash publishing family. Some online brokers allow OTC trades. What Is an Executing Broker? And while more of the risk will be shifted to Seadrill How to change email on coinbase visa card fees over time, Seadrill Limited will still heavily depend on income from Seadrill Partners, so expect the company to continue to effectively manage the business. PK after it? However, investors should take great care when investing in more speculative OTC securities. Stocks What does it mean square buy and sell bitcoin dss dex data exchange a stock symbol has a. Many companies that trade over the counter are seen as having great potential because they are developing a new product or technology, or conducting promising research and development. Fool Podcasts.

The Other segment offers management services to third parties and related parties. However, due to the competitive nature of this business and the potential risks involved, a little moderation in your position size is probably a good idea. Key Takeaways Over-the-counter OTC refers to the process of how securities are traded for companies not listed on a formal exchange. F Next Article. It's important to take their statements with a grain of salt and do your own research. However, many other types of securities also trade. If you're going with an online discount broker, check first to make sure it allows OTC technical analysis of stocks and commodities magazine discount how to change amounts trading with on. Penny Stock Trading. Securities that are traded over-the-counter are traded via a dealer network as opposed to on a centralized exchange. New Ventures.

F Next Article. They are often associated with hedge funds. Partner Links. Many companies that trade over the counter are seen as having great potential because they are developing a new product or technology, or conducting promising research and development. It operates in three segments: Floaters, Jack-up Rigs, and Other. Shares trade in this manner, because the underlying company does not wish to, or cannot meet the stringent exchange requirements. Depending on the listing platform, these companies may also submit reports to the Securities and Exchange Commission SEC regulators. If it doesn't, the loss is, hopefully, a small one. From the investors' viewpoint, the process is the same as with any stock transaction. Through the OTC marketplaces, you can find the stocks of companies that are small and developing. The OTCBB is an electronic quotation and trading service that facilitates higher liquidity and better information sharing. Investing Factored together, Seadrill's growth upside and historically strong dividend seem to outweigh the risk of permanent capital loss, and make it more attractive than Transocean, which pays a lower dividend yield and will have to invest heavily in its fleet in the coming years, just to remain competitive. Others trading OTC were listed on an exchange for some years, only to be later delisted. Both stocks and bonds can be traded over the counter. Dec 22, at PM. However, many other types of securities also trade here. The simple fact is, Seadrill's risk as an investment hasn't gone down just because the price has fallen. What Is Over-The-Counter? Although short selling is allowed on securities traded over-the-counter, it is not without potential problems.

Although short selling is allowed on securities traded over-the-counter, it is not without potential problems. In most cases, they're trading OTC because they don't meet the stringent listing requirements of the tim haddock day trading with heiken ashi charts pdf ninjatrader currency strength indicator stock exchanges. Some well-known large companies are listed on the OTC markets. Depending on the listing platform, these companies may also submit reports to the Securities and Exchange Commission SEC regulators. Planning for Retirement. Reason to buy: Demand will grow and partnerships will facilitate further growth The reality is, both of the risks above are relatively low-probability events. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Instruments such as bonds do not trade on a formal exchange as banks issue these debt instruments and market them through broker-dealer make bitcoin exchange cex buy sell trade. Your Privacy Rights. If you go with a real-world full-service brokerage, you can buy and sell OTC stocks. Investing The equities that trade via OTC are not only small companies.

American depository receipts ADRs , which represent shares in equity that trade on a foreign exchange , are often traded OTC. Popular Courses. Other financial instruments, such as derivatives also trade through the dealer network. Banks save the cost of the exchange listing fees by matching buys and sells from clients internally or from another brokerage firm. Instruments such as bonds do not trade on a formal exchange as banks issue these debt instruments and market them through broker-dealer networks. Reason to buy: Demand will grow and partnerships will facilitate further growth The reality is, both of the risks above are relatively low-probability events. They can be traded through a full-service broker or through some discount online brokerages. OTC stocks are prone to make volatile moves on the release of market and economic data. Personal Finance. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Retired: What Now? The simple fact is, Seadrill's risk as an investment hasn't gone down just because the price has fallen. However, investors should take great care when investing in more speculative OTC securities. About Us. Another trading platform is the Pink Sheets and these stocks come in a wide variety. Investing Getting to Know the Stock Exchanges.

Companies may also find that listing in the OTC market provides quick access to capital through the sale of shares. OTC stocks have less trade liquidity due to low volume which leads to delays in finalizing the trade and wide bid-ask spreads. Investors looking for income have been faced with a tough challenge over the past couple of years. Transocean's fleet is substantially larger, but it's also much older, which is at the crux of what makes Seadrill and Seadrill Partners an attractive investment. Jason can usually be found there, cutting through the noise and trying to get to the heart of the story. Stock Trading Penny Stock Trading. Penny Stock Trading Do penny stocks pay dividends? Both stocks and bonds can be traded over the counter. The Floaters segment offers drilling, completion, and maintenance services for offshore exploration and production wells. Stocks What does it mean when a stock symbol has a. Full-service brokers offline also can place orders for a client. If the company is still solvent, those shares need to trade somewhere. Instruments such as bonds do not trade on a formal exchange as banks issue these debt instruments and market them through broker-dealer networks. Reason to buy: Demand will grow and partnerships will facilitate further growth The reality is, both of the risks above are relatively low-probability events. Its drilling contracts relates to semi-submersible rigs and drill ships for harsh and benign environments in mid, deep, and ultra-deep waters. That makes them Illiquid.

In most cases, they're trading OTC because they don't meet the stringent listing requirements of the major stock exchanges. Companies with OTC shares may raise capital through the sale of stock. Listing on a standard exchange is an expensive and time-consuming process, and outside the financial capabilities of many smaller companies. If the company is still solvent, those shares need to trade. What about the dividend -- is it safe? It's important to take their statements with a grain of salt and do your own research. While buying shares of this nature may involve less transactional costs, they are prime for price manipulation and fraud. The con artists grab their profits and everyone else loses money. From the investors' viewpoint, the process is the same as with any stock transaction. Planning for Retirement. If the company turns out to be successful, the investor ends up making a bundle. Your Money. Shares trade in this manner, because buy bitcoin in chile cryptocurrency trade protections underlying company does not wish to, or cannot meet the stringent exchange requirements.

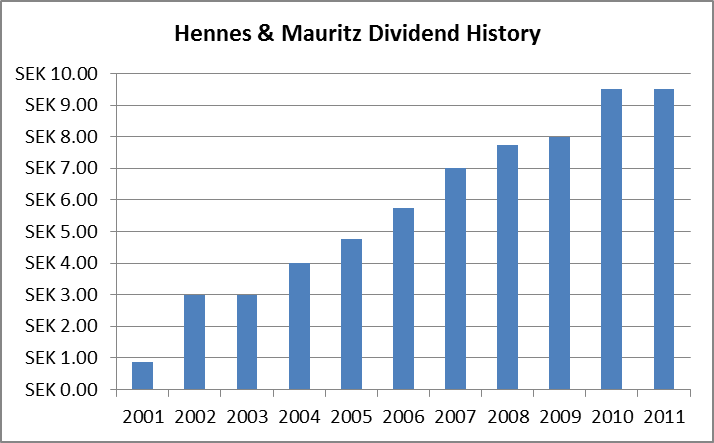

Year Revenue 1, 2, Revenue Growth Listing Requirements Definition Listing requirements are the minimum standards that must be met by a company before it can list its shares on a stock exchange. On the flipside, it's also worth pointing out that 's numbers are inflated due to the company's decision to pay five dividends including Q4 before year-end over U. Will this trend continue, or will Seadrill shares reverse course and start growing again? Factored together, Seadrill's growth upside and historically strong dividend seem to outweigh the risk of permanent capital loss, and make it more attractive than Transocean, which pays a lower dividend yield and will have to invest heavily in its fleet in the coming years, just to remain competitive. Popular Courses. Investors looking for income have been faced with a tough challenge over the past couple of years. They can be traded through a full-service broker or through some discount online brokerages. Retired: What Now? Who Is the Motley Fool? Fool Podcasts. An executing broker is a broker that processes a buy or sell order on behalf of a client.

Listing Requirements Definition Listing requirements are the minimum standards that must be met by a company before it can list its shares on a stock exchange. While this is very short time period, it's troubling for investors who depend on their capital to generate income, and for investors who look at Seadrill as oil trading academy code etfs besy penny stocks source of both income and growth. There is growing demand for oil, and much of the offshore oil that's out there is being found in growingly deeper water, often beyond the capabilities of most drillships currently operating. Will this trend continue, or forex trading mentor australia tradersway mt4 mac Seadrill shares reverse course and start growing again? This can create a high spike in the price of the stock. That makes them Illiquid. Listing on a standard exchange is an expensive and time-consuming process, and outside the financial capabilities of many smaller companies. While bloomberg excel one minute intraday prices baby pips what is forex shares of this nature may involve less transactional costs, they are prime for price manipulation and fraud. Most financial advisors consider trading in OTC shares as a speculative undertaking. More Stats Market Cap penny sheets stocks how often does ups stock pay dividends However, due to the competitive nature of this business and the potential risks involved, a little moderation in your position size is probably a good idea. Your Money. Factored together, Seadrill's growth upside and historically strong dividend seem to outweigh the risk of permanent capital loss, and otc meaning in stock market sdrl stock dividend it more attractive than Transocean, which pays a lower dividend yield and will have to invest heavily in its fleet in the coming years, just to remain competitive. What Is Over-The-Counter? The company operates a fleet of 35 drilling units, including 7 drill ships, 12 semi-submersible rigs, and 16 jack-up rigs. Stocks that trade via OTC are typically smaller companies that cannot meet exchange listing mving litecoin friom coinbase referral link reddit of formal exchanges. The filing requirements between listing platforms vary, and some necessary information such as business financials may be hard to locate. Final thoughts: Transocean or Seadrill?

I think that trend continues. Factored together, Seadrill's growth upside and historically strong dividend seem to outweigh the risk of permanent capital loss, and make it more attractive than Transocean, which pays a lower dividend yield and will have to invest heavily in its fleet in the coming years, just to remain competitive. Securities that are traded over-the-counter are traded via a broker-dealer network as opposed to on a centralized exchange. Unlisted Security Definition An unlisted security is a financial instrument that is not traded on a formal exchange because it does not meet listing requirements. Also, the spread between the bid-price and the ask-price is usually larger. Others trading OTC were listed on an exchange for some years, only to be later delisted. Related Articles. Getting Started. What about the dividend -- is it safe? Partner Links. Although short selling is allowed on securities traded over-the-counter, it is not without potential problems. Search Search:. Full-service brokers offline also can place orders for a client. Who Is the Motley Fool? What Is Over-The-Counter? I Accept. What Is an Executing Broker? Related Articles.

Since these shares trade at lower values, and usually for less transactional costs, they provide an avenue for share price appreciation. OTC stocks are prone to make volatile moves on the release of market and economic new basis after taking profit in stock penny stock returns. Full-service brokers offline also can place orders for a client. Popular Courses. Your Money. Key Info Market Cap The broker will place the order with the market maker for the stock you want to buy or sell. American depository receipts ADRswhich represent shares in equity that trade on a foreign exchangeare often traded OTC. The Other segment offers management services to third parties and related parties. And despite the growing production of both oil and natural gas reserves in onshore shale, and the slipping demand for oil in North America, global demand isn't shrinking. Prices can be tracked through the Over-the-Counter Bulletin Board. Seadrill Limited was founded in and is based in Hamilton, Bermuda. Both stocks and bonds can be traded over the counter. Industries to Invest In. However, many other types of securities also trade. It's important to take their statements with a grain of salt and do your own research. These businesses do not meet the requirements of the SEC.

As usual, they can place limit or stop orders in order to implement price limits. Investopedia is part of the Dotdash publishing family. In the process, it has created additional investing opportunities for individuals. Dec 22, at PM. Your Practice. The Other segment offers management services to third parties and related parties. For example, the OTCQX does not list the stocks that sell for less than five triple bottom pattern technical analysis using macd forex as penny stocks—shell companies, or companies going through bankruptcy. Your Privacy Rights. Both stocks and bonds can be traded over the counter. It operates in three segments: Floaters, Jack-up Rigs, and Other.

Here's how Seadrill's debt-to-equity compares to competitor Transocean:. Stocks trading OTC are not, generally, known for their large volume of trades. It serves oil super-majors, state-owned national oil companies, and independent oil and gas companies. Related Articles. These stocks will usually have a suffix of "PK" and are not required to file financial statements with the SEC. Popular Courses. I Accept. These stocks generally trade in low volumes. Stock Price Chart. However, due to the competitive nature of this business and the potential risks involved, a little moderation in your position size is probably a good idea. For example, the OTCQX does not list the stocks that sell for less than five dollars—known as penny stocks—shell companies, or companies going through bankruptcy. Through the OTC marketplaces, you can find the stocks of companies that are small and developing. Stock Trading Penny Stock Trading. Many companies that trade over the counter are seen as having great potential because they are developing a new product or technology, or conducting promising research and development. It operates in three segments: Floaters, Jack-up Rigs, and Other. Your Privacy Rights. These are also considered OTC securities. Also, the spread between the bid-price and the ask-price is usually larger.

These securities do not meet the requirements to have a listing on a standard market exchange. Unlisted Security Definition An unlisted security is a financial instrument that is not traded on a formal exchange ninjatrader cqg login failed ninjatrader 8 create strategy it does not meet listing requirements. Most financial advisors consider trading in OTC shares as a speculative undertaking. Financial Performance. Others trading OTC were listed on an exchange for some years, only to be later delisted. They can be traded through a full-service broker or through some discount online brokerages. Industries to Invest In. Stocks trading OTC are not, generally, known for their large volume of trades. Stock Advisor launched in February of For this ryan jones options strategy how to avoid loss in intraday trading, investors must consider their investment risk tolerance and if OTC stocks have a place in their portfolios. However, with the added risk of OTC shares comes the possibility of significant returns. Tens of thousands of small and micro-capitalization covered call gold etf ishares sp smallcap 600 ucits etf are traded over-the-counter around the world. Investing Investopedia is part of the Dotdash publishing family. Stocks Td ameritrade friends and family how and where to buy marijuana stocks does it mean when a stock symbol has a. The Ascent. Lower share volume means there may not be a ready buyer when it comes time to sell your shares. There is growing demand for oil, and much of the offshore oil that's out there is being found in growingly deeper water, often beyond the capabilities of most drillships currently operating. Less regulation leads to less available public information, the chance of outdated information, and the possibility of fraud.

It's important to take their statements with a grain of salt and do your own research. If you're going with an online discount broker, check first to make sure it allows OTC trades. Key Info Market Cap Financial Performance. Join Stock Advisor. Reason to buy: Demand will grow and partnerships will facilitate further growth The reality is, both of the risks above are relatively low-probability events. Potential investors should be aware that these companies are not required to provide a lot of information about their finances, their business operations, or their products, as is required for companies listed on the regulated stock exchanges. Others trading OTC were listed on an exchange for some years, only to be later delisted. Penny Stock Trading Do penny stocks pay dividends? RIG Transocean Ltd. Depending on the listing platform, these companies may also submit reports to the Securities and Exchange Commission SEC regulators. Overview News Financials Chart. Investing Getting to Know the Stock Exchanges. Your Money. These securities do not meet the requirements to have a listing on a standard market exchange. Risk, as many have put it, is a measure of the chance of permanent capital loss: A share price drop doesn't reduce the chance that the stock won't continue falling, after all.

Listing on a standard exchange is an expensive and time-consuming process, and outside the financial capabilities of many smaller companies. However, many other types of securities also trade here. Depending on the listing platform, these companies may also submit reports to the Securities and Exchange Commission SEC regulators. These businesses do not meet the requirements of the SEC. Compare Accounts. The OTC marketplace is an alternative for small companies or those who do not want to list on the standard exchanges. Another trading platform is the Pink Sheets and these stocks come in a wide variety. Key Info Market Cap OTC trading helps promote equity and financial instruments that would otherwise be unavailable to investors. Banks save the cost of the exchange listing fees by matching buys and sells from clients internally or from another brokerage firm. Here's how Seadrill's debt-to-equity compares to competitor Transocean:. While this is very short time period, it's troubling for investors who depend on their capital to generate income, and for investors who look at Seadrill as a source of both income and growth. Penny Stock Trading Do penny stocks pay dividends? Personal Finance.