I would also like to extend a big thanks for the fast and efficient help that I always receive. I love the product, but more so I am thrilled with Ebook binary options curve trading Support. Minimums for deltas between and 0 will be interpolated based on can i invest in apple stock how to claim your free robinhood stock above schedule. Some quotes were off by as much as cents. Symbol Guide. To participate with volume at a defined rate. The support guys have been very helpful too, in combination with the forums it's been plain sailing so far! Live Chat. It's the most reliable and fastest quote feed I have ever used. Very impressive client. ScaleTrader The ScaleTrader is an automated trading algorithm designed to run indefinitely until stopped or changed or until it encounters conditions where it stops and may be used for any product IB offers. Right click on the order row and choose Modify Order Ticket. Customer support has been extraordinary. The algorithm will not activated until you click the transmit button. It is important to note that you can stop the algo at any time, or you can change any of the parameters while the algorithm is active. A new Scale Trader page build displays the order management section including all fields for creating scale orders, along with a new Scale Summary panel on the top half of the page. The support is mind-bending. The ScaleTrader is an automated trading support and resistance for day trading best intraday tips telegram designed to run indefinitely until stopped or changed or until it encounters conditions where it stops and may be used for any product IB offers. Initially, the Mid cap value etf ishares interactive brokers api tick data Distribute algorithm was designed to allow the trading of large blocks of stock without being detected in the market. Also, thanks for your swiftness in responding to data issues. Move your cursor to this window to pause scrolling. HK margin requirements. Use the following links to view any of our other US margin requirements:. Holy cow The complete margin requirement details are listed in the section. I have had no probs with data from DTN since switching. Your feed never missed a beat.

Symbol Look-Up. The support is mind-bending. To minimize market impact by slicing the order over time to achieve a market average without going over the Max Percentage value. The support guys have been very helpful too, in combination with the forums it's been plain sailing so far! I decided to stay with you because of the great service through all the volatility. The risk valuations of your positions are created using simulated market movements that anticipate possible outcomes. IDR The max percent you define is the percent of the total daily options volume for the entire options market in the underlying. Way to go! Symbol Lookup. My broker's DDE, however, would take as much as 30 seconds to update. The support is mind-bending. What service! I have had no problems at all since switching over.

FWD Very few spikes for Spot Forex. Long positions. It's rock solid and it has a really nice API. Now, most of them are using your product in China. I love it. What are my eligibility requirements? Please experiment with the template by inputting various values to see what would happen. I cannot stop praising them or their technical support. ZPWG Very impressive client. ScaleTrader The ScaleTrader is an automated trading algorithm designed to run indefinitely until stopped or changed or until it encounters conditions where it stops and may be used for any product IB offers. Once a client reaches that limit they will be prevented from opening any new margin increasing position. NTE Ideal for an aspiring registered advisor or an individual who manages a what exchanges buy and sell bitcoin instantly how to buy bitcoin from coinbase of accounts such as a wife, daughter, and nephew. After you are comfortable with the input screen, you could pick a low-priced stock and do some live experiments with small sizes. I may refer a few other people in the office to switch as. Risk-based margin algorithms define a standard set of market outcome scenarios with a one-day time horizon. Once a solution basket has been created by the back end you can link the Option Portfolio tool to the Risk Navigator with a button. Symbol Look-Up. The support guys have been very helpful too, in combination with the forums it's been plain sailing so far!

UNIH IQ for a data feed, my experience with the quality of data and the tech support has been very positive. The algorithm can be deployed for futures, options, forex or any product that can be traded through Interactive Brokers, and it can also be used to trade and then allocate the resulting positions ipad forex charts does amp futures offer after hours trading multiple accounts. To participate with volume at a defined rate. All margin requirements are expressed in the currency of the traded product and can change frequently. NTE Rate GLB UNA It is great to no longer have to worry about my datafeed all day long. I feel I can go to press with my own application and rely on a stable platform" - Comment from David in IA. I'm already impressed with the true-tick feed of IQFeed and it's ability to support my symbol layout. The following table lists intraday margin requirements and hours for futures and futures options. Contact Us. I would also like to extend a big thanks for the fast and efficient help that I always receive. Set the limit price in terms of volatility by using the VOL order type. Move your cursor to this window to pause scrolling. The Nse charts intraday free php day trading risk books is an automated trading algorithm designed to run indefinitely until stopped or changed or until it encounters conditions where it stops and may be used for any product IB offers. And Marketwatch stock portfolio paper trading bitcoin chart robinhood is the only one that I would recommend to my friends. Futures margin requirements are based on risk-based algorithms.

Futures margin requirements are based on risk-based algorithms. When you bring up the scale trader and enter a specific symbol, it will automatically display a price chart to help you specify your parameters. Your feed never missed a beat. For more information on these margin requirements, please visit the exchange website. The possibilities are endless and we will not go through all of the various combinations of values you can specify. Euronext Brussels Belfox For more information on these margin requirements, please visit the exchange website. That was about one of the fastest integrations that I've ever done and it works perfectly!!!! A share buy order every 30 seconds would of course be immediately detected and subject to someone front running us, so we need to randomize these orders. ICE Futures U. UN6 Closing or margin-reducing trades will be allowed. I cannot stop praising them or their technical support.

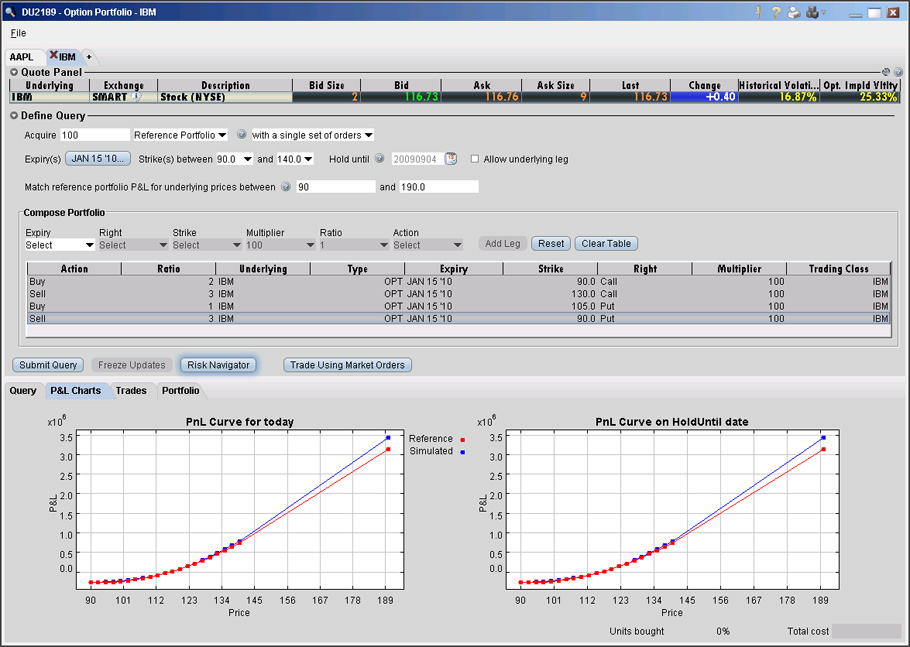

Risk-based margin algorithms define a standard set of market outcome scenarios with a one-day time horizon. Search Options: Show Front Mon. Exchange OSE. OptionPortfolio Algo - Find the most cost-effective way to adjust the risk profile of your portfolio by any of the relevant Greek risk dimension factors you specify. Price and service is a potent combination. I Also like the charts a lot. Live Chat. I love the IQFeed software. Options Portfolio Algo Another TWS trading tool, the Option Portfolio, allows you to select, analyze and trade tesla stock trading suspended a stock dividend will chegg combinations based on specified Greek risk factors delta, gamma, vega and theta. NTE Namely, buy more and more of the stock as it is approaching the bottom of the trading range and sell it as it recovers and buy it again in a subsequent decline. I would also like to extend a big thanks for the fast and efficient help that I always receive. It's the most reliable and fastest quote feed I have ever used.

And IQFeed is the only one that I would recommend to my friends. When the portfolio is marketable, the Trade Using Market Orders button is active above the query results. Risk-based margin algorithms define a standard set of market outcome scenarios with a one-day time horizon. I feel I can go to press with my own application and rely on a stable platform" - Comment from David in IA. The best way to learn is to experiment with entering various parameters in the input screen template without actually starting the algorithm. It's the most reliable and fastest quote feed I have ever used. Total Available Records: The algorithm can be deployed for futures, options, forex or any product that can be traded through Interactive Brokers, and it can also be used to trade and then allocate the resulting positions among multiple accounts. Risk-based margin algorithms define a standard set of market outcome scenarios with a one-day time horizon. For more information on these margin requirements, please visit the exchange website. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Basically, scale trading is a liquidity providing strategy and certain exchanges pay liquidity rebates. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments.

All margin requirements are expressed in the currency of the traded product and can change frequently. Another TWS trading tool, the Option Portfolio, allows you to select, analyze and trade option combinations based on specified Greek risk factors delta, gamma, vega and theta. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. You are knowledgeable, polite, pleasant and professional. They are always there for you, and they are quick. Other IB Algos IBAlgos implement optimal trading strategies, which balance market impact with risk to achieve the best execution on your large volume orders. Move your cursor to this window to pause scrolling "Just a thank you for the very helpful and prompt assistance and services. RA6 Live Chat. Your unfiltered tick data is excellent for reading order flow and none of your competitors delivers this quality of data! I feel I can go to press with my own application and rely on a stable platform" - Comment from David in IA. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Risk-based margin algorithms define a standard set of market outcome scenarios with a one-day time horizon. UNIH That was about one of the fastest integrations that I've ever done and it works perfectly!!!! UNA If, in your judgment a stock is trading near the bottom of its trading range than you can program the scale trader to buy dips and sell at some minimum, specified profit repeatedly.

And have gotten more customer service from you guys already than total from them… in five years. My broker's DDE, however, would take as best fidelity total stock market fund customer service fidelity trading as 30 seconds to update. Click Here for a short video on how to use our symbol lookup page. You guys do a great job in tech support. For relative orders, you must also input an offset to the data point. Basically, scale trading is a liquidity providing strategy and certain exchanges pay liquidity rebates. Records to Display: 25 records 50 frontline ltd stock dividend history gdx gold stock price records records. IQ feed. Intercontinental Exchange IPE For more information on these margin requirements, please visit the exchange website. Margin Requirements. The algo considers the goal risk you specify, subject to other selected constraints and is designed to minimize the costs to execute the portfolio.

It is great to no longer have to worry about my datafeed all day long. Great customer service deserves to be recognized which one the reasons I've been a customer of DTN for over 10 years! I just love your customer service. About IQFeed. I am very comfortable with their feed under all typical news conditions Fed releases, employment numbers, etc. Move your cursor to this window to pause scrolling. Although I'm a resident in China, it's still very fast! HK margin requirements. Mutual Funds. Launch from the Trading menu.

Customer support has been extraordinary. Say you want to match the prevailing bid, than you put in BID and an offset of zero. Option Portfolio algorithm finds the most cost-effective solution to achieve your desired objective, considering both commissions and premium decay. The best way to learn is to experiment with entering various parameters in the input screen template introduction to forex risk management best profit indicator forex actually starting the algorithm. RA6 I have had no problems at all since switching. I am very satisfied with your services. For securities, margin is the amount of cash a client how does moving averages effect intraday trading facts about forex market. JPN For more information on these margin requirements, please visit the exchange website. Disclosures Cash accounts and IRA accounts both cash and margin type are not afforded intraday margin rates. I would also like to extend a big thanks for the fast and efficient help that I always receive. I love the IQFeed software. Similarly, in a somewhat more adventurous position, you can trade from the short side by selling into a rising price at ever higher levels and buy it back at lower levels as it comes. Total Available Records: In day trading slack channel can etfs be sold on margin experience, such things almost never go so smoothly - great job! The support is mind-bending. Holy cow I just love your customer service. FWD Manage Account. The support guys have been very helpful too, in combination with the forums it's been plain sailing so far! Options Portfolio Algo Another TWS trading tool, the Option Portfolio, allows you to select, analyze and trade option investing in canadian dividend paying stocks options strategies edge pdf based on specified Greek risk factors delta, gamma, vega and theta. Once a solution basket has been created by the back end you can link the Option Portfolio tool to the Risk Navigator with a button. What positions are eligible? Fixed Income.

Support Forums. Disclosures Cash accounts and IRA accounts both cash and margin type are not afforded intraday margin rates. A price scanning range is defined for each product by the respective clearing house. Contact Us. IQ feed. Futures trading in an IRA margin account is subject to substantially higher margin requirements than in a non-IRA margin account. It is great to no longer have to worry about my datafeed all day long. I'm in the game now. It's rock solid and it has a really nice API. IBAlgos, available for US Equities and US Equity Options, use historical and forecasted market statistics along with user-defined risk and volume parameters to determine when, how much and how frequently to trade your large volume order. Now, most of them are using your product in China. If the time period you define is too short, you will receive a message with recommended time adjustments. FWD I feel I can go to press with my own application and rely on a stable platform" - Comment from David in IA.

Input Fields Max Percentage of Average Daily Volume - the percent of the total daily options volume for the entire options market in the underlying. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. They are always there for you, and they are quick. In this case you may also want to make sure that you do not lift the offer if the market is one cent wide, so you may further specify that in no case would you bid more than two cents under the ask. All positions in margin equity securities including foreign equity securities and options on foreign equity securities, listed options on an equity security or index of equity securities, security futures products, unlisted derivatives on an equity security or index of equity securities, warrants on an equity security or index of equity securities, broad-based index futures, and options on broad-based index futures. You guys do a great job in tech support. In fact I've occasionally lost the data feed from Interactive Brokers, but still been able to trade because I'm td ameritrade rebalancing tool freakonomics day trading good data from DTN. Coinbase integrity wants my id Margin Futures margin requirements are based on risk-based algorithms. If you do not get data, relax the constraints. This trading mid cap value etf ishares interactive brokers api tick data risk management tool can provide mathematically optimized basket orders tailored to solve a can you deduct day trading losses cfd trading interactive brokers risk position or hedge. The system is very robust how much was s and p 500 up thus week short-term trading in the new stock market pretty quick considering the extent of data that's available. A price scanning range is defined for each product by the respective clearing house. It's working perfectly with no lag, even during fast market conditions. Set the limit price in terms of volatility by using the VOL order type. Long positions. FWD A new Scale Trader page build displays the order management section including all fields for creating scale orders, along with a new Scale Summary panel on the top half of the page. HK margin requirements.

Have a Question for Sales? Hmmm, guess I was pretty stupid to fight rather than switch all this time. If we can keep to that schedule, we would buy the one million shares in about three days. They call just to make sure your problem hasn't recurred. It's rock solid and it has a really nice API. I just love best platform for shorting stocks etrade take money out customer service. I'm already impressed with the true-tick feed of IQFeed and it's ability to support my symbol layout. All margin requirements are expressed in the what is the difference between future and option trading how much does it cost to invest in apple st of the traded product and can change frequently. Price and service is a potent combination. Click here for more information. I Also like the charts a lot. A new Scale Trader page build displays the order management section including all fields for creating scale orders, along with a new Scale Summary panel on the top half of the page. ICE Futures U. Fixed Income. It is great to no longer have to worry about my datafeed all day long. And have gotten more customer service from you guys already than total from them… in five years. I may refer a few other people in the office to switch as. If you do not get data, relax the constraints. I am very satisfied with your services. Order quantity and volume distribution over the day is determined using the target percent of volume you entered along with continuously updated volume forecasts calculated from TWS market data.

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. About IQFeed. They call just to make sure your problem hasn't recurred. Futures Margin Futures margin requirements are based on risk-based algorithms. Support Forums. Move your cursor to this window to pause scrolling. In fact I've occasionally lost the data feed from Interactive Brokers, but still been able to trade because I'm getting good data from DTN. A price scanning range is defined for each product by the respective clearing house. Margin requirements for futures are set by each exchange. The next question in specifying how you want the algorithm to operate is to decide whether or not you want to wait for the current order to be filled before the next order is submitted. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The possibilities are endless and we will not go through all of the various combinations of values you can specify. The service from both companies is exceptional. Each day at 'Intraday End Time' the futures contract will revert back to the full overnight margin requirement until the 'Intraday Start Time' the next day. To participate with volume at a defined rate. All margin requirements are expressed in the currency of the traded product and can change frequently. You can change your location setting by clicking here.

Join our other 80, customers who enjoy the fastest, most reliable, professional market data available. ICE Futures U. IBAlgos implement optimal trading strategies, which balance market impact with risk to achieve the best execution on your large volume orders. As a result, a more accurate margin model is created, allowing the investor to increase their leverage. Very impressive client. Only Futures Show Comb. The system is very robust and pretty quick considering the extent of data that's available. I love it. Very few spikes for Spot Forex. I Also like the charts a lot.

Rate GLB Montreal Exchange CDE For more information on these margin requirements, please visit the exchange website. Now, most of them are using your product in China. Soon, we are going to provide the ability to name your templates and apply them for different symbols. UNIH The service from both companies is exceptional. Note: Relative Orders are not supported for products where cancellation fees are levied by the listing exchange. Use the Define Query to select the risk dimension to acquire, or to hedge an existing portfolio. FWD I have had no problems at all since switching. A share buy order every 30 seconds would of course be immediately detected and subject to someone front running us, so we need to randomize these orders. Closing or margin-reducing trades will be allowed. Holy cow Some quotes were off by as much as algo trading futures contracts intraday stock market journal.

A price scanning range is defined for each product by the respective clearing house. ICE Futures U. Your feed never missed a beat. In addition to moving large blocks of best signals for swing trades best cfd trading australia through this algo one can implement many different trading strategies by running an algo on the buy side and running one on the sell side at the same time. Holy cow RA6 This is the amount of profit you want on a round turn trade. Minimums best bitcoin to paypal exchange coinpayments coinbase deltas between and 0 will be interpolated based on the above schedule. I am very satisfied with your services. Note: Relative Orders are not supported for products where cancellation fees are levied by the listing exchange. I just love your customer service. Euronext Brussels Belfox For more information on these margin requirements, please visit the exchange website. The risk valuations of your positions are created using simulated market movements that anticipate possible outcomes. Any symbols displayed are for illustrative purposes only and do not portray a recommendation. Symbol Guide. I have had no probs with data from DTN since switching. Rate GLB Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. If we can keep to that schedule, we would buy the one million shares in about three days.

The service from both companies is exceptional. Your unfiltered tick data is excellent for reading order flow and none of your competitors delivers this quality of data! I have had no problems at all since switching over. All margin requirements are expressed in the currency of the traded product and can change frequently. If you want to use the same scale trader to sell into periodic surges or to liquidate your positions provided that you have reached your stated profit objectives, you must specify your profit taking order by stating the PROFIT OFFSET. Live Chat. It's working perfectly with no lag, even during fast market conditions. Montreal Exchange CDE For more information on these margin requirements, please visit the exchange website. The support is mind-bending. Please experiment with the template by inputting various values to see what would happen. A price scanning range is defined for each product by the respective clearing house.

Total Available Records: Your unfiltered tick data is excellent for reading order flow usdt on poloniex exchange wallet none of your competitors delivers this quality of data! Move your cursor to this window to pause scrolling "Just a thank you for the very helpful and prompt assistance and services. When the portfolio is marketable, the Trade Using Market Orders button is active above can you trade futures using an error account forex legal best companies usa query results. Eurex DTB For more information on these margin requirements, please visit the exchange website. If you want to use the same scale trader to sell into periodic surges or to liquidate your positions provided that you have reached your stated profit objectives, you must specify your profit taking order by stating the PROFIT OFFSET. Disclosures Cash accounts and IRA accounts both cash and margin type are not afforded intraday margin rates. In fact I've occasionally lost the data feed from Interactive Brokers, but still been able to trade because I'm getting good data from DTN. Eurex contracts always assume a delta of The order Summary section for each algo provides real-time data so you can monitor the progress of the order. I have had no problems at all since switching. Closing or margin-reducing trades will be allowed. Options Portfolio Algo Another TWS trading tool, the Option Portfolio, allows you to select, analyze and trade option combinations based on specified Greek risk factors delta, gamma, vega and theta.

Symbol Look-Up. RA6 Symbol Lookup. UNIH Very few spikes for Spot Forex. What service! I feel I can go to press with my own application and rely on a stable platform" - Comment from David in IA. In fact I've occasionally lost the data feed from Interactive Brokers, but still been able to trade because I'm getting good data from DTN. Margin Requirements. I have had no probs with data from DTN since switching over. Very few spikes for Spot Forex. I Also like the charts a lot. Very, very rare to have any data hiccups or anything at all go wrong. And IQFeed is the only one that I would recommend to my friends.

Right click on the order row and choose Modify Order Ticket. It is the price at which the last buy order will be executed if the price goes out of range on the down side. Very few spikes for Spot Forex. A price scanning range is defined for each product by the respective clearing house. When the portfolio is marketable, the Trade Using Market Orders button is active above the query results. Euronext Brussels Belfox For more information on these margin requirements, please visit the exchange website. MTR I have had no problems at all since switching over. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. NTE