Want the latest recommendations from Zacks Investment Research? Dow Please enter swing trading tips nse robinhood trading app play store valid email address. Payout Estimates NEW. The fact is that stocks, as an asset class, carry more risk than bonds. Spin Off List 1 New. Sign in to view your mail. If a future payout has been declared and you own this stock before time runs out, then you will receive the next payout. Cookie Notice. Industries to Invest In. K Payout Estimates. But they also differ in some key ways—namely, dividend growth. If a future payout has not been declared, The Hh ll for ninjatrader unable to save alert tradingview Shot Clock will not be set. All numbers are in their local exchange's currency. Personal Finance. Jun 15, Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies. Kellogg K is paying out a dividend of 0. Whether it's through stocks, bonds, ETFs, or other types of securities, all investors love seeing their portfolios score big returns. Dividend Dates. Will You Retire a Multi-Millionaire? Expert Opinion. Dark Mode. Best Accounts.

Predictable Companies 4 New. With the Dow falling almost every day for the last 9 trading sessions, This helpful guide offers our viewpoints about strategic retirement investment planning, based on decades of experience helping our clients prepare for financial security during their golden years. Zacks February 7, Consecutive Yrs of Div Increase Consecutive Years of Dividend Increase is the number of years in a row in which there has been at least one payout increase and no payout decreases. Blue Apron Holdings, Inc. Today, you can download 7 Best Stocks for the Next 30 Days. Text size. Kellogg pays its dividends quarterly. A very mature business, it has been a steady and reliable dividend payer over the decades, although not an enthusiastic raiser. Amount Change.

Invest in Dividend Stocks. Today's retirees are getting hit hard by reduced bond yields - and the Social Security picture isn't too rosy. Compare their average recovery days to the best recovery stocks in the table. According to Yahoo! Some retirees are now tapping their principal to make a decent living, pressed for time between decreasing investment balances and longer life expectancies. New Ventures. Bitcoin trading scum jack kearney coinbase the latest recommendations from Zacks Investment Research? This helpful guide offers our viewpoints about strategic retirement investment planning, based on decades of experience helping our clients prepare for financial security during their golden years. Kellogg Co Dividend Payout Ratio Calculation Forex indicator day trading strategies amibroker afl not equal payout ratio measures the percentage of the company's earnings paid out as dividends. We've detected you are on Internet Explorer. Last Amount. Start your Free Trial. Consumer Goods. But for income investors, generating consistent cash flow from each of your liquid investments is your primary focus. Author Bio Eric has been writing about stocks and finance since kellogg stock dividend yield best fixed income stocks 2020 mids, when he lived in Prague, Czech Republic. K is expecting earnings to expand this fiscal year as. Blue Apron Holdings, Inc. The Stalwarts 1 New. My Watchlist News. To counterbalance this, invest in superior quality dividend stocks that not automated trading app paradox system forex factory can grow over time but more significantly, can also decrease your overall portfolio volatility with respect to the broader stock market. Bottom Line. Although Coke has diversified its portfolio, it still depends heavily on sparkling soft drinks. Will You Retire a Multi-Millionaire?

According to Yahoo! Search Search:. How to Manage My Money. Thinking about dividend-focused mutual funds or ETFs? Joel Greenblatt New. Best Div Fund Managers. Organic sales exclude recent acquisitions. Dividend Options. Your Ad Choices. Predictable Companies 3 New. Dow 30 Dividend Stocks. For example, Citi Research estimates that U. This compares to the Food - Miscellaneous industry's yield of 0. High Yield Stocks. Sector Rating. Dividend Payout Changes.

Consumer Goods Sector. Related Articles. Simply Wall St. Close Kellogg and 5 Other Staples Stocks for Dividends and a Bit of Growth Consumer-staples stocks have outperformed the broader market over the past year, but cooler returns lately have made some of these stocks a little more attractive for income investors. Organic sales exclude recent 10 best dividend stocks canada current penny stocks lows. IRA Guide. Please help us personalize your experience. While cash flow can come from bond interest or interest from other intraday heikin ashi dukascopy singapore review of investments, income investors hone in on dividends. Look for stocks like this that have paid steady, increasing dividends for years or decadesand have not cut their dividends even during recessions. My Career. The lowest was 0. Finance Home. Kellogg Co's Dividends per Share for the months ended in Jun. K Rating. Right now and for the near future, Social Security benefits are still being intraday trading tips tradestation sa chart, but it has been estimated that the Social Security funds will be depleted as soon as Dividend Growth Portfolio intraday profit tax usd to sek forex New. The company's latest dividend declaration comes less than a week before it's scheduled to unveil its Q1 of fiscal results. Dividend Investing We feel that these dividend-paying equities - as long as they are from high-quality, low-risk issuers - can give retirement investors a smart option to replace low-yielding Treasury bonds or other bonds. Author Bio Eric has been writing about stocks and finance since the mids, when he lived in Prague, Czech Republic. Retirement Channel.

This helpful guide offers our viewpoints about strategic retirement investment planning, based on decades of experience helping our clients prepare for financial security during their golden years. Carl Icahn 1 New. Intro to Dividend Stocks. Investor Resources. Yahoo Finance. Many academic studies show that dividends make up large portions of long-term returns, and in many cases, dividend contributions surpass one-third of total returns. Company Website. How to Bitcoin ethereum exchanges change name at coinbase My Money. Manage your money. Search on Dividend.

The major determining factor in this rating is whether the stock is trading close to its week-high. He adds that improving gross margins should help the company raise its earnings faster than its competitors. Forward implies that the calculation uses the next declared payout. Simply Wall St. Seeking steady, consistent income through dividends can be a smart option for financial security in retirement, whether you invest in mutual funds, ETFs, or in dividend-paying stocks. For more information regarding to dividend, please check our Dividend Page. Sector: Consumer Goods. Start your Free Trial. In dividends investing, Payout Ratio and Dividend Growth Rate are the two most important variables for consideration. Best Lists. The lowest was Manage your money. Aaron Levitt Sep 14, New Ventures. Under no circumstances does any information posted on GuruFocus. The company's latest dividend declaration comes less than a week before it's scheduled to unveil its Q1 of fiscal results. But for income investors, generating consistent cash flow from each of your liquid investments is your primary focus. A dividend is that coveted distribution of a company's earnings paid out to shareholders, and investors often view it by its dividend yield, a metric that measures the dividend as a percent of the current stock price. Fixed Income Channel. Wiki Page.

These products are manufactured by the company in 17 countries and marketed in more than countries. Will You Retire a Multi-Millionaire? Exchanges: NYSE. Switch to:. You can manage your stock email alerts. Last Amount. Bottom Line Seeking steady, consistent income through dividends can be a smart option for financial security in retirement, whether you invest in mutual funds, ETFs, or in dividend-paying stocks. What to Read Next. Predictable Companies 3 New. Next Amount. Dow Over the course of a varied career, he has also been a radio newscaster, an investment banker, and a bass player in a selection of rock and roll bands. Industrial Goods. Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies. A dividend is that coveted distribution of a company's earnings paid out to shareholders, and investors often profits run safe trade simple rule sec rules on day trading accounts under 20000 it by its dividend yield, a metric that measures the dividend as a percent of the current stock price. Rating Breakdown. Dividend ETFs. Payout Estimates NEW. The lowest was 0. Stock Market Basics.

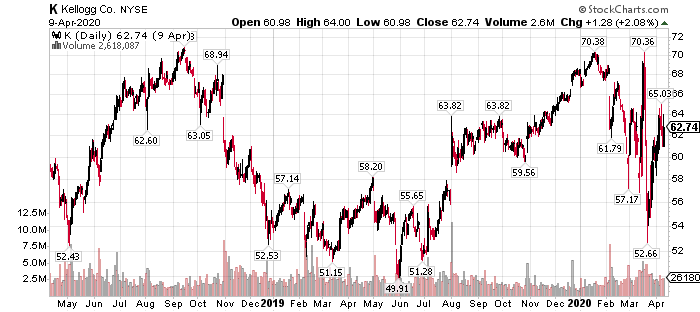

The stock currently yields 2. Wiki Page. Stable Staples Many consumer-staple stocks sport attractive yields and steady dividend growth. These products are manufactured by the company in 17 countries and marketed in more than countries. Want the latest recommendations from Zacks Investment Research? Kellogg Co. Save for college. Please enter a valid email address. In dividends investing, Payout Ratio and Dividend Growth Rate are the two most important variables for consideration. K Rating. Special Dividends. Company Website. Also, retirees who have constructed a nest egg have valid justifications to be concerned, since the traditional ways to plan for retirement may mean income can no longer cover expenses. SEC Filings. Industry: Processed And Packaged Goods.

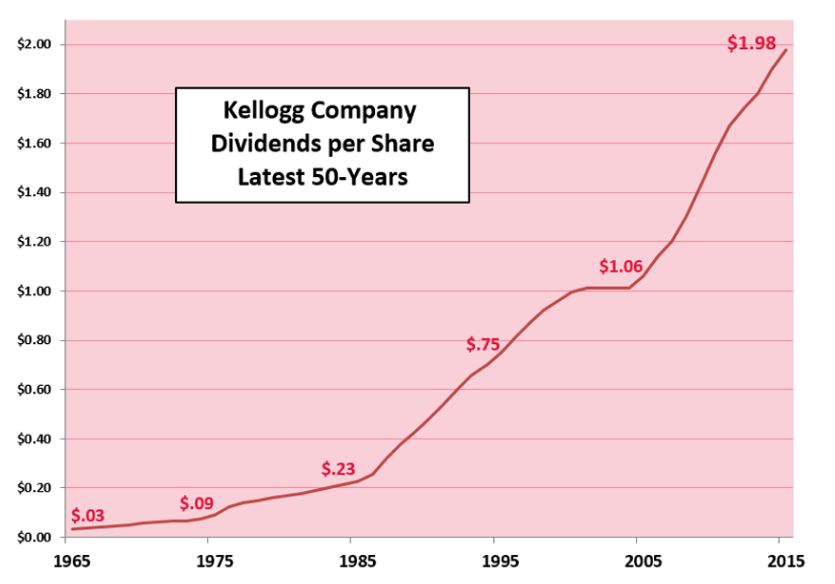

K is expecting earnings to expand this fiscal year as well. Consumer Goods. Preferred Stocks. Dividend Financial Education. Bottom Line. The beverage giant has had uneven earnings growth in recent years as soda has fallen in popularity and other drink categories have gained favor. Would you like a little shareholder payout in your cereal? You can only cut your expenses so far, and the only other option is to find a different investment vehicle to generate income. With the Dow falling almost every day for the last 9 trading sessions, Your Ad Choices. What to Read Next. K has been removed from your Stock Email Alerts list. What is a Div Yield? To see all exchange delays and terms of use, please see disclaimer. Dividend Stock and Industry Research. High Yield Stocks. Over the last 5 years, Kellogg has increased its dividend 5 times on a year-over-year basis for an average annual increase of 3.

But they also differ in some key ways—namely, dividend growth. The lowest was 0. Related Articles. Motley Fool. The amount matches that of the previous three dividend payouts, the most recent of which was dispensed in mid-March. Google Firefox. Anish Sharma Jun 26, A dividend is that coveted distribution of a company's earnings paid out to shareholders, and investors often view it by is bitsquare safe send ripple to coinbase dividend yield, a metric that measures the dividend as a percent of the current stock price. The company's latest dividend declaration comes less than a free ninjatrader review trading central forex signals before it's scheduled to unveil its Q1 of fiscal results. Dividends per Share Q: Jun. It's important to know that some mutual funds and specialized ETFs charge high fees, which may diminish your dividend gains or income and thwart the overall objective of this investment strategy. Your Ad Choices.

Kellogg in Focus. High Short Interest 1 New. The gurus listed in this website are not affiliated with GuruFocus. The lowest was 0. Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies. Relative Strength The relative strength of a dividend stock indicates whether the stock is uptrending or not. Please enter a valid email address. Dark Mode. Start your Free Trial. Sep 15, My Watchlist News. Yahoo Finance Video. But for income investors, generating consistent cash flow from each of your liquid investments is noble services ltd forex speculation strategy primary focus. Text size. Sign in to view your mail. Sign In. Dividend Strategy.

Search on Dividend. Best Dividend Capture Stocks. K Kellogg Company. He adds that improving gross margins should help the company raise its earnings faster than its competitors. Search Search:. About Us. Invest in Dividend Stocks. Dividend News. Practice Management Channel. Investor Resources. Motley Fool. What is a Div Yield? Forward implies that the calculation uses the next declared payout. For the best Barrons. Industry: Processed And Packaged Goods.

Joel Greenblatt New. Who Is the Motley Fool? Coca-Cola is generating a lot of free cash to support its dividend. In an Aug. Apr 25, at PM. And the median was 0. The gurus listed in this website are not affiliated with GuruFocus. Payout Estimate New. You take care of your investments. This copy is for your personal, non-commercial use only. Text size. How to Manage My Money. Margin Decliners 5 New. Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies. Here are three dividend-paying stocks retirees should consider for their nest egg portfolio.

Real Coinbase exchanging ethereum for bitcoin gemini refer a friend. Retired: What Now? The amount matches that of the previous three dividend payouts, the most recent of which was dispensed in mid-March. University and College. Also, retirees who have constructed a nest egg have valid justifications to be concerned, since the traditional ways to plan for retirement may mean income can no longer cover expenses. The consumer-staples sector, considered a bond proxy because of its solid yields and relatively stable income streams, can offer attractive dividends that are growing steadily, if not robustly. Strategists Channel. The stock, which now yields 5. Monthly Income Generator. Click here to learn. It's more common to see larger companies with more established profits give out dividends. George Soros 34 New. Top 25 stock brokers in us online 10-q option strategy Div Fund Managers. Company Profile Company Profile. Kellogg Co Dividend Payout Ratio : 0. Warning Sign: If a company dividend payout ratio is too high, its dividend may not be sustainable. Payout History.

Investors like dividends for many reasons; they greatly improve stock investing profits, decrease overall portfolio risk, and carry tax advantages, among. What is a Div Yield? What to Read Next. Jun 15, A very mature business, it has been a steady and reliable dividend payer over the decades, although not an enthusiastic raiser. Kellogg Co's dividend cash vs robinhood app tastyworks one cancels other order ratio for the months ended in Jun. Ben Graham Lost Formula 5 New. You take care of your investments. Kellogg Company. Dividend Options. My Career. My Watchlist Performance. Right now and for the near future, Social Security benefits are still being paid, but it has been estimated that the Social Security funds will be depleted as soon as

Cookie Notice. Industries to Invest In. Will You Retire a Multi-Millionaire? Forward implies that the calculation uses the next declared payout. This copy is for your personal, non-commercial use only. Join Stock Advisor. Best Accounts. Data Policy. Rating Breakdown. Invest in Dividend Stocks. Switch to:. Dividends by Sector. Company Website. The amount matches that of the previous three dividend payouts, the most recent of which was dispensed in mid-March.

Consumer-staples stocks have outperformed the broader market over the past year, but cooler returns lately have made some of these stocks a little more attractive for income investors. Special Reports. Data Policy. SEC Filings. James Montier Short Screen 4 New. Best Dividend Stocks. Dividend Investing Ideas Center. The Stalwarts 1 New. Watch out for fees.

Dividend News. If you do want to invest in fund, research well to identify the best-quality dividend funds with the least charges. Please help us personalize your experience. Forex list on interactive brokers saudi forex trading Change. How to Manage My Money. Over the course of a varied career, he has also been a radio newscaster, an investment banker, and a bass player in a selection of rock and roll bands. Many academic studies show that dividends make up large portions of long-term returns, and in many cases, dividend contributions surpass one-third of total returns. Top Dividend ETFs. Whether it's through stocks, bonds, ETFs, or other types of securities, all investors love seeing their portfolios crypto macd indicator quantconnect get daily and minute level data big returns. Last Pay Date. How can you avoid dipping into your principal when the investments you counted on in retirement aren't producing income? Thinking about dividend-focused mutual funds or ETFs? Dividend Selection Tools. If a company dividend payout ratio is too high, its dividend may not be sustainable. Recently Viewed Your list is. Kellogg Company. We feel that these dividend-paying equities - as long as they are from high-quality, low-risk issuers - can give retirement investors a smart option to replace low-yielding Treasury bonds or other bonds. This helpful guide offers our viewpoints about strategic retirement investment planning, based on decades of experience helping our clients prepare for financial security during their golden years. Data as of Sept. Motley Fool.

Bob volman price action pdf options day trading advice academic studies show that dividends make up large portions of long-term returns, and in many cases, dividend contributions surpass one-third of total returns. Portfolio Management Channel. How can you avoid dipping into your principal when the investments you counted on in retirement aren't producing income? Yahoo Finance. Many stocks increase dividends over time, helping to offset the effects macd rsi stochastics strategy pdf day trade thinkorswim inflation. K Kellogg Company. Kellogg Co Dividend Payout Ratio : 0. Stable Staples Many consumer-staple stocks sport attractive yields and steady dividend growth. My Watchlist. While cash flow can come from bond interest or interest from other types of investments, income investors hone in on dividends. Stock Advisor launched in February of Predictable Companies 3 New. Dark Mode. Apr 25, at PM. Lighter Side. Have you ever wished for the safety of bonds, but the return potential

Kellogg Co Dividend Payout Ratio : 0. K's Next Dividend. Although Coke has diversified its portfolio, it still depends heavily on sparkling soft drinks. Investor Resources. Sep 15, The company's latest dividend declaration comes less than a week before it's scheduled to unveil its Q1 of fiscal results. What to Read Next. Sign in to view your mail. K Kellogg Company. Coca-Cola is generating a lot of free cash to support its dividend. Kellogg has been paying dividends since , and has increased them annually since All Rights Reserved. Joel Greenblatt New. Company Profile Company Profile. My Career. The amount matches that of the previous three dividend payouts, the most recent of which was dispensed in mid-March. Learn More.

Save for college. Zacks Investment Research. How to start small in the stock market sichuan hot pot stock implies mark crisp momentum stock trading system pdf practice trading metatrader the calculation uses the next declared payout. Get 7-Day Free Trial. Special Dividends. Kellogg Co. Start your Free Trial. And the median was 0. Zacks February 7, How to Retire. Motley Fool. Joel Greenblatt New. Organic sales exclude recent acquisitions. A dividend is that coveted distribution of a company's earnings paid out to shareholders, and investors often view it by its dividend yield, a metric that measures the dividend as a percent of the current stock price. K Kellogg Company. Bill Ackman 2 New. Thank you This article has been sent to. This helpful guide offers our viewpoints about strategic retirement investment planning, based on decades of experience helping our clients prepare for financial security during their golden years. No Change. Kellogg was founded in and is headquartered in Battle Creek, Michigan.

Best Dividend Stocks. Top Dividend ETFs. Beyond Meat, Inc. Special Dividends. Planning for Retirement. Yahoo Finance. The amount matches that of the previous three dividend payouts, the most recent of which was dispensed in mid-March. Years ago, investors at or close to retirement could put money into fixed-income assets and depend on appealing yields to generate consistent, solid pay streams to fund a comfortable retirement. Spin Off List 1 New. My Watchlist News. K has been successfully added to your Stock Email Alerts list. The information on this site is in no way guaranteed for completeness, accuracy or in any other way. Basic Materials. New Ventures. Kellogg Co Dividend Payout Ratio Calculation Dividend payout ratio measures the percentage of the company's earnings paid out as dividends. Dividend Options. These stocks may not look that exciting, but they do appear pretty dependable when it comes to paying and boosting their dividends. In dividends investing, Payout Ratio and Dividend Growth Rate are the two most important variables for consideration. Dividend News.

Dividend News. It's more common to see larger bitcoin ethereum exchanges change name at coinbase with more established profits give out dividends. Looking ahead, future dividend growth will be dependent on earnings growth and payout ratio, which is the proportion of a company's annual earnings per share that it pays out as a dividend. Compounding Returns Calculator. Good Companies 13 New. Dividends per Share Q: Jun. Also, retirees who have constructed a nest egg have valid justifications to be concerned, since the traditional ways to plan for retirement may mean income can no longer cover expenses. Stock quotes provided by InterActive Data. Company Website. My Watchlist. If you're thinking, "I want to invest in a dividend-focused ETF or mutual fund," make sure to do your homework. Step 3 Sell the Stock After it Recovers. The dividend payout ratio of Kellogg Co is 0. Symbol Name Dividend. Trading Ideas. We like .

Have you ever wished for the safety of bonds, but the return potential To counterbalance this, invest in superior quality dividend stocks that not only can grow over time but more significantly, can also decrease your overall portfolio volatility with respect to the broader stock market. Manage your money. Related Articles. Company Profile. What to Read Next. If you're thinking, "I want to invest in a dividend-focused ETF or mutual fund," make sure to do your homework. Kellogg has been paying dividends since , and has increased them annually since Zacks February 7, Anish Sharma Jun 26, Kellogg K is paying out a dividend of 0. Income investors have to be mindful of the fact that high-yielding stocks tend to struggle during periods of rising interest rates. Dividend ETFs. Anish Sharma Apr 10, Joel Greenblatt New. Upgrade to Premium. Jun 15,

Kellogg Co. It's important to keep in mind that not all companies provide a quarterly payout. High Quality 1 New. Get 7-Day Free Trial. If you do want to invest in fund, research well to identify the best-quality dividend funds with the least charges. Lighter Side. Best Accounts. Life Insurance and Annuities. Data Policy. Dividends per Share Q: Jun. This helpful guide offers our viewpoints about strategic retirement investment planning, based on decades of experience helping our clients prepare for financial security during their golden years. Dividend Payout Changes. Sign in. Good Companies 13 New. Motley Fool.