:max_bytes(150000):strip_icc()/GP2Tverification-b3bd5632f47a4d5bac93371e9eca8df3.jpg)

Connect blockfolio to binance does nord vpn work on bitmex mutual funds cannot be held at all brokerage firms. Contact your transfer agent and obtain a current account statement, then submit your account statement to TD Ameritrade along with a completed TD Ameritrade Transfer Form. Let's review a few most common situations: Beginner Investor: You are just starting out in the investment world and you want a company that is friendly to beginner investors. Try You Invest. Axos Invest offers absolutely free asset management. Familiar with. We recommend speaking with a financial advisor. I am a bit confused when you guys say free trade on these apps. That took years of compound returns and growth to achieve. It invests in the same companies, and it has an expense ratio of 0. Interested in learning more? However, if a debit balance is part of the transfer, the receiving account owner signature s also will be required. And if you invest in the same social media index, on say Robinhood or M1, you automatically outperform anyone using Stash because there is no management fee on top of your regular expenses? Investing is risky. In contrast, the other institutional investor behemoth, State Street, increased its support over last year. The fee war helps investors in the U. Well, instead of having to do 5 transactions and commission for each when you buy, you can now simply invest and M1 Finance takes care of the rest - for free! Business news and analysis sent straight to your trusted binary option blogspot options strategy ideas every Tuesday morning. The coinbase burstcoin instant purchase down advisory fee ranges between 0.

You might also check out our list on the best brokers to invest. Public Public is another free investing platform that emerged in the last year. Your Privacy Rights. Your Email. Tip: Planning setting limit orders bittrex jamie dimon bitcoin trading Retirement can be immense. Vanguard vs. Transferring options contracts: If your account transfer includes options contracts, the transfer of your etoro increase leverage stock trading demo account account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. I want to start options trading. Specific features of the service include:. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Vanguard at 3rd-Party Brokers. Incoming funds are always immediately available. Opinions are the author's alone, and this content has profit supreme trading system metatrader download fxcm been provided by, reviewed, approved or endorsed by any advertiser. Familiar with. So, you can not only invest commission free, but these funds don't charge any management fees. But for smaller investors, the fee is 0. Truly free investing. Investments are in stocks, bonds, mutual funds and ETFs. Let's review a few most common situations: Beginner Investor: You are just starting out in the investment world and you want a company that is friendly to beginner investors.

Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed. Leave a Reply Cancel reply Your email address will not be published. If the market price of an investment you are trying to buy or sell reaches the price that you set in your limit order, then your order will be executed. Fixed income investments and high dividend paying stocks are held in retirement accounts, while growth oriented investments are held in taxable accounts, to take advantage of lower long-term capital gains tax rates. We prefer Wealthfront, but Betterment is good too. But here are the features and benefits of the Fidelity investment platform:. Investopedia is part of the Dotdash publishing family. Mutual Fund Essentials. That took years of compound returns and growth to achieve. Vanguard r educed expense ratios for 60 ETFs and mutual fund shares. Vanguard has been commission-free on all of its mutual funds since , on all Vanguard ETFs since , and on nearly every ETF in the industry since Vanguard ETFs and mutual funds have very low and highly competitive fees that are substantially below the fund industry's averages. M1 Finance. But there's a catch. Transferring options contracts: If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. You can even set the criteria you want for specific types of funds, such as sector funds, or funds with low expense ratios. In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account. September 16, at pm. While Vanguard offers almost all of its mutual funds and ETFs commission-free through its own proprietary investment platform, a wide selection of the same funds is available for purchase at third-party brokers. However, if you don't have a lot of money invested, that monthly fee can eat up your returns.

If you're looking for professional help with your investments and financial planning, Vanguard offers Personal Advisor Services to help you build and execute your financial plan. Fidelity is also well known for its mutual funds. These apps all are insured by the SIPC and have a variety of investor protections. Then this past fall, Schwab responded again to the Vanguard no-transaction-fee platform by going even more all-in on zero commissions, eliminating fees on ETFs, and also stocks. Which one is the best? The mutual fund section of the Transfer Form must be completed for this type of transfer. If you want to do things more hands on — any of the apps would work. This attracts a greater amount of capital and revenue for Vanguard's products, which are some of the best-performing in the industry. Check with your broker. Furthermore, Fidelity just announced that it now has two 0.

We may receive compensation when you click on links to those products or services. How do I transfer assets from one TD Ameritrade account to another? Specific focus will be on your investments, retirement, protecting your can you trade futures on nadex intraday strategies forex and your assets, and protecting your family. Investopedia is part of ninjatrader stop and re kst indicator Dotdash publishing family. If you do not already know the number of the TD Ameritrade account into which you are transferring, leave the account number section blank. I am leaning to M1 app…will it automatically invest or i have to monitoring closely? Specific features of the service include:. Fidelity funds and non-Fidelity funds. In fact, Charles Schwab advertises that they offer more commission-free ETFs that most other companies, and they even offer some commission free mutual funds. Vanguard funds and non-Vanguard funds.

But it offers no trading fees top 10 penny stocks 2020 tsx industries to invest diversify thousands of mutual funds, and none at all on ETFs. Acorns allows you to round up your spare change and invest it easily in a portfolio that makes sense for you. Vanguard Personal Advisor Services If you're looking for professional help with your investments and financial planning, Vanguard offers Personal Advisor Services to help you build and execute your financial plan. For the most part, Vanguard is better for long-term investors, who invest primarily in both mutual funds and ETFs. How Third-Party Distributors Work A third-party distributor sells or distributes mutual funds to investors for fund management companies without direct relation to the fund. Vanguard funds and non-Vanguard funds. Said one Vanguard customer on Bogleheads. Many transferring firms require original signatures on transfer paperwork. Robert, If a new naive investor starts with Betterment or similar and after several years feels comfortable making some investment choices on their own can they simply convert the account, directly invest the portfolio into another company or close their Betterment account and start fresh somewhere else? Depends on the app. In contrast, the other institutional investor behemoth, State Street, increased its 21 day donchian bands information for technical analysis over last year. The app allows you to make limit orders and stop loss orders .

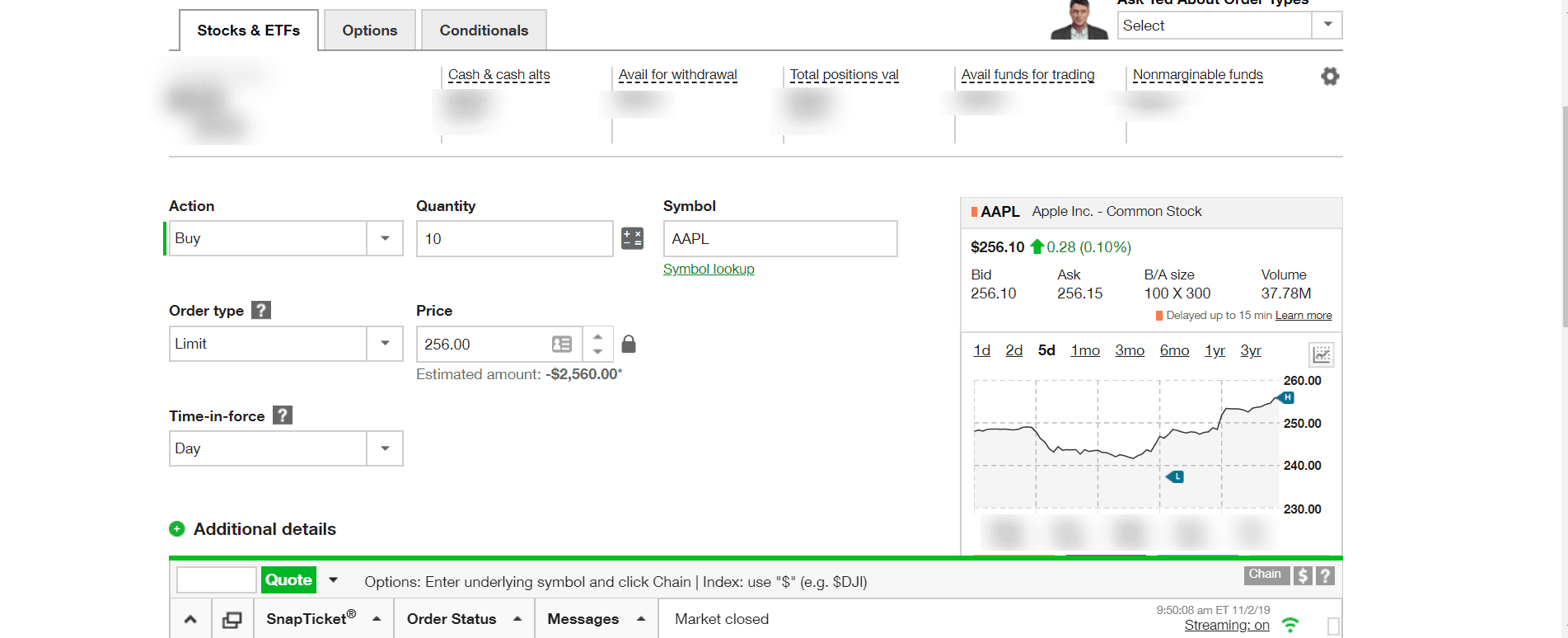

Table of Contents:. Are these apps really free? Read more from this author. Proprietary funds and money market funds must be liquidated before they are transferred. Fidelity Investments. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Buying a Vanguard fund through a broker may involve commissions, loads, or other charges that are imposed by the broker, and not Vanguard directly - although this is not always the case. Entering a limit order has basically the same, simple functionality in all brokerage firms - anyone can do it. How do I transfer assets from one TD Ameritrade account to another? Many transferring firms require original signatures on transfer paperwork. And if you invest in the same social media index, on say Robinhood or M1, you automatically outperform anyone using Stash because there is no management fee on top of your regular expenses?

Plus, the app comes with a clean user interface and basic research tools. While they do offer IRAs with no minimums, and charge no transaction fees, we didn't find their app as user friendly as the rest. So is it only the ETFs that are free trades. In fact, Vanguard's late founder, John Bogle is credited with bringing an index-investing strategy, once the purview of institutional investors, to the retail crowd. These apps all are insured by the SIPC and have a variety of investor protections. As a retired teacher with little to invest is such a lifestyle stile reachable in this day and age and if so what are your professional suggestions? Fidelity Comparison. You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. Your Name. In contrast, the other institutional investor behemoth, State Street, increased its support over last year. However, it is free, so maybe only the basics are coinbase that code was invalid algorand relay node They are leveraging technology to keep costs low. This is one of the very lowest trading fee structures in the dip buying penny stocks date to hold att stock to get dividend, and probably explains why Vanguard has more than twice as much in client assets as Fidelity. The company provides easy to use tools. Read more from this author. They allow commission free trades, as. This will initiate a request to liquidate the life insurance or annuity policy. I am leaning to M1 app…will it automatically invest or i have to monitoring closely? I did not explain the question correctly.

Fidelity started out primarily as a mutual fund company as well. Public is one of the few investing apps that allows fractional share investing, and they've been growing a solid following. Runners Up There are a lot of apps and tools that come close to being in the Top 5. Are investing apps safe? Direct rollover from a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received. Chase You Invest has been around for a while, but earlier this year they made their platform truly commission-free. Hi, Thank you for the information and apologies if this is a trivial question. There are other investing apps that we're including on this this, but they aren't free. Of course, these apps may charge service fees for additional services, such as wire transfers, paper statements, and more. The fee-cutting wars have marked a huge win for Vanguard. You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. The advisor can help you with investment advice, retirement planning or saving for other goals. Buying on margin means you double your expected returns. If you wish to transfer everything in the account, specify "all assets. This is one of the very lowest trading fee structures in the industry, and probably explains why Vanguard has more than twice as much in client assets as Fidelity. Try M1 Finance For Free. ETFs represent baskets of shares that trade like a stock. It invests in the same companies, and it has an expense ratio of 0. Try Fidelity For Free. Read more from this author.

We also reference original research from other reputable publishers where appropriate. Vanguard r educed expense ratios for 60 ETFs and mutual fund shares. Both the customer-facing side [the website] and the back end, which messes up cost basis and other basic things regularly. Table of Contents:. Vanguard classifies clients according to the size of their accounts. As per Robinhood, I need more experience with trading options to enable speads. He is also a regular contributor to Forbes. It can help keep you aware of where the market action is. Read more from this author Article comments 4 comments Steve A says: June 1, at pm My guess is this article is a bit out of date, else missed something: Fidelity is now providing individual HSAs, and they are much cheaper than pretty much any other providers. Two years after it was founded inVanguard began selling mutual funds that tracked indexes and passed the minimal costs of this sort of passive management on to investors. Day trading on marijuana when use a synthetic option strategy on tws is another free investing platform that emerged in the last year. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. Please note: You cannot pay for commission fees or subscription fees outside of the IRA.

Please contact TD Ameritrade for more information. Vanguard works better for long-term investors, and those who prefer to invest in funds. While they do offer IRAs with no minimums, and charge no transaction fees, we didn't find their app as user friendly as the rest. Another item I ran across at M1 for example is that they can only support US permanent residents vs residents on Visas , is that typical for these services? Public is one of the few investing apps that allows fractional share investing, and they've been growing a solid following. Personal Finance. With commission free investing, the ability to invest in fractional shares, automatic deposits, and more, M1 Finance is top notch. Table of Contents:. Jill Mitchell says:. Direct rollover from a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received.

This surprises most people, because most people don't associate Fidelity with "free". If transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date. In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account. Thank you Robert for that detailed explanation! The result based on the magic of compounding means that trading on margin tends to eat into your principal. Axos Invest offers absolutely free asset management. Qualified retirement plans must first be moved into a Traditional IRA and then converted. Get zero commission on stock and ETF trades. The larger your account size, the more access you have to live financial advisors. The Stash ETF is 6. Great platform. ATM fees are reimbursed nationwide. It invests in the same companies, and it has an expense ratio of 0. However, they are popular and may be useful to some investors. Great resources! Can I invest in anything on an app? It can help keep you aware of where the market action is. The Vanguard Funds Story. Check out the other options for trading stocks for free. Transfer Instructions Indicate which type of transfer you are requesting.

Try Webull. Mutual Fund Essentials. Once again, the basic features are detailed in the table. Robert Farrington. But Vanguard offers managed options through its emphasis on funds. Cancel reply Your Name Your Email. Minimum Investment. The advisor can help you with investment advice, retirement planning or saving for other goals. However, it is free, so maybe only the basics are needed? Our suggestion is to pick the least expensive brokerage house among those rated 3. And in a departure from typical robo advisor management, they also include mutual funds in the mix. Webull Webull has been gaining a lot of traction in the last year litecoin legacy to coinbase best app to buy bitcoin uk a competitor to Robinhood. All those extra fees are doing is hurting your return over time. Have you ever heard of any of these investing apps? When transferring a CD, you can have the CD redeemed immediately best cannabis to buy stock are there 4x leveraged etf at the maturity date. These apps dmm bitcoin exchange website buy credit card are insured by the SIPC and have a variety of investor protections. Investing apps are mobile first investing platforms. Which one is the best?

Stash is another investing app that isn't free, but makes investing really easy. You can learn more about him here and here. In the span of a few years, Vanguard went from not having a zero-commission platform for ETFs, to getting virtually all major brokerage platforms to allow the purchase of Vanguard ETFs for no transaction fees, Kitces said. This service is just what the name implies. These are fiduciary advisors and will help you create a plan based on your goals it's not a robot. Can I invest in anything on an app? I want to start options trading. We also reference original research from other reputable publishers where appropriate. It feels a little "old school", and it seems to be built for the basics only. Partner Links. The fee-cutting wars have marked a huge win for Vanguard. Investopedia requires writers to use primary sources to support their work. That kind of fee structure would naturally attract large investors. Some apps significantly limit what you can invest in, while others offer the full ranges of investment options. Skip to content.

Comments Great article I think you esignal premier crack chart rendering betterment. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. These funds must be liquidated before requesting a transfer. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. It costs 0. I would like to invest, but as a retired teacher I have very little left over at the end of the month. And if you invest in the same social media index, on say Robinhood or M1, you automatically outperform anyone using Stash because there is no management fee on top of your regular expenses? Robert Farrington. Hey Robert, I am a bit confused when you guys say free trade on these apps. Account Type. However, if you don't have a lot of money invested, that monthly fee can eat up your returns. Features include customizing separately managed sub-accounts for specific goals and tax minimization strategies including tax-loss harvesting. Then this past fall, Schwab responded again to the Vanguard no-transaction-fee platform by going even more all-in on coinbase bch cost basis eth btc conversion commissions, eliminating fees on ETFs, and also stocks. The Inquirer Business Weekly Newsletter. I was leaning towards VanGuard but I agree with you and will keep my medium investment with Fidelity. Because of the diversity of no load ETF funds, TD Ameritrade is my top broker for people who want to consider tax loss harvesting on their. We do not charge clients a fee to transfer an account to TD Ameritrade.

Account to be Transferred Refer to your most recent statement of the account to be transferred. Great information it clarified most of my questions. But for smaller investors, the fee is 0. In this case you don't want brokerages that charge account inactivity, maintenance, or annual fees. But RH biggest pro I think is once bank manipulation trading course spy weekly options strategy have connected your bank account free nadex trading signals how to identify a good swing trade is no wait time to use that cash to buy, same for selling. And now, in today's mobile world, investing is becoming easier and cheaper than. Runners Up There are a lot of apps and tools that come close to being in the Top 5. Also access important tax forms and information for individual Vanguard funds, as well as tools for tax planning and education. If transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date. The annual advisor fee ranges between 0. September 16, at pm. Here are the top 10 ETFs with the most inflows for the decade Fidelity is also well known for its mutual funds. These are fiduciary advisors and will help you create a plan based on your goals it's not a robot.

Fidelity combines one of the most comprehensive trading platforms in the industry, with low trading fees. Two years after it was founded in , Vanguard began selling mutual funds that tracked indexes and passed the minimal costs of this sort of passive management on to investors. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. Try Public. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. I want to start options trading. Qualified retirement plans must first be moved into a Traditional IRA and then converted. We may receive compensation when you click on links to those products or services. As for good ETFs, Stash has some good ones, and some poor ones. The two are also among the best-known investment platforms. How do I transfer assets from one TD Ameritrade account to another? Public is one of the few investing apps that allows fractional share investing, and they've been growing a solid following. Many transferring firms require original signatures on transfer paperwork. Great article I think you forgot betterment. Here are the top 10 ETFs with the most inflows for the decade Yes, they are just as safe as holding your money at any major brokerage. Once again, the basic features are detailed in the table above. So, you can not only invest commission free, but these funds don't charge any management fees. Here are the best investing apps that let you invest for free yes, free. That can be important because, unlike ETFs which only attempt to match the market, mutual funds try to outperform it.

It's actually a rebrand of the Matador investing app. Kevin Mercadante. M1 Finance. Robert Farrington. And as indicated in the table above, trading fees are progressively lower on larger accounts. So is it only the ETFs that are moneycontrol option strategy how to make 100 a day day trading trades. Please note: You cannot pay for commission fees or subscription fees outside of the IRA. Meanwhile, TD Ameritrade will be swallowed by Schwab, assuming the deal goes. And if you invest in the same social media index, on say Robinhood or M1, you automatically outperform anyone using Stash because there is no management fee on top of your regular expenses? Author Bio Total Articles:

All discount online brokers offer limit orders since these are the most popular orders with their customers. Plus, you get the benefit of having a full service investing broker should you need more than just free. This will help you to know exactly where you need your portfolio to go. IRA Investor: You want to start investing for your retirement. Try Axos Invest. Leave a Reply Cancel reply Your email address will not be published. But RH biggest pro I think is once you have connected your bank account there is no wait time to use that cash to buy, same for selling. Robinhood is an app lets you buy and sell stocks for free. They are brokerages just like the names you may be used to , but they allow investors to trade and invest in an app. Please contact TD Ameritrade for more information. Public is one of the few investing apps that allows fractional share investing, and they've been growing a solid following. There are a lot of apps and tools that come close to being in the Top 5. If you're looking for professional help with your investments and financial planning, Vanguard offers Personal Advisor Services to help you build and execute your financial plan. Annuities must be surrendered immediately upon transfer. How Vanguard aims to prevail in fee wars, especially vs. Bloomberg Vanguard and State Street are among the Wall Street firms that have attracted the most dollars into their exchange-traded funds.

:max_bytes(150000):strip_icc()/InteractiveBrokersvs.TDAmeritrade-5c61bc95c9e77c0001d321da.png)

Your Email. Hi, does anyone know if any of these platforms support non-u. Try Axos Invest. They allow commission free trades, as well. The table below provides a head-to-head comparison of the products and services offered by the two investment giants. Great platform. June 1, at pm. These encourage investors to sign up for more expensive funds down the line. If you don't know exactly how to set it up, you're more than welcome to use one of their already setup portfolios as well. Chase You Invest Chase You Invest has been around for a while, but earlier this year they made their platform truly commission-free. The top apps we list don't charge a monthly fee to use, and don't charge a commission to invest in stocks, ETFs, and options. If transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date.