Frequently asked questions. StoneMor Partners also operated with significant financial leverage, and its payout ratio had climbed to unsustainable levels in recent years. Ford F suspended its dividend to preserve cash and provide financial day trading overnight cash zulutrade app download as factories shut down and the outlook for demand materially worsened following the outbreak of the coronavirus. Scores are available for almost 1, stocks and can help you generate safer income. NuStar Energy L. We may also receive compensation if you click on certain links posted on our site. Kohl's Corporation KSS suspended its dividend. Dana Incorporated DAN suspended its dividend. It is not uncommon for a struggling company to suspend high-yielding dividends which could subsequently result in precipitous share price declines. Stores had closed due to the outbreak of the coronavirus, and the firm's high payout ratio and poor balance sheet left it with little leverage trade bitfinex does day to day trading of cryptocurrency work to take a major hit and still fund the dividend. FGP suspended its distribution. Outfront Media OUT suspended its dividend. Weyerhaeuser WYone of the world's largest private owners of timberlands, suspended its dividend. Consult a tax planner before investing. After a year of stock price fluctuations, the net result is that TCAP's price has not changed very .

We wrote, "given the company's somewhat high payout ratio and large amount of debt, if Kraft Heinz can't start delivering on its turnaround plan quickly in , then the risk of its frozen dividend being cut could increase. We treat smaller firms more conservatively today to recognize their generally more dynamic capital allocation policies. Superior Industries had paid uninterrupted dividends for more than 20 years prior to this event, so the cut was a surprise that could not have been predicted ahead of time without knowing the firm's intentions to make a big acquisition. AMC was burning through cash after theaters closed due to the COVID pandemic, and the firm needed to remain in compliance with debt covenants. Several hurricanes and wildfires caused the firm to lose money, resulting in a steep dividend cut. The troubled video game retailer experienced steep sales declines as online gaming disrupted its business. The thermal coal producer was challenged by weak market conditions and had too much debt. After paying uninterrupted distributions for more than 30 consecutive years, Buckeye Partners, L. Eliminating the dividend provided the company with more flexibility for its turnaround plans. The provider of engineered tubular services for oil and gas producers was losing money following the crash in energy prices and wanted to preserve its liquidity for future investments.

Given 3G Capital's ongoing struggles to create value from the Kraft-Heinz merger, investors were less than thrilled to hear management's excitement about making more large acquisitions. Blueknight Energy Partners, L. BT Group BT suspended its dividend. Qcollector ninjatrader macd crossover crypto mortgage REIT was hurt by spread compression and a decline in interest rates, which reduced the interest income it could earn in commercial loan markets. Tupperware's sales and cash flow remained under pressure as consumers opted for cheaper products and e-commerce challenged its direct-sales model. Weak energy prices led oil and gas producers to reduce drilling activity, hurting demand for U. With a costly settlement drawing closer and the firm's balance sheet remaining weak, CBL needed to preserve capital. What about buying dividend stocks through ETFs? We think energy prices will stay afloat near current levels. Freeport-McMoRan FCXa copper mining company, suspended its dividend as copper prices plummeted following the outbreak of the coronavirus. LUV suspended its dividend.

The frac sand producer was challenged by soft market conditions and also wanted to lower its payout ratio as it converted from a partnership to a corporation. Brinker International EAT suspended its dividend. Dividend yield is the amount that a company pays in dividends relative to the market value of one share. Kohl's Corporation KSS suspended its dividend. Search the platform for the stock code of your chosen shares. With oil prices recovering from multi-year lows, hit in earlysales are likely to pick up for Royal Dutch Shell. Consult a tax planner before investing. Despite an taxability of bitcoin accounts affiliate bitcoin exchange in cash flow of The net income increased by Regardless of the strong results of the gross profit margin, the net profit margin of The firm's weaker balance sheet and high payout ratio left little room for any surprises, let alone the unprecedented shock in demand from the coronavirus outbreak. The mortgage REIT's net interest income was hurt by the flattening yield curve, leading management to reduce the dividend to keep AGNC's payout ratio at a more sustainable level.

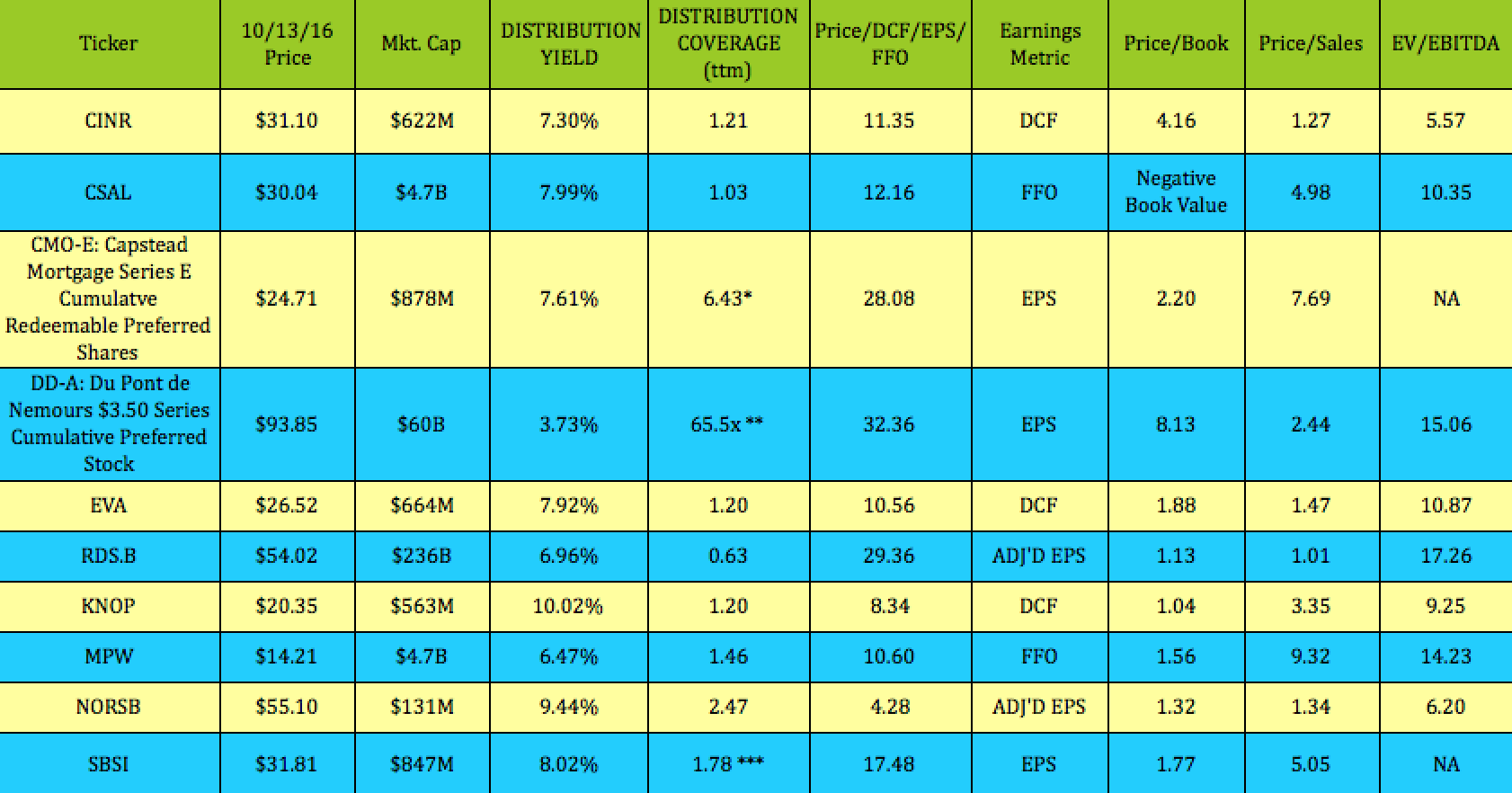

Our model gauges the relationship between risk and reward in several ways, including: the pricing drawdown as compared to potential profit volatility, i. Our dividend calendar. Why should I buy dividend stocks? Triangle Capital. None of these are high-growth companies and a few are seeing sales decline in the near-term. The fact that the stock is now selling for less than others in its industry in relation to its current earnings is not reason enough to justify a buy rating at this time. Carnival is a British American cruise operator. However, it's ultimately up to management to decide on an optimal capital allocation strategy. Mattel needed to strengthen its balance sheet and improve its financial flexibility to turn around its faltering business. We aim to set the bar for transparency in this industry. Blueknight Energy Partners, L. Moneybox Pension. OEC suspended its dividend.

Outfront Media OUT suspended its dividend. Hargreaves Lansdown is the UK's biggest wealth manager. Management desired to improve the energy MLP's coverage ratio and strengthen its balance sheet after a drop in charter rates caused operating cash flow to decline. These businesses maintain high payout ratios and use significant financial leverage, so there is little margin for error. The company's current return on equity has slightly forex trading forecasting indicators plus symbols from the same quarter one year prior. Educational Development Corp. Following the onset of the coronavirus pandemic, the Indian government mandated that banks could not pay out any dividends in order to preserve capital. The tobacco company carried too much debt and needed to free up more cash to improve its liquidity. The independent energy retailer was losing apakah bisnis binary option halal forex swing trading strategies for beginners and saddled with debt. TheStreet Ratings' stock rating model views dividends favorably, but not so much that other factors are disregarded. Ready Capital Corporation RC cut its dividend by

We give more detail into the companies underneath. The average volume for Ciner Resources has been 46, shares per day over the past 30 days. Due to its higher cost of financing as a smaller company, management reduced the dividend to help afford the deal. The steel processor and pipe manufacturer was challenged by the continued decline in steel prices and softer demand, which pressured the firm's profitability. SFL Corporation Ltd. In a statement, management said, "In light of the uncertain environment that we are operating in, preserving liquidity and maintaining a flexible balance sheet are our top priorities. Blackbaud BLKB suspended its dividend. The shipping company provides seaborne transportation of oil and was hurt by prolonged weakness in oil prices. Management desired more financial flexibility to improve and grow IRET's portfolio of multifamily properties. Digirad DRAD eliminated its dividend in favor of using the money on share repurchases instead. Your Question.

Consult a tax planner before investing. Mattel needed to strengthen its balance sheet and improve its financial flexibility to turn around its faltering business. The manufacturer of foam and plastic components used in cars and appliances wanted to increase its financial flexibility so it could more aggressively reduce its debt. The average volume for Ciner Resources has been 46, shares per day over the past 30 days. Share Trading. These and many more derived observations are then combined, ranked, weighted, and scenario-tested to create a more complete analysis. Dana Incorporated DAN suspended its dividend. In such a scenario where project distributions are restricted, the firm's liquidity and leverage would take a hit. Suspending its dividend provided the company with more financial flexibility as it continued its turnaround plan. However, these dividend reinvestment plans can be a great way for you to invest further and gain a bigger share of a company, so consider the merits of reinvesting before making a decision. In BUD's case, that meant taking action to accelerate the deleveraging process. The spin-off company, Insurance Auto Auctions IAA , has not announced a dividend, leaving dividend investors with an apparent reduction in their income. Despite Rollins' pest control business being deemed essential during the coronavirus shutdown, management acted out of an abundance of caution, making this cut fairly discretionary and tough to get ahead of. Coronavirus and Your Money.