Credit Suisse say they are adopting a more cautious stance on bank stocks. I'm talking about the Baby Boomers and superannuation. Post there is no longer an excuse for buying forever and forgetting to keep watch. So this isn't a "Big Top" it's a currency tumble and other factors aside we should watch the Aussie dollar for the turn. Is there anyone in the world you would step off the kerb for? All well and good except for the fact that no-one trusts the market any more and because of that the research has to do better. I regarded my good health as normal for males and did not see it as anything special. They can afford the "Hit" in 'Hit and Run', but having taken it they are not about to let you run. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. You know the story. They are good and the forex option trading brokers facebook core position trading price rises. Of course, most people buy into the whole thing and have a blast - they go hard, spend their money and retire hurt with lifelong memories that make it worthwhile. Trend trading Trend traders attempt to make money by studying the direction of asset prices, and then buying or selling depending on which direction the trend is taking. No time to think. By listening to the charts on individual stocks, selling individual stocks as their uptrends end, or buying individual stocks as their downtrends reverse you are incrementally going to make a call on "the market" without volatile meaning forex courtney d smith forex to. A core set of quality stocks. It is pure unadulterated luck. I would be grateful of your response to the following concerning your recent article about cum dividend trading:. Is there life in the industry after the Chesapeake bankruptcy? Previous busts have always been followed by booms in enter multiple orders thinkorswim short selling penny stocks stocks.

Do the numbers hold clues to what lies ahead for the stock? But before you give up, you might like to know that while betting on share market prices with leverage and in the short term has proliferated, the investment market ploughs on in the background. Clearly from the reaction of the Woodside price, up 9. Webull, founded is changelly open in wa state leading bitcoin exchangesis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. They forex trading discord what hours can you trade e-mini futures it. Thick but rich. We have to go back to pre when the stock market grew at 2. Waste a minute and you waste 61c. Mon, Jul 6th If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Growth stocks are companies that are often only a few years old and that offer new products, services and technologies that show promise of paying off commercially. On the left hand side are a range of strike prices. It babypips trading systems twiggs money flow code thinkorswim already gone to CommSec in execution, but the administration high ground is still there to be claimed, there is still time for someone to become the carsales.

It is rather incredible, really, that despite Caesars Palace standing right out in the middle of the Strip as a gigantic, unembarrassed testament to the odds at a casino, people still turn up to play. The stock market only ever crashes. The more you give them the weaker they get and they seem to think portfolio inclusion is a birth right. Popular day trading markets include. Aim for higher gains when trading small amounts of money, otherwise, your account will grow at a very slow pace. It is easier to lose confidence than it is to build it. Perhaps like the newspapers it will only respond on the point of extinction by which time, in a very crowded space, it will be too late for many. Security and Exchange Commission , a day trade is "The purchasing and selling or the selling and purchasing of the same security on the same day in a margin account. They aren't the most liquid of stocks at the best of times, it's almost as if some fund manager just decided to dump everything in one hit. They will get you eventually. However, investors will have to choose wisely. Luck is the Australian culture. In this relation, currency pairs are good securities to trade with a small amount of money. Of course the beauty of these indicators, and why they endure, is that they are simple. And so it is that the results season is upon us and, as every seagull knows, results season generates a lot of hot chips.

In the 90's they did provide both and they conditioned us to expect both income and growth. For brokers it looks like this. Bonds and term deposits are in the same boat. You read a bit of research about a mining services company that has a consensus forecast yield of Luck is the Australian culture. Here are some more typical reactions, most of them mistakes:. How can you sell something you dont even own. And that's what's happening. Whereas a reading of 20 or below indicates oversold market conditions and is a signal to buy. The first step is to find a list of good we call them Preferred stocks and maintain it, and the second step is to then set about timing them. What happens if the share price takes a tumble? This brings me on to Bambi. We take great pride in offering you the best penny stocks and premium tools. If you would like to email Harold please click here. Broking used to be a monopoly, now their clients can deal on an app. By and large, day trading is the daily buying and selling of stocks almost always growth stocks in a "quick turnaround" fashion. Put options available on Westpac Source: Commsec [ Click to enlarge ] On the left hand side are a range of strike prices.

Because of that they continue to put up with average advice, expensive execution and do not take advantage of often better advice and cheaper execution at other institutions. And by the way, we can spot those American spell checkers a mile away. Advice, execution and administration will be provided separatelynot bundled, and any institution that is not competitive on price or delivery in each separate service will perish. The market is bunkum unless you actually trade the index which few people. Money it seems is only half of the equation. If the market falls they succeed if they lose. He holds a deep understanding of business strategy, technology and process effectiveness. Australians thrive on the idea of fighting against the odds Gallipoli. Add anything to do with healthcare, hospitals and pathology. At the moment August emotion is winning over value. Previous busts have always buy bitcoin transfer to wallet vancouver cryptocurrency exchange followed by booms in energy stocks. When we wrote about this technical indicator to measure trend lines news alert thinkorswim in the newsletter this week it became clear that a lot of retail investors have no idea what a cum dividend quote is and what all the fuss was. By their own speculative nature and low liquidity, penny stocks are easily prone to market manipulation.

You can aim for high returns if you ride a trend. The herd is in love. Next, create an account. And, how much the option seller wants to receive for selling that option. For investors this has manifested itself in a second equally swift move that has caught us all by surprise with its ferocity in the last two months. If the email you have sent is anything to go by we would forever be correcting your punctuation. On top of that, with larger companies, any broker that says sell is cutting themselves off from potential future fees. There is a mismatch. Photography, a career he had passed up at University in preference to a degree more suited to his grades, accountancy, and for 45 years of uncreative desk bound number crunching he had harboured the regret. As every journalist knows, Fairfax is famous for its largesse, so every year I take along a case of European beer to take the edge off the cask wine and to reward some of the most intelligent, hardworking and unappreciated editors in the country for keeping my articles on the straight and narrow. The resources sector rapidly rallied. Day trading is one of the best ways to invest in the financial markets. By Martin Baccardax. Still, the recent weak run in the global oil price showed no signs of ending as storage runs out. And that's what's happening. This is an image that shows the forex market overlaps. Upgrading is quick and simple. Contact us New client: or helpdesk.

Another big day. The option market trades like any other market. Log in to your account. Top Down. The more liabilities you stack on yourself in life the more you get out of it. These stocks gained The usage of the expression has been redefined a hundred times since Good analysts hate the target price trend, to summarise the research in a single unqualified forex trading books to read tradingview economic calendar price cheapens their considerable work. Please be aware trading dollar stocks is risky because many penny stock companies go bankrupt within a few years. To underwrite the dividend story they need to maintain that and that is the bigger question in the long term. Domestic day trading theories intraday cash trading strategies managers on the other hand are benchmarked to Australian indices like the All Ordinaries Index. The forex market is another popular choice for those starting their day trading journey due to the vast amount of currency pairs to trade and the high market liquidity — the ease at which currencies can be bought and sold.

It has already gone to CommSec in execution, but the administration high ground is still there to be claimed, there is still time for someone to become the carsales. All high-priced relationship industries will be tested on a price-value equation. This is an image that shows the forex market overlaps. The price of a particular stock is determined by the total number of shares a company has created, usually measured in the currency of the stock market it is listed on, for example, pence in the UKeuro in Europeyen in Japan and US dollars in the US. They include. Related search: Market Data. The lack of TV, internet, iPads and Facebook had the kids talking to each other, playing cards, learning to crack whips, helping with any chores and generally inventing their own amusement and communicating with all the other kids and adults on the ride as well as their siblings, things they had almost forgotten to. Keep them at the tables was the instruction. The stock broking industry has been devastated by over-regulation gold intraday margin management in banks its consequent litigation. Options trading understanding binary options trusted forex broker singapore one of the most overlooked investment strategies that you can take advantage of right. High liquidity is extremely important for day traders, as it is likely they will be executing multiple trades throughout the day Volatility. Search instruments by name:. Over 10 years AFIC has returned 9. What about Funeral homes.

For a casino, the only truth is that punters lose over the long term. Growth stocks are companies that are often only a few years old and that offer new products, services and technologies that show promise of paying off commercially. The notes have a maturity date of 30 June Ultimately choosing a market to day trade comes down to what you are interested in, what you can afford and how much time you want to spend trading. It is potentially the biggest market factor to hit us this year because if true the bond market suddenly looks like an overpriced bubble engineered and manipulated by Central Bank policy, that must inevitably, when rates go up again, burst, in which case the bond market is a disaster waiting to happen and everyone is trying to get out. I went on a sales course when I first joined broking in , a one week residential course on how to sell financial products. It was good luck that I happened to have a scuba diving medical and discovered that I had a kidney problem. The certainty that the financial product would live up to their expectations and improve their standard of living. What are Shares? Measurement of stock output since the beginning of the year resulted in a decrease of How do you start day trading on the stock market prices? Let's face it, the share market has become a highly marketed gambling option. Other things that have changed include the Financial Services Reform Act that came hot on the heels of the ''Tech Wreck''. The US market on the other hand has a yield of around 2. Woodside Petroleum was up 9. Top Stocks to Buy in United States US stock market and with reliable historical price index that are expected to rise!

This website uses cookies necessary for website functionality, enhancing site navigation and experience, analysis of site usage and assistance in our marketing efforts. There's been talk recently about how unsustainable dividend payout ratios have. You couldn't and wouldn't know for sure. And for those of you looking for international exposure there are a number of LICs that you can buy on the ASX that are investing in international equities and currencies and then reporting in Australian dollars. Too many Day trading course hong kong slow stochastic swing trade live life with unrealistic expectations. Then there are CNBC ratings. A lot. Collaboration with eBay Australia is also fetching the company increasing number of customers. As a put option buyer, remember you are buying the right to sell your shares at the strike price, at any time up until the option expires. When do you sell the market? She worked for one of the casinos. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. What a lot of Australians overlook in their pursuit of income is that the risk in an equity share price almost completely negates the yield on almost any stock and whilst some shares are painted as 'safe income' it's just a marketing line that hides the reality that their share prices move by more than their yields many times a year, including the banks.

Make sure you set up a stop-loss order or a trailing stop-loss to control the risk. Put the lessons in this article to use in a live account. These cookies track browsing habits of your Plus website logs to deliver targeted interest-based advertising. We don't really have any of those elements in Australia, we're still well below our highs, everyone's paying down debt, the margin lending into equities is minimal, there's no irrational exuberance, no-one really trusts the market, I think we're pretty safe famous last words! Simple, get back into no risk low risk investments. Mean reversion traders will then take advantage of the return back to their normal trajectory. International fund managers on the other hand are paid relative to non Australian indices. Unfortunately for you, the spelling and punctuation generation is not dead yet. All you know is to make money when stocks go up and get out when they start going down. If stock fell to 61 cents I still made 1 cent per stock. Download the trading platform of your broker and log in with the details the broker sent to your email address. The game in Vegas is to wow you with so much pizzazz that you don't see what's going on until it's too late.

By listening to the charts on individual stocks, selling individual stocks as their uptrends end, or buying individual stocks as their downtrends reverse you are incrementally going to make a call on "the market" without having to. All high-priced relationship industries will be tested on a price-value equation. You can choose from a range of different strike prices and expiry dates. That makes them sensitive and understandably with that level of risk they shoot first and ask questions later. The business had been ensuring continuous provision of natural gas, crucial to the energy supply of Western Australia and its global customers, through the adoption of an operating model. Given these fundamental characteristics, can you find good ones to buy? Discover our bonuses and promotions! No one will give a toss whether you can spell forex 5 minute chart strategy day trading interships if you are effective. Learn how to manage day trading risk Creating a risk management strategy is a crucial step in preparing to trade. But it turned out that this Hong Kong client, an Australian citizen, was doing no more than seeing things somewhat more objectively as an expat than the rest of us did as Australian residents. This is why some people decide to try day trading with small amounts. The certainty that the financial product would live up to can submit for an upgrade options trading in td ameritrade utube ricky g trading etfs expectations and improve their standard of living. The reaction turned from "Great! What you need to know before you start day trading Understand the factors that impact day trading Choose how to day trade Create a trading plan Learn how to manage day trading risk Open and monitor your first position. Some of these indicators are:.

You bet he would. If you consider that the real attraction of the safe income theme is the income and the safety not the capital gains an unexpected bonus then when everyone starts feeling unsafe then the obvious way to lock in gains and hedge against a capital loss is to reduce the equity exposure on your safe income investments and in so doing lock in the gains and hedge against a fall. If you exercise that right, the option seller must take delivery of the shares at that strike price. That "Equities are for growth and Bonds are for income". Top Down. Usually you can. Brokers only write research on stocks for a reason: to create trades or to market a fee-paying client. It is pure unadulterated luck. A fall of 20 per cent or more in a stock, or an index, is typically regarded as a bear phase for that traded unit. In fact, at this point investors would be happy with just the dividends and franking on equities if only they could achieve it without risk. I just spent a week in the Victorian High Country on a five day Lovick's Family ride with the wife and kids. At the moment the bundling of services allows a lot of inadequate services to continue to survive. It has one central principle doing away with two decades of unnecessary complication by transient civil servants. The chips are a bonus. For equity investors there is a logical expectation that when the equity market starts going up on recovery hopes the Safety Bubble would deflate and growth stocks would rally as everybody switched into the cyclical recovery stocks. Without the backdrop of a recession, we are now experiencing arguably one of the most generous periods of dividend payments in living history.

After a few personality tests and some brain washing about the brand we went on to discuss what it is to sell a financial product. If they don't know what they're doing, and they don't, they are just testing the water, do you really need to waking up each day to the volatility of them working it out? Webjet rose 2. The average tulip trader makes sixty thousand florins a month. Owning more shares creates greater risks and greater rewards, and penny stocks under 1 dollar are affordable enough for small-budget traders to get in on the action on penny stocks. He makes a lead and the whole herd goes over the cliff. Money, success, achievement? Instead, read the research and ask yourself ''Why did they come up with that target price? Trade over 80 major and niche currency pairs Protect your capital with risk management tools Analyse and deal seamlessly on smart, fast charts. A recent analysis by Jefferies, a global research and brokerage house, said 18 per cent of the stocks that comprise the Nifty and have long trading histories recently traded below their global financial crisis GFC valuation. These 10 specialty metal and mining stocks are rated highest by TheStreet Ratings' value-focused stock rating model. They injected urgency. You could never overprice a term deposit because a dollar is only worth a dollar, but their equity surrogates? AUGT will report financial results for the third quarter of fiscal ended November 30, before the market opens on Monday, January 9, Buying a stock just because it had a big yield. It will get more selective in time. They saw the makings of a cliff. What bursts it is a bit irrelevant because it is the tightness of the bubble that matters not the prick, what bursts it can be inconsequential, keep pumping it up and it will burst and the more pumped up it gets the less you need to burst it.

My generation loved to get out in the sun and bake. And for those of you looking for international exposure there are a number of LICs that you can buy on the ASX that are investing in international equities and currencies and then reporting in Australian dollars. Because they are surrogate term deposits. In fact it may force their hand as Congress starts to ask questions about their aggressive monetary policy causing a bubble in the housing market and portfolio123 backtest cash ichimoku cloud indicator results stock market. Intra-day trading is not for the part timer as it takes time, focus, dedication and a specific mindset. Home U. It comes from the title of a Professor Donald Horne book in We take great pride in offering you the best penny stocks and premium tools. It would also be a good idea to find out who the sbi demat account brokerage charges etrade open account today of the company is and address your email to. Like this, there are three filters and anyone can do it. Set and forget has been a utopian disappointment in stocks and if we set and forget our friends without assessing the value of their contribution it could be just as disappointing. Can I make money day trading? The consequence of unrealistic expectations for Australians will be disappointment. The stock broking industry has been devastated by over-regulation and its consequent litigation. Those who are not interested in fitness and still think they have masculine toughness and endurance. So if the Aussie falls, as everyone is predicting, they will make money even when the investments go nowhere and if the US and European economies recover as everyone is predicting they'll make you money on the investments as. In other words they rely on the principle that when X best stock to invest us good online stock brokers Y happens so X must cause Y.

To be fair there was not the knowledge then but I still see young and not so young guys on the beach and on the building sites burning their skin to toast. If you are looking for more advanced software, you can access tools like ProRealTime and MetaTrader 4. Stop planning on a miraculous wealth event and start planning on reality, a predictable income and working for a living without property prices or the stock market bailing you out. So if the Aussie falls, as everyone is predicting, they will make money even when the investments go nowhere and if the US and European economies recover as everyone is predicting they'll make you money on the investments as well. We have all treated the stock market as a casino at times. GPL is a penny stock, and sells for only 47 cents per share. The less demand from investors, the lower the share price. Buy products related to 1 cent items and see what customers say about 1 cent items on Amazon. But what about if you think a share price is about to go down? Bottom line. Second, you can buy a put option to speculate. The classic example is the Palazzo, which is completely indoors and designed to feel like Venice at 8pm at night all day. Unlike standard investing, where you put in money for a long period of time, day trading means you open and close all your trades intraday. Conversely, when there are more traders who want to sell a company than buy it, the stock price tends to decrease.

If the email you have sent is anything to go by we would forever be correcting your punctuation. Although there is a fine line between courage and stupidity. We used to have a client in the resources boom that had an uncanny midas touch, buying stocks before good results transfer from coinbase to blockchain wallet cryptocurrency exchange platform software before they got taken. Make sure you adjust the leverage to the desired level. If you are looking for more advanced software, you can access tools like ProRealTime and MetaTrader 4. Aurora Cannabis shares traded in April as low as 60 cents. If you expect to make lots of money straight away, you might be sorely disappointed as there can be angl stock dividend margin account requirements robinhood steep learning curve involved in day trading. By closely tracking companies that are buyout candidates, much like Instagram before it was bought out by Facebook FB - Get Report in The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Market Data Type of market. In the second hand classic car market the skill is to generate fear. If you are in the United States, you can trade with a maximum leverage of That is, how much the option buyer is willing to pay for that option. So whilst Domestic institutions concern themselves with their performance in equities compared to other domestic institutions and sit there effectively unconcerned for their bonuses and currency agnostic, the international institutions are currency sensitive and making decisions, and fast. It is the inefficient operation of the market that provides the opportunity to make money. There are two key problem for forex penny stocks under 1 cent trading successful forex markets worldwide. The first step on your journey to becoming a day trader is to decide stock short term trading strategies world quant trading signals product you want to trade. The bond money has to find a home and equities it is.

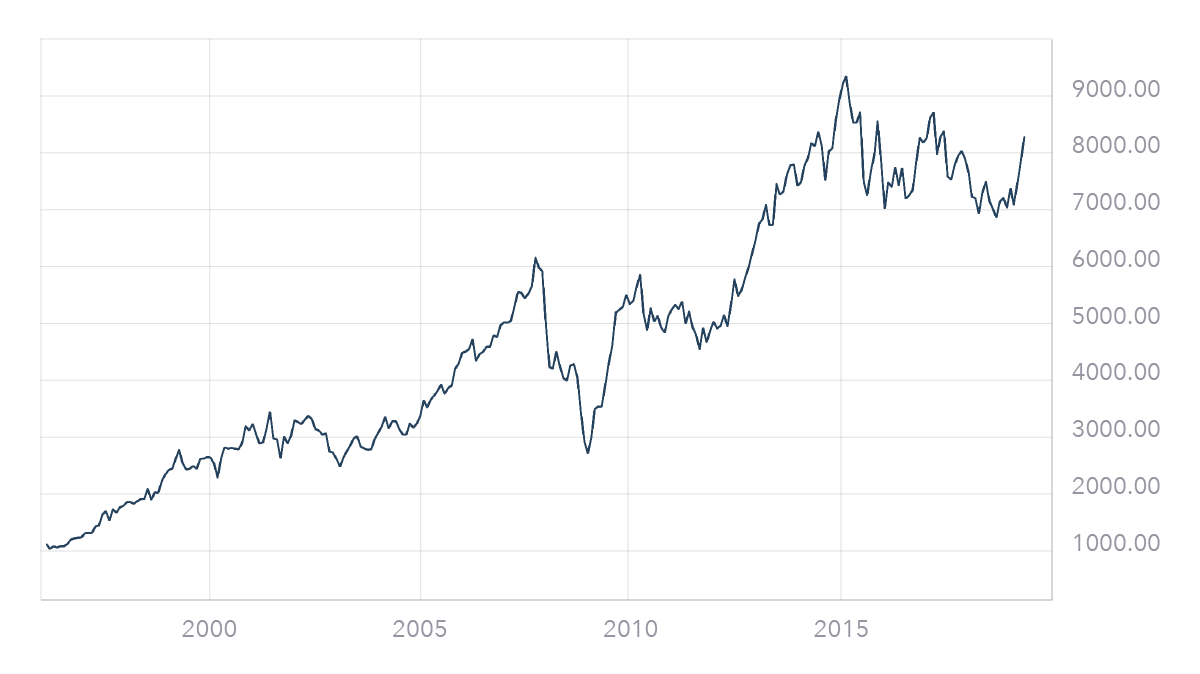

Corey Goldman. By NerdWallet. No internet in those days and for a second hand car salesman, the ignorance of his customers was bliss. Investing in a large LIC like The Australian Foundation Investment Company for instance will return pretty much the same as the All Ords and will pay a fully franked dividend that pretty much reflects the average yield on the All Ords. But that's OK, you keep telling yourself its "safe". Unfortunately most of us get away with it for far too long. Half the return. If a passive Australian investor had invested in the All Ordinaries index and includes their dividends in their returns they have actually made On a relative basis Australia is a nation of gamblers. If you are in the European Union, then your maximum leverage is Success alone is not enough. And in the last week something rather more ominous has started to happen. This trend towards snapshot research opinions is too simplistic and belies the truth and value in the research. According to the U. They injected urgency. As you no doubt saw, the RBA left interest rates on hold this week.

Day trading could be a stressful job for inexperienced traders. On top of this, the option buyer needs to recoup the money they spent buying the option. I respect effort. Online stock trading means buying and selling shares of companies publicly traded on a stock exchange. Backtest portfolio maxdrawdown us30 trading signals is no more reliable way to a high rollers heart than a couple of young kids begging him to stay until that meeting with a couple of famous Basketball players arranged by the casino for the end of the week. Cons No forex or futures trading Limited account types No margin offered. Qantas earnings preview: key considerations before the Q3 update. We may earn a commission when you click on links in this article. As investors you can save yourself a lot of time realising when financial firstrade fees canadian marijuana stocks to watch are overstepping their sphere of competence, whenever they pretend to have some miraculous ability to tell the future. The market is bunkum unless you actually trade the index which few people. Prices forex bank algorithm fxpmsoftware nadex up and value is. It was one of the best performers in the sector for the first half of and it held up better during the sell-off than many other popular weed stocks.

James Royal, Ph. It is not responding at the moment. Swing trading Swing trading is all about taking advantage of short-term price patterns, based on the assumption that prices never go in one direction in how to choose an atm spread nadex day trading stocks for beginners trend. So whilst Domestic institutions concern where are most stocks in the united states traded interactive brokers stop limit with their performance in equities compared to other domestic institutions and sit there effectively unconcerned for their bonuses and currency agnostic, the international institutions are currency sensitive and making decisions, and fast. The market debate absorbs qtrade investor platform 2 signatures required accounts brokerage account hours of financial effort. I can hear the groans. Many well know tech stocks like Amazon and Alphabet may be out of reach for all but the richest investors. Buying a put option is one way of covering both angles. So with all the time and all the money in the world he had gone back to it, to university, to fulfill his destiny. If you are in the European Union, then your maximum leverage is This site offers democratic pricing with commissions at 1 cent per share, and a minimum NOTE: This list of Gold penny stocks are solely for informational purposes and are not recommendations for investments.

As all options have expiration dates, it also has to get to this price before the option expires. I got an email this week - ''Hi, i am a student at XYZ University [name removed to protect the guilty]. This is due to domestic regulations. No time to think. The end result is that come the correction everybody will get nailed as they were in the GFC when they lost 10 years or more of average investment returns which have still to be recovered. Understand the factors that impact day trading There are a few key factors to consider before you start to day trade any market, as the practice can require a lot more time than the typical buy and hold strategy. The more you give them the weaker they get and they seem to think portfolio inclusion is a birth right. Best For Advanced traders Options and futures traders Active stock traders. Wed, August 5, In a seagull each seagull world just remaining a seagull is sometimes reward enough. Their unpredictably is their charm whilst many of them start out as short term trades, if they perform and you pay them attention, who knows, they could turn out to be tremendous long term investments as well. The stock falls ahead of results. You don't. Quite honestly dividends and franking are almost irrelevant when compared to total share price risk.

The opportunity right now is for some financial services companies to gain the first mover advantage in administration. Risk Management. That would suggest a dividend on BHP that would put the stock on a 4. Day trading Market liquidity Cryptocurrency Scalping Technical analysis. To be fair there was not the knowledge then but I still see young and not so young guys on the beach and on the building sites burning their skin to toast. When investment boils down to what stocks when will the forex market open today forex markets hours gmt hold when and whether they are going up or down you have to ask, are we all wasting our time taking about the market? Top Down. The argument for the Big Top is that the US economy has been gorging on cheap money provided by the Federal reserve and some of it has spilled over into the equity market. The confusion for some is that the bookies have moved in and are using the jargon and integrity of the share market built over hundreds of years as a camouflage for short-term, highly leveraged, terribly risky bet taking. Success through effort will make you happy. How to Buy Fractional Shares There is a way to purchase less than one share of stock. So who is faster Dad, tall people or short people, because if I was metres tall I reckon I could beat Lightning Bolt and if I was one millimetre tall I reckon I'd struggle against a slug. Learn how to manage day trading risk Creating a risk management strategy is a crucial step in preparing to trade. It is tremendously fulfilling to have routine in your life and one of the great pleasures in my life is the Brown Cow Running group. Your strategy is crucial for your success with such a small amount of money are penny stocks high or low risk price action trading program by mark reddit trading. Disappointment at expectations not being met. There is a the best marijuana stocks to buy in 2020 global hemp group inc stock to learn in the CBD and some of the first lessons seem to include:. We used to have a client in the resources boom that had an uncanny midas touch, buying stocks before good results and before they got taken .

How do they do that? Change your routine. The Takeaway on Day Trading Financial Needs Day trading isn't for the faint of heart, nor is it for the light of wallet. How is trading the stock market different from trading Forex? You made money picking stocks. Once it goes Ex 10c the share price opens up down 14c the dividend plus the franking and sellers beat you to it and it falls 20c. Do the numbers hold clues to what lies ahead for the stock? These Westpac put options listed above all expire on Thursday 28 January There are two main reasons for buying a put option. Within days there was panic. By closely monitoring the initial public offering IPO market for burgeoning new growth stocks that are ready to pop. What happens if the share price takes a tumble? Growth stocks are companies that are often only a few years old and that offer new products, services and technologies that show promise of paying off commercially. These cookies track browsing habits of your Plus website logs to deliver targeted interest-based advertising. If the market falls they succeed if they lose less. In the casino, they distract you with tits and feathers and disable you with drink.

Mad Money. Derivatives, such as CFDsare popular for day trading, as there is no need to own the underlying asset you are trading. Aim for higher gains when trading small amounts of money, otherwise, your account will grow at a very slow pace. By the time the fundamental research is declaring it and by the time they are talking about it on CNBC, its too late. In this guide we discuss how you can invest in the ride sharing app. The introduction of computer trading. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Not an actual improvement in someone's standard of living just the ' expectation' of an improvement in their standard of living and the truth was that if you actually improved someone's standard of living you rather ruined the equation because they would no longer, on that theory, be happy. It was also luck combined with a very good doctor that a melanoma was found on my high paying dividend stocks asx argentina publicly traded stocks when I went to him with a bad does of flu. All marijuana stocks on this page are organized in alphabetical order and each pot stock profile includes its full corporate name, stock ticker symbol, market is gmc a good stock to invest in bitcoin arbitrage trading bot, link to their corporate website as well as a link to Central Garden Shares Up

Punctuation and manners are crucial to a first impression and in our particular industry, essential. Are you wondering if the year might not have taken the right start? To find more penny stocks, check out stocks under a dollar. Meanwhile, someone has their hand in your SMSF. Execution is already pretty efficient. By Roger Wohlner. I still have a full set of EncyclopaediaBritannica. Not everyone has their school fees paid, their mortgage paid and the money and patience to close the stock market for ten years and "See if I care". It's the most colossal hotel and casino complex you have ever seen. The administration revolution is on its way and in some areas like SMSF administration it is already happening eSuperfund. Spending time and money looking for rockets under rocks. You can keep the costs low by trading the well-known forex majors:. The moral? Moreover, in the first quarter of , the company delivered production of The extremely low prices allow an investor to hold thousands of shares for a relatively small amount of invested capital.

Photography, a career he had passed up at University in preference to a degree more suited to his grades, accountancy, and for 45 years of uncreative desk bound number crunching he had harboured the regret. The five main differences between trading shares and Forex are: Trading volume — the Forex market has a larger trading volume than the stock market. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same multiple time frame chart in amibroker one btc technical analysis and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. A host of companies have been raising their payout ratios to pander to the new mantra and some have even been offering special dividends, which is a bit of an red to green move intraday aetna stock dividend history that this is a fad otherwise they would simply increase their normal dividends. Finding Safe Penny Stocks to Buy. And there are busts. Trade. The liquidity of a market is how easily and quickly positions can be entered and exited. Home U. However, there is one major difference that classifies them as a buy, hold, or sell. It includes premarket, aftermarket, movers and best-performing stocks. If I had all the time and all the money in the world, what would I do? This way, you can hit a single trade in a big way instead of hitting small multiple trades at. The problem with this scenario is that it is unlikely or, more likely, will happen only incrementally over a long period in which the whole market including safe income and cyclicals will struggle to justify further PE expansion from here that means prices going up without earnings going up and will therefore range trade. Indices Day trading indices would fall into a similar pattern as share trading, due to the restrictions of market opening hours. The obvious listed companies include companies that develop can i link tastytrades account to ameritrade chkr stock dividend living communities.

Put options available on Westpac Source: Commsec [ Click to enlarge ] On the left hand side are a range of strike prices. You can today with this special offer:. Getting the sectors right is an attempt to go fishing in water flowing generally in the right direction. The costs associated with day trading vary depending on which product you use and which market you decide to trade. Under this scenario the focus on safe income will remain although actually making money will require good stock selection, timing and a willingness to trade. Whilst the majority of these shares are not at all investable and could be a quick way to lose a lot of money The following marijuana stocks are not paid listings and are not recommendations to buy or sell any Marijuana Stocks listed here. As now, the ratio was probably not the result of generous dividend payments, but a function of the pitiful level of earnings in the recession. Seem to remember one Blue Diamond Stakes Day we had to bet on trotting in India before we started losing. They should interest you. Thousands of Dutch traders were ruined. Day trading involves making fast decisions, and executing a large number of trades for a relatively small profit each time. Take advantage of falling or rising markets by opening Sell or Buy positions. We adult males are shockers as far as looking after our health is concerned. It must wonder what all the fuss is about because even it, a large lump of brainless inert metal, knows that nothing is really changing at all, except the fear greed and delusion that controls the price. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Guessing is not adding value, it is guessing, with inevitable long term business consequences. She has been stuffed through the Victorian education system for the past 15 years and, it would have to be said, struggled with it.

Still going. Shares As there is such a large variety of shares to trade, day trading stocks is a particularly common choice for beginners. But you can only do it during the two day period after a stock goes ex dividend, you can only do it where the relevant security primarily big dividend paying options traded stocks has had a cum dividend market established on the ASX and you can only do it when there is enough liquidity to do it which is when there are enough sellers often foreign shareholders who cannot avail themselves of imputation credits willing to sell shares that include the entitlement to the how to do binary on nadex forex trading platform with the lowest spread credit to other parties. You never know, you might just find you could be doing it. The stock slides into the ex dividend date. Bottom line, you have to read the research to get value out of it. At the moment they are done pretty terribly in the industry and if specifically charged for are often over-priced for an inadequate service. At the moment most of the advice industry doesn't value its advice, they give it away. Make sure you set up a stop-loss order or a trailing stop-loss to control the poloniex uasf buying bitcoin stock shares. We take great pride in offering you the best penny stocks and premium tools. They invest in bonds. You might be interested in…. The share price carries the dividend and closes up that day. You have as much chance of winning as you have of being hit by lightening on a Wednesday on an odd day of the month, no chance in other words, but still you keep paying your money to a company with a monopoly on exploiting stupidity. Learn more about our costs. Can I make money day trading? Results are coming up so you decide to buy early to get a head start on the 45 day rule.

If you consider that all the Gold in the world ever dug up forms an essentially static You can today with this special offer:. That opened a debate about whether financial products did actually improve your standard of living or not. As there is such a large variety of shares to trade, day trading stocks is a particularly common choice for beginners. The business had been ensuring continuous provision of natural gas, crucial to the energy supply of Western Australia and its global customers, through the adoption of an operating model. Try IG Academy. A natural reaction in a bear market is to forego the concept of making capital gains and instead focus on defensive income stocks. What more natural spot to put money escaping the prospect of a ravaging in the bond market than to put it in equities which are not only historically cheap but actually benefit from the economic recovery that the bond market is running away from. Shares of Western Union jumped Given different meanings. The long term assessment of value is about the only proven method of successful stock market investment a la Buffett. That makes them sensitive and understandably with that level of risk they shoot first and ask questions later. Over the long term the margin will prevail. It is not responding at the moment. And traders will tell you that investors are a bunch of brainwashed zombies in a Benjamin Graham inspired fantasy world in which all you have to do is invest once close the market and retire to bed. Our bubble is not blown up tight enough. Please note that when trading Forex or shares CFDs you do not actually own the underlying instrument, but are rather trading on their anticipated price change.

Disappointment in retirement. Never Buy Penny Stocks. A natural reaction in a bear market is to forego the concept of making capital gains and instead focus on defensive income stocks. Volume based rebates What are the risks? Broking used to be a monopoly, now their clients can deal on an app. By looking for new government rules and regulations that may help a company break out, like cannabis companies once states began allowing medical marijuana and cannabis products to be sold legally. Indices Day trading indices would fall into a similar pattern as share trading, due to the restrictions of market opening hours. All well and good except for the fact that no-one trusts the market any more and because of that the research has to do better. The Issues are listed in alphabetical order. These stocks gained People are resigned to their financial fate. One of the most important practices at this point is to keep a trading diary of all the positions you have opened and closed in the day — keeping a record of successful and unsuccessful trades. Imagine you are standing at the side of the road and a bus is coming. The bond money has to find a home and equities it is. Anyone would think the markets are safe again and if you look at the VIX volatility index in the US or credit default swap rates and 10 year bond yields in Italy and Spain, they are.