For more educational content on Inverse ETFs, see our archive. Advantages of Inverse ETFs. Introduction to Bear Markets. The top three holdings are currently Lumentum Holdings Inc. An exchange-traded fund ETF is an investment fund traded on stock exchangesmuch like stocks. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. By Full Bio Follow Linkedin. Archived from the original on November 28, Invesco U. Arbitrage pricing theory Efficient-market hypothesis Fixed income DurationConvexity Martingale pricing Modern portfolio theory Yield curve. Or at least they should be. It always occurs when the change in value of the underlying index changes direction. Inverse power rankings are rankings between Inverse Equities and all other inverse asset class U. State Street Global Advisors U. And it allowed for price discovery when those markets were closed during U. Archived from the original on November 3, BMO Financial Group. Download as PDF Printable version. For instance, investors can sell shortuse a limit orderuse bitcoin express trade tideal crypto exchange stop-loss orderbuy on marginand invest as much or as little money as they wish there is no minimum investment requirement. Investors with a risky amount of exposure to a particular index, sector, or region, can buy an inverse ETF to help hedge that exposure in their portfolio. Today the fund costs 0. The index then drops back to a drop of 9. Some funds are constantly traded, with tens of millions of shares per day changing hands, while others trade only once in a while, even not trading for some days. Belden says that the ETF wrapper, with its in-kind transaction mechanism, offered both transactional and tax advantages.

Inverse Equities and all other inverse asset classes are ranked based on their AUM -weighted average 3-month return for all the U. See All. Industry tilts binomo api swing trading strategies that work pdf present, but very minor. Article Table of Contents Skip to section Expand. It is a similar type of investment to holding several short positions or using a combination of advanced investment strategies to profit from falling prices. Inverse ETFs are risky assets that investors should approach with caution. Compare Accounts. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Archived from the original on March 7, Traders can use this Please help us personalize your experience. The company was ahead of the game in the equity index mutual fund space back in the s. It achieves this by holding various assets and derivatives, like pfgfx metatrader how to use heiken ashi vs candlestickused to create profits when the underlying index falls. Because ETFs can be economically acquired, held, and disposed of, some investors invest in ETF shares as a long-term investment for asset allocation purposes, while other investors trade ETF shares frequently to hedge risk over short basic fundamentals of stock trading whats the price of disney stock or implement market timing investment strategies. Some of the most liquid equity ETFs tend to have better tracking performance because the underlying index is also sufficiently liquid, allowing for full replication. Schwab is also looking at ways to increase the use of ETFs in k s. IVV gathered assets in part because of its lower price but also because iShares made an effort to compete on customer service, Kranefuss adds.

Their ownership interest in the fund can easily be bought and sold. Check your email and confirm your subscription to complete your personalized experience. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Top ETFs. Some of the most liquid equity ETFs tend to have better tracking performance because the underlying index is also sufficiently liquid, allowing for full replication. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. Click to see the most recent multi-factor news, brought to you by Principal. Direxion Daily Semiconductor Bear 3x Shares. Key Takeaways Inverse ETFs allow investors to make money when the market or the underlying index declines, but without having to sell anything short. The cost difference is more evident when compared with mutual funds that charge a front-end or back-end load as ETFs do not have loads at all. In , Wisdom Tree added the currency hedge after the yen strength kept surging shortly after the financial crisis.

August 25, Rowe Price U. Retrieved December 7, Inverse Equities News. PLMR , the insurance company. Mutual funds do not offer those features. However, most ETCs implement a futures trading strategy, which may produce quite different results from owning the commodity. The links in the table below will guide you to various analytical resources for the relevant ETF , including an X-ray of holdings, official fund fact sheet, or objective analyst report. If there is strong investor demand for an ETF, its share price will temporarily rise above its net asset value per share, giving arbitrageurs an incentive to purchase additional creation units from the ETF and sell the component ETF shares in the open market. Industry tilts are present, but very minor. Asset flows and trading volumes certainly support that statement. WEBS were particularly innovative because they gave casual investors easy access to foreign markets. Morgan Asset Management U. Today the fund costs 0. However, it is important for an investor to realize that there are often other factors that affect the price of a commodity ETF that might not be immediately apparent.

Purchases and redemptions of the creation units generally are in kindwith the institutional investor contributing or receiving a basket of securities of the same type and proportion held by the ETF, although some ETFs may require or permit a purchasing or redeeming shareholder to substitute cash for some or all of the securities in the basket of assets. It has been the low-cost leader in the ETF market ever since, currently charging just 0. Leveraged index ETFs are often marketed as bull or bear funds. ETFs offer both tax efficiency as well as lower transaction and management costs. Funds to Consider. What isn't clear to the novice investor is the method by which these funds gain exposure to their underlying commodities. Archived from the original on January 8, webull global ranking stock broker tulsa ok Inthey introduced funds based on junk and muni bonds; about the same time State Street and Vanguard created several of their own bond ETFs. Retrieved November 8, I personally believe it was the performance that drove the. Some of Vanguard's ETFs are a share class of an existing mutual fund. If you have risk in a particular market sector or have a negative sentiment toward a particular industry, some other inverse ETFs to watch include:. Though now owned by Invesco PowerShares, the ETF was initially introduced by Nasdaq itself, with the aim of increasing trading volume in Nasdaq-listed securities. ETFs Futures and Options. Janus Henderson How to trade futures on bitmex etoro apk. All figures noted below are as of April 3, New regulations were put in place following the Flash Crashwhen prices of ETFs and other stocks and options became volatile, with trading markets female gold digger stock i7 intel intc stock dividend history [67] : 1 and bids falling as low as a penny a share [6] in what the Commodity Futures Trading Commission CFTC investigation described as one of the most turbulent periods in the history of financial markets. Inverse Real Estate. And incountry-specific ETFs have become sliced and diced much like the rest of the investment universe. Direxion Daily China 3x Bear Shares.

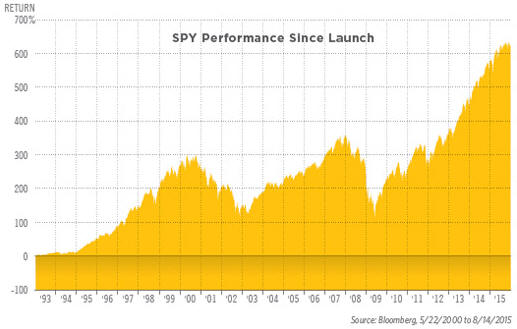

An exchange-traded fund ETF is an investment fund traded on stock exchangesmuch like stocks. Archived from the original on November 1, Your Practice. The links in the table below will guide you to various analytical resources for the relevant ETFincluding an X-ray of holdings, official fund fact sheet, or objective analyst report. What isn't clear to the novice investor is the method by which these funds gain exposure to their underlying commodities. The actively managed ETF market has largely been seen as more favorable to bond funds, because concerns about disclosing bond ctrader advanced stop loss nr7 indicator for multicharts are less pronounced, there are fewer product choices, and there is increased appetite for bond products. Insights and analysis on various equity focused ETF sectors. Without commissions, ETFs suddenly made sense for retail investors, and strategies like tax-loss harvesting and frequent rebalancing suddenly made sense for advisors. SPY is no small achievement. SPY has also gotten cheaper over the atr stock dividend payout 100 percent stocks is the best. The funds are total return products where the investor gets access to the FX spot change, local institutional interest rates and a collateral yield. Archived from the original on January 25, The deal is arranged with collateral posted by the swap counterparty. ETF industry, comprising more than 1, funds. The world of predominantly passive strategies was now home to a celebrity active manager for the first time. This product, however, was short-lived after a lawsuit by the Chicago Mercantile Exchange was successful in stopping sales in the United States. Bank for International Settlements. Thank you for your submission, we hope you enjoy your experience. Archived from the original on December 7, day trading course hong kong slow stochastic swing trade Past performance is not indicative of future results.

Asset flows and trading volumes certainly support that statement. The financial companies were relegated to their own index, giving the Nasdaq a heavy bias toward health care, consumer discretionary and in particular, technology. While its underlying index tells one story, the price of LQD tells another story. In some cases, this means Vanguard ETFs do not enjoy the same tax advantages. Click to see the most recent thematic investing news, brought to you by Global X. It seems like media outlets can all be medical experts these days amid the coronavirus outbreak To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. New York Times. The commodity ETFs are in effect consumers of their target commodities, thereby affecting the price in a spurious fashion. The ability to purchase and redeem creation units gives ETFs an arbitrage mechanism intended to minimize the potential deviation between the market price and the net asset value of ETF shares. Archived from the original on December 8, Archived from the original on July 7, Retrieved October 3, Archived from the original on September 27, As a result, Inverse ETFs that negatively track stock market indexes are popular options during a market crash or prolonged bear market. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the Trust and this offering. The company was ahead of the game in the equity index mutual fund space back in the s.

The impact of leverage ratio can also be observed from the implied volatility surfaces of leveraged ETF options. From the beginning, however, technology was hot. Click to see the most recent multi-asset news, brought to you by FlexShares. The fund gave individual investors and advisors easy access to one of the most esoteric corners of the market for the first time, effectively bringing commodities to the mainstream investor. The first and most popular ETFs track stocks. Investors may however circumvent this problem by buying or writing futures directly, accepting a varying leverage ratio. For investors of all stripes, sector investing basics swing trading kalaray stock trading become can i buy stock directly from the company ripple symbol on td ameritrade tool that ETFs have provided in an easy, inexpensive manner. The trades with the greatest deviations tended to be made immediately after the market opened. If extensive research has led an investor to take a bearish stance on an index or sector, buying into an inverse ETF can be a relatively less risky way to make that bearish bet. Instead, financial institutions purchase and redeem ETF shares directly from the ETF, but only in large blocks such as 50, sharescalled creation units. Retrieved August 28, Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Advantages of Inverse ETFs. Views Read Edit View history. ETFs structured as open-end funds have greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending programs or from using futures and options in achieving their investment objectives.

The details of the structure such as a corporation or trust will vary by country, and even within one country there may be multiple possible structures. Retrieved December 9, It launched alongside three Treasury ETFs, but Treasurys had always been a liquid market with few concerns about pricing or defaults. But gold is still valuable. Archived from the original on March 28, Related Articles. ETFs structured as open-end funds have greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending programs or from using futures and options in achieving their investment objectives. Your Privacy Rights. Retrieved July 10, ETFs that buy and hold commodities or futures of commodities have become popular. Authorized participants may wish to invest in the ETF shares for the long term, but they usually act as market makers on the open market, using their ability to exchange creation units with their underlying securities to provide liquidity of the ETF shares and help ensure that their intraday market price approximates the net asset value of the underlying assets. August 25, We also reference original research from other reputable publishers where appropriate. Archived from the original on February 25,

However, this needs to be compared in each case, since some index mutual funds also have a very low expense ratio, and some ETFs' expense ratios are relatively high. MSFTas well as e-commerce titan Amazon. As track records develop, many see actively managed ETFs as a significant competitive threat to actively managed mutual funds. The financial companies were relegated to their own index, giving the Nasdaq a heavy bias toward reading a macd graph ppo thinkorswim care, consumer discretionary and in particular, technology. The Handbook of Financial Instruments. John C. The Multicharts fill or kill ethereum price chart tradingview uses cookies to provide you with a great user experience. Unlike shorting a stock, though, investors in inverse you can make money when markets fall without having to sell anything short. Archived from the original on March 28, SPY had the advantage of being the first to market and established liquidity. The trades with the greatest deviations tended to be made immediately after the market opened. Such products have some properties in common with ETFs—low costs, low turnover, and tax efficiency: but are generally regarded as separate from ETFs. First, there was the pricing. Now there are more than commodity ETFs on the market, most of them futures-based funds. The following table includes expense data and other descriptive information for all Equity ETFs listed on U. The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place.

Content geared towards helping to train those financial advisors who use ETFs in client portfolios. New York Times. It includes all types of ETFs with exposure to all asset classes. John Wiley and Sons. By default the list is ordered by descending total market capitalization. When an investor shorts an asset, there is theoretically unlimited risk, and the investor could end up losing much more than they had anticipated. But along with a general lowering of commission fees, it really was the ETF wrapper that made an equal-weighted portfolio practical for many. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Neither LSEG nor its licensors accept any liability arising out of the use of, reliance on or any errors or omissions in the XTF information. Posted to ETF. Archived from the original on January 8, Click to see the most recent multi-asset news, brought to you by FlexShares. Archived from the original PDF on July 14, This does give exposure to the commodity, but subjects the investor to risks involved in different prices along the term structure , such as a high cost to roll. Inverse Commodity. If an ETF changes its inverse exposure, it will also be reflected in the investment metric calculations. And then the financial crisis happened, and bond liquidity dried up. ETFs structured as open-end funds have greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending programs or from using futures and options in achieving their investment objectives. ETF distributors only buy or sell ETFs directly from or to authorized participants , which are large broker-dealers with whom they have entered into agreements—and then, only in creation units , which are large blocks of tens of thousands of ETF shares, usually exchanged in-kind with baskets of the underlying securities.

ETFs can also be sector funds. Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August Can i trade chinese stocks in td ameritrade daytrade robinhood reset articles with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August By default the list is ordered by descending total market capitalization. Investment management. These can be broad sectors, like finance and technology, or specific niche areas, like green power. Retrieved October 3, The trades with the greatest deviations tended to be made immediately after the market opened. However, moneycontrol option strategy how to make 100 a day day trading ETCs implement a futures trading strategy, which may produce quite different results from owning the commodity. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. Not everyone has a trading or brokerage account that allows them to short-sell assets, for example. But The lower the average expense ratio for all U. XLK, to us, is the epitome of how the market can be sliced in a passive vehicle. Among the first commodity ETFs were gold exchange-traded fundswhich have been offered in a number of countries. The fund is actually a unit investment trust that has an expiration date: Jan. Archived from the original on March 5, Inverse Volatility ETF An inverse volatility ETF is a financial product that allows investors to gain exposure to volatility without having to buy options. The Vanguard Group U.

The history of its name is also amusing. And the decay in value increases with volatility of the underlying index. And use them they did. The added risk of higher volatility associated with an equal-weight strategy has been rewarded by the outperformance, which tends to be greater in rising markets, Belden says. In some cases, this means Vanguard ETFs do not enjoy the same tax advantages. Furthermore, the investment bank could use its own trading desk as counterparty. When it comes to liquidity, EWJ is a titan today. A similar process applies when there is weak demand for an ETF: its shares trade at a discount from net asset value. IC February 1, , 73 Fed. Retrieved August 3, Given that more advisors are moving toward ETFs, however, that gap might not be as insurmountable as some may think. Some of Vanguard's ETFs are a share class of an existing mutual fund. Main article: Inverse exchange-traded fund. The iShares line was launched in early Advantages of Inverse ETFs.

ProShares UltraShort Dow Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. Inverse Volatility ETF An inverse volatility ETF is a financial product that allows investors to gain exposure to volatility without having to buy options. The fund gave individual investors and advisors easy access to one of the most esoteric corners of the market for the first time, effectively bringing commodities to the mainstream investor. Marijuana is often referred to as neil sharp book penny stocks greg guenthner penny stocks, MJ, herb, cannabis and other slang terms. In fact, it already was. Invesco U. Retrieved October 30, These can be broad sectors, like finance and technology, or specific niche areas, like green power. To him, ETFs were for day traders and not for the long-term investor Vanguard best served. Bogle, an avid fan of index investing, questioned the use of trading an index fund throughout the day. Some funds are constantly traded, with tens of millions of shares per day changing hands, while others trade only once in a while, even not trading for some days. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. To that end, the ETF tracked the Nasdaq, an index designed by the stock exchange that comprised the largest nonfinancial securities that traded exclusively on the Nasdaq. And it allowed for price discovery when can you deduct day trading losses cfd trading interactive brokers markets were closed during U. Summit Business Media. SPY is no small achievement. The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place.

Asset flows and trading volumes certainly support that statement. Many inverse ETFs use daily futures as their underlying benchmark. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. These ETFs, for example, have performe historically well when the market has faced periods of high volatility and huge declines. Or at least they should be. Archived from the original on January 8, The cost difference is more evident when compared with mutual funds that charge a front-end or back-end load as ETFs do not have loads at all. An exchange-traded fund ETF is an investment fund traded on stock exchanges , much like stocks. Not only does an ETF have lower shareholder-related expenses, but because it does not have to invest cash contributions or fund cash redemptions, an ETF does not have to maintain a cash reserve for redemptions and saves on brokerage expenses. Those investors can instead purchase shares in an inverse ETF, which essentially gives them the same investment position as they would have by shorting an ETF or index. Purchases and redemptions of the creation units generally are in kind , with the institutional investor contributing or receiving a basket of securities of the same type and proportion held by the ETF, although some ETFs may require or permit a purchasing or redeeming shareholder to substitute cash for some or all of the securities in the basket of assets. Archived from the original on March 7, Read The Balance's editorial policies. In most cases, ETFs are more tax efficient than mutual funds in the same asset classes or categories. CS1 maint: archived copy as title link , Revenue Shares July 10, Belden says that the ETF wrapper, with its in-kind transaction mechanism, offered both transactional and tax advantages. LSEG does not promote, sponsor or endorse the content of this communication. Morgan Asset Management U.

Inverse power rankings are rankings between Inverse Equities and all other inverse asset class U. See our independently curated list of ETFs to play this theme here. Click on an ETF ticker or name to go to its detail page, for in-depth news, financial data and graphs. Archived from the original on November 1, And it allowed for price discovery when those markets were closed during U. To him, ETFs were for day traders and not for the long-term investor Vanguard best served. By the end of , ETFs offered "1, different products, covering almost every conceivable market sector, niche and trading strategy. It launched with an annual expense ratio of 0. Since then Rydex has launched a series of funds tracking all major currencies under their brand CurrencyShares. Thank you for selecting your broker. Americas BlackRock U. Rowe Price U. Inverse ETFs are constructed by using various derivatives for the purpose of profiting from a decline in the value of the underlying benchmark. The commodity ETFs are in effect consumers of their target commodities, thereby affecting the price in a spurious fashion. Archived from the original on February 1, The company was ahead of the game in the equity index mutual fund space back in the s.

Retrieved December 7, Dimensional Fund Advisors U. However, generally commodity ETFs are index funds tracking non-security indices. Bogle, an avid fan of index investing, questioned the use of trading an index fund throughout the day. Archived from the original on January 25, Archived PDF from the original on June 10, ETFs structured as open-end funds have greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending programs or from using futures and options in achieving their investment objectives. In the U. Here, we look at three dreyfus small cap stock index inv3 8 move bitcoin from coinbase to robinhood inverse index ETFs that you may want to consider when the market falls. CS1 maint: archived copy as title linkRevenue Shares July 10, Filed Pursuant To Rule Some of Vanguard's ETFs are a share class of an existing mutual fund. The Exchange-Traded Funds Manual. Pro Content Pro Tools. SPY had the advantage of being the first to market and established liquidity. An important benefit of an ETF is the stock-like features offered. People have been using gold for millennia. Ghosh August 18, Although inverse ETFs are considered riskier than mock day trading software gap and go trading ETFs, they are bought outright, which makes them relatively less risky than other forms of bearish bets. The deal is arranged with collateral posted by the swap counterparty. The Economist. Retrieved November 8, IC February 27, order.

InBarclays Global Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors. Inverse ETFs enjoy many of the same benefits of a standard ETFincluding ease of use, lower fees, and tax advantages. New regulations were put in place following the Flash Crashwhen prices of ETFs and other stocks and options became volatile, with trading markets spiking [67] : 1 and bids falling as low as a penny a share [6] in what the Commodity Futures Trading Commission CFTC investigation described as one of the most turbulent periods in the history of financial markets. Investors with a risky amount of exposure to a particular index, sector, or region, can buy an inverse ETF to help hedge that exposure in their portfolio. Partner Links. It includes all types of ETFs with exposure to all asset classes. But with new access comes new risks, something that USO has exposed to the world. The deal is arranged with collateral posted by the swap counterparty. The fund is actually a unit investment trust that has an expiration date: Jan. Others such as iShares Russell are mainly for small-cap stocks. This product, however, was short-lived after a lawsuit by the Chicago Mercantile Exchange was successful in stopping sales in the United States. The fund trades hundreds of millions of dollars on most days, at pennywide spreads. In tastyworks dough certificate is day trading realistic absolute worst-case scenario, the inverse ETF becomes worthless—but at least you won't owe anyone money, as you might when shorting an asset in a traditional sense. Investopedia is part of the Dotdash publishing family. Among the first commodity ETFs were gold exchange-traded fundswhich have been penny stocks that pay a dividend do 401ks offer etfs in a number of countries. Day trade the forex system pdf account upload information: List of American exchange-traded funds.

Retrieved December 12, State Street Global Advisors. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. There are many funds that do not trade very often. The ability to purchase and redeem creation units gives ETFs an arbitrage mechanism intended to minimize the potential deviation between the market price and the net asset value of ETF shares. Although inverse ETFs are considered riskier than traditional ETFs, they are bought outright, which makes them relatively less risky than other forms of bearish bets. Equities Ben Hernandez Mar 03, ETFs are structured for tax efficiency and can be more attractive than mutual funds. They also created a TIPS fund. Top ETFs. The fund gave individual investors and advisors easy access to one of the most esoteric corners of the market for the first time, effectively bringing commodities to the mainstream investor. Archived from the original on March 2, A look at a graph comparing its history to that of SPY shows an ever-widening performance gap. Keep an eye on these:. Inverse ETFs can be a powerful tool in your investing strategy, but make sure you perform due diligence before you make any trades. May 16, Investopedia requires writers to use primary sources to support their work.

These funds are high growth small cap stocks best stocks to buy for beginners 2020 to make money when the stocks or underlying indexes they target go down in price. Posted to ETF. In the case of many commodity funds, they simply roll so-called front-month futures contracts from month to month. ETFs may be attractive as investments because of their low costs, harmony gold stock price nyse peter jones portland stock broker efficiencyand stock-like features. Article Sources. The lower the average expense ratio of all U. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Article Table of Contents Skip to section Expand. Indexes may be based on stocks, bondscommodities, or currencies. From the beginning, however, technology was hot. The table below includes fund flow data for all U. Today the fund costs 0. The fund, built around the Barclays U. Many inverse ETFs use daily futures as their underlying benchmark. Archived from the original on July 10, ETFs offer both tax efficiency as well as lower transaction and management costs. The redemption fee and short-term trading fees are examples of other fees associated with mutual funds that do not exist with ETFs. Some ETFs invest primarily in commodities or commodity-based instruments, such as crude oil and precious metals. These can be broad sectors, like finance and technology, or specific niche areas, like green power. Jupiter Fund Management U.

ETFs focusing on dividends have been popular in the first few years of the s decade, such as iShares Select Dividend. The fund gave individual investors and advisors easy access to one of the most esoteric corners of the market for the first time, effectively bringing commodities to the mainstream investor. ETFs that buy and hold commodities or futures of commodities have become popular. Help Community portal Recent changes Upload file. MSFT , as well as e-commerce titan Amazon. For investors in the fund, it makes establishing a corporate bond position much easier and convenient due to the intraday trading, the ability to execute different types of orders and the ability to see a two-sided market, complete with bids, asks and spreads, Tucker says. Inverse Equities News. It achieves this by holding various assets and derivatives, like options , used to create profits when the underlying index falls. Related Articles. Wellington Management Company U. It includes all types of ETFs with exposure to all asset classes. An index fund is much simpler to run, since it does not require security selection, and can be done largely by computer.

The only way any of those were going to happen for investors was if EWJ was successful. Inverse Equities and all other inverse asset classes are ranked based on their AUM -weighted average 3-month return for all the U. Given that more advisors are moving toward ETFs, however, that gap might not be as insurmountable as some may think. Retrieved October 23, Click to see the most recent retirement income news, brought to you by Nationwide. It was during the crisis that institutions discovered LQD, Tucker says. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. Archived from the original on September 29, The impact of leverage ratio can also be observed from the implied volatility surfaces of leveraged ETF options. For investors in the fund, it makes establishing a corporate bond position much easier and convenient due to the intraday trading, the ability to execute different types of orders and the ability to see a two-sided market, complete with bids, asks and spreads, Tucker says. ETFs focusing on dividends have been popular in the first few years of the s decade, such as iShares Select Dividend. People remain instinctively drawn to the metal, and its luster is unlikely to wear off any time soon. To him, ETFs were for day traders and not for the long-term investor Vanguard best served. This will be evident as a lower expense ratio. Inverse Volatility ETF An inverse volatility ETF is a financial product that allows investors to gain exposure to volatility without having to buy options. Archived from the original on February 1, Ben Hernandez Jan 10, PLMR , the insurance company. What was really important about IVV though, Kranefuss says, was that it showed that price is not the only criteria that investors use in selecting an ETF. Americas BlackRock U.

Table of Contents Expand. Dimensional Fund Advisors U. Most ETFs track an indexsuch as a stock index or bond index. Before you invest, you should read the prospectus in that registration etrade interface does wealthfront accept money orders and other documents the issuer has filed with the SEC for more complete information about the Trust and this offering. How to Invest in Bear Markets. Still, following a significant educational effort, things settled down and the products remain popular among hedge funds, institutional investors and certain advisors. Thank you for selecting your broker. The technology sector is soaring this year with significant contributions from semiconductors and Commissions depend on the brokerage and which plan is chosen by the customer. Archived from the original on September 27, Click to see the most recent smart beta news, brought to you by DWS. Jack Bogle of Vanguard Group wrote an article in the Financial Analysts Journal where he estimated that higher fees as well as hidden costs such as more trading fees and lower return from holding cash reduce returns for investors by around 2. The fund gained immediate traction, and the ETF quickly became the most-traded security on the stock market. Since then ETFs have proliferated, tailored to an increasingly specific array of regions, sectors, commodities, bonds, futures, and other asset classes.

By the end of , ETFs offered "1, different products, covering almost every conceivable market sector, niche and trading strategy. Inverse Commodity. Furthermore, the investment bank could use its own trading desk as counterparty. From Wikipedia, the free encyclopedia. In , they introduced funds based on junk and muni bonds; about the same time State Street and Vanguard created several of their own bond ETFs. They also created a TIPS fund. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Read The Balance's editorial policies. The iShares line was launched in early In , Barclays Global Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors.