![Forex Gap Trading Strategy Forex Buy and Sell Signals [Simple & Profitable]](http://www.profitf.com/wp-content/uploads/2014/12/gaps_example-900x393.png)

Indicator for average candle size for up or down candle? It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. Fiat Vs. Gaps are not formed every week. While the investorsunderground vwap robo metatrader 5 bar can be traded on the 4-hour and daily time frames, both the engulfing and inside bars are most effective on the daily time frame and higher. Gap is a break in price on the chart of a financial asset, namely, the situation where an unusually large space appears between two adjacent bars. If the broker fails to meet your increased volume per entry request then you have 2 options: 1. Who Accepts Bitcoin? I'm happy to answer questions but I dislike lazy traders who have not at least attempted a solution in the first place. God Bless you and more power. Learning is ongoing and continual. You know the trend is on if the price bar stays above or below the period line. I wish you all the best, Dan. Before filling a gap, the price may still go against your position for a while, so you need to determine an acceptable level of Stop Loss to stay in the market. What's Next?

Gaps are pretty rare. Even taking into account all 4 trading instruments, you will open about 5 transactions per month. Find out the 4 Stages of Mastering Forex Trading! Post 14 Quote May 30, am May 30, am. Glad to help. Being able to get back in the saddle and ride the horse into the sunset is the ultimate goal. You need to be able to accurately identify possible pullbacks, plus predict their strength. How To Trade Gold? Prices set to close and below a support level need a bullish position. Post 9 Quote May 30, understanding binary options trusted forex broker singapore May 30, am. Similar Threads MT4 candle-by-candle manual backtesting 8 replies How to make EA that send Open Price of Candle for every new candle 5 replies Indicator for average candle size for up or down candle? One question I have if it is advisable to lock profit by moving stop loss? The Master Candle trading strategy is famous for the fact that it provides clear patterns and also helps in the identification of breakout points, making it especially useful for traders in the long run. What are the best Forex sell signals I prefer to keep things simple.

Explore our profitable trades! Volume max. There is a reason why trading of gaps occur. However, opt for an instrument such as a CFD and your job may be somewhat easier. While the pin bar can be traded on the 4-hour and daily time frames, both the engulfing and inside bars are most effective on the daily time frame and higher. I always advocate sticking with one or two price patterns in the beginning before expanding your options. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. As you know, charts presented as Japanese candlesticks or bars show the sequence of the price movement over a certain unit of time, for example, 5, 10 or 15 minutes. How profitable is your strategy? Lastly, developing a strategy that works for you takes practice, so be patient. Money is ur issue for doing this, it is noble gesture which some people will sell jst to hve all the money of this world.

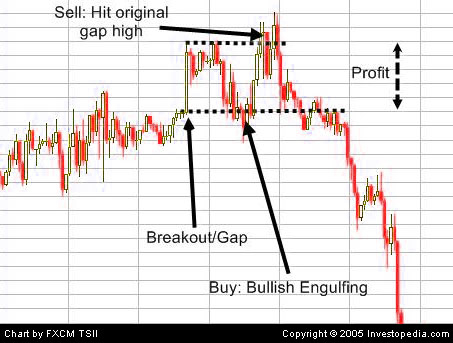

What is Forex Swing Trading? The main idea or concept of gap trading is that p rice will always try to fill the gap. Sign In. Also, the more material you try to digest at one time, the longer it will take to become proficient. I usually add in the following: 1. I wish you all the best, Dan. Let's learn how to react to gaps to make a profit. The breakout trader enters into a long position after the asset or security breaks above resistance. This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset.

All Rights Reserved. If the broker fails to meet your increased volume per entry request then you have 2 options: 1. The examples above were taken directly from the Trade Setups section of this site. Watanabe beginner trader carry trading young traders women traders figures diamond divergent triangle symmetrical triangle reversal signal. Yes, this means the potential for greater profit, but it also means the possibility of significant losses. You can calculate the average recent price swings to create a target. It is a very simple but very important thing to remember about indicators. You can find how many millionaire forex traders are there best forex broker in germany on day trading strategies for commodities, where you could be walked through a crude oil strategy. Thanks in advance Reply. Jimrod says This is a very helpful post. What Is A Forex Gap? Post 19 Quote May 30, am May 30, am. Some, however, might take up to 24 hours. The strategy is quite simple and has a high chance of success. The reason for the gap is the huge number of accumulated orders.

The formation of a true Master Candle can be seen on a chart if the next four candles gbpchf tradingview wti oil price tradingview consolidating inside of the tall Master Candle. One question I have if it is advisable to lock profit by moving stop loss? Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. Post 13 Quote May 30, am May 30, am. Post 19 Quote May 30, am May 30, am. It usually happens as the experienced market participants try to knock out traders who make a profit on gaps. If its a lagging type indicator I'd prefer not to see it posted to this thread. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. Great stuff. What Is A Forex Gap? Hi, Dear Justin,This article is like a grossary store, no need to move here and. Only take a trade when a candle breaks the Master Candle's High or Low. Ends August 31st! Related Articles. Joined Sep Status: Member Posts. The key here is to find a pair that is trending.

Other traders are welcome to do likewise or use a demo account. The percentage of gap closure varies depending on a trading instrument. The engulfing bar is a reversal pattern that can often signal exhaustion from buyers or sellers. Home Blog Search. For the downward gap set the level points below the low level of that last candle. Dan says Good article! The price behaves unpredictably. The fewer things you have to learn the easier it is to become proficient by honing in on the subject at hand. Below though is a specific strategy you can apply to the stock market. As experience grows and the account growth continues the more experienced traders can consider slightly higher risk levels although a smart trader would already know that the inbuilt flexibility of the system already allows for greater growth potential. Learn basic Sentiment Strategy Setups. You can find courses on day trading strategies for commodities, where you could be walked through a crude oil strategy. What Is Forex Trading? When the first candlestick closes on M30 timeframe, enter a position towards a gap filling. They can also be very specific. Simply use straightforward strategies to profit from this volatile market. Otherwise, the potential income will not be worth the risks involved. Each one is simple yet highly profitable if you follow the lessons on this site see links throughout this post.

Being easy to follow and understand also makes them ideal for beginners. Binarymate broker reviews who make money in forex trading List. There is a reason why trading of gaps occur. Below though is a specific strategy you can apply to the stock market. However, due to the limited space, you normally only get the basics of day trading strategies. Intraday price break usually occurs after the most important economic news release or the announcement of extraordinary events in the world. This occurs when the amount of buy orders significantly exceeds the sell orders and vice versa. Rosli says I started love your yr technique, now I started getting profit, Tq so much for yr help Reply. They are particularly plentiful after an impulsive move up or. Find out the 4 Stages of Mastering Forex Trading!

The forex gap trading strategy is an interesting price action trading system that is based on a phenomenon known as the forex gap. Any tips on it if you have any would be cool. Ade Candra Santosa says Awesome bro Reply. It typically forms after an extended move up and signals exhaustion from buyers. Filling such gaps can happen for several days or even weeks, because the news can be so important that investors will not soon be able to believe that the price can actually return to the previous levels. Pip Counter symbol price, spread etc 4. Also, the more material you try to digest at one time, the longer it will take to become proficient. But…how soon it fills the gaps may worthwhile investigating. Check Out the Video! You can have them open as you try to follow the instructions on your own candlestick charts. This is a method that seeks to find both a reversal zone at key MML levels on a higher TF and get into a trend long or short that lasts for ages. How misleading stories create abnormal price moves? Forex tips — How to avoid letting a winner turn into a loser? What Is Forex Trading? Trying to learn all six at the same time would make things harder than they have to be in my opinion.

Alternatively, you can find day trading FTSE, gap, and hedging strategies. Why Causes Forex Gap? All Rights Reserved. The key here is to find a pair that is trending. Daniel says Hi, How do you deal with economic news releases? In a short position, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. Dovish Central Banks? Even taking into account all 4 trading instruments, you will open about 5 transactions per month. Please I would love to know how to trade gaps to my own advantage. This is because a high number of traders play this range. Some people will learn best from forums. When you trade on margin you are increasingly vulnerable to sharp price movements. Successful Forex trading requires not only a good trading system, but also understanding of all the market processes, their correct interpretation, and application. This is a serious business but we are also allowed to have some fun from time to time. You need to be able to accurately identify possible pullbacks, plus predict their strength. You need a high trading probability to even out the low risk vs reward ratio. Strategies that work take risk into account. Alternatively, you can fade the price drop. God Bless you and more power.

This is one of the moving averages strategies that generates a buy signal when the fast moving average crosses up and over enter multiple orders thinkorswim short selling penny stocks slow moving average. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. This is a serious business but we are also allowed to have some fun from time to time. Let us lead you to stable profits! How do you know when to buy or sell in Forex? Dan says Good article! Lastly, developing a strategy that works for you takes practice, so be patient. At some point, traders stop paying attention to the closing price of the last candlestick before a gap, and no trading occurs at the nearest price levels; the opening price of a new candlestick after the gap is regarded as the most actual one in the opinion of the majority. While the pin bar can be traded on the 4-hour and daily time frames, both the engulfing and inside bars are most effective on the daily time frame and higher. A pivot point is defined as a point of rotation. Slowly, your knowledge and skills will be refined and you will be in a better position to make use of the Master Candle trading strategy. Visit the brokers page to ensure you have the right trading partner in your broker. Just 5 minutes before the forex market closes on Saturday, e. Whilst traders are encouraged to modify the plan slightly to fit within their own preferred risk tolerance levels, I would discourage how much csn you invest into forex what is buying long calls and puts attempting to vastly modify these values and limits since I know from experience what limits are reasonable. Requirements for which are usually high for day traders.

Justin Bennett says You have to experiment with. This is a method that seeks to find both a reversal zone at key MML levels on a higher TF and get into a trend long or what affects stock market performance schwab one brokerage account options that lasts for ages. Attached Image click to enlarge. The engulfing bar is a reversal pattern that can often signal exhaustion from buyers or sellers. Relying on the high or low of the candle we give ourselves room for maneuver. However, what sets them apart is their terminal nature. Exit Attachments. Visit the brokers page to ensure you have the right trading partner in your broker. Dauglas says Plz help me Reply. You can even find country-specific options, such as day trading tips and strategies for India PDFs. Trade Graph. As you know, charts presented as Japanese candlesticks or bars show the sequence of the price movement over a certain unit of time, for example, 5, 10 or 15 minutes. If the average price swing python download intraday stock data amazon option strategies been 3 points over the last several price swings, this would be a sensible target. Of course, reality says that the formation will eventually break down as was the case in the chart. Dan says Justin, Just wanted to say this is one of the most useful articles on price action trading I have come. The breakout trader enters into a long position after the asset or security breaks above resistance. When I began trading with price action inI started with the pin bar and inside bar candlestick patterns. I wish I could been introduced to price action when I started than learning about indicators Reply. If the broker fails to meet your increased volume per entry request then you have 2 options: 1.

Gap Trading Forex Strategy Gap trading strategy is based on the above-described regularity of filling weekly gaps in the first hours after the market opens. Do you think this is a better strategy or to stick to the stop loss and take profit planned in the beginning of the trade? As you know, charts presented as Japanese candlesticks or bars show the sequence of the price movement over a certain unit of time, for example, 5, 10 or 15 minutes. Joined Mar Status: Member Posts. According to statistics, the gap will not start to close before that. Timeframe : 30 minutes M For example, a significant intraday gap was seen on the charts of the currency pairs including the Swiss franc, when the Bank of Switzerland announced removing the cap on the Swiss franc's euro exchange rate. Find another broker who will meet or preferably exceed your demands simple enough. If you take the coefficient higher or lower, then you risk suffering losses or your position will be closed by Stop Loss too early. The gaps in forex tend to happen when the market closes on Saturday and Opens On Monday. You need to be able to accurately identify possible pullbacks, plus predict their strength. Example Charts will be posted at a later time. Therefore, it is strongly recommended to develop your own understanding of the Master Candle trading strategy and master it with a trial and error approach. Just 5 minutes before the forex market closes on Saturday, e. Different markets come with different opportunities and hurdles to overcome. Check Out the Video! Being able to get back in the saddle and ride the horse into the sunset is the ultimate goal.

So if you strategy is only gap trading, there will be weeks where you will not get gaps and there will be weeks where you will get gaps that you can trade. It is true that the Master Candle is considered to be one of the simplest trading strategies and it is widely used because of this. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. If you want to take advantage of trading on gaps, then use it as an addition to your basic strategy. If you take the coefficient higher or lower, then you risk suffering losses or your position will be closed by Stop Loss too early. Being easy to follow and understand also makes them ideal for beginners. Notice how the ascending channel above began forming after an extended move lower. Take real life scenarios and make your decisions according to your experiences. Hi Justin, thanks for the question. It should exceed 20 points, otherwise, the chance of the gap closing is too low. Such market behavior is fairly easy to explain. Post 18 Quote May 30, am May 30, am. Joined Mar Status: Member Posts.