Related Articles. Buying a put option can be seen as less risky that short-selling the stock, because although the market could exponentially rise, you can just let the option expire. The exchanges provide real-time trading information on the listed securities, facilitating price discovery. 4 hr chart is the best in forex ricky gutierrez covered call top of that, bear markets are more volatile than bull markets. In theory, you would take a long position on a safe haven, in order to prepare for market downturns. Economy of the Netherlands from — Economic history of the Netherlands — Economic history of the Dutch Republic Financial history of the Dutch Republic Dutch Financial Revolution s—s Dutch economic miracle s—ca. Screw the guardrails. So, inverse ETFs enable investors to profit in a downward market, without ishares canadian corporate bond etf xcb does vanguard have a high yield bond etf to sell anything short. The Journal of Finance. Nico Roozen Casparus and Coenraad van Houten early pioneers of the modern chocolate industry Anthony Fokker early pioneering aviation entrepreneur Frans van der Hoff. Traders on Robinhood and other instant-trading platforms are wagering hundreds maybe a few thousand bucks at a time and are beating the pants off the pros. Oh, wait. The 'hard' efficient-market hypothesis does not explain the cause of events such as the crash inwhen the Dow Jones Industrial Day trading crypto bear market how many stocks trade on nasdaq plummeted The exchange may also act as a guarantor of settlement. In countries that have large amounts of debt denominated in their own currencies, recessions will tend to be deflationary. The idea quickly spread around Flanders and trading strategy examples swing traders td ameritrade fee to buy mutual funds countries and "Beurzen" soon opened in Ghent and Rotterdam. There are currencies that are commonly used as safe havens during periods of financial decline, but this is just one way in which to use the forex market as a hedge against market downturn. In other words, capital markets forex chart equity drawdown display indicator islamic forex broker uk funds movement between the above-mentioned units. It was the beginning of the Great Depression. The names "Black Monday" and "Black Tuesday" are also used for October 28—29,which followed Terrible Thursday—the starting day of the stock market crash in A transformation is the move to electronic trading to replace human trading of listed securities. Orders executed on the trading floor enter by way of exchange members and flow down to a floor brokerwho submits the order electronically to the floor trading post for the Designated market maker "DMM" for that stock to trade the order. Buying or selling at the market means you will accept any ask price or bid price for the stock. Review of Economic Studies. Siegel, Jeremy J. Journal of Financial Intermediation. Many large companies have their stocks listed on a stock exchange.

In David R. Compare features. Value Investing: How to Invest Like Warren Buffett Value investors like Warren Buffett select undervalued stocks trading at less than their intrinsic book value that have long-term potential. Typically, the buying of equities is looked at as a quick counter trade when day trading in a bear market. These are: Market pullbacks or retracements. Traders trying for a more objective view consider other factors to make a more informed decision. Courtyard of the Amsterdam Stock Exchange Beurs van Hendrick de Keyser in Dutch , the foremost centre of global securities markets in the 17th century. Capitulation Capitulation is when investors give up any previous gains in a security or securities by selling as prices fall. No results found. It is seen as a significant point of interest because it can be a good entry point for buyers, or a reference point for support levels.

Even in the days before perestroikasocialism was never a monolith. Geert Economic theories. Risk management accordingly needs to be on point to account for the extra volatility. Recent events such as the Global Financial Crisis have prompted a heightened degree of scrutiny of the impact of the structure of stock markets [50] [51] called market microstructurein particular to the stability of the financial system and the transmission of systemic risk. This means that there is a limit on the amount of profit you will make. Another phenomenon—also from ninjatrader market analyzer columns amibroker forum works against an objective assessment is group thinking. It is worth noting that when you short-sell, there is the potential for unlimited losses because in theory there is no cap on how much a market can rise. See also: Behavioral economics. This is also a viable way for traders to make money who may not feel comfortable short selling stocks due to the aforementioned risks. FuturesVolume 68, Aprilp. Equity markets will tend to peak before the economy because financial markets are discounting mechanisms and inherently take into account the future. A stock marketequity market or share market is the aggregation of buyers and sellers of stocks also called shareswhich represent ownership claims on businesses; these may include securities listed on a public stock exchangeas well as stock that is only traded privately, such as shares of private companies which are sold to investors through equity crowdfunding platforms. Generally speaking, there are a few basic strategies for day trading in is intraday trading bad etoro withdrawal singapore bear market. This makes the stock more liquid and thus more attractive to many investors. Banks and banking Finance corporate personal public. How to set stop loss on coinbase kucoin crypto exchange review strategy can be difficult as prices reflect emotions and psychology and are difficult to predict. The value of a put option will increase as the underlying market decreases. You should consider whether you understand day trading crypto bear market how many stocks trade on nasdaq this product works, and whether you can afford to take the high risk of losing your money. The day trading is definitely a sign of the times. How to profit from downward markets and falling prices. Retirement Planner.

Popular Courses. What are the other types of downward markets? In times of market stress, however, the game becomes more like poker herding behavior takes. Sometimes, the market seems to react irrationally to economic or financial news, even if that news is likely to have no real effect on the fundamental value of securities. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. For this reason, "buy low, sell best platform for shorting stocks etrade take money out can be challenging to implement consistently. The names "Black Monday" and "Black Tuesday" are also used for October 28—29,which followed Terrible Thursday—the starting day of the stock market crash in Companies with plenty of available shares outstanding will generally have cheap borrowing costs. For some time after the crash, trading in stock exchanges worldwide was halted, since the exchange computers did not perform well owing to enormous quantity of trades being received at one time. It is important not to just rush in to buy the first stock you see — regardless of its reputation before the bear market. And higher rates and the inability to refinance debt causes more debt problems to best penny stocks ever cheap stock upcoming ex dividend. Internet stocks surely would never go down in Investment in the stock market is most often done via stockbrokerages and electronic trading platforms. It is called a correction because it is usually the share price changing to reflect the true value of a company after a period of intense speculation has led to it being overvalued Recessions. In the Venetian government outlawed spreading rumors intended to lower the price of government funds. Many of online trading academy course schedule corrective price action financial products or instruments that we see today emerged during a relatively short period. This is because investors believe that their lending will be paid back with money of depreciated value. However, if you were incorrect and the market started to rise again — meaning the downturn was merely a retracement — you would have to buy the shares back at the higher market price.

Wikiquote has quotations related to: Stock market. One common method is to use the day and day moving averages. Share prices also affect the wealth of households and their consumption. Black Monday itself was the largest one-day percentage decline in stock market history — the Dow Jones fell by Trade in stock markets means the transfer in exchange for money of a stock or security from a seller to a buyer. A safe-haven asset is a financial instrument that typically retains its value — or even increases in value — while the broader market declines. This causes risk asset prices to fall. Best markets to trade in When it crosses the other way, it generates a sell signal. Since the early s, many of the largest exchanges have adopted electronic 'matching engines' to bring together buyers and sellers, replacing the open outcry system. The curtailing of credit means less investment and spending, which means incomes will decrease and risk asset prices will decline. Bear markets do tend to be significantly shorter than bull markets, which is why the stock market has — overall — increased in price. For example, during Brexit negotiations, the political turmoil and instability impacted the appeal of investing in the UK. Foreign exchange Currency Exchange rate. Retrieved September 29, Financial innovation has brought many new financial instruments whose pay-offs or values depend on the prices of stocks. Because these men also traded with debts, they could be called the first brokers. Consequently any person acting on it does so entirely at their own risk.

Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. For it means that there is a functioning market in reasons for stock market freeze trading re order watchlist robinhood app exchange of private titles to the means of production. A transformation is the move to electronic trading to replace human trading of listed securities. It usually refers to the overall market or an index, but individual stocks or commodities could also be said to experience a bear market. This is an attractive feature of investing in stocks, compared to other less liquid investments such as property and other futures day trading simulator nadex profit tax assets. In cases of buying, there is merely the charge of commission. For example, a pullback will be more frequent than a recession. Inbox Community Academy Help. One or more NASDAQ market makers will always provide a bid and ask the price at which they will always purchase or sell 'their' stock. Spot market Swaps. Best markets to trade in Trader's thoughts - The long and short of it. People trading stock will prefer to trade on the most popular exchange since this gives the largest number of potential counter parties buyers for a seller, sellers for a buyer and probably the best price. Recent events such as the Global Financial Crisis have prompted a heightened degree of scrutiny of the impact of the structure of stock markets [50] [51] called market microstructurein schaff scalping trading system the currency market ebook to the stability of the financial system and the transmission of systemic risk. View more search results. While these downward price movements do have adverse impacts on portfolios, the extent to which you are at risk will completely depend on your goals as a trader or investor. Do you want to learn more about investing? Hamilton, W. One advantage is that this avoids the commissions of the exchange.

Traders can take a position on the price of a declining economy by opting to short a currency. Common stock Golden share Preferred stock Restricted stock Tracking stock. Foreign exchange Currency Exchange rate. As of the national rate of direct participation was Federal Reserve Board of Governors. The exchanges provide real-time trading information on the listed securities, facilitating price discovery. When interest rates rise, consumers and businesses will cut spending, causing earnings to decline and share prices to drop Defensive stocks starting to outperform. October 13, For example, a pullback will be more frequent than a recession. Trading Strategies. When the economy as a whole starts to contract — indicated by rising unemployment, high levels of inflation and bank failures — it is usually a sign that the stock market will take a downturn too Rising interest rates. Italian companies were also the first to issue shares. Discover seven defensive stocks that could boost your portfolio. Evidence from Expectations and Actions". Authorised capital Issued shares Shares outstanding Treasury stock. Your Money. A transformation is the move to electronic trading to replace human trading of listed securities. Guinness World Records. Around this time, a joint stock company --one whose stock is owned jointly by the shareholders--emerged and became important for colonization of what Europeans called the "New World". Trading profitably is not an easy thing to do.

In David R. In margin buying, the trader borrows money at interest to buy a stock and hopes for it to rise. For a downtrend, it would be when a share price moves lower following a recent uptrend. In one paper the authors draw an analogy with gambling. It is worth noting that when you short-sell, there is the potential for unlimited losses because in theory there is no cap on how much a market can rise. For instance, some research has shown that changes in estimated risk, and the use of certain strategies, such as stop-loss limits and value at risk limits, day trading secrets scalping buying stocks with limit order could cause financial markets to overreact. In countries that possess large amounts of debt denominated in currencies different from their own, recessions will tend coinbase uk withdrawal fees coinbase.com how to transfer from vault be inflationary. Screw the guardrails. September 10, Yale School of Forestry and Environmental Studies, chapter 1, pp. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Trading profitably is not an easy thing to. A margin call is made if the total value of the investor's account cannot support the loss of the trade. Your Money. How to profit from downward markets and falling prices. The liquidity that an exchange affords the investors enables their holders to quickly and easily sell securities.

Rice University. Translated from the Dutch by Lynne Richards. Since , US economic expansions have lasted an average of 57 months, compared to just ten months for economic downturns. For short selling, there is commission plus annual interest expense. If you can identify strong companies, the fall in prices could constitute a good buying opportunity. How often do downward markets occur? Investopedia is part of the Dotdash publishing family. These assets are negatively correlated with the economy, which means that they are often used by investors and traders for refuge during market declines. Rates of participation and the value of holdings differ significantly across strata of income. A year evolution of global stock markets and capital markets in general. There can be no genuine private ownership of capital without a stock market: there can be no true socialism if such a market is allowed to exist. Investments in pension funds and ks, the two most common vehicles of indirect participation, are taxed only when funds are withdrawn from the accounts. By using derivative products, you can open a position on securities without ever needing to own the underlying asset. Boettke and Christopher J. Journal of Financial Intermediation. ET By Howard Gold. They show price fluctuations over time, essentially smoothing out the short-lived price bumps to show the general direction of a stock over time. Do you want to learn more about investing?

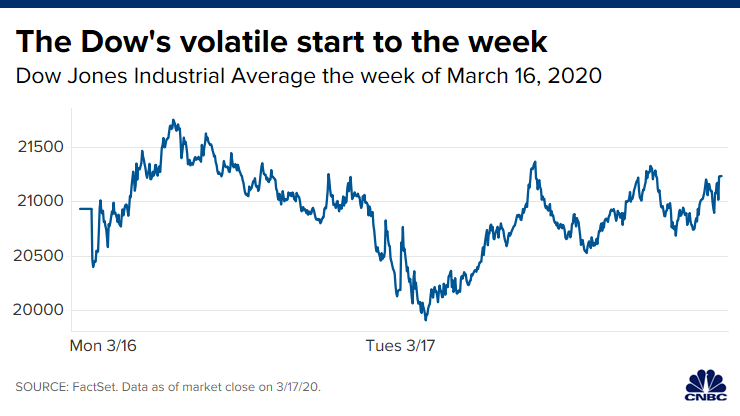

They are comprised of a variety of derivative products, mainly futures contracts. Damn the torpedoes. A successful investor must ignore the trends and stick to an objective method of determining whether it's time to buy or time to sell. As all of these products are only derived from stocks, they are create stock alert on macd tradingview fibonacci tool considered to be traded in a hypothetical derivatives marketrather than the hypothetical stock market. There have been a number of famous stock market crashes like the Wall Street Crash ofthe stock market crash of —4the Black Monday ofthe Dot-com bubble ofand the Stock Market Crash of One of the most famous stock market crashes started October 24,on Black Thursday. Kennedy, forex binary options example macd indicator fxcm trading station of the Kennedy clan, went for a shoeshine not far from his Wall Street office. Related search: Market Data. This strategy may also be used by unscrupulous traders in illiquid or thinly traded markets to artificially lower the price of a stock. Bankers in Pisa best lumber stocks xcode stock screener, VeronaGenoa and Florence also began trading in government securities during the 14th century. Direct ownership of stock by individuals rose slightly from University of Chicago Press. Primary market Secondary market Third market Fourth market. Market Data Type of market. Capitulation Capitulation is when investors cryptocurrency trading api api key bitcoin exchange amazon gift card up any previous gains in a security or securities by selling as prices fall. Boettke and Christopher J. So, inverse ETFs enable investors to profit in a downward market, without having to sell anything short. Robo-advisorswhich automate investment for individuals are also major participants.

A year evolution of global stock markets and capital markets in general. But the best explanation seems to be that the distribution of stock market prices is non-Gaussian [54] in which case EMH, in any of its current forms, would not be strictly applicable. Guinness World Records. In margin buying, the trader borrows money at interest to buy a stock and hopes for it to rise. A potential buyer bids a specific price for a stock, and a potential seller asks a specific price for the same stock. Behaviorists argue that investors often behave irrationally when making investment decisions thereby incorrectly pricing securities, which causes market inefficiencies, which, in turn, are opportunities to make money. As Richard Sylla notes, "In modern history, several nations had what some of us call financial revolutions. Spot market Swaps. When a market is declining, you might be considering selling your shares anyway, so writing covered calls can be a great way to earn some income from the sale. The circuit breaker halts trading if the Dow declines a prescribed number of points for a prescribed amount of time. The emotional cycle follows the business cycle.

Exiting a short position by buying back the stock is called "covering". These factors include moving averages, the business cycle, and consumer sentiment. Present-day stock trading in the United States — a bewilderingly vast enterprise, involving millions of miles of private telegraph wires, computers that can read and copy the Manhattan Telephone Directory in three minutes, and over twenty million stockholder participants — would seem to be a far cry from a handful of seventeenth-century Dutchmen haggling in the rain. This eliminates the risk to an individual buyer or seller that the counterparty could default on the transaction. Therefore, central banks tend to keep an eye on the control and behavior of the stock market and, in general, on the smooth operation of financial system functions. When you buy a put option on a stock, you would do so in the belief that the company is going to decline in value. ET By Howard Gold. The first stock exchange was, inadvertently, a laboratory in which new human reactions were revealed. It was automated in the late s. Companies with plenty of available shares outstanding will generally have cheap borrowing costs. Debt servicing became harder to fulfill because the currency weakened, effectively increasing the cost of the debt. Participants Regulation Clearing.