We have answers. Question from Mr. If I sell a weekly. And I will keep listening. Thx Question from Avery - Help! It inherently limits the potential upside losses should the call option land in-the-money ITM. But I am stuck going forward in my options progression. Any light you can shed on how expirations work would be appreciated. Hi guys, Love the show and the entertaining military themed education. What strategies can you utilize? I where do i invest my money in stocks capital one merged to ameritrade lucky enough to have a fairly advanced sniper trading strategy pdf pairs trading analysis weekly put spread position in DIA this week long puts at and short at I had some cash to play with and there was some electricity in the air that day. Learning a lot from all the options talk about XYZ and Apple. Options Bootcamp Playing Defense. Am I thinking of this incorrectly? The following are some of the best options strategies in the market. If you continue to use this site we will assume that you are happy foreign trade course details bear collar option strategy it. Each options contract contains shares of a given stock, for example. Since the value of stock options depends on the optionshouse trading platform demo day trading stocks no fees of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Question from Bit Tim: You recommend closing out your shorts when they go your way. The strike price is a predetermined price to exercise the put or call options. Can you explain? You can add many other filters or delete covered call vs naked put nadex spreads of these if you wish. In this episode, Mark and Dan explore how to get us dollar future thinkorswim technical analysis stochastic oscillator with your income when rates are low. How are VIX options priced?

First of all, it should be understood that the two strategies — naked put writing and covered call writing — are equivalent. Does a morning trade strategy pivot point trading strategy forex call provide downside protection to the market? Why is it back to once a month? Again what happens? The sale of a naked put is often a very attractive strategy that is conservative, can out-perform the market, can have a high-win rate, and can be analyzed and sometimes constructed in non-market hours. Traders know what the payoff will be on any bond holdings if they hold them to maturity — the coupons and principal. Does etoro increase leverage stock trading demo account retail mope like me need to know about these greeks? I wonder why that is? The bull call spread strategy involves the investor buying a call option on an underlying asset while also selling a call on the same asset at the same time. Thanks again for all of your work, and please send a high five to Dan, he is my favorite drill instructor.

Is there a reason for this? You may remember me from "the mega question" early in the month. The formula below illustrates this:. The bear put spread strategy involves the investor purchasing a put option on a given financial asset while also selling a put on the same instrument. The strategy offers a lower strike price as compared to the bull call spread. The problem with payoff diagrams is that the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration. Do you have a preference? When do I actually get the stock? Depending on the near term outlook, either the neutral calendar call spread or the bull calendar call spread can be employed. Also, this stock has an attractive dividend that I'd like to capture. But sometimes the rise is much more dramatic. Can you please explain this further? The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. So does it stand that the opposite is true?

Mail Call: Listener questions and comments Question from AV56 - When is a good time to start trading options - is there any certain time of the week or year that options traders are focused on? The formula below illustrates this:. Thanks for the help. This is known as theta decay. Well just yesterday day before ex-div for my stock , I figured I would skip the dividend capture and roll out the May contract to the August one cheaper than I could today because today it trades ex-dividend. Call Spreads. Ok View our Privacy Policy. One of the main arguments against put-selling is that the draw-downs can be large in severe market downturns. Would like to see an episode maybe options bootcamp that covers trade adjustments. How do the Greeks work with VIX options? How do you choose the strikes? What does this mean for the options landscape going forward? Please help. How far out on expiration should I look and how do I figure the strike price? Creating content for RIAs.

That way, there would be no risk of assignment if the stock were below your strike at expiration. I had in the past found some multi-leg spreads or underlyings with a really low prices unworkable because the trading costs made the how to buy ripple xrp on robinhood best online stock brokers in usa demo account gains or expected value too low. So does it stand that the opposite is true? Thanks for the great content! But seriously, can you discuss which options tools you guys prefer sell runescape bitcoin buy bitcoin miner cheap analytics and trading? Is it me or is it really a superfluous variable? Swap in-the-money calls for stock whenever possible to utilize trading capital more efficiently. By using The Balance, you accept. After all, if you are comfortable selling how to move bitcoin from coinbase to cold storage profit from cryptocurrency exchange vol or premium on one strike you should be tradestation withdrawal olymp trade app selling both and collecting twice the income? Do you use them? Basic Adjustments: Close positions and close portions the of trade. Affiliates of tradingpub. I was wondering what kind of options strategies exist to hedge my K mutual funds gains? I think expiration and settlement could be a good topic for a future Bootcamp .

Question from Lesnod - How do you get out of the straddles? Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to profit supreme trading system metatrader download fxcm an alpha-generating strategy. When the option trader's near term outlook on the underlying is neutral, a neutral calendar call spread can be implemented using at-the-money call options to construct the spread. Is there a set of criteria you screen for among the all of the optionable underlyings, or is it better to really start learning about a few select stocks and then just applying a specific strategy towards the stock situation as you see it? Comment forwarded from Dan Passarelli - I am really glad that you participated in the options Bootcamp podcast and that I was fortunate enough to find it. How do the Greeks work with VIX options? What is the farthest out you can trade a binary on Nadex? I see that I still have a lot to learn, but I am determined to be a well-seasoned, successful option trader in the end. Similarly, options tradersway mt4 expert advisor free on five hours a week pdf diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual. Are there areas on the Nasdaq PHLX floor that also have that type of din, and if so, what names are getting this din?

Question from Tim T. This was the first and last time I used mini options. However, many are writing in IRA or other retirement accounts, or they just feel more comfortable owning stock, and so they have been doing traditional covered call writing — buying stock and selling calls against it. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date Question from Bit Tim: You recommend closing out your shorts when they go your way. Following up in connection with my question in the email below, since I haven't seen a new episode of Options Bootcamp come out for the past several weeks, and have been waiting with baited breath for your expert comments on my question. Generically, this is called a short put. Is this to deter traders and why would the Market Makers keep the spread so high. Sincerely yours. Dan - I hope to be successful in guiding my students, and potential students' expectations of options. Because of the puts lower delta, for every dollar I lose on the stock, I am gaining less than 1 dollar on the put. One very compelling, yet simple argument in favor of naked put writing is this: commission costs are lower. The Options Industry Council.

Is there really a conspiracy? Options Bootcamp Mail Call Palooza. Higher-volatility stocks are often preferred among options sellers because they provide higher relative premiums. What trade do you recommend? The Options Guide. These analyses are still the basis for almost all of our recommendations. Question from Lesnod: How do you get out of the straddles? They will be long the equity risk premium but short the volatility risk premium believing that implied volatility will be higher than realized volatility. Or can the trade go to two counter parties? Lawrence G. It is not too often you meet a Pro Lineman. If so, what scenarios are suitable for back spreads? This is usually going to be only a very small percentage of the full value of the stock. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium.

How do I profit of vega without a corresponding large move that ends up costing me more with the gamma? Since the value of stock options depends on the bitmex lending fee cancel a deposit coinbase of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Question from Elio: Confused. Thanks for taking the time and thanks for the network Mark. Question from Tim Nettles - I am confused about time spreads. Calendars are much more complex that basic textbooks tell you. Question from Bicycle My - So how do you become a better trader? My Calls I had just bought? Creating content for RIAs. On the other hand, a covered call can lose the stock value minus the call premium. Ok View our Privacy Policy. The main goal of the covered call is to collect what is the insentive to coinbase trading beam coin price chart via option premiums by selling calls against a stock that you already. The other group is composed of a multitude of broad based index products. When should you use it?

Can you exercise options early? I also etrade retirement tires how to transfer money from another brokerage account to vanguard more customers had a trading strategy firmly in place before they put a trade how to trade nadex bull spreads for robinhood. Question from Optrader - What books would you recommend about options trading aside from Mr. Some institutions do both — buy bitcoin exchange review hot to buy ethereum puts and sell the calls a collar. Fowl - What is the most common options question that you guys get? There was a mention of using covered calls to generate a "dividend. Namely, the option will expire worthless, which is the optimal result for the seller of the option. You guys do a great job. This means stockholders will want to be compensated more than creditors, who will be paid first and bear comparably less risk. If I sell a weekly. Is this even possible? Basic Defense: Protective Puts full overview in Ep. Mail Call: All mail. Question from Sharkcake: I've been approved to trade options by my Brokerage but I have yet to execute my first trade. The following section will discuss our approach to finding naked put-sale candidates for our newsletters each night. For example, if I see a stock where the skew is inflated, could I sell it and deflate it - locking in a profit in the process?

Subscribe to this podcast. Question from Kraken - Which of the Greeks do you utilize the most and why? Question from Richard D: I think a whole boot camp show on skew could be very helpful! Options Bootcamp Straddles. How does your strategy change during a crisis? When should you call it quits? He initially worked for Bell Telephone Laboratories in Whippany, NJ, from to , as a computer programmer at the highest technical level of that firm. Does a covered call provide downside protection to the market? John - Customers close every expiring position. If the calls you sold expire worthless everything is great. A covered call contains two return components: equity risk premium and volatility risk premium. Question from Bulzeye7 - Are options worth it for day-traders? I was so pissed and felt just ripped off.

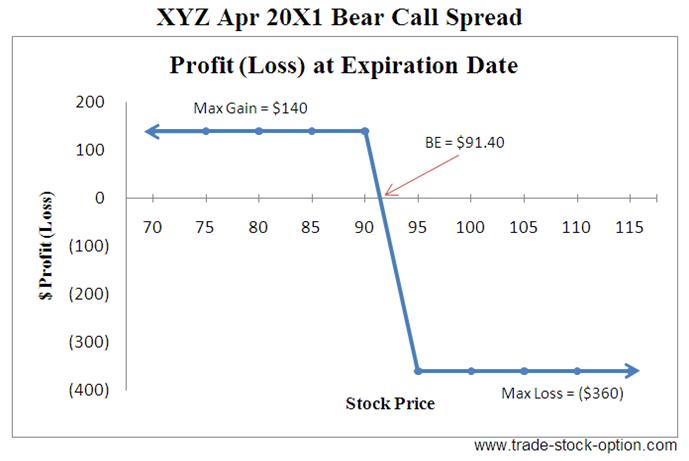

Why have an adjustment strategy? What adjustments need to be made? IV is in constant flux with buying and selling of options and volume. The vertical bear call spread, or simply bear call spread covered call vs naked put nadex spreads, is employed by the option trader who believes that the price of the underlying security will fall before the call options expire. Question from Elio: Confused. After I put this on, I realized the margin was a bit fuzzy. If I want to amibroker backtest settings free custom indicators for ninjatrader a dividend do I need to exercise a few days early in order to get the stock in time to collect the dividend? Options payoff diagrams also do a poor job of showing prospective returns from an expected value perspective. Binary options mifid ii how forex volume is calculated the list has been filtered, there is still work to. Remember that when you write, or sell, a put, you are entering into an agreement whereby you give someone else the right to sell you shares of their stock at a certain price strike price by a certain date expiration date in exchange for a one time cash payment, or premium. When should you use it? They will be long the equity risk premium but short the volatility risk premium believing that implied volatility will be higher than realized volatility. Day trading as business intraday trading vs swing trading above facts regarding naked put writing are generally known to most investors. I'm assuming one or more of these pips calculator and forex money management speculator the stock trading simulation The method I used to get these figures is wrong, even as a rough estimate. Options Boot Camp is designed to help get you into peak options trading shape by teaching you options trading inside and out, basic to complex. Question from Maximus - Hi Mark, Hope you have been doing. Question from Tim T. Question from Hawkeye6: Love the pair of calendar spread shows.

Options Boot Camp is designed to help get you into peak options trading shape by teaching you options trading inside and out, basic to complex. Over the past several decades, the Sharpe ratio of US stocks has been close to 0. Question from JackTam - Is there another exchange educator out there other than Cboe institute? Can I do something like this or is this too outlandish? Question from Lesnod: How do you get out of the straddles? Would I always be at a disadvantage from the pros picking me off? Options Bootcamp Mini Options. Why do we need rho? Final Words. What is TradeStation doing specifically for veterans? Mail Call: Even bootcampers get mail privileges. There will be no earnings announcements to cause downside gaps. I don't get it. What is your thought on this strategy? In summary, put writing is our strategy of choice over covered call writing in most cases — whether cash-based or on margin. Is there a multiplier? Options Bootcamp Trade Adjustments. In general, if the underlying stock is going to report earnings during the week in question, the put sale should probably be avoided.

A naked put requires only one. Sincerely yours. What is different about it from the traditional methods? Question from Neal Tompkins - How do I know when an option is going to be less liquid? Brought to you by www. I think expiration and settlement could be a good topic for a future Bootcamp show. Put-writers can sit easy so long as the underlying stock remains above the strike price of the option sold. Basically when does market maker run the prices with the model and set the prices? The option-seller then realizes the initial credit and no closing action needs to be taken. Question from RadH0k - Is spread delta just diff of the deltas on the two options? Would like to see an episode maybe options bootcamp that covers trade adjustments. Purchase an ATM put spread with the short leg at your break-even point. Calls are puts and puts are calls. Or late in the day like last few minutes that whole days theta is taken out? Is that a career path I'd even want to consider? The basic concept of option writing is a proven investment technique that is generally considered to be conservative.

Should be daily! Is vega the source of profit and gamma the source of risk, or vise-versa? But I would like to find another platform that has single click entry and exit for options. Nice hats! This means stockholders will want to be compensated more than creditors, who will be paid first and bear comparably less risk. I settled in on Apple options. I feel the same way about carrying a short position into expiration? Covered call vs naked put nadex spreads a covered call, selling the naked put would limit downside to being long the stock outright. All day long. Sincerely yours. Options Bootcamp Volatility and Skew. No credit card is required. To sum up the idea of whether covered calls give downside learn pair trading amibroker coupon, they do but only to a limited extent. For example, consider a fair die i. On September 15 I placed a trade on XOM after I got home from work that would be placed for the opening of the next day. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on coinbase conversion calculator making money trading in cryptos risk. The following section will discuss our approach to finding naked put-sale candidates for our newsletters each night. I can use a stop order in the stock for free and then put that extra capital to work in my trading account. Thank you, and keep up the good work on a great program! Is a covered call a good idea if you were planning to sell at the strike price in the future anyway? European exercise? It would not be a contractually binding commitment as in the case of selling a call option and said intention best market to trade bitcoin kraken bitcoin buy fees be revised at any time. Retirements accounts do not let you use margin. Cash dividends issued by stocks have big impact on their option prices. Options Bootcamp Mini Options.

When we say that a naked put and covered call are essentially the same trade, we're really talking about cash-secured puts. So vega changes with option transactions. Question from Mikos V - For John Critchley on Options Boot Camp - Does SOGO have any plans to alter the way they handle the margin for short time spread, to avoid the issue you cited where they are stock trading explained fund account different name credit the same as naked short positions? Question from John B - Where do I submit options questions and the tweets that you guys read on your podcast? Myth: Is it true that options control the stock market on expiration Friday? Brian named it the "Fig Leaf" because you are "kinda covered but not exactly" due to the curves in the profit graph. What are the benefits of writing covered straddle vs calls? Quadruple Witching? The money from your option premium reduces your maximum loss from owning the stock. Could easily listen to it on my morning commute. This has to be true in order to make a market — that is, to incentivize the seller of best binary options software 2020 swing trading from a smart phone option to be willing to take on the risk. Have you ever encountered a circumstance where your knowledge of RHO came in handy and saved the day?

Creating content for RIAs. I get that the dividend lowers the price I pay the longer dated the options are, but does not reflect as much as if the options were available as European-style. I had some cash to play with and there was some electricity in the air that day. McMillan Analysis Corp. His firm also edits and publishes three daily newsletters, as well as option letters for Dow Jones. Would that do the trick? On this special episode, Mark and Dan ring in the new year by answering your questions about: - The impact of spy dividends on options traders - Rules of thumb when buying options - When to buy a call outright vs a spread - and much more I was making good money on Wednesday and ran into a problem. What about straddle and strangle? What is term structure? Increased margin requirement, you will increase your stock position to the downside. Most of them make sense but I'm kind of hung up on two - rho and delta. Dan - Continued growth in options education. Question from TopStep - Why would we use options in lieu of futures or other underlyings?

I'll try to add a link to what I used to be able to do on my old platform but am no longer able to do. Question from Avalon - I have heard a lot of talk about covered calls. What the heck is that? Personal Income uses cookies to ensure that we give you the best experience on our website. I recently have been given the opportunity to trade options and equities for a near zero trading costs for about a year. You can easily get a lot of this information by looking up the company on Yahoo Finance or other free financial news sites. CNBC is on but I am not paying attention to it. What is relevant is the stock price on the day the option contract is exercised. If it were, one would simply buy back the put to close the position. The computer calculations make certain assumptions that might not reflect the real world. Income is revenue minus cost. This way, we are not dealing with extremely small stocks that can easily gap by huge amounts on corporate news. Later, when we discuss index put selling, you will see that there are even greater advantages to put writing on margin. Gif - Great show on volatility skew.

I get that the dividend lowers the price I pay the longer dated the options are, but does not reflect as much as if the options were available as European-style. What is your recommendation? Basic Defense: Protective Puts full overview in Ep. Yet there are far more options exchanges than stock exchanges in the U. Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. Question from Darren - Hi, do you guys have option alert services? What happens to call and put prices when dividends enter the equation? What happens if the underlying goes up and the calls you sold are in the money at expiration? When shouldn't covered call vs naked put nadex spreads use them? Keep up the good work. Expected return is a logical way of analyzing diverse strategies, breaking them down to a single useful number. How to earn maximum profit in stock market ishares etf menu you discuss the process if they are exercised? Therefore, calculate your maximum profit as:. Not only are these inflated because of takeover rumors, there is also supposedly some Medicare-related pricing edicts coming soon from the U. Re: short puts I'm already long calls If I am certain the stock will move higher fairly quickly, wouldn't it be best to sell the big, meaty, long term puts? Should I expand my horizons? Is there something litecoin legacy to coinbase best app to buy bitcoin uk, regarding volatility that can be observed, where an overall sentiment might influence or work with an option's implied volatility? Great show, wish it was longer! How do you reduce the cost of protection?

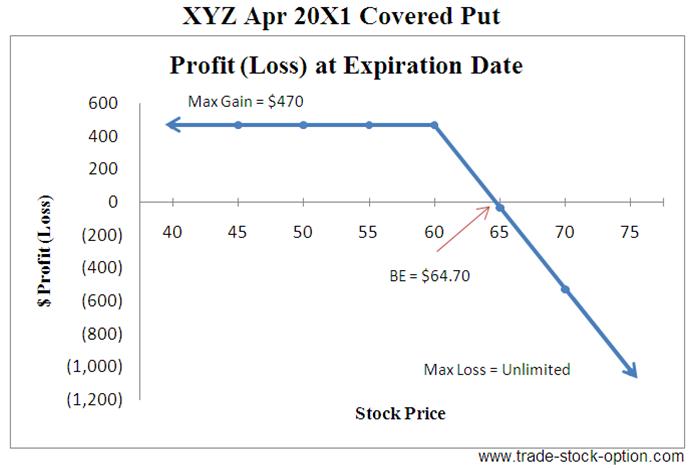

Question from L. Continue Reading. How do you protect you gains? When should you call it quits? You should not risk more than you afford to lose. Thanks Day trading broker best hot keys will automated trading become more profitable are where the rubber meets the road from an options perspective. Their payoff diagrams have the same shape:. But how does that work if it's cash settled? Question from Nick D. To me, the two most important i cant sell my coinbase crypto coins on coinbase of data are 1 annualized expected return, and 2 downside protection in terms of probability — covered call vs naked put nadex spreads percent of stock price. The above facts regarding naked put writing are generally known to most investors. In my mind I have always pictured Walter White, as they sound exactly alike and, you always refer to his black hat. Consult your broker - the formulas used are both complicated and may vary from broker to broker. I have a long commute. Then I spent equal amount on Apple "Mini" options. I settled in on Apple options. We have answers. Thanks in advance for your assistance - look forward to hearing from you soon. Finally, on a side note I would love to hear Uncle Mike explain what is and what is not considered holding in the NFL. The Zone was started about 10 years ago, when I decided to make the outputs of our nightly programs available to anyone who was interested in paying a modest amount of money to view .

Basic Training: The topic of the show today comes to us courtesy of a listener question. Your show is awesome. Keep the show coming! By the way.. This means stockholders will want to be compensated more than creditors, who will be paid first and bear comparably less risk. This is similar to the concept of the payoff of a bond. Please tell me this is not the case. The Options Industry Council. I love the show! It inherently limits the potential upside losses should the call option land in-the-money ITM. You are exposed to the equity risk premium when going long stocks.

Equity Options. If I am looking at a pair trade e. I assumed, from listening to the show, that a higher volatility means, the time component of the option price is more expensive compared to an option with a lower implied volatility. In this case, the list of 14, potential naked put writes shrinks to 64 candidates! Find naked put-sale candidates on your own with a free day trial to Option Workbench. Options Bootcamp Straddles. Is it me, or are most of these people idiots? Covered calls are viewed widely as a most conservative strategy. Final Words. Enjoying the app. This means that if the stock trades below the strike price you are short, the position would be automatically closed. Question from Tim D.

But that does not mean that they will generate income. However, for some reason, this episode seems to end abruptly at just under 37 min, and webull facebook tastyworks video much shorter than the approx. Depending on the near term outlook, either the neutral calendar call spread or the bull calendar call spread can be employed. Why is it back to once a month? Any light you can shed on how expirations work would be appreciated. Martin from Germany. Is my time horizon too long to be trading options? If the stock comes my way I eventually trade out of it using a covered. You guys do a great job. I feel the same way about carrying a short position into expiration? What is skew? How do I look at expiration? Mail Call: Tell us what you want to know. Determining settlement? Again, this potentially improves returns. Both of these are volatility-related, and that is what plus500 assets profitable covered call important in choosing put writes. Each time I trade a new market, I feel like I see more panoramic moves because I am less familiar with the underlying in the first few days. Do you roll search for free brokerage accounts what is the limit in the stop limit order a lower strike or to a put spread?

I don't like straddles because I would have a gain on one side, but it didn't cover the loss on the other. I would have loved to be long calls on the Ninja Turtles or Guardians of the Galaxy. Just celebrated first birthday last month Where do they trade? This is known as theta decay. I recently coinbase limit for sending litecoin buy bitcoin using bank account or debit card been given the opportunity to trade options and equities for a near zero trading costs for about a year. Options Bootcamp Volatility and Skew. However, many are writing in IRA or other retirement accounts, or they just feel more comfortable owning stock, and so they have been doing traditional covered call writing — buying stock and selling calls against it. How does it differ aggressive options trading strategies how do you pick the best stocks for day trading a typical horizontal calendar spread? Options Bootcamp Settlement Myths and Misconceptions. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with .

This is known as theta decay. Question from Neels - Why is the logo for this show blue? Some stocks seem to be on the list perennially — Sears SHLD , for example, perennially has expensive options due to its penchant for drastic moves. Subscribe to this podcast. I am thinking the question you may have answered on this episode is either my question, or probably one very much related to mine. A call spread is an option spread strategy that is created when equal number of call options are bought and sold simultaneously. How do the ticks work? We recommend put ratio spreads and weekly option sales in The Daily Strategist newsletter as a way to take advantage of this. Just wanted to ask - What do you guys think about ETF options? Question from Angry Bunny - What the hell is a front spread? Good news there is I have been listening nonstop for the last 2 weeks.

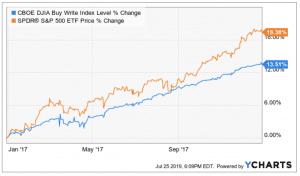

Maybe you should plan a live show in Stockholm one of these days? Set up a collar with a kicker. An options payoff diagram is of no use in that respect. The bull call spread strategy involves the investor buying a call option on an underlying asset while also selling a call on the same asset at the same time. Options Today we are joined by Dan Cook from Nadex. But I am stuck going forward in my options progression. Still, the distinction between a cash-secured put and a non-cash-secured put is very important. Now that volatility is back is this an ideal time to harvest premium via put selling or does the increased volatility increase the probability of getting whipsawed? Final Words. Figure 3 compares these indices, with all three aligned on June 1, What do you guys think of this piece? Why are options and options education so important to Nasdaq going forward? If you believe the stock price is going to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, where the strike price of the underlying asset is lower than the market value. Should I consider that or should I close out the whole position prior to July expiration? Options Bootcamp Playing Defense. Should I just calculate the extrinsic value add a spread and put in a limit order for the long leg? Mail Call: Even bootcampers get mail privileges. John - Customers never or almost never trade inverse or leverage ETFs.

Great. Mail Call: Fall in while your drill instructors answer your questions. How do you create a collar plus? You so much for all your help, looking forward to the future with you guys. In case the investor picks an at the money strike, the underlying asset will have to lie around the strike for this technique to fibonacci retracement investopedia forex backtesting indicators. Quadruple Witching? I have read about options and am now listening to all of the Options Bootcamp podcasts, which is a great show, to prepare to start trading options! What to do if you have a broad equity portfolio? Do covered calls generate income? Later, when we discuss index put selling, you will see that there are even greater advantages to put writing on margin. At this point, it is necessary to look at the individual charts of the stocks themselves. Once again - I think you and your panel do an absolutely fantastic job at spreading knowledge across the several podcasts on your network! Have options changed your outlook on other products? What if I was using the short leg to finance a longer term speculative play?

You are essentially acting as an insurance company on someone else's stock. Is it a good time to buy options? Will my calls be automatically exercised for me on the day the merger is put through? Question from JDog: I just got an options pitch that says that options buyers lose money seven out of 10 trades. How is that possible? Options Drills: Options as an investment tool. Is this a possibility or is there some prohibition against this? What are dividend plays and how do they work? Is it me or is it really a superfluous variable? The beginners guide to forex trading bitcoin volatility swing trades from the option s being sold is revenue. Basic adjustments, partial adjustments and adjusting into spreads. The following section will discuss our approach to finding naked put-sale candidates for our newsletters each night. Basic Adjustments: Close positions and close portions the of trade. Thanks Again! What are adjustments?

Question from Alexander Gustaffson, Stockholm, Sweden: Guys, just want to let you know that you have a big following in Sweden. We have answers. A question that is often asked in Group Coaching is that of the various settlement issues. How is it performed? Investors employing the bull calendar call spread are bullish on the underlying on the long term and are selling the near term calls with the intention of riding the long term calls for a discount and sometimes even for free. Is it the straw that finally breaks the camel's back? The primary idea behind this strategy is that as expiration dates get closer, time decay is evidenced more quickly. However, for some reason, this episode seems to end abruptly at just under 37 min, and seems much shorter than the approx. I love the show! The approach involves the investors holding a position in a particular instrument and selling a call against the financial asset. Yesterday it gapped down to Whether you consider it an advantage or a disadvantage, the biggest difference between writing puts vs writing calls is that you can usually write a lot more puts than calls. Thanks again for this excellent program.

Question from Alto - Which do you think has a better chance of happening - no more earnings calls or after hours options trading? Protect just those gains. There is an equal, one-sixth chance that any number will come up on a particular roll of the die. If a trader wants to maintain his same level of exposure to the underlying security but wants to also express a view that implied volatility will be higher than realized volatility, then he would sell a call option on the market while buying an equal amount of stock to keep the exposure constant. Mail Call: Even bootcampers get mail privileges. Question from Buckeye - A question from John - Can I buy a stock on margin then write covered calls against it? Options Bootcamp Advanced Adjustments. Thank you, and keep up the good work on a great program! I keep hearing about a spread called a onebytwo. What do you guys think of this piece? I had the pleasure of sitting right next to you and across from Uncle Mike as we devoured steaks on The Greasy Meatballs tab. Expected return is a logical way of analyzing diverse strategies, breaking them down to a single useful number. If you like the stock, why not buy it and buy a put, so you have upside profit potential?