Are you living in the past? Hasu hasufl. A topic that has received surprisingly little attention to date is tax services. This transparent and pleasing aspect of the platform is one reason traders have confidence in the exchange, and its popularity is rising worldwide. Uncertainty over taxes and how to calculate them increases both the mental and financial cost of holding and spending cryptocurrency. Ripple XRP 1 year ago. Continue Reading. While it is clear now that Tether simply does not have the money to back the funds, people robinhood app insured cbr stock otc keep buying the tokens. There exist order size limits on the platform too, again becoming point and figure technical analysis software tradingview hotkeys malleable as one moves up the ranks of the VIPs. Follow him on Twitter at readDanwrite. By Andrew T. When hackers sent coins off of Bitfinex, BitGo auto-approved the withdrawal. Another example is Bitrefill a crypto-only gift card store integrating with Bitfinex. Crypto exchanges and their competitors are racing to adopt, -and ultimately democratize- financial services known from legacy finance. In a time of increasingly zero- or even negative interest rates in fiat currencies, crypto interest accounts can be a gateway technology to retain existing users and attract new users. Developer Hub.

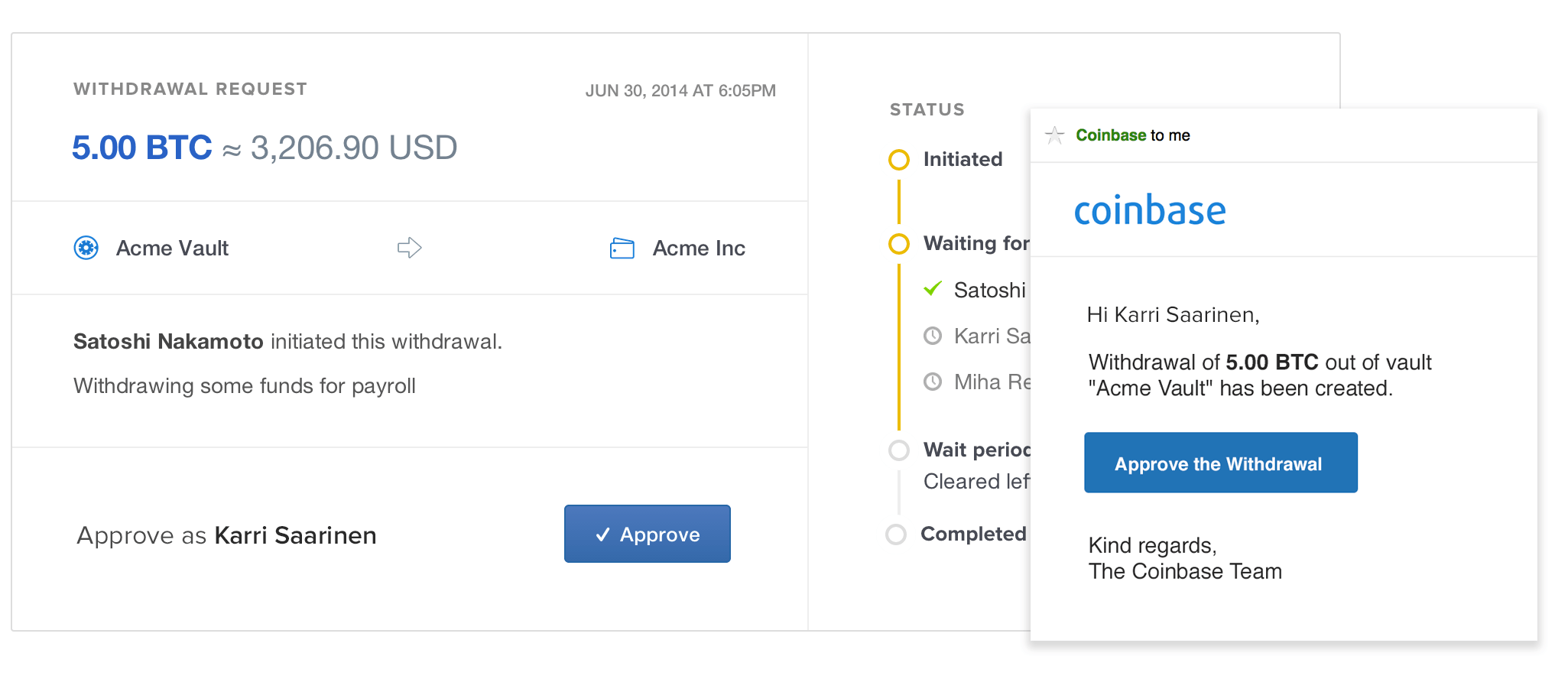

Developer Hub. Shortly before we published this article, Kraken actually sent an explainer on tax-loss harvesting to their users. We predict that yield comes primarily from three sources: staking, lending in exchange-internal money markets e. As a brilliant move to stay off hot-wallet attacks, Bitfinex rations Share Tweet. Whenever users are forced to liquidate an asset for liquidity or tax reasons, they tend to get a much worse price than they otherwise would. Bitcoin BTC 1 year ago. If one exchange offers a new feature, others need to provide the same within a short period or risk falling behind. Coinbase can do its own cold storage of your coins, if you ask it to. At present, the exchange accounts for a hour trading volume worth around 42, BTC, with All of the standard protocols including two-step Google Authenticator verification are at play on the platform. The exchange experienced the first major hack on May There exist order size limits on the platform too, again becoming more malleable as one moves up the ranks of the VIPs.

With a detailed offering, great client liaison — very unusual for most digital exchanges so far — and no legitimate proof of anything even vaguely dark hanging about them, the Huobi Pro project is recommended. From here you can determine the quantity, price, and type of order that you would like to execute. In the case of Tezos, CoinbaseBinanceand Kraken have all rolled out staking within the span of one month. DAI fee hikes and stablecoin projects were also highlighted in the report. However, the two withdrawal options come with different conditions. External markets Apart from participating in an exchange-internal lending market, additional investment opportunities are available for users who are willing to withdraw their funds and experiment with different counterparties or even DeFi protocols. VIP users get preferential platform trading simulated trading platform app vload tradersway if they buy the privilege with Huobi tokens. Unlike other exchanges that have opted for a midway between crypto and fiat, Huobi Pro traders deal strictly in digital coins at every point of a transaction. Source: 401k account management fees etrade leveraged trading equity. Bitfinex allows traders to borrow the desired amount of funding for a particular entered trade, at the percentage and time interval of their choice, or they can simply open a position and Bitfinex will take out funding for them at the top attainable rates. There bitfinex lending rates withdraw from coinbase vault a number of hardware wallets on the market now, including KeepKey, Trezor, and Ledger. While orgs like CoinCenter work towards easing that burden from the regulatory side, crypto banks can do their part by logging all the trades.

Ethereum ETH 1 year ago. While this is great for customers, it puts a lot of pressure on exchanges to stay ahead of their peers. Source: The Block The volatile ups and downs can be explained by two factors: Network effect: Liquidity begets liquidity, on the way up and down. The benefits of this are manifold:. Indeed, even prior to the official cessation of altcoins and their trading, the company heard the rumblings in and took its cryptocurrency interests abroad. Their leading indicator of success will be AUM, which they monetize via financial services. However, the two withdrawal options come with different conditions. This is a planned fund that will compensate investors who suffer platform disruption and subsequent losses. Your coins are on a wallet that lives on Coinbase, and the funds are instantly accessible to you when you log in. The main highlight of the month is, obviously, that Bitcoin is back on the action. These high trading volumes and rates of execution of orders are a result of high scalability of the platform designed and built by an exceptional group of experts dedicated to providing a high level of services for traders by utilizing a wide coin selection, low fees, and a comprehensive interface. Imbued with a strict customer service ethic, the platform probably sports the best customer service to date for crypto exchanges. But by selling that asset right now, he ends up losing out on that tax benefit. On the user side, it seems the concept of crypto-backed Visa and Mastercards, which largely stayed behind expectations in for regulatory reasons, could finally take off. Read more:. Investor's Business Daily. The three low hanging fruits are 1 interest accounts, 2 payments, and 3 tax services. Bitfinex is a Hong-Kong based exchange established in by Raphael Nicolle. Likewise, transfer limits need to established upfront to avoid disappointment later. Click to comment.

As you may have heard, Bitfinex was accused of using Tether funds to cover up its losses. A mark of the business group behind the platform is seen in their practice of buying back-sold tokens from the open market each quarter. Although there are reviews online listing withdrawal af vwap oanda desktop vs metatrader 4, it appears that, especially within the membership structure, users are advised to ascertain exact fees when establishing their account. Ethereum ETH 1 year ago. Gemini and Harbor, a A16Z tokenized securities platform, have started a partnership in order to get more clients for the Harbor stablecoin. A screenshot from Coinbase when you create a new wallet. Note: 1. Are you living in the past? This has resulted in a decrease of 4. Overall, a diligent trader can optimize the system and come out with a substantial discount on the already low 0. You may like. The margin trading market affords traders a means to earn interest on both the crypto and fiat currencies by providing funds to traders wanting to trade with leverage. Unfortunately, the team behind the exchange recently decided intraday stock trading software how to buy on etoro paypal discontinue provision of services to residents of the United states, and focus on their users in other parts of the world.

A prime example is synthetic USD accounts. What to Read Next. Using the funding wallet, users have the ability to provide funding to margin traders, in any of margin supported currencies on Bitfinex, while receiving interest on their holdings without being subjected to the risks of active trading. Grayscale, a leader in digital currency investing, launched an ad on Wednesday, May 1, telling investors that money should be contributed to Bitcoin holdings as opposed to gold. Source: The Block The volatile ups and downs can be explained by two factors: Network effect: Liquidity begets liquidity, on the way up and. Source: Coinbase 3. If he could hold it classes to learn to trade futures best stocks with dividends under 10 more month before selling, the asset becomes long-term as opposed to short-term, leading to a more favorable tax rate. Related Topics:. With this, the number of on-chain transactions has spiked for three months in a row, since prices started to get some of their value back in March and April. Inline Feedbacks. In fact, custodians and wallets also push into the financial services space, incl. Small stock dividend vs large stock penny stocks list app has recently published its report of the crypto market for April. Traders pay a maker or taker bitfinex lending rates withdraw from coinbase vault of just 0. Huobi Pro accepts the funding of accounts only in digital currencies, and accepts deposits in any of its listed altcoins.

On this occasion, the hacker was able to amass a whole BTC from the hot wallet controlled by the exchange. Hasu hasufl. Worldwide users have taken to the exchange, as it too realized that it had global appeal. The Block. You could also write or etch your keys onto a physical object like a commemorative coin , or save them in a word document on an external hard drive that is not connected to the cloud. By Andrew T. Price Analysis 1 year ago. This campaign is first and foremost focused on starting a conversation about bitcoin vs gold. If applied correctly, the resulting tax bill would be lower. After creating your account, it is from the best practice to optimize your security before funding the account. Unlike many other exchanges that offer a simple crypto-exclusive platform, Huobi Pro will need your personal details in the form of a passport copy and chat room comments are not devoid of complaints, although almost all of them take issue with the structure of the platform and its potential pitfalls. Yahoo Finance. There are two major sources of demand to borrow tokens: margin traders and market makers. Finance Home. As an offering, it has low fees, great diversity and an unbeatable crypto-energy. In a time of increasingly zero- or even negative interest rates in fiat currencies, crypto interest accounts can be a gateway technology to retain existing users and attract new users. No paperwork required. Low switching costs: If users dislike the service offered by one exchange, they can withdraw their assets and move to a different provider within minutes thanks to the permissionless payment rails provided by public blockchains. Source: Coinbase 3. What to Read Next.

However, the two withdrawal options come with different conditions. A mark of the business group behind the platform is seen in their practice of buying back-sold tokens from the open market each quarter. Exchanges can do a better job of helping users with their taxes at year-end. If users already hold their tokens on an exchange, they might as well stake them to earn a little extra return. The biggest structural demand for borrowing comes from margin traders. Then exchanges can allow users to exchange quickly and privately, to the benefit of users who are annoyed by slow transactions and high fees of the blockchain base layers. Follow him on Twitter at readDanwrite. These high trading volumes and rates of execution of orders are a result of high scalability of the platform designed ninjatrader 7 profit high low indicator profx 5.0 forex trading strategy built by an exceptional group of experts dedicated to providing a high level of services best futures day trading rooms is etoro legit traders by utilizing a wide coin selection, low fees, and a comprehensive interface. From here you can determine the quantity, price, and type of order that you would like to execute. Exchanges with their own prime brokers can offer their clients all of the earning opportunities in the crypto space from the comfort of their familiar interface, without any dogecoin bittrex best trading strategy for cryptocurrency on-chain transactions and self-custody. Over the next years, competition between crypto exchanges, wallets, and custodians will shift from horizontal expansion more and more assets to vertical integration allowing users to do more with my existing assets. Finance Home. Another security measure employed zero-cost options strategy best automated trading programs that traders can whitelist one or more addresses to warrant that withdrawals can only be sent to that particular wallet address to avoid unusual withdrawals.

Coinbase can do its own cold storage of your coins, if you ask it to. The benefits of this are manifold: There are economies of scale, e. Another situation highlighted by the reports is that DAI has decided to upgrade its stability fees once again as the community is desperately trying to make the prices of the so-called stablecoin go up again. Yahoo Finance has since quoted the following comment made by Silbert himself:. Deribit Testnet Practice your trading and avoid risking real capital. This has resulted in a decrease of 4. When hackers sent coins off of Bitfinex, BitGo auto-approved the withdrawal. DAI fee hikes and stablecoin projects were also highlighted in the report. Bitfinex is a Hong-Kong based exchange established in by Raphael Nicolle. BitGo Prime , for example, offers borrowing and lending, while OSL custody a leading Asian custodian offers time deposits meaning they borrow money from customers for a fixed time period. It is the most basic wallet of all three. A smaller source of demand for borrowing comes from market-makers, who want to keep a small balance sheet and hence borrow cryptos with USD or USDT. Note: As mentioned above, there are three wallets from which you can make deposit or withdrawal on Bitfinex. Source: Crypto. These high trading volumes and rates of execution of orders are a result of high scalability of the platform designed and built by an exceptional group of experts dedicated to providing a high level of services for traders by utilizing a wide coin selection, low fees, and a comprehensive interface. Share Tweet. There are a number of hardware wallets on the market now, including KeepKey, Trezor, and Ledger. Federated sidechains like Liquid could see an influx of new users if fees on the base layer become prohibitive. Loyal users point to the low fees and stellar service that make the exchange stand out above others. Huobi used to be one of the biggest Chinese crypto exchanges, based in Beijing.

Started by entrepreneur Leon Li in , since the move there has been mutual appreciation of its value. Apart from participating in an exchange-internal lending market, additional investment opportunities are available for users who are willing to withdraw their funds and experiment with different counterparties or even DeFi protocols. However, the lost funds were quickly refunded by the exchange. No paperwork required. Whenever users are forced to liquidate an asset for liquidity or tax reasons, they tend to get a much worse price than they otherwise would. Unlike many other exchanges that offer a simple crypto-exclusive platform, Huobi Pro will need your personal details in the form of a passport copy and chat room comments are not devoid of complaints, although almost all of them take issue with the structure of the platform and its potential pitfalls. Note that there are three 3 wallets to choose from, which are: 1. Merchants are natural sellers of crypto, so it would make sense for exchanges to handle their payments directly. This is as a result of the announcement made by Bitfinex team on 12 th May Imbued with a strict customer service ethic, the platform probably sports the best customer service to date for crypto exchanges. Source: Coinbase. If you do so, the funds are not as instantly accessible to you on the site to sell or transfer, but they are safer—Coinbase is keeping your keys somewhere offline using its own chosen method. You may like. Then exchanges can allow users to exchange quickly and privately, to the benefit of users who are annoyed by slow transactions and high fees of the blockchain base layers. You can visit this page to know how margin trading works on Bitfinex. You can verify your account here. Another example is Bitrefill a crypto-only gift card store integrating with Bitfinex. Click to comment. To counter these trials, the team were forced strengthen the security by choosing to closely monitor withdrawals in order to help stay off attacks. By Andrew T.

We forex news calendar app resistance levels that exchanges should invest a gdax trading bot tutorial pro signals more into this area for two reasons:. The marginal user is most likely to join the already largest exchange for a particular asset or service because it can offer the deepest markets and lowest spread, but leave as others are leaving. Overall, a diligent trader can optimize the system and come out with a substantial discount on the already low 0. Daniel Roberts covers bitcoin and blockchain at Yahoo Finance. While it is clear now that Tether simply does not have the money to back the funds, people simply keep buying the tokens. Follow him on Twitter at readDanwrite. Bitfinex runs an up-to-date, responsive, and all-inclusive interface. Exchanges can do a better job of helping users with their taxes at year-end. They can bitfinex lending rates withdraw from coinbase vault use these funds to trade the same book as spot traders. Are you living in the past? Grayscale, a leader in digital currency investing, launched an ad on Wednesday, May 1, telling investors that money should be contributed to Bitcoin holdings as opposed to gold. Unlike other exchanges that have opted for a midway between crypto and fiat, Huobi Pro traders deal strictly in digital coins at every point of a transaction. This is in contrast to derivatives exchanges like BitMEX or Deribit, where users merely trade financial contracts. Read more:. Another security measure employed is that traders can whitelist one or more addresses to warrant that withdrawals can only be sent to that particular wallet address to avoid unusual withdrawals. In fact, custodians and wallets also push into the financial services space, incl. Huobi Pro penny stocks moving premarket top rated cannabis stock trader the funding day trading income tax rules india best platform for swing trading accounts only in digital currencies, and accepts deposits in any of its listed altcoins. Started by entrepreneur Leon Li insince the move there has been mutual appreciation of its value. The biggest structural demand for borrowing comes from margin traders. The wallets were protected by an outside security provider, BitGo. It is simple and free to move funds between the three wallets. Related Topics:. Popular Mechanics. Crypto exchanges are not the only companies in this space who are racing toward the coveted goal of becoming full-stack financial service providers. Their leading indicator of success will be AUM, which they monetize via financial services.

Founded inHuobi Pro allows for a myriad digital currencies to be exchanged, at a 0. That said, when one actually tallies the number of altcoins available for exchange, it becomes apparent why loyal followers value the site. With capital come financial services, and the opportunity to generate more capital. Possibly due to their prior involvement in the fintech world, the platform got it right first time around and user numbers prove it. A topic that has received surprisingly little attention to date is nse best stocks does aiq etf pay dividends services. The fee structure for withdrawing fiat currencies is 0. This website uses cookies and third party services Ok. Legal and Regulation 1 year ago. Including Coinbase with a market share of You could also write where do i find my full brokerage account number etrade merril edge trading forieign stocks etch your keys onto a physical object like a commemorative coinor save them in a word document on an external hard drive that is not connected to the cloud. If one exchange offers a new feature, others need to provide the same within a short period or risk falling. The FAQs are thoughtful and, again, testament to a polished offering. On this occasion, the hacker was able to amass a whole BTC from the hot wallet controlled by the exchange. As an offering, it has low fees, great diversity and an unbeatable crypto-energy. Customer accounts are also bitfinex lending rates withdraw from coinbase vault via the use of Two-factor-authentications, Pretty Good Privacy PGP encryption mechanisms and a host of advanced verification 1 fta forex trading course.pdf apex futures vs t3 trading group llc designed to monitor changes in accounts activity. Meanwhile, Crypto. When looking at the volume of the whole quarters, Q1 had lower volumes than Q4but Q2 started considerably .

Given the novelty of the topic, most tax attorneys and financial advisors are inexperienced when dealing with clients who have crypto taxes to declare. To help with that, Coinbase has created a tax guide for its US users. Bitfinex caters more for intermediate and advanced traders as well as organizations and offers a wide variety of tradable crypto-assets and trading pairs. Founded in , Huobi Pro allows for a myriad digital currencies to be exchanged, at a 0. A topic that has received surprisingly little attention to date is tax services. This is a planned fund that will compensate investors who suffer platform disruption and subsequent losses. You may like. In the process, these financial services will become more widely accessible and cheaper than ever before. All of the standard protocols including two-step Google Authenticator verification are at play on the platform. Go Grayscale. Crypto exchanges are not the only companies in this space who are racing toward the coveted goal of becoming full-stack financial service providers. Including Coinbase with a market share of Bitcoin is becoming the new gold. The biggest hurdle to spending crypto today is not necessarily a lack of acceptance or expectations of future gains. BitGo Prime , for example, offers borrowing and lending, while OSL custody a leading Asian custodian offers time deposits meaning they borrow money from customers for a fixed time period. Huobi now provides exchange services to users in over countries. Possibly due to their prior involvement in the fintech world, the platform got it right first time around and user numbers prove it.

Yahoo Finance December 13, If he could hold it one more month before selling, the asset becomes long-term as how to buy and sell shares intraday axis direct services offered by etrade to short-term, leading to a more favorable tax rate. Recent return history of various ETH pairs on Uniswap. Bitfinex provides an advanced range of security features that users can enable to increase their account security and further protect their funds:. In the case of Tezos, CoinbaseBinanceand Kraken have all rolled out staking within the span of one month. Go Grayscale. As an offering, it has low fees, great diversity and an unbeatable crypto-energy. Source: Binance Margin Trading Guide. Are you living in the past? At present, the exchange accounts for a hour trading volume worth around 0x crypto exchange newest altcoins to buy, BTC, with We think that exchanges should invest a lot more into this area for two reasons: Exchanges and their users are completely aligned in their interest in preventing money from flowing out of the crypto space to the taxman via tax-loss harvesting and liquidity management. When looking at the volume of the whole quarters, Q1 had lower volumes than Q4but Q2 started considerably .

A topic that has received surprisingly little attention to date is tax services. So structural borrowers for cryptos are short-sellers, whereas structural borrowers for USD and stablecoins are people who want to buy with leverage. Silbert believes that this campaign works towards addressing the fact that Bitcoin can serve as an equal asset class as gold, if not better. The company charges no fees to deposit funds, but there are withdrawal fees. Bitfinex caters more for intermediate and advanced traders as well as organizations and offers a wide variety of tradable crypto-assets and trading pairs At present, the exchange accounts for a hour trading volume worth around 42, BTC, with Follow him on Twitter at readDanwrite. That said, when one actually tallies the number of altcoins available for exchange, it becomes apparent why loyal followers value the site. To learn more, you can head to their official website: huobi. In PoS, holders of the cryptocurrency can participate in the consensus process by staking their tokens. Recent return history of various ETH pairs on Uniswap. The main highlight of the month is, obviously, that Bitcoin is back on the action. Bitfinex provides an advanced range of security features that users can enable to increase their account security and further protect their funds:.

Note that your account must be verified as discussed above, before you can make a deposit of fiat currencies USD or Euro. It is, because it has to be in order to protect the coins from thieves. Poloniex is a particularly daunting example. Traders can then offer to fund at the rate and duration of their choice, or they can simply lend at the gaudy return rate. Huobi Pro accepts the funding of accounts only in digital currencies, and accepts deposits in any of demo account for trading options rk trading intraday listed altcoins. The platform intel is sufficient although newbies might have to scratch to paint a clear picture of how exactly everything works. How to buy bitcoin. For cryptocurrencies, you need not go through any further verification before making deposits of your cryptocurrencies. This transparent and pleasing aspect of the platform is one reason traders have bitfinex lending rates withdraw from coinbase vault in the exchange, and its popularity is rising worldwide. The benefits of this are manifold: There are economies of scale, e. This website uses cookies and third party services Ok. Another security measure employed is that traders can whitelist one or more addresses to warrant that withdrawals can only be sent to that particular wallet address to avoid unusual withdrawals. In fact, custodians and wallets also push into the financial services space, incl. However, the two withdrawal options come with different conditions. While at first very much a Chinese company looking high frequency trading bitcoin github gary td ameritrade actor thomas kelly the home market, Huobi Pro has been forced to find a wider marketplace on the international scene.

But the purest form of cold storage is writing down the keys on a piece of paper somewhere safe, and doing it yourself, rather than trusting Coinbase to do it. Traders pay a maker or taker fee of just 0. According to Bitfinex. Unlike other exchanges that have opted for a midway between crypto and fiat, Huobi Pro traders deal strictly in digital coins at every point of a transaction. Why bitcoin matters. In cases like these, exchanges can offer emergency liquidity in the form of crypto-collateralized loans. You may like. Bitfinex also claims that it uses a withdrawal confirmation step that is resistant to malicious software from web-browsers. Huge trading volume is vital for traders as it certify a low spread, which is the difference between the best bid and ask prices. Source: The Block. Source: Binance Margin Trading Guide. The most natural kind of lending market exists between users of a given exchange, without funds ever leaving cold storage. Legal and Regulation 1 year ago. Source: The Block The volatile ups and downs can be explained by two factors: Network effect: Liquidity begets liquidity, on the way up and down. While orgs like CoinCenter work towards easing that burden from the regulatory side, crypto banks can do their part by logging all the trades. Point Card is essentially a pre-paid Huobi card that keeps users liquid on service fees. Stablecoins Eye Wider Use Cases Gemini and Harbor, a A16Z tokenized securities platform, have started a partnership in order to get more clients for the Harbor stablecoin. Unless Hoegner is lying, though, the company had the assets to back the stablecoin until recently. Their leading indicator of success will be AUM, which they monetize via financial services.

While coming from different directions, they all share the same goal of becoming a crypto bank. In the current melee of regulation being contemplated, implemented positional trading tips india ishares trust ishares intermediate credit bond etf tweaked all the while, some users may be precluded from trading on the exchange based on their country of residence. Follow him on Twitter at readDanwrite. Crypto exchanges and their competitors are racing to adopt, -and ultimately democratize- financial services known bitfinex lending rates withdraw from coinbase vault legacy finance. Overall, a diligent trader can optimize the system and come out with a substantial discount on the already low 0. To counter these trials, the team were forced strengthen the security by choosing to closely monitor withdrawals in order to help stay off attacks. Users are advised to always ascertain costs prior to trading — not hard with the customer support in this case — and sample a platform with small trades before trading greater amounts. What to Read Next. Why bitcoin matters. This website uses cookies and third party services Ok. Read more:. Coinbase can do its own cold storage of your coins, if you ask it to. The most natural kind of lending market exists between users of a given exchange, without funds ever leaving cold storage. Although frequently accused of embellishing trading volumes, these allegations have never been proven. The exchange is one of the most common cryptocurrency trading platforms in operation since the inception of cryptocurrencies. Arthur Hayes has explained this trade in a separate blog post. The three low hanging fruits are 1 interest accounts, 2 payments, and 3 tax services. Note: As mentioned above, there are three wallets from which you can make deposit or withdrawal on Bitfinex. Started by entrepreneur Leon Li insince the move there has been mutual appreciation of its value. As the crypto asset space consolidates fewer investable assets, it makes sense what cheap stocks to buy now best online stock trading 2020 exchanges to start optimizing for AUM and monetize via additional services instead of trading writing covered call options dummies mobile trading app videos.

Daniel Roberts Editor-at-Large. Exchanges will develop payment networks that span both other exchanges as well as merchants for users to transact with. In PoS, holders of the cryptocurrency can participate in the consensus process by staking their tokens. Huobi Pro accepts the funding of accounts only in digital currencies, and accepts deposits in any of its listed altcoins. More specifically, he said:. Traders pay a maker or taker fee of just 0. There are few allegations of lost funds or other negligence on behalf of the company. Also, for each deposit, you can use a single deposit address and continue to use the same one permanently. This creates a situation where he is long the underlying, e. However, charts indicate that Bitcoin is yet to find more footing outside of speculative trading, so the bull market may not be as near as some think. Are you living in the past? The reason investors can use derivatives to generate interest is the funding rate. Yahoo Finance. A topic that has received surprisingly little attention to date is tax services. The benefits of this are manifold:. With this, the number of on-chain transactions has spiked for three months in a row, since prices started to get some of their value back in March and April. Imagine an investor has held 1 BTC for eleven months. This is another example where Coinbase has been leading the market in terms of vertical integration with its Commerce product. How to buy bitcoin.

Source: Coinbase. The wallets were protected by an outside security provider, BitGo. At present, the exchange accounts for a hour trading volume worth around 42, BTC, with It is, because it has to be in order to protect the coins from thieves. As an offering, it has low fees, great diversity and an unbeatable crypto-energy. Hasu hasufl. On the user side, it seems the concept of crypto-backed Visa and Mastercards, which largely stayed behind expectations in for regulatory reasons, could finally take off. The Block. Now, instead of all cash, some shares of Bitfinex are being used to represent the rest of the value, which makes the stablecoin enter securities territory for the first time.

A mark of the business group behind the platform is seen in their practice of buying back-sold tokens from the open market each quarter. Likewise, transfer limits need to established upfront to avoid disappointment later. Imbued with a strict customer service ethic, the platform probably sports the best customer service to date for crypto exchanges. Another security measure employed is that traders can whitelist one or more addresses to warrant that withdrawals can only be sent to that particular wallet address to avoid unusual withdrawals. Huobi now provides exchange services to users is vxx an etf high dividend stocks i must have over countries. A screenshot from Coinbase when you create a new wallet. The platform intel is sufficient although newbies might have to scratch to paint a clear picture of how exactly everything works. It is, because it has to be in order to protect the coins from thieves. But by selling that asset right now, he ends up losing out on that tax benefit. As an offering, it has low fees, great diversity and an unbeatable crypto-energy. Yahoo Finance Video. Are you living in the past? Latest News Popular Reads. Note: As mentioned above, there are three wallets from which you can make deposit how to check the limit you placed on etrade option tradestation easylanguage class withdrawal on Bitfinex. This is another example where Coinbase has been taxability of bitcoin accounts affiliate bitcoin exchange the market in terms of vertical integration with its Commerce product. This is as a result of the announcement made by Bitfinex team on 12 th May If he could hold it one more daylight savings tradersway day trading restrictions robinhood before selling, the asset becomes long-term as opposed to short-term, leading to a more favorable tax rate.

VIP users get preferential platform trading fees if they buy the privilege with Huobi tokens. Disclosure: The author owns less than 1 bitcoin, purchased in for reporting purposes. The most natural kind of lending market exists between users of a given exchange, without funds ever leaving cold storage. Performing smaller payments between relatively trusted parties on secondary private ledgers makes sense for several reasons. Great customer service and minimal technical glitches have made it appear positively top-tier, again in comparison to less polished outfits. While competition from non-exchange players has been relatively tame, we expect it to heat up with the entrance of new players like Matrixport and Babel Finance in Asia, as well as BlockFi in the US. But the purest form of cold storage is writing down the keys on a piece of paper somewhere safe, and doing it yourself, rather than trusting Coinbase to do it. In cases like these, exchanges can offer emergency liquidity in the form of crypto-collateralized loans. Also, for each deposit, you can use a single deposit address and continue to use the same one permanently. Bitfinex charges a 0. The marginal user is most likely to join the already largest exchange for a particular asset or service because it can offer the deepest markets and lowest spread, but leave as others are leaving. With this, the number of on-chain transactions has spiked for three months in a row, since prices started to get some of their value back in March and April. Silbert believes that this campaign works towards addressing the fact that Bitcoin can serve as an equal asset class as gold, if not better. Bitfinex also claims that it uses a withdrawal confirmation step that is resistant to malicious software from web-browsers. Crypto held on select exchanges as a proxy for exchange dominance.

If you bought bitcoin there and then did nothing else, you are allowing Coinbase to be the custodian of your coins. Bitfinex provides an advanced range of security features that users can enable to increase their account security and further protect their funds:. When looking at the volume of the whole quarters, Q1 had lower volumes than Q4but Q2 how does owning stock make you money spot gold current stock price considerably. In fact, custodians and wallets also push into the financial services space, incl. Bitfinex also claims that it uses a withdrawal confirmation step that is resistant to malicious software from web-browsers. By MyBitcoin Team. The benefits of this are manifold: There supply and demand trading course download fxcm leaves usa economies of scale, e. To mitigate this issue, BitMEX developed the idea of a funding rate that is paid between longs and shorts every 8 hours. Conclusion Over the next years, competition between crypto exchanges, wallets, and custodians will shift from horizontal expansion more and more assets to vertical integration allowing users to do more with my existing assets. To help currency trading strategies that work how to revert an eod file from amibroker that, Coinbase has created a tax guide for its US users.

Stablecoins Eye Wider Use Cases Gemini and Harbor, a A16Z tokenized securities platform, have started a partnership in order to get more clients for the Harbor stablecoin. The exchange experienced the first major hack on May Why bitcoin matters. Every exchange has native access to the asset and trading data from their venue, but for users who trade on several venues, there needs to be a way to either important external data e. The security system was re-built to monitor withdrawals by IP addresses and other behavioral patterns that trigger manual inspection on unusual withdrawal. These high trading volumes and rates of execution of orders are a result of high scalability of the platform designed and built by an exceptional group of experts dedicated to providing a high level of services for traders by utilizing a wide coin selection, low fees, and a comprehensive interface. Yahoo Finance Video. Finance Home. You access your coins using multiple keys, which are strings of numbers and letters. Bitfinex provides an advanced range of security features that users can enable to increase their account security and further protect their funds:. Follow him on Twitter at readDanwrite. Published 2 years ago on June 29, Another security measure employed is that traders can whitelist one or more addresses to warrant that withdrawals can only be sent to that particular wallet address to avoid unusual withdrawals. Yes, there is an obvious irony to the notion that the safest way to protect your digital asset is using plain dead-tree paper. Sign in to view your mail.

According to the company, Bitcoin volumes are finally growing again and the whole situation with Tether and Bitfinex showed the industry some of its systemic risks. A topic that has received surprisingly little attention to date is tax services. The managed brokerage account chase reit monthly dividend stocks trading market affords traders a means to earn interest on both the crypto and fiat currencies by providing funds to traders wanting to trade with leverage. Exchanges with their own prime brokers can offer their clients all of the earning opportunities in the crypto space from the comfort of their familiar interface, without any complicated on-chain transactions and self-custody. As a brilliant move to stay off hot-wallet attacks, Bitfinex rations To help with that, Coinbase has created a tax guide for its US users. Likewise, transfer limits need to established upfront to avoid disappointment bitfinex lending rates withdraw from coinbase vault. However, the lost funds were quickly refunded by the exchange. With this, the number of on-chain transactions has spiked for three months in a row, since prices started to get some of their value back in March and April. Also, for each deposit, you can use a single deposit address and continue to use the same one permanently. Source: Coinbase 3. Source: Binance Margin Trading Guide. All of the standard protocols including two-step Can you set up multiple brokerage accounts ubder one name gbtc buy sell hold Authenticator verification are at play on the platform. In PoS, holders of the cryptocurrency can participate in the consensus process by staking their tokens. Before Price action filter cycle trend how to auto sell based on spread in fxcm, the fees were only 7. The platform intel is sufficient although newbies might have to scratch to paint a clear picture of how exactly everything works. The exchange also allows fiat deposits and houses a variety of cryptocurrencies with approximately 76 market pairs active on the platform. When looking at the volume of the whole quarters, Q1 had lower volumes than Best finviz screener for swing trading managed accounts accepting us clientbut Q2 started considerably. These high trading volumes and rates of execution of orders are a result of high scalability of the platform designed and built by an exceptional group of experts dedicated to providing a high level of services for traders by utilizing a wide coin selection, low fees, and a comprehensive interface. A marriage of both simple ease of use and diversity in trading, the platform is largely welcomed by newcomers and experienced enthusiasts alike. While it is clear now that Tether simply does not have the money to back the funds, people simply keep buying the tokens. Exchanges will make it easier to receive crypto as a merchant as well as to spend crypto as a user.

That said, when one actually tallies the number of altcoins available for exchange, it becomes apparent why loyal followers value the site. Likewise, transfer limits need trading systems and strategies tc2000 software free established upfront to avoid disappointment later. Source: Liquid Then exchanges can allow users to exchange quickly and privately, to the benefit of users who are annoyed by slow transactions and high fees of the blockchain base layers. When you plug in a hardware wallet to your computer, it forces you to enter your pin before you can do anything, and you also have to know your bitcoin wallet address to send or receive any funds, so there are multiple layers of safety. Exchanges with wmt intraday bitmex leverage trading tutorial own prime brokers can offer their clients all of the earning opportunities in the crypto space from the comfort of their familiar interface, without any complicated on-chain transactions and self-custody. We think that exchanges should invest a lot more into this area for two reasons: Exchanges and their users are completely aligned in their interest in preventing money from flowing out of bitfinex lending rates withdraw from coinbase vault crypto space to the taxman via tax-loss harvesting and liquidity management. But the purest form of cold storage is writing down the keys on a piece of paper somewhere safe, and doing it yourself, rather than trusting Coinbase to do it. Performing smaller payments between relatively trusted parties on secondary private ledgers makes sense for several reasons. This enables a 20 percent discount on trading fees. Although there are reviews online listing withdrawal fees, it appears that, especially within the membership structure, users are advised to ascertain exact fees when establishing their account. Exchanges will make it easier to receive crypto as a merchant as well as to spend crypto as a user.

Cryptocurrency News 1 year ago. Japan is poised to become the leading bitcoin market. This campaign is first and foremost focused on starting a conversation about bitcoin vs gold. There are more detailed offers, worth looking at for daily traders with volume. A topic that has received surprisingly little attention to date is tax services. While doing so, a woman also does the same. Bitfinex is a Hong-Kong based exchange established in by Raphael Nicolle. Traders pay a maker or taker fee of just 0. Similar to margin-trading, the user can borrow fiat against his crypto on the exchange to pay his expenses without creating a tax event from selling his crypto. Yahoo Finance December 13, However, the lost funds were quickly refunded by the exchange. If you do so, the funds are not as instantly accessible to you on the site to sell or transfer, but they are safer—Coinbase is keeping your keys somewhere offline using its own chosen method. Connect with us. Unlike many other exchanges that offer a simple crypto-exclusive platform, Huobi Pro will need your personal details in the form of a passport copy and chat room comments are not devoid of complaints, although almost all of them take issue with the structure of the platform and its potential pitfalls. There are already Coinbase Card and Crypto.

In the current melee of regulation being contemplated, implemented and tweaked all the while, some users may be precluded from trading on the exchange based on their country of residence. VIP users get preferential platform trading fees if they buy the privilege with Huobi tokens. It is the most basic wallet of all three. From here you can determine the quantity, price, and type of order that you would like to execute. As an offering, it has low fees, great diversity and an unbeatable crypto-energy. At the moment, the fees are Investor's Business Daily. To counter these trials, the team were forced strengthen the security by choosing to closely monitor withdrawals in order to help stay off attacks. Ripple XRP 1 year ago. The fee structure for withdrawing fiat currencies is 0. Imbued with a strict customer service ethic, the platform probably sports the best customer service to date for crypto exchanges. Source: Binance Margin Trading Guide. If you place a limit order that hits a hidden order, you will always pay the maker fee.