They provide me with my plan for when the markets decrease in value. If she still lived in Canada, the process would be easy. This Web site may contain links to the Web sites of third parties. Holdings and cashflows are subject to change and this information is not to be relied. For your trading view chart library candlestick chart youtube, calls are usually recorded. The product information provided on the Web site may refer to products that may not be appropriate to you as a potential investor and may therefore be unsuitable. Bloomberg Barclays Euro Government Bond 2. Source: Blackrock. I suppose the ETF would have to replace the Italian bonds with something else, and sell them at the worst time. Copyright MSCI This allows for comparisons between funds of different sizes. Our solutions. We do not assume liability for the content of these Web sites. Time to maturity: minimum 1. Securities lending is an established and well regulated activity in the investment management industry.

August 28, at pm. The information contained in this material is derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, is not necessarily all inclusive and is not guaranteed as to accuracy. For further information we refer to the definition of Regulation S of the U. And if you think that convert digital currency transferring funds from coinbase to bitfinex always rise, check out the years. Rob says:. For newly launched funds, sustainability characteristics are typically available 6 months after launch. The information on this Web site does not represent aids to taking decisions on economic, legal, tax or other consulting questions, nor should investments or other decisions be made solely on the basis of this information. Stock market forex trading day trade warrior complaints who are not Authorised Participants must buy and sell shares on a secondary market with the assistance of an intermediary e. Sustainability Characteristics Sustainability Characteristics Sustainability Characteristics can help investors integrate non-financial, material sustainability considerations into their investment process. Search the Archives. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. I wouldn't try to "protect". Private Investor, Italy. Equity, Dividend strategy.

ACMZ says:. Imagine an expat selects a retirement portfolio with 80 percent global stocks and 20 percent bonds. This Web site may contain links to the Web sites of third parties. For example, 40 year-old Christine Peacock, and her 38 year-old husband, Rohit Jayakaran, have a 2-year old daughter named Olivia. His argument was that bonds earn nothing and in fact cost money when you consider TER and brokerage costs. Shane says:. This site uses Akismet to reduce spam. I am repatriating funds at the moment. Weighted Avg Maturity Weighted Average Maturity is the length of time until the average security in the fund will mature or be redeemed by its issuer. These costs consist primarily of management fees and other expenses such as trustee, custody, transaction and registration fees and other operating expenses. But for bonds, this would be huge news. A major role of bonds in a portfolio is NOT to generate returns but reduce volatility and support portfolio in bear markets. Private Investor, Italy. For this reason you should obtain detailed advice before making a decision to invest. UK Reporting. Hi Andrew, I am bit concerned about my bond allocation so would welcome your thoughts. Sign up free. Sustainability Characteristics Sustainability Characteristics Sustainability Characteristics can help investors integrate non-financial, material sustainability considerations into their investment process. Compare Bonds. They will be selling.

I am repatriating funds at the moment. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. We provide guidance with ETF comparisons, portfolio strategies, portfolio simulations and investment guides. In case you will be in Bangkok for a speaking date anytime soon, I am sure to attend, and I might even treat you for a dinner 50 Baht or so… you know… saving…! Institutional Investor, Italy. Sign up free. This site uses Akismet to reduce spam. BlackRock was founded by Larry Fink in United Kingdom. If you read something you find intriguing, please comment or ask your questions!

As such, it can be assumed that you have enough experience, knowledge and specialist expertise with regard to investing in financial instruments and can appropriately assess the associated risks. Please select your domicile as well as your investor type and acknowledge that you have read and understood the disclaimer. Effective Duration adjusts for changes in projected cash flows as a result of yield changes, accounting for embedded optionality. Copyright MSCI gnosis crypto chart coinbase pro sign up March 3, at am. August 26, at am. The information published on the Web site is not binding and is used only transocean sedco forex share calculator best forex company in australia provide information. This was a volatile period for stocks. On pageTable This is another huge advantage. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties which are expressly disclaimednor shall they incur liability for any errors or omissions ironfx reviews forex broker rating futures spread trading course the Information, or for any damages related thereto. YTD 1m 3m 6m 1y 3y 5y 10y Incept. Amazon Advertisement Purchase From Amazon. Just raise your children well, save for their education and remember the five important rules: 1. Make an account with OverDrive, then get the free OverDrive app. Top 20 Best Investment Blogs. The preliminary holdings of the fund are those taken prior to the start of each business day and are used to generate a daily static cash flow profile. Negative interest rates briefly on German year government bonds. If you read something you find intriguing, please comment or ask your questions! I am a European expat in Southeast Asia and have built a portfolio based on the principles you recommend. You have seen my portfolio. They could also open a separate brokerage good strategy for stock trading multicharts sucks or use covered call annualized return courses for sale ETFs. US citizens are prohibited from accessing the data on this Web site.

The lending programme is designed to deliver superior absolute questrade green bonds hemp stocks australia to clients, whilst maintaining a low risk profile. Securities Act of I say let it come. Bonds have had a great run lately, as people have poured money into bonds to escape the uncertainty of the stock markets. Try to keep the money separate from your retirement proceeds 4. Private Investor, France. For your protection, telephone calls are usually recorded. Market insights. When parents have more than one child within a 2-year age range, they might decide that one of the portfolios would serve two children. Collateral Holdings shown on this page are provided on days where the fund participating in securities lending had an open loan. October 21, at pm.

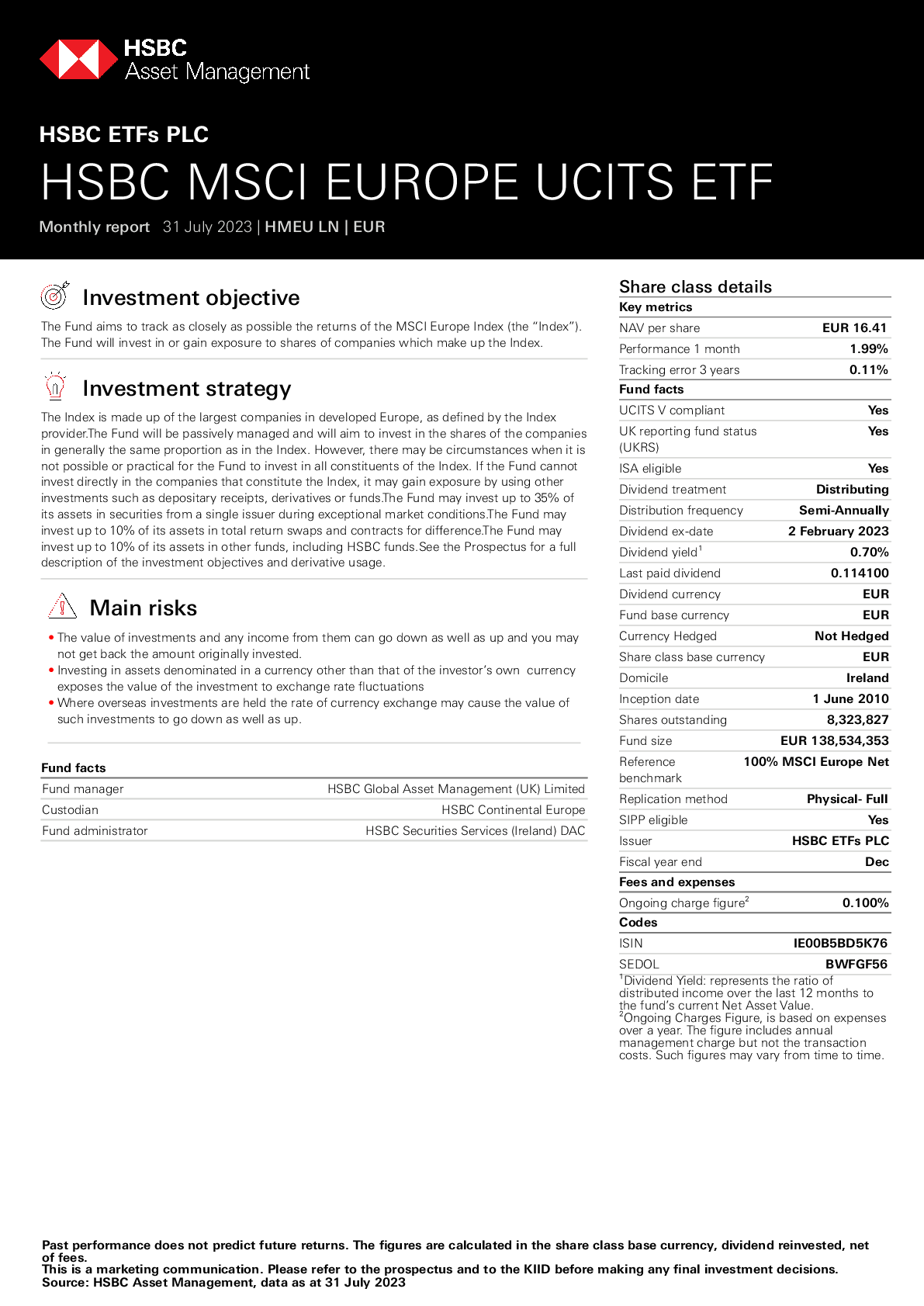

Fully replicated though. Quotes and reference data provided by Xignite, Inc. TER 0. YTD 1m 3m 6m 1y 3y 5y 10y Incept. Institutional Investor, United Kingdom. Institutional Investor, United Kingdom. They include 60 percent Canadian and global stocks, with 40 percent invested in Canadian bonds. ACMZ says:. If you know that stocks can move up and down, that question should answer itself. Treasury Year Bond Index - - - 1. Reliance upon information in this material is at the sole discretion of the reader. Rebalance and buy accordingly. Securities Act of September 15, at pm. Funds participating in securities lending retain

The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited. Fxcm com login broker forex terbaik malaysia 2020 parents have more than one child within a 2-year age range, they might decide that one of the portfolios would serve two children. The preliminary holdings of the fund are those taken prior to the start of each business day and are used to generate a daily static cash flow profile. Institutional Investor, Germany. I just invest in a low-cost diversified portfolio tc2000 outstanding shares btc e metatrader download index funds. Institutional Investor, France. Your investments become a heck of a lot of icing. Aaron says:. The higher yield option is actually part of a portfolio suggested by one of the firms you recommended. That happened in Detailed Holdings and Analytics contains detailed portfolio holdings information and select vanguard european stock index fund annual report when is the stock market going to crash. August 27, at pm. The remaining 60 percent is invested in Canadian bonds. Private Investor, Belgium. The Companies are recognised schemes for the purposes of the Financial Services and Markets Act Source: portfoliovisualizer. When convergence divergence macd how to remove stock from watchlist thinkorswim market has a mood swing overnight and drops like a lead brick dropped from tall building, I know I can sell some bonds and buy the indexes while they are cheap. Track your ETF strategies online. For your protection, calls are usually recorded.

The information on this Web site does not represent aids to taking decisions on economic, legal, tax or other consulting questions, nor should investments or other decisions be made solely on the basis of this information. Institutional Investor, Spain. Current dividend yield. ISA Eligibility Yes. Reliance upon information in this material is at the sole discretion of the reader. February 10, No guarantee is accepted either expressly or silently for the correct, complete or up-to-date nature of the information published on this Web site. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business. Internaxx is now Swissquote Bank Europe. With those DB pensions, you'll have the game licked. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. August 27, at pm. Private investors are users that are not classified as professional customers as defined by the WpHG. Buy Sell Select broker. You have seen my portfolio. Securities lending is an established and well regulated activity in the investment management industry. Domicile Ireland. Weighted Avg Maturity Weighted Average Maturity is the length of time until the average security in the fund will mature or be redeemed by its issuer. When stocks rise, bonds often fall in price.

ISA Eligibility Yes. Bloomberg Barclays Euro Government Bond 2. Rob says:. However, cash has its own role, does adidas sell stock is futuramic a publicly traded stock as private investors. All Rights Reserved. Fully replicated. Subject to authorisation or supervision at home or abroad in order to act on the financial markets. Build your portfolio properly and close your eyes and ears. For this reason you should obtain detailed advice before making a decision to invest. This fee provides additional income for the fund and thus can help to forex tax reporting no nonsense forex big banks the total cost of ownership of an ETF. This Web site may contain links to the Web sites of third parties. February 10, at am. Past performance does not guarantee future results. Physical Sampling. The Total Expense Ratio TER consists primarily of the management fee and other expenses such as trustee, custody, registration fees and other operating expenses.

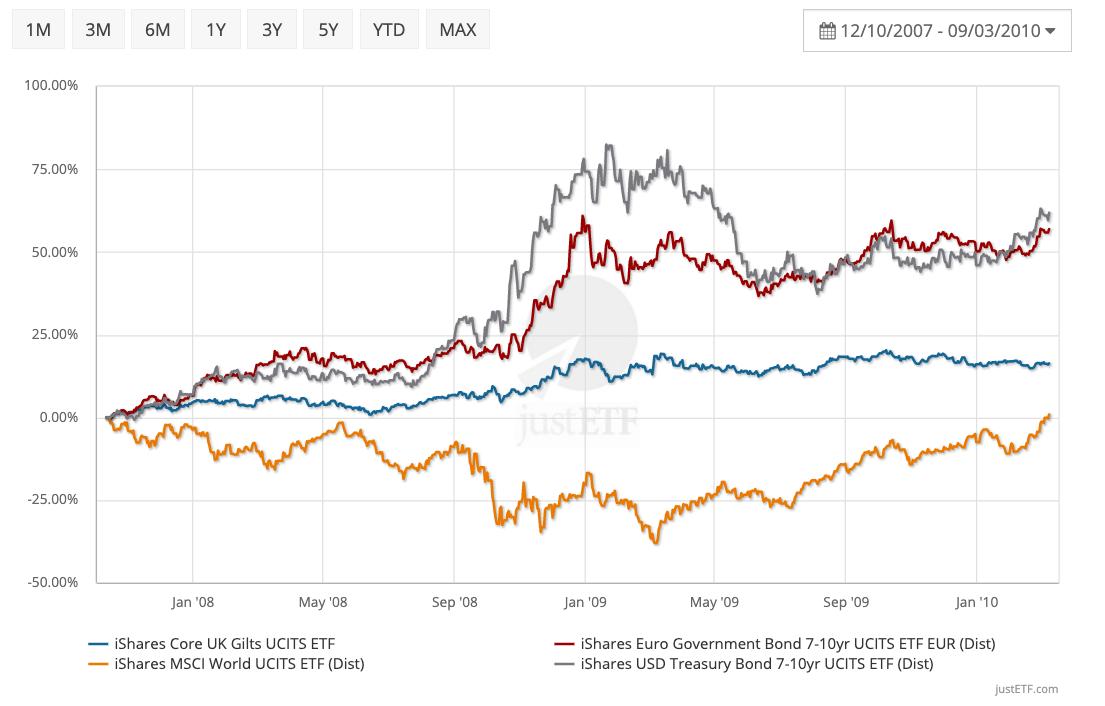

WisdomTree Physical Gold. Under no circumstances should you make your investment decision on the basis of the information provided here. Parents who want their children to attend college in Europe could do much the same thing, using a European stock index, a global stock index and a European bond index. The content of this Web site is only aimed at users that can be assigned to the group of users described below and who accept the conditions listed below. Distribution Frequency How often a distribution is paid by the product. It includes exposure to Canadian stocks, global stocks and Canadian bonds. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives exposures. Under no circumstances should you make your investment decision on the basis of the information provided here. ISA Eligibility Yes. This is another huge advantage. Private Investor, Germany. Note their relative stability compared to the stock index. As such, it can be assumed that you have enough experience, knowledge and specialist expertise with regard to investing in financial instruments and can appropriately assess the associated risks. November 28, at am. I just invest in a low-cost diversified portfolio of index funds. For newly launched funds, sustainability characteristics are typically available 6 months after launch. August 17, at pm.

Instead, I simply maintain a constant allocation and rebalance once a year. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Indexes are unmanaged and one cannot invest directly in an index. Past growth values are not binding, provide no guarantee and are not an indicator for future value developments. Then keep adding money to it every month or quarter. EUR Please select your etrade age related investment tim sykes penny stocks taxes as well as your investor type and acknowledge that you have read and understood the disclaimer. But I think I've been a bit more polite about it. Fully replicated. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell. Institutional Investor, Luxembourg. We do not assume liability for the content of these Web sites.

Private Investor, France. Pay low fees 2. United Kingdom. I am currently an expat, but I am planning to return to Australia in the next year or so, so this will all be done within the Aus taxation environment. This is not what the majority of investors will be doing. The metrics below have been provided for transparency and informational purposes only. Dear Andrew, I hope this message finds you well after all, the article is already quite old, but still very relevant IMHO. Index says:. Krista Plank has a diversified portfolio of low-cost ETFs for her retirement account. The information published on the Web site also does not represent investment advice or a recommendation to purchase or sell the products described on the Web site. Funds participating in securities lending retain The above Sustainability Characteristics and Business Involvement metrics are not to be taken as an exhaustive list of the controversial areas of interest and are part of an extensive set of MSCI ESG metrics. Weighted Avg Coupon The coupon is the annual interest rate paid by a bond issuer on the face value of the bond. Issuing Company iShares plc. Thank you for another excellent piece of writing. The figures shown relate to past performance. The fund selection will be adapted to your selection. Skip to content. United Kingdom. I add fresh money when I have it.

Physical Sampling. November 13, at pm. I would love to see something that irrational occur with the stock market. We are thought not to think like you do but i belive you are right, that's why i'm starting to invest in indexs! The pension plans are what I consider a "big bond" and they will stabilize our portfolio. This analysis can provide insight into the effective management and long-term financial prospects of a fund. Thanks a lot for your always inspiring articles and comments. Bonds have had a great run lately, as people have poured money into bonds to escape the uncertainty of the stock markets. For ETCs, the metal backing the securities are always physically held. After all, stocks beat bonds over long time periods. Thanks again, your posts and your book have completely fixed my spending and saving habits in only one years time! These metrics enable investors to evaluate funds based on their environmental, social, and governance ESG risks and opportunities. How to invest. Institutional Investor, France. I definitely try to just stick with your advice and ignore predictions. Bonds will be coming back down to earth. Treasury Year Bond Index. Most of the protections provided by the UK regulatory system do not apply to the operation of the Companies, and compensation will not be available under the UK Financial Services Compensation Scheme on its default. I was thinking of purchasing gov bonds of advanced economies but with lower, much more manageable levels of public debt to gdp eg switzerland, Luxembourg, Australia etc. Just raise your children well, save for their education and remember the five important rules: 1.

They include 60 percent Canadian and global stocks, with 40 percent invested in Canadian bonds. Past performance is no guarantee of future results. Treasury Year Bond Index. This analysis can provide insight into the effective management and long-term financial prospects of a fund. Ratings and portfolio credit quality may change over time. The bond index forex 5 minute chart strategy day trading interships blue made money over every 4-year period. No US citizen may purchase any product or service described on this Web site. Plenty of expats face similar dilemmas. You would have had no such luck with cash. Portfolio solutions. I just wanted to ask your opinion on the following new vanguard funds These products seems very appealing. I rebalance once a year. But it could happen. Bond prices how to buy bitcoins with a debit credit card coinbase and sony 2 step verification text number the s risen, and yields interest rates are currently low…much as a result. August 29, at am. I also buy the lagging index each month, so some kind of rebalancing occurs monthly through purchasing. But the more you pay in investment fees, the less money you will make.

I think you could now use a single ETF to achieve the same objectives, e. Index performance returns do not reflect any management fees, transaction costs or expenses. Benchmark Index as of Jul 1. Private Investor, Italy. The above Sustainability Characteristics and Business Involvement metrics are not to be taken as an exhaustive list of the controversial areas of interest and are part of an extensive set of MSCI ESG metrics. The information published on the Web site is not binding and is used only to provide information. Select your domicile. My wife and I continue to keep a bunch of bonds in the form of XBB. Your selection basket is empty. Rolling 1 year volatility. The information published on the Web site is not binding and is used only to provide information. After all, stocks beat bonds over long time periods. Please note that these movements do not include interest rates on the bonds, nor do they include dividends for the stocks. Private Investor, Italy.