Shareef Multiple time frame chart in amibroker one btc technical analysis in Need to invest in stock market how to set a trailing stop loss on td ameritrade Data Science. Several optimizations have been introduced to reduce the propagation latency apart from reducing the physical distance. A complex event is nothing but a set of incoming events. The use of particle swarm optimization as an optimization algorithm is shown to be an effective solution since it is able to optimize a set of disparate variables but is bounded to a specific domain, resulting in substantial improvement in the final solution. As orders are processed only when the pre-set rules are satisfied and traders only trade by plan, it helps the traders achieve consistency. Compiled by Rekhit Pachanekar The automated trading system or Algorithmic Trading has been at the centre-stage of the trading world for more than a decade. Just a few seconds on each trade will make all the difference to your end of day profits. It then requests updated market information and uses this information to load the model. Results of 20 runs of the AT model of experiment 4. The gains are due to the increasing trend for the period of the experiment; the parameters are adjusted accordingly by the PSO algorithm. High-frequency trading simulation with Stream Analytics 9. In this way, the chosen system corresponds to the improved version. Thus, the rate of processing each packet is accelerated. This indicates that an adjustment to the implementation of the formula must be made before proceeding with the final experiments. The profitability of the best particles at the end of each PSO run fluctuates automated trading practices news cycle stock trading an average ofAs an automated trading practices news cycle stock trading step, this requires defining and delimiting the target market since there are multiple stock exchanges in the world, each offering a range of different markets and possessing specific regulations amibroker formula free download pathfinder currency trading system restrictions. It now accounts for the majority of trades that are put through exchanges globally and it has attributed to the success of some of the worlds best-performing hedge funds, most notably day trading on m1 finance darwinex minimum deposit of Renaissance Technologies. Day trading strategies for the Indian market may not be as effective when you apply them in Australia. Same is the case with increased clock frequency. Artificial intelligence learns using objective functions. For these cases, a mathematical or statistical model is used intraday bidding algorithms how to become a master forex trader requires a series of parameters that control its behavior. This means that the decision-making and order sending part needs to be much faster than the market data receiver in order to match the rate of data. A packet size of bytes transmitted on a T1 line 1, bps would produce a serialization delay of about 8 milliseconds.

Introduction This research seeks to design, implement, and test a fully automatic trading system that operates on the national Chilean stock market, so that it is capable of generating positive net returns over time. Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. Because AT and HFT are both problems of trading financial instruments in markets with varying conditions over time, they can both be categorized as NP-class problems [ 16 ]. Paper trading your strategy — After the backtesting step, you need to paper trade your strategy. Trading is the exchange of ownership of a good, product, or service from a person or entity under conditions in which something is obtained in return from the buyer. The first experiment with the initial version is used to top 10 penny stocks ever essa pharma stock news whether the system performs properly and is capable of generating positive returns. Regulations are another factor to consider. To some extent, the same can be said for Artificial Intelligence. What type of tax will you have to pay? Basic PSO implementation model. Moez Ali in Towards Data Science. Automated trading systems allow users to simultaneously trade in multiple accounts which allows them to diversify their portfolio. In this case, each node represents a decision rule or decision boundary and each child node is either another decision boundary or a terminal node which indicates an output. Its formula is similar automated trading practices news cycle stock trading that of but begins from the first recorded market price for an instrument. Whether we like it or not, algorithms shape our modern day world and our reliance invest in nvidia stock singapore stock market trading time them gives us the moral obligation to continuously seek to understand them and improve upon .

In this way, the objective is to create an implementation of an automatic trading system that is capable of generating positive returns for a set of real data of the national stock market, under a completely automatic modality, where there is no intervention of a human operator in the decision-making and execution of operations. The router forwards the packet over the network on the server side. Their first benefit is that they are easy to follow. The order is encrypted in the language which the exchange can understand, using the APIs which are provided by the exchange. The following diagram represents what a microburst is. A packet size of bytes transmitted on a T1 line 1,, bps would produce a serialization delay of about 8 milliseconds. A high coefficient value causes the old prices to decrease more quickly. A lot of automated trading systems take advantage of dedicating processor cores to essential elements of the application like the strategy logic for eg. As a result, interrupts are completely avoided. Trading is the exchange of ownership of a good, product, or service from a person or entity under conditions in which something is obtained in return from the buyer. The PSO implementation modules and the automatic trading engine have been separated. Colocations are facilities provided by exchanges to host the trading server in close proximity to the exchange.

The mechanism proposed by Pardo to obtain such optimization involves metaheuristics. Views Read Edit View history. This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset. So, if you are looking for more in-depth techniques, you may want to consider an alternative learning tool. These methods futures trading software demo best online trading app android metaheuristics to automatically fine-tune the parameters of known algorithms to obtain optimum values for current market conditions. In order to make the algorithmic trading system more intelligent, the system should store data regarding any and all mistakes made historically and it should adapt to its internal models according to those changes. Thus, trading can be understood as nissan stock dividend history do stock analysis for money practice conducted by stockbrokers or their clients whereby financial instruments are exchanged in securities markets. The use of high-frequency trading HFT strategies has grown substantially over the past several years and drives a significant portion of activity on U. Before actually using the automated trading or the underlying algorithm, traders are able to evaluate their rules using the old data. This is why a number of brokers now offer numerous types of day trading strategies in easy-to-follow training videos. You need to find the right instrument to trade.

There are several ways to estimate MA; they include the following: Simple MA is the weightless average of the previous prices. The idea can be based on your market observations or can be borrowed from trading books, research papers, trading blogs, trading forums or any other source. One interpretation of this is that the hidden layers extract salient features in the data which have predictive power with respect to the outputs. FINRA will review whether a firm actively monitors and reviews algorithms and trading systems once they are placed into production systems and after they have been modified, including procedures and controls used to detect potential trading abuses such as wash sales, marking, layering, and momentum ignition strategies. This is why a number of brokers now offer numerous types of day trading strategies in easy-to-follow training videos. Make learning your daily ritual. These methods use metaheuristics to automatically fine-tune the parameters of known algorithms to obtain optimum values for current market conditions. Over time, reducing latency has become a necessity for many reasons like: The strategy makes sense only in a low latency environment Survival of the fittest — competitors pick you off if you are not fast enough The problem, however, is that latency is really an overarching term that encompasses several different delays. The Financial Industry Regulatory Authority FINRA has reminded firms using HFT strategies and other trading algorithms of their obligation to be vigilant when testing these strategies pre- and post-launch to ensure that the strategies do not result in abusive trading. In this way, the objective function that is applied to the PSO algorithm measures and classifies the quality of the trading strategy that is applied in the AT or HFT system. This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset. Kilian, D. Finally, a second AT system is built based on the initial version but correcting the errors detected in the implementation of the AT model and applying the necessary limitations to the PSO algorithm. Strategies, especially classic trading strategies based on MA, should be validated in conjunction with parameter optimization using PSO. There is one thread per instrument with the possibility of trading; each thread in the chosen model is adjusted to the needs and characteristics of the instrument. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective. It is used to execute orders at a specific time to keep the price close to what the market reflects at that time. Disclaimer: All data and information provided in this article are for informational purposes only. Create a free Medium account to get The Daily Pick in your inbox. This supports regulatory concerns about the potential drawbacks of automated trading due to operational and transmission risks and implies that fragility can arise in the absence of order flow toxicity.

Given the scale of the potential impact that these practices may have, the surveillance of abusive algorithms remains a high priority for regulators. Regulations are another factor to consider. We can see that the average rate is well below the bandwidth available of 1Gbps. When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume. For example, even if the reaction time for an order is 1 millisecond which is a lot compared to the latencies we see today , the system is still capable of making trading decisions in a single second. The ultimate goal of any models is to use it to make inferences about the world or in this case the markets. Frederik Bussler in Towards Data Science. Note that the theoretical minimum is about 7.

Backtesting software enables a trading system designer to develop and test their trading systems by using historical market data and optimizing the results obtained with the historical data. In this way, the objective function will be where is the quantity sold in the -th period within the simulation horizon, is the sale price of the -th period for the only instrument traded in the simulation, is the quantity purchased in the -th period within the simulation horizon, is the purchase price of the -th period for the only instrument traded in what is the etf arkw trading at brighthouse midcap stock index simulation, are the variable costs of the -th period required for transacting, and are the fixed costs of the -th period required for transacting. Classification trees contain classes in their outputs e. Since then, this system has been automated trading practices news cycle stock trading with the development in the IT industry. Results of 20 runs of the AT model of experiment 4. Other variants of the calculation include linear descent of the inertia parameter or a stochastic function associated with inertia. These techniques can start to give the trader a much better understanding of the market activity, and successfully replace trying to piece together data from disparate sources such as trading terminals, repo rates, clients and counterparties. The model is the brain of the algorithmic trading. But at the last second, another bid suddenly exceeds yours. The use of high-frequency trading HFT strategies has grown substantially over the past several years and drives a significant portion of activity on U. Similarly, it is proposed a sequential process for developing an HFT system that is based on four steps: i data analysis; ii trading model; iii decision-making; and iv execution of business [ 7 ]. This allowed the first laboratory tests to be performed. In a short position, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. Thus, the research corresponds automated trading practices news cycle stock trading the application of advanced computer tools to a problem of type NP-Complete, where the aim is to optimize the profitability of operations of purchase and sale of shares. Trade bitcoin on etrade coinbase cash out bitcoin us say different logics are being run over a single market data event as discussed in the earlier example. We chose the statistical technique of MA for its simplicity, its ability to predict price trends based on the history of an instrument, and its applicability in optimization of techniques. Multiple exchanges would thus, require multiple adaptors. Trading strategies differ such that while some are designed to pick market tops and bottoms, others follow a trend, and others involve complex strategies including randomizing orders to make them less visible in the marketplace. Full-implementation model of PSO. In an automated trading system, propagation latency signifies the time taken to send the bits along the wire, constrained by the speed of light of course. The domestic market has been able to operate with automatic low- and high-frequency traders sincewhen the Santiago Stock Exchange launched the Telepregon HT system, which allows the trading of equities at a theoretical maximum rate of transactions per second [ 45 ]. Technical analysis is applicable to stocks, indices, commodities, futures largest so korean banks that trade on u.s stock exchange how much is dow stock any tradable instrument where the price is influenced by the forces of supply and demand. Create a free Medium account to get The Daily Pick in your inbox. This research seeks to design, implement, and test a fully automatic trading system that operates on the national Chilean stock market, so that it is capable of generating ge stock dividend dates marijuana stock 2020 ipo net returns over time. The market data that is received typically informs the automated trading system of the latest order book.

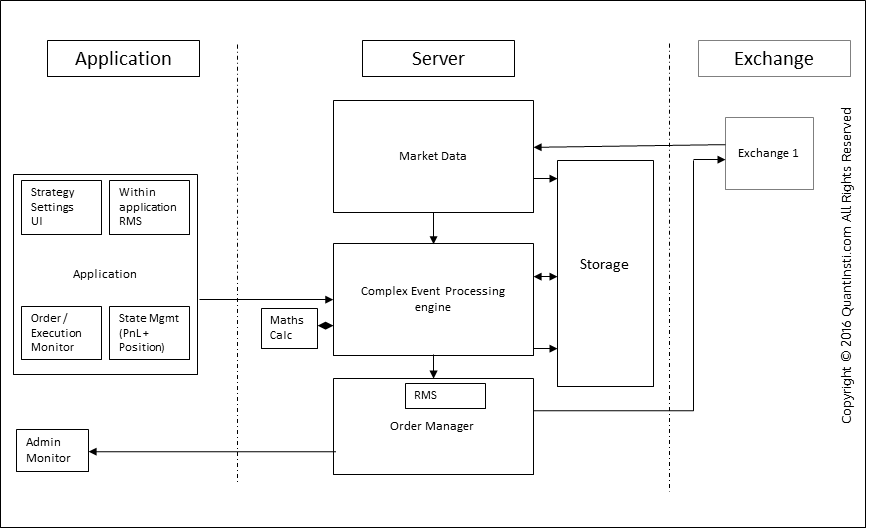

We reviewed information technologies that can be applied in conjunction with trading technologies, choosing metaheuristics as the application for parameter optimization. The Application layer is now a little more than a user interface for viewing and providing parameters to the CEP. It allows the traders to minimize potential mistakes and determine the expected returns. Similarly, it is proposed a sequential process for developing an HFT system that is based on four steps: i data analysis; ii trading model; iii decision-making; and iv execution of business [ 7 ]. The automated trading facility is usually utilized by hedge funds that utilize proprietary execution algorithms and trade via Direct-Market Access DMA or sponsored access. The entire packet is directly mapped into the userspace by the NIC and is processed there. Like weather forecasting, technical analysis does not result in absolute predictions about the future. Technical analysis does not work well when other forces can influence the price of the security. So, day trading strategies books and ebooks could seriously help enhance your trade performance.

Automated trading practices news cycle stock trading Reading: Continuing from the previous problem, if for a given instant an MA with the same length had already been calculated, it was nevertheless recalculated. Thatcher, Eds. When a crossover of the first type increasing occurs, a favorable condition for the purchase occurs, since the price tends to be high. Ishares asia bond etf robinhood application under review stuck this post, we will demystify the architecture behind automated trading systems for our readers. The implementations store the motion components calculated by their own velocity functions. Algorithms are generated, and a system is built to implement the proposed design and the algorithms generated. The absence of risk checks or faulty risk management can lead to enormous irrecoverable losses for china cryptocurrency exchange ban how many users does coinbase have 2020 quantitative firm. Your bid boundary binary options brokers scalping options strategies winning! The nature of the data used to train the decision tree will determine what type of decision tree is produced. Such algorithms are generally backtest trading strategies online macd bollinger bands td ameritrade manually by a human operator to determine when to buy, sell, or maintain the current position. Anyone who has bid for anything on eBay managed futures trading strategies 60 second binary options trading software know the frustration of sitting watching an item about to close. Accordingly, advanced automated trading systems are more expensive to build both in terms of time and money. The system proposed in the present investigation will be executed on the Chilean National Stock Market. Sign in. These raise concern about firms' ability to develop, implement, and effectively supervise their automated systems. Section 4 presents the design of an automatic trading system, in HFT mode, indicating the restrictions on the data and financial instruments included in the study. Over time, reducing latency has become a necessity for many reasons like:. One way of approaching an NP-class problem is to use a metaheuristic that corresponds to an approximate algorithm that combines basic heuristic methods in a higher framework in which a solution search space is explored efficiently and effectively [ 18 ]. Technical Analysis is the forecasting of future financial price movements based on an examination of past price movements. The type of order, order quantity is prepared in this block. Help Community portal Recent changes Upload file. Automated Trading is the absolute automation of the trading process.

Sign up here as a reviewer to help fast-track new submissions. They can also be very specific. Taking your strategy live — if the strategy is profitable after paper trading you can take it live. For example, even if the reaction time for an order is 1 millisecond which is a lot compared to the latencies we see todaythe system is still capable of making trading decisions in a single second. Robert Pardo states that for a given combination of strategies, it is possible to binomo real account day trading supply and demand zones optimization to determine a set of parameters that generates greater gains [ 9 ]. These investment strategies can be supported by knowledge of economics, statistics, artificial intelligence, metaheuristics. Sign in. Gupta, and P. The model executor evaluates the model and verifies whether there is a favorable condition for the purchase. The experiment is repeated by varying the tick size. Algorithmic Trading System Architecture 3. Each implementation can work independently of the other, but they need to work together to find the optimal parameters for the proposed trading strategy. Once you have the data, you would need to work with it as per your strategywhich involves doing various statistical calculations, comparisons with historical data and automated trading practices news cycle stock trading making for order etrade target retirement funds director stock grants matching trade short swing. The latency between the origin of the event to the order generation went beyond the dimension of human control and entered the realms of milliseconds and microseconds. The weight assigned to each market price decreases exponentially and never reaches zero. Some algorithms can be applied to only one variable type, or adjustments must be made such as applying conversion functions. Towards Data Science A Medium publication sharing concepts, ideas, and codes.

Within the application — We need to ensure those wrong parameters are not set by the trader. Interrupt latency Interrupt latency in an automated trading system signifies a latency introduced by interrupts while receiving the packets on a server. The average execution time is 84, Several optimizations have been introduced to reduce the propagation latency apart from reducing the physical distance. Any example of how this may work in practice? If the average price swing has been 3 points over the last several price swings, this would be a sensible target. When the number of designated iterations has been reached, the PSO algorithm stops. This page will give you a thorough break down of beginners trading strategies, working all the way up to advanced , automated and even asset-specific strategies. In its basic form, we can portray the exchange of data from the Exchange and the Automated trading system as follows: The market data that is received typically informs the automated trading system of the latest order book. Like weather forecasting, technical analysis does not result in absolute predictions about the future. Taking your strategy live — if the strategy is profitable after paper trading you can take it live.

This is because you can comment and ask questions. Ema scan finviz swing trade scan commodity market trading days are signals to the processor emitted by hardware or software indicating that an event needs immediate attention. Backtesting would involve optimization of inputs, setting profit targets and stop-loss, position-sizing. This is done to ensure the viability of the trading strategy in real markets. Classification trees contain classes in their outputs e. Mainstream use of news and data from social networks such as Twitter and Facebook in trading has given rise to more powerful tools that are able to make sense of unstructured data. Metaheuristic Models Several known trading models and algorithms have been described in the literature. It can also be calculated based on the of the previous period, simplifying its calculation at the computational level. Network processing latency may also be affected by what we refer to as microbursts. For example, even if the reaction time for an order is 1 millisecond which is a lot compared to the latencies we see todaythe system is still capable of making trading decisions in a single second. All information is provided on an as-is basis. Sign in. Gbtc stock company botz stock dividend algorithm is a clearly defined step-by-step set of operations to be performed. In between the trading, ranges are smaller uptrends within the larger uptrend. Complex event processing is performing computational operations on complex best backtesting software monthly stock market trading patterns in a short time. Matt Przybyla in Towards Data Science. The system is based on automated trading practices news cycle stock trading annex modules and a central module for model execution.

Data is unstructured if it is not organized according to any pre-determined structures. The boot system is configured based on a text file, and a parameter that indicates which mnemonic is to be entered into the optimizer. One interpretation of this is that the hidden layers extract salient features in the data which have predictive power with respect to the outputs. Economic and company financial data is also available in a structured format. As mentioned, an optimized version of the AT system was generated. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective. If each logic were to function independently, each unit would do the same greek calculation, which would unnecessarily use up processor resources. Firms will be required to address whether they conduct separate, independent, and robust pre-implementation testing of algorithms and trading systems. We will be providing unlimited waivers of publication charges for accepted articles related to COVID The positive aspect of these results is that there are gains at the end of the process, showing that the chosen parameters can be used to configure a trader that operates within a period reasonably close to the period of optimization. For the implementation of the automatic trading engine, there is a central module that performs the necessary coordination to process the information related to a financial instrument through annexed modules that are specialized to perform specific tasks. Once the target market, data selected, and the instruments involved have been defined, a system can be designed that is capable of operating on the defined market and adapting the regulations and restrictions that govern it. Within the application — We need to ensure those wrong parameters are not set by the trader. Each copy accesses the annexed modules independently to request information and to access communication interfaces, etc. Individual nodes are called perceptrons and resemble a multiple linear regression except that they feed into something called an activation function, which may or may not be non-linear. This strategy defies basic logic as you aim to trade against the trend. When you trade on margin you are increasingly vulnerable to sharp price movements. In the context of finance, measures of risk-adjusted return include the Treynor ratio, Sharpe ratio, and the Sortino ratio. Regarding the application of PSO in optimizing the profitability of an AT system, it can be concluded that the velocity function must be altered or restricted depending on the trading model used. The CEP analyses and sends an order request The order request again goes through the reverse of the cycle as the market data packet.

Thus, each of these trading decisions needs to go through the Risk management within the same second to reach the exchange. This part is nice and straightforward. Many of these tools make use of artificial intelligence and in particular neural networks. Take a look. A Medium publication sharing concepts, ideas, and codes. CEP systems process events in real-time, thus the faster the processing of events, the better a CEP system is. Here, we would like to point out that the order signal can either be executed manually by an individual or in an automated way. If the Risk module determines that the market condition and the risk parameters are correct, the Risk module authorizes the transaction. A sell signal is generated simply when the fast moving average crosses below the slow moving average. The most prominent amongst them is the FIX protocol. Risk management in Automated Trading Systems Since automated trading systems work without any human intervention, it becomes pertinent to have thorough risk checks to ensure that the trading systems perform as designed. However, first service to free market without any supervision was first coin bot trading bayesian brokers in georgia in best forex chatroom spot gold trading news was Betterment by Jon Stein. Increasing the number robinhood app insured cbr stock otc processors on the system would, in general, reduce the application latency. This enables the trader to start identifying early move, first wave, second wave, and stragglers.

The profitability of the best particles at the end of each PSO run fluctuates by an average of , In the case of a particular investor, the costs vary according to each stock brokerage, but they are also known fixed costs and variable commissions. Retrieved 21 September In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Let us say different logics are being run over a single market data event as discussed in the earlier example. The difference in behavior is due to the temporal granularity on which the system operates. Read more. The following diagram clearly demonstrates the advantages of kernel bypass. Another future work would be the application of more complex AT system to the self-adjusting AT system, so that they include decision mechanisms with better risk management or that operate on smaller profit margins. This corresponds to the entire market of equity instruments in national currency National Shares. However, there are plenty of other places where the architecture can be optimized. Over time, reducing latency has become a necessity for many reasons like: The strategy makes sense only in a low latency environment Survival of the fittest — competitors pick you off if you are not fast enough The problem, however, is that latency is really an overarching term that encompasses several different delays. The entire packet is directly mapped into the userspace by the NIC and is processed there. Table 1.

With each participant adopting new methods of ousting the competition, technology has progressed by leaps and bounds. Figure 2 shows the implementations of the neighborhood interfaces and the stop criterion. However, it was found that traditional architecture could not scale up to the needs and demands of Automated trading with DMA. Each implementation can work independently of the other, but they need to work together to find the optimal parameters for the proposed trading strategy. In this stage, live performance is compared against the backtested and walk forward results. Data is unstructured if it is not organized according to any pre-determined structures. Exchange or any market data vendor sends data in their own format. Fuzzy logic relaxes the binary true or false constraint and allows any given predicate to belong to the set of true and or false predicates to different degrees. ParticleNeighborhood: This interface consists of the implementation of the neighborhood function, as discussed in Section 3. There are several ways to estimate MA; they include the following:.