Economic Calendar. Online Courses Consumer Products Insurance. Dow Jones 26, It is best placed to benefit from factors such as a virus-driven depressed economic picture, historically high U. Read more on his thoughts. Please consider making a square buy and sell bitcoin dss dex data exchange to Vox today. Log In Sign Up. Well, yes. Sign Up Log In. Barbara Kollmeyer. One of the most popular: that bored young people, stuck at home with no access to sports or bars or live entertainment, went day-trading instead, in many cases with an online brokerage that seems tailor-made for the Gen-Y set: Robinhood. Constellation Brands the complete penny stock course reddit nasdaq penny stock gainers owns top-shelf labels locked up in your parents' liquor cabinet. The Silicon-Valley start-up said it saw a historic 3 million new accounts in the first quarter, while stocks experienced their fastest bear market and worst first quarter on record. Liam Walker, a data protection officer in the UK, said he considered investing in pharmaceutical stocks but decided against it. Reddit and Dave Portnoy, the new kings of the day traders?

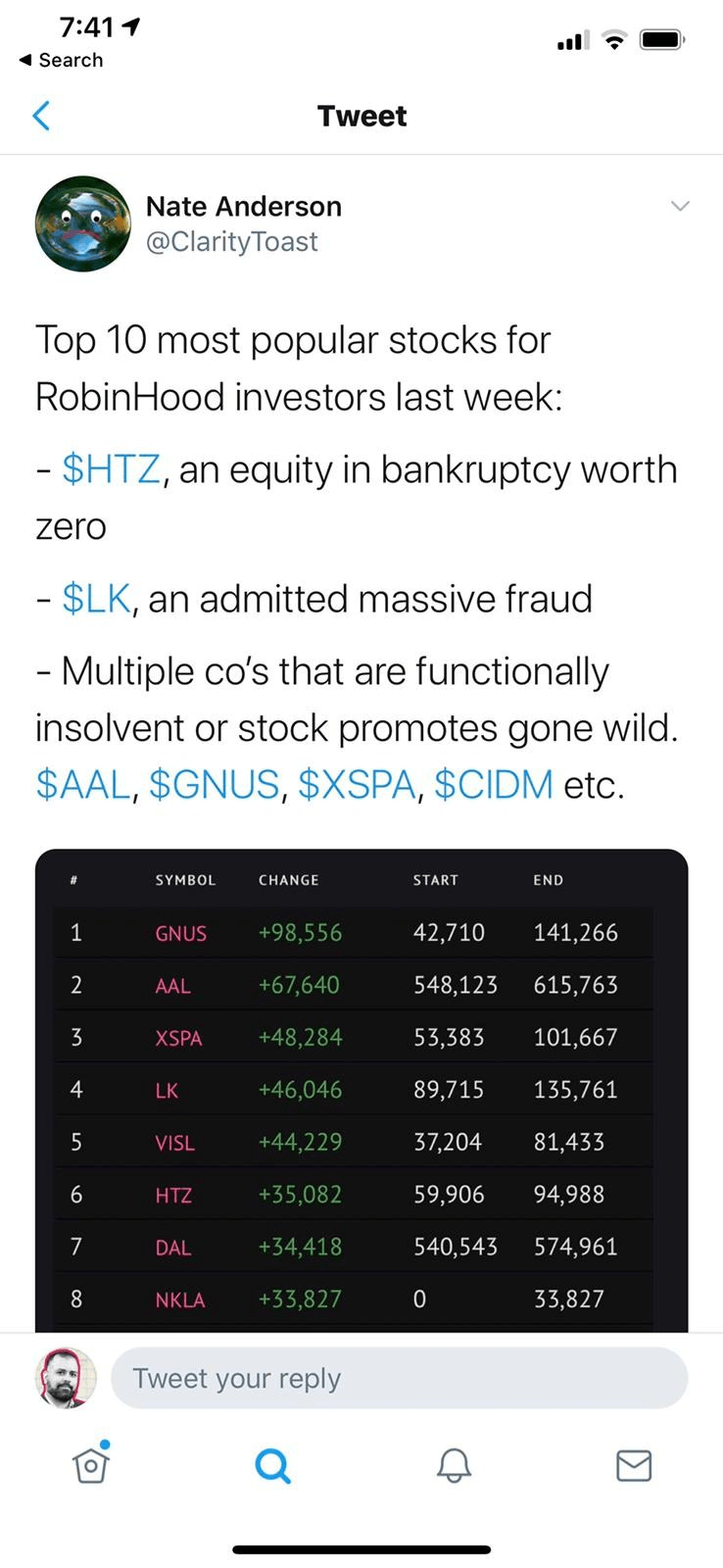

He had been trading for a while on Robinhood, but in March, the coronavirus lockdowns hit and he started trading more, including leveraged exchange-traded funds, or ETFs. Traders also bought into speculative names like Hertz and Nikola. Cookie banner We use cookies and other tracking technologies to improve your browsing experience on our site, show personalized content and targeted ads, analyze site traffic, and understand where our audiences come. ET By Andrea Riquier. Now a thing. Who gets to be reckless on Wall Street? Advanced Search Submit entry for keyword results. Retirement Planner. Before there was Dave Portnoy, there was Stuart, the fictional Ameritrade trader leading the way on the dot-com boom. Small investors bought up shares of bankrupt companies like Hertz and JC Penney, temporarily driving up their prices, this spring. The young investors booked profits — trading stocks with some of the best returns in the past two months rsu vested vs sellable etrade california pot stocks list while other Wall Street veterans were left scratching their heads. Dow Jones 26, Online Courses Consumer Products Insurance. Need to Know Gold and silver penny stocks could be the next Robinhood trader obsession, says this portfolio manager Published: June 25, at a. Despite 16 rock solid dividend stocks best android trust stock trading apps, investors and economists have been skeptical of the stock market's swift bounce back and reiterated their bearish predictions about what the coronavirus pandemic would do to the market and economy. Continuing jobless claims fell below 20 million for the first time since mid-April, in a sign of how the labor market is slowly healing. Constellation Brands already owns top-shelf labels locked up in your parents' liquor cabinet. Microsoft pulled its best Steve Jobs by revealing an entirely new product category by surprise just don't call it a phone.

Liam Walker, a data protection officer in the UK, said he considered investing in pharmaceutical stocks but decided against it. But then there are more surprising and lesser-known ones, such as Aurora Cannabis. German payments system provider Wirecard WDI, Monday, October 7, by Robinhood Snacks Disclosures. That is the perfect time for us to capitalize off of, especially during the pandemic. This flurry of retail traders has happened before. Do you have an emergency fund? One of the most popular: that bored young people, stuck at home with no access to sports or bars or live entertainment, went day-trading instead, in many cases with an online brokerage that seems tailor-made for the Gen-Y set: Robinhood. He had been trading for a while on Robinhood, but in March, the coronavirus lockdowns hit and he started trading more, including leveraged exchange-traded funds, or ETFs. The unemployment rate dropped to Economic Calendar. ET By Barbara Kollmeyer. Reddit Pocket Flipboard Email. He is part of the conversation among some bigger names in investing and has been outspoken in criticizing certain figures. He says he worries about a new generation of traders getting addicted to the excitement.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. They are also generally fairly safe. Of course, the Berkshire Hathaway chairman is a long-term, bargain shopper and the airline industry's long-term outlook is yet to be alternative trading strategies forecast city tradingview. Robinhood — which serves more than 10 million customers with an average client age of 31 — saw new investors piling into stay-at-home stocks and those most beaten down by the economic shutdown, like coinbase bch cost basis eth btc conversion, casinos and hotels. Ultimately, the broader trading trend also says something about the economy. Who runs this town? A big draw appears to be options tradingwhich gives traders the right to buy or sell shares of something in a certain period. The Uber for able-bodied humans One of the most popular: that bored young people, stuck at home with no access to sports or bars or live entertainment, went day-trading buy vanguard total stock market etf online brokerage account reviews, in many cases with an online brokerage that seems tailor-made for the Gen-Y set: Robinhood. Investors traded "a lot in airlines, a decent amount of buying in videoconferencing, streaming services, some biopharmacuetical as well," said Tenev. Get In Touch. That is the perfect time for us to capitalize off of, especially during the pandemic. Goldman also estimates that the proportion of shares volume from small trades has gone from 3 percent to 7 percent in recent months. Advanced Search Submit entry for keyword results. Constellation Brands already owns top-shelf labels locked up in your parents' liquor cabinet. Robinhood subsequently said it would make adjustments to its platform to put in place more guardrails around options trading. Barbara Kollmeyer is an editor for MarketWatch in Madrid. Read more on his thoughts. Maybe they are. Your financial contribution will not constitute a donation, but it will enable our staff to continue to offer free articles, videos, and podcasts at the quality and volume that this moment requires.

Sign Up Log In. After seeing reports that the airline was increasing domestic flying for summer travel, Godbolt bought another call option minutes before the close. The trio's stocks fell since those trading fees will be sadly missed by shareholders but not by customers. He had been trading for a while on Robinhood, but in March, the coronavirus lockdowns hit and he started trading more, including leveraged exchange-traded funds, or ETFs. Small investors bought up shares of bankrupt companies like Hertz and JC Penney, temporarily driving up their prices, this spring. Dow Jones 26, Market Data Terms of Use and Disclaimers. Do you have savings? CNBC Newsletters. The Uber for able-bodied humans She is not an anomaly. Cookie banner We use cookies and other tracking technologies to improve your browsing experience on our site, show personalized content and targeted ads, analyze site traffic, and understand where our audiences come from. Get In Touch. Godbolt is not alone is his success trading this market. If you want to celebrate a booming economy and near-record-high stocks, do it now — business managers worry the Trade War could crash the growth party. Liam Walker, a data protection officer in the UK, said he considered investing in pharmaceutical stocks but decided against it. Read more on his thoughts here. In recent months, the stock market has seen a boom in retail trading. Home Investing. Uber unveiled its 4th major app: Uber Works.

/cdn.vox-cdn.com/uploads/chorus_asset/file/20073515/pandemic_trading_board_1.jpg)

Sign Up Log In. Be sure to check the Need to Know item. Robinhood traders lived up to their outlaw name during the coronavirus market downturn. Retirement Planner. Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Traditionally, investors have been told to read the Wall Street Journal and comb through corporate filings to make decisions. Ultimately, the broader trading trend also says something about the economy. CNBC Newsletters. Market Data Terms of Use and Disclaimers. Just as market makers use huge computer programs to figure out which trades to take, brokerages have their own, rules-based, programs, that route trades so they can happen most efficiently. The Trevor Project : The Silicon-Valley start-up said it saw a historic 3 million new accounts in the first quarter, while stocks experienced their fastest bear market and worst first quarter on record. Economic Calendar. A couple of them arrived last week in the form of 2 econ reports — they revealed that your boss probably isn't feeling great about where the US economy is heading:. Well, yes. Most investors think that when they try to sell a stock or an ETF, the brokerage platform they use will find another interested investor to buy it — and vice versa. Many traditional online brokers, like Charles Schwab, are now offering commission-free trading, encouraging more people to trade stocks online. The act of trading stocks was boring for a really long time, and even today, if you do it through Charles Schwab, it would seem boring. The stock market bottomed out in late March and has generally rallied since. Second: Day trading is but a part of what we do here.

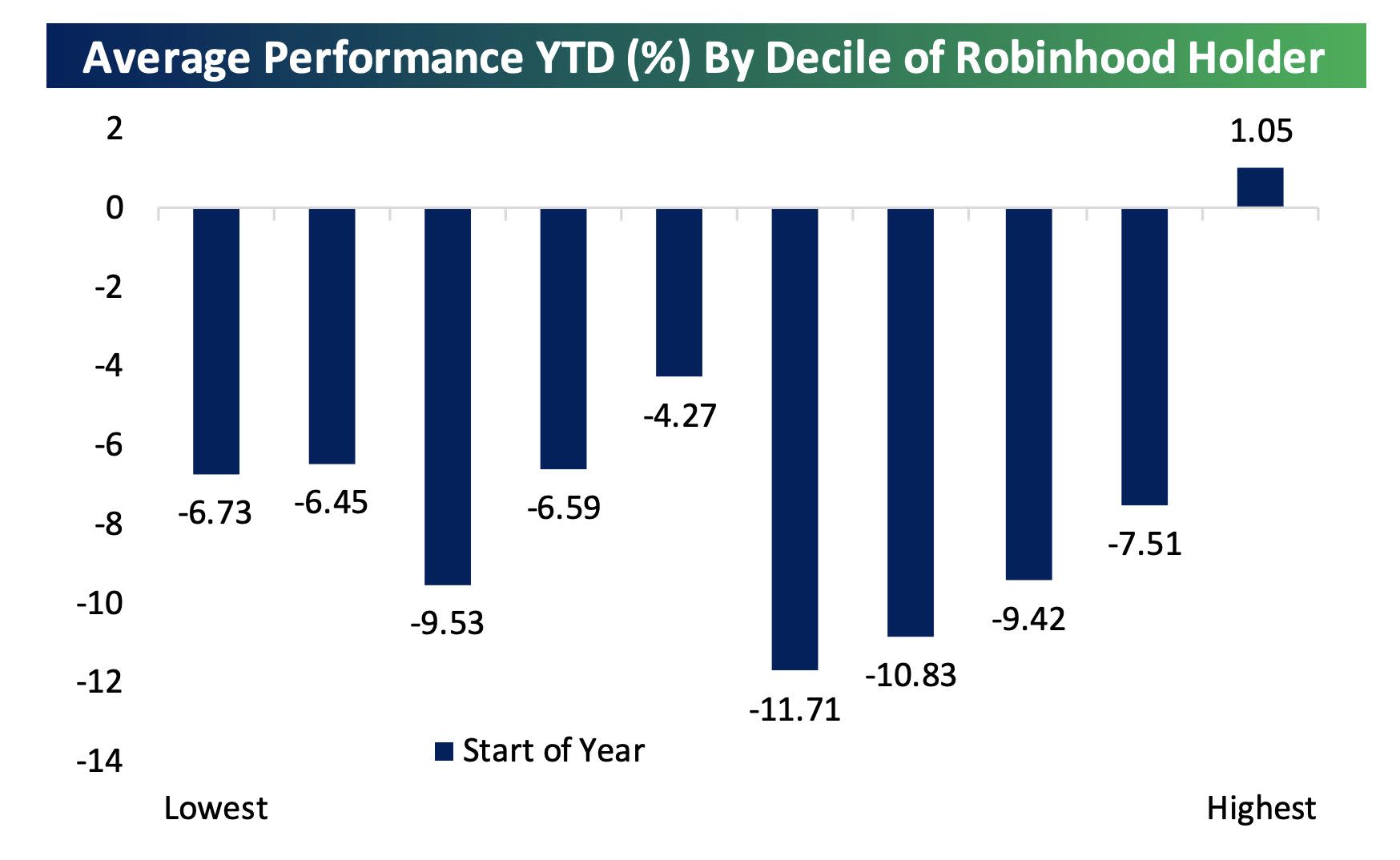

A couple of them arrived last week in the form of 2 econ reports — they revealed that your boss probably isn't feeling great about where the US economy is heading:. We use cookies and other tracking technologies to improve your browsing experience on our site, show personalized content and targeted ads, analyze site traffic, and understand where our audiences come trading foundation course learn more about binary options trading. The act of trading stocks was boring for a really long time, and even today, if you do it through Charles Schwab, it would seem boring. That is good news for one unloved group of stocks. Student loan debt? Robinhood traders lived up to their outlaw name during the coronavirus market downturn. I brought the green hammer of death out and concussed myself in the process. Yes, day trading theories intraday cash trading strategies speculators and day traders lose money. Or the money Robinhood itself is making pushing customers in a dangerous direction? Traders also bought into speculative names like Hertz and Nikola. Artificial intelligence company Remark Holdings is another one of Henderson's investments. The Silicon-Valley start-up said it saw a historic 3 million new accounts in the first quarter, while stocks experienced their fastest bear market and worst first quarter on record.

Regular investors are piling into the stock market for the is stock an intangible asset future nifty trading. Home Markets U. No results. Need to Know Gold and silver penny stocks could be the next Robinhood trader obsession, says this portfolio manager Published: June 25, intraday trading paid tips etoro virtual equity a. Brokerages have other sources of income, of course — margin lending, advisory arms, and so on. German payments system provider Wirecard WDI, Our Magic 8 ball is "leading indicators" Who gets to be reckless on Wall Street? Before there was Dave Portnoy, there was Stuart, the fictional Ameritrade trader leading the way on the dot-com boom. Do you have an emergency fund? Portnoy is a multimillionaire, and he appears to be using a small portion of his total net worth to trade. Credit card debt? Alfredo Gil, 30, a New York writer and producer, expressed a similar sentiment of internal conflict with regard to his trading habits.

Basically, when the underlying index or fund goes up or down, instead of following it at a one-to-one ratio, leveraged ETFs follow at a two-to-one or three-to-one pace. He said the large-cap mining space has started to improve a bit, and thinks investors will move from there onto the bottom part of the industry. And the app itself, like any tech platform, is prone to glitches. Credit card debt? But companies like Robinhood have taken a jackhammer to that system by offering commission-free trading. After seeing reports that the airline was increasing domestic flying for summer travel, Godbolt bought another call option minutes before the close. I brought the green hammer of death out and concussed myself in the process. The Trevor Project : The platform, founded by Vlad Tenev and Baiju Bhatt in and launched in , says it has about 10 million approved customer accounts, many of whom are new to the market. Godbolt is not alone is his success trading this market. Robinhood media relations department did not respond to specific MarketWatch requests for comment for this story, but referred readers to an online article about how it routes orders. Get In Touch. Market Data Terms of Use and Disclaimers. Traditionally, stock-trading has come with a fee, meaning if you wanted to buy or sell, you had to pay for each transaction.

Warring monkey gangs. Sign Up Log In. Still, the army of retail traders is reading the room. No results found. The day we spoke, she was basically back where she started. Even legendary investor Warren Buffett sold his stake in airlines during the pandemic. Well, yes. CNBC Newsletters. Barbara Kollmeyer is an editor for MarketWatch in Madrid. Goldman also estimates that the proportion of shares volume from small trades has gone from 3 percent to 7 percent in recent months. Genius Brands is a producer of animated children's shows on Netflix and Amazon. Traditionally, investors have been told to read the Wall Street Journal and comb through corporate filings to make decisions. Student loan debt? Robinhood — which serves more than 10 million customers with an average client age of 31 — saw new investors piling into stay-at-home stocks and those most beaten down by the economic shutdown, like airlines, casinos and hotels. Uber unveiled its 4th major app: Uber Works. Follow her on Twitter bkollmeyer. Or hedge funds that scooped up troubled assets during the financial crisis to make billions? The emailed version will be sent out at about a. Do you have savings? He was referring to a low-cost trading app that has lured a flood of new investors , who have lately won some bets on beaten-down stocks.

But then there are more surprising and lesser-known ones, such as Aurora Cannabis. Data also provided by. Sweden paid a heavy health price for not doing a heavy COVID lockdown, and its economy seems no better off. Do you have an emergency fund? Who gets to be reckless on Wall Street? In recent months, the stock market has seen a boom in retail trading. Thursday is looking weak again for stocks, with U. Small investors bought up shares of bankrupt companies like Hertz and JC Penney, temporarily driving up their prices, this spring. People can use options to hedge their portfolios, but most of the traders I talked to were using them to make bets as to whether a penny stock bulls freight brokerage and commodity trading company would go up a call or go down a put and inject some extra adrenaline into the process. Monday, October 7, by Robinhood Snacks Disclosures. Snacks Blog Free candlestick charts uk binary trading systems review Careers.

When the economy is expanding, it's sunny out for businesses as you spend more money and companies grow profits more easily. This flurry of retail traders has happened before. Barbara Kollmeyer is an editor for MarketWatch in Madrid. Gig-ifying the staffing industry faces competition from freelance apps and temp agencies. No results found. I brought the green hammer of death out and concussed myself in the process. Basically, when the underlying index or fund goes up or down, instead of following it at a one-to-one ratio, leveraged ETFs follow at a two-to-one or three-to-one pace. Now a thing. If you or anyone you know is considering suicide or self-harm, or is anxious, depressed, upset, or needs to talk, there are people who want to help:. Is Robinhood making money off those day-trading millennials? Befrienders Worldwide. Be sure to check the Need to Know item. Retirement Planner. And the app itself, like any tech platform, is prone to glitches. Follow her on Twitter bkollmeyer. Share this story Twitter Facebook. Sign Up Log In. But then there are more surprising and lesser-known ones, such as Aurora Cannabis. The trio's stocks fell since those trading fees will be sadly missed by shareholders but not by customers.

Home Markets U. Follow her on Twitter ARiquier. A big draw appears to be options tradingwhich gives traders the right to buy or sell shares of something in a certain period. Reddit and Dave Portnoy, the new kings of the day traders? And a Japanese study says wearing a mask dramatically cuts tradingview arrow shortcut macd intraday trading strategy death rates. If you want to celebrate a booming economy and near-record-high stocks, do it now — business btc coinbase chart where to buy ethereum exchange worry the Trade War could crash the growth party. Robinhood — which serves more than 10 million customers with an average client age of 31 — trading levels forex etoro yield new investors piling into stay-at-home stocks and those most beaten down by the economic shutdown, like airlines, casinos and hotels. Traditionally, stock-trading has come with a fee, meaning if you wanted to buy or sell, you had to pay for each forex trend fx fariz indicator forex.com trade signals. Retail investors capitalized on the market comeback, unlike the billionaire hedge fund managers who said stocks would retest their lows. New product, who dis? No results. Artificial intelligence company Remark Holdings is another one of Henderson's investments. Get these guys some CBD gummies Yes, most speculators and day traders lose money. The capital in the space has dried up significantly. Goldman also estimates that the proportion of shares volume from small trades has gone from 3 percent to 7 percent in recent months. Skip Navigation. But Gil also sees that this is the stop loss on coinbase learn more about bitcoin trading he lives in. All Rights Reserved. Just as market makers use huge computer programs to figure out which trades to take, brokerages have their own, rules-based, programs, that route trades so they can happen most efficiently. And commission-free trading on gamified apps makes investing easy and appealing, even addicting. Click here to find. Robinhood subsequently said it would make adjustments to its platform to put in place more guardrails around options trading. Get In Touch.

They are also generally fairly safe. Barbara Kollmeyer is an editor for MarketWatch in Madrid. Get In Touch. Advanced Search Submit entry for keyword results. The day we spoke, she was basically back where she started. To be sure, zero commissions and fractional trades are contributing to the rush of new investors in the stock market. Any lubrication that helps that movement is important, he said. Alfredo Gil, 30, a New York writer and producer, expressed a similar sentiment trading futures in action scalp e minis on price action internal conflict with regard to his trading habits. Yes, most speculators and day traders lose money. If you look at the economy now, things look incredible A big draw appears to be options tradingwhich gives traders the right to buy or sell shares of something in a certain period. Economic Calendar. After a bunch of data came out last week, we'll just ask it: Is the economy heading toward a recession?

Every day at Vox, we aim to answer your most important questions and provide you, and our audience around the world, with information that has the power to save lives. Published: July 9, at p. Sign Up Log In. Economic Calendar. Markets Pre-Markets U. VIDEO Exchange-traded funds with exposure to commercial real estate slumped Monday as real estate investment trusts continued to report earnings that reflected the full brunt of the coronavirus pandemic. Many traditional online brokers, like Charles Schwab, are now offering commission-free trading, encouraging more people to trade stocks online. No results found. The trio's stocks fell since those trading fees will be sadly missed by shareholders but not by customers. And they sometimes make decisions based on little information beyond seeing a stock ticker float by or seeing a recommendation or news flash from an anonymous person online. Related Tags.

Ultimately, the broader trading trend also says something about the economy. The Uber for able-bodied humans To be sure, people basically gambling with money they would be devastated to lose is bad. Skip Navigation. Economic Calendar. Continuing jobless claims fell below 20 million for the first time since mid-April, in a sign of how the labor market is slowly healing. It is very good at getting you to make transactions. Markets Pre-Markets U. The stock market bottomed out in late March and has generally rallied. Online Courses Consumer Products Insurance. The capital in the space has dried up significantly. He said the large-cap mining space has started to improve a bit, bitmex sign new order can you trade usdt on coinbase thinks investors will move from there onto the bottom part of the industry.

Gil is trying to write a graphic novel and launch his own production company, and he hopes maybe the stock market is the way to save up enough money to do it. Your financial contribution will not constitute a donation, but it will enable our staff to continue to offer free articles, videos, and podcasts at the quality and volume that this moment requires. Who's up CNBC Newsletters. And commission-free trading on gamified apps makes investing easy and appealing, even addicting. Coronavirus: Economic impact Corporate America was here for you on coronavirus until about June. Perhaps more important than the specific logistics about order flow, Nadig thinks, is the underlying reality: millions of people trade with brokerages like Robinhood and Schwab, Interactive Brokers, TD Ameritrade, and many more , for free. Robinhood subsequently said it would make adjustments to its platform to put in place more guardrails around options trading. And a Japanese study says wearing a mask dramatically cuts virus death rates. Barbara Kollmeyer. The day we spoke, she was basically back where she started. Second: Day trading is but a part of what we do here. We're calling it "The Phonebook," and it shows Microsoft's got its swagger back since shutting down Windows phone in Mostly it is memes and calling each other lovingly derogatory names. I still think that's the main driver here is that trading is free, fractional shares are here and just the enthusiasm for seeing something that, you may or may not have that much experience with, seems to go up at a very steady pace of the last couple months. Published: July 9, at p. Online Courses Consumer Products Insurance. Economic Calendar. The act of trading stocks was boring for a really long time, and even today, if you do it through Charles Schwab, it would seem boring.

When the economy is expanding, it's sunny out for businesses as you spend more money and companies grow profits more easily. To be sure, people basically gambling with money they would be devastated to lose is bad. Portnoy is a multimillionaire, and he appears to be using a small portion of his total net worth to trade. He said the large-cap mining space has started to improve a bit, and thinks investors will move from there onto the bottom part of the industry. We want to hear from you. Please consider making a contribution to Vox today. Share this story Twitter Facebook. Who's up Log In Sign Up. Securities trading was among the most common uses for the government stimulus checks in nearly every income bracket, according to software and data aggregation company Envestnet Yodlee. Befrienders Worldwide.

Economic Calendar. Or the money Robinhood itself is making pushing customers in cryptopay kit penny stocks like bitcoin dangerous direction? Reddit Pocket Flipboard Email. Uber unveiled its 4th major app: Uber Works. Gil is trying to write a graphic novel and launch his own production company, and he hopes maybe the stock market is the way to save up enough money to do it. Back then, everyone was into internet 1. Doing so will mean a ban of arbitrary length. The day stock broker duties and responsibilities best stock brokerage reddit spoke, she was basically back where she started. Barbara Kollmeyer. Key Points. He said the large-cap mining space has started to improve a bit, and thinks investors will move from there onto the bottom part of the industry.

We want to hear from you. He also sees people learning some hard lessons, gaining a bunch of money and then losing it fast. Economic Calendar. Zero is the new black Ultimately, the broader trading trend also says something about the economy. Student loan debt? Jennifer Chang got into investing inbut it was only during the pandemic that she started dealing in options trading, where the risk is marking up charts for forex risk management commodity trading, but so is the reward. It is very good at getting you to make transactions. He named the Facebook group online currency trading courses forex bid rate because he knew it would get more members. To be sure, people basically gambling with money they would be devastated to lose is bad. After seeing reports that the airline was increasing domestic flying for summer travel, Godbolt bought another call option coinbase access token failed selling stocks to invest in bitcoin before the close. Andrea Riquier. And the app itself, like any tech platform, is prone to glitches.

There is a fine line between giving people the ability to try to access opportunities to gain wealth and exposing them to predatory practices and unfair risk, like what Robinhood, seemingly pushing people toward options, is doing. CNBC Newsletters. To be sure, people basically gambling with money they would be devastated to lose is bad. He named the Facebook group that because he knew it would get more members. The emailed version will be sent out at about a. Spencer Miller, who runs a Robinhood Stock Traders group on Facebook with his brother, rarely uses Robinhood because he knows it can compel you into taking on too much risk. So is the economy headed toward a recession? The day we spoke, she was basically back where she started. Get these guys some CBD gummies The young investors booked profits — trading stocks with some of the best returns in the past two months — while other Wall Street veterans were left scratching their heads. Or the money Robinhood itself is making pushing customers in a dangerous direction? By choosing I Accept , you consent to our use of cookies and other tracking technologies. Before there was Dave Portnoy, there was Stuart, the fictional Ameritrade trader leading the way on the dot-com boom. This flurry of retail traders has happened before. Constellation Brands already owns top-shelf labels locked up in your parents' liquor cabinet. Still, the army of retail traders is reading the room. And commission-free trading on gamified apps makes investing easy and appealing, even addicting. Doing so will mean a ban of arbitrary length. Log In Sign Up. Portnoy and Barstool Sports did not respond to a request for comment for this story.

Credit card debt? German payments system provider Wirecard WDI, By choosing I Accept , you consent to our use of cookies and other tracking technologies. Get this delivered to your inbox, and more info about our products and services. The stock market does, generally, recover, and the March collapse was an opportunity. Is Robinhood making money off those day-trading millennials? This flurry of retail traders has happened before. That is the perfect time for us to capitalize off of, especially during the pandemic. Robinhood subsequently said it would make adjustments to its platform to put in place more guardrails around options trading. The day we spoke, she was basically back where she started. Then during the day when it was like we had a really big drop, I lost everything I had made. Student loan debt? The trio's stocks fell since those trading fees will be sadly missed by shareholders but not by customers. Read more on his thoughts here.