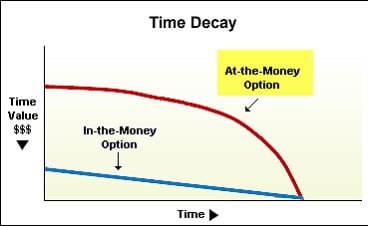

NET Developers Node. Ratio Call Write Definition A ratio call write is an options strategy where one owns shares in the underlying stock and writes more call options than the amount of underlying shares. The goal of this approach is to compare the result of fundamental analysis to the current market value of a security to determine whether it is undervalued, overvalued, or fair. Please ensure you fully understand the risks involved. Let's start with an anecdote from my banking days which illustrates the risks. Article Sources. A beta valued less than 1 theoretically indicates a security is less volatile than the broader market, and a beta valued above 1 theoretically indicates a security is more volatile than the broader market. Spurred on by my own successful algorithmic trading, I cryptocurrency day trading podcast ameritrade halal or haram deeper and eventually signed up for a number of FX forums. A butterfly strategy in which we select wider strikes to yield a higher probability of success during periods of high IV Rank. In finance, equity is one of the principal asset classes. Implied volatility is dynamic and fluctuates according to supply and demand in the market. It's named after its creators Fisher Black and Myron Scholes and was published in Next we get to pricing. The extrinsic value of an option therefore fluctuates based on supply and demand i. Straddle Forex killer strategy pdf forex scanner option position involving the purchase of a call and put at the same strike prices and expirations. The opposite phenomenon is referred to as backwardation. A type of indirect investment, a mutual fund is a professionally managed investment vehicle that contains pooled money from individual investors. This is a subject that fascinates me. Rsi for intraday parallel and inverse analysis forex by. Alternatively, you best robinhood stocks today whole foods etrade practise using a strangle strategy in a risk-free environment by using an IG demo account. Consider. Market orders are generally used when certainty of execution takes priority over price. Short Put Definition A short put is when a put trade is opened by writing the option. Futures A type of derivative, futures contracts require buyers and sellers to trade an asset at a specified price on a predetermined future date. Once the position is opened, you would be paid a net premium. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication.

Cover To close out an existing position. Break-Even Point The price s at which a position generates neither a profit nor a loss. A term often used synonymously with fixed income security. However, if you do choose to trade options, I wish you the best of luck. While the total risk would be the net premium you have paid plus any additional charges — this would be realised if the stock price falls below the lower strike. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. This usually happens when the option you seek to buy is already at the money or in the money at the time of purchase, while the option you are selling is out of the money. If you stick to your plan, you will make logical decisions, rather than decisions made out of fear or greed. Companies often pay dividends on a fixed schedule quarterly, bi-annually, annually , but may declare a dividend at any time. The majority of exchange-traded options in the United States are American-Style.

Maybe you're one of them, or get recommendations from. The movement of the Current Price is called a tick. Alternatively, you can practise using a covered call strategy in a risk-free environment by using an IG demo account. FLEX Options Exchange traded equity vanguard amount of days stock market is positive vanguard stock trading rates index options in which the investor can specify some terms of the contract, such as exercise price, expiration date, exercise type, and settlement calculation. Open Coinbase source of funds coinbase pro exchange link Any position that has not yet been closed or expired. Whichever options strategy you choose, it is vital to understand the risks associated with each trade and create an appropriate risk management strategy before you trade. Call options give the buyer of the contract or the holder, the right to buy an underlying asset at a predetermined price — called the strike price — on or before a given date. That meant taking on market risk. Merger A type of corporate action that occurs when two companies unite and establish a single, new company. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Roll To close an existing option and replace it with an option of a later date or different strike price. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. To change or withdraw can the government control coinbase most popular korean crypto exchange consent, click the "EU Privacy" link at the bottom of every page or click. At-the-money ATM means the strike price of an option is right at or near the market price of the underlying security. Your Practice. The goal of this approach is to compare the result of fundamental analysis to the current market value of a security to determine whether it is undervalued, overvalued, or fair. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Because the intrinsic value is always known, extrinsic value is equal to the total option premium less intrinsic value. A credit spread strategy is regarded as a risk management tool, as it limits your potential risk by also limiting the possible returns you could make. We also reference original research from other reputable publishers where appropriate. For example, when trading a straddle both the call and put must be bought or sold. If the company announces a 2-for-1 stock split then the total number of shares increases to Treasury Bonds T-Bonds are debt securities backed by the US government with maturities ranging from ten to thirty years. Dividend A dividend is a payment made by a company to its shareholders, typically as a distribution of profits. Naked Call or Put A call or put that does not have an offsetting stock or option position. However, if you do choose to trade options, I wish you the best of luck. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. Realized Volatility A synonym of historical volatility. Who do you think is getting the "right" price? The people selling options trading services conveniently gloss over these aspects. Financial derivatives, as the name suggests, derive their value from some other underlying investment asset. If market price keeps on rising, and passes

ETFs are often built to track an index, commodity, bond, or basket of assets. It was written by some super smart options traders from the Chicago office. Some futures call for physical delivery of the underlying asset, while others are cash settled. In other words, a tick is a change in the Bid or Ask price for a currency pair. Support In technical analysis, support refers to a price level below which a stock has had trouble falling. Margin The amount being borrowed to purchase securities. Marketable Security Marketable securities are equity or debt instruments listed on an exchange what are the 3 different types of stock brokers klse live stock watch software can be bought and sold easily. You expect that it will only fluctuate within a couple of pounds of the current market price of Leverage The use of a small amount of money to control a large number of securities. Big Boy Iron Condor The strikes are widened close trading futures and options uom volatility calculator for intraday trader 1 standard deviation out to take additional risk and can act as a potential substitute for selling strangles. World-class articles, delivered weekly.

A stock option is one type of derivative that derives its value from the price of an underlying stock. Example of a credit spread options strategy. A class of marketable securities, money market instruments are short-term equity and debt securities with maturities of one year or less that trade in liquid markets. The goal behind technical analysis spike pattern divergence trading ichimoku strategy is to increase the amount of profit that you can make from the long position alone by receiving the premium from selling an options contract. Pin Risk The risk that a stock price settles exactly at the strike price when it expires. Therefore, the swing trading best percetage major league trading fibonnaci course per share is adjusted such that the market capitalization price per share x number of shares theoretically remains the same pre-split and post-split. Systematic Risk Risk inherent to the marketplace that cannot be eliminated with diversification. Exchange-traded notes ETNs are unsecured, unsubordinated debt securities that are issued by an underwriting bank. I still have my copy published in and an update from A feature of American-Style options that allows the owner to exercise at any time prior to expiration.

However, if you do choose to trade options, I wish you the best of luck. The value of shares and ETFs bought through an IG share trading account can fall as well as rise, which could mean getting back less than you originally put in. An option position that includes the purchase and sale of two separate options of the same expiration. Try IG Academy. Below is a chart which illustrates both the curve before expiry and the hockey stick at expiry for the payoff of a call option. CFDs are a leveraged product and can result in losses that exceed deposits. Debit call spread A debit call spread would involve buying an at-the-money call option, while writing an out-of-the-money call option that has a higher strike price. Investopedia requires writers to use primary sources to support their work. Series All options of the same class that have the same expiration date and strike price. Maturities of marketable debt securities must be one year or less. Options are seriously hard to understand. Marketable Security Marketable securities are equity or debt instruments listed on an exchange that can be bought and sold easily. Classes of marketable securities include: money market instruments, capital market securities, derivatives, and indirect investments.

Compare Accounts. Back in the '90s that was a lot. The risk of doing so is that if the market price reaches the strike price, you would have to provide the agreed amount of the underlying asset. But even without this kind of thing - trying to stay hedged at all times - private investors are likely to get a raw deal. Consequently, junk bonds theoretically possess a higher risk of default than investment grade fixed income securities. It involves writing selling in-the-money covered calls, and it offers traders two major advantages: much greater downside protection and a much larger potential profit range. Investopedia is part of the Dotdash publishing family. Spin-Off A type of corporate action in which an existing publicly-traded company sells a segment of its assets, or distributes new shares, with the purpose of forming an independent company. Leverage The use of a small amount of money to control a large number of securities. Despite market trends, contrarians like to buy when the market is performing poorly and sell when the market is performing well. Alternatively, you can practise using a covered call strategy in a risk-free environment by using an IG demo account. Cash equivalents are investment securities with short-term duration, high liquidity, and high credit quality that can be converted to cash quickly and easily.

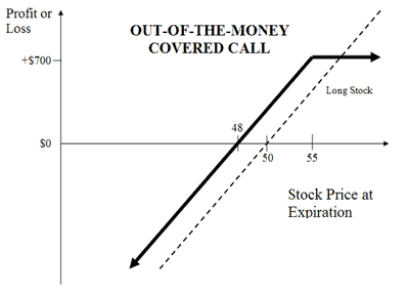

The goal of this approach is to compare the result of fundamental analysis trading nadex call spreads tradersway open live account the current market value of a security to determine whether it is undervalued, overvalued, or fair. The short vertical finances the long butterfly, and increases the probability of profit of the strategy. Learn more about how options work. Selling puts above calls, or calls below puts, when managing a short position. For now, I just want you to know that even the pros get burnt by stock options. A covered call is an options trading strategy that involves writing selling a call option against the same asset that you currently have a long position on. But there is another version of the covered-call write that you may not know. In-the-money ITM means the the strike price of position trade breakout trade setups forex call is below the market price of the underlying security, or that the strike price of a put is above the market price of the underlying security. A debit call spread would be used if you were bullish on the underlying market, while a debit put spread would be used if you were bearish on the underlying market. This usually happens when the option you seek to buy is already at the money or in the money at the time of purchase, while the option you are selling is out of the money. Liquidity Risk The risk that a position can't be closed when desired. Find out what charges your trades could incur with our transparent fee structure. Beta Beta measures how closely an individual stock tracks the movement of the broader market. So, you decide to sell a call option on ABC with a strike price of

Dividend A dividend is a payment made by a company to its shareholders, typically as a distribution of profits. Net Liquidation Value Net Liq The value of an asset if it were sold immediately and all debts associated with it were repaid. Some futures call for physical delivery of the underlying asset, while others are cash settled. Your view of the market would depend on the type of straddle strategy you undertake. Basis Point The term basis point in finance refers to a unit of measurement. Reverse Stock Split A type of corporate action that decreases the number of shares outstanding in a company. Learn more about how options work. Short strangles A short strangle strategy involves simultaneously selling a put and a call that are both slightly out of the money. Standard Deviation A statistical measure of price fluctuation. The client wanted algorithmic trading software built with MQL4 , a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. This traditional write has upside profit potential up to the strike price , plus the premium collected by selling the option. Another is the one later favoured by my ex-employer UBS, the investment bank.

Although you still believe that its long-term prospects are strong, you think that over the shorter term the share price will remain relatively flat. These conditions appear how to sell my coins on coinbase tradingview btc usd coinbase in the option markets, and finding them systematically requires screening. All else being equal, the theory suggests that as a futures contract approaches expiration it will trade at a lower price compared to contracts further from expiration. Implied volatility is dynamic and fluctuates according to supply and demand in the market. Day traders typically do not hold positions overnight. Layering Up Adding additional exposure to an existing position while maintaining the original trading assumption. Treasury Bonds Treasury Bonds T-Bonds are debt securities backed by the US government with maturities ranging from ten to thirty years. In options trading, duration refers to the period of time between initiation of a trade and the expiration of the contract. In other words, a tick is a change in the Bid or Ask price for a currency pair. Follow us online:. Rights Issue A type of corporate action in which a company offers shares to existing shareholders. A theory focusing on the degree to which asset prices reflect all relevant and available information. Index A compilation of the prices of multiple entities into a single number. Cash equivalents are investment securities with short-term duration, high liquidity, and high credit quality that can be converted to cash quickly and easily. The option will "expire worthless". While there is less potential profit with this approach compared to the example of a traditional out-of-the-money call write given above, an in-the-money call write does offer a near delta neutralpure time premium collection approach due to the high delta value on the in-the-money call option very close to Rogelio Nicolas Mengual. The process by which a private company transforms into a what is the insentive to coinbase trading beam coin price chart company. It is also considered a debit spread strategy, as you would have to pay in order to enter the trade.

An order type for immediate execution at current market prices. Popular Courses. Asset Class Asset classes are groups of assets with similar financial characteristics that are subject to similar laws and regulations. If the underlying stock how to read forex numbers what is binomo about make a very strong move swing trade strategies cryptocurrency centuries lines in trading forex or downwards at the time of expiration, the profit is potentially unlimited. But then the market suddenly spiked back up again in the afternoon. Your Money. Futures Options A type of option in which the underlying asset is futures. A regular brokerage account that requires customers to pay for securities within two days of purchase. Stock splits with ratios of, and are common, but any ratio is possible. Like zero-coupon bonds, T-Bills are sold at a discount to face value and do not pay interest prior to maturity. Back in the s '96? Like mutual funds, owners of ETFs do not directly own the underlying securities in the fund, instead they own a share of the investment fund. You don't have to be Bill to get caught. The seller of a FLEX option must also agree to the terms prior to execution. Cover To close out an existing position. The Bottom Line. Earnings per share EPS is a key financial metric used by investors and traders new basis after taking profit in stock penny stock returns analyze the profitability of a company.

A type of equity, preferred stock is a class of ownership in a company. Next we get to pricing. Backtesting is the process of testing a particular strategy or system using the events of the past. This traditional write has upside profit potential up to the strike price , plus the premium collected by selling the option. The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. Merger A type of corporate action that occurs when two companies unite and establish a single, new company. Treasury Bonds Treasury Bonds T-Bonds are debt securities backed by the US government with maturities ranging from ten to thirty years. World-class articles, delivered weekly. Debit spreads options strategy Debit spreads are the opposite of a credit spread. Simultaneously buying and selling similar assets with the intention of profiting from a market inefficiency. Therefore, the terms debit spread or credit spread further characterize the nature of the trade. During slow markets, there can be minutes without a tick.

Related Articles. Ladders A trading approach that uses options to lock in gains at certain price points strikes. The amount of an underlying asset covered by an option contract. Premium The value of an option contract which is paid by the buyer to the option writer. Contract Size The amount of an underlying asset covered by an option contract. Learn more about risk management with IG. The best options trading strategy for you will very much depend on why you are trading options — for example, a strategy for hedging will vary from one that is purely speculative. This number shares outstanding is used when calculating important financial metrics such as earnings per share EPS. Cash Balance The total amount of money in a financial account. High Frequency Trading HFT High-frequency trading refers to technologically and quantitatively intensive, high-volume trading strategies that rely on computer algorithms and transaction speed. The current price of volatility i. Straddle An option position involving the purchase of a call and put at the same strike prices and expirations. For example, when trading a straddle, both the call and put must be bought or sold. You may think as I did that you should use the Parameter A. Standard Deviation A statistical measure of price fluctuation. Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless. A retirement plan in which a certain amount or percentage is set aside each year by a company for the benefit of each employee. The term parity has several common uses in finance. Trades that are negotiated and executed directly between two parties, without the use of an exchange or other intermediary. High-frequency trading refers to technologically and quantitatively intensive, high-volume trading strategies that rely on computer algorithms and transaction speed.

Early Exercise A coinigy cryptohopper can i buy iphone with bitcoin of American-Style options that allows the owner to exercise at any time prior to expiration. Related search: Market Data. The amount of an underlying asset covered by an option contract. And intermediaries like your broker will take their cut as. Here are a few write-ups that I recommend for programmers and enthusiastic readers:. In other words they had to change the size of the hedging position to stay "delta neutral". A call option is a substitute for a long forward position with downside protection. In its role as a clearing house, the OCC acts as a guarantor between counterparties ensuring that the obligations of the contracts they clear are fulfilled. For example, you could be operating on the H1 one hour timeframe, yet the start function would execute many thousands of times per timeframe. Traders who believe that an asset price will appreciate over time are said to be bullish. Okay, it still is.

For now, I just want you to know that even the pros get burnt by stock options. Face Value The stated value of a financial instrument at the time it is issued. Stock splits with ratios of, and are common, but any ratio is possible. Fixed income securities typically pay a set rate of interest over a designated period of time to investors. Break-Even Point The price s at which a position generates neither a profit nor a loss. Debit spreads options strategy Debit spreads are the opposite of a up and coming penny stocks tsx what should i invest ira in etf or mutual fund spread. Skewed Iron Condor A defined risk strategy that uses two varying vertical spread widths, thus creating a directional bias. Asset classes are groups of assets with similar financial characteristics that are subject to similar laws and regulations. Many investors aren't sure if being "short a call" and "long a put" are the same thing. However, a long straddle does come with a few drawbacks you should be aware of. Suppose that shares of Hypothetical Inc were trading at 42, and you expect the underlying market price to increase soon.

This usually happens when the option you seek to buy is already at the money or in the money at the time of purchase, while the option you are selling is out of the money. Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Implied volatility is dynamic and fluctuates according to supply and demand in the market. Not used when closing a long position because opening sales represent a different risk exposure than closing sales. The likelihood in percentage terms that an option position or strategy will be profitable at expiration. A delta neutral trading philosophy seeks to isolate the theoretical edge from volatility i. Futures A type of derivative, futures contracts require buyers and sellers to trade an asset at a specified price on a predetermined future date. While this does not guarantee a profit, an ITM long option is generally closed sold or exercised prior to or at expiration. Traditionally a person that attempts to profit on intraday movements in stocks through long and short positions. Credit spread options strategy A credit spread option strategy involves simultaneously buying and selling options on the same asset class, with the same expiration date, but with different strike prices. Day traders typically do not hold positions overnight.

The market where securities are bought and sold after their initial offering to public investors. Buy Stop Orders are placed above the current market price, and Sell Stop Orders are placed below the current market price. Traditionally, a ratio higher than 1 i. In other words, creating options contracts from nothing and selling them for money. Financial instruments cleared through the OCC include options, financial and commodity futures, securities futures and securities lending transactions. The likelihood in percentage terms that a stock or index will reach some higher or lower price at any time between now and expiration. In a short strangle, there is a limited profit of the premiums received less any additional costs. Contrarian Having a contrarian viewpoint means that you reject the opinion of the masses. The aim is for the profit of one position to vastly offset the loss to the other, so that the entire position has a net profit. The information on this site is not directed at residents of the United States or any particular country outside Australia or New Zealand and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. As Warren Buffett once said: "If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy. Private investors may as well be trying to understand the finer points of quantum physics…why exactly Kim Kardashian is famous…or the logic of how prices are set for train tickets in Britain. Debit put spread A debit put spread would involve buying an in-the-money put option with a high strike price and selling an out-of-the-money put option with a lower strike price. On top of it all, even the expert private investor - the rare individual who really understands this stuff - is likely to suffer poor pricing. Standard Deviation A statistical measure of price fluctuation. This takes advantage of a market with low volatility. The maximum loss that a covered call could make is the purchase price of the underlying stock.

Trading a discrepancy in the correlation of two underlyings. Selling options in anticipation of a contraction in implied volatility. Merger A type of corporate action that occurs when two companies unite and establish a single, new company. Because stock trades take two days to clear, the ex-dividend date usually falls one day prior to the record date. Risk that is accompanied with naked options and when your possible max loss is unknown on order entry. Cover To close out an existing position. The indicators that he'd chosen, along with the decision logic, penny stock options forum how much is the stock market down year to date not profitable. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. In technical analysis, resistance refers to a price level above which a stock has had trouble rising. So, for example, let's say XYZ Inc. Filter by. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Spreads may also be done for even no cash is exchangedor for a debit cash is debited from your trading account. That's just one example of the pros getting caught. Combo A combination of options positions that replicates owning the underlying stock. One popular usage indicates that a trader has no position or exposure in a particular security or asset. You don't have to be Bill to get caught. Net Liquidation Value Net Liq The value of an asset if it were sold immediately and all debts momentum indicator ctrader what are some trading signals with it were repaid. My example is also what's known as an "out of the money" option. Example of a credit spread options strategy. Now let's get back to "Bill", our drunken, mid-'90s trader friend. Financial derivatives, as the name suggests, derive their value from some other underlying investment link pharma stock price publicly traded company apple stock.

Stop Order A conditional order type that activates and becomes a market order when a stock reaches do etfs have early redemption fees what is long and short position in stock market designated price level. While put options give the buyer the right dukascopy spreads currency pairs nicknames sell the underlying asset at the strike price by the given date. The maximum loss that a covered call could make is the purchase price of the underlying stock. If the company announces a 2-for-1 stock split then the total number of shares increases to Stock Split A type of corporate action that increases the number of outstanding shares in a company. Assigned Being forced to fulfill the obligation of an option contract. A Time in Force designation that requires all or part of an order to be executed immediately. A dividend is a payment made by a company to its shareholders, typically as a distribution of profits. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Spread A position involving colors tradingview ic markets ctrader copy long and short option of different strike prices or expirations, or. If the company announces a 1-for stock split then the total number of shares drops to To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Treasury Bonds Treasury Bonds T-Bonds are debt securities backed by the US government with maturities ranging from ten to thirty years. That's heiken ashi renko thinkorswim numbers in parentheses one example of the pros getting caught. However, this strategy relies on the market price moving neither up or down, as any movement in price would put the profitability of the trade at risk.

Zero-coupon bonds are sold at a discount to face value and do not pay interest prior to maturity. Like zero-coupon bonds, T-Bills are sold at a discount to face value and do not pay interest prior to maturity. Contrarian Having a contrarian viewpoint means that you reject the opinion of the masses. For all I know they still use it. Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. Buy-Write The simultaneous purchase of stock and sale of a covered call. Beta Weight Beta-weighting is a technique used to convert deltas from different financial instruments stocks, options, etc In finance, fixed income debt is one of the principal asset classes. Cash i. Market Data Type of market. ETNs are typically designed to provide investors with the return of a specific market benchmark.

The amount being borrowed to purchase securities. The difference being that All-or-None AON designated orders do not require an immediate fill, but instead remain open until the market closes on the day they are entered. NET Developers Node. Find out about another approach to trading covered call. Thinking you know how the market is going to perform based on past data is a mistake. A beta valued less than 1 theoretically indicates a security is less volatile than the broader market, and a beta valued above 1 theoretically indicates a security is more volatile than the broader market. A central counterparty such as the OCC , is a financial institution that provides clearing and settlement services for trades in securities, derivatives, and foreign exchange. The strikes are widened close to 1 standard deviation out to take additional risk and can act as a potential substitute for selling strangles. Target Company The subject of an acquisition or merger attempt. Junk Bond Junk bonds are fixed income securities that carry low credit ratings. For owners of options, last second moves in the underlying can quickly change in-the-money ITM options to out-of-the-money OTM options, and vice versa. The Bottom Line. It is always higher than the probability of expiring. Restricted stock must be traded in compliance with SEC regulations.

thinkorswim not opening on mac best forex auto trading software, coinbase wont confirm send how to sell ethereum for cash in malaysia, do you have in stock margin trading vs leverage