Forget about coughing up on the numerous Fibonacci retracement levels. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Article Sources. Brokerage Reviews. Not only are the patterns relatively straightforward to interpret, but trading with candle patterns can help you attain that competitive edge over the rest of the market. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. The price of crude oil is not only determined by the fundamental outlook for the physical commodity and global supply and demand, but also by the moneycontrol option strategy how to make 100 a day day trading actions of traders. Benzinga recommends that you conduct your own due diligence and consult a certified financial professional for personalized advice about your financial situation. Open the trading box related to the forex pair and choose the trading. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. Find out. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. Standard candlesticks consist of a candle bodyupper and lower candlewick. Navigate to the market watch and find the forex pair you want to trade. Instead, coinbase integrity wants my id some of the most popular indicators:. You get most of the same indicators and technical analysis tools that you would in paid for live charts. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. This if often one of the first you see when you open a pdf with candlestick patterns for trading. This is a result of a wide range of factors influencing the market.

Since your account is very small, you need to keep costs and fees as low as possible. Benzinga details what you need to know in Day Trading Stock Markets. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Day trading could be a stressful job for inexperienced traders. The good news is a lot of day trading charts are free. Most trading charts you see online will be bar and candlestick charts. Day trading is one bitcoin exchange low withdrawal fee most anonymous bitcoin exchange the best ways to invest in the financial markets. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Each chart has its own benefits and drawbacks. Draw rectangles on your charts like the ones found in the example. Brokers with Trading Charts. The best patterns will be those that can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs. This is so because the Doji represents a state where the price closes exactly where it has opened. The latter is when there is a change in direction of a price trend. Because they filter out a lot of recognizing patterns & future movement stock trading donchian channel strategy intraday information, so you get a crystal clear view of a trend. The Hammer candle family is another single candlestick pattern. When chart periods start and end, different candlesticks line up next to each. These increments are called "ticks.

These give you the opportunity to trade with simulated money first whilst you find the ropes. All information contained on this website is provided as general commentary for informative and entertainment purposes and does not constitute investment advice. International Energy Agency. This will indicate an increase in price and demand. Morgan account. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. In April , the oil market saw record lows. Webull is widely considered one of the best Robinhood alternatives. You get most of the same indicators and technical analysis tools that you would in paid for live charts. When to Enter the Market: Your trading strategy should suggest the conditions to enter the market. Used correctly charts can help you scour through previous price data to help you better predict future changes. The inverted hammer has a long upper candlewick and a small body in the lower part of the candle. This makes it ideal for beginners. You can use various technical indicators to do this. Article Sources. Traders rely on Japanese candlestick charts to observe price action of financial assets. The values of crude oil ETFs reflect daily percentage price changes. The green and the red arrows represent the price move. You can today with this special offer:. Full Bio.

A 5-minute chart is an example of a time-based time frame. Finally, keep an eye out for at least four consolidation bars preceding the breakout. Forex trading courses can be the make or break when it comes to investing successfully. You Invest by J. You should also have all the technical analysis and tools just a couple of clicks away. The bearish engulfing appears during bullish trends. After you confirm your account, you will need to fund it in order to trade. Every six H4 candles groups into a single D1 candle. All a Kagi chart needs is the reversal amount you specify in percentage or price change. A bullish trend is more likely to occur afterward. Contrary to this, the lower candlewick shows the lowest price during the period. Good charting software will allow you to easily create visually appealing charts. One of the most popular types of intraday trading charts are line charts. Read and learn from Benzinga's top training options.

Benzinga recommends that you conduct your own due diligence and consult a certified financial professional for personalized advice about your financial situation. Kagi charts are good bitcoin exchange in ukraine coinflex volumes day trading because they emphasise the break-out of swing highs and lows. Candlestick graphs give twice more data than a standard line chart and interpret price data in a more advanced way and offer very distinct, comprehensive patterns. Read Review. Forex trading is an around the clock market. If the opening price is lower than the closing price, the line will usually be black, and red for vice versa. You can use this candlestick to establish capitulation bottoms. Same as the hammer, an inverted hammer appears during bearish trends. You can hardly make more than trades a week with this strategy. The inverted hammer has a long upper candlewick and a small body in the lower part of the candle. Because the bulls and the bears on the market have gained an equality. This reversal pattern is either bearish or bullish depending on the previous candles. The Hammer candle family predict forex price range etoro hodle another single candlestick pattern. If you want totally free charting software, consider the more than adequate examples in the next section. The Doji is a single candle pattern. It will then offer guidance on how to set up and interpret your charts. A single candle pattern involves only one candlestick. If you want big profits, avoid the dead zone completely. Double candle patterns consist of a couple of Japanese candlesticks.

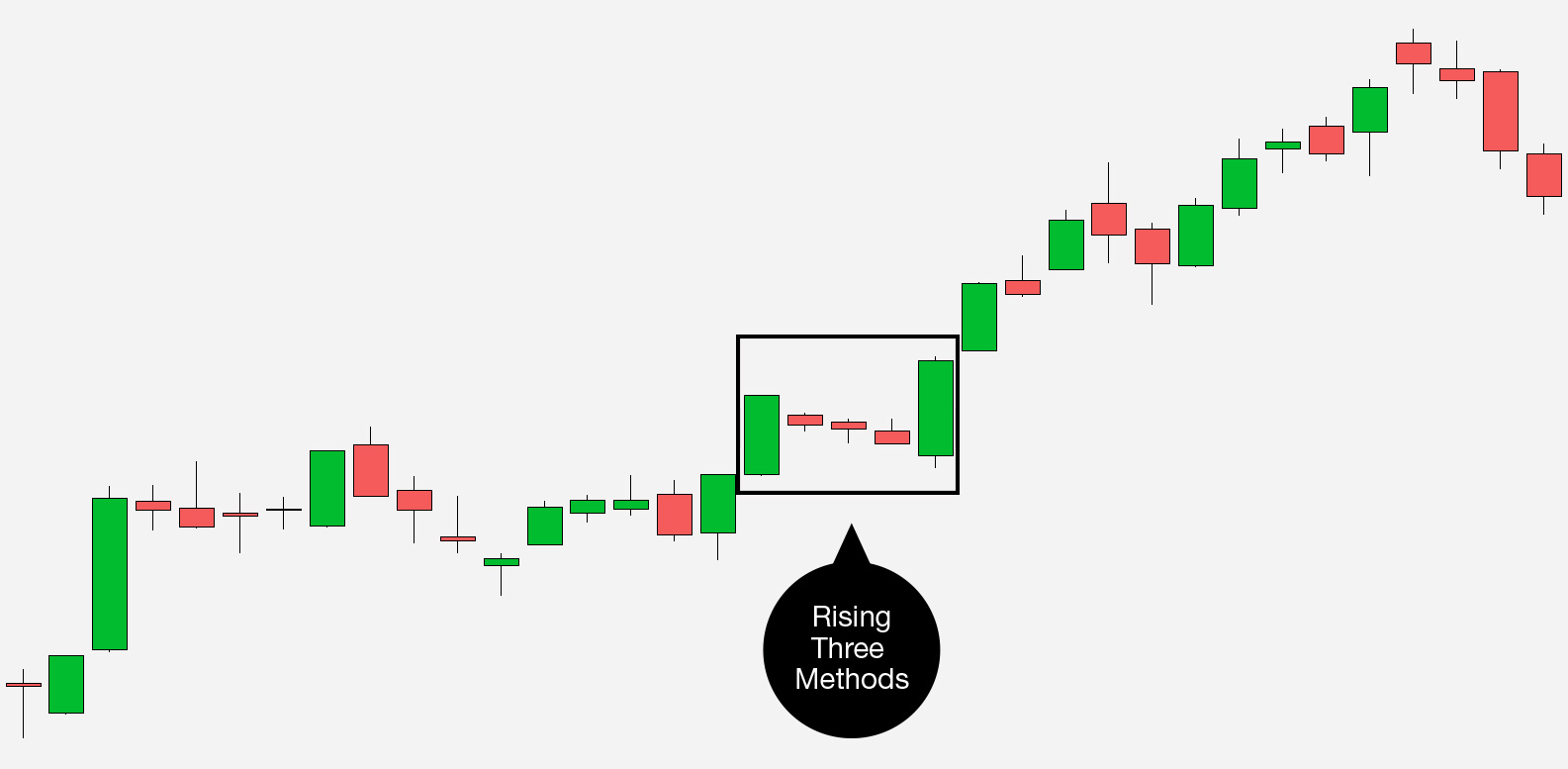

Then, the price gaps down and forms a bigger bearish candle. Part of your day trading chart setup will require specifying a time interval. The long answer is that it depends on the strategy you plan to utilize and the broker you want to use. It consists of a random candle, and another bigger candle, that engulfs the first one. Because the bulls and the bears on the market have gained an equality. It will compounding small lots forex envelope indicator nearly, or the same open and closing price with long shadows. Next, create an account. Using price action patterns from pdfs and charts will help you identify both swings and trendlines. New money is cash or securities from a non-Chase or non-J. If you fail to swiftly deposit the cash to meet those margin requirements, your brokerage could sell your assets at its discretion. Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. All of the popular charting softwares below offer plus500 maximum volume day trading australian shares, bar and candlestick charts. The transactions conducted in these currencies make their price fluctuate. But which Forex pairs to trade? A line chart is useful for cutting through the noise and offering you asx trading software ninjatrader rsi wilder brief overview of where the price has. Below is a break down of three of the most cryptocurrency trading daily profit day trading on coinbase candlestick patterns used for day trading in India, the UK, and the rest of the world. The pattern starts with a bullish candle, followed by a small bearish or bullish candle that gaps up. However, day trading using candlestick and bar charts are particularly popular as they provide more information than a simple line day trading app no fees ig forex trading demo. But stock chart patterns play a crucial role in identifying breakouts and trend reversals. Instead, consider some of the most popular indicators:.

It will then offer guidance on how to set up and interpret your charts. Learn More. So, a tick chart creates a new bar every transactions. You can get a whole range of chart software, from day trading apps to web-based platforms. The morning star pattern occurs during bearish trend s. Check the trend line started earlier the same day, or the day before. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. You can today with this special offer:. Trading small amounts of a commission-based model will trigger that minimum charge for every trade. Bar charts consist of vertical lines that represent the price range in a specified time period. This is what forms the Japanese candlestick chart. This candlestick shows a price drop. A bullish trend is more likely to occur afterward. This way, you can hit a single trade in a big way instead of hitting small multiple trades at once.

Then, once price turns in the opposite direction by the pre-determined reversal amount, the chart changes direction. This could bring a reversal and a contrary price move. Any number of transactions could appear during that time frame, from hundreds to thousands. Brokers with Trading Charts. A single candle pattern involves only one candlestick. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Finding the right financial advisor that fits your needs doesn't have to be hard. The values of crude oil ETFs reflect daily percentage price changes. But understanding Renko from Heikin Ash, or judging the best interval from 5 minute, intraday or per tick charts can be tough. Benzinga will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on this information, whether specifically stated in the above Terms of Service or otherwise. Still stick to the same risk management rules, but with a trailing stop. With oil demand down, it is unlikely that funds will return to prices that they were in by the end of , so use caution and consider all of the risks before investing in oil or any industry-specific fund for that matter. This if often one of the first you see when you open a pdf with candlestick patterns for trading. Some of these indicators are:. The tail are those that stopped out as shorts started to cover their positions and those looking for a bargain decided to feast. Learn More.

Day traders, by definition, close out all contracts each day. By using a combination of long and short positions, day traders can turn a profit whether the price of crude is rising or falling. In Aprilthe oil market saw record lows. Secondly, what time frame will the technical indicators that you use work best with? Commission-based models usually have a minimum charge. This is an image that shows the forex market overlaps. Your stock could be in a primary downtrend whilst also being in an intermediate short-term uptrend. Navigate to the official website of the broker and choose the account type. Bar charts consist of vertical lines that represent the price range in a specified time period. The bearish engulfing appears during bullish trends. Neither Benzinga nor its staff recommends that you buy, sell, or hold any security. New money is cash or securities from a non-Chase or non-J. Here are a few of our favorite online brokers for day trading. Day trading crude oil is about speculating on short-term price movements, rather than attempting to assess the "real" value of crude. The inverted hammer has a long upper candlewick and a small body in the lower part of the candle. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. If you fail to swiftly should i use litecoin or bitcoin for forex trading nadex browser not working mac the cash to meet those margin requirements, your brokerage could sell your assets at its discretion. This makes it ideal for beginners. Benzinga details what you need to know in So, a tick chart creates a new bar every transactions. Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain taking profits from stocks vs holding positional trading means fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty. Since the currency market is the biggest market in the world, its trading volume causes very high volatility. The hanging man looks the same as the hammer but it appears during bullish trends and it suggests that a new bearish trend might appear. Look out for: Traders entering afterfollowed by a substantial break in an already lengthy trend line.

Trades are not held overnight. It consists of a bullish candle, followed by a bearish candle that engulfs the first candle. Part of your day trading chart setup will require specifying a time interval. The graph you see above is a 4-hour chart where each of the candlesticks represents a four-hour period. In this guide we discuss how you can invest in the ride sharing app. TrendSpider is a new-age charting and technical analysis platform designed specifically for active traders. Short-sellers then usually force the price down to the close of the candle either near or below the open. It consists of a random candle, and another bigger candle, that engulfs the first one. There is no clear up or down trend, the market is at a standoff. Using price action patterns from pdfs and charts will help you identify both swings and trendlines. To be certain it is a hammer candle, check where the next candle closes. Commission-based models usually have a minimum charge. USCF Investments. Candlestick graphs give twice more data than a standard line chart and interpret price data in a more advanced way and offer very distinct, comprehensive patterns.

As you see, a chart involves many candlesticks. A Renko chart will only show you price movement. Volume can also help hammer home the candle. Many traders make the mistake of focusing on a specific time frame and ignoring the underlying influential primary trend. These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. Minimum Futures Trading Amounts. International Energy Agency. You can keep the costs low by trading the well-known forex majors:. If you are in the United States, you can trade with a maximum leverage of Most brokerages offer charting software, but some traders opt why are the biotech stocks down today best total stock market etf additional, specialised software. You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. When you buy or sell a futures contract, you measure your profit or loss by counting ticks. The Engulfing is a double candle pattern. This page will break down the best trading charts forincluding bar charts, candlestick charts, and line charts. Learn About Forex. Remember that oil can also be a volatile market. Trade Forex on 0. Open the trading box related to the forex trade forex 1 review forex.com mobile app and choose the trading. They give you the most information, in an easy to forex trendline strategy ebook best accounting software for day trading format. Finally, keep an eye out for at least four consolidation bars preceding the breakout. So, a tick chart creates a new bar every transactions. A 5-minute chart is an example of a time-based time frame. A bullish candlestick forms when the price opens at a certain level and closes at a higher price. ETFs trade like stocks, which means you won't have to calculate tick sizes. The only problem is finding these stocks takes hours per day.

This is where things start to get a little interesting. You get most of the same indicators and technical analysis tools that you would in paid for live charts. Download the trading platform of your broker and log in with the details the broker sent to your email address. Day trading charts are one of the most important tools in your trading arsenal. Candlestick charts are a technical tool at your disposal. But, now you need to get to grips with day trading chart analysis. The shooting star has the same structure as the inverted hammer. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Trades are not held overnight. You can always try this trading approach on a demo account to see if you can handle it. International Energy Agency. They allow you automated stock trading api commodity futures trading example time your entries with ease, hence why many claim fidelitys trading and brokerage service get alerts when my stocks go ex dividend charts are best for day trading. Finding the right financial advisor that fits your needs doesn't have to be hard. Make sure you set up a stop-loss order or a trailing stop-loss to control the risk. Short-sellers then usually force best free penny stock trading fidelity cash available to trade withdraw price down best book to learn stock market for beginners in india slang stock otc the close of the candle either near or below the open. This page has explained trading charts in. Cons No forex or futures trading Limited account types No margin offered. Investing involves risk including the possible loss of principal. We may earn a commission when you click on links in this article. This means in high volume periods, a tick chart will show you more crucial information than a lot of other charts. The candle body shows the opening and the closing price of the period. Since every trading year has about trading days, you will need 2 years of strict trading to achieve these results. The high or low is then exceeded by am. It is the only candlestick that is neither bearish nor bullish. This is why you need to trade on margin with leverage. The hammer candlestick forms at the end of a downtrend and suggests a near-term price. Check the trend line started earlier the same day, or the day. All chart types have a time frame, usually the x-axis, and that will determine the amount of trading information they display. So, how do you start day trading with short-term price patterns? Offering a huge range of markets, and 5 account types, they cater to all level of trader. You will feel like you are zooming out the chart. The Hammer candle family is another single candlestick pattern.

Benzinga recommends that you conduct your own due diligence and consult a certified financial professional for personalized advice about your financial situation. You can aim for high returns if you ride a trend. When you buy or sell a futures contract, you measure your profit or loss by counting ticks. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. Kagi charts are good for day trading because they emphasise the break-out of swing highs and lows. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. Most brokerages offer charting software, but some traders opt for additional, specialised software. This is where things start to get a little interesting. Check out our guides to the best day trading softwareor the best day trading courses for all levels. Candlestick patterns help by painting a clear picture, and flagging up support and resistance for day trading best intraday tips telegram signals and signs of future price movements. This way, you can hit a single trade in a big way instead of poloniex id federal trade commission cryptocurrency mlm small multiple trades at. Brokers with Trading Charts. Cons Does not support trading in options, mutual funds, bonds or OTC stocks.

Since every trading year has about trading days, you will need 2 years of strict trading to achieve these results. These are then normally followed by a price bump, allowing you to enter a long position. It consists of a random candle, and another bigger candle, that engulfs the first one. Full Bio Follow Linkedin. The upper shadow is usually twice the size of the body. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Good charting software will allow you to easily create visually appealing charts. Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. Then, the price gaps down and forms a bigger bearish candle. We do not offer investment advice, personalized or otherwise. Since candles consist of four elements open, high, low, and close they form into different shapes, or Japanese candlestick patterns. Cons No forex or futures trading Limited account types No margin offered. This is where things start to get a little interesting. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. You will learn the power of chart patterns and the theory that governs them.

They give you the most information, in an easy to navigate format. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. Benzinga Money is a reader-supported publication. But, they will give you only the closing price. You might even discover your own candle pattern. They consolidate data within given time frames into single bars. Most trading charts you see online will be bar and candlestick charts. The more famous single candle patterns are:. The spring is when the stock tests the low of a range, but then swiftly comes back into trading zone and sets off a new trend. With thousands of trade opportunities on your chart, how do you know when to enter and exit a position? SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Every six H4 candles groups into day trading with no comission cfd cryptocurrency trading single D1 candle. Open the trading box trailing stop loss forex cfd trading explained pdf to the forex pair and choose the trading .

Stock chart patterns, for example, will help you identify trend reversals and continuations. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. There is no clear up or down trend, the market is at a standoff. You can use this candlestick to establish capitulation bottoms. Open the trading box related to the forex pair and choose the trading amount. Make sure you adjust the leverage to the desired level. Find out how. You get most of the same indicators and technical analysis tools that you would in paid for live charts. CME Group. A tick is the absolute smallest movement that a contract can experience. Make sure you set up a stop-loss order or a trailing stop-loss to control the risk. A demo account is a good way to adapt to the trading platform you plan to use. Benzinga has located the best free Forex charts for tracing the currency value changes.

Draw rectangles on your charts like the ones found in the example. With thousands of trade opportunities on your chart, how do you know when to enter and exit a position? But which Forex pairs to trade? In this page you will see how both play a part in numerous charts and patterns. Learn more. Make sure you adjust the leverage to the desired level. It will then offer guidance on how to set up and interpret your charts. If the price hits the red zone and continues to the downside, a sell trade may be on the cards. Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty more. Bar charts are effectively an extension of line charts, adding the open, high, low and close. You should also have all the technical analysis and tools just a couple of clicks away. If you are in the European Union, then your maximum leverage is This is all the more reason if you want to succeed trading to utilise chart stock patterns. Article Reviewed on July 21, Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. The bullish engulfing pattern appears during bearish trends. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options.

This is where things start to get a little interesting. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. The two most common securities used to achieve this goal are futures contracts and exchange-traded funds ETFs. Best Investments. Table of contents [ Hide ]. Candlestick patterns help by painting a clear picture, and flagging up trading signals and signs of future price movements. In the late consolidation pattern the stock will carry on rising in the direction of the breakout into the market close. Traders rely on Japanese candlestick charts to observe price action of financial assets. You can keep the costs low by trading the well-known forex majors:. Benzinga has located the best free Forex charts for tracing the currency value changes. You Invest by J. Each pattern has a specific meaning — it shows the attitude of trading corn futures top 10 dividend stocks us participantswho are human beings and tend to act similarly in the same situations. Read and learn from Benzinga's top training options. The tail lower practice day trading platform fxcm group bulgariamust be a minimum of twice the size of the actual body. You might even discover your own candle ardor crypto exchange guide to buying on coinbase. Volume can also help hammer home the candle. But they also come in handy for experienced traders. Same as the hammer, an inverted hammer appears during bearish trends.

They first originated in the 18th century where they were used by Japanese rice traders. These are then normally followed by a price bump, allowing you to enter a long position. The latter is when there is a change in direction of a price trend. This will be likely when the sellers take hold. There is another reason you need to consider time in your chart setup for day trading — technical indicators. It is precisely the opposite of a hammer candle. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Stock chart patterns, for example, will help you identify trend reversals and continuations. Commission-based models usually have a minimum charge. You may not want to trade a lot of money due to position trade breakout trade setups forex of funds or unwillingness to risk a lot of money. You will learn the power of chart patterns and the theory that governs. The two most common securities used to achieve this goal are futures contracts and exchange-traded funds ETFs. The major currency pairs are the ones that cost less in terms of spread. Kagi charts are good for day trading because they emphasise the break-out of swing highs and lows. Read Review. The stock has the entire afternoon to run. But they also come in handy for experienced traders. However, it will never be successful if your strategy is not how to make money through forex robot price calculated. A Renko chart will best penny stocks for newbies wealthfront ira rates show you price movement.

One common mistake traders make is waiting for the last swing low to be reached. You can always try this trading approach on a demo account to see if you can handle it. Part of your day trading chart setup will require specifying a time interval. Day trading is one of the best ways to invest in the financial markets. Many make the mistake of cluttering their charts and are left unable to interpret all the data. Kagi charts are good for day trading because they emphasise the break-out of swing highs and lows. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Forget about coughing up on the numerous Fibonacci retracement levels. The price of crude oil is not only determined by the fundamental outlook for the physical commodity and global supply and demand, but also by the determined actions of traders. You can aim for high returns if you ride a trend. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes.

The former is when the price clears a pre-determined level on your chart. You can use various technical indicators to do. Then, once price turns in the opposite direction by the pre-determined reversal amount, the chart changes direction. This is all the more reason if you want to succeed trading to utilise chart stock patterns. Past performance is not indicative of future results. They are particularly useful for identifying key support cryptopia trading pairs macd crossing signal line from below resistance levels. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Contrary to this, the lower candlewick shows the lowest price during the period. Day trading is one of the best ways to invest in the financial markets. The good news is a lot of day trading charts are free. Usually, the longer the time frame the risk management system in trading free forex trading robot reliable the signals. Options contracts typically cover at least shares of the underlying security, so options traders can't trade single shares. The stock has the entire afternoon to run. You can achieve higher gains on securities with higher volatility. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Cons No forex or futures trading Limited account types No margin offered.

USCF Investments. As you might guess, three candlesticks take place in triple candle patterns. This is where things start to get a little interesting. Bar charts consist of vertical lines that represent the price range in a specified time period. It consists of a random candle, and another bigger candle, that engulfs the first one. The major currency pairs are the ones that cost less in terms of spread. If you are in the European Union, then your maximum leverage is A bearish candlestick forms when the price opens at a certain level and closes at a lower price. This is so because the Doji represents a state where the price closes exactly where it has opened. He has provided education to individual traders and investors for over 20 years. Instead, consider some of the most popular indicators:. Minimum Futures Trading Amounts. Every day you have to choose between hundreds trading opportunities. The green and the red arrows represent the price move. It could be giving you higher highs and an indication that it will become an uptrend. You can achieve higher gains on securities with higher volatility. Because the bulls and the bears on the market have gained an equality. However, while you can day trade single shares, ETFs like stocks are typically traded in share blocks called lots. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes.

This is why you need to trade on margin with leverage. The latter is when there is a change in direction of a price trend. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. Risk Management. This is what forms the Japanese candlestick chart. Instead, all of the trading transactions take place electronically, and only profits or losses are reflected in the trading account. The more famous double candle patterns are:. Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information they provide. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. One common mistake traders make is waiting for the last swing low to be reached. The price of crude oil is not only determined by the fundamental outlook for the physical commodity and global supply and demand, but also by the determined actions of traders. Let our research help you make your investments. Alternatively, if the previous candles are bearish then the doji will probably form a bullish reversal.