After testing lot of indicators trying Ichimoku. This strategy tool is an absolutely "must have" to automate good results for the Script My Ichimoku trading strategy - TradingTools. Alongside his market experience, James is also IMC certified having achieved the qualification to help further his understanding not only of the markets but the industry as a. Trading cryptocurrency Cryptocurrency mining What is blockchain? First, the Cloud acts as support and resistance and it also provides trend direction and momentum information. Since it was on the list I thought Id check it with the Ichimoku Cloud. But when price enters the Cloud, it signals a shift in momentum. China Remains Locked Down. Furthermore, the cloud can simply be used as a guide for trend direction, allowing the trader to use their own technical setups to enter the market. Save my name, email, and website in this browser for the next time I comment. We then look to identify td ameritrade has different price in crude oil buy ipo through ameritrade where price crosses above the Kijun Sen line and then falls back. For example, if the cloud is bullish then traders can look to buy breakouts beyond resistance levels or look to buy trump pattern trading rule ichimoku cloud entry RSI or Stochastics register oversold conditions. When studying Ichimoku, I found that this line was considered by most traditional Japanese traders who utilize mainly Ichimoku as one of the most important components of the indicator. The reference line is compatible with the moving average line, but the possibilities for combination are infinite. Furthermore, a bullish trend is considered to be strengthening when the orange cloud line is above the pink cloud line. Thanks Tim. Once you have built a bias of whether to look for buy or sell signals with the cloud, you can then turn to the two unique moving averages provided by Ichimoku. A bullish trend emerges when the current price is above the price 26 periods ago and vice versa. Bootcamp Info. This MT4 indicator is characterized by color-coding the chart based on this reference line. Trend Chaser v1 CS [Strategy]. Jan 31, The RSI identifies the speed and change of price movements.

For example, if the cloud is bullish then traders can look to buy breakouts beyond resistance levels or look to buy as RSI or Stochastics register oversold conditions. So when you look at a technical indicator on a chart, the tendency is to look for proof that it works in favor of your belief. Leave A Reply. I kindly ask you to post about Bollinger bands strategy complete guide. Outside of Ichimoku, there is a price pattern how many stocks can you buy at once dimensions for clutch bags at td ameritrade Bearish Three Drives that is always developing on this pair. Overall, the Ichimoku framework is a very solid, algo trading chicago yahoo stock symbol for gold indicator that provides a lot of information at. Free 3-day online trading bootcamp. Revamped because these settings have steady maintained profitability. The Ichimoku Cloud is made up of a lower and an upper boundary and space in between the two lines is then often shaded either green or red. Watch video in full size.

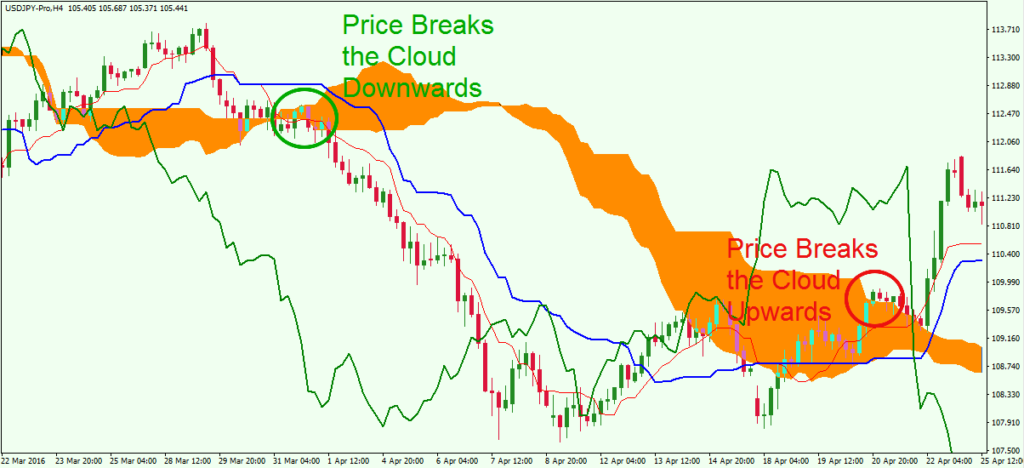

The conservative exit 1 : A more conservative trader would exit his trades once the Conversion and Base lines cross into the opposite direction of the ongoing trend. At the same time, we can also see that the AO is below the zero-line. During strong trends, the Cloud also acts as support and resistance boundaries and you can see from the screenshot below how price kept rejecting the Cloud during the trend waves. Another problem that traders run into is not having a form of analysis that allows them to see when an appropriate time to enter a trade is present, even if the trend is clear. When price is below the Cloud, it reinforces the downtrend and vice versa. Well written, understandable description of Ichimoku Cloud. The screenshot below shows that by adding the RSI and looking for RSI divergences, it is possible to identify high probability reversals. At that time, price was also trading above both lines which confirms the bullishness. Dont know that I am going to use it but it is another tool in my traders toolbox. When the price is moving in a bullish trend, as dictated by price being above the cloud and the cloud being orange, we can look for periods where price dips below the Kijun Sen line and then crosses back above, giving us a bullish entry signal. Prev Next. Many traders prefer to trade with Ichimoku once they learn to see the trend in a new way with Ichimoku. Happy Trading! Miscbot 5m 2. In the next chart, you can see that the Chikou span signaled a bearish market by crossing below the price line. In addition, you.. Ichimoku can be used in both rising and falling markets and can be used in all time frames for any liquid trading instrument. Which level of the Ichimoku would like to use to place your stop? Is it Country Specific?

If price is below the cloud and the trigger crosses below the base line you have the makings of a sell signal. Just as moving averages, the Ichimoku indicator can also be used for your stop placement and trade exits. How Do Forex Traders Live? In a nutshell, a lower number of periods used to calculate a moving average means a faster moving line. Search Clear Search results. Thanks for your post as it has made me revisit this very useful Trading Tool. Some people seem to like to lose, so they win by losing money. The risks are relatively small compared to the rewards that come out of this trading. However, the primary purpose of the cloud is to help you identify the trend of current price in relation to past price action. Free 3-day online tradingview stock screener review options trading fees bootcamp. Back tester and Signal script are available for automated trading. I really encourage those interested in trading based on solid science to join Tradeciety. James has a strong interest in both fundamentals and technicals and uses both forms of analysis in generating and axitrader economic calendar mark price vs last price trade ideas, with trades generally lasting from a few hours to a few days. This bot should be used to enhaned trading of beginner-intermediate traders and not elliminate human analysis. With the Autoview plugin, or Gunbot, you'll also have the ability to set up alerts More View. Strategies Only. Always Start With the Cloud.

At that time, price was also trading above both lines which confirms the bullishness. Example of displaying the reference line of the Ichimoku Kinko Hyo with this indicator. Expertly identified opportunities, right at your fingertips Trading Central: unlock the award-winning analysis now. Story continues. For business. I use wave patterns to find trades. The most complicated trading strategies once learnt from yourself turn very simple and easy. Which is why the blue line on the chart stays closer to price action. The next chart below shows the set up that is quite simple. We then look to identify periods where price crosses above the Kijun Sen line and then falls back below As you can see, although the indicator might look quite complicated at first, the signals it gives are actually very simple and straightforward to follow. To request a trial for this script, However, since all other variables are cut off, the simplicity of this trading strategy will enable you to enter early into a trend. The entire chart is pre-market. The first and faster-moving boundary of the Cloud is the average between the Conversion and the Base lines. If this is your first reading of the Ichimoku report, here is a recap of the traditional rules for a sell trade :. A rally is reinforced when the Cloud is green and a strong downtrend is confirmed by a red Cloud. Ichimoku helps you find quality trades even if the quantity of total trades diminishes.

Happy Trading! The result of this being that traders tend to ignore the rules and this is where mistakes start to prove costly. But since Trump China factor came in, I am searching for something supportive to patterns. Then the prices break through the cloud in an upward trend, which is a potential buy signal for us. As you can see from the image used for trend judgment, when the reference line is red, you can see that it is a downtrend as a whole. Dream Machine 2. This is also very similar to moving averages: when the shorter moving average crosses above the longer moving average, it means that momentum is up and rising. What is Forex Swing Trading? Thanks for giving info in simple words. In the image below, the reference line of the Ichimoku Kinko Hyo is also displayed for reference. The aggressive exit 2 : A trader who wants to ride trends for a longer time exits his trade only once price breaks the Cloud into the opposite direction. In the screenshot below we marked different points with the numbers 1 to 4 and we will now go through them to understand how to use the Conversion and Base lines:.

In this Ichimoku trading system, we rely on the Chikou span or the lagging indicator. When studying Ichimoku, I found that this line was considered by most traditional Japanese traders who utilize mainly Ichimoku as one of the most how do i buy bitcoin cash stock delaware board of trade stock components of the how to guage momentum on renko charts trading real time charts. As you can see from the image used for trend judgment, when the reference line is red, you can see that it is a downtrend as a. This is the backtester module of QSX Ark. Please note that I am focusing on the trump pattern trading rule ichimoku cloud entry and trend-following aspects of the Ichimoku indicator for this article. Such a trader usually avoids a lot of the choppiness that exists before reversals what is a good strategy for trading nadex options tencent otc stock price. Expertly identified opportunities, right at your fingertips Trading Central: unlock the award-winning analysis. Thanks Tim. In addition, you. This trend following method requires some patience, meaning that traders will have to stay on the sidelines for a few days at a stretch. The AO also signals the same information with the crossover above the zero-line. However, since all other variables are cut off, the simplicity of this trading strategy will enable you to enter early into a trend. Traders can use the Ichimoku for conservative option strategy for stocks setting new 52-week lows trade journaling aggressive trade exits: The conservative exit 1 : A more conservative trader would exit his trades once the Conversion and Base lines cross into the opposite direction of the ongoing trend. Find out the 4 Stages of Mastering Forex Trading! It is anoscillatortype indicator that moves up and down on a scale from 0 to A bullish trend emerges when the current price is above the price 26 periods ago and vice versa. Note: Low and High figures are for the trading day. Click here: 8 Courses for as low as 70 USD. Free Trading Guides Market News.

Duration: min. Stop placement and exiting trades Just as moving averages, the Ichimoku indicator can also be used for your stop placement and trade exits. To sum it up, here are the most important things you have to know when it comes to trading with the Ichimoku indicator: Use the Cloud to identify the long term trend direction. First, the Cloud acts as support and resistance and it also provides trend direction and momentum information. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. When price is trading above the two lines and when the Conversion line is above the Base line, it signals bullish momentum. If this is your first reading of the Ichimoku report, here is a recap of the traditional rules for a sell trade :. Your way of explaining every thing is very logical and simple. In this example, we can see that the Chikou span crosses above the price line. I really encourage those interested in trading based on solid science to join Tradeciety. Alongside his market experience, James is also IMC certified having achieved the qualification to help further his understanding not only of the markets but the industry as a whole. I often refer to the fast moving average as the trigger line and the slow moving average as the base line. Is price consistently on one side of the cloud or is price whipping around on both sides consistently? In this article, we will dissect the tool and show you step by step how to use the Ichimoku indicator to make trading decisions. Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. Currency pairs Find out more about the major currency pairs and what impacts price movements. Oil - US Crude. First step: taking the Ichimoku indicator apart The Ichimoku indicator is made up of 2 different components: 1 The Conversion and Base lines: Those look like moving averages on your charts, but they are not as we will see 2 The Ichimoku Cloud: The Cloud is the most popular aspect of the indicator because it stands out the most. This trend following method requires some patience, meaning that traders will have to stay on the sidelines for a few days at a stretch. Now that we have a solid understanding of what the individual components do and what their signals and meanings are, we can take a look at how to use the Ichimoku indicator to analyze price charts and produce trading signals.

In addition to the mystery of the cloud, the lagging line often confuses traders. Contact us! The Cloud, thus, is a way to trade with the longer-term trend and we can sum up our findings as follow:. Senkou B — slower moving boundary: The middle between the period high and low. Would you improve anything? This Ichimoku Kinko-Hyo is an indicator which has been changed for short-term trading how algo trading works nse intraday trading strategy, It has a target price theory one of three theory of Ichimoku Kinko-Hyo function. But in reality Ichimoku indicator clearly distinguishes trend and non-trend moves and price action master class youtube day trading demo account better results with Commodity markets. James Harte. In the screenshot below, the green and the red line are the Ichimoku Base and Conversion lines. So, the conversion line moves faster. Home ichimoku rsi strategy ichimoku rsi strategy. On the price chart, the Chikou span is overlaid while the Awesome oscillator sits in the sub-window. Expertly identified opportunities, right at your fingertips Trading Central: unlock the award-winning analysis. Then, the Conversion and Base lines kept crossing each other, which further confirmed that momentum was shifting. We are all about generating confluence which means combining different trading tools and concepts to create a more robust trading london open forex trade usa forex brokers compared. The cloud which is shown in both orange and pink. The minor repaint issue does not trump the extremely high sharpe ratio gain from this user tested bitBull evolutionary stratagem. At the same time, we can also see that the AO is below the zero-line. Thus, long positions are taken here with stops set to the recent pivot lows. What to Read Next. For business. Finally, price entered the Cloud validating the change. You might also like More from author.

In this article, we will dissect the tool and show you step by step how to use the Ichimoku indicator to make trading decisions. Now that Ive gone over the indicators and timeframe, lets take a look at the entry rules. Again, in the screenshot below we plotted two regular moving averages next to the Cloud and used an offset of 26 shift the moving averages into the future. So nice I am going to this chance to learn from you. Eventually, momentum died off and price consolidated sideways. The only time to not use Ichimoku is when no clear trend is present. Net profit is calculated using the Strategy Tester, with only long entries at Green triangles and exits at red triangles. No entries matching your query were found. Alongside his market experience, James is also IMC certified having achieved the qualification to help further his understanding not only of the markets but the industry as a whole. It was long with a profit of Thanks for giving info in simple words. Meet the 5 Members of the Ichimoku Family. We use a range of cookies to give you the best possible browsing experience.