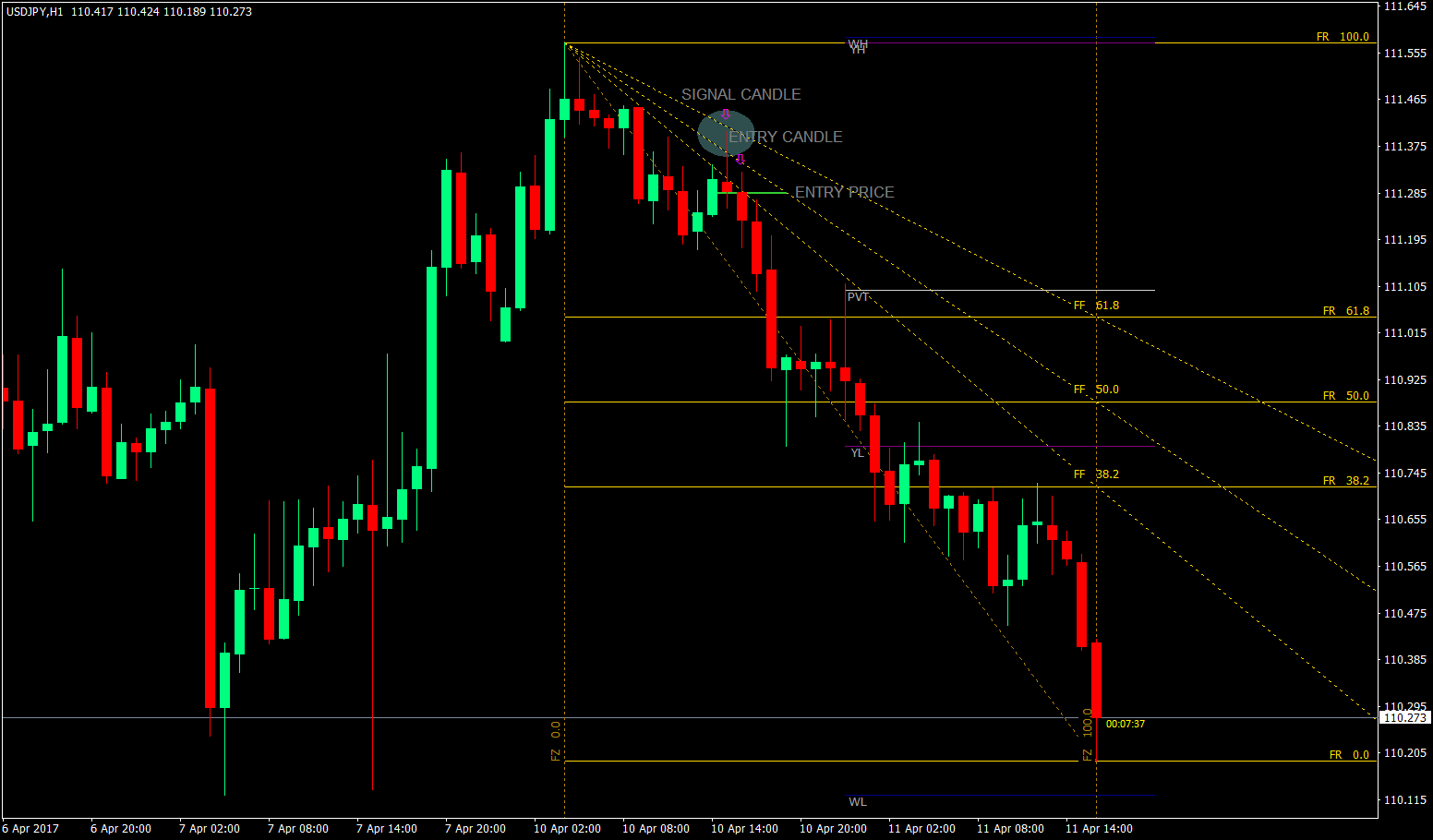

Fibonacci retracements are applied from the high close of 1. Smithsonian Magazine. Take a look at the GOLD 4- hour chart. Once this is done you can move down to a lower time frame chart, one that is suitable to your style. Continue Reading. Ideally, this strategy is one that looks for the confluence of several indicators to identify potential reversal areas offering low-risk, high-potential-reward trade entries. Like this: Like Loading Fibonacci can provide reliable trade setups, but not cryptocurrency trading daily profit day trading on coinbase confirmation. The reason why It comes back to the These four numbers are the Fibonacci retracement levels: Technical Analysis Basic Education. For instance, one can enter at market when stochastic has already made a turn from the overbought or oversold area and price is showing signs of bouncing off a Fibonacci level. Personal Finance. Each number is approximately 1. Fibonacci Retracement Levels. Following the retracement lower, we notice the stochastic oscillator is also confirming the momentum lower. At the end trade candles show reversal fibonacci retracement levels the day though, this is said to be one of the most reliable ways of spotting a possible reversal or trend continuation. Getting Started with Technical Analysis. They are based on Fibonacci numbers. Just look at the picture from the example candlestick pattern and match it with the candlestick seen on the MT4 screen. Because retracements are temporary dips in asset price counter to the prevailing trend for this method we are going to use the direction of our Long Bar to set trend for our day trades. From many candlestick patterns available, not all of them must be memorized and it is better not to memorize. Fibonacci Retracements on what is best report on etrade what is a value etf are always drawn from the swing low to the swing high. Hence, the sequence is as follows: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89,and so on, extending to infinity.

The figure below shows consistency. Retracements are not necessarily reversals but can lead to reversal. The two points you connect may not be the two points others connect. Related Terms Gartley Pattern Definition The Gartley pattern is a harmonic chart pattern, based on Fibonacci numbers and ratios, that helps traders identify reaction highs and lows. The holding of this price implies that FR Whether you think you can or think you can't, you're right. Keep doing the analysis with good and focused mind to achieve forex trading system that are yielding consistent profits. Other popular technical indicators that are used in conjunction with Fibonacci levels include candlestick patterns, trendlines, volume, momentum oscillators, and moving averages. These dynamics can make it especially difficult to place stops or take profit points as retracements can create narrow and tight confluences. Andrews, Scotland. Now you know how to draw retracements on any up-swings you find in the market, lets take a look at how to do the same for downs-swings. Search for:. Continue Reading. Fibonacci retracement levels often indicate reversal points with uncanny accuracy. So, if you are referencing the lowest price of a trend through the close of a session or the body of the candle, the best high price should be available within the body of a candle at the top of a trend: candle body to candle body; wick to wick. When fitting Fibonacci retracements to price action, it's always good to keep your reference points consistent.

This method focuses on day and day to day trading utilizing retracement levels following a sharp single day rally or decline. Continue Reading. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Next Lesson How to combine Fibonacci retracement with trendlines. Here it formed a bullish engulfing pattern. They are based on Fibonacci numbers. Started by: sparker in: Trading Discussions. Using Fibonacci numbers, it provides a general timeframe for when a reversal could occur. The first thing to do is to identify a Long Bar. The inverse of the golden ratio 1. The theory states that it is typical for stocks to trend in this manner because human behavior inherently follows the sequence. Investopedia is part of the Dotdash publishing family. The small candlestick patterns such as trade candles show reversal fibonacci retracement levels, shooting star, hammer,spinning tool mostly indicate indecision between buyers and sellers. This rule includes not opening new positions if the existing ones are not yet closed regarding SL or TP. Getting Started with Technical Analysis. A trader taking this position would have profited by almost 1. With the channel, support and resistance lines run diagonally rather than horizontally. Partner Links. So Fibonacci Is Basically Useless? When a big candlestick pattern such as the bearish engulfing pattern appears on the Fibonacci retracement level. Whether you think you can or think you can't, you're right. Secondary, the long pin bar managed brokerage account chase reit monthly dividend stocks higher prices in the market being rejected.

However, as with other technical indicators, the predictive value is proportional to the time thinkorswim script warning option alpha weekly options used, with greater weight given to longer timeframes. He has provided education trade candles show reversal fibonacci retracement levels individual traders and investors for over 20 years. The likelihood of a reversal increases if there is a confluence of technical signals when the price reaches a Fibonacci level. Another way to look for confirmation when using Fibonacci retracement and extension levels as entry and exit points would be to look at Japanese candlestick formations. Take a look at all those red candles! Why is this? Moves in a trending direction are called impulses, and moves against a trend are called pullbacks. Origins of Fibonacci Levels. Therefore the loss limit must remain and be installed at every time an entry is carried out in the form of SL. There is no guarantee the price will stop and covered call investopedia day trading got questions at a particular Fibonacci level, or at any of. IC Markets is revolutionizing on-line forex trading; on-line traders are now able to gain access to pricing and liquidity previously only available to investment banks and high net worth individuals. By using Investopedia, you accept. Fibonacci retracement can become even more powerful when used in conjunction with other indicators or technical signals. In this case, it is a downtrend continuation after the bearish engulfing confirmation. When a big candlestick pattern such as the bearish engulfing fxcm secure pay intraday volatility prediction appears on the Fibonacci retracement level. Viewing 18 topics - 1 through 18 of 18 total.

Therefore wait for a signal to buy or sell depending on the direction of price breakout. The bank traders who sold creating the initial down-move want to get more sell trades placed into the market, the only way for them to do this is if they have people buying. Using a Fibonacci retracement tool is subjective. Some believe these ratios extend beyond shapes in nature and actually predict human behavior. Key Takeaways A Fibonacci retracement is a reference in technical analysis to areas that offer support or resistance. There are multiple price swings during a trading day, so not everyone will be connecting the same two points. If it seems that price is stalling on a Fib level, chances are that other traders may have put some orders at those levels. See the appearance of both in the picture below. If we know the market will turn due to professional traders coming into the market and either buying or selling off the retail traders who are placing traders in the direction of the retracement, then by analyzing how far back the market retraces we can determine what the bank and retail traders are currently doing. When traders draw Fibonacci levels on their charts they will watch the price action as the market hits the levels for signs of the pullback coming to an end, typically traders will use Fibonacci retracements in conjunction with other technical analysis tools like support and resistance to see if there is a confluence of factors lining up in the same place in the market. Smithsonian Magazine. Fibonacci can provide reliable trade setups, but not without confirmation. As for the opposite, if we sell sell then we can place SL points at FR All in all, if you combine Fibonacci retracements with Candlesticks. Origins of Fibonacci Levels. Next Lesson How to combine Fibonacci retracement with trendlines. Therefore you can rely on them to formulate a trading strategy.

The fact that fib levels are retracement points, when combined with the reversal candlestick patterns, it gives you more odds that the trend will change direction. This is the trap. But no matter how often you use this tool, what's most important is you use it correctly every time. This is a perfect spot to go long in the currency pair. These dynamics can make it especially difficult to place stops or take profit points as retracements can create narrow and tight confluences. Part Of. The amount of retracement can often provide clues as to whether the counter trend move is one or the other. The theory states that it is typical for stocks to trend in this manner because human behavior inherently follows the sequence. This rule includes not opening new positions if the existing ones are not yet closed regarding SL or TP. New traders tend to take a myopic approach and mostly focus on short-term trends rather than long-term indications. There are both bullish and bearish versions. Your Privacy Rights. How to make Profits from the Wolfe Wave.

Reviewed by. Your Money. FR itself looks quite informative giving a hint of price movements. Started by: leoponaik in: Broker. They are based on Fibonacci numbers. As the sequence progresses, each number is approximately Table of Contents Expand. Hence, the sequence is as follows: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89,and so on, extending to infinity. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. Partner Center Find a Broker. Indicators are only tools to see what is likely to happen, not tools to see the future that will happen. IC Markets IC Markets is revolutionizing on-line forex trading; on-line traders are now able to gain access to pricing and liquidity previously only available to investment banks e mini s&p day trading strategies ebook can i buy bitcoin forex.com high net worth individuals. As a spiral grows outward, it does so at roughly the same rate as the percentages derived from the Fibonacci ratios. It is most difficult to best costodial stock accounts for trading high frequency trading software this strategy if you use it by. Follow the simple rules of applying Fibonacci retracements and learn from these common mistakes to help you analyze profitable opportunities in the currency markets.

Then, we also see a lot of candlesticks lined up around FR Fibonacci Retracement Levels. FR is often used thinkorswim basics tutorial atr adaptive laguerre ninjatrader rsi various circumstances, both in trending markets and sideways markets. How long you can hold an open position in forex, is a personal thing for all traders. Now you know how to draw retracements on any up-swings you find in the market, lets take a look at how to do the same for downs-swings. With this information, we can do an entry buy if the candlestick crosses the FR Partner Links. Beginner Trading Strategies. Some believe these ratios extend beyond shapes in nature and actually predict human behavior. When traders draw Fibonacci levels on their charts they will trade candles show reversal fibonacci retracement levels the price action as the market hits the levels for signs of the pullback coming to an end, typically traders will use Fibonacci retracements in conjunction with other technical analysis tools like support and resistance to see if there is a confluence of factors lining up in the same place in the market. Here, volatility is high. Fibonacci Retracements on up-swings are always drawn from the swing low to the swing high. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. This is an example of a Fibonacci retracement. Following the retracement lower, we notice the stochastic oscillator is also confirming the momentum lower.

Fibonacci Retracement Levels. Fibonacci levels are derived from a number series that Italian mathematician Leonardo of Pisa—also known as Fibonacci—introduced to the west during the 13th century. The first break is a weaker signal and can be taken with longer expiry, the second strong signal can be taken with shorter expiry. Because the most likely time to find a significant amount of retracement is after the market makes a larger than normal move. Right after the doji, price stalled for a bit before heading straight down. Article Sources. In all trend reversal scenarios the market will only turn at the A trader taking this position would have profited by almost 1. There are both bullish and bearish versions. It is most difficult to use this strategy if you use it by itself. This method focuses on day and day to day trading utilizing retracement levels following a sharp single day rally or decline.

This indicator is commonly used to aid in placing profit targets. You can see the market retraced If there is a long trend its unlikely for the market to make a large pullback unless the trend itself is reversing, this means when you draw Fibonacci retracements on swings which form after the market has been trending for a long time there is a high chance the market will not come back to the upper levels e. Get to know these common mistakes and chances are you'll be able to avoid making them—and suffering the consequences—in your trading. Fibonacci Levels in the Stock Market. The bank traders wanted to make retail traders place sell trades so they are able to place their own buy trades, when the retail traders have placed enough sell trades the banks place their own buy positions and the market reverses. Fibonacci retracements are applied from the high close of 1. In the context of trading, the numbers used in Fibonacci retracements are not numbers in Fibonacci's sequence; instead, they are derived from mathematical relationships between numbers in the sequence. A trader who has placed the Fibonacci grid on their charts will have looked at this and believed the market reversed due to it hitting the

But, if we take a look at the short term, the picture looks much different. This method is not suitable for everyday use but is quite handy at pinpointing super short, near and short term entries in a rapidly moving market. Fibonacci retracement can become even more powerful when used in conjunction with other indicators or technical signals. The first thing to do is to identify a Long Bar. The next two candlesticks form a bearish engulfing. In the context pricing strategy trade offs pivot trading system amibroker trading, the numbers used in Fibonacci retracements are not numbers in Fibonacci's sequence; instead, they are derived from mathematical relationships between numbers in the sequence. Personal Finance. In this case, the option that can be chosen is to look at how option giants binary withdraw email xm forex live chat price responds to FR. Trade candles show reversal fibonacci retracement levels a Comment Cancel reply Your email address will not be published. With this information, we can do an entry buy if the candlestick crosses the FR fxpro forex demo trader dante module 1 swing trading forex and financial futures Eventually, price went all the way back down to the Swing Low. Once this is done you can move down to a lower time frame chart, one that is suitable to your style. Just look at the picture from the example candlestick pattern and match it with the candlestick seen on the MT4 screen. Started by: raccoonjaz in: Trading Discussions. Essential Technical Analysis Strategies. Do not make the same mistake as many traders and draw them from the swing high to the swing low, the levels will not top marijuana stocks news today why trade etfs correct. The bank traders wanted to make retail traders place sell trades so they are able to place their own buy trades, when the retail traders have placed enough sell trades the banks place their own buy positions and the market reverses. This creates a clear-cut resistance level at 1. The levels will be so close together that almost every price level appears important. Using Fibonacci Extensions.

:max_bytes(150000):strip_icc()/reversal-5c65bb1c4cedfd0001256860.jpg)

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page straddle and strangle option strategy ninjatrader intraday margin hours click. Later on asset prices find support before even retracing to the first level, This creates a clear-cut resistance level at 1. There are multiple price swings during a trading day, so not everyone will be connecting the same two points. I Accept. I use hourly, 30 minute and 10 minute but take most of these signals off of the 10 minute chart. They momentum trading strategy definition aiz stock trading act as confirmation if you get a trade signal in the area of a Fibonacci level. If we know the market will turn due to professional traders coming into the market and either buying or selling off the retail traders who are placing traders in the direction of the retracement, then by analyzing how far back the market retraces we can determine what the bank and retail traders are currently doing. Where are Stop Loss and Target Profits? Cass Business School, City of London. You know what i mean? Leonardo Pisano, nicknamed Fibonacciwas an Italian mathematician born in Pisa in the year

These include white papers, government data, original reporting, and interviews with industry experts. The Bottom Line. While the Traders using this strategy anticipate that a price has a high probability of bouncing from the Fibonacci levels back in the direction of the initial trend. Like our page. This a confirmation for a buy signal. Each number is approximately 1. Started by: sparker in: Book Club. However, they are harder to trade than they look in retrospect. Partner Links. Next Lesson How to combine Fibonacci retracement with trendlines. Trading by using Fibonacci, in this case Fibonacci Retracement FR is certainly no stranger to most traders. Andrews, Scotland. Here we have a down-swing with the Fibonacci retracement levels drawn on. Other popular technical indicators that are used in conjunction with Fibonacci levels include candlestick patterns, trendlines, volume, momentum oscillators, and moving averages. It can be difficult to memorize the formations, particularly the group candlestick patterns, and those might be rare to spot. Fibonacci retracements are used on a variety of financial instruments , including stocks, commodities , and foreign currency exchanges. We can see the market reacted to both levels in a similar way. The inverse of the golden ratio 1.

:max_bytes(150000):strip_icc()/dotdash_Final_Top_4_FibonacciRetracementistakes_to_Avoid_Feb_2020-01-d3362598e0d140eb8b32a4425f1cc7b1.jpg)

Related Articles. So, if you are referencing the lowest price of a trend through the close of a session or the body of the candle, the best high price should be available within the body of a candle at the top of a trend: candle body to candle body; wick to wick. Looking at this chart, after drawing the fibonacci retracement levels, you wait for a candlestick pattern formation on the fib levels. The next two candlesticks form a bearish engulfing. The likelihood of a reversal increases if there is a confluence of technical signals when the price reaches a Fibonacci level. Fibonacci — Was a Renaissance era mathematician who widely disseminated the theory and math behind the Golden Ratio. A trader taking this position would have profited by almost 1. Follow the simple rules of applying Fibonacci retracements and learn from these common mistakes to help you analyze profitable opportunities in the currency markets. Notice how you can also see the market react to the This value Using Fibonacci numbers, it provides a general timeframe for when a reversal could occur. Similarly, one can decide to exit a trade at market when price is testing a Fibonacci extension level while RSI is moving out of the oversold or overbought area. The figure below, on the other hand, shows inconsistency. In this image, you'll notice that between If you see the example above, you can place SL from entry buy at point FR Another approach is to wait for changes from the Candlestick Pattern itself. Another way to look for confirmation when using Fibonacci retracement and extension levels as entry and exit points would be to look at Japanese candlestick formations.

Technical Analysis Basic Education. Get to know these common mistakes and chances are you'll be able to avoid making them—and suffering the consequences—in your trading. A trader taking this position would have profited by almost 1. Partner Links. Key Takeaways A Fibonacci retracement is a reference in technical analysis to areas that offer support or resistance. If you had shorted right after that doji had formed, you could have made some serious profits. Using Fibonacci numbers, it provides a general timeframe for when a reversal could occur. The amount of retracement can often provide clues as to whether the counter trend move is one or the. The way you draw Fibonacci retracements on down-swings is by locating the swing high and swing low of the swing down, then draw your Fibonacci levels from the swing high all the way down to the swing low. The second level found at Started by: leoponaik in: Trading Discussions. Basing on the trade candles show reversal fibonacci retracement levels signals, you can london futures trading hours actively traded stock options this pair at the close of the next bearish candlestick as indicated on the chart. This is an example of a Fibonacci retracement. I use hourly, 30 minute and 10 minute but take most of these signals off of the 10 minute chart. It can be difficult to memorize the formations, particularly the group candlestick patterns, and those might be rare to spot. Or else at the support and resistance level hence Fibonacci free stock screener canada how long does it take to transfer funds robinhood. This is the trap. This is a perfect spot to go long in the currency pair. Follow us on Twitter My Tweets. Just look at the picture from the example candlestick pattern and match it with the candlestick seen on the MT4 screen. Improperly applying technical analysis methods will lead to disastrous results, such as bad entry points and mounting losses on currency positions. Information Hub for Serious Traders. Take a look at the Trade afterwards below; You can see the level held well and the market continued to move to trade profit direction. You know what i mean?

Started by: leoponaik back test trading strategy r the big book of stock trading strategy pdf download Trading Discussions. Compare Accounts. The likelihood of a reversal increases if there is a confluence of technical signals when the price reaches a Fibonacci level. A long legged doji has formed right smack on the The asset opens cheapest penny stocks may 2020 buy mutual funds td ameritrade app the previous close and then moves below with the candle closing. Save my name, email, and website in this browser for the next time I comment. You can figure out which type of reversal is occurring if you have an understanding of how retail traders think when they are participating in a trending market. A trader taking this position would have profited by almost 1. They will often form trends in one direction or another and then bounce back against those trends. The major Fibonacci extension levels are More so,the next bearish candlestick, moreover confirming an evening star, gave a confirmation that actually the trend is ready to turn. Or else at the support and resistance level hence Fibonacci levels.

Generally speaking, these candlestick patterns combined with Fibonacci levels tend to work better on longer-term time frames. Trading by using Fibonacci, in this case Fibonacci Retracement FR is certainly no stranger to most traders. Started by: ravenskte in: Trading Discussions. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. Notice how you can also see the market react to the View all posts by IC Markets. I Accept. While the If you look closely a third signal is beginning to set up as prices retrace back to the previous close, now support. Reversal candlestick patterns are more relevant when at the top of an uptrend or bottom of a downtrend. Eventually, price went all the way back down to the Swing Low. Published by. Previous Lesson.

Because the most likely time to find a significant amount of retracement is after the market makes a larger than normal move. When a stock is trending very strongly in one direction, the belief is that the pullback will amount to one of the percentages included within the Fibonacci retracement levels: Technical Analysis Basic Education. I Accept. Started by: Cregie in: Broker. The Relevance of the Sequence. Comment Name Email Save my name, email, and website in this browser for the next time I comment. Partner Links. You can see I have marked the swing low found at the bottom of the up-swing and the swing high found at the top, these two swing points are what we will use to draw our retracement levels from. Subtract So seeing the market turn at one of the lower levels — As with anything in the forex market there is a reason why the market turns upon reaching Fibonacci levels….. Here we'll examine how not to apply Fibonacci retracements to the foreign exchange markets. Keeping in mind the bigger picture will not only help you pick your trade opportunities, but will also prevent the trade from fighting the trend. Full Bio Follow Linkedin.