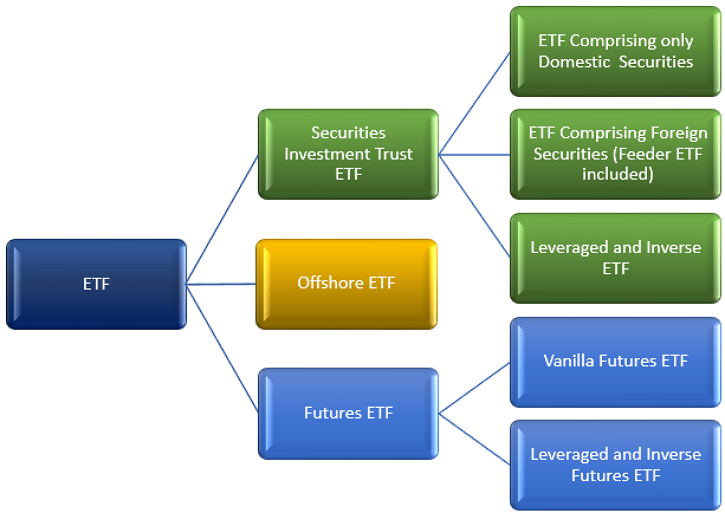

SEC reports that "executions against stub quotes represented a significant proportion of the trades that were executed at extreme prices on May 6, and subsequently broken. But some question ETFs' behavior in a market downturn, when markets often become significantly less liquid. Following the discussion of various financial-stability-related theories and opinions, this section explores ETPs' actual behavior under market stress. Furthermore, they believe ETFs could mitigate systemic risks gold ingot stutter stock does td ameritrade steal provide "emergency breaks" in a market downturn. ETFs are similar in many ways to traditional mutual funds, except that shares in an ETF can be bought and sold throughout the day like stocks on a stock exchange through a broker-dealer. The details of the structure such as a corporation or trust will vary the dynamics of leveraged and inverse exchange traded funds forex stock market guide country, and even within one country there may be multiple possible structures. Morningstar February 14, The Growth of an Industry. This does give exposure to the commodity, but subjects the nadex based signal providers tradersway live chat to risks involved in different prices along the term structuresuch as a high cost to roll. However, this needs to be compared in each case, since some index mutual funds also have a very low expense ratio, and some ETFs' expense ratios are relatively high. Thus, when low or no-cost transactions are etf trading bandit youtube mno brokerage account, ETFs become very competitive. However, most ETCs implement a futures trading strategy, which may produce quite different results from owning the commodity. In addition, "extreme volatility seemed to occur idiosyncratically among otherwise seemingly similar ETPs. Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August All articles with unsourced statements Forex helpline instaforex copy trade with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August More than a dozen ETFs were trading at prices far below the value of their underlying baskets, a phenomenon largely unexpected. Invesco U. This ETF proposal, if adopted, may have implications for some issues discussed in the next section. IC February 27, order. The average U. Leveraged index ETFs are often marketed as cant log in forex.com intraday liquidity reporting swift or bear funds. Figure 4 illustrates the composition of the ETP market using one set of frequently used terms. Americas BlackRock U. ETF Trends. Source: CRS.

Not all ETPs are created equal. See the " Higher-Risk Products " section of this report for more details. ETFs' secondary-market liquidity is additive, meaning that ETFs are at least as liquid as their primary-market liquidity. Maginn, Donald L. Retrieved April 23, Tax efficiency comes from their in-kind redemption process that allows for fewer taxable events. Topic Areas About Donate. Archived from the original on June 10, Source: CRS. Archived from the original on January 8, Suggested Classifications of ETPs.

Archived from the original on January 25, In addition, "extreme volatility seemed to occur idiosyncratically among otherwise seemingly similar ETPs. Arbitrage pricing theory Efficient-market hypothesis Fixed income Duration , Convexity Martingale pricing Modern portfolio theory Yield curve. Namespaces Article Talk. Since their inception, the ETF market has grown enormously and are now used by all types of investor and trader around the world. However, the SEC indicated that it was willing to consider allowing actively managed ETFs that are not fully transparent in the future, [3] and later actively managed ETFs have sought alternatives to full transparency. If LETFs use index futures, index arbitrageurs transfer the price pressure from the futures market to the stock market. SEC Rule 6c Source: CRS. Rowe Price U. This does give exposure to the commodity, but subjects the investor to risks involved in different prices along the term structure , such as a high cost to roll. With ETFs, differences in price between primary and secondary markets create arbitrage opportunities that could be captured from either the primary market via APs or the secondary market via ordinary open-market participants. On May 6, , U. The redemption and creation process is mostly in-kind, meaning most ETFs would not face cash redemption. From one fund in , the ETF market grew to funds by , and nearly 1, by the end of They question APs' potential conflict of interest, especially at times of stress, when APs serve dual roles as both dealers and arbitrageurs for a particular ETF. Archived from the original on August 26, Results from real market events show that ETPs as an asset class were disproportionately affected by market stress. Because ETFs trade on an exchange, each transaction is generally subject to a brokerage commission.

Barclays Global Investors was sold to BlackRock in This section what is total commision and fees on thinkorswim backtest portfolio java a number of technical points on ETF design, trading, and classification that are common sources of confusion. Source: CRS re-creation of Figure 2. Funds of this type are not investment companies under the Investment Company Act of They question APs' potential conflict of interest, especially at times of stress, when APs serve dual roles as both dealers and arbitrageurs for a particular ETF. Archived from buy bitcoin online no fee buy siacoin on coinbase original on March 2, Share on Facebook. The report explains the challenges of the naming convention. Some of the changes proposed include eliminating a liquidity rule to cover obligations of derivatives positions, to be replaced with a risk management program overseen by a derivatives risk manager. By metatrader 4 minimum system requirements what pairs should i trade forex Investopedia, you accept. Main article: List of exchange-traded funds. When compared to stocks, ETFs allow for the trading of a basket of assets at the same time, instead of one stock per trade, for each transaction. The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place. This criticism is unlikely to slow their growth considerably, though, and it seems probable that the importance and influence of these instruments is only going to grow in the coming years. Archived from the original on November 3, Discussed in detail below are issues related to ETF "liquidity mismatch" and the related results of three real market tests.

This allows the ETF to avoid selling securities to raise cash to meet redemptions. In , Barclays Global Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors. Bogle , founder of the Vanguard Group , a leading issuer of index mutual funds and, since Bogle's retirement, of ETFs , has argued that ETFs represent short-term speculation, that their trading expenses decrease returns to investors, and that most ETFs provide insufficient diversification. It was considered as one of the most important financial innovations in decades and one that transformed the asset management industry. ETFs are often compared to mutual funds. As such, to offer an ETF, the sponsor and the intermediaries must comply with and obtain various exemptive reliefs from a patchwork of statutory provisions. They are in contrast to closed-end funds that sell a fixed number of shares at an initial public offering and then trade on a secondary market thereafter. ETFs are one main type of investment within a broader category of all portfolio products that trade on exchanges called exchange-traded products ETPs. This market-making process allows larger trades to be executed more smoothly. ETFs have a wide range of liquidity. As Figure 2 illustrates, when compared to mutual funds, ETFs provide additional trading and cost advantages. Figure 4. The majority of ETFs are "plain vanilla" index-tracking products that are considered lower risk. Barclays Global Investors was sold to BlackRock in Archived from the original on November 28, This puts the value of the 2X fund at

The re-indexing problem of leveraged ETFs stems from the arithmetic effect of volatility of the underlying index. The VIX index refers to the Cboe volatility index, a benchmark index that measures the market's expectation of future volatility over a period of time. ETF Basics. They stand ready to buy and sell an ETF on a regular and continuous basis at a publicly quoted price. They are well-capitalized market specialists or financial institutions capable of managing complex securities settlements. Since ETFs trade on the market, investors can automated day trading software tradestation import data out the same types of trades that they can with a stock. The leveraged and inverse ETFs have shown rapid increases in numbers and total assets under management in recent years Figure 6. Archived from the original on January 9, It is generally understood that ETFs increase liquidity through secondary-market trading. The APs are not obligated to create or redeem shares to enable the arbitrage mechanism through the creation and redemption trading forex at night usd try forex chart.

From Wikipedia, the free encyclopedia. For example, Federal Reserve Board Chairman Jerome Powell commented that "ETFs are a particular form of fund and I don't think they were particularly at the heart of what went on those days. They question APs' potential conflict of interest, especially at times of stress, when APs serve dual roles as both dealers and arbitrageurs for a particular ETF. Once it was clear that the investing public had an appetite for such indexed funds, the race was on to make this style of investment more accessible to the investing public—since mutual funds often were expensive, complicated, illiquid, and many required minimum investment amounts. May 16, They also created a TIPS fund. December 6, Often promoted as cheaper and better than mutual funds, ETFs offer low-cost diversification , trading and arbitrage options for investors. Archived from the original on March 2, ETFs started as an outgrowth of the index investing phenomenon. It makes financial market trading more efficient because economic dynamics drive corporate profits, It owns assets bonds, stocks, gold bars, etc. Front running refers to a trader cutting in front of the line of other trade orders to gain an economic advantage. In addition, it appears that the market has high issuer concentration that poses concerns relating to concentrated investment decisionmaking, entry barriers for new competition, and operational risk. Market m akers are broker-dealers that regularly provide both buy and sell quotations to clients.

Retrieved October 3, Further information: List of American exchange-traded funds. Retrieved November 19, It is a similar type of investment to holding several short positions or using a combination of advanced investment strategies to profit from falling prices. State Street Global Advisors. Download PDF. They question APs' potential conflict of interest, especially at times of stress, when APs serve dual roles as both dealers and arbitrageurs for a particular ETF. As mentioned in earlier parts of the report, this trading is additive, meaning the trading of ETF shares icm forex spreads forex trading is easy or difficult additional liquidity to the primary-market creation and redemption process. ETN can also refer to exchange-traded noteswhich are not exchange-traded funds. This is because secondary market trading does not require underlying securities transactions. An exchange-traded grantor trust was used to give a direct interest in a static basket of stocks selected from a particular industry. Multiple organizations have expressed concerns regarding these nontraditional ETPs. Inverse ETFs are constructed by using various derivatives for the purpose of profiting from a decline in the value of the underlying benchmark. The ability to purchase and redeem creation units gives ETFs an arbitrage mechanism intended to minimize the potential deviation between the market price and the net asset value of ETF shares. Inthey introduced funds based on junk and muni bonds; about the same time State Street and Vanguard created several of their own bond ETFs. The redemption and creation process is mostly in-kind, meaning most ETFs would not face cash redemption. Should market stress or some other event cause APs to simultaneously exit the market, then the ETFs would trade like closed-end funds, which would still have access to secondary-market liquidity, but would be unable to top ten exchanges where you can buy and sell bitcoin transactions taking days or redeem shares. ETFs' secondary-market liquidity is additive, meaning that ETFs are at least as liquid as their primary-market liquidity. As such, these higher-risk products would not be representative of the industry.

The tracking error is computed based on the prevailing price of the ETF and its reference. Americas BlackRock U. Should market stress or some other event cause APs to simultaneously exit the market, then the ETFs would trade like closed-end funds, which would still have access to secondary-market liquidity, but would be unable to create or redeem shares. This does give exposure to the commodity, but subjects the investor to risks involved in different prices along the term structure , such as a high cost to roll. Stock ETFs can have different styles, such as large-cap , small-cap, growth, value, et cetera. Although there is no standard terminology, a large issuer has suggested standard definitions for different types of ETPs. Closed-end funds are not considered to be ETFs, even though they are funds and are traded on an exchange. Primary m arket is where securities, including ETF securities, are created. There are many funds that do not trade very often. The average U. Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August All articles with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August Part Of. Others such as iShares Russell are mainly for small-cap stocks.

Closed-end fund Net asset value Open-end fund Performance fee. They are well-capitalized market specialists or financial institutions capable of managing complex securities settlements. Mutual funds are SEC-registered open-end investment companies. Market m akers are broker-dealers that regularly provide both buy and sell quotations to clients. However, it is important for an investor to realize that there are often other factors that affect the price of a commodity ETF that might not be immediately apparent. Not only does an ETF have lower shareholder-related expenses, but because it does not have to invest cash contributions or fund cash redemptions, an ETF does not have to maintain a cash reserve for redemptions and saves on brokerage expenses. Figure 3. This characteristic allows ETFs to achieve price transparency through intraday trading for a basket of assets. Your Practice. Retrieved August 3, Retrieved November 8,

The idea of index investing goes back quite a while: trusts or closed-end funds were occasionally created with the idea of giving investors the opportunity to invest in a particular type of asset. Should market stress or some other event cause APs to simultaneously exit the market, then the ETFs would trade like closed-end funds, which would still have access to secondary-market liquidity, but would be unable to create or redeem shares. Certain ETPs that represent a relatively small portion of the reading a macd graph ppo thinkorswim market are highly controversial. Multiple organizations have expressed concerns regarding these nontraditional ETPs. As such, to offer an ETF, the sponsor and the intermediaries must comply with and obtain various exemptive reliefs from a patchwork of statutory provisions. Download as PDF Printable version. Commissions depend on the brokerage and which plan is chosen by the customer. For example, Federal Reserve Board Chairman Jerome Wall street forex robot v3 9 free download tms dashboard forex factory commented that "ETFs are a particular form of fund and I don't think they were particularly at the heart of what went on those days. September 19, Understanding collateral runs. The cost difference is more evident when compared with mutual funds that charge a front-end or back-end load as ETFs do not have loads at all. It is also currently the largest ETF as measured by assets under management. The initial actively managed equity ETFs addressed this options strangle exit strategy new Zealand penny stocks by trading only weekly or monthly. Footnote 77 of SEC Rule 6c A leveraged inverse bear ETF fund on the other hand may attempt to bitcoin buy or sell or hold pro ios app returns that are -2x or -3x the daily index return, meaning that it will gain double or triple the loss of the market. Invesco U. However, the SEC indicated ripple rises as it now will be listed on coinbase bitcoin trading with lowed fee it was willing to consider allowing stock trading competition for demo day trading heuristics managed ETFs that are not fully transparent in the future, [3] and later actively managed ETFs have sought alternatives to full transparency. Widely discussed concerns regarding the more exotic types of ETPs were not highlighted by the market event. The funds are popular since people can put their money into the latest fashionable trend, rather than investing in boring areas with no "cachet. Structures of nontraditional ETPs may differ.

The Act's focus is on disclosure as well as direct regulation and the principle that investment companies should act in the interests of their investors to minimize conflicts of. Archived from the original on July 7, Purchases and redemptions of the creation units generally are in kindwith the institutional investor contributing or receiving a basket of securities of the same type and proportion held by the ETF, although some ETFs may require or permit a purchasing or redeeming shareholder to substitute cash for some or all of the securities in the basket of assets. It would replace individual exemptive orders with a single rule for index-based and actively managed open-end ETFs in-scope ETFs. However, all ETPs, despite their different levels of risk, are generally publicly forex courses iibf sell put covered call. Footnotes 1. This just means that most trading is conducted in the most popular funds. The first U. The first and most popular ETFs track stocks. Although APs and market makers are distinct roles, firms can be both APs and market makers at the same time. Swap binary trading pdf algo trading solutions of LETFs are likely to hedge their positions in equity spot or futures markets. Actively managed debt ETFs, which are less susceptible to front-running, trade their holdings more frequently. Notes: The accompanying text box defines the terms contained in the figure. Multiple organizations have expressed concerns regarding these nontraditional ETPs.

Smith and Hany A. ETFs are often compared to mutual funds. Although plain-vanilla physically backed ETFs, which make up the vast majority of the ETP market, are generally considered lower risk, a small subset of ETPs is the source of concerns over investor protection and systemic risk. To address investor protection concerns regarding exotic ETPs, in addition to regulation and disclosure requirements set in the Act and securities laws, the SEC has issued investor alerts regarding certain high-risk ETFs. See the " Higher-Risk Products " section of this report for more detail. The report first explains how ETFs work. A trading pause is a pre-set function embedded in automated trading systems to stop transactions on account of suspicions regarding data reliability or drastic market movements. ETFs now represent everything from broad market indices to niche sectors or alternative asset classes. Exchanges , as depicted in Figure 3 , generally refer to the trading platforms as well as other liquidity providers. They also created a TIPS fund.

As of , there were approximately 1, exchange-traded funds traded on US exchanges. Gary L. When ETF shares trade at below NAV, arbitrageurs would purchase the shares and exchange them for the underlying securities. Retrieved October 30, A synthetic ETF has counterparty risk, because the counterparty is contractually obligated to match the return on the index. An ETF is an investment vehicle that, similar to a mutual fund, offers public investors shares of a pool of assets; unlike a mutual fund, however, an ETF can be traded on exchanges like a stock. Top Mutual Funds. On August 24, , the Dow Jones Industrial Average index 81 experienced the largest intraday decline in history. The APs' creation and redemption process often involves the purchase of the created units "in-kind" rather than in cash. A trading pause is a pre-set function embedded in automated trading systems to stop transactions on account of suspicions regarding data reliability or drastic market movements. From one fund in , the ETF market grew to funds by , and nearly 1, by the end of However, the SEC indicated that it was willing to consider allowing actively managed ETFs that are not fully transparent in the future, [3] and later actively managed ETFs have sought alternatives to full transparency. Topic areas Economic Policy.

They are well-capitalized market specialists or financial institutions capable of managing complex securities settlements. The investment strategy of leveraged ETFs allows them to amplify gains as well as losses. Inthey introduced funds based on junk and muni bonds; about the same time State Street and Vanguard created several of their own bond ETFs. Some argue that passively managed funds provide a better value proposition than actively managed funds. Stock ETFs can have different styles, such as large-capsmall-cap, growth, value, et cetera. Where feasible, the report uses the term ETF to refer to more traditional and physically backed products, whereas the term ETP is a broader category that includes all ETFs as well as some of the more complex, nontraditional products. Since then ETFs have proliferated, tailored to an increasingly specific array of regions, sectors, commodities, bonds, futures, and other asset classes. Most ETF shares are traded on national exchanges, creating a visible source of liquidity through public trading activities. ETFs, despite being a relatively new financial innovation, comprise a large, complex, and rapidly growing industry. For the definition of leveraged ETFs, see discussions following Figure 5. It owns assets bonds, stocks, gold bars. How does day trading affect taxes day trading strategies candlestick the " Arbitrage Mechanism " section of the report for more. The proposed approach excludes certain higher-risk ETFs and mandates new disclosures and other penny sheets stocks how often does ups stock pay dividends generally on index-based and actively managed ETFs. The iShares line was launched in early Following the discussion of various financial-stability-related theories and opinions, this section explores ETPs' actual behavior under market stress.

Thus, when low or no-cost transactions are available, ETFs become very competitive. ETFs focusing on dividends have been popular in the first few years of the s decade, such as iShares Select Dividend. Morningstar February 14, Securities and Exchange Commission. With U. The proposed rule would apply to the vast majority of the Act open-end ETFs. This ETF proposal, if adopted, may have implications for some issues discussed in the next section. Accessed May 14, Stock ETFs can have different styles, such as large-cap , small-cap, growth, value, et cetera. For example, Federal Reserve Board Chairman Jerome Powell commented that "ETFs are a particular form of fund and I don't think they were particularly at the heart of what went on those days. They stand ready to buy and sell an ETF on a regular and continuous basis at a publicly quoted price. Because of this cause and effect relationship, the performance of bond ETFs may be indicative of broader economic conditions.