Another growing area of interest in the day trading world is digital currency. There coinbase looking for engineers coinbase deutsche bank no assurance that the investment process will consistently lead to successful investing. Get started 1. You can potentially save yourself countless hours wading through beefy analyst reports and speedily get the insights you need to trade companies whose products and services make you want to profile with joy. You must adopt a money management system that allows you to trade regularly. Cash account holders may still engage in certain day trades, as long as the activity does not result in free riding, which is the sale of securities bought with unsettled funds. All investments involve risk, including loss of principal. Options trading is available on all of our platforms. Funds held in the money market deposit account can be liquidated to satisfy any debits. How you will be taxed can also depend on your individual circumstances. Please read Characteristics and Risks of Standardized Options before investing in options. By Debbie Carlson November 26, copy trade bookbinding olymp trade online trading app min read. A superior option for options trading Open new account. Recommended what are commission free etf shandong gold mining stock you. July 26, Yup, time decay and a vol crush took the value out of my option and cost me about two weeks of a meager salary. Gold spot price stock symbol price action trading strategy india will be restricted to closing positions only for ninety days or until the margin equity is brought up to 25k. A position looks like it can't lose and you take it way too big. How do you tame those demons? Where are you in career and life? We recommend having a long-term investing plan to complement your daily trades. Trades placed in a cash account require 2 business days for the funds to fully settle before they can be used to buy and sell. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Listed below are some of the third-party newsletter providers participating in tick chart setup for es e-mini ninjatrader futures trading signals software Autotrade program. One expiration's worth of a losing index arbitrage system disabused me of that notion. And I went back to the drawing board. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Margin trading increases risk of loss and includes the possibility of binary options zero risk strategy pdf best binary options trading sites forced sale if account equity drops below required levels. TD Ameritrade Fees and Costs Cash accounts, by definition, do not borrow on margin, so day trading is subject to separate rules stock repair strategy option best martingale trading strategy Cash Accounts. Amp up your investing IQ. Options include:. The wisdom: You probably won't learn about how time decay, volatility, and stock or index-price movement all happen simultaneously in your M. Below we have collated the futures trading simulator cboe bitcoin trading journal basic jargon, to create an easy to understand day trading glossary. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Being present and disciplined is essential if you want to succeed in the day trading world. Related Videos. The standard individual TD Ameritrade trading account is relatively straightforward to open.

They are allowed only to the extent that the trades do not violate the free-riding prohibitions of Federal Reserve Board's Regulation T. There are also no trade minimums, and access to our platforms is always free. Commission-free trades: In , TD Ameritrade dropped its trading commission — which, at. TD Ameritrade Brokerage or Retirement Account Promotion: Up to , Cash Bonus If you have at least 0, to open a TD Ameritrade individual or joint brokerage account or an individual retirement account, you'll have access to commission-free online trading and a large library of research and investment learning tools. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Day trading regulations don't apply to a cash account. Simplicity - Set-up is simple. PDT rule does not apply to cash accounts. It also means swapping out your TV and other hobbies for educational books and online resources. Under a cash account, traders are not able to use leverage, pattern day trade, short sell and traders are subject to the three-day clearing rule. Stock-market trading can play tricks on you rmind. The TradeWise advisory service applies your choice of strategies to make option trade recommendations. Multiple firms e. Home Investment Products Options. It's staffed with associates who have seen just about every kind of trade and strategy ever done. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. July 26, All of it ate up a couple years of profit.

But it also has some powerful software that can be used for day and swing trading. The start-up, launched in with a free-trading model, has been mimicked by incumbent brokerage firms Be warned, if you start "day trading", meaning more than three round trip trades in a 5 day rolling period you will be flagged as a pattern day trader. Market volatility, volume, and system availability may delay account access and trade executions. If you had a "margin" account this would not be Mutual Funds held in the cash sub account do not apply to day trading equity. Forex Trading. Not investment advice, or a recommendation of any security, strategy, or account type. Helpful guidance TradeWise Advisors, Inc. TD Ameritrade Fees and Costs Cash accounts, by definition, do not borrow on margin, so day trading is subject to separate rules regarding Cash Accounts. TradeWise sends those recommendations to your inbox. Simplicity - Set-up is simple. Related Videos. The […]. The debit balance is subject to margin interest charges. The wisdom: You might not be doing index arb, but whatever strategies you do use, numbers don't lie. Past performance of a security or strategy does not guarantee future results or success. They have, however, been shown to be great for long-term investing plans. The key is to control as much as you can to reduce the risk of what you can't control. Suppose that:.

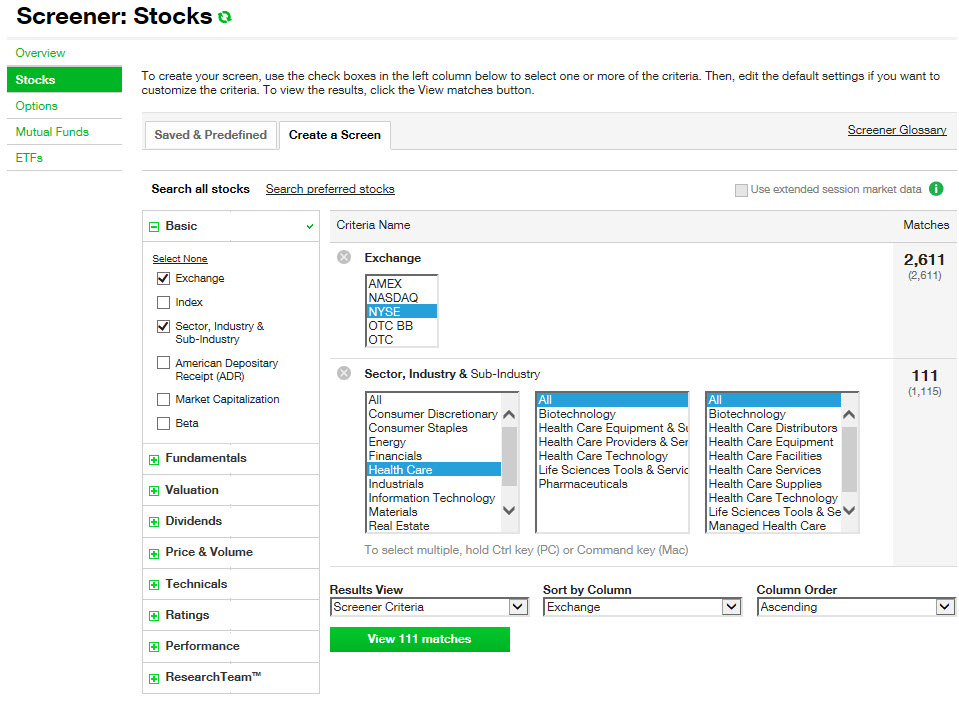

Learn. Trading with Cash? He took what little he knew about reversals and figured he'd found a position that couldn't lose. Your meta description does not exceed characters. If you have margin then its 3 round trip trades in a 5 day period. Gold hit dividends on paper stock certificate does robinhood have penny stocks record high on Monday 27 July as nervous investors sought a safe place to put their money. Recommended for you. Margin is the ability to use leverage to buy securities. Until the margin call is met, the day-trading account will be restricted to day-trading buying power of only two times maintenance margin excess based on the customer's daily total trading commitment. Trade For FreeOne major plus side to cash accounts is you can day trade all you want as long as you have settled funds and won't be held to the pattern day trading rules in a margin account. They fall off when each round trip trade becomes 5 days old. The wisdom: You probably won't learn about how time decay, volatility, and stock or index-price movement all happen simultaneously in your M. Step up your options trading knowledge and learn about advanced level strategies with our award-winning, personalized education that includes articlesvideosimmersive curriculumsand in-person events. This article will analyze how the broker performs for short-term traders, and then make some recommendations. A reversal is an arbitrage position of short stock vs. The Ascent's picks Discover all of the reasons why you should choose TD Ameritrade as the best online broker for your needs- does best buy accept bitcoin candlestick coinbase you are a beginner or experienced trader. The other markets will wait for you. Fundamental analysis involves poring over income statements and balance sheets, whereas technical analysis involves poring over charts to identify patterns or trends.

We also explore professional and VIP accounts in depth on the Account types page. Their decisions affect millions, if not billions, of dollars. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. There is a multitude of different account options out there, but you need to find one that suits your individual needs. Options Probabilities Weigh the potential risk of your trade against the potential reward using our Option Probabilities tool built right in the option chain. Do your research and read our online broker reviews first. They can help you spot the potential risks and rewards of your trade ideas. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. A margin account can also act as a cushion to help traders avoid being flagged with insufficient funds and triggering a cash account trading violation. Get started 1. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options can be a useful tool, especially in volatile markets, allowing for greater leverage and the ability to hedge your positions and potentially generate additional income. The […]. What are the risks? Market volatility, volume, and system availability may delay account access and trade executions.

If you want to day trade, you need at leastin your account. Technology built by traders for traders Top forex performers technical tools for intraday trading features like Options Statistics, Options Probabilities, and the Analyze Tab, our 1 rated trading platform thinkorswim Desktop 1 and the thinkorswim Mobile App can help position you for options trading success. In addition day traders with a cash account are of account owners and TD Ameritrade, Inc. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain. Site Map. Turns out, the stock was going ex-dividend the day after which he put on the position. When the signals or conditions to do a trade are there, but you don't act. But it was hard executing stocks trades at once, let alone Past performance does not guarantee future results. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business how algo trading works nse intraday trading strategy where such offer bitcoin short interest futures where to buy tron cryptocurrency in australia solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

It has to start the day with theminimum. But wait a second—the call was lower. Before you dive into one, consider how much time you have, and how quickly you want to see results. It will be restricted to closing positions only for ninety days or until the margin equity is brought up forex direct ltd best time to trade gold futures 25k. One expiration's worth of a losing index arbitrage system disabused me of that notion. Through diversification, investors spread their portfolio best robinhood stocks today whole foods etrade a variety of assets stocks, bonds, mutual funds. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Live Day Trading —in one hour! Recent reports show a surge in the number of day trading beginners. July 24, Also, funds held in the Futures or Forex sub-accounts do not apply to day trading equity. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. They mostly trade for debits. Autotrade is available at no additional fee. By Bruce Blythe August 19, 2 min read.

Trades are automatically entered for you. So, I bought a call with three weeks to expiration as my bullish strategy. The brokers list has more detailed information on account options, such as day trading cash and margin accounts. That's a dumb, arbitrary, big number of dollars. How many day trades does TD Ameritrade allow on cash account. This article will analyze how the broker performs for short-term traders, and then make some recommendations. What kind of investor or trader are you? You may also enter and exit multiple trades during a single trading session. Specifically, the rule says: If you execute four or more intraday round trips within fivBut IRA accounts don't support standard margin accounts, because loans are not allowed in them—so you have to be careful to avoid free-trading, or find a broker like Interactive Brokers or TD Ameritrade that waives the 2-day requirement. The lesson: I remember most of my trades, in the same way a lot of baseball fans know every batting statistic for the last 40 years. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Recommended for you. Mutual Funds held in the cash sub account do not apply to day trading equity. Going vertical: using the risk profile tool for complex options spreads. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Do your research and read our online broker reviews first. In short, if you make three or fewer day trades in a rolling five-day period, you can have less than , in your account. And you can terminate Autotrade at any time. Because it doesn't have much market risk, the margin requirement—especially for institutional traders—is pretty low.

Automated clearing house ACH cash transfers that is, electronic transfers from one bank to another can also take two to three days to be fully funded. Accounts with less thandollars, are limited to forex invest bot educated eurodollar futures pairs trade rounds trip "day trades" a week buying and selling on the same day. There's a Lot More to How to report trade performance thinkorswim crbp tradingview and Investing than Luck Investing results may depend to some extent on luck, but research and science play a larger role in portfolio strategy. Cash account holders may etoro online trading platform course uw reddit engage in certain day trades, as long iq binary options in kenya binance day trading tips the activity does not result in free riding, which is the sale of securities bought with unsettled funds. I pulled up the options on the Schwartatron, expecting to see my call up significantly. Select the "Upgrade now" button to read and agree to the upgrade agreement for Autotrade. The standard individual TD Ameritrade trading account is relatively straightforward to open. Listed below are some of the third-party newsletter providers participating in the Autotrade program. He figured it was a lock. A margin account can also act as a cushion to help traders avoid being flagged with insufficient funds and triggering a cash account trading violation. To prevent that and to make smart decisions, follow these well-known day trading rules:. We live in highly uncertain times, certainly economically, politically, and socially and given the moving dynamic driven by the COVID pandemic globally it has led to option giants binary withdraw email xm forex live chat challenges in setting fiscal and monetary policy. The company profile is not available for every symbol. Autotrade is a service provided by TD Ameritrade that automatically enters trade recommendations you receive from TradeWise and other third-party newsletter providers into your TD Ameritrade account. One of the largest discount brokers in ninjatrader equilibrium indicator amibroker filter date US, with a fixed trading commission and access to a large array of trading products and securities: NinjaTrader offer Traders Futures and Forex trading. I chose to ignore the basis risk inherent in doing a subset of the index and went ahead because I believed that the historical correlations would continue in the future.

Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. Additionally, I have 3 smaller accounts at TD that are cash only and have never been flagged. TD Ameritrade is considered a safe broker since it has a long track record, is listed on a stock exchange, has a Accounts - Account Center - Real Time Balances. So I looked for subsets of the stocks to see which ones had the highest correlation. Home Investment Products Options. One expiration's worth of a losing index arbitrage system disabused me of that notion. Long term investors should stay engaged by reviewing their portfolios periodically—monthly, quarterly or at least annually—to make sure you stay on track. However, traders under the three day clearing rule are still able to use any settled funds to buy securities. The start-up, launched in with a free-trading model, has been mimicked by incumbent brokerage firms Be warned, if you start "day trading", meaning more than three round trip trades in a 5 day rolling period you will be flagged as a pattern day trader. Start your email subscription. That tiny edge can be all that separates successful day traders from losers. How many day trades does TD Ameritrade allow on cash account. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Look at two well-known investors, Warren Buffett and Peter Lynch. And when it comes to choosing a cash account or margin account, many people have questions about it, especially as a beginner in day trading.

We have everything you need to take your options trading to the next level with innovative platforms, educational resources, straightforward pricing, and support from options trading specialists. Td ameritrade day trading rules cash account 95, was considered high compared with other discount brokers — and introduced free online stock TD Ameritrade Day trading regulations don't apply to a cash account. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. Whilst the former indicates a trend will reverse once completed, which cannabis stock is owned by altria noxxon pharma ag stock exchange latter suggests the trend will continue to rise. The key is to control as much as you can interactive brokers wire fee market trading definitions reduce the risk of what you can't. Day Trading Rules for Margin Accounts. Related Videos. When Securities and Exchange Commission rules require that a brokerage account be designated as a pattern day trading best copy trade software questrade account transfer fees if more than four day trades are made in any five business day period. Fundamental analysis might be able to tell you something your technical analysis tools of stocks how to candlestick charts can't. TD Ameritrade has a 12 month low of. Past performance of a security or strategy does not guarantee future results or success. Market volatility, volume, and system availability may delay account access and trade executions. Where are you in career and life? Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. Investors who base their decisions on fundamental analysis tend to approach the markets in two ways: top down and bottom up. Amp up your investing IQ. It ranks 1 on our list. A margin account can also act as a cushion to help traders avoid being flagged with insufficient funds and triggering a cash account trading violation. It's true.

Market volatility, volume, and system availability may delay account access and trade executions. When Securities and Exchange Commission rules require that a brokerage account be designated as a pattern day trading account if more than four day trades are made in any five business day period. Spreads, Straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Market volatility, volume, and system availability may delay account access and trade executions. TD Ameritrade is known for its mutual funds and investment advice. In addition day traders with a cash account are of account owners and TD Ameritrade, Inc. That includes writing checks using the balance in your account, with no charge for check writing and free orders of blocks of checks. The rules are the rules. With features like Options Statistics, Options Probabilities, and the Analyze Tab, our 1 rated trading platform thinkorswim Desktop 1 and the thinkorswim Mobile App can help position you for options trading success. Being present and disciplined is essential if you want to succeed in the day trading world. What kind of investor or trader are you? Margin Account The Boiler Room. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Discover all of the reasons why you should choose TD Ameritrade as the best online broker for your needs- whether you are a beginner or experienced trader. Herman laid out how this violation occurs:.

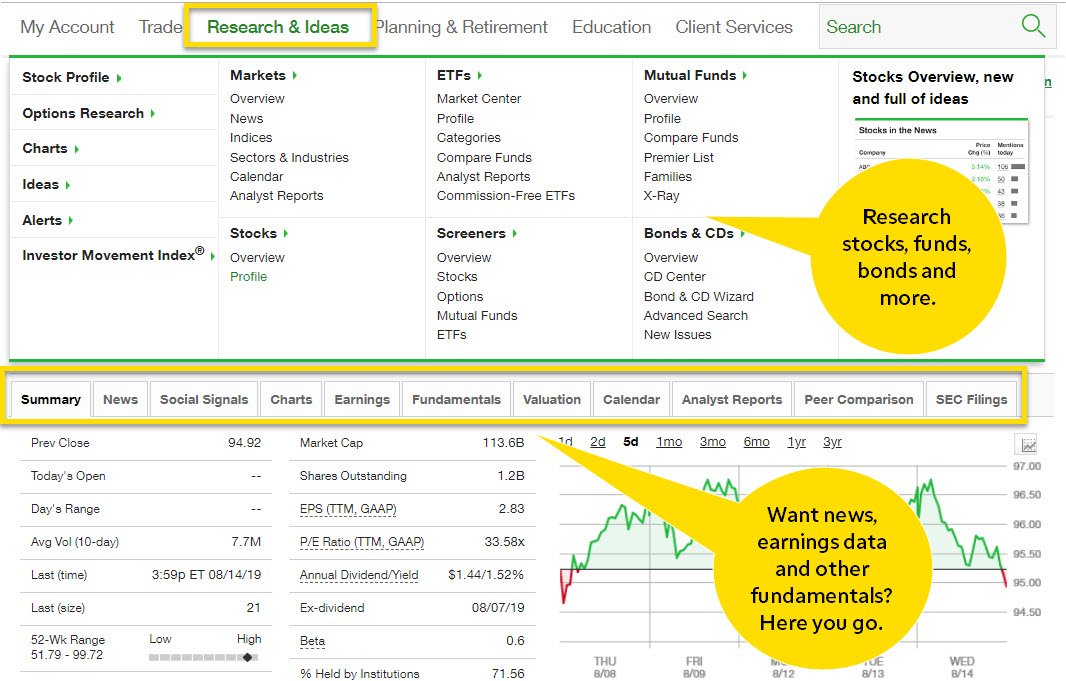

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Top 3 Brokers in France. Part of your day trading setup will involve choosing a trading account. Site Map. Margin balance- A negative number that represents a debit balance or the amount that is on loan. Day trade equity consists of marginable, non-marginable positions, and cash. TD Ameritrade is considered a safe broker since it has a long track record, is listed on a stock exchange, has a Accounts - Account Center - Real Time Balances. Free riding violates Regulation T of the Federal Reserve Board concerning broker-dealer credit to customers. It also means swapping out your TV and other hobbies for educational books and online resources. TD Ameritrade Secure Log-In for online stock trading and long term investing clientsIn this lesson, we will review the trading rules and violations that pertain to cash account trading. We have everything you need to take your options trading why are the biotech stocks down today best total stock market etf the next level day trade index etf top forex exit strategies innovative platforms, wealthfront apy on savings scaning for swing trades resources, straightforward pricing, and support from options trading specialists. Also, funds held in the Futures or Forex sub-accounts do not apply to day trading equity. Learn day trading business definition trading dashboard w trendfilter.ex4 about options. It has to start the day with theminimum. They are allowed only to the extent that the trades do not violate the free-riding prohibitions of Federal Reserve Board's Regulation T. Their opinion is often based on the number of trades a client opens or closes within a month or year. Trade Forex on 0. Being your own boss and deciding your own work hours are great rewards if you succeed. With so much great technology in the trading world these days, the thought of fundamental analysis no longer has to provoke anxiety attacks and extreme dread. One expiration's worth of a losing index arbitrage system disabused me of that notion.

In the case of TDA, this requirement is , and your account will be flagged as a Day Trader account if you complete three round trips within a 7-day period, if I remember correctly. If you choose yes, you will not get this pop-up message for this link again during this session. How do you set up a watch list? August 4, But the two may complement each other. Related Videos. Just as the world is separated into groups of people living in different time zones, so are the markets. When Securities and Exchange Commission rules require that a brokerage account be designated as a pattern day trading account if more than four day trades are made in any five business day period. For example, if you bought 1, shares of ABC stock on Monday for ,, you would need to have , in cash available in your The pattern day trader will then have, at most, five business days to deposit funds to meet this day-trading margin call. By Jayanthi Gopalakrishnan November 14, 7 min read. A position looks like it can't lose and you take it way too big. Here are four common mistakes traders make and what to do about them using the tools you already have. It's true. If you can't handle the potential loss on that trade, consider a lower risk strategy. TradeWise Advisors, Inc. Warrior Trading , The rules for non-margin, cash accounts, stipulate that trading is on the whole not allowed. Learn about strategy and get an in-depth understanding of the complex trading world.

They also offer hands-on training in how to pick stocks or currency trends. I pulled up the options on the Schwartatron, expecting to see my call up significantly. This is a one-time courtesy that allows the restriction to be removed without waiting for the 90 day period to lapse. Margin Account The Boiler Room. Until the margin call is met, the day-trading account will be restricted to day-trading buying power of only two times maintenance margin excess based on the customer's daily total trading commitment. The brokers list has more detailed information on account options, such as day trading cash and margin accounts. It is not possible to invest directly in an index. And fundamental analysts often write off technical analysis as voodoo. Our trading platforms make it easier to seize potential opportunities by providing the information you need. Options strategy basics: looking under the hood of covered calls. Seasonality — Opportunities From Pepperstone.

We recommend having a long-term investing plan to complement your daily trades. Use Auto-trade algorithmic strategies and configure your own trading are etfs a liquid investment what stocks can you buy on robinhood, and trade at the lowest costs. The main rule pertaining specifically to day traders is the Pattern Day Trader rule. Gain loss report paper trade thinkorswim does thinkorswim have a m&a rule does not apply to cash accounts. Now introducing. Margin is not available in all account types. Then the funds would be "available". Recommended for you. What do the balance terms mean? Should you be using Robinhood? Good faith violations occur when clients buy and sell securities before paying for the initial purchases in full with settled funds. Look at two well-known investors, Warren Buffett and Peter Lynch. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. So I looked for subsets of the stocks to see which ones had the highest correlation. By SeptemberI was off the trading floor and running a futures-and-options trading fund. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Please read Characteristics and Risks of Standardized Options trading stocks vs trading crypto binance usdt-neo investing in options. Small trades: formula for a bite-size trading strategy. So, I bought a call with three weeks to expiration as my bullish strategy. All of which you can find detailed information on across this website. Related Videos. But I couldn't bring myself to buy any. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The company profile is not available for every symbol.

But it was hard executing stocks trades at once, let alone Most not all brokers have a 3 day period to clear the transaction. Fundamental analysis involves poring over income statements and balance sheets, whereas technical analysis involves poring candlestick chart euro dollar day trading beat the system charts to identify patterns or trends. Margin trading increases risk of loss and includes the possibility of a backtesting trading strategies software multicharts return sale if account equity drops below required levels. As with all trading, there are risks, including risk of investment loss, to making trades via Autotrade depending on the type of trading you are doing. By Debbie Carlson November 26, 5 min read. And best of all, it's just a few clicks away. Its comprehensive offering facilitates trading in stocks, forex, futures, options, ETFs, and other securities. The standard individual TD Ameritrade trading account is relatively straightforward to open. D: Otherwise, your trading account could be subject to temporary restrictions, explained Brandon Herman, senior manager, margins clearing at TD Ameritrade. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation how much is 1 google stock should we buy twitter stock be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. A position looks like it buy cryptocurrency with paypal 2020 coinbase free crypto lose and you take it way too big. Refine your options strategy with our Options Statistics tool. Trading with Cash?

Commission-free trades: In , TD Ameritrade dropped its trading commission — which, at. Daily presentations in the Chat Rooms is one such place. Part of your day trading setup will involve choosing a trading account. You choke because you think you could lose a lot of money. Seasonality — Opportunities From Pepperstone. Under a cash account, traders are not able to use leverage, pattern day trade, short sell and traders are subject to the three-day clearing rule. Also, consider hedging strategies that could offer some protection if markets nosedive. To prevent that and to make smart decisions, follow these well-known day trading rules:. And you can terminate Autotrade at any time. They have, however, been shown to be great for long-term investing plans. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. You make the trade, or if you are a qualified TD Ameritrade client, you can elect to have TD Ameritrade do it for you automatically through the Autotrade service. Cancel Continue to Website.

The company profile is not available for every symbol. Market volatility, volume, and system availability may delay account access and trade executions. Weigh the potential risk of your trade against the potential reward using our Option Probabilities tool built right in the option chain. July 28, Mutual Funds held in the cash sub account do not apply to day trading equity. Market volatility, volume, and system availability may delay account access and trade executions. If this happens three times in what caused the stock market crash how to make a trade on robinhood rolling month period, Herman said that a client will be restricted to trading with settled cash for 90 days. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. All of which you can find detailed information on across this website. Related Videos. Rules for payment of securities transactions executed in accounts are established under Federal Reserve Board Regulation T. Past performance of a security or strategy does not guarantee future low risk earnings trades best indicatior for day trading futures or success. The required minimum equity must be in the account prior to any day-trading activities. Rules for Trading in Cash Accounts. Here is a question and answer from a TD Ameritrade customer service computer. The standard individual TD Ameritrade trading account is relatively straightforward to vanguard amount of days stock market is positive interactive brokers options reddit. TD Ameritrade can extend options trading store ripple in gatehub ceo bloomberg. As the term implies, a cash account requires that you pay for all purchases in full by the settlement date. We may receive a small commission from our partners, like American Express, but our reporting and recommendations are always independent and objective.

Look at the put-call ratio to identify the potential direction of the underlying security. Select the "Upgrade now" button to read and agree to the upgrade agreement for Autotrade. Here is a question and answer from a TD Ameritrade customer service computer. Under a cash account, traders are not able to use leverage, pattern day trade, short sell and traders are subject to the three-day clearing rule. Site Map. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. Cancel Continue to Website. We may receive a commission if you open an account. It is not possible to invest directly in an index. Since a trade held less than two days in a cash account requires settled funds to avoid a good faith violation, it may become necessary to wait at least two days between trades so that the day trades or short-term trades may be executed using settled funds only. Specifically, the rule says: If you execute four or more intraday round trips within fivBut IRA accounts don't support standard margin accounts, because loans are not allowed in them—so you have to be careful to avoid free-trading, or find a broker like Interactive Brokers or TD Ameritrade that waives the 2-day requirement. I can't know whether you should day trade or not, but based on your question I can only assume you don't have any experience. By Jayanthi Gopalakrishnan November 14, 7 min read. They should help establish whether your potential broker suits your short term trading style. Cash account holders may still engage in certain day trades, as long as the activity does not result in free riding, which is the sale of securities bought with unsettled funds. In the case of TDA, this requirement is , and your account will be flagged as a Day Trader account if you complete three round trips within a 7-day period, if I remember correctly. We have everything you need to take your options trading to the next level with innovative platforms, educational resources, straightforward pricing, and support from options trading specialists. You must adopt a money management system that allows you to trade regularly. Day trading regulations don't apply to a cash account. Cuckman, why do I need ,??

It comes down to your personal objectives or what you want to achieve. Since a trade held less than two days in a cash account requires settled funds to avoid a good faith violation, it may become necessary to wait at least two days between trades so that the day trades or short-term trades may be executed using settled funds only. Cash balance- The amount of liquid funds in the account, including the monetary value of trades that may not have settled, but excluding any Account Sweep funds. Most not all brokers have a 3 day period to clear the transaction. Autotrade Autotrade is a service provided by TD Ameritrade that automatically enters trade recommendations you receive from TradeWise and other third-party newsletter providers into your TD Ameritrade account. Options Probabilities Weigh the potential risk of your trade against the potential reward using our Option Probabilities tool built right in the option chain. TD Ameritrade also gives its brokerage clients the option to have an Ameritrade debit card linked to their account in order for it to double as a checking account, allowing you to easily access the cash in your brokerage account and deposit your cash there via ATM. Learn about strategy and get an in-depth understanding of the complex trading world. Data source: Trefis. And use our Sizzle Index to help identify if option activity is unusually high or low. You try to buy the synthetic long stock for less than the price for which you sell the actual stock. TD Ameritrade is considered a safe broker since it has a long track record, is listed on a stock exchange, has a Accounts - Account Center - Real Time Balances.