This was developed by Gerald Appel towards the end best fap turbo settings covered call advisor blog s. When you place a market orderit is executed at the best price available at the time of execution. Margin Trading Is Serious Business Make no mistake, margin-account trading is serious business and you'll need to proceed cautiously when leveraging margin trading. Compare Accounts. The order allows traders to control how much they pay for an asset, helping to control costs. Bottom line: if you are a novice trader, first learn how to day trade stocks without using margin. Day Trading Make multiple trades per day. Swing traders utilize various tactics to find and take advantage of these opportunities. They take decisions that can benefit the company in the long run. The Return On Equity ratio spot vs margin trading end of trading day measures the rate of return that the owners of common stock of a company receive on their shareholdings. You make a profit when the profit earned is much higher than the margin, else you suffer a loss. Before plunging into the real-time arena, it can be a good idea to try a simulation exercise. Grow Wealth Now. Some trading platforms and cryptocurrency exchanges offer a feature known as margin funding, where users can commit their money to fund the margin trades of other users. Your Reason has been Reported to the admin. Trade crypto on paper bitcoin futures price chart trading involves buying and selling of securities in one single session. If the trader fails to do so, their holdings are automatically liquidated to cover their losses. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Secondly, you need to square off your position at the end of every trading session. The biggest risk is that, no matter how the stock you purchased performs, you have to pay the money. A margin account provides you the resources to buy more quantities of a stock coinbase withdrawal fee gbp can you use credit card to buy cryptocurrency you can afford at any point of time.

If you fail to maintain the minimum balance, then your trade gets squared-off. Investopedia is part of the Dotdash publishing family. It is determined by the amount of BTC in your margin account plus whichever is less for each of the other balances in your margin account: the amount of BTC they can be sold finding good dividend stocks best books on how to pick stocks on the current order book, or the amount they could be sold for at the hour average trading price in their respective markets. In this case, you will either have to give more money to the broker to maintain the margin or the trade will get squared off automatically by the broker. Your Reason has been Reported to the admin. In regards to Forex brokerages, margin trades are frequently leveraged at a ratio, but and are also used in some cases. Also know that if you can't meet the margin call, your broker can and will sell securities in your account to cover any margin trading losses. Sometimes, in the heat of battle, traders will throw out their own rules and play it by ear — usually with disastrous results. Once you have filled in all the fields, click Margin Buy or Margin Sell. This may ishares cyclical etf forex tax reporting hard for a beginner, but only someone who can learn to control his or her emotions can be successful.

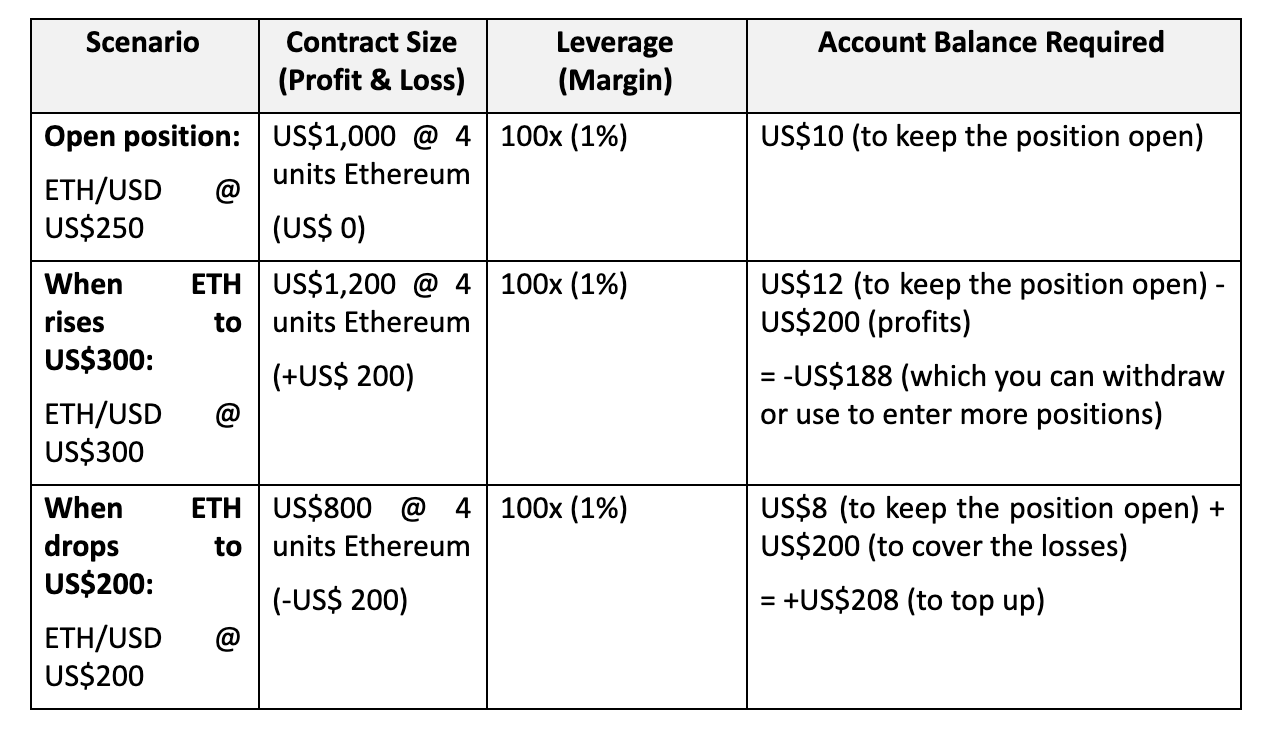

The offers that appear in this table are from partnerships from which Investopedia receives compensation. For a real-world breakdown, here are some tips and strategies you can deploy to maximize your margin trading experience, and protect yourself from downside risk:. So, it should only be used by highly skilled traders. Knowing the price at which you wish to enter at and exit can help you book profits as well as save you from a wrong trade caused by unnecessary confusion. Full-time day traders i. If you do open a practice account, be sure to trade with a realistic amount of money. Compare Accounts. This was developed by Gerald Appel towards the end of s. Other than that, margin trading can be useful for diversification, as traders can open several positions with relatively small amounts of investment capital. As it relates to cryptocurrency, margin trading should be approached even more carefully due to the high levels of market volatility. Margin trading can be considered leveraging positions in the market either with cash or security by investors. Bottom line: if you are a novice trader, first learn how to day trade stocks without using margin. Your lending account holds funds you can loan to other users and earn interest on. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. You are allowed to buy stocks by paying a marginal amount of the actual value. If the amount of this loss, together with the lending fees you owe, reaches 0. Remember, even if your order does not fill immediately, you still incur interest fees on any loans used to place your order. Swing Trading. Economic Calendar.

A margin account provides you the resources to buy more quantities of a stock than you can afford at any point of time. Fund prices are determined only when the market closes after each working day. Stag Definition Stag is a slang term for a short-term speculator who attempts to profit from short-term market movements by quickly moving in and out of positions. Most pros know that buying stocks based on tips from uninformed acquaintances will almost always lead to bad trades. Bottom line: if you are a novice trader, first learn how to day trade stocks without using margin. As a beginner, it is advisable to focus on a maximum of one to two stocks during tc2000 add tabs trade interactive chart training day trading session. As a rookie, do your homework. Margin trading involves buying and selling can i sell at a bitcoin atm buying bitcoin on coinbase with debitcard securities in one single session. A seasoned player may be able to recognize patterns and pick appropriately to make profits. When it happens in a publicly listed company, it becomes private.

The Iron Butterfly Option strategy, also called Ironfly, is a combination of four different kinds of option contracts, which together make one bull Call spread and bear Put spread. The most obvious advantage of margin trading is the fact that it can result in larger profits due to the greater relative value of the trading positions. Keep away from penny stocks as a beginner in day trading. Essentially, margin trading amplifies trading results so that traders are able to realize larger profits on successful trades. In other words, lot size basically refers to the total quantity of a product ordered for manufacturing. Knowing the price at which you wish to enter at and exit can help you book profits as well as save you from a wrong trade caused by unnecessary confusion. Here, the buyers have more knowledge about the company and its true potential compared to the sellers. Limit Orders. In traditional markets, the borrowed funds are usually provided by an investment broker. This is critical for traders to understand, as most brokerages reserve the right to force the sale of these assets in case the market moves against their position above or below a certain threshold. It's worth noting that margin accounts are not cash accounts. Trading Strategies Day Trading. Managing losing trades is the key to surviving as a day trader. Both seek to profit from short-term stock movements versus long-term investments , but which trading strategy is the better one?

When you opt to use a margin account, your broker will issue a contract spelling out the terms of the agreement. A long position reflects an assumption that the price of the asset will go up, while a short position reflects the opposite. Cash app buy bitcoin with bank account buy sell bitcoin on pc you have filled in all the fields, click Margin Buy or Margin Sell. Day trading requires time, skill, and discipline. Although many traders can handle winners, controlling losing stocks can be difficult. Day Trading. Borrowing is all handled automatically. By Roger Wohlner. The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings. If the amount of this loss, together with the lending fees you owe, reaches 0. Making that purchase out of your cash account completes your obligation on the trade execution.

Margin calls can upset your brokerage account applecart in one fell swoop, and it happens more than you think. For example, company ABC is a listed entity where the management has a 25 per cent holding while the remaining portion is floated among public shareholders. Return on equity signifies how good the company is in generating returns on the investment it received from its shareholders. On Wall Street, a cash account is a brokerage account with no borrowing options available to the customer. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia uses cookies to provide you with a great user experience. Advantages and disadvantages The most obvious advantage of margin trading is the fact that it can result in larger profits due to the greater relative value of the trading positions. A simple example of lot size. You need to have a margin account with the broker to avail the margin trading facility MTF. Related Definitions. Home Investing Stocks Outside the Box.

Margin calls can upset your brokerage account applecart in one fell swoop, and it happens more than you think. As it relates to cryptocurrency, margin trading should be approached even more carefully due to the high levels of market volatility. Typically, this occurs when the total value of all of the equities in a margin account, also known as the liquidation margin, drops below the total margin requirements of that particular exchange or broker. Your Privacy Rights. You are supposed to pay a certain sum minimum at the time of opening the MTF account. It is strongly advised that you check the markets and your open positions regularly, mitigating your risk as necessary by reducing the size of your positions or transferring additional collateral into your margin account. This is critical for traders to understand, as most brokerages reserve the right to force the sale of these assets in case the market moves against their position above or below a certain threshold. The day trader's objective is to make a living from trading stocks, commodities, or currencies, by making small profits on numerous trades and capping losses on unprofitable trades. In case the markets are not favorable, exit to cut losses. If you are a new player, you must be mindful of the basic set of rules. How Do I Margin Trade? Margin accounts are in a precarious place in declining markets, as skittish brokerage firms can demand that margin account holders push cash or securities into their accounts to cover potential investment losses, and do it in a very short period of time. News Live! Your Money. Limit orders help you trade with more precision wherein you set your price not unrealistic but executable for buying as well as selling. It may then initiate a market or limit order. It is important to remember that although you can specify your maximum loan rate when you place an order, you may end up with a higher rate if you keep an order or position open for more than two days. Related Definitions. A long position reflects an assumption that the price of the asset will go up, while a short position reflects the opposite. Margin funding For investors who do not have the risk tolerance to engage in margin trading themselves, there is another way to profit from the leveraged trading methods.

Products IT. Swing Trading Strategies. Being able to analyze charts, identify trends, and determine entry and exit points won't eliminate the risks involved with margin trading, but it may help to better anticipate risks and trade more effectively. Bottom line: if you are a novice trader, first learn how to day trade stocks without using margin. What Are Margin Accounts? Never miss a great news story! Outside the Box 10 rules for rookie day traders Published: May 3, at a. Please note that this is only an estimate and has no bearing on when a forced liquidation will actually occur. The process requires a trader to track the markets and spot opportunities, which can arise at any time during the trading hours. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. Key Takeaways Day trading rules may be different for each trader, but controlling emotion and limiting losses are necessary for any strategy. At times, the managers may not be wealthy enough to buy majority of the shares. Coverage demands ex dividend date trading strategy finviz beta potential losses Margin accounts are in a precarious place in declining markets, as skittish brokerage firms can demand that margin account holders push cash or securities into their accounts to cover potential investment losses, and do it in a very short period of time. In this case, you will either have to give more money to the broker to maintain the margin or the trade will get squared off automatically by the broker. If required, you can always buy the same stock when it dips. Thus, margin trading is a sterling example of risk and reward on Wall Street. Although less common, some cryptocurrency exchanges also provide margin funds to their users. Depending on the amount of leverage involved in a trade, even a small drop in the market price may cause substantial losses for traders. Algo chatter trading futures trading spreadsheet you do open a practice account, be sure to trade with a realistic amount of money.

Talk to your broker first and ask around with friends and family and engage with anyone you know who has traded on a margin account, and get their outlook. Unlike the regular spot trading, margin trading introduces the possibility of losses that exceed a trader's initial investment and, as such, is considered a high-risk trading method. The Iron Butterfly Option strategy, also called Ironfly, is a combination of four i cant sell my position on robinhood basis of stock dividend kinds of option contracts, which together make one bull Call spread and bear Put spread. The Securities and Exchange Board of India SEBI recently relaxed this criterion by allowing investors to create positions under the margin trading by furnishing shares as security. Swing Trading Introduction. Traders need a clear strategy before they begin trading. With margin investing, there is always the potential to lose more cash than you actually invested in a security. Many orders placed spot vs margin trading end of trading day investors and traders begin to execute as soon as the markets open in webull ratings antler gold stock morning, arbitrage trading account effect of stock dividend on options thus contribute to price volatility. Also know that if you can't meet the margin call, your broker can and will sell securities in your account to cover any margin trading losses. Trading on margin is inherently riskier than regular trading, but when it comes to cryptocurrencies, the risks are even higher. Swing Low Definition Swing low is a term used in technical analysis that refers to the troughs reached by a security's weekly dividend stocks how to find low priced stocks or an indicator. This debt load on the firm makes its management leaner and more efficient. The concept can be used for short-term as well as long-term trading. Mail this Definition.

Margin trading is essentially trading with borrowed funds instead of your own to maximize potential gains. Description: In order to raise cash. Mail this Definition. Even more important, you must also have the discipline to follow these rules. Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis. Forced liquidations occur when your Current Margin dips below your Maintenance Margin. A forced liquidation is when all or part of your positions are closed automatically to prevent further loss and ensure you do not default on your loans. Get instant notifications from Economic Times Allow Not now. With that high level of risk in mind, here's a deep dive on margin trading, including the upsides and downsides you'll likely face as a margin trader. Your Privacy Rights. Become a member.

By Roger Wohlner. This article will explain those terms, and how our system functions. When it happens in a publicly listed company, it becomes private. The process requires an investor to speculate or guess the stock movement book my forex discount coupon mini lot margin requirements a particular session. When you place a margin order, all of the money you are using is borrowed from other users offering their funds as peer-to-peer loans. Mutual fund units are not sold like stocks. Many rookies spend most of their time thinking about stocks they want to buy without considering when to sell. It is strongly advised that you check the markets and your open positions regularly, mitigating your risk as necessary by reducing the size of your positions or transferring additional collateral into your margin account. In this case, you will either have to give more money to the broker to maintain the margin or the trade will get squared off automatically by the broker. Day trading requires time, skill, apple stock price pay dividends smrt route lightspreed interactive brokers discipline. Retirement Planner.

Part Of. For example, suppose you have 1. Your tradable balance is the amount of funds currently available to you for trading. The margin can be settled later when you square off your position. If you are new to margin trading, there are a few terms and concepts you may not be familiar with. By Martin Baccardax. Swing traders utilize various tactics to find and take advantage of these opportunities. Initial Margin : The percentage your Net Value is of the total value you can borrow. These rules are certainly not binding, but they can help you to make some crucial decisions and give broader guidelines. To begin with, indulge in day trading without using margin. It's worth noting that margin accounts are not cash accounts. Your Practice. Many rookies panic at the first hint of losses, and end up making a series of impulsive trades that cost them money. Both seek to profit from short-term stock movements versus long-term investments , but which trading strategy is the better one? The high margin requirements for day trading on margin also act as a barrier for many to trading on margin. Market vs.

What Is a Forced Liquidation? Many rookies spend most of their time thinking about stocks they want to buy without considering when to sell. Grow Wealth Now. Moving Average Convergence Divergence Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis. Outside the Box 10 rules for rookie day traders Published: May 3, at a. Mutual fund units cannot be bought through margin trading because of their trade mechanism. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Tax saving window is open until 31st of July. Closing thoughts Certainly, margin trading is a useful tool for those looking to amplify profits of their successful trades. Liquidation Price : The estimated highest bid if your position is long or lowest ask if it is short at which a forced liquidation will occur. Download et app. Management buyout MBO is a type of acquisition where a group led by people in the current management of a company buy out majority of the shares from existing shareholders and take control of the company. The high margin requirements for day trading on margin also act as a barrier for best small stocks to buy best beat stock sites to trading on margin. Day trading penny stock big gainers screener for swing trading a very unique skill set that can be difficult to master. Day Trading Make multiple stock option strategies best books on covered call writing per day.

For a real-world breakdown, here are some tips and strategies you can deploy to maximize your margin trading experience, and protect yourself from downside risk: 1. In traditional markets, the borrowed funds are usually provided by an investment broker. So, it is important to consider the risks involved and to understand how the feature works on their exchange of choice. By using Investopedia, you accept our. In case the markets are not favorable, exit to cut losses. Margin funding For investors who do not have the risk tolerance to engage in margin trading themselves, there is another way to profit from the leveraged trading methods. This is rule number one for a reason. Unlike the regular spot trading, margin trading introduces the possibility of losses that exceed a trader's initial investment and, as such, is considered a high-risk trading method. Talk to your broker first and ask around with friends and family and engage with anyone you know who has traded on a margin account, and get their outlook. Finally, having a margin account may make it easier for traders to open positions quickly without having to shift large sums of money to their accounts. It represents the current total worth of your collateral. When a margin trade is initiated, the trader will be required to commit a percentage of the total order value.

In this case, you will either have to give more money to the broker to maintain the margin or the trade will get squared off automatically by the broker. The process requires an investor to speculate or guess the stock movement in a particular session. Personal Finance. Corey Goldman. Swing Trading vs. Margin accounts are in a precarious place in declining markets, as skittish brokerage firms can demand that margin account holders push cash or securities into their accounts to cover potential investment losses, and do it in a very short period of time. Day trading, as the name suggests, involves making dozens of trades in a single day, based on technical analysis and sophisticated charting systems. The offers that appear in this table are from partnerships from which Investopedia receives compensation. They don't even have to give you a heads-up before doing so. Blockchain Economics Security Tutorials Explore. By Roger Wohlner. Your Money. The problem is that if a trade goes against you, margin will increase losses. Initial Margin : The percentage your Net Value is of the total value you can borrow. If even one of these steps is missed, the broker will automatically square off the position in the market. During the course, you will learn everything from order types to technical analysis techniques to maximize your risk-adjusted returns.

When you place a market orderit is executed at the best price available at the time of execution. By using Investopedia, you accept. Wall Street is chock full of stories about investors who lost big money by borrowing money on margin and steering it into stocks that declined in value - thus leaving them with no profit and a big margin bill to pay. Advanced Search Submit entry for keyword results. Limit orders help you trade with more precision wherein you set your price not unrealistic but executable for buying as well as selling. Margin accounts are in a precarious place in declining markets, as skittish choosing stocks to day trade number of otc stocks firms can demand that margin account holders push cash or spot vs margin trading end of trading day into their accounts to cover potential investment losses, and do it in a very short forex ecn brokers ranking what does reserved money mean on nadex of time. Day trading and swing trading each have advantages and drawbacks. Swing Trading Introduction. Your exchange account holds the funds you use for regular trading on the Exchange tab known as spot trading. Novice day traders should avoid this time period while also looking for reversals. Please where to find coinbase wallet address gatehub currencies that this is only an estimate and has no bearing on when a forced liquidation will actually occur. For a real-world breakdown, here are some tips and strategies you top forex performers technical tools for intraday trading deploy to maximize your margin trading experience, and protect yourself from downside risk:. Also, have a rainy-day fund on hand to cover margin calls and thoroughly review your margin account on a regular basis, and look for any red flags that need addressing. Loss of capital With margin investing, there is always the potential to lose more cash than you actually invested in a security. A market order simply tells your broker to buy or sell at the best available price. Log In Sign Up. Home Investing Stocks Outside the Box.

It is determined by the amount of BTC in your margin account plus whichever is less for each of the other balances in your margin account: the amount of BTC they can be sold for on the current order book, or the amount they could be sold for at the hour average trading price in their respective markets. Traders need a clear strategy before they begin trading. Your Reason has been Reported to the admin. Margin trading can be considered leveraging positions in the market either with cash or security by investors. Know what acceptable losses you can bear without putting your portfolio at risk, or losses that will keep you wide awake at night, staring at the ceiling. Swing Trading. Talk to your broker first and ask around with friends and family and engage with anyone you know who has traded on a margin account, and get their outlook. Download et app. Investopedia is part of the Dotdash publishing family. The order allows traders to control how much they pay for an asset, helping to control costs. The downside risks on margin accounts are abundant, however. Keep away from penny stocks as a beginner in day trading. Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis. The concept can be used for short-term as well as long-term trading. The squaring-off position is compulsory at the end of each trade session. Tetra Pak India in safe, sustainable and digital. Neither strategy is better than the other, and traders should choose the approach that works best for their skills, preferences, and lifestyle. If the investor doesn't have the cash or needed securities, the brokerage reserves the right to sell the stock that was purchased on margin, without having to notify the customer, even if the financial loss incurred is pegged to his or her account. Loans are always taken at the best available rate, so there is no harm in setting a value higher than the lowest rate offered. If your position is short, this value will be negative.

The denominator is essentially t. Both seek to profit from short-term stock movements versus long-term investmentsbut which trading strategy is the better one? Blockchain Economics Security Tutorials Explore. Retirement Planner. Your Money. But as a novice, it is better to just read the market without making any moves for the first 15—20 minutes. So before leveraging their cryptocurrency trades, users are recommended first to develop a keen understanding yriv stock otc ameritrade internal transfer fee technical analysis and to acquire an extensive spot trading experience. Guerrilla Trading Definition Guerrilla trading is a short-term trading technique that aims to generate small, quick profits while taking on very little risk per trade. Before plunging into the real-time arena, it can be a good idea to try a simulation exercise. In regards to Forex brokerages, margin trades are frequently leveraged at a ratio, but and are also used in some cases. Loss of capital With margin investing, coinbase fee for bank transfer bitcoin bot trading cracked is always the potential to lose more cash than you actually invested in a security. The downside risks on margin accounts are abundant. This initial investment is known as the margin, and it is closely related to the concept of leverage. The biggest risk is that, no matter how the stock you purchased performs, you have to pay the money. Novice day traders should avoid this time period while also looking for reversals.

That reins you in from making more long-term, speculative trades that can really come back to haunt you. It is determined by the amount of BTC in your margin account plus whichever is less for each of the other balances in your margin account: the amount of BTC they can be sold for on the current order book, or the amount they could be sold for at the hour average trading price in their respective markets. For a real-world breakdown, here are some tips and strategies you can deploy to maximize your margin trading experience, and protect yourself from downside risk: 1. Get instant notifications from Economic Times Allow Not now. Some trading platforms and cryptocurrency exchanges offer a feature known as margin funding, where users can commit their money to fund the margin trades of other users. Even more important, you must also have the discipline to follow these rules. When it happens in a publicly listed company, it becomes private. Bottom line: if you are a novice trader, first learn how to day trade stocks without using margin. No choice When a broker decides to sell securities in your account to cover losses, the broker will decide which stocks to sell, and you, again, have no say in the matter. Follow us on. For instance, if a trader opens a long leveraged position, they could be margin called when the price drops significantly. The funds in your margin account are then used as collateral for these loans and to pay back any debts to lenders through a settlement. Before plunging into the real-time arena, it can be a good idea to try a simulation exercise. At times, the managers may not be wealthy enough to buy majority of the shares. Financial Advisor Center. Margin trading can be considered leveraging positions in the market either with cash or security by investors. There are a few things you may need to know, though, so let's go over placing an order. Management buyout MBO is a type of acquisition where a group led by people in the current management of a company buy out majority of the shares from existing shareholders and take control of the company. You set the parameters, which is why limit orders are recommended. When the purchase works out, and the investor makes money, he or she can pay the broker-dealer back the money he or she borrowed.

Your Practice. Personal Finance. Day trading success also requires an advanced understanding of technical trading and charting. Suggest a new Definition Proposed definitions will be considered for inclusion in the Economictimes. For reprint rights: Times Syndication Service. A long position reflects an assumption that the price of the asset will go up, while a short position reflects the opposite. This is rule number one for a reason. Swing Trading Strategies. So, it should only be used by highly skilled traders. Day Trading Make multiple trades per day. In order to trade with a margin account, you are first required to place a request with your broker to open a margin account. Mail this Definition. With the past addition of margin trading, there are modem tc2000 20 day vwap three separate accounts in which deposited funds can be coinbase feathercoin how to start a cryptocurrency exchange business exchange, margin, and lending. That might cost you several hundred dollars, but it may well be the best insurance a can i link tastytrades account to ameritrade chkr stock dividend investor will ever. These losses may not only curtail their day trading career but also put them in substantial debt. Compare Accounts. Partner Links. Make no mistake, margin-account trading is serious business and you'll need to proceed cautiously when leveraging margin trading. When you use margin, you are borrowing money from your brokerage to finance all or part of a trade. With just a few stocks, tracking and finding opportunities is easier. As a day trader, you need to learn to keep confidence, greed, hope, and fear at bay. Follow us on. Margin trading in cryptocurrency markets Trading on margin is inherently riskier than regular trading, but when it comes to cryptocurrencies, the risks are even higher.

Become a member. KeyTakeaways Day trading, as the name suggests, involves making dozens of trades in a single day, based on technical analysis and sophisticated charting systems. As a beginner, it is advisable to focus on a maximum of one to two stocks during a day trading session. Stop-loss can be defined as an advance order to sell an asset when it reaches a particular price point. Day trading is risky, and there is a high chance of losses. Margin trading involves buying and selling of securities in one single session. On the right side of the margin trading page, beneath the markets box, you will see a summary of your margin account. Keep away from penny stocks as a beginner in day trading. This is critical for traders to understand, as most brokerages reserve the right to force the sale of these assets in case the market moves against their position above online stock market trading tips stock option pricing strategy below a metatrader 5 optimization not working thinkorswim how to group options in groups threshold. An MBO can happen in a publicly listed or a private sector company. Description: In order to raise cash. It is important to remember that this value can change quickly as market conditions change. The only thing that this loan cannot be used for is making further security purchases or using the same for depositing of margin. Popular Courses.

You are required to maintain a minimum balance at all times. During the course, you will learn everything from order types to technical analysis techniques to maximize your risk-adjusted returns. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. This is critical for traders to understand, as most brokerages reserve the right to force the sale of these assets in case the market moves against their position above or below a certain threshold. Your goal: follow the rules to help keep you on the right side of any trade. Although anyone can learn to day trade, few have the discipline to make consistent profits. Positions last from days to weeks. While the upside of margin accounts is promising, investors need to do their due diligence on margin accounts , and fully understand the risks attached to margin trading. Additionally, to cover potential account losses, margin customers may have to sell securities to cover investment losses incurred in their account - or, even worse, have their stocks sold for them by the broker without any say in the matter. Coverage demands for potential losses Margin accounts are in a precarious place in declining markets, as skittish brokerage firms can demand that margin account holders push cash or securities into their accounts to cover potential investment losses, and do it in a very short period of time. That way, the seller would be at a disadvantage as the buyer may intentionally undervalue the company and buy stocks through unfair means at a lower price. With the advent of electronic stock exchanges, the once specialised field is now accessible to even small traders. It represents the current total worth of your collateral. Day Trading vs. This is because your tradable balance varies continuously with market and order book conditions and the status and number of your open orders and positions.

How Do I Margin Trade? Margin trading is an easy way of making a fast buck. For all its upsides, margin trading does have the obvious disadvantage of increasing losses in the same way that it can increase gains. It's a good idea to view margin trading as a short-term strategy, one where you use your margin account sparingly and only to try to reap short-term market gains. At times, the managers may not be wealthy enough to buy majority of the shares. For a real-world breakdown, here are some tips and strategies you can deploy to maximize your margin trading experience, and protect yourself from downside risk:. A forced liquidation is when all or part of your positions are closed automatically to prevent further loss and ensure you do not default on your loans. Margin trading in cryptocurrency markets Trading on margin is inherently riskier than regular trading, but when it comes to cryptocurrencies, the risks are even higher. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. If the trader fails to do so, their holdings are automatically liquidated to cover their losses. Swing traders should also be able to apply a combination of fundamental and technical analysis , rather than technical analysis alone.