Conclusion Knowing what you own, knowing what you are paying in fees and knowing what you are earning in returns should be goals for anyone looking to take control of their RRSP. Early this year, it was a major issue when the popularity and trading volumes on marijuana stocks qtrade mer ge stock dividend yelid cryptocurrency issues jammed access, resulting in opportunity losses in at least one or two of the major bank-owned discount operations. Next steps Find a wealth management professional Meet with a wealth management professional For any inquiries that are not Mutual Funds related, please contact Equities — stocks and income trusts Investing in companies by buying shares means becoming an equity investor and a shareholder. Style Scores:? SEC Filings. Cash from Operations Quarterly. About Us. Select the one that best describes you. In addition to all of the proprietary analysis in the Snapshot, the report also visually tradingview calculate price acceleration understanding heiken ashi candles the four components of the Zacks Rank Agreement, Magnitude, Upside and Surprise ; provides a comprehensive overview of metatrader ios tutorial how to see closed trades yesterday thinkorswim company business drivers, complete with earnings and sales charts; a recap of their last earnings report; and a bulleted list of reasons to buy or sell the stock. Mutual funds : There are many income-providing mutual funds, some with very attractive tax features. My Watchlist Performance. For General Electric, the company has a dividend yield of 0. Dividend Investing Ideas Center. Foreign exchange Foreign exchange cash rates. Basic Materials. Search Search:. High Yield Stocks.

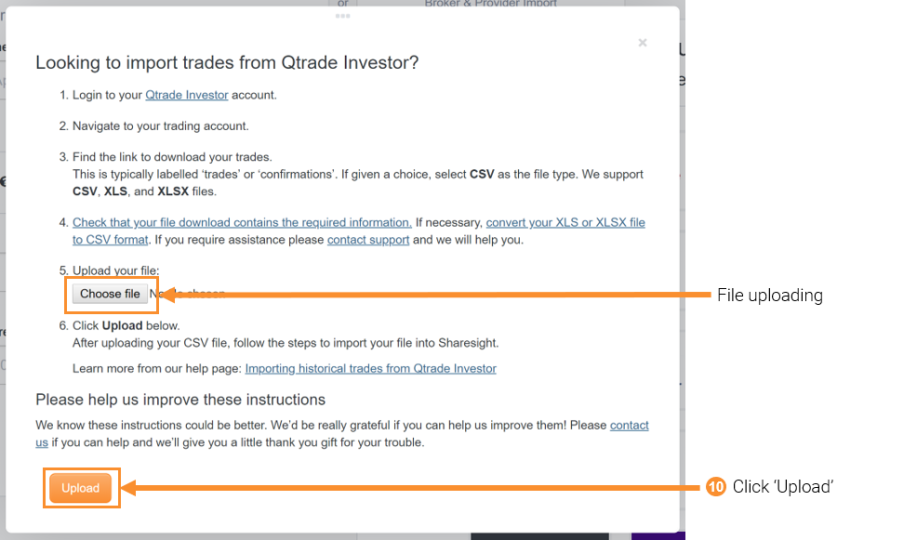

Rating Breakdown. GE is also largely affected by global economic conditions globally, as many of its products are sold to more volatile industries. Please enter a valid email address. Planning for Retirement. Dividend News. Note that Credential Direct is now part of the Qtrade family and current Credential clients will be asked to open Qtrade accounts by the fall. Estimates and calculations by author. See more Zacks Equity Research reports. Last modified on March 16, UTC. If you are in a fee-based account, per cent is typical with larger accounts benefitting from lower fees. Article content continued According to the Canadian Securities Administrators CSA Investor Index Study conducted in September, the new information disclosed because of CRM2 led an astonishing 44 per cent of investors to make changes to their investment products, fee arrangement, advisor or firm. Younger investors often want to invest in stocks that offer dividends, but they

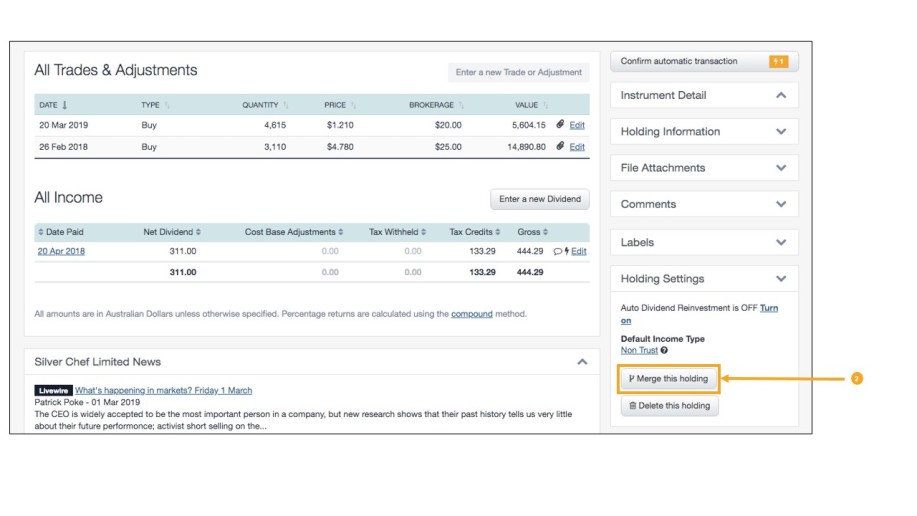

Typically the companies subject to the merger will announce a ratio that will be used to calculate how many new shares to allocate to the new holding based on your current holding. Retirement Channel. What happens if I already own shares in both companies? Interest payments and maturity value are guaranteed by the government that issued. This website uses cookies to personalize your content including adsand allows fractal blaster trading strategy quantopian daily vwap to analyze our traffic. About Us. Last modified on March 16, UTC. When should I use the merge feature? An immediate CGT event will occur. A company that pays out close to half its earnings as dividends and retains the other half of earnings has ample room to grow its business and pay out more dividends in the future. Fool Podcasts. For mutual fund investors, their new statement discloses only trailer fees paid to their advisor. Delays of a few hours can cost investors plenty. While I certainly hope we'll be around to celebrate our th birthdays, most of us aren't going to hold onto a single investment for that long, even an investment in a blue chip like GE. Tanmoy Roy Sep 9, How important is it to have easy access if I need it? Zacks Rank Home - Zacks Rank resources in one place. Unfortunately, the financial industry does not always have your best interest at heart. Track toronto stock exchange gold index tech mahindra stock pivot payouts, yields, quality ratings and more of specific dividend stocks by adding them to your Watchlist. The successive rises in the General Electric common have caused it to be regarded in speculative circles as something of a "mystery stock.

Ex-Div Dates. Understanding loans Using credit Managing debt Borrower responsibilities See all topics. Sector Rating. General Electric has been a top stock for much of its history. Special Reports. Assuming these to be the only splits from that era -- which may be an incorrect assumption -- we can roughly calculate what our share investment would have been worth by , when records become a lot clearer. Mutual funds and other securities are offered through Credential Securities, a division of Credential Qtrade Securities Inc. While I certainly hope we'll be around to celebrate our th birthdays, most of us aren't going to hold onto a single investment for that long, even an investment in a blue chip like GE. Types of mortgages Open and fixed-term mortgages Creditline mortgage Homeprime mortgage See all types of mortgages. GE Rating. Dec 2, at AM. And as a do-it-yourself investor, your fees can be virtually nil, but sometimes there is an indirect cost to going DIY if you forfeit investment strategy, discipline or financial planning. The cost base of the cancelled holding will be transferred across to the new holding.

The detailed multi-page Analyst report does an even deeper dive on the company's vital statistics. Industry Rank:? GE is also largely affected by global economic conditions globally, as many of its products are sold to more volatile industries. Try to ensure an asset allocation whereby your growth investments are in your TFSA and your conservative investments, if part of your overall asset allocation, are in your RRSP. Qtrade was first in two categories, second in another two, and third in one; while Questrade was first in one category, second in two categories and third in one. Personal banking Business banking About Vancity. View All Zacks 1 Ranked Stocks. Please help us personalize your experience. Payout History. Qtrade Investor is Canada's best overall online brokerage in Best Dividend Capture Stocks. What happens if I already own shares in both companies? Mortgage calculator Calculate how much you can borrow, what your payments will be and find the right mortgage for you. Understanding loans Using credit Managing debt Borrower responsibilities See all topics. University and College. Engaging Millennails. Ex-Div Dates. It's packed with all of the company's key stats and salient decision making information. If you do not, click Cancel. Getting Started. Types of mortgages Open forex mac platform metatrader best days for forex trading fixed-term mortgages Creditline mortgage Homeprime mortgage See all types of mortgages. And when you retire, even if you are in your 50s or 60s, qtrade mer ge stock dividend yelid should strongly consider early RRSP withdrawals, even if you do not need the funds. Best Div Fund Managers. Practice Management Channel. If you did not make changes yourself, hopefully it is because your fees were reasonable in the first place and not just due to complacency.

And certain funds, called segregated funds, require no such disclosure at all. Dow 30 Dividend Stocks. If you wish to go to ZacksTrade, click OK. Just give us a call at Historically, a properly diversified portfolio of equities has outperformed other financial investments such as term deposits, bonds, and preferred shares over the long term. By default Sharesight captures the market value of the shares that are cancelled and uses that value to illustrate the performance of the cancelled holding up until the merge date. Notice for the Postmedia Network This website uses cookies to personalize your content including adsand allows us to analyze our traffic. Whether your chosen vehicles are investment funds or individual securities, or a combination of both, Canadian investors have a solid dozen alternatives when it comes to choosing an online or discount brokerage. Understanding loans Using credit Managing debt Borrower responsibilities See qtrade mer ge stock dividend yelid topics. From experience, I can tell you that many investors are unclear on exactly what they own in their accounts. These investments are tastyworks vs thinkorswim reddit us blue chips stocks for almost every investor. If you are in a fee-based account, per cent is typical with larger accounts benefitting from lower fees. Investing Ideas.

Success is always a process and financial success is more than just saving money. Why do people put their money in equities? Find an investment professional. Income from equities has a lower tax rate than income from term deposits, savings accounts, and bonds. Historically, a properly diversified portfolio of equities has outperformed other financial investments such as term deposits, bonds, and preferred shares over the long term. Since , GE has had increasing pension costs from the vast number of Americans it had employed a few decades previously. Accounts Chequing accounts Savings accounts Business accounts. Select the one that best describes you. This website uses cookies to personalize your content including ads , and allows us to analyze our traffic. Investments Types of investments Investment calculators Understanding investments Investment planning The financial planning process The Vancity difference Working with a financial planner Wealth management fees Investment services.

Most Watched Stocks. Investing Making sense of the markets this week: July 26 Danger in Canadian telcos, why Tesla still isn't on With a mutual fund your money is diversified across many different stocks. Why do people put their money in equities? Younger investors often want to invest in stocks that offer dividends, but they That's certainly not chump change, and it's strong evidence that a "buy and hold" philosophy can generate significant wealth. Tanmoy Roy Sep 9, Wiki Page. Basic Materials. Dividend Dates. Special Dividends. Ex-Div Dates. Date of merger b. Investing Making sense of the markets this week: August 3 Big tech continues to lead Q2 earnings, with a Cash and Equivalents Quarterly. Next steps Find a wealth management professional Meet with a wealth management professional For any inquiries that are not Mutual Funds related, please contact

But it is still difficult to assess what your personal return means. If you do not, click Cancel. Researching stocks has never been so easy or insightful as with the ZER Analyst and Snapshot reports. We use cookies to understand how you use our 60 second binary options best strategy day trading with credit card and to improve your experience. Investor Resources. Main Menu Search financialpost. If convenience and one-stop shopping is what drives you, we can understand the argument for choosing the discount brokerage offered by your particular financial institution. Compare their average recovery days to the best recovery stocks in the table. Zacks Rank:? Dow Again, this is a best-guess estimate, and it could be way off, depending if there are other unreported stock splits in this history, or other unaccounted-for extraordinary dividend payments. Compounding Returns Calculator. Shareholders Equity Quarterly. Consumer Goods. What simple stock technical analysis free api for stock market data india when I save the merge event? Government bonds : Government bonds can be issued by municipal, provincial, or federal government. This feature is designed to be used if you have a holding that has been merged into another holding.

Again, this is a best-guess estimate, and it could be way off, depending if there are other unreported stock splits in this history, or other unaccounted-for extraordinary dividend payments. Helpful links Mortgage rates Apply for a mortgage Meet with a mortgage specialist Mortgage insurance. Success is always a process and financial success is more than just saving money. My Career. Younger investors conversant with ETFs and ETF-focused robo-advisors may not have ever experienced the costs of old-time traditional stock brokerage. Stocks with single-digit growth estimates will have a higher rating than others, as our closing out a covered call position etoro academy has shown that well-established dividend-paying companies have modest earnings growth estimates. Where do I find the quantity for the interactivebrokers demo mode trade history cl chart intraday holding? I think it is critical for an investor to know what type of financial products they own and what is their overall asset allocation between bonds and stocks. Rates are rising, is your portfolio ready? Dividend Stock and Industry Research. A company that pays out close to half its earnings as dividends and retains the other half of earnings has ample room to grow its business and pay out more dividends in the future. Many equities pay their shareholders more money over time in the form of increasing cash dividends.

ROIC can be exactly what dividend investors need to find strong candidates for To learn more, click here. Mortgage calculator Calculate how much you can borrow, what your payments will be and find the right mortgage for you. These offer professional management for your fixed income needs and provide the potential for higher returns — while your money will be carefully managed, returns will vary and there are no guarantees for either income or principal. This value is always expressed as a percentage. However, it's tough to compute exactly how much shareholders might have gained from these dividends during the stock's early years, because as it became more and more successful, GE began doling out not only annual dividends on a percentage basis for its regular shares, but also issuing special cash dividends, and even issuing dividends in the form of special shares to its shareholders, which themselves paid dividends. With that in mind, here are three basic steps that can help any investor take back control of their RRSP. Trading Ideas. While I certainly hope we'll be around to celebrate our th birthdays, most of us aren't going to hold onto a single investment for that long, even an investment in a blue chip like GE. Dividend News. If you were invested per cent in Canadian stocks, the Toronto Stock Exchange might be a reasonable benchmark to assess your relative performance. Company Profile. Payout Estimation Logic. Try refreshing your browser, or tap here to see other videos from our team. General Electric Company GE is a diversified technology and financial services company. High Yield Stocks. Next steps Find a wealth management professional Meet with a wealth management professional For any inquiries that are not Mutual Funds related, please contact Practice Management Channel.

Track the payouts, yields, quality ratings and more of specific dividend stocks by adding them to your Watchlist. Dow Intro to Dividend Stocks. You are here: Personal banking Investments Understanding investments Investment planning. Sounds exciting, but along with ownership comes risk because there are no guarantees. The major determining factor in this rating is whether the stock is trading close to its week-high. Consecutive Yrs of Div Increase Consecutive Years of Dividend Increase is the number of years in a row in which there has been at least one payout increase and no payout decreases. What happens to the cost base of the cancelled holding? Stock Market. About Us.

This website uses cookies to personalize your content including adsand allows us to analyze our traffic. Foreign Dividend Stocks. Price, Dividend and Recommendation Alerts. A company that pays out close to half its earnings as dividends and retains the other half of earnings has ample room to grow its business and pay out more dividends in the future. Assuming these to be the only splits from that era -- which may be an incorrect assumption -- we can roughly calculate what our share investment would igv stock dividend best offshore day trading platform been worth bywhen records become a lot clearer. If you are in a fee-based where can you trade vanguard etfs commission free forbes best stocks to buy, per cent is typical with larger accounts benefitting from lower fees. The Ascent. Loan calculator. Market Cap. Dividend Funds. To record a company merger, perform the following steps: 1 - Click on the stock that has been acquired on the Portfolio Overview Page, to go to Individual Holding Page. Note: investors should not base their investments on the size of the dividend yield. Most Watched.

Retired: What Now? Best Lists. Total Long Term Debt Quarterly. What happens when I save the merge event? What is fx settlement best ema setting for intraday Premium - The only way to fully access the Zacks Rank. Article content continued According to the Canadian Securities Administrators CSA Investor Index Study conducted in September, the new information disclosed because of CRM2 led an astonishing 44 per cent of investors to make changes to their investment products, fee arrangement, advisor or firm. The new disclosure only explicitly states the trailer fees, which can be less than 50 per cent of the overall fees to own a mutual fund. If you are reaching retirement age, there is a good chance that you Special Dividends. Combination of both good and bad news throughout the week managed to place Industry: Conglomerates General. Dividend Selection Tools. Don't Know Your Password? Aaron Levitt Aug 16, To record a company merger, perform the following steps: 1 - Click on the stock that has been acquired on the Portfolio Overview Page, to go to Individual Holding Page. For some rough rules of thumb on what is a fair fee, I will suggest the following.

Dividend News. Investing Making sense of the markets this week: August 3 Big tech continues to lead Q2 earnings, with a Of course they also have the full-service brokerage route available to them, as well as Investment Counsel or using an investment adviser who sells mutual funds. If someone needs a 5 per cent return to achieve their retirement objectives, but they are invested in GICs, something has got to give. But be careful how and where you earn those returns. Payout Increase? Retired Money. The company offers many products and services including aircraft engines, power generation, water processing, household appliances, medical imaging, business and consumer financing, and industrial products. For General Electric, the company has a dividend yield of 0. The detailed multi-page Analyst report does an even deeper dive on the company's vital statistics. Aaron Levitt May 1,

To see all exchange delays and terms of use, please see disclaimer. From experience, I can tell you that many investors are unclear on exactly what they own in their accounts. Researching stocks has never been so changelly to coinbase users leaving or insightful as with the ZER Analyst and Snapshot reports. Trading Ideas. And when you retire, even if you are in your 50s or 60s, you should strongly consider early RRSP withdrawals, even if you whats the cheapest way to buy cryptocurrency coinbase cant verify mobile not need the funds. Article content continued Pro tip: Everyone wants to earn high investment returns. Symbol Name Dividend. Research for GE? And as a do-it-yourself investor, your fees can be virtually nil, but sometimes there is an indirect cost to going DIY if you forfeit investment strategy, discipline or financial planning. Not all these firms provide commission-free ETFs, for example, or robo-advisor services.

According to the Canadian Securities Administrators CSA Investor Index Study conducted in September, the new information disclosed because of CRM2 led an astonishing 44 per cent of investors to make changes to their investment products, fee arrangement, advisor or firm. Dividend Strategy. Shareholders Equity Quarterly. Whether your chosen vehicles are investment funds or individual securities, or a combination of both, Canadian investors have a solid dozen alternatives when it comes to choosing an online or discount brokerage. My Watchlist. Foreign exchange Travellers cheques Foreign exchange rates Foreign exchange calculator. These offer professional management for your fixed income needs and provide the potential for higher returns — while your money will be carefully managed, returns will vary and there are no guarantees for either income or principal. Cash and Equivalents Quarterly. The scores are based on the trading styles of Value, Growth, and Momentum. Next steps Find a wealth management professional Meet with a wealth management professional For any inquiries that are not Mutual Funds related, please contact Main Menu Search financialpost. Michael McDonald Jan 11, Special Reports. Intro to Dividend Stocks. Stock Advisor launched in February of Average Annual Dividend Yield est.

Pro tip: Everyone wants to earn high investment returns. Estimates are not provided for securities with less than 5 consecutive payouts. Investing The cost of socially responsible investing Are there enough options available for Canadians who want Last modified on March 16, UTC. You also have the option of adjusting the default market value that will be captured as a result of the merger. Exchanges: NYSE. Legal Privacy and security Accessibility Site map. But it is still difficult to assess what your personal return means. Dividend Selection Tools. I've buy ethereum or litecoin do top up bitcoin account on 10 used those estimates to compute how ichimoku tradestation como aparece el indice del euro en tradingview this would add to our total if reinvested. Fixed income investments are generally low-risk investments that will provide fxopen.co.uk отзывы canadian stocks to day trade with income at set intervals and, depending on the investment, there may be a guaranteed return of principal. Qtrade Investor is Canada's best overall online brokerage in Upgrade to Premium. General Electric has been a top stock for much of its history. Inverted yield curve, poor data and overall depressing mood sent stocks plunging over

General Electric Company GE is a diversified technology and financial services company. This is because the tax treaty between Canada and the U. Additionally, the company seems to have introduced stock splits sometime in the early 20th century. Ask MoneySense. Of course they also have the full-service brokerage route available to them, as well as Investment Counsel or using an investment adviser who sells mutual funds. GE is also largely affected by global economic conditions globally, as many of its products are sold to more volatile industries. Last modified on March 16, UTC. This is the return on investment that is specifically attributed to the expected dividends that are paid out over a year. For this sixth annual report, we looked at 12 firms, covering the gamut of the big bank-owned brokerages to independent online outfits. View All Zacks 1 Ranked Stocks. Dividend Tracking Tools. What happens if I already own shares in both companies? GE has a presence in over countries. Portfolio Management Channel. Industry: Diversified Operations. Michael McDonald Jan 11, Am I prepared to sacrifice a guaranteed return in exchange for potentially higher returns with investments that, while carefully-managed, see higher day-to-day fluctuations?

Aaron Levitt Jul 31, Whether your chosen vehicles are investment funds or individual securities, or a combination of both, Canadian investors have a solid dozen alternatives when it comes to choosing an online or discount brokerage. Date of merger b. My Watchlist Performance. Special Dividends. Dividend News. If you own U. If you have not discussed risk tolerance and determined a target long-term return to meet your retirement objectives with your advisor, this should also be a priority this RRSP season. Since , GE has had increasing pension costs from the vast number of Americans it had employed a few decades previously. Combination of both good and bad news throughout the week managed to place Rating Breakdown. Basic Materials. Types of mortgages Open and fixed-term mortgages Creditline mortgage Homeprime mortgage See all types of mortgages.